Elis: H1 2024 results

Very solid H1 2024 results

Further improvement in industrial and

commercial performance

Upwards revision of full-year 2024

organic growth and EBITDA margin targets

Solid financial performance: strong

revenue growth and improvement in profitability

- Revenue of

€2,246.7m (+6.9% of which +5.5% organic)

- Adjusted EBITDA

margin up +120bps at 34.5% of revenue

- Adjusted EBIT

margin up +20bps at 15.3% of revenue

- Net income down

-14.1% at €119.1m (in line with the expected half-yearly phasing

that should result in a strong increase in the full-year 2024)

- Headline net income

up +0.9% at €208.7m

- Headline net income

per share up +1.6% at €0.83 (on a fully diluted basis)

- Free cash flow

(after lease payments) at €55.5m, up +€38,6m vs. last year

- Financial leverage

ratio at 2,06x as of June 30, 2024

Revenue up +6.9% in H1 2024, of which

+5.5% on an organic basis: numerous commercial successes,

improvement of customer retention rate and good pricing

dynamic

- Commercial momentum

is well-oriented with the signature of new contracts, driven by

further outsourcing development and growing client needs in

hygiene, traceability and sustainable products and services

- Customer retention

rate back to its normative level at c. 94%, reflecting the quality

of the Group’s commercial relationships with its

clients

- In Hospitality,

Southern Europe continues to be very dynamic; in France and in the

UK, poor weather conditions and general elections in both countries

penalized activity in the 2nd quarter

- Pricing dynamic

remains favorable in all our markets, driven by the adjustments

implemented to offset cost base inflation

EBITDA margin up de +120bps, reflecting

the Group’s industrial excellence

- Further

productivity gains in all our geographies, driven by the

optimization of industrial processes and logistics as well as

better energy purchasing conditions

- Outstanding

progress in Germany, where various operational changes are bearing

fruit

Further development in M&A strategy

with the acquisitions of Moderna and Wonway

- With the

acquisition of Moderna in the Netherlands, consolidated since March

1, Elis is expanding its offer to the flat linen market and

strengthening its network density in the country

- On July 1, Elis

announced its first operation in Asia with the acquisition of

Wonway, operating in the buoyant Cleanroom market in Malaysia

Elis continues its progress in terms of

CSR commitment

- Significant

improvement of Elis’ rating by Moody’s Analytics in H1 2024

- Accident frequency

rate down c. -14% (over 12 rolling months ending in May 2024)

Update of full-year 2024 profitability

objectives

- Full-year organic

growth now expected between +5.2% and +5.5% (previously expected at

c. +5%)

- Adjusted EBITDA

margin now expected between 35.2% and 35.5% (previously expected

close to 35%)

- Adjusted EBIT

margin still expected stable yoy at c. 16%

- Headline net income

per share still expected above €1.75 on a fully-diluted basis

- Free cash flow

still expected c. €340m

- Financial leverage

ratio as of December 31, 2024 still expected down -0.2x compared to

December 31, 2023

Saint-Cloud, 24 July 2024 –

Elis, the global leader in circular services at work, today

announces its half-year 2024 financial results. The accounts have

been approved by the Management Board and examined by the

Supervisory Board today. They have been subject to a limit review

by the Company’s auditors.

Commenting on the announcement, Xavier

Martiré, CEO of Elis, said:

« Our H1 2024 results are very satisfactory.

Elis recorded revenue growth of +6.9% at 2,247 million euros, with

organic growth of +5.5%, combined with significant improvement in

EBITDA margin and free cash-flow.

In H1, the commercial dynamic remained

strong. Our offers, which address the increasing needs of

our clients for hygiene, traceability and for a more secure supply

chain, continue to be a resounding success; we recorded many new

contract wins in all our markets, notably in workwear. In addition,

revenue continues to benefit from pricing adjustments implemented

to offset cost base inflation; in this context, we note with

satisfaction the return to normal of the customer retention rate,

which demonstrates improvements in the Group’s quality of service

and the good commercial relationships it enjoys with its

clients.

In Hospitality, activity was disappointing

in Q2: poor weather conditions and the general elections in France

and in the UK seem to have limited travel and tourism. In addition,

the Parisian hospitality market was penalized by the preparation of

the Olympics, with many business events postponed to Q3.

EBITDA margin in the first half was strongly

up by +120bps at 34.5%, reflecting new productivity gains, and

better purchasing conditions for energy. This is particularly the

case in Germany, where the implementation of various operational

measures is bearing fruit.

In the first half of 2024, M&A activity

has picked up after a subdued year in 2023. At end-February, we

closed the acquisition of Moderna in the Netherlands, which enables

the Group to strengthen its offer in workwear and to address the

still very fragmented Dutch flat linen market. On July 1, 2024,

Elis also announced the acquisition of Wonway in Malaysia, to serve

our clients in the fast-growing cleanroom market.

These good first-half results enable us to

revise upwards our full-year 2024 organic growth and EBITDA margin

objectives and we confidently confirm all the other objectives

communicated last March.

The great resilience that Elis demonstrated

through the various recent crises, its operational know-how, its

strengthened organic growth and its model based on the principles

of the circular economy are major assets that will enable the Group

to continue to assert its leadership in all the countries in which

it operates.”

I. 2024 half-year results

H1 2024 revenue

| In millions of

euros |

Q1 |

2024

Q2 |

H1 |

Q1 |

2023

Q2 |

H1 |

Q1 |

Var.

