Bitcoin Records Surge In Retail Investors – Is A Price Rebound On?

30 Giugno 2024 - 8:57AM

NEWSBTC

According to data from CoinMarketCap, the price of Bitcoin declined

by 5.25% in the past week falling below the $60,000 mark. This

price dip adds to the string of negative performances in the last

month during which BTC has lost 9.88% of its value. However,

Bitcoin has recently seen an increase in buying interest despite

its recent price dips and popular notions that the maiden

cryptocurrency is bound to remain in a consolidation state for now.

Prominent crypto analyst Ali Martinez has now stated another

development that characterizes the resilient interest in Bitcoin

amidst its current overall bearish trend. Related Reading: Analyst

Identifies Bitcoin Liquidity Pools You Should Be Aware Of Going

Into July Retail BTC Investors Return In Numbers: Incoming Price

Rally? In an X post on Saturday, Martinez reported that the number

of new Bitcoin (BTC) addresses reached 352,124 on Friday. This

figure marks the highest level since April and breaks a downtrend

that has persisted since November 2023. Based on this data, the

crypto analyst announced a resurgence in the number of retail

Bitcoin investors indicating renewed interest from key players in

the market. For context, retail investors refer to individual

investors who trade assets for their personal accounts. They

typically trade in smaller quantities than organizations but are

quite important for market stability and liquidity.

Generally, a rise in retail investors represents an increase in the

token’s demand due to an influx of new participants to the market

which can subsequently translate into a rise in market price.

Furthermore, this surge in new addresses can be interpreted as a

positive signal stating that individuals have disposable income and

are willing to invest in speculative assets like Bitcoin.

Finally, retail investors can also serve as a barometer for market

sentiment with their increased activity indicating a broader

bullish sentiment on Bitcoin’s future in the market.

Interestingly, Bitcoin’s price already saw a slight increase of

0.92% on Saturday, briefly surpassing the $61,000 mark. However, it

is still too early to determine if this price bounce could trigger

a market rebound for the most valuable cryptocurrency. Related

Reading: Is The Bitcoin Price Correction Over? Here’s The Support

Level To Watch Bitcoin Price Overview At the time of writing,

Bitcoin is trading at $60,884, as it continues to move within the

$60,100 to $63,200 range. The token’s daily trading volume has

decreased by 49.16% and is now valued at $12.7 billion. If Bitcoin

bulls can generate sufficient buying pressure to break out of this

sideways movement, the asset could potentially return to $67,000.

Conversely, if the coin experiences a price breakdown, it could

fall as low as $40,000. Featured image from The Defiant, chart from

Tradingview

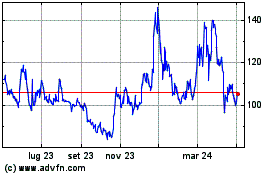

Grafico Azioni Quant (COIN:QNTUSD)

Storico

Da Ott 2024 a Nov 2024

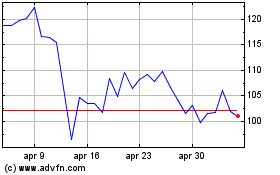

Grafico Azioni Quant (COIN:QNTUSD)

Storico

Da Nov 2023 a Nov 2024