ALSTOM SA: Alstom’s orders and sales for the first three months of

2022/23

Alstom’s orders and sales for the first

three months of 2022/23

- Q1 order intake at €5.6

billion, including large orders in Rolling Stock bundled with

Services

- Sustained backlog at €83.4

billion

- Solid Q1 sales at €4.0

billion, up 8%1 vs. last year, in line with announced growth

trajectory

- Full year outlook and

mid-term 2024/25 objectives confirmed

19

July

2022 – Over the first quarter of 2022/23

(from 1 April to 30 June 2022), Alstom booked €5.6 billion of

orders. The Group sales increased by 8% reaching €4.0 billion, in

line with the targeted trajectory. The backlog, as of 30 June 2022,

settled at €83.4 billion, providing strong visibility on future

sales.

Key figures

|

Actual figures(in € million) |

2021/22Q1 |

2022/23Q1 |

% ChangeReported |

% ChangeOrganic |

|

Orders received |

6,439 |

5,601 |

(13)% |

(16)% |

|

Sales |

3,701 |

4,002 |

+8% |

+5% |

Geographic and product breakdowns of reported orders and sales

are provided in Appendix 1. All figures mentioned in this release

are unaudited.

“Alstom has recorded a solid quarterly order

intake on the back of a continuously sound market. In particular,

the Group secured a landmark contract to supply 130 Coradia Stream

trains with 30 years of maintenance for the state of

Baden-Württemberg, demonstrating our leadership in Germany. Our

sales have developed as expected, thanks to the stabilisation of

our Rolling Stock projects and strong performance in Services and

Systems. Despite a more complex global environment, marked notably

by inflation and the electronic components shortages, the Group

continues to progress on the delivery of its Alstom in Motion

strategic plan, demonstrating the resilience of its business

model,” said Henri

Poupart-Lafarge, Alstom Chairman and Chief

Executive Officer.

***

Detailed review

During the

first quarter of

2022/23

(from 1 April

to 30 June

2022),

Alstom recorded

€5,601 million

in orders,

with notably strong order intake in Rolling Stock and

Services. Orders for Services reached a

new record level of €1,844 million. Over three months, orders for

Services, Signalling and Systems reached 46% of the total order

intake. On a regional level, Europe accounted for the majority of

the orders, i.e. 70% of the Group total. Of particular note, Alstom

was awarded a landmark contract to supply 130 Coradia Stream High

Capacity electric double-deck trains, together with full

maintenance for 30 years, to Landesanstalt Schienenfahrzeuge

Baden-Württemberg (SFBW) network in Germany. Furthermore, the

contract reserves an option to order up to 100 additional trains.

With a value of almost €2.5 billion for the first 130 trains and 30

years’ maintenance, this order is a positive indication for

Alstom’s market share ambitions in Germany.

Alstom also signed an historic agreement with

Sweden’s national rail operator SJ to supply 25 Zefiro Express

electric high-speed trains, with an option of 15 additional trains.

The contract for the firm tranche is valued at around €650 million.

The new trains will be Sweden’s fastest, capable of operating at

maximum speeds of 250km/h. The first train is scheduled for

delivery in 2026.

In the Asia/Pacific region, Alstom has signed a

framework contract with the Department of Transport of Victoria in

Australia, for the provision of 100 Flexity low-floor Next

Generation Trams (NGTs) for the largest urban tram network in the

world. Valued at approximately €700 million, the contract includes

supply of rolling stock and 15 years of maintenance, making this

the biggest tram contract in Australia and in the Southern

hemisphere.

Sales were €4,002 million in Q1 2022/23 (from 1

April to 30 June 2022) versus €3,701 million in Q1 2021/22 (+8%).

In Systems, Alstom reported €388 million sales, up 63% vs. last

year, including remarkable growth on the Cairo monorail project.

Services delivered €909 million of sales in Q1 2022/23, up 19%

versus last year, demonstrating a sound level of execution. Sales

in Rolling Stock stood at €2,175 million, up 1% versus last year,

reflecting stronger contributions from projects in India and in the

UK, which are ramping-up, and contracts in Switzerland and Canada

ramping-down. Signalling sales stood at €530 million in Q1 2022/23,

roughly stable versus Q1 2021/22.