Q2 |

H1 |

| France |

316.6 |

346.6 |

663.2 |

303.5 |

336.8 |

640.3 |

+4.3% |

+2.9% |

+3.6% |

| Central Europe |

275.2 |

281.6 |

556.8 |

245.6 |

251.8 |

497.3 |

+12.1% |

+11.8% |

+12.0% |

| Scandinavia &

East. Eur. |

157.0 |

152.4 |

309.4 |

153.3 |

146.8 |

300.1 |

+2.4% |

+3.8% |

+3.1% |

| UK &

Ireland |

132.5 |

143.4 |

275.9 |

121.9 |

135.5 |

257.3 |

+8.7% |

+5.8% |

+7.2% |

| Latin America |

114.5 |

117.8 |

232.3 |

102.4 |

111.3 |

213.7 |

+11.8% |

+5.8% |

+8.7% |

| Southern Europe |

90.2 |

105.4 |

195.5 |

81.3 |

98.7 |

179.9 |

+11.0% |

+6.8% |

+8.7% |

| Others |

6.4 |

7.1 |

13.5 |

5.5 |

7.1 |

12.6 |

+17.7% |

-0.2% |

+7.6% |

| Total |

1,092.4 |

1,154.2 |

2,246.7 |

1,013.4 |

1,087.9 |

2,101.3 |

+7.8% |

+6.1% |

+6.9% |

« Others » includes Manufacturing Entities

and Holdings.

Percentage change calculations are based on actual

figures.

H1 2024 revenue breakdown

| In millions of

euros |

H1 2024 |

H1 2023 |

Organic growth |

External growth |

FX |

Reported growth |

| France |

663.2 |

640.3 |

+3.6% |

- |

- |

+3.6% |

| Central Europe |

556.8 |

497.3 |

+7.7% |

+3.6% |

+0.7% |

+12.0% |

| Scandinavia &

East. Eur. |

309.4 |

300.1 |

+4.2% |

- |

-1.1% |

+3.1% |

| UK &

Ireland |

275.9 |

257.3 |

+5.1% |

- |

+2.1% |

+7.2% |

| Latin America |

232.3 |

213.7 |

+7.5% |

- |

+1.2% |

+8.7% |

| Southern

Europe |

195.5 |

179.9 |

+6.6% |

+2.1% |

- |

+8.7% |

| Others |

13.5 |

12.6 |

+5.9% |

- |

+1.7% |

+7.6% |

| Total |

2,246.7 |

2,101.3 |

+5.5% |

+1.0% |

+0.4% |

+6.9% |

« Others » includes Manufacturing Entities

and Holdings.

Percentage change calculations are based on actual

figures.

H1 2024 organic revenue growth

| |

Q1 2024

organic growth |

Q2 2024

organic growth |

H1 2024

organic growth |

| France |

+4.3% |

+2.9% |

+3.6% |

| Central Europe |

+9.0% |

+6.4% |

+7.7% |

| Scandinavia &

East. Eur. |

+4.2% |

+4.1% |

+4.2% |

| UK &

Ireland |

+6.1% |

+4.1% |

+5.1% |

| Latin America |

+7.5% |

+7.6% |

+7.5% |

| Southern

Europe |

+8.9% |

+4.8% |

+6.6% |

| Others |

+15.4% |

-1.4% |

+5.9% |

| Total |

+6.4% |

+4.6% |

+5.5% |

« Others » includes Manufacturing Entities

and Holdings.

Percentage change calculations are based on actual

figures.

Q2 2024 revenue

| In millions of

euros |

Q2 2024 |

Q2 2023 |

Organic growth |

External growth |

FX |

Reported growth |

| France |

346.6 |

336.8 |

+2.9% |

- |

- |

+2.9% |

| Centrale

Europe |

281.6 |

251.8 |

+6.4% |

+5.2% |

+0.3% |

+11.8% |

| Scandin. &

East. Eur. |

152.4 |

146.8 |

+4.1% |

- |

-0.3% |

+3.8% |

| UK &

Ireland |

143.4 |

135.5 |

+4.1% |

- |

+1.7% |

+5.8% |

| Latin America |

117.8 |

111.3 |

+7.6% |

- |

-1.8% |

+5.8% |

| Southern

Europe |

105.4 |

98.7 |

+4.8% |

+2.0% |

- |

+6.8% |

| Others |

7.1 |

7.1 |

-1.4% |

- |

+1.2% |

-0.2% |

| Total |

1,154.2 |

1,087.9 |

+4.6% |

+1.4% |

+0.1% |

+6.1% |

« Others » includes Manufacturing Entities

and Holdings.

Percentage change calculations are based on actual

figures.

H1 2024 adjusted EBITDA

| In millions of

euros |

H1 2024

reported |

H1 2023

restated1 |

Var.

H1 2024 / H1 2023 |

| France |

271.4 |

250.4 |

+8.4% |

| As of % of

revenue |

40.9% |

39.0% |

+190bps |

| Central Europe |

175.0 |

147.3 |

+18.8% |

| As of % of

revenue |

31.3% |

29.5% |

+180bps |

| Scandinavia &

East. Eur. |

108.1 |

106.5 |

+1.6% |

| As of % of

revenue |

34.9% |

35.5% |

-50bps |

| UK &

Ireland |

85.7 |

76.5 |

+12.0% |

| As of % of

revenue |

31.1% |

29.7% |

+130bps |

| Latin America |

80.5 |

73.6 |

+9.5% |

| As of % of

revenue |

34.7% |

34.4% |

+20bps |

| Southern

Europe |

62.5 |

53.0 |

+17.9% |

| As of % of

revenue |

31.9% |

29.4% |

+250bps |

| Others |

(9.0) |

(9.1) |

+1.2% |

| Total |

774.3 |

698.1 |

+10.9% |

| As of % of

revenue |

34.5% |

33.2% |

+120bps |

1 : Please refer to the

« Restated income statement for prior financial years »

section of this release.

