Stacks: New Developments Push STX Price 18% Higher – Details

23 Agosto 2024 - 4:00AM

NEWSBTC

The market swung in favor of Stacks (STX) as the token continued

its upward momentum. As of writing, CoinGecko notes a solid 18%

gain in the past week as it captured the bullish momentum of the

market despite the slight dip yesterday. Since then, STX has

attracted more investors as it has shown strength despite the

volatility. Related Reading: XRP Smashes Through Resistance, Could

Soar 15%, Analyst Says As STX goes up, investors and traders weigh

in on the on-chain developments that occurred this week. With new

add-ons that improve both the security and user experience on the

platform, we might see STX move up even more in the coming

weeks. Security Improves UX On Stacks Zest Protocol announced

its new system to improve smart contract security on Stacks. Named

Clarity Alliance, the auditing group will provide the network with

better protection against malicious actors that may exploit certain

weaknesses of Stacks itself. 1/ We’re excited to share a big

ecosystem improvement to smart contract security on the @Stacks

blockchain After working with multiple auditors for Clarity smart

contract on Stacks, we saw a big need for a higher quality auditing

group. Introducing: Clarity Alliance 👇 pic.twitter.com/ZmDedxa9bV —

Zest Protocol 🍊 (@ZestProtocol) August 21, 2024 “When Zest Protocol

launched, we experienced first hand the shortcomings of the

security ecosystem around Clarity, Stacks’ smart contract

language,” Zest said in their thread regarding the

announcement. According to the thread, the Clarity Alliance

is comprised of “the highest ranking white hat hackers in crypto”

with credentials including the auditing of Bitflow, a market

aggregator on Stacks. Zest also partnered with Hypernative

Labs to track incidents as well as pinpointing possible attacks

before it even happens. $1.5-$1.6 Trading Range Holds Strong

For STX As of press time, the token entered the $1.5 to $1.6 price

range with the bulls successfully slowing the bearish momentum that

built up over the last couple of days. This, along with the overall

bullish developments on-chain, helped STX remain profitable despite

the market dips that happened this week. STX’s current position

opens up possibilities not seen prior to the rally the token

experienced earlier this month. With this in mind, the relative

strength index of STX reveals an overall bullish narrative.

Related Reading: Tron Rises 24% Amid New Developments – Will The

Uptrend Continue? This leaves STX the opportunity to hold this

trading range before resuming its upward trajectory. If the token

regains momentum at a shorter period, we might see a return to $2

and more if the momentum continues. However, its significant

correlation with Bitcoin might be a double-edged sword for STX. Any

market movement made by BTC, in the long run, will be amplified and

felt by STX’s small market compared to the top crypto. If Bitcoin

suddenly flips, returning to sub-$60k levels, STX will fall

potentially beneath its current trading range towards $1.2 or $1

respectively. For now, investors and traders should monitor the

general swings of the market before making any big decision.

Featured image from Xverse, chart from TradingView

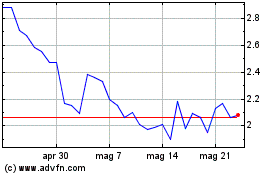

Grafico Azioni Stacks (COIN:STXUSD)

Storico

Da Gen 2025 a Feb 2025

Grafico Azioni Stacks (COIN:STXUSD)

Storico

Da Feb 2024 a Feb 2025