The book-to-bill ratio is 1.4.

***

Main highlights of

the first quarter

of

2022/23

During the quarter, Alstom reached important

delivery milestones, and launched a range of initiatives to

accelerate its transformation into a more competitive and agile

group.

-

Key projects

achievements

In May, the new Elizabeth line entered passenger

service under Central London using Alstom’s state-of-the-art

Aventra fleet. Alstom has supplied trains, technology and

infrastructure for this new line and will also maintain the trains.

The transformational railway is set to reduce journey times, to

create additional transport capacity, to improve accessibility and

to provide an economic boost to the capital and beyond.

Also in May, Alstom successfully delivered

India’s first semi high-speed regional train for Delhi-Meerut RRTS

project. The first train has been delivered in less than a year

since the beginning of production, and is 100% made in India at

Alstom’s factory in Savli (Gujarat). The semi high-speed regional

train is designed and built to run at 180 km/h, and is expected to

decrease travel time between Delhi-Meerut by 40%. These trains are

energy efficient, designed to offer high end comfort and safety

features for premium passenger experience for commuters, including

those who are disabled.

In April, Alstom took another step towards

Autonomous Train Operation by testing Elta Systems Obstacle

Detection System (ODS) with infrastructure manager ProRail and rail

freight operator Lineas in the Netherlands. These tests, which were

conducted in Oosterhout, near the city of Breda in the Netherlands,

have demonstrated that the ODS installed aboard the locomotive is

able to detect obstacles up to 500 metres ahead in all weather and

visibility (day and night) conditions. It can be operated as a

Driver Assistance System, as well as a fully automated system in

conjunction with Alstom’s AutoPilot component. The next steps, to

be finalised this summer, will be to test ODS in combination with

Automatic Train Operation (ATO) to pave the way for GoA42 in

freight.

At the end of May, Alstom signed a strategic

cooperation agreement with PKN ORLEN for the supply of

zero-emission, eco-friendly trains and hydrogen fuel for public

rail transport. The corporation, which is implementing the hydrogen

strategy, announced earlier this year that it will provide the

refuelling infrastructure for trains produced by Alstom. Under the

agreement, Alstom will be responsible for the supply of

zero-emission trains powered by hydrogen fuel cells.

-

One Alstom team Agile, Inclusive and

Responsible

In May 2022, the Group disclosed its enhanced

ESG 2025 targets applicable to the whole new perimeter as well as

its commitment to achieving Net Zero carbon in its value chain by

2050. CO2 emissions targets have been set for 2030 covering

Alstom’s own direct and indirect emissions (scope 1 & 2) as

well as indirect emissions from Products sold (Scope 3). Alstom

plans to further engage with suppliers and customers to make its

solutions Net Zero through their entire life cycle3.

The reinforced strategy reflects the Group’s

commitment to deliver a strong response to increased expectations

on sustainability performance from stakeholders. Its priorities

remain: Enabling decarbonisation of mobility; Caring for our

people; Creating a positive impact on society; and Acting as a

responsible business partner.

As part of its Sustainability strategy, Alstom

published in June its CSR journey brochure, now available on our

website.

***

Financial

trajectory for FY 2022/23

The current economic and political context, becoming more

complex, creates uncertainties in business activities, and Alstom

is no exception. In particular, inflation is expected to weigh to

some extent on FY 2022/23 profitability, and the electronic

components shortages may create tension on the deliveries. The

Group has therefore put in place strong risk mitigation and

cost-out actions to navigate these uncertainties.

As the basis for its 2022/23 outlook, the Group

assumes neither further disruptions to the world economy (including

further inflation or aggravated geopolitical crisis), nor

significant supply-chain shortages, that would materially impact

the Group’s ability to deliver products and services.

- Sales growth supported by solid

order backlog and Book to bill ratio above 1

- Progressive aEBIT margin increase

vs FY 2021/22 through healthy order intake and sound backlog

execution

- Free Cash Flow generation4

***

Mid-term financial trajectory and

objectives

The outlook given in connection with

Alstom in Motion 2025 is confirmed.

