UNI Surges 30% Amid Ongoing On-Chain Development Talks

29 Settembre 2024 - 3:00AM

NEWSBTC

Uniswap’s UNI has grown in favor of investors as the token

continues its upward trajectory in the face of crucial on-chain

developments. According to CoinGecko, the token surged 30% since

last month, keeping the token on the green zone. With the market’s

renewed bullishness, UNI might be on the road for some gains in the

short term. Uniswap recently announced a development that may

enhance user experience in using the platform altogether. Investors

are excited as the platform continues to find innovative ways to

improve user engagement. Related Reading: Bitcoin Breaks $65K

With $365 Million In Spot ETF Inflows Fueling The Rally Gas

Abstraction: A Leap For Uniswap UX? Across Protocol’s Chief

Technology Officer, Matt Rice, and Uniswap’s Staff Software

Engineer, Mark Toda recently discussed about the ERC-7702 which, if

passed, would introduce a new transaction type known as externally

owned accounts (EOAs). In general, ERC-7702 will implement gas

abstraction, a feature that would both improve user experience and

save users a ton of money in the process. ERC-7702 Uniswap’s

next big leap 🦄@MarkToda from @uniswap talks with @mrice32 about

how gas abstraction could simplify DeFi for millions. Is this the

user experience revolution we’ve been waiting for?

pic.twitter.com/UVR3Mid5HQ — Across (@AcrossProtocol) September 24,

2024 According to Mark Toda, the biggest obstacle for gas

abstraction to be successfully implemented is authorizing a users

address without gas on-chain. “…Think about it right now, if

you are trying to send some tokens on some random chain and you’re

trying to swap out of there or do anything there, right now you

need to have a native token to pay the gas…or authorize the

contract of some sort to take your tokens,” Toda said when asked

about a scenario where a user swaps tokens with no available chains

on the platform. To put it simply, ERC-7702’s most notable

feature regarding gas sponsorship which helps users pay gas fees

distinct from their chain of origin. This feature, once ERC-7702 is

implemented, will greatly improve cross-interoperability, enhancing

user experience. As of writing, ERC-7702 is still in its

draft stage which means the new on-chain goodies featured between

Toda and Rice are still subject to revision. Nonetheless, it

presents a good future for the Uniswap community. UNI:

Investors Should Watch These Levels As of writing, UNI has

continued to make ground against the bears in the medium term which

places the token at the gates of the $7.518 resistance level. This

crucial resistance level might continue to resist in the coming

days as the market hits its peak after days of continued bullish

movement. Related Reading: Stacks: New Network Upgrades Push

STX Price Up By 18% – Details With this in mind, investors should

monitor the token’s movement in the coming hours and days as this

may determine the trajectory of the token. If UNI breaks through

this crucial resistance level, it opens the door toward $9.012 in

the medium term. However, if $7.518 remains unbeaten or the

bulls breakthrough for a short while before pulling back, it might

trigger a downward movement by the bears targeting $5.899 in the

medium term. Featured image from Pexels, chart from

TradingView

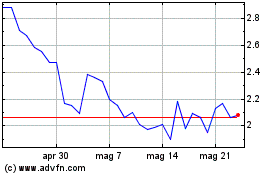

Grafico Azioni Stacks (COIN:STXUSD)

Storico

Da Gen 2025 a Feb 2025

Grafico Azioni Stacks (COIN:STXUSD)

Storico

Da Feb 2024 a Feb 2025