- 2023 revenues of €6m, x2.7 vs. 2022, higher than the target

of €4.5m

- Strong sales dynamic: 21 300 tons sold, +78% vs.

2022

- Validation of international development strategy: signature

of a licensing contract in Saudi Arabia and agreement in principle

for the signature of a licensing contract in the United

States

- Strengthening of production capacity: lauch of the H2 unit

in summer 2023, the world's first vertical cement plant

- Solid financial structure: shareholder’s equity of €67m and

cash position of €25m

Regulatory News:

Hoffmann Green Cement Technologies (ISIN: FR0013451044, Ticker:

ALHGR) (“Hoffmann Green Cement” or the “Company”) (Paris:ALHGR), an

industrial player committed to the decarbonation of the

construction sector that designs and markets innovative

clinker-free cements, provides an update on its activities, and

announces its 2023 annual results. The Supervisory Board of the

Company met on March 14, 2024, and reviewed the 2023 financial

statements approved by the Management Board. The audit procedures

have been carried out and the audit report on the certification is

being issued.

Key elements of the Company’s consolidated annual

accounts

€ thousands – IFRS

FY 2023

FY 2022

Revenue

6 041

2 219

EBITDA

-5 170

-6 617

Recurring operating profit/loss (EBIT)

-8 546

-9 358

Financial profit/loss

986

-1 111

Tax

-45

2 626

Net profit/loss

-7 862

-6 739

€ thousands – IFRS

At Dec. 31, 2023

At Dec. 31, 2022

Cash and cash equivalents (including

placements)

25 034

42 001

Shareholders’ equity

67 035

74 693

Julien BLANCHARD et David HOFFMANN, co-founders of Hoffmann

Green Cement Technologies, commented: "2023 was shaped by

significant progress in Hoffmann Green's development. First of all,

the growth of our revenue up to €6 million reflects the willingness

of the construction industry to decarbonize its activities in the

context of increasingly ambitious environmental policies. This

paradigm change is necessary to ensure a sustainable and

environmentally friendly future with construction projects relying

on decarbonized solutions such as those offered by Hoffmann Green.

The commercial dynamic of recent quarters has been confirmed by the

signature of multiple partnerships with key players in the sector,

some of which have reaffirmed their commitment, such as Bouygues

Immobilier. In order to meet the growing demand for our

decarbonized cement, we inaugurated our H2 production unit at the

beginning of summer 2023, a unique plant in the world combining

cutting-edge technology, industrial performance and minimal

environmental impact. 2023 was also marked by Hoffmann Green's

international development, particularly with the signature of a

licensing agreement in Saudi Arabia. Hoffmann Green also has a

solid financial structure, recently strengthened by an issue of

OCEANE, which is slightly dilutive for our shareholders and was

carried out under attractive conditions for the Company. The

transaction was subscribed by Eiffel Investment Group, a key

investor. We look forward to 2024 with confidence, in an

increasingly restrictive regulatory environment for traditional

cement manufacturers, which should favor Hoffmann Green's growth

perspectives."

A 2023 financial year characterised by an acceleration in

sales dynamic and industrial deployment in line with the Company

roadmap

Strong growth in sales volumes, increase of the order book,

and international expansion:

- Increase in sales in 2023, with sales volumes reaching 21,370

tons, up 78% vs. 2022 fiscal year;

- The order book progressed to 260,000 tons (+20,000 tons vs.

2022), thanks to several cement supply contracts with key partners,

including:

- VM Matériaux from the HERIGE Group, the leading distribution

network in mainland France offering 25 kg bags of H-IONA cement to

building professionals, artisans, and the general public across 50

points of sale in France.

