Fnac Darty: Resilient business in 2023

FULL-YEAR RESULTS

2023Ivry-sur-Seine, February 22, 2024, 5:45 p.m.

CET

Resilient business in

2023Current operating income in line with

expectations at €171mFree cash-flow from

operations1 of €180m

2023 PERFORMANCE

- Revenue stable at nearly €8

billion

- Current operating income of

€171 million, in line with consensus, reflecting tight

control over margin and costs

- Consolidated net income,

Group share of €50 million, following the final closure of

Comet disposal litigation in favor of the Group

- Free cash-flow from

operations1 of €180 million, in

line with the objectives of the strategic plan

- 1.1 million French

people have placed their trust in Darty

Max

- Dividend of €0.45

proposed to the Annual General Meeting of May 29, 2024

STRATEGIC INITIATIVES ROLLED OUT IN

2023

- Weavenn, the

creation of a major player in the European e-commerce logistics and

SaaS Marketplace

- Retail Link, the

Group’s omnichannel retail media agency, ~€90m of revenue

- Roll-out of 2nd life

products, ~€120m GMV (+30% vs 2022)

2024 OUTLOOKAt this stage, the

Group remains attentive to the evolving macroeconomic situation

- Current operating income

expected to be at least equal to that of 2023

- Cumulative free cash-flow

from operations1 of €500 million

for the period 2021-2024 confirmed

Enrique Martinez, Chief Executive

Officer of Fnac Darty, declared:“In this unprecedented

context of significant inflationary pressure, Fnac Darty has been

able to accelerate the profound transformation of its digital

customer and service model.

Our unique positioning, supported by strong

brands, makes us a key partner in meeting the needs of our

customers and our 11 million subscribers worldwide.

2023 has been dominated by great momentum in our

innovation projects, particularly in using artificial intelligence

to improve our customer service and our websites performances.

We have pursued our commitment towards products

sustainability through the very strong growth of our Darty Max

subscription model, which now has more than one million

subscribers, the accelerated development of our training program

for repair technicians, who have fixed 2.5 million products, and

the considerable growth in our Second Life business.

Finally, 2023 saw us finalize two

growth-generating projects: the integration of MediaMarkt's

activities in Portugal, which significantly strengthens our

position in the country, and the signing of an agreement with Ceva

Logistics to create Weavenn, a joint venture dedicated to

e-commerce logistics.

I would like to thank our employees for these

successes, as they undertake to work hard every day to support and

promote responsible consumption. Together, we are approaching 2024

with enthusiasm as it brings unique celebrations: the Olympic and

Paralympic Games, 50 years of Darty’s “Contrat de confiance” and 70

years of Fnac.”

FULL-YEAR RESULTS 2023 IN LINE WITH

EXPECTATIONS

| |

|

|

|

|

|

|

(in €m) |

2022 |

2023 |

Change |

|

|

Revenue |

7,949 |

7,875 |

(0.9)% |

|

|

Change on a like-for-like basis2 |

|

|

(1.1)% |

|

|

Gross margin |

2,410 |

2,380 |

(30) |

|

|

As a % of revenue |

30.3% |

30.2% |

(10) bps |

|

|

Current EBITDA |

580 |

533 |

(47) |

|

|

Current operating income |

231 |

171 |

(60) |

|

|

As a % of revenue |

2.9% |

2.2% |

(70) bps |

|

|

Net income from continuing operations, Group share –

adjusted3 |

104 |

31 |

(73) |

|

|

Net income from continuing operations, Group share |

100 |

(75) |

(175) |

|

|

Free cash-flow from operations, excluding IFRS

16 |

(30) |

180 |

+210 |

|

2023 was marked by a lack of visibility on

business activity. The Group faced a high level of inflation, which

had a significant impact on household purchasing power. Against

this backdrop, Fnac Darty once again demonstrated its resilience,

thanks to its strategic choices, its positioning as a key player in

omnichannel retailing and its rigorous cost control.