- Market share: By 2024/25, Alstom is aiming to grow its market

share by 5 percentage points5 by leveraging its unique strategic

positioning, supported by its enlarged group momentum and its

competitive offering.

- Sales: Between 2020/21 (proforma sales of €14 billion) – and

2024/25, Alstom is aiming at sales Compound Annual Growth Rate over

5% supported by strong market momentum and unparalleled €83.4

billion backlog as of 30 June 2022, securing sales of ca. €35 to 37

billion over the next three years. Rolling stock should grow above

market rate, Services at solid mid-single digit path and Signalling

at high single digit path.

- Profitability: The adjusted EBIT

margin should reach between 8% and 10% from 2024/25 onwards,

benefiting from operational excellence initiatives, the completion

of the challenging projects in backlog while synergies are expected

to deliver €400 million run rate in 2024/25 and €475 - 500 million

annually from 2025/26 onwards.

- Free Cash Flow: from 2024/25

onwards, the conversion from adjusted net profit6 to Free Cash Flow

should be over 80%7 driven by mid-term stability of working

capital, stabilisation of CAPEX to around 2% of sales and cash

focus initiatives while benefiting from volume and synergies take

up.

- Alstom will maintain its

disciplined capital allocation focusing on maintaining its

investment grade profile, while keeping flexibility and ability to

pursue growth opportunities through focused bolt-on M&A.

Alstom’s Baa2 rating with negative outlook was confirmed during Q1

by Moody’s.

- Alstom is committed to delivering

sustained shareholder returns with a dividend pay-out ratio8 of

between 25% and 35%.9

***

Combined

Shareholders’

Meeting

The Combined Shareholders’ Meeting of Alstom was

held on July 12, 2022, under the chairmanship of Mr. Henri

Poupart-Lafarge. The Shareholders’ Meeting was the opportunity to

review the highlights of the fiscal year 2021/22 as well as the

first year of integration of Bombardier Transportation. The

Combined Shareholders’ Meeting approved the dividend related to the

2021/22 fiscal year for an amount of €0.25 gross per share, and has

decided to offer to each shareholder an option, with respect to

100% of the dividends attached to the shares owned by such

shareholder, for payment of such dividend to be made in cash or in

new shares.

The shareholders adopted all the resolutions

approved by the Board of Directors.

The full results of the votes as well as the presentations made

to shareholders will be available on July 20, 2022, on the Alstom

website.

1 Of which 5% organic growth.2 Grade of

Automation 43 Reduction of GHG emissions (Scope 1 et 2) from

Alstom’s sites by 40% by 2030 compared to FY2021/22. Reduction of

GHG emissions (Scope 3) from the use of sold rolling stock products

by 35% per passenger-km and per tonne-km by 2030 compared to

FY2021/22.4 Subject to short term volatility5 In comparison to

Alstom’s market share in 2020/216 Adjusted net profit7 Subject to

short term volatility8 The pay-out ratio is calculated by dividing

the amount of the overall dividend with the “Adjusted net profit

from continuing operations attributable to equity holders of the

parent, Group share” as presented in the management report in the

consolidated financial statements.9 Of adjusted net profit

|

|

About Alstom |

|

|

|

Leading societies to a low carbon future, Alstom develops and

markets mobility solutions that provide sustainable foundations for

the future of transportation. From high-speed trains, metros,

monorails, trams, to turnkey systems, services, infrastructure,

signalling and digital mobility, Alstom offers its diverse

customers the broadest portfolio in the industry. 150,000 vehicles

in commercial service worldwide attest to the company’s proven

expertise in project management, innovation, design and technology.

In 2021, the company was included in the Dow Jones Sustainability

Indices, World and Europe, for the 11th consecutive time.