- Belin Promotion, an historic real estate developer based in the

South-West of France, Belin Promotion, a long-established property

developer in south-west France, for the supply of 0% clinker

cements for the construction of several flat blocks and

offices;

- VENDEE HABITAT, one of the most dynamic social housing

providers in the Pays de la Loire region, to supply concrete made

with Hoffmann 0% clinker cements for future real estate projects

throughout the Vendée region;

- Structuring partnership with the leading brand POINT.P to

distribute Hoffmann Green's clinker-free cement;

- SPIE BATIGNOLLES, a key player in building, infrastructure, and

service industries, for the supply of decarbonized cements,

including a volume commitment until 2027;

- Contract to supply decarbonized cement, including a volume

commitment of around 20,000 tons until 2027, with the OGIC Group, a

major French property developer.

- Validation of international development strategy, based on a

licensing model:

- Signature of a partnership agreement with the Belgian group

ELOY to carry out initial pilot projects in the Liège region;

- Signature of an exclusive 22-year licensing contract with the

Shurfah Group to build several H2 type units in Saudi Arabia, to

support the decarbonization of the construction sector in the

country;

- Pre-agreement with a partner for the signing of a licensing

contract in the United States, in the state of Florida, with

potential signing expected in 2024.

Progress of the implementation of the industrial

plan:

- Operational launch of the H2 factory, the world's first

vertical cement plant built entirely from Hoffmann cement. From the

second half of 2023, this plant has been producing bulk cement to

meet growing demand. This achievement increases production capacity

from 50,000 to 300,000 tons per year at the Bournezeau site;

- Launch of Hoffmann Green's R&D concrete plant to test and

develop new low-carbon concrete formulations using Hoffmann cements

and recycled aggregates.

Validation of a proactive CSR (Corporate Social

Responsibility) policy:

- Strengthening the offer on the carbon credit market:

- Since the end of 2022, Hoffmann Green has been the first

industrial player, outside of agriculture and renewable energies,

to generate carbon credits on the voluntary market, validating the

decarbonized production process of its cement;

- In 2023, the Company strengthened its carbon credit offering,

corresponding to the CO2 emissions avoided through the use of 0%

clinker cements developed by Hoffmann Green. The revenue from the

sale of carbon credits amounted to €276 K in 2023. Hoffmann Green

currently holds 13,000 carbon credits available for sale.

- Hoffmann Green has received several awards confirming its ESG

commitment:

- Solar Impulse Efficient Solution label, which guarantees the

quality and economic profitability of its H-UKR cement, certifying

Hoffmann Green's decarbonized manufacturing process.;

- Factory of the Year Award in the CSR category at the Trophées

des Usines, organised by L'Usine Nouvelle, celebrating the launch

of the new production unit H2;

- Low Carbon Cement Award, granted by the World Cement

Association in October 2023, highlighting the positive impact of

its decarbonized cements on the environment;

- Hoffmann Green has been awarded a Gaïa extra-financial rating

by Ethifinance of 62/100, confirming a higher level of ESG maturity

compared to similar companies based on workforce size and sector of

activity, using the 2022 baseline.

2023 annual results

Hoffmann Green's 2023 revenue is significantly higher than in

2022 (€6.0m vs. €2.2m) and above the initial target of €4.5m. This

increase is due to the 78% rise in cement sales volumes (21,377

tons in 2023 vs. 12,010 tons in 2022) and the signature of the

first international licensing contract in Saudi Arabia, which gave

rise to an entry fee of €2.0m. It should be noted that the

marketing of Hoffmann Green carbon credits, which began at the end

of 2022, generated €276k in revenue in 2023.

EBITDA for 2023 is -€5.2m, compared with -€6.6m in 2022. The

year-on-year improvement of EBITDA (+€1.4m) is mainly explained by

the development of the business. It should be noted that Hoffmann

Green's workforce has increased from 43 employees at the end of

2022 to 52 employees at the end of 2023 due to the strengthening of

the sales and technical teams. Personnel costs increased by €0.7m

compared with the previous year.