2023 revenue was €7,875

million, almost stable compared to 2022 (down by -0.9% in reported

data and by -1.1% on a like-for-like basis1). Once again, the Group

demonstrated its ability to outperform the market, the volumes of

which have fallen compared to 2022.

The gross margin rate reached

30.2% in 2023, stable compared to 2022 excluding the dilutive

impact of the franchise. The negative impact of the product mix

(growth in gaming and telephony) was offset by a positive impact in

the channel mix (increase in in-store sales) and the growth in

services.

Operating costs increased by

€30 million amounting €2,209 million in 2023. Performance plans

were strengthened to improve productivity and the investment plan

for reducing energy consumption was rolled out. These did not

offset inflation-related increases, in particular the increased

cost of energy (+€21 million), rents and payroll costs. The Group

has therefore limited the overall increase in its costs to just

+1.4% compared to 2022 (compared with an average inflation in

France of +4% in 20234).

Current EBITDA amounted to €533

million, €264 million of which related to the application of IFRS

16, down -€47 million compared to 2022.

Current operating income was

€171 million at the end of December 2023, down by -€60 million

compared to 2022. A particularly sharp drop in sales in Spain and

for Nature & Découvertes in the fourth quarter accounted for

half of this decline. The remainder reflects the increase in the

Group’s operating costs. The operating margin rate was down, at

2.2%.

Changes by distribution channel

In 2023, in-store sales posted solid momentum,

with 71 million checkout transactions, while online sales felt (22%

of the Group’s total sales, down -1 point compared to 2022).

Omnichannel sales continued to grow, accounting for 50% of the

Group’s online sales, up by +1.6 points. The omnichannel model, the

central element of Fnac Darty’s strategy, enabled the Group to

support the implementation of the French Darcos Law 5 by perfectly

addressing the changing needs of book-buying customers.

Changes by product category

Editorial products continued to

post solid momentum, driven mainly by gaming and book sales. The

kitchen business, boosted by increased brand awareness and a global

network of 203 dedicated spaces, recorded strong growth.

Services also continued to grow strongly, with an

increase in the number of Darty Max subscribers and the launch of

Fnac Vie Digitale.

Conversely, Domestic appliances

recorded a slight increase in average selling prices, this did not

compensate for the continuing decline in volumes. Consumer

electronics recorded good momentum in telephony, audio and

photography, which was not offset by the sharp decline in the

television and IT equipment categories. These two categories saw

their sales fall this year, still impacted by the high level of

equipment seen during the pandemic and a lack of innovation in the

PC market.

Changes by region

|

FRANCE AND SWITZERLAND(€ millions) |

2022 |

2023 |

Change |

|

Revenue |

6,613.3 |

6,515.1 |

(1.5)% |

|

Current operating income |

202.6 |

152.4 |

(50.2) |

|

Current operating margin |

3.1% |

2.3% |

(70) bps |

Revenue in France and

Switzerland remained relatively resilient, down by -1.1%

on a like-for-like basis 6 over the year. In France, the Group

outperformed the market by nearly 3 points in 2023 according to the

latest figures published by the Banque de France 7. As a

result of the fall in consumer discretionary spending in France,

Nature & Découvertes posted a sharp decline in sales and

profitability compared to last year.Current operating income came

to €152.4 million in 2023 compared to €202.6 million in

2022. Current operating margin was 2.3% in 2023.

|

IBERIAN PENINSULA(€ millions) |

2022 |

2023 |

Change |

|

Revenue |

719.6 |

731.7 |

+1.7% |

|

Current operating income |

16.9 |

12.3 |

(4.6) |

|

Current operating margin |

2.3% |

1.7% |

(60) bps |

Revenue in the Iberian

Peninsula fell by -4.0% on a like-for-like basis 2

over the year, reflecting contrasting trends. On the one hand,

Portugal grew by +3.5% on a like-for-like basis2 thanks to

increased brand awareness and market share. The business activities

of MediaMarkt, consolidated since October 1, 2023, contributed €39

million to revenue in the country. Conversely, revenue in Spain

fell, penalized by purchasing power that was heavily impacted by

the level of inflation, the rise in interest rates and an

environment that remained competitive. Current operating income

came to €12.3 million in 2023 compared to €16.9 million

in 2022. Current operating margin was 1.7%.