Margin rates and percentage change calculations are based on

actual figures.

« Others » includes Manufacturing Entities and

Holdings.

France

H1 2024 revenue was up +3.6% (entirely organic),

driven by commercial momentum in workwear (Industry, Trade &

services). Pricing dynamic was good and enabled us to offset cost

inflation. In Hospitality, poor weather conditions in May and June,

combined with the disturbances linked to the Olympics preparations

and the general elections, penalized Q2 activity. However, our

clients remain confident: September and October should benefit from

the postponement of business events initially scheduled before

summer.

Productivity gains in our plants, combined with

improved purchasing conditions for energy, led to an adjusted

EBITDA margin improvement of +190bps in the first half of 2024, to

40.9%.

Central Europe

The region’s revenue was up +12.0% in H1 2024

(+7.7% on an organic basis). The acquisition of Moderna in the

Netherlands, consolidated since 1 March 2024, contributed c. +3.6%

to region’s growth in the half-year. Germany delivered organic

growth above +8%, driven by good commercial momentum in workwear

and a good pricing dynamic. Poland and the Netherlands are

well-oriented as well.

H1 2024 adjusted EBITDA margin was up +180bps

compared to H1 last year, at 31.3%, driven by better purchasing

conditions for energy and significant productivity gains, notably

in Germany where the measures implemented, including a management

reorganization, are bearing fruit.

Scandinavia & Eastern Europe

The region’s revenue was up +3.1% in H1 2024

(+4.2% on an organic basis), with a negative FX impact of

-1.1%. Organic growth was driven by the performance of the Baltics,

Sweden and Norway, where the outsourcing trend remains strong. In

Denmark, the Group’s strict pricing discipline led to limited

volume losses.

H1 2024 adjusted EBITDA margin was down -50bps,

at 34.9% compared to H1 2023. Despite a strong position on these

markets, pricing negotiations are sometimes tough, notably with

public sector clients.

UK & Ireland

The region’s revenue was up +7.2% in H1 2024

(+5.1% on an organic basis), with a positive FX impact of +2.1%.

The UK continued its growth in all markets, notably in Healthcare

and workwear (standard and cleanroom). We also recorded an

improvement in the majority of our client satisfaction KPIs and

quality of service. In Hospitality, poor weather conditions and the

general elections penalized Q2 activity.

H1 2024 adjusted EBITDA margin was up +130bps

compared to H1 2023, at 31.1%, driven by further improvements in

our industrial processes and logistics and by better purchasing

conditions for energy.

Latin America

The region’s revenue was up +8.7% in H1 2024

(+7.5% on an organic basis), with a positive FX impact of +1.2%.

Inflation is below +5%; our pricing adjustments in the region are

thus comparable to those implemented in Europe. Commercial momentum

was good, notably in Healthcare. Mexico and Colombia both recorded

organic growth of c. +10%.

H1 2024 adjusted EBITDA margin was up +20bps

compared to H1 2023, at 34.7%, driven by productivity gains.

Southern Europe

The region’s revenue was up +8.7% in H1 2024

(+6.6% on an organic basis), driven by dynamism in Hospitality. In

Industry, Trade & Services, further outsourcing continued, and

we recorded many new contract signings. All the countries in the

region were well-oriented, notably Portugal where organic growth

was close to +9%. Finally, the 2023 acquisitions in Italy and Spain

in the Pest Control market contributed for +2.1% to half-year

growth.

In H1 2024, better purchasing conditions for

energy combined with further productivity gains led to an

improvement of +250bps in adjusted EBITDA margin, to 31.9%.

Adjusted EBITDA to net income

| In millions of

euros |

H1 2024

reported |

H1 2023

restated1 |

Var. |

| Adjusted EBITDA |

774.3 |

698.1 |

+10.9% |

| As of % of

revenue |

34.5% |

33.2% |

+120bps |

| D&A |

(430.6) |

(381.7) |

|

| Adjusted EBIT |

343.6 |

316.4 |

+8.6% |

| As of % of

revenue |

15.3% |

15.1% |

+20bps |

| Miscellaneous

financial items |

(1.0) |

(0.9) |

|

| Non-current

operating income and expenses |

(40.8) |

(21.5) |

|

| IFRS 2 expense |

(12.5) |

(10.3) |

|

| Amortization of

intangible assets recognizing in a business combination |

(41.8) |

(41.6) |

|

| Operating

income |

247.6 |

242.2 |

+2.3% |

| Net financial income

(expense) |

(66.5) |

(56.9) |

|

| Income tax |

(62.0) |

(46.6) |

|

| Income from

continuing operations |

119.1 |

138.6 |

-14.1% |

|

Net income |

119.1 |

138.6 |

-14.1% |

1 : Please refer to the

« Restated income statement for prior financial years »

section of this release.

Margin rates and percentage change calculations are based on

actual figures

Adjusted EBIT

H1 2024 adjusted EBIT was up +20bps as a

percentage of revenue. Depreciations were back to a normative level

at 19.2% vs. 18.2% in H1 2023 (amortization in 2023 was below

normative level due to the lower linen investments during the

pandemic).

Operating income

The main items between adjusted EBIT and

Operating income are as follows:

- Other operating

income and expenses strongly increased due to the reevaluation of

the earn-out of the acquisition in Mexico in 2022: the financial

outlook of the acquired group has been revised upwards once again

given its performance.

- Expenses

related to share-based payments correspond to the requirements of

the IFRS 2 accounting standard. They increased compared to H1 2023,

at 12.5 million euros as a result of the share price increase over

the last 3 years.