Recurring Operating Profit amounted to €8.5m. The year-on-year

change (+€0.8m) was due to the rise in EBITDA and the increase in

depreciation, amortization and provisions (-€0.6m) linked to the

launch of the H2 unit and the concrete plant in 2023.

Net financial income for 2023 amounted €1.0m, a significant

increase over the previous year (+€2.1m) due to the rise in the

market value of OPCVMs (+€1.9m).

Overall, the Net Result for 2023 stands at -€7.9m.

Solid financial structure

As of December 31, 2023, the Company maintains a strong balance

sheet with equity amounting to €67.0m, down by €7.7m due to the net

result for the year.

The available cash position as of December 31, 2023, stands at

€25.0m (including placements). The variation in cash over the

period (-€17.0m) is attributed to investment outflows (-€7.6m),

mainly related to the construction of the H2 production unit, the

construction of the R&D concrete plant, and the rehabilitation

of the Hoffmann Microtech site, as well as operating outflows

(-€5.m), and loan repayments (-€4.2m).

The Company's financial statements for the year ended 31

December 2023 will be disclosed in the Company's annual financial

report, which will be available to shareholders on the Company's

website by 30 April 2024 at the latest, in compliance with legal

and regulatory requirements.

Post-closing events: continued sales dynamic and recognition

of the added value of the Hoffmann Green model

Since January 1st 2024, Hoffmann Green has been pursuing the

strong sales dynamic observed in 2023 by signing strategic

contracts and extending its existing partnerships:

- Extension of the partnership with Bouygues Immobilier, a key

player in real estate development, for a duration of two

years;

- Signature of a major partnership to distribute its decarbonized

cements within Bricomarché, Bricorama, Brico Cash, and Tridôme

stores. This represents the first distribution partnership for

Hoffmann cements targeting the B2C market in 600 retail outlets

across France;

- Signature of a partnership with Trecobat Group until the end of

2027, the 4th largest builder of individual houses in France;

- Signature of a strategic partnership with ViaVilla, an elite

property company specialising in the construction of villas on the

Atlantic coast;

- Signature of a commercial partnership with Groupe Tartarin, a

company based in Vienne (86), manufacturing a wide range of

ready-mixed concrete products.

Furthermore, Hoffmann Green announced the issue of bonds

convertible into and/or exchangeable for new or existing shares

("OCEANE") for a nominal amount of approximately €5.0m. This

transaction provides the Company with additional financial

resources with attractive financial terms for the Company, to

support its industrial and commercial strategy while limiting

dilution for its shareholders,.

The company has also obtained the Solar Impulse Efficient

Solution label for its H-UKR carbon-free cement, and has joined the

Bpifrance Excellence Club, two prestigious distinctions that

validate the Hoffmann Green model and the added value of its

solutions.

Strategy and Outlook: Confirmation of medium-term financial

targets

In 2024, the Company will continue to implement its strategic

plan, with particular focus on the following priorities:

- Commercial:

- Continuing to sign and extend contracts with strategic

partners;

- International expansion through the expected signature in 2024

of a licensing agreement with an American partner to build several

Hoffmann units in Florida.

- Industrial:

- Launch of the construction of the H3 plant at the Dunkirk Grand

Maritime Port (Grand Port Maritime de Dunkerque) for delivery in

2025;

- Finalisation of the rehabilitation of the Hoffmann Microtech

subsidiary's site to bring in-house the industrial process of

grinding blast furnace slag, one of the essential raw materials for

the production of H-UKR and H-IONA cements.

- Financial:

- Achieve a positive EBITDA, in line with management's

commitments of 2021.

- R&D:

- Accelerating R&D funding to strengthen the environmental

performance and quality of Hoffmann Green products, already

rewarded in 2023 by the World Cement Association's Low Carbon

Cement Award.

- CSR:

- Continue the commercialization of carbon credits.