|

BELGIUM AND LUXEMBOURG(€ millions) |

2022 |

2023 |

Change |

|

Revenue |

616.5 |

628.0 |

+1.9% |

|

Current operating income |

11.1 |

6.0 |

(5.1) |

|

Current operating margin |

1.8% |

1.0% |

(80) bps |

Revenue in the Belgium and

Luxembourg increased by +2.0% on a like-for-like basis8

over the year, mainly due to the resilience of domestic appliances

and very strong performance of editorial products, driven by gaming

and books. Services posted significant growth thanks to the roll

out of Vanden Borre Life, while consumer electronics was the only

category to decline. Current operating income for the Belgium and

Luxembourg segment was €6.0 million in 2023, compared with

€11.1 million in 2022. Current operating margin was 1.0%.

Other income statement items

Non-current items amounted to

-€131 million in 2023, compared to -€27 million in 2022. This

amount includes:

- Exceptional items of €106 million:

a provision of €85 million for ADLC9 litigation and brand

impairments of €20 million.

- Other items of €25 million, stable

compared to 2022, comprising the residual cost of the closure of

Manor shop-in-shops in German-speaking Switzerland, riot-related

costs and a provision for employees’ rights to accrue paid leave

during periods of sick leave. This provision reflects the Group’s

compliance with the rulings of the French supreme court (Cour de

Cassation) and European law.

Net financial income was -€79

million, compared to -€45 million in 2022. The increase

reflects:

- The cost of net financial debt

remaining stable;

- IFRS 16 expenses up by +€11 million

due to changes in interest rates; and

- Non-recurring items, including the

depreciation and disposal of the stake in the Daphni Purple Fund

(as a reminder, the Group’s investment, since 2016, in the Daphni

Purple fund recorded a cumulative capital gain on disposal of €10

million).

Tax expenses were -€31 million,

an improvement compared to 2022, given the reduction in the Group’s

results. The effective tax rate was significantly impacted by the

provision allocated in 2023 for fines imposed by the French

Competition Authority, which is not tax deductible.

Restated to take account of the €106 million in

exceptional non-current items described above, net income

from continuing operations, Group share –

adjusted10 totaled €31 million in

2023.

Financial structure

Free cash-flow from operations,

excluding IFRS 16, was +€180 million, a clear improvement compared

to the end of 2022. This is the result of a lower operating income,

the normalization of the WCR, which returned to the level observed

at the end of 2021, and operating investments that were in line

with the Group’s expectations. Over the 2021-2023 period, the Group

generated cumulative free cash-flow from operations, excluding IFRS

16, of €320 million, in line with the cumulative target of €500

million over the 2021-2024 period.

The Group’s gross financial

debt was €923 million, which was mainly comprised of:

- A €300 million bond issue maturing

in May 2024, the refinancing of which was fully secured by an

additional undrawn credit line in the form of a delayed drawn term

loan (DDTL) maturing in December 2026 if it is drawn (with a

confirmed option to extend to December 2027);

- A €350 million bond issue maturing

in May 2026; and

- A €200 million convertible bond

issue (OCEANE) maturing in 2027.

After taking available cash (€1.1 billion) into

account, the Group’s net cash position stood at

€198 million as of December 31, 2023.

In addition, the Group has an RCF credit line of

€500 million, which was undrawn at the end of 2023. Its maturity

date has been extended to March 2028 (with two further confirmed

extension options of March 2029 and March 2030).

