XRP Breaks Key Barrier, Surges Past 100-Day SMA And $2.7 Resistance

15 Febbraio 2025 - 10:30PM

NEWSBTC

XRP has finally shattered a critical resistance level, surging past

$2.7 and breaking above the 100-day Simple Moving Average (SMA).

This bullish move signals renewed strength in the market, with

buyers stepping in to drive momentum higher. After weeks of

sideways trading, XRP’s breakout could be the catalyst for further

gains, but can the bulls sustain this rally? With technical

indicators flashing positive signals, XRP now faces the challenge

of turning this breakout into a lasting uptrend. If buying pressure

remains strong, the crypto might be eyeing higher resistance zones,

setting the stage for an extended rally. However, if the price

struggles to hold above $2.7, a pullback would likely come into

play. Market Sentiment Shifts As XRP Gains Momentum XRP’s breakout

above $2.7 and the 100-day SMA have injected fresh optimism into

the market, shifting sentiment in favor of the bulls. After a

period of consolidation, traders are now seeing renewed confidence

as buying pressure pushes the price higher. Investor enthusiasm is

growing, with many anticipating further upside if key resistance

levels continue to fall. Related Reading: Analyst Shares Upper And

Lower Targets For XRP Price The breakout has sparked renewed buying

interest, evident in the rising trading volume and improving

technical indicators, which suggest a potential continuation of the

upward trend. As more market participants recognize the breakout as

a bullish signal, demand for XRP is increasing, reinforcing

positive sentiment in the market. One of the key indicators

confirming this upward push is the Moving Average Convergence

Divergence (MACD), which is currently trending higher above the

zero line. This positioning signals that bullish momentum is

strengthening, with the MACD line diverging more from the signal

line, a classic indication that buying pressure is increasing.

However, despite the growing optimism, market volatility remains a

factor. If the altcoin fails to maintain its position above $2.7,

it could trigger profit-taking, leading to a short-term

retracement. That said, as long as market sentiment remains

positive and XRP holds above key support levels, the bulls might

maintain control and push the price higher in the coming sessions.

Key Levels To Watch After The Breakout With XRP surging past $2.7

and the 100-day SMA, all eyes are now on the next critical price

levels that could determine the coin’s next move. Holding above

this breakout zone is crucial for bulls to maintain control and

push the price toward higher targets. Related Reading: XRP Price

Explodes 25%: Will The Recovery Sustain or Fizzle Out? Immediate

resistance to watch is the $2.9 level, which currently stands as a

crucial hurdle for XRP’s price action. A decisive breakout above

this range may confirm that bulls are firmly in control, setting

the stage for more upside momentum such as the $3.4 range. A drop

below the $2.7 level could signal that the recent breakout was not

sustainable, potentially leading to a shift in market sentiment. If

XRP fails to establish $2.7 as a strong support zone, it may

indicate a false breakout, where bullish momentum fades and sellers

regain control. Featured image from Adobe Stock, chart from

Tradingview.com

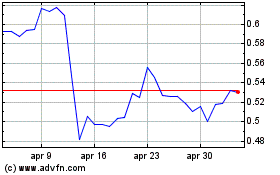

Grafico Azioni Ripple (COIN:XRPUSD)

Storico

Da Gen 2025 a Feb 2025

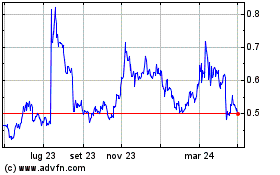

Grafico Azioni Ripple (COIN:XRPUSD)

Storico

Da Feb 2024 a Feb 2025