-

Amortization of intangible assets linked with past acquisitions are

relatively stable as it mostly results from the acquisition of

Berendsen in 2017.

Net financial result

Net financial expense was €66.5m in H1 2024. It

is c. €9.6m higher compared to H1 2023, mainly due to the increase

of interest charges of recent refinancings.

Income tax

In H1 2024, income tax was at €62.0m, up €15.4m

compared to H1 2023. Indeed, the 2023 basis was reduced due to the

use of tax loss carryforwards in Spain and in the UK.

Net income

Net income was down -14.1%, at €119.1m in H1

2024 compared to €138.6m in H1 2023. The strong increase in EBITDA

(+€76m) was offset by the normalization of amortization (-€49m),

the increase of financial expenses (-€10m), earn-out payments

(-€19m) and tax base effect (-€16m). These effects should be erased

over the year; we anticipate a strong increase in net income in

2024.

Net income to headline net income

| In millions of

euros |

H1 2024 reported |

H1 2023 restated1 |

Var. |

| Net income |

119.1 |

138.6 |

-14.1% |

| Amortization of

intangible assets recognized in a business combination |

41.8 |

41.3 |

|

| IFRS 2 expense |

12.5 |

10.3 |

|

| Accretion expense

resulting from the Mexican acquisition earn-outs |

7.8 |

5.1 |

|

| Non-current

operating income and expenses |

40.8 |

21.5 |

|

| Tax effect |

(13.2) |

(10.0) |

|

| Headline net

income |

208.7 |

206.8 |

+0.9% |

| Non-controlling

interests |

(0.0) |

(0.0) |

|

| Headline net income

attributable to owners of the parent (A) |

208.7 |

206.8 |

+0.9% |

| Convertible related

interests (B) |

6.5 |

8.1 |

|

| Headline net income

attributable to owners of the parent, adjusted for the dilution

effect |

215.3 |

215.0 |

+0.1% |

| Share count - basis

(C) |

235.8 |

232.6 |

|

| Share count – fully

diluted (D) |

259.5 |

263.4 |

|

| Headline net income

per share (in euros): |

|

|

|

| - basic,

attributable to owners of the parent = A/C |

0.89 |

0.89 |

-0.4% |

| - diluted,

attributable to owners of the parent = (A-B)/C |

0.83 |

0.82 |

+1.6% |

1 : Please

refer to the “Restated income statement for prior financial years”

section of this release.

Headline net income was €208.7m in H1 2024, up

+0.9% compared to H1 2023. Headline net income per share was up

+1.6% at €0.83 (on a fully-diluted basis).

Cash flow statement

| In millions of

euros |

H1 2024

reported |

H1 2023

restated1 |

| Adjusted

EBITDA |

774.3 |

698.1 |

| Adjustment of

(gains) and losses on disposal or fixed assets and change in

provisions |

2.0 |

1.2 |

| Monetary

non-recurring items including in Operating income and expense |

(11.5) |

(6.6) |

| IFRS 2 expense

(social contributions) |

(1.7) |

(1.8) |

| Other |

(1.0) |

(0.9) |

| Cash flow before

net financial costs and tax |

762.1 |

689.9 |

| Net capex |

(430.5) |

(414.1) |

| Change in working

capital requirement |

(77.5) |

(85.9) |

| Net interest paid

(including interest on lease liabilities) |

(71.6) |

(63.7) |

| Tax paid |

(64.6) |

(56.5) |

| Lease liabilities

payments – principal |

(62.6) |

(52.9) |

| Free cash flow |

55.5 |

16.9 |

| Acquisitions of

subsidiaries, net of cash acquired |

(134.0) |

(61.5) |

| Other change

arising from subsidiaries (gain or loss of

control) |

(18.8) |

(1.8) |

| Other flows related

to financial operations |

3.8 |

(4.0) |

| Dividends paid |

(101.3) |

(61.7) |

| Equity increase,

treasury shares |

(2.1) |

0.5 |

| Other |

(9.6) |

2.2 |

| Net financial debt

increase |

(206.5) |

(109.5) |

| |

30 June 2024 |

31 Dec 2023 |

| Net financial

debt |

3,231.9 |

3,025.4 |

1 : A

reconciliation is provided in the “Restated income statement for

prior financial years” section of this release.

Net capex

In H1 2024, the Group’s net capex was up c.

+€16m compared to H1 2023. As a percentage of revenue, this ratio

stood at 19.2% (vs. 19.7% as of 30 June 2023), in line with the

expected ratio for the full-year.

Change in working capital requirements

In H1 2024, calendar effect (Saturday 29 June,

Sunday 30 June) had a strong negative impact on the change in WCR,

at c. -€77m. The Group’s average payment time remained very good,

even if it slightly deteriorated at 30 June 2024, at 55 days vs. 54

days at 30 June 2023.

Free cash-flow

In H1 2024, the Group delivered free cash flow

(after lease payments) of €55.5m, up +€38.6m compared to H1 2023.

This amount is in line with the full-year objectives, as the

2nd half historically represents nearly all yearly free

cash flow.

Net financial debt and financing

The Group’s net financial debt at June 30, 2024

stood at €3,231.9m compared to €3,025.4m at December 31, 2023 and

€3,275.4m at June 30, 2023. The financial leverage ratio was 2.06x

at June 30, 2024 compared to 2.04x at December 31, 2023 and 2.36x

at June 30, 2023.

On March 14, 2024, Elis issued a €400m aggregate

principal amount of senior unsecured notes under its EMTN (Euro

Medium Term Notes) Program. The maturity of the notes is 6 years

and the notes carry a fixed annual coupon of 3.75%.