This strong liquidity position supports Group

confidence to strategically allocate its resources in the most

opportune way (M&A, debt reduction, shareholder return, etc.)

while remaining attentive to its leverage ratio.

As of December 31, 2023, Fnac Darty is fully

compliant with its contractual commitments relating to its bonds

and corporate loans.

Finally, the Group is rated by the rating

agencies Standard & Poor’s, Scope Ratings and Moody’s, which

assigned ratings of BB+, BBB and BB+ respectively during 2023, with

a negative outlook (S&P and Scope) or a stable outlook

(Fitch).

CONTINUED IMPLEMENTATION OF THE

STRATEGIC PLANThe resilience of the 2023 full-year results

continues to demonstrate the power and singularity of the Group’s

omnichannel model, with the aim, in its day-to-day work and

for the long haul, to be alongside consumers, helping them to be

sustainable in their consumption habits and daily household

tasks.

Fnac Darty keeps its commitment to its

customers. In the last 4 years, 1.1 million French people

have placed their trust in Darty Max. This emblematic

Group service offers the repair of domestic and high-tech

appliances to extend their life span and therefore reduce their

environmental impact. In total, 2.5 million products have been

repaired by our technicians, making the Group the leading repairer

in France. Launched in 2023, Fnac Vie Digitale is

an innovative monthly subscription service with a unique

three-pronged approach: it offers security, advice and maintenance

to guide customers’ digital experiences while guaranteeing them a

stressless digital life. These illustrations support the

transformation of Fnac Darty around high value-added services,

generating recurring cash flows.

Second Life activities

contribute to the Group's environmental ambitions in terms of

circular economy, through the buyback of used products and the

development of the refurbished product offering. In 2023, the

volumes under the Fnac 2nde Vie and the Darty 2nde Vie brands has

risen to almost 120 million euros, up 30% on 2022, giving concrete

expression to the Group's desire to support consumers towards more

sustainable and responsible consumption.

Retaillink, the Group’s fully

integrated, omnichannel retail media agency, deploys innovative

offers and enhanced presence to help brands achieve their

awareness, commitment and sales objectives by getting closer to

their communities. In 2023, this activity represents close to €90

million in revenue11, up compared to 2022.

Following the implementation of a plan to reduce

energy consumption in 2022, the Group is continuing its actions in

favor of energy sobriety. The ambitious commitment to reduce

electricity consumption by at least 15% by 2024 (compared to 2022)

has already been met, one year ahead of schedule. In 2023, the

Group reduced its electricity consumption by 17%

primarily through the use of reduced energy-consumption and

better-managed installations across the entire Fnac and Darty

integrated store network (€12 million invested in 2023). This

ambition is an integral part of the Group's objective of reducing

CO2 emissions by 50% (scope 3) by 2025. The scope selected covers

transport (direct and indirect emissions) and site energy. On this

scope, Fnac Darty recorded a -26% reduction in CO2 emissions in

2023, compared to 2019. The Group relies on strengthened governance

that is structured around a Climate Committee to monitor the

trajectory of its CO2 emissions, draw up action plans, monitor the

roadmaps for its various operational sectors and work toward the

expansion of the low-carbon strategy to other indirect emission

items. Finally, the Group's CDP rating was renewed to A-. Fnac

Darty is amongst the 22% of companies worldwide to be rated

"Leadership"12.

Fnac Darty and CEVA Logistics have

joined forces to create Weavenn, with the ambition to make

it a major European player in the e-commerce logistics and SaaS

Marketplace. This joint venture aims to simplify the daily lives of

sellers by offering them a unique, fully integrated solution that

will draw on their power and collective knowledge and expertise.

Having secured regulatory approval, operations should start during

the first half of 2024. In the next 5 years, the joint venture is

expected to generate €200 million in revenue with a double-digit

operating margin.

