Elis: Q3 2024 revenue

Q3 2024 revenue up +5.5%

+4.9% organic growth, driven by the

Group’s many commercial initiatives

Disappointing performance in Hospitality

in the quarter

Full-year 2024 objectives

confirmed

Q3 2024 organic revenue growth at +4.9%

(+5.3% over the first nine months of the year)

- New contract

signings continue, driven by the commercial initiatives implemented

in each country to benefit from local growth opportunities

- Confirmation of the

return to normalized client retention rate, reflecting Elis’

quality of service and the Group’s good commercial relationships

with its clients

- No sign of economic

slowdown in our geographies, including in Germany where organic

growth is

c. +8% in Q3

- Disappointing

activity in Hospitality, with a decrease in occupancy rate in the

quarter, notably in France and in the UK

- Pricing dynamics

remains favorable in all our geographies

Continuation of the M&A strategy and

opening of a first country in Asia

- On July 1, Elis

announced its first operation in Asia with the acquisition of

Wonway, a player operating in the buoyant Cleanroom market in

Malaysia

- As part of its

strategy to regularly enter new countries, the Group held

exploratory conversations with two US market players during the

third quarter; both discussions were terminated at the beginning of

October, as neither would have allowed Elis to complete a

transaction that would have been in line with its strict financial

discipline

- Many opportunities

of small-sized acquisitions (revenue below c. €30m) are currently

under study in our existing geographies

Full-year 2024 objectives

confirmed

- Full-year organic

growth between +5.2% and +5.5%

- Adjusted EBITDA

margin between 35.2% and 35.5%

- Adjusted EBIT

margin stable yoy at c. 16%

- Headline net income

per share above €1.75 on a fully-diluted basis

- Free cash flow at

c. €340m

- Financial leverage

ratio as of December 31, 2024 down 0.2x compared to December 31,

2023

Significant improvement of Elis’ CSR

ratings with many agencies: Ecovadis, ISS ESG and S&P

Global

Saint-Cloud, 30 October 2024 –

Elis, the global leader in circular services at work, today

announces its revenue for the 9 months ended 30 September 2024.

These figures are unaudited.

Commenting on the announcement, Xavier

Martiré, Chairman of the Management Board of Elis,

said:

“In Q3 2024, Elis delivered further growth,

with revenue up +5.5%, of which +4.9% on an organic basis.

Commercial momentum remained solid, driven

by the many initiatives launched by the Group in each country,

aiming at benefitting from the organic opportunities identified

locally.

Q3 revenue continued to benefit from the

pricing adjustments implemented to offset cost base inflation.

Furthermore, we are pleased to confirm the return to a normalized

retention rate, which reflects the improvement of our quality of

service and the Group’s good client relationships.

In Hospitality, Q3 performance was

disappointing: the Olympic and Paralympic Games penalized tourist

activity with, notably, the cancellation, or the postponement of

many professional events scheduled in Paris during the summer. In

addition, hospitality operators seem to be focused on maintaining

high prices to the detriment of occupancy rates, with a negative

effect on activity, notably in France and in the UK.

Our Q3 operational performance enables us to

confirm all our 2024 objectives with, notably, full-year organic

revenue growth expected between +5.2% and +5.5%, 2024 EBITDA margin

expected between 35.2% and 35.5%, and financial leverage ratio

expected at c. 1.8x as of 31 December 2024.

The Group’s operational know-how, its growth

profile and its model based on the principles of the circular

economy will enable Elis to continue to assert its leadership in

all the countries in which it operates, while exploring all

profitable growth opportunities in new geographies.”