Payout for the 2023 financial year

The General Shareholders Meeting held on May 23,

2024 approved the distribution of a dividend of €0.43 per share in

cash for the financial year 2023. The amount was paid on May 29,

2024 for a total amount of €101m.

II. Upwards revision of full-year 2024 organic

growth and EBITDA margin targets

- Full-year organic

growth now expected between +5.2% and +5.5% (previously expected at

c. +5%)

- Adjusted EBITDA

margin now expected between 35.2% and 35.5% (previously expected

close to 35%)

- Adjusted EBIT

margin still expected stable yoy at c. 16%

- Headline net income

per share still expected above €1.75 on a fully diluted basis

- Free cash flow

still expected c. €340m

- Financial leverage

ratio as of December 31, 2024 still expected down -0.2x compared to

December 31, 2023

III. CSR

The circular economy at the heart of Elis’ business

model

Elis offers its clients products that are

maintained, repaired, reused, and reemployed to optimize their

usage and lifespan. The Group therefore selects its textile

products based on sustainability criteria, to ensure frequent

washing, and also operates repair workshops. Elis’ conviction is

that the circular economy model, which notably aims at reducing

consumption of natural resources by optimizing the lifespan of

products, is a sustainable solution to address today’s

environmental challenges.

The services offered by Elis represent a

sustainable alternative to the simple purchase or use of products

or to single-use disposable, products.

Moreover, these alternatives to a linear

approach to consumption allow our clients to avoid CO2 emissions

and thus contribute to the reduction of their own emissions.

The Ellen MacArthur Foundation states that the

circular economy can significantly contribute to reaching Net Zero

and that nearly 9 billion tons of CO2eq (i.e. 20% of world

emissions) could be reduced thanks to the transition of just some

key industries from the current model towards a circular

economy.

Non-financial rating

|

Rating agencies |

MSCI |

Ecovadis |

CDP |

Sustainalytics |

Ethifinance ESG Rating |

Moody’s Analytics |

|

Scores |

A |

75/100

Gold |

A-

Climate change |

Low risk |

75/100

Gold |

61/100 |

The Group’s CSR performance has been recognized

by non-financial rating agencies:

- In 2023, the MSCI

rating agency improved Elis’ ESG rating to A from BBB. It rewards

the Group’s CSR commitments and its continuous improvements,

- In 2023, Elis

obtained a Gold medal for the EcoVadis questionnaire, maintaining

its score of 75/100. This award confirms Elis’ commitment to its

clients, partners and employees, and places the Group within the

best-assessed companies in its sector. Elis’ CSR strategy fulfills

EcoVadis’ assessment criteria, which are based on international

standards and 4 CSR themes (Environment, Social & Human Rights,

Ethics and Sustainable Purchasing). This medal places Elis within

the top 5% of the c. 100,000 companies assessed by EcoVadis,

- In its last

assessment, the Group was also rated A by the CDP (Carbon

Disclosure Project), a non-profit organization which performs

independent assessments on the basis of information provided by

companies on their strategy, performance and commitment of

stakeholders on climate goals. This assessment places the Group in

the “Leadership” category and underlines its commitment and action

in the area of climate change,

- Sustainalytics

maintained the Group rating as “low risk” concerning CSR,

- Elis improved its

score with rating agency Ethifinance ESG Rating (ex-Gaia), to 75

from 73 previously, maintaining its “Gold” level,

- Finally, Moody’s

Analytics significantly upgraded Elis’ score, from 50/100 to

61/100.

Our climate commitment: ambitious 2030 climate

targets

On September 4, 2023, Elis unveiled its climate

roadmap and related 2030 targets, underscoring its commitment to

contributing to a low-carbon society.

Elis’ ambition is to achieve the following

targets by 2030:

- Reduce absolute

scopes 1 and 2 GHG emissions by -47.5% by 2030 from a 2019 base

year 1;

- Reduce absolute

scope 3 GHG emissions from purchased goods and services, fuel and

energy related activities, upstream transportation and

distribution, employee commuting, and end-of-life treatment of sold

products by -28% within the same timeframe.

These targets have been approved by the Science

Based Targets initiative (SBTi), an international reference and a

partnership between the United Nations Global Compact, the World

Resources Institute (WRI), the Carbon Disclosure Project (CDP) and

the World Wildlife Fund for Nature (WWF). They are fully in line

with the objectives of the 2015 Paris Climate Agreements to

contribute to restrict global warming to less than 1.5°C compared

to pre-industrial levels on scopes 1 and 2, and well below 2°C on

scope 3.

These climate targets mark a new step in Elis’

sustainability strategy and climate actions. The Group has worked

for many years to reduce its energy consumption and CO2eq

emissions.

In December 2023, these 2030 targets have been

integrated to the calculation of the margin of the Group’s

900-million-euro Sustainability-Linked Revolving Credit

Facility.

Our CSR performance

In H1 2024, the Group recorded a noticeable

improvement in its performance in terms of health and safety at

work, with a c. -14% decrease of the accident frequency rate (in

May 2024 yoy). This reduction results from heightened actions plans

implemented by the Group and from the strengthening of the health

and safety culture overall in its operations.

The deployment of the climate plan continues.

The new collections of more-sustainable products (workwear or

hygiene and well-being solutions) are being rolled out in all

geographies of the Group. Many actions were also launched in

countries to contribute to the reuse of linen or to the reduction

of single-use plastics.

Close to 75 electric heavy trucks and close to

45 exclusive biofuel vehicles will be delivered in France before

year-end. The energy performance of European laundries continues

its improvement with an improvement of close to +1.5% to date

compared to the same period in 2023.