Meanwhile, Fnac Darty signed a

collaboration with Rakuten France in September

2023 allowing Darty to expand its online presence and thus reach

nearly 15 million new users each month.

Finally, the Group signed a partnership

agreement with the organizing committee for the Paris 2024 Olympic

and Paralympic Games to be an official supporter.

Ahead of the Paris 2024 Olympic and Paralympic Games, Fnac Darty

wants to develop initiatives for the Cultural Olympiad. Throughout

the Paris 2024 Olympic and Paralympic Games, the Group also

undertakes to contribute to the athlete experience by offering

services inside the Athletes’ Village. Indeed, Fnac Darty's teams

aim to supply the Village with small and large household

appliances, including certain products from the IOC's TOP Partners,

to ensure the best possible stay for athletes and their delegation,

just as they do in the daily lives of French men and women.

Committed to informed and sustainable consumption, Fnac Darty also

intends to provide after-sales service for the host site. The

Company has announced a “100% reuse” target for all its products,

in line with its goal to expand its Second Life product range.

SCOPEThe Group has

finalized its acquisition of MediaMarktSaturn in Portugal,

consolidating its number 2 position in the country. This operation

is a real opportunity to accelerate Group growth in its core

businesses, to diversify and expand in the large and small domestic

appliance categories, as well as to enhance its services and

improve its overall efficiency.

On August 2, 2023, Fnac Darty announced the

evolution of its strategic ticketing partnership,

initiated in 2019 with the CTS Eventim Group, the European leader

in the sector. In accordance with the terms of the agreement

between the two parties, CTS Eventim notified Fnac Darty of its

intention to exercise its call option to become the majority

shareholder of France Billet. The transaction is subject to

obtaining the necessary approvals from the European and Swiss

competition authorities. The procedure for obtaining the necessary

approvals from the competition authorities is still underway, in a

phase that remains preliminary to date, making the timeframe for

completion of this transaction uncertain.

RECENT EVENT

On February 12, the Supreme Court in London has

refused the application by the liquidator of Comet Group Limited to

challenge the judgment handed down by the Court of Appeal in London

in October 2023 in favor of Darty Holdings SAS, a subsidiary of the

Fnac Darty Group. This decision definitively closes the litigation

linked to the disposal of Comet Group Limited in 2012. Fnac Darty

should receive the balance of the sum initially paid in December

2022, as well as the reimbursement of interest and legal costs

incurred, representing a positive impact on its cash position

estimated at least at €40 million.

GOVERNANCE AND SHAREHOLDERS As

of December 31, 2023, Vesa Equity Investment was the Group’s

largest shareholder with 29.9% of the capital, followed by Ceconomy

with 23.4% of the capital and GLAS SAS (receiver of Indexia

Développement’s pledged stake in October 2023) with 10.9% of the

capital.

Fnac Darty’s Board of Directors decided to

implement the share buyback program approved by the General Meeting

of May 24, 2023, for the purpose of performance share plans (LTIP)

to the amount of €20 million. As of January 31, 2024, a total sum

of €15.4 million (representing 603,604 shares) has been

repurchased. On February 23, 2024, the Group plans to restart a

program to reach the authorized amount.

At the General Meeting, the Board shall also

propose the renewal of Brigitte Taittinger-Jouyet, Laure Hauseux

and Stéphanie Meyer as independent directors for a term of 4

years.

DIVIDENDSFnac Darty will

propose that the General Meeting scheduled for May 29, 2024

approves the distribution of a dividend of €0.45 per

share. This amount represents a 39% payout ratio,

calculated on the net income from continuing operations, Group

share – adjusted13. This is in line with previous years and with

the shareholder return policy presented in the strategic plan

Everyday.The ex-date is July 3, 2024 and the payment date is July

5, 2024.

2024 OUTLOOK

In 2024, growth should be supported by the

declining inflation, which is beneficial to purchasing power, and

by the decline in the savings rate level. Nevertheless, the timing

of the recovery in household consumption remains very uncertain,

affecting visibility of the recovery in volumes.