Headquartered in France and present in 70 countries, Alstom employs

more than 74,000 people. The Group posted revenues of €15.5 billion

for the fiscal year ending on 31 March 2022. Log onto

www.alstom.com for more information |

|

|

|

| |

Contacts |

Press:Samuel MILLER - Tel.: +33 (1) 57 06 67

74Samuel.miller@alstomgroup.com Investor

relations:Martin VAUJOUR – Tel.: +33 (0) 6 88 40 17

57martin.vaujour@alstomgroup.com Estelle MATURELL ANDINO –

Tel.: +33 (0)6 71 37 47 56estelle.maturell@alstomgroup.com

|

|

This press release contains forward-looking

statements which are based on current plans and forecasts of

Alstom’s management. Such forward-looking statements are relevant

to the current scope of activity and are by their nature subject to

a number of important risks and uncertainty factors (such as those

described in the documents filed by Alstom with the French AMF)

that could cause actual results to differ from the plans,

objectives and expectations expressed in such forward-looking

statements. These such forward-looking statements speak only as of

the date on which they are made, and Alstom undertakes no

obligation to update or revise any of them, whether as a result of

new information, future events or otherwise.This press release does

not constitute or form part of a prospectus or any offer or

invitation for the sale or issue of, or any offer or inducement to

purchase or subscribe for, or any solicitation of any offer to

purchase or subscribe for any shares or other securities in the

Company in France, the United Kingdom, the United States or any

other jurisdiction. Any offer of the Company’s securities may only

be made in France pursuant to a prospectus having received the visa

from the AMF or, outside France, pursuant to an offering document

prepared for such purpose. The information does not constitute any

form of commitment on the part of the Company or any other person.

Neither the information nor any other written or oral information

made available to any recipient or its advisers will form the basis

of any contract or commitment whatsoever. In particular, in

furnishing the information, the Company, the Banks, their

affiliates, shareholders, and their respective directors, officers,

advisers, employees or representatives undertake no obligation to

provide the recipient with access to any additional

information.

APPENDIX 1A – GEOGRAPHIC

BREAKDOWN

|

Actual figures |

2021/22 |

% |

2022/23 |

% |

|

(in € million) |

3 months |

Contrib. |

3 months |

Contrib. |

|

Europe |

4,559 |

71% |

3,933 |

70% |

|

Americas |

1,696 |

26% |

405 |

7% |

|

Asia / Pacific |

50 |

1% |

1,235 |

22% |

|

Middle East / Africa |

134 |

2% |

28 |

1% |

|

Orders by destination |

6,439 |

100% |

5,601 |

100% |

|

Actual figures |

2021/22 |

% |

2022/23 |

% |

|

(in € million) |

3 months |

Contrib. |

3 months |

Contrib. |

|

Europe |

2,323 |

63% |

2,412 |

60% |

|

Americas |

648 |

17% |

661 |

17% |

|

Asia / Pacific |

467 |

13% |

574 |

14% |

|

Middle East / Africa |

263 |

7% |

355 |

9% |

|

Sales by destination |

3,701 |

100% |

4,002 |

100% |

APPENDIX 1B – PRODUCT BREAKDOWN

|

Actual figures |

2021/22 |

% |

2022/23 |

% |

|

(in € million) |

3 months |

Contrib. |

3 months |

Contrib. |

|

Rolling stock |

3,362 |

52% |

3,013 |

54% |

|

Services |

1,139 |

18% |

1,844 |

33% |

|

Systems |

1,366 |

21% |

271 |

5% |

|

Signalling |

572 |

9% |

473 |

8% |

|

Orders by product line |

6,439 |

100% |

5,601 |

100% |

|

Actual figures |

2021/22 |

% |

2022/23 |

% |

|

(in € million) |

3 months |

Contrib. |

3 months |

Contrib. |

|

Rolling stock |

2,164 |

58% |

2,175 |

54% |

|

Services |

762 |

21% |

909 |

23% |

|

Systems |

238 |

6% |

388 |

10% |

|

Signalling |

537 |

15% |

530 |

13% |

|

Sales by product line |

3,701 |

100% |

4,002 |

100% |

APPENDIX 2 - NON-GAAP

FINANCIAL INDICATORS DEFINITIONS

This section presents financial indicators used

by the Group that are not defined by accounting standard

setters.

Orders

received

A new order is recognised as an order received

only when the contract creates enforceable obligations between the

Group and its customer. When this condition is met, the order

is recognised at the contract value. If the contract is denominated

in a currency other than the functional currency of the reporting

unit, the Group requires the immediate elimination of currency

exposure using forward currency sales. Orders are then measured

using the spot rate at inception of hedging instruments.