IV. Other information

Restated income statement for prior financial

years

The table below presents the adjustments made

retrospectively linked to business combination (IFRS 3) on the

previously-published income statement as of June 30, 2023.

| In millions of

euros |

H1 2023 reported |

IFRS 3 |

H1 2023

restated |

| Revenue |

2,101.3 |

- |

2,101.3 |

| Adjusted

EBITDA |

698.1 |

- |

698.1 |

| D&A |

(381.7) |

- |

(381.7) |

| Adjusted EBIT |

316.4 |

- |

316.4 |

| Miscellaneous

financial items |

(0.9) |

- |

(0.9) |

| Non-current

operating income and expenses |

(21.5) |

- |

(21.5) |

| IFRS 2 expense |

(10.3) |

- |

(10.3) |

| Amortization of

intangible assets recognized in a business combination |

(41.3) |

(0.3) |

(41.6) |

| Operating

income |

242.4 |

(0.3) |

242.2 |

| Net financial

income (expense) |

(56.9) |

- |

(56.9) |

| Income tax |

(46.7) |

0.1 |

(46.6) |

| Income from

continuing activity |

138.8 |

(0.2) |

138.6 |

| Net income |

138.8 |

(0.2) |

138.6 |

Financial definitions

- Organic growth in

the Group’s revenue is calculated excluding (i) the impacts of

changes in the scope of consolidation of “major acquisitions” and

“major disposals” (as defined in the Document de Base) in each of

the periods under comparison, as well as (ii) the impact of

exchange rate fluctuations.

- Adjusted EBITDA is

defined as adjusted EBIT before depreciation and amortization net

of the portion of grants transferred to income.

- Adjusted EBITDA

margin is defined as adjusted EBITDA divided by revenue.

- Adjusted EBIT is

defined as net income (loss) before net financial income (loss),

income tax, share in net income of equity accounted companies,

amortization of intangible assets recognized in a business

combination, goodwill impairment losses, other operating income and

expense, miscellaneous financial items (bank fees recognized in

operating income) and IFRS 2 expense (share-based payments).

- Adjusted EBIT

margin is defined as adjusted EBIT divided by revenue.

- Headline net result

corresponds to net income or loss excluding extraordinary items

which, due to their type and unusual nature, cannot be considered

as intrinsic to the Group’s current performance.

- Free cash flow is

defined as adjusted EBITDA less non-cash-items and changes in

working capital. purchases of linen, capital expenditures (net of

disposals), tax paid, financial interest paid and lease liabilities

payments.

- The financial

leverage ratio is the leverage ratio calculated for the purpose of

the financial covenant included in the banking agreement signed in

2021: Leverage ratio is equal to Net financial debt / adjusted

EBITDA, pro forma of acquisitions finalized during the last 12

months, and after synergies.

Consolidated financial statements

Condensed interim consolidated financial statements for H1 2024

will be available at this address:

https://fr.elis.com/en/group/investor-relations/regulated-information

Geographical breakdown

- France

- Central Europe:

Germany, Austria, Belgium, Hungary, Luxembourg, Netherlands,

Poland, Czech Republic, Slovakia, Switzerland

- Scandinavia &

Eastern Europe: Denmark, Estonia, Finland, Latvia, Lithuania,

Norway, Russia, Sweden

- UK &

Ireland

- Latin America:

Brazil, Chile, Colombia, Mexico

- Southern Europe:

Spain & Andorra, Italy, Portugal

Presentation of Elis’ 2024 half-year results (in

English)

Date: 24 July 2024 at 5:00pm GMT (6:00pm CET)

Speakers: Xavier Martiré, CEO and Louis Guyot, CFO

Webcast link:

https://edge.media-server.com/mmc/p/ibx7bux4

Conference call & Q&A session link:

https://register.vevent.com/register/BI8c54a52a81b441aaa6a4006a1b3ded12

An investor presentation will be available at 4:50pm GMT (5:50pm

CET) at this address:

https://fr.elis.com/en/group/investor-relations/regulated-information

Disclaimer

This press release may include data information

and statements relating to estimates, future events, trends, plans,

expectations, objectives, outlook and other forward-looking

statements relating to the Group’s future business, financial

condition, results of operations, performance and strategy as they

relate to climate objectives, financial targets and other goals set

forth therein. Forward-looking statements are not statements of

historical fact and may contain the terms “may”, “will”, “should”,

“continue”, “aims”, “estimates”, “projects”, “believes”, “intends”,

“expects”, “plans”, “seeks” or “anticipates” or words of similar

meaning. In addition, the term “ambition” expresses an outcome

desired by the Group, it being specified that the means to be

deployed do not depend solely on the Group. Such forward-looking

information and statements have not been audited by the statutory

auditors. They are based on data, assumptions and estimates that

the Group considers as reasonable as of the date of this press

release and, by nature, involve known and unknown risks and

uncertainties. These data, assumptions and estimates may change or

be adjusted as a result of uncertainties, many of which are outside

the control of the Group, relating particularly to the economic,

financial, competitive, regulatory or tax environment or as a

result of other factors of which the Group is not aware on the date

of this press release. In addition, the materialization of certain

risks, especially those described in chapter 4 “Risk management and

internal control” of the Universal Registration Document for the

financial year ended December 31, 2023, which is available on

Elis’s website (www.elis.com), may have an impact on the Group’s

business, financial condition, results of operations, performance,

and strategy, notably with respect to these climate-related

objectives, financial objectives or other objectives included in

this press release. Therefore, the actual achievement of

climate-related objectives, financial targets and other goals set

forth in this press release may prove to be inaccurate in the

future or may differ materially from those expressed or implied in

such forward-looking statements. The Group makes no representation

and gives no warranty regarding the achievement of any climate

objectives, targets and other goals set forth in this press

release. Therefore, undue reliance should not be placed on such

information and statements.