Energy costs will benefit from a favorable

comparable basis, while rental costs and wages are expected to

rise.

Against this backdrop, the Group will ensure

that it:

- Continues to outperform the

markets thanks to its operational agility and the

complementarity nature of its stores and websites, which are

important assets in mature markets that are preparing for a new

cycle of innovation from H2 2024.

- Preserves its gross

margin as much as possible thanks to the relevance of its

offer and the growing contribution of services.

- Pursues tight

cost control thanks to the performance plans that

offset a large part of the inflation in 2023.

- Maintains a solid liquidity

position and remains attentive to potential market

opportunities, while reducing its financial leverage ratio (c. 1.5x

on 31 Dec.).

- Continues to deploy

strategic initiatives to simplify its model and

support future growth; testing in particular the possibilities

offered by recent breakthroughs in artificial intelligence.

The Group is therefore continuing to have a

cautious view of the economic and geopolitical context, and at this

stage it anticipates a Current Operating Income (COI) for

2024 at least equal to that of 2023.

The Group reaffirms its objective of achieving a

cumulative free cash-flow from

operations14 of approximately

€500 million over the period 2021-2024 (i.e. €180 million

in 2024).

*********

PRESENTATION OF ANNUAL RESULTS

2023

Enrique Martinez, Chief Executive

Officer and Jean-Brieuc Le Tinier, Group Chief Financial

Officer, will host a virtual presentation of the results

in French, with simultaneous interpretation into English, on

Thursday February 22, 2024 at 6:30 p.m.

(CET); 5:30 p.m. (UK); 12:30 p.m. (East Coast USA).

The webcast will be available at this link.

You can listen to a recording of the presentation at any time,

in either French or English, via the website www.fnacdarty.com.

FINANCIAL CALENDAR

April 24, 2024 (as of the close of

business): Revenue for the first quarter of

2024May 29, 2024: General Meeting

2024July 26, 2024 (as of the close of

business): Half-year results 2024October 26,

2024 (as of the close of business): Third quarter

2024 revenue

CONTACTS

ANALYSTS/INVESTORSDomitille

Vielle – Head of Investor Relations –

domitille.vielle@fnacdarty.com – +33 (0)6 03 86 05 02Laura Parisot

– Investor Relations Manager – laura.parisot@fnacdarty.com – +33

(0)6 64 74 27 18

PRESSAudrey Bouchard – Head of

Media Relations and Reputation – audrey.bouchard@fnacdarty.com –

+33 (0)6 17 25 03 77

NOTES

The Board of Directors of Fnac Darty SA met

under the chairmanship of Jacques Veyrat on February 22, 2024 to

approve the consolidated financial statements for the year 2023.

The procedures for auditing the consolidated financial statements

were performed and the certification report will be issued after

the verification of the Management Report and the due diligence

relating to the ESEF electronic format of the 2023 accounts are

finalized.

The Group’s unaudited 2023 consolidated

financial statements are available on the website

www.fnacdarty.com.

The following tables contain individually

rounded data. The arithmetical calculations based on rounded data

may present some differences with the aggregates or subtotals

reported.