I. Q3 2024 revenue

Reported revenue

| In millions of

euros |

2024 |

2023 |

Var. |

| |

H1 |

Q3 |

9M |

H1 |

Q3 |

9M |

H1 |

Q3 |

9M |

|

|

|

|

|

|

|

|

|

|

|

|

France |

663.2 |

357.9 |

1,021.1 |

640.3 |

347.2 |

987.5 |

+3.6% |

+3.1% |

+3.4% |

| Central Europe |

556.8 |

291.3 |

848.1 |

497.3 |

257.3 |

754.6 |

+12.0% |

+13.2% |

+12.4% |

| Scandinavia. &

East. Eur |

309.4 |

150.8 |

460.2 |

300.1 |

143.8 |

444.0 |

+3.1% |

+4.8% |

+3.6% |

| UK &

Ireland |

275.9 |

150.7 |

426.6 |

257.3 |

143.4 |

400.7 |

+7.2% |

+5.1% |

+6.5% |

| Latin America |

232.3 |

113.0 |

345.3 |

213.7 |

117.0 |

330.7 |

+8.7% |

-3.4% |

+4.4% |

| Southern Europe |

195.5 |

113.4 |

308.9 |

179.9 |

108.1 |

288.0 |

+8.7% |

+4.9% |

+7.2% |

| Others |

13.5 |

7.9 |

21.4 |

12.6 |

6.6 |

19.1 |

+7.6% |

+20.1% |

+11.9% |

| Total |

2,246.7 |

1,184.9 |

3,431.6 |

2,101.3 |

1,123.3 |

3,224.7 |

+6.9% |

+5.5% |

+6.4% |

« Others » includes Manufacturing

Entities, Holdings and Malaysia.

Percentage change calculations are based on actual figures.

Q3 2024 reported growth breakdown

| In millions of

euros |

Q3 2024 |

Q3 2023 |

Organic growth |

External growth |

FX |

Reported growth |

| France |

357.9 |

347.2 |

+3.1% |

- |

- |

+3.1% |

| Central Europe |

291.3 |

257.3 |

+7.6% |

+5.1% |

+0.5% |

+13.2% |

| Scandinavia. &

East. Eur |

150.8 |

143.8 |

+3.8% |

- |

+1.0% |

+4.8% |

| UK &

Ireland |

150.7 |

143.4 |

+3.6% |

- |

+1.5% |

+5.1% |

| Latin America |

113.0 |

117.0 |

+8.9% |

- |

-12.3% |

-3.4% |

| Southern

Europe |

113.4 |

108.1 |

+3.7% |

+1.2% |

- |

+4.9% |

| Others |

7.9 |

6.6 |

-3.4% |

+22.4% |

+1.1% |

+20.1% |

| Total |

1,184.9 |

1,123.3 |

+4.9% |

+1.4% |

-0.8% |

+5.5% |

« Others » includes Manufacturing

Entities, Holdings and Malaysia.

Percentage change calculations are based on actual figures.

9-month 2024 organic revenue growth

| |

Q1 2024 |

Q2 2024 |

Q3 2024 |

9-months 2024 |

| France |

+4.3% |

+2.9% |

+3.1% |

+3.4% |

| Central Europe |

+9.0% |

+6.4% |

+7.6% |

+7.6% |

| Scandinavia. &

East. Eur |

+4.2% |

+4.1% |

+3.8% |

+4.0% |

| UK &

Ireland |

+6.1% |

+4.1% |

+3.6% |

+4.6% |

| Latin America |

+7.5% |

+7.6% |

+8.9% |

+8.0% |

| Southern

Europe |

+8.9% |

+4.8% |

+3.7% |

+5.5% |

| Others |

+15.4% |

-1.4% |

-3.4% |

+2.7% |

| Total |

+6.4% |

+4.6% |

+4.9% |

+5.3% |

« Others » includes Manufacturing

Entities, Holdings and Malaysia.

Percentage change calculations are based on actual figures.

France

Q3 revenue was up +3.1% (entirely organic). As

expected, activity in Hospitality was penalized by the organization

of the Paris Olympic and Paralympic Games, with the postponement or

cancellation of many professional events and a decrease in

occupancy rates over the period. However, commercial dynamism

remains solid in all our markets, and we continued to record many

new contract wins. Pricing momentum is also still

well-oriented.