This press release and the information included

therein were prepared on the basis of data made available to the

Group as of the date of this press release. Unless stated otherwise

in this press release, this press release and the information

included therein are accurate only as of such date. The Group

assumes no obligation to update or revise any of these

forward-looking statements, whether to reflect new information,

future events or circumstances or otherwise, except as required by

applicable laws and regulations.

This press release includes certain

non-financial metrics, as well as other non-financial data, all of

which are subject to measurement uncertainties resulting from

limitations inherent in the nature and the methods used to

determine them. These data generally have no standardized meaning

and may not be comparable to similarly labelled measures used by

other companies. The Group reserves the right to amend, adjust

and/or restate the data included in this press release, from time

to time, without notice and without explanation. The data included

in this press release may be further updated, amended, revised or

discontinued in subsequent publications, presentations and/or press

releases of Elis, depending on, among other things, the

availability, fairness, adequacy, accuracy, reasonableness or

completeness of the information, or changes in applicable

circumstances, including changes in applicable laws and

regulations.

This press release may include or refer to

information obtained from or established on the basis of various

third-party sources. Such information may not have been reviewed,

and/or independently verified, by the Group and the Group does not

approve or endorse such information by including them or referring

to them. Accordingly, the Group does not guarantee the fairness,

adequacy, accuracy, reasonableness or completeness of such

information, and no representation, warranty or undertaking,

express or implied, is made or responsibility or liability is

accepted by the Group as to the fairness, adequacy, accuracy,

reasonableness or completeness of such information, and the Group

shall not be obliged to update or revise such information.

The climate-related data and the climate-related

objectives included in this press release were neither audited nor

subject to a limited review by the statutory auditors of the

Group.

Next information

Q3 2024 revenue: 30 October 2024 (after

market)

V. Contacts

Nicolas Buron

Director of Investor Relations, Financing and Treasury

Phone: + 33 (0)1 75 49 98 30 - nicolas.buron@elis.com

Charline Lefaucheux

Investor Relations

Phone: + 33 (0)1 75 49 98 15 – charline.lefaucheux@elis.com

Excerpt from condensed consolidated financial

statements

Consolidated income statement

| (In millions of

euros) |

06/30/2024 |

06/30/2023 |

|

(Unaudited) |

|

restated* |

|

Revenue |

2,246.7 |

2,101.3 |

| Cost of linen,

equipment and other consumables |

(356.7) |

(308.0) |

| Processing

costs |

(834.0) |

(809.3) |

| Distribution

costs |

(333.7) |

(307.4) |

|

Gross margin |

722.3 |

676.6 |

| Selling, general

and administrative expenses |

(386.4) |

(370.7) |

| Net impairment on

trade and other receivables |

(5.6) |

(0.7) |

| Amortization of

intangible assets recognized in a business combination |

(41.8) |

(41.6) |

| Other operating

income and expenses |

(40.8) |

(21.5) |

|

Operating income |

247.6 |

242.2 |

| Net financial

income (expense) |

(66.5) |

(56.9) |

|

Income (loss) before tax |

181.1 |

185.2 |

| Tax |

(62.0) |

(46.6) |

|

Income (loss) from continuing operations |

119.1 |

138.6 |

| Income from

discontinued operation, net of tax |

0.0 |

0.0 |

|

Net income (loss) |

119.1 |

138.6 |

| Attributable

to: |

|

|

| - owners of the

parent |

119.1 |

138.6 |

| - non-controlling

interests |

(0.0) |

(0.0) |

| Earnings (loss) per

share (EPS) (in euros): |

|

|

| - basic,

attributable to owners of the parent |

€0.51 |

€0.60 |

| - diluted,

attributable to owners of the parent |

€0.48 |

€0.56 |

| Earnings (loss) per

share (EPS) from continuing operations (in euros): |

|

|

| - basic,

attributable to owners of the parent |

€0.51 |

€0.60 |

|

- diluted, attributable to owners of the parent |

€0.48 |

€0.56 |

|

*: A reconciliation is provided in the “Restated income

statement for prior financial years” section of this release. |

Consolidated statement of financial

position

Assets

| (In millions

of euros) |

06/30/2024 |

12/31/2023 |

|

(Unaudited) |

|

restated* |

| Goodwill

impairment |

3,965.8 |

3,982.9 |

| Intangible

assets |

657.3 |

702.6 |

| Right-of-use

assets |

535.9 |

513.2 |

| Property, plant

and equipment |

2,282.1 |

2,210.7 |

| Other equity

investments |

0.1 |

0.1 |

| Other

non-current assets |

70.7 |

66.2 |

| Deferred tax

assets |

43.4 |

46.9 |

| Employee benefit

assets |

4.1 |

12.3 |

| Total

non-current assets |

7,559.2 |

7,534.9 |

| Inventories |

186.6 |

185.6 |

| Contract

assets |

53.8 |

51.9 |

| Trade and other

receivables |

908.6 |

823.6 |

| Current tax

assets |

29.6 |

24.5 |

| Other

assets |

23.2 |

19.3 |

| Cash and cash

equivalents |

420.7 |

665.3 |

| Assets held for

sale |

0.0 |

0.0 |

| Total current

assets |

1,622.6 |

1,770.1 |

|

Total assets |

9,181.8 |

9,305.0 |

*: A reconciliation is provided in the “Restated income

statement for prior financial years” section of this release.