Q4 2023 REVENUE BY OPERATING SEGMENT

| |

|

|

|

|

|

| (in €m) |

Q4 2023 |

Change compared with Q4 2022 |

|

|

|

Actual |

At comparable scope and at constant exchange rates |

Like-for-like basis – LFL15 |

|

| France and

Switzerland |

2,223.3 |

(0.9)% |

(1.0)% |

(0.3)% |

|

| Iberian

Peninsula |

278.9 |

+13.9% |

+13.9% |

(2.6)% |

|

| Belgium and

Luxembourg |

188.6 |

+2.1% |

+2.1% |

+2.8% |

|

|

Group |

2,690.8 |

+0.7% |

+0.6% |

(0.3)% |

|

2023 REVENUE BY OPERATING SEGMENT

| |

|

|

|

|

|

|

(in €m) |

2023 |

Change compared with 2022 |

|

|

|

Actual |

At comparable scope and at constant exchange rates |

Like-for-like basis – LFL1 |

|

| France and

Switzerland |

6,515.1 |

-1.5% |

-1.6% |

-1.1% |

|

| Iberian

Peninsula |

731.7 |

+1.7% |

+1.7% |

-4.0% |

|

| Belgium and

Luxembourg |

628.0 |

+1.9% |

+1.9% |

+2.0% |

|

|

Group |

7,874.7 |

-0.9% |

-1.0% |

-1.1% |

|

2023 CURRENT OPERATING INCOME BY OPERATING

SEGMENT

| |

|

|

|

|

|

|

(in €m) |

2022 |

As a % of revenue |

2023 |

As a % of revenue |

|

| France and

Switzerland |

202.6 |

3.1% |

152.4 |

2.3% |

|

| Iberian

Peninsula |

16.9 |

2.3% |

12.3 |

1.7% |

|

| Belgium and

Luxembourg |

11.1 |

1.8% |

6.0 |

1.0% |

|

|

Group |

230.6 |

2.9% |

170.7 |

2.2% |

|

SUMMARY INCOME STATEMENT

| |

|

|

|

|

|

|

|

(in €m) |

2022 |

2023 |

Change |

|

|

|

|

|

|

|

|

Revenue |

7,949 |

7,875 |

(0.9)% |

|

|

Gross margin |

2,410 |

2,380 |

(30) |

|

|

As a % of revenue |

30.3% |

30.2% |

(10) bps |

|

|

Total costs |

2,179 |

2,209 |

+30 |

|

|

As a % of revenue |

27.4% |

28.1% |

+70 bps |

|

|

Current operating income |

231 |

171 |

(60) |

|

|

Products and non-current operating income and expenses |

(27) |

(131) |

(104) |

|

|

Exceptional non-current operating expenses16 |

(4) |

(106) |

(102) |

|

|

Other non-current operating income and expenses |

(23) |

(25) |

(2) |

|

|

Operating income |

204 |

40 |

(164) |

|

|

Net financial expense |

(45) |

(79) |

(33) |

|

|

Income tax |

(54) |

(31) |

+24 |

|

|

Net income from continuing operations for the

period |

104 |

(69) |

(173) |

|

|

Net income from continuing operations for the period, Group

share |

100 |

(75) |

(175) |

|

|

Net income from discontinued operations |

(132) |

125 |

+257 |

|

|

Consolidated net income, Group share |

(32) |

50 |

82 |

|

|

|

|

|

|

|

|

Current EBITDA17 |

580 |

533 |

(47) |

|

|

As a % of revenue |

7.3% |

6.8% |

(50) bps |

|

|

Current EBITDA2 excluding

IFRS 16 |

326 |

269 |

(57) |

|

FREE CASH-FLOW FROM OPERATIONS

| |

|

|

|

|

(in €m) |

2022 |

2023 |

|

|

|

|

|

|

|

|

|

Cash flow before tax, dividends and interest |

572 |

496 |

|

|

|

IFRS 16 impact |

(254) |

(264) |

|

|

|

Cash-flow before tax, dividends and interest, excluding

IFRS 16 |

317 |

232 |

|

|

|

Change in working capital requirement, excluding IFRS 16 |

(155) |

63 |

|

|

|

Income tax paid |

(70) |

8 |

|

|

|

Net cash-flows from operating activities, excluding IFRS

16 |

93 |

302 |

|

|

|

Operating investments |