Book-to-Bill

The book-to-bill ratio is the ratio of orders

received to the amount of sales traded for a specific period.

Adjusted EBIT

Adjusted EBIT (“aEBIT”) is the Key Performance

Indicator to present the level of recurring operational

performance. This indicator is also aligned with market practice

and comparable to direct competitors. Starting September 2019,

Alstom has opted for the inclusion of the share in net income of

the equity-accounted investments into the aEBIT when these are

considered to be part of the operating activities of the Group

(because there are significant operational flows and/or common

project execution with these entities). This mainly includes

Chinese joint-ventures, namely CASCO joint-venture for Alstom as

well as, following the integration of Bombardier Transportation,

Alstom Sifang (Qingdao) Transportation Ltd. (former Bombardier

Sifang), Bombardier NUG Propulsion System Co. Ltd. and Changchun

Changke Alstom Railway Vehicles Company Ltd (former Changchun

Bombardier).aEBIT corresponds to Earning Before Interests and Tax

adjusted for the following elements:

- net

restructuring expenses (including rationalization costs)

- tangibles and

intangibles impairement

- capital gains or

loss/revaluation on investments disposals or controls changes of an

entity

- any other

non-recurring items, such as some costs incurred to realize

business combinations and amortization of an asset exclusively

valued in the context of business combination, as well as

litigation costs that have arisen outside the ordinary course of

business

- and including

the share in net income of the operational equity-accounted

investments

A non-recurring item is a “one-off” exceptional

item that is not supposed to occur again in following years and

that is significant.Adjusted EBIT margin corresponds to Adjusted

EBIT expressed as a percentage of sales.

Adjusted net profitFollowing the Bombardier

Transportation, Alstom decided to introduce the “adjusted net

profit” indicator aimed at restating its net profit from continued

operations (Group share) to exclude the impact of amortisation of

assets exclusively valued when determining the purchase price

allocations (“PPA”) in the context of business combination, net of

the corresponding tax effect. This indicator is also aligned with

market practice.

Free cash flow

Free Cash Flow is defined as net cash provided by

operating activities minus capital expenditures including

capitalised development costs, net of proceeds from disposals of

tangible and intangible assets. Free Cash Flow does not include any

proceeds from disposals of activity. The most directly comparable

financial measure to Free Cash Flow calculated and presented in

accordance with IFRS is net cash provided by operating

activities.

Net cash/(debt)

The net cash/(debt) is defined as cash and cash

equivalents, marketable securities and other current financial

asset, less borrowings.

Pay-out ratio

The pay-out ratio is calculated by dividing the

amount of the overall dividend with the “Adjusted Net profit from

continuing operations attributable to equity holders of the parent,

Group share” as presented in the management report in the

consolidated financial statements.

Organic basis

Figures given on an organic basis eliminate the

impact of changes in scope of consolidation and changes resulting

from the translation of the accounts into Euro following the

variation of foreign currencies against the Euro. The Group uses

figures prepared on an organic basis both for internal analysis and

for external communication, as it believes they provide means to

analyse and explain variations from one period to another. However,

these figures are not measurements of performance under IFRS.

| |

Q1 2021/22 |

|

Q1 2022/23 |

|

|

|

|

(in € million) |

Actual figures |

Exchange rate |

Comparable Figures |

|

Actualfigures |

|

% Var Act. |

% Var Org. |

|

Orders |

6,439 |

225 |

6,664 |

|

5,601 |

|

(13)% |

(16)% |

|

Sales |

3,701 |

123 |

3,824 |

|

4,002 |

|

8% |

5% |

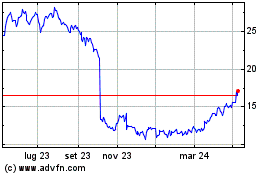

Grafico Azioni Alstom (EU:ALO)

Storico

Da Mar 2024 a Apr 2024

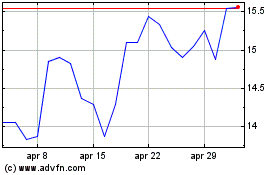

Grafico Azioni Alstom (EU:ALO)

Storico

Da Apr 2023 a Apr 2024