- Continuous improvement of the CSR strategy: increase in the

extra-financial rating

Confirmation of 2026 targets: €130m revenue and 40% EBITDA

margin

The tightening of the regulatory environment, in particular with

the introduction in 2025 of the second, more restrictive RE1 2020

threshold, combined with the growing sales dynamic recorded in

recent quarters, give the Company confidence that it will be able

to achieve its commercial and financial targets.

In France, Hoffmann Green aims to commercialise 550,000 tons of

cement per year by 2026 via three production sites, representing

sales of around €120 million and a 3% market share in France.

Following the success of its international deployment in 2023,

particularly in Saudi Arabia, the Company intends to increase the

number of licensing agreements signed with new partners. These

partners will be responsible for financing, building and operating

Hoffmann H2 units and for producing and commercialising Hoffmann

cements in their geographical territory in return for the payment

of an entry fee, royalties and the purchase of a pre-formulation

from the Company. The Company aims to have 4 operational units by

2026, generating sales of around €10m.

ABOUT HOFFMANN GREEN CEMENT TECHNOLOGIES

Founded in 2014 and based in Bournezeau (Vendée, Western

France), Hoffmann Green Cement Technologies designs, produces and

distributes innovative extremely low-carbon cements – with a carbon

footprint 5 times lower than traditional cement – that present, at

equivalent dosage and with no alteration to the concrete

manufacturing process, superior performances than traditional

cement.

Hoffmann Green operates two production units powered by a solar

tracker park on the Bournezeau site: a 4.0 factory and H2, the

world's first vertical cement plant inaugurated in May 2023. A

third factory will be established at the Grand Port of Dunkirk in

2025, bringing the total production capacity to 550,000 tons per

year, representing 3% of the French market. The group has

industrialized a genuine technological breakthrough based on

modifying cement composition and creating a cold manufacturing

process, with 0% clinker and low energy consumption, making it a

leading and unique player in the cement market that has not evolved

for 200 years.

In a context of climate urgency and energy price inflation,

Hoffmann Green Cement actively participates in energy transition by

producing clean cement that consumes 10 to 15 times less energy

than Portland cement. It also promotes eco-responsible construction

and encourages circular economy and natural resource preservation.

With its unparalleled and constantly evolving technological

expertise, driven by high-performing teams, Hoffmann Green Cement

Technologies serves all markets in the construction sector, both in

France and internationally.

Hoffmann Green was selected among the 2022 promotion of the top

20 French green startups as part of the French Tech Green20

program, led by the French Tech Mission in partnership with the

Ministry of Ecological Transition. In June 2023, the company was

selected for French Tech 2030, a new ambitious support program

operated by the French Tech Mission alongside the General

Secretariat for Investment (SGPI) and Bpifrance.

The company continues its international development with

contract signings in the United Kingdom, Belgium, Switzerland,

Saudi Arabia and recently in the United States.

For further information, please go to :

www.ciments-hoffmann.fr/

1Environmental Reglementation

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240318113697/en/

Hoffmann Green Jérôme Caron Chief Financial Officer

finances@ciments-hoffmann.fr 02 51 460 600

NewCap Investors Relations Thomas Grojean Alban Dufumier

ciments-hoffmann@newcap.eu 01 44 71 94 94

NewCap Financial Media Relations Nicolas Merigeau Antoine

Pacquier ciments-hoffmann@newcap.eu 01 44 71 94 98

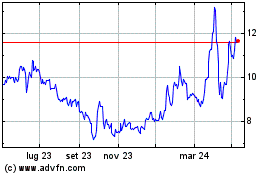

Grafico Azioni Hoffmann Green Cement Te... (EU:ALHGR)

Storico

Da Nov 2024 a Dic 2024

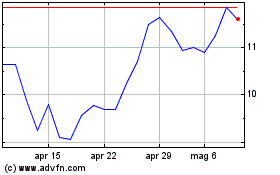

Grafico Azioni Hoffmann Green Cement Te... (EU:ALHGR)

Storico

Da Dic 2023 a Dic 2024