Equity and liabilities

| (In millions

of euros) |

06/30/2024 |

12/31/2023 |

|

(Unaudited) |

|

restated* |

| Share

capital |

235.6 |

234.0 |

| Additional

paid-in capital |

2,476.1 |

2,477.7 |

| Treasury share

reserve |

(2.8) |

(0.7) |

| Other

reserves |

(360.8) |

(289.1) |

| Retained

earnings |

1,077.7 |

1,053.4 |

| Equity

attributable to owners of the parent |

3,425.7 |

3,475.3 |

|

Non-controlling interests |

(0.0) |

0.7 |

| Total

equity |

3,425.7 |

3,476.1 |

| Provisions |

90.8 |

94.0 |

| Employee benefit

liabilities |

86.9 |

90.7 |

| Borrowings and

financial debt |

2,637.1 |

2,717.5 |

| Deferred tax

liabilities |

289.6 |

295.6 |

| Lease

liabilities |

447.5 |

430.4 |

| Other

non-current liabilities |

21.4 |

58.0 |

| Total

non-current liabilities |

3,573.3 |

3,686.1 |

| Current

provisions |

15.0 |

17.1 |

| Current tax

liabilities |

32.0 |

24.3 |

| Trade and other

payables |

385.4 |

404.7 |

| Contract

liabilities |

87.6 |

83.7 |

| Current lease

liabilities |

115.3 |

107.5 |

| Other

liabilities |

531.9 |

532.4 |

| Bank overdrafts

and current borrowings |

1,015.5 |

973.2 |

| Liabilities

directly associated with assets held for sale |

0.0 |

0.0 |

| Total current

liabilities |

2,182.8 |

2,142.8 |

|

Total equity and liabilities |

9,181.8 |

9,305.0 |

*: A reconciliation is provided in the “Restated income

statement for prior financial years” section of this release.

Consolidated statement of cash flows

(In millions

of euros)

(Unaudited) |

06/30/2024 |

06/30/2023

restated* |

|

Net income (loss) |

119.1 |

138.6 |

| Tax |

62.0 |

46.6 |

| Net financial

income (expense) |

66.5 |

56.9 |

|

Operating income |

247.6 |

242.2 |

| Share-based

payments |

10.7 |

8.4 |

| Depreciation,

amortization and provisions |

470.3 |

422.7 |

| Portion of

grants transferred to income |

(0.3) |

(0.3) |

| Net gains and

losses on disposal of property, plant and equipment and intangible

assets |

1.6 |

1.0 |

| Adjustments to

consideration payable to the vendor and other cash items |

32.0 |

15.9 |

|

Cash flows before finance costs and tax |

762.1 |

689.9 |

| Change in

inventories |

0.4 |

(2.8) |

| Change in trade

and other receivables and contract assets |

(86.9) |

(93.4) |

| Change in other

assets |

(3.3) |

(4.4) |

| Change in trade

and other payables |

(12.0) |

(30.2) |

| Change in

contract liabilities and other liabilities |

29.1 |

49.5 |

| Other

changes |

(2.4) |

(1.9) |

| Employee

benefits |

(2.3) |

(2.7) |

|

Tax paid |

(64.6) |

(56.5) |

|

Net cash from operating activities |

620.1 |

547.5 |

| Acquisition of

intangible assets |

(10.9) |

(13.4) |

| Proceeds from

sale of intangible assets |

0.0 |

(0.0) |

| Acquisition of

property, plant and equipment |

(425.3) |

(402.9) |

| Proceeds from

sale of property, plant and equipment |

4.9 |

2.0 |

| Acquisition of

subsidiaries, net of cash acquired |

(134.0) |

(61.5) |

| Proceeds from

disposal of subsidiaries, net of cash transferred |

0.0 |

0.0 |

| Changes in

loans and advances |

0.3 |

0.2 |

| Dividends

earned |

0.0 |

0.0 |

|

Investment grants |

0.8 |

0.2 |

|

Net cash from investing activities |

(564.2) |

(475.4) |

| Capital

increase |

(0.0) |

0.0 |

| Treasury

shares |

(2.1) |

0.5 |

| Dividends

paid |

(101.3) |

(61.7) |

| Proceeds from

new borrowings |

882.8 |

624.2 |

| Repayments of

borrowings |

(942.5) |

(400.5) |

| Lease liability

payments - principal |

(62.6) |

(52.9) |

| Net interest

paid (including interest on lease liabilities) |

(71.6) |

(63.7) |

|

Other cash flows related to financing activities |

3.8 |

(4.0) |

|

Net cash from financing activities |

(293.4) |

41.9 |

|

Net increase (decrease) in cash and cash

equivalents |

(237.5) |

113.9 |

| Cash and cash

equivalents at beginning of period |

664.8 |

286.1 |

|

Effect of changes in foreign exchange rates on cash and cash

equivalents |

(6.6) |

3.8 |

|

Cash and cash equivalents at end of period |

420.6 |

403.8 |

| |

|

|

| |

|

|

- Elis - H1 2024 results - Press release

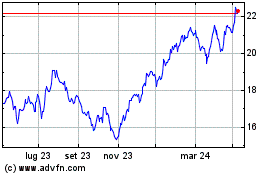

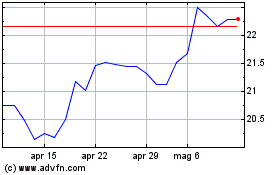

Grafico Azioni Elis (EU:ELIS)

Storico

Da Nov 2024 a Dic 2024

Grafico Azioni Elis (EU:ELIS)

Storico

Da Dic 2023 a Dic 2024