Bitcoin Price Drops Below $58K Again, BTC To Make A Comeback Says Key Metric

04 Settembre 2024 - 6:00AM

NEWSBTC

After briefly trading above $59,000 in the early hours of Tuesday,

Bitcoin price has now seen a significant retracement, dropping

below the $58,000 price mark once again. However, despite this

struggle to rally, a CryptoQuant analyst named Kripto Mevsimi

recently shared an intriguing observation regarding Bitcoin price

on the CryptoQuant QuickTake platform. Related Reading: Bitcoin’s

Breakout Blueprint: Analyst Reveals Roadmap For Imminent Surge

Bitcoin’s Sharpe Ratio Hits New Lows: Bullish Signal Or A Warning?

According to the analyst, Bitcoin’s short-term Sharpe ratio has

dipped to levels last seen during September-October 2023. For

context, the Sharpe ratio is a measure used in financial markets to

assess risk-adjusted returns, helping investors understand whether

the returns of an asset are worth the risk involved. Mevsimi

revealed that in September-October 2023, a similar drop in the

Sharpe ratio was observed. This period marked a significant turning

point for Bitcoin, as the top crypto rebounded strongly after the

ratio hit its lows. The current scenario, according to the analyst,

could indicate a potential opportunity for those with a bullish

outlook. Particularly. The dip in the Sharpe ratio might suggest

that Bitcoin’s price is poised for another recovery, offering a

favourable entry point for investors looking to buy into the market

with a risk-adjusted strategy. However, despite the bullish signal

this metric might currently be suggesting Mevsimi cautioned: On the

other hand, a bearish interpretation could see this as an

indication of sustained volatility and caution against entering the

market until a clearer trend emerges. Furthermore, the analyst

explained that in 2023, the dip in the ratio coincided with the

news of the Bitcoin Spot exchange-traded fund (ETF), which played a

significant role in driving the market’s momentum. This time,

however, the situation might be different, as external factors like

macroeconomic conditions and market sentiment will also play

crucial roles in determining Bitcoin price trajectory. Bitcoin

Market Performance And Outlook Over the past week, Bitcoin price

has experienced a mixture of bulls and bears. After trading as high

as above $62,000 last Friday, the asset has seen a noticeable

correction, dropping below the psychological price level of

$60,000. Although Bitcoin price attempted to reclaim this level

earlier today reaching a 24-hour high of $59,812, it has since been

pulled down back by the bears to currently trade at a price of

$57,653, at the time of writing down by 1.5% over the past day.

Amid this price performance, a renowned crypto analyst known as

Crypto Jelle on X has commented on BTC’s latest price action,

disclosing that the asset is now forming a weekly golden cross for

the first time. Related Reading: Bitcoin’s Price Potential: Analyst

Maps Path To $700,000 And Beyond According to the analyst, forming

this pattern in the traditional financial market is often

considered bullish. However, Jelle questioned, is it possible for

the pattern to work for BTC too? #Bitcoin is forming a weekly

golden cross, for the first time in its history! The 100-week MA is

crossing above the 200-week MA this week. In traditional markets,

these crossovers are considered a bullish sign; will it work for

BTC too? pic.twitter.com/e6GbOfU5Uy — Jelle (@CryptoJelleNL)

September 2, 2024 Featured image created with DALL-E, Chart from

TradingView

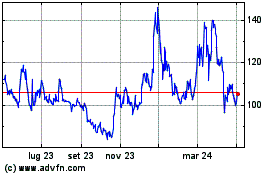

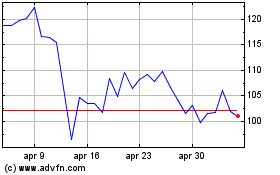

Grafico Azioni Quant (COIN:QNTUSD)

Storico

Da Dic 2024 a Gen 2025

Grafico Azioni Quant (COIN:QNTUSD)

Storico

Da Gen 2024 a Gen 2025