Central Europe

Q3 revenue was up +13.2% in the region (+7.6% on

an organic basis). Germany and the Netherlands, the region’s two

main contributors, delivered quarterly organic revenue growth of

above +8% and above +9% respectively, driven by further outsourcing

in workwear and good pricing dynamics. The acquisition of Moderna

in the Netherlands, consolidated since the beginning of March 2024,

contributed +5.1% to the quarterly growth of the region.

Scandinavia & Eastern Europe

The region’s revenue was up +4.8% in Q3 2024

(+3.8% on an organic basis). Commercial momentum remained good in

Sweden, Norway and in the Baltics. In Denmark, the limited client

losses recorded in the first half, notably in Hygiene and

well-being, continued to weigh on growth.

UK & Ireland

The region’s revenue was up +5.1% in Q3 2024

(+3.6% on an organic basis), driven by a favorable pricing effect

in relation to the marked inflation in the region. Commercial

momentum remains good in Healthcare and in workwear (standard and

cleanroom), but activity was disappointing in Hospitality in August

and September.

Latin America

The region delivered organic revenue growth of

+8.9% in Q3, still driven by good commercial dynamism and further

outsourcing. Reported revenue decreased -3.4%, resulting from the

evolution of local currencies over the period (negative FX impact

of -12.3% in Q3).

Southern Europe

The region’s revenue was up +4.9% in Q3 2024

(+3.7% on an organic basis), with a negative calendar effect,

linked to the weekly billing method in place in Portugal. Our

commercial initiatives enabled us to record many new contract wins,

driven by further outsourcing. In Hospitality, activity was

globally disappointing in the quarter, especially in July. Finally,

the acquisition of Compania de Tratamientos Levante S.L in November

2023 in the Pest Control market in Spain contributed +1.2% to the

quarterly growth.

II. CSR

The circular economy at the heart of Elis’ business

model

Elis offers its clients products that are

maintained, repaired, reused, and reemployed to optimize their

usage and lifespan. The Group therefore selects its textile

products based on sustainability criteria, to ensure frequent

washing, and also operates repair workshops. Elis’ conviction is

that the circular economy model, which notably aims at reducing

consumption of natural resources by optimizing the lifespan of

products, is a sustainable solution to address today’s

environmental challenges.

The services offered by Elis represent a

sustainable alternative to the simple purchase or use of products

or to single-use disposable, products.

Moreover, these alternatives to a linear

approach to consumption allow our clients to avoid CO2 emissions

and thus contribute to the reduction of their own emissions.

The Ellen MacArthur Foundation states that the

circular economy can significantly contribute to reaching Net Zero

and that nearly 9 billion tons of CO2eq (i.e. 20% of world

emissions) could be reduced thanks to the transition of just some

key industries from the current model towards a circular

economy.

Synthesis of non-financial rating

|

Rating agencies |

MSCI |

ISS ESG |

S&P Global |

Ecovadis |

CDP |

Sustainalytics |

Ethifinance ESG Rating |

Moody’s Analytics |

|

Scores |

A |

55.81/100 Prime |

53/100 |

84/100

Platinum |

A-

Climate change |

Low risk |

75/100

Gold |

61/100 |

In Q3 2024, many agencies revised upward the Group’s CSR

rating:

- Ecovadis rewarded

Elis with a “Platinium” medal, with a score improvement of +9

points, to 84/100. This rewards Elis’ commitment to its clients,

partners and employees, and places the Group within the top 1% of

c. 100,00 companies tested. Ecovadis’ criteria are based on

international standards and on four CSR themes (Environment, Social

& Human Rights, Ethics and Sustainable Purchasing).

- ISS ESG agency

upgraded the Elis’ score by +7.44 points, to 55.87/100. This

rewards the Group’s CSR commitments and places it in the “Prime”

category.

- Finally, S&P

Global upgraded Elis’ score by +5 points, at 53/100.

Our climate commitment: ambitious 2030 climate

targets

On September 4, 2023, Elis unveiled its climate

roadmap and related 2030 targets, underscoring its commitment to

contributing to a low-carbon society.