(138) |

(132) |

|

|

|

Operating divestments |

7 |

17 |

|

|

|

Change in payables and receivables relating to non-current

assets |

9 |

(7) |

|

|

|

Net cash-flows from operating investment

activities |

(123) |

(122) |

|

|

|

Free cash-flow from operations, excluding IFRS

16 |

(30) |

180 |

|

|

BALANCE SHEET

|

|

|

|

|

|

Assets (€m) |

At December 31, 2022 |

At December 31, 2023 |

|

|

Goodwill |

1,654 |

1,680 |

|

|

Intangible assets |

562 |

566 |

|

|

Property, plant and equipment |

570 |

544 |

|

|

Rights of use relating to lease agreements |

1,115 |

1,105 |

|

|

Investments in associates |

2 |

1 |

|

|

Non-current financial assets |

44 |

22 |

|

|

Deferred tax assets |

60 |

63 |

|

|

Other non-current assets |

0 |

0 |

|

|

Non-current assets |

4,008 |

3,981 |

|

|

Inventories |

1,144 |

1,158 |

|

|

Trade receivables |

250 |

189 |

|

|

Tax receivables due |

6 |

8 |

|

|

Other current financial assets |

19 |

22 |

|

|

Other current assets |

389 |

536 |

|

|

Cash and cash equivalents |

932 |

1,121 |

|

|

Current assets |

2,739 |

3,034 |

|

|

Assets held for sale |

0 |

0 |

|

|

Total assets |

6,747 |

7,015 |

|

|

|

|

|

|

|

|

|

|

|

|

Liabilities (€m) |

At December 31, 2022 |

At December 31, 2023 |

|

|

Share capital |

27 |

28 |

|

|

Equity-related reserves |

971 |

987 |

|

|

Translation reserves |

(4) |

(6) |

|

|

Other reserves |

518 |

416 |

|

|

Shareholders’ equity, Group share |

1,512 |

1,522 |

|

|

Shareholders’ equity – Share attributable to non-controlling

interests |

11 |

17 |

|

|

Shareholders’ equity |

1,523 |

1,539 |

|

|

Long-term borrowings and financial debt |

917 |

604 |

|

|

Long-term leasing debt |

897 |

898 |

|

|

Provisions for pensions and other equivalent benefits |

145 |

167 |

|

|

Other non-current liabilities |

22 |

9 |

|

|

Deferred tax liabilities |

165 |

199 |

|

|

Non-current liabilities |

2,147 |

1,876 |

|

|

Short-term borrowings and financial debt |

20 |

319 |

|

|

Short-term leasing debt |

244 |

246 |

|

|

Other current financial liabilities |

10 |

9 |

|

|

Trade payables |

1,965 |

2,153 |

|

|

Provisions |

37 |

115 |

|

|

Tax liabilities payable |

0 |

1 |

|

|

Other current liabilities |

803 |

758 |

|

|

Current liabilities |

3,078 |

3,600 |

|

|

Liabilities relating to assets held for sale |

0 |

0 |

|

|

Total liabilities |

6,747 |

7,015 |

|

STORE NETWORK

| |

Dec. 31, 2022 |

Opening |

Closure |

Dec. 31, 2023 |

|

|

France and Switzerland* |

826 |

28 |

16 |

838 |

|

|

Traditional Fnac |

96 |

2 |

2 |

96 |

|

|

Suburban Fnac |

17 |

0 |

0 |

17 |

|

|

Travel Fnac |

36 |

3 |

2 |

37 |

|

|

Proximity Fnac |

79 |

3 |

0 |

82 |

|

|

Fnac Connect |

7 |

0 |

0 |

7 |

|

|

Darty |

486 |

17 |

11 |

492 |

|

|

Fnac/Darty France |

1 |

0 |

0 |

1 |

|

|

Nature & Découvertes** |

104 |

3 |

1 |

106 |

|

| Of which

franchised stores |

414 |

26 |

9 |

431 |

|

| |

|

|

|

|

|

|

Iberian Peninsula |

75 |

14 |

1 |

88 |

|

|

Traditional Fnac |

