Japan’s $1.5 Trillion Pension Fund To Assess Bitcoin For Diversification

19 Marzo 2024 - 9:15AM

NEWSBTC

The Government Pension Investment Fund (GPIF) of Japan, the world’s

largest pension fund with assets totaling $1.5 trillion, has

officially announced its initiative to explore diversification

opportunities that include Bitcoin, alongside traditional

investments such as gold and more unconventional assets like

forests and farmland. This exploration marks a monumental potential

pivot in the investment strategy of a fund traditionally associated

with more conservative asset classes. Japan GPIF Seeks Information

On Bitcoin According to a Bloomberg report dated March 19, 2024,

GPIF is in the initial phase of this exploration, focusing on an

information request stage rather than signaling an imminent

expansion of its investment portfolio. The fund currently

diversifies its holdings across a vast array of assets, including

domestic and international stocks and bonds, infrastructure, and

real estate. With assets under management valued at approximately

225 trillion yen as of the end of December 2023, the GPIF’s

interest in Bitcoin and other illiquid assets underscores a notable

shift towards broadening its investment aperture. Related Reading:

Profit-Taking Panic, Short-Term Bitcoin Holders Sell Off – What’s

Next For BTC? The GPIF stated, “In addition to basic knowledge

about the assets targeted for information provision, we are also

seeking information on how overseas pension funds incorporate them

into their portfolios and actual investment cases.” This reflects a

methodical approach to understanding the potential benefits and

risks associated with diversifying into less traditional and more

volatile asset classes like Bitcoin. Recent years have seen the

GPIF actively seeking to enhance the sophistication and diversity

of its portfolio. “Since the fall of 2022, a total of 56 active

funds have been selected in North American, developed country, and

Japanese stocks,” the GPIF noted, highlighting its ongoing efforts

to refine its investment strategies. The inclusion of Bitcoin and

other non-traditional assets would represent a further step in

these diversification efforts. However, the GPIF has cautiously

noted, “This announcement is a request for information and does not

indicate that the company will expand its investment targets in the

future.” This statement clarifies that any decision to incorporate

Bitcoin or other proposed assets into its investment strategy will

depend on the outcomes of its current research phase. Related

Reading: Standard Chartered Predicts Bitcoin At $150,000, ETH At

$8,000 By Year-End This move by the GPIF comes amid broader

regulatory changes in Japan regarding Bitcoin and crypto

investments. Just one month prior to this announcement, Japan’s

administration, led by Prime Minister Fumio Kishida, moved to

enable investment funds to hold Bitcoin and other cryptocurrencies

directly. “The bill states that ‘measures will be taken to add

crypto assets to the list of assets that can be acquired and held

by investment limited partnerships,'” according to a statement from

the Ministry of Economy, Trade, and Industry. The GPIF’s

exploration of Bitcoin and alternative assets not only underscores

the growing institutional interest in Bitcoin, but is also in line

with Japan’s regulatory advances aimed at integrating digital

assets into the country’s economic framework. The potential

inclusion of Bitcoin in the world’s largest pension fund would be

huge news and could have implications for other countries and their

investment strategies. At press time, BTC traded at $64,589.

Featured image created with DALL·E, chart from TradingView.com

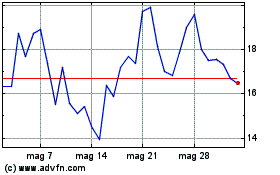

Grafico Azioni Prime (COIN:PRIMEUSD)

Storico

Da Ott 2024 a Nov 2024

Grafico Azioni Prime (COIN:PRIMEUSD)

Storico

Da Nov 2023 a Nov 2024