Elis’ ambition is to achieve the following

targets by 2030:

- Reduce absolute

scopes 1 and 2 GHG emissions by -47.5% by 2030 from a 2019 base

year1;

- Reduce absolute

scope 3 GHG emissions from purchased goods and services, fuel and

energy related activities, upstream transportation and

distribution, employee commuting, and end-of-life treatment of sold

products by -28% within the same timeframe.

These targets have been approved by the Science

Based Targets initiative (SBTi), an international reference and a

partnership between the United Nations Global Compact, the World

Resources Institute (WRI), the Carbon Disclosure Project (CDP) and

the World Wildlife Fund for Nature (WWF). They are fully in line

with the objectives of the 2015 Paris Climate Agreements to

contribute to restrict global warming to less than 1.5°C compared

to pre-industrial levels on scopes 1 and 2, and well below 2°C on

scope 3.

These climate targets mark a new step in Elis’

sustainability strategy and climate actions. The Group has worked

for many years to reduce its energy consumption and CO2eq

emissions.

III. Other information

Financial definitions

- Organic growth in

the Group’s revenue is calculated excluding (i) the impacts of

changes in the scope of consolidation of “major acquisitions” and

“major disposals” (as defined in the Document de Base) in each of

the periods under comparison, as well as (ii) the impact of

exchange rate fluctuations.

- Adjusted EBITDA is

defined as adjusted EBIT before depreciation and amortization net

of the portion of grants transferred to income.

- Adjusted EBITDA

margin is defined as adjusted EBITDA divided by revenue.

- Adjusted EBIT is

defined as net income (loss) before net financial income (loss),

income tax, share in net income of equity accounted companies,

amortization of intangible assets recognized in a business

combination, goodwill impairment losses, other operating income and

expense, miscellaneous financial items (bank fees recognized in

operating income) and IFRS 2 expense (share-based payments).

- Adjusted EBIT

margin is defined as adjusted EBIT divided by revenue.

- Headline net result

corresponds to net income or loss excluding extraordinary items

which, due to their type and unusual nature, cannot be considered

as intrinsic to the Group’s current performance.

- Free cash flow is

defined as adjusted EBITDA less non-cash-items and changes in

working capital. purchases of linen, capital expenditures (net of

disposals), tax paid, financial interest paid and lease liabilities

payments.

- The financial

leverage ratio is the leverage ratio calculated for the purpose of

the financial covenant included in the banking agreement signed in

2021: Leverage ratio is equal to Net financial debt / adjusted

EBITDA, pro forma of acquisitions finalized during the last 12

months, and after synergies.

Geographical breakdown

- France

- Central Europe:

Germany, Austria, Belgium, Hungary, Luxembourg, Netherlands,

Poland, Czech Republic, Slovakia, Switzerland

- Scandinavia &

Eastern Europe: Denmark, Estonia, Finland, Latvia, Lithuania,

Norway, Russia, Sweden

- UK &

Ireland

- Latin America:

Brazil, Chile, Colombia, Mexico

- Southern Europe:

Spain & Andorra, Italy, Portugal

- Others:

