Ethereum Analyst Sees Altseason Potential As BTS Is Still Outpacing ETH – Time To Buy Altcoins?

08 Novembre 2024 - 10:30PM

NEWSBTC

Ethereum has finally surged after breaking through a critical

resistance level that had kept the price subdued since early

August. This move has shifted market sentiment, as many investors

and analysts previously doubted ETH’s potential in the current

cycle, expecting it to lag behind. However, Ethereum’s recent

strength is starting to reshape these perspectives. Prominent

analyst and investor Ali Martinez recently shared insights

indicating that while Ethereum’s momentum is building, the

much-anticipated “Altseason” hasn’t arrived just yet. Related

Reading: Solana Breaks Above Key Resistance – Top Analyst Sets $300

Target According to Martinez, this stage of the cycle typically

sees Bitcoin outperforming Ethereum and other altcoins—a common

pattern as BTC often leads market rallies. This dynamic could

provide a strategic opportunity for investors looking to enter ETH

and other altcoins before the broader market euphoria begins. As

Ethereum gains traction, market participants are keeping an eye on

further confirmations of its breakout, with many speculating that

once Bitcoin’s lead cools, capital may flow more aggressively into

altcoins. Ethereum Waking Up Ethereum is making a remarkable

comeback, surging over 22% in just two days of strong upward

momentum. While this performance is impressive, key data highlights

that Bitcoin is still leading the market, slightly overshadowing

Ethereum’s gains. For savvy investors, this could present a prime

opportunity to start accumulating Ethereum and select altcoins

before they potentially rally in the next phase of the cycle. Ali

Martinez, a prominent analyst, recently shared a Glassnode chart

revealing insights on the “Bitcoin Altseason Indicator.” This tool

compares net capital flows between Bitcoin and Ethereum, showing

that while Ethereum is on the rise, Bitcoin’s net capital change is

currently outpacing it. This trend confirms that

Altseason—where altcoins outperform Bitcoin—hasn’t begun yet.

Martinez points out that such dynamics are typical for this stage,

with Bitcoin usually leading the initial rally and Ethereum

following shortly after. Related Reading: Bitcoin Indicator Signals

Equilibrium After Trump Victory – A Clear Path To New Highs?

Historically, Altseason often arrives once Bitcoin’s price momentum

stabilizes, as capital flows from Bitcoin into high-potential

altcoins. Many seasoned investors recognize this part of the cycle

as an ideal time to accumulate ETH and strong altcoins at

attractive prices before the broader market shifts its focus. In

the coming weeks, the relationship between BTC and ETH performance

will be closely watched, potentially setting up a shift in market

sentiment and capital distribution. ETH Technical View Ethereum

recently surged past a critical resistance at $2,820, breaking

above the 200-day exponential moving average (EMA) and touching the

200-day moving average (MA) at $2,955. This marks a significant

bullish move, as ETH had been trading below these levels since

early August, and reclaiming these indicators is seen as a positive

signal for further gains. For the bullish momentum to continue, ETH

must break above and sustain itself above the daily MA at $2,955,

solidifying this breakout as a foundation for the next phase of the

uptrend. However, some analysts suggest that a period of

consolidation just below the 200 MA could be beneficial, allowing

ETH to gather strength for a more sustained rally. This pause could

temper the rising euphoria and avoid overextension in the short

term. Related Reading: Ethereum Analyst Shares Correlation With

S&P500 – Last Dip Before It Hits $10,000? As the market

sentiment turns increasingly optimistic, many investors are eyeing

this level closely. Holding above these critical indicators would

give bulls more control, potentially setting Ethereum up for a more

robust recovery as it targets new highs. Featured image from

Dall-E, chart from TradingView

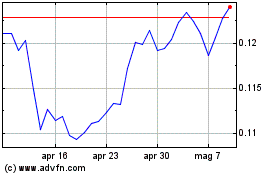

Grafico Azioni TRON (COIN:TRXUSD)

Storico

Da Nov 2024 a Dic 2024

Grafico Azioni TRON (COIN:TRXUSD)

Storico

Da Dic 2023 a Dic 2024