Manufacturing Entities, Holdings and Malaysia

Disclaimer

This press release may include data information

and statements relating to estimates, future events, trends, plans,

expectations, objectives, outlook and other forward-looking

statements relating to the Group’s future business, financial

condition, results of operations, performance and strategy as they

relate to climate objectives, financial targets and other goals set

forth therein. Forward-looking statements are not statements of

historical fact and may contain the terms “may”, “will”, “should”,

“continue”, “aims”, “estimates”, “projects”, “believes”, “intends”,

“expects”, “plans”, “seeks” or “anticipates” or words of similar

meaning. In addition, the term “ambition” expresses an outcome

desired by the Group, it being specified that the means to be

deployed do not depend solely on the Group. Such forward-looking

information and statements have not been audited by the statutory

auditors. They are based on data, assumptions and estimates that

the Group considers as reasonable as of the date of this press

release and, by nature, involve known and unknown risks and

uncertainties. These data, assumptions and estimates may change or

be adjusted as a result of uncertainties, many of which are outside

the control of the Group, relating particularly to the economic,

financial, competitive, regulatory or tax environment or as a

result of other factors of which the Group is not aware on the date

of this press release. In addition, the materialization of certain

risks, especially those described in chapter 4 “Risk management and

internal control” of the Universal Registration Document for the

financial year ended December 31, 2023, which is available on

Elis’s website (http://www.elis.com), may have an impact on the

Group’s business, financial condition, results of operations,

performance, and strategy, notably with respect to these

climate-related objectives, financial objectives or other

objectives included in this press release. Therefore, the actual

achievement of climate-related objectives, financial targets and

other goals set forth in this press release may prove to be

inaccurate in the future or may differ materially from those

expressed or implied in such forward-looking statements. The Group

makes no representation and gives no warranty regarding the

achievement of any climate objectives, targets and other goals set

forth in this press release. Therefore, undue reliance should not

be placed on such information and statements.

This press release and the information included

therein were prepared on the basis of data made available to the

Group as of the date of this press release. Unless stated otherwise

in this press release, this press release and the information

included therein are accurate only as of such date. The Group

assumes no obligation to update or revise any of these

forward-looking statements, whether to reflect new information,

future events or circumstances or otherwise, except as required by

applicable laws and regulations.

This press release includes certain

non-financial metrics, as well as other non-financial data, all of

which are subject to measurement uncertainties resulting from

limitations inherent in the nature and the methods used to

determine them. These data generally have no standardized meaning

and may not be comparable to similarly labelled measures used by

other companies. The Group reserves the right to amend, adjust

and/or restate the data included in this press release, from time

to time, without notice and without explanation. The data included

in this press release may be further updated, amended, revised or

discontinued in subsequent publications, presentations and/or press

releases of Elis, depending on, among other things, the

availability, fairness, adequacy, accuracy, reasonableness or

completeness of the information, or changes in applicable

circumstances, including changes in applicable laws and

regulations.

This press release may include or refer to

information obtained from or established on the basis of various

third-party sources. Such information may not have been reviewed,

and/or independently verified, by the Group and the Group does not

approve or endorse such information by including them or referring

to them. Accordingly, the Group does not guarantee the fairness,

adequacy, accuracy, reasonableness or completeness of such

information, and no representation, warranty or undertaking,

express or implied, is made or responsibility or liability is

accepted by the Group as to the fairness, adequacy, accuracy,

reasonableness or completeness of such information, and the Group

shall not be obliged to update or revise such information.

The climate-related data and the climate-related

objectives included in this press release were neither audited nor

subject to a limited review by the statutory auditors of the

Group.

Next information

- 2024 annual

revenue: 30 January 2025 (after marker)

- Full-year 2024

results: 6 March 2025 (before market)

IV. Contacts

Nicolas Buron

Director of Investor Relations, Financing & Treasury

Phone: + 33 (0)1 75 49 98 30 - nicolas.buron@elis.com

Charline Lefaucheux

Investor Relations

Phone: + 33 (0)1 75 49 98 15 - charline.lefaucheux@elis.com

1 The target boundary includes land-related

emissions and removals from bioenergy. Scope 2 emissions targets

are market-based.

Scope 1 (direct emissions) is mainly associated with consumption of

gas, fuel, etc.

Scope 2 (indirect emissions) is associated with consumption of

electrical energy or steam;

Scope 3 (other indirect emissions) is associated with emission from

other areas: purchases, upstream transport, employee travel,

etc.

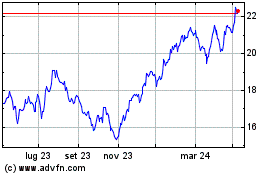

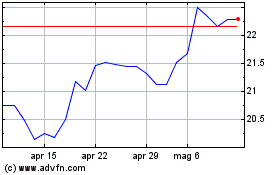

Grafico Azioni Elis (EU:ELIS)

Storico

Da Nov 2024 a Dic 2024

Grafico Azioni Elis (EU:ELIS)

Storico

Da Dic 2023 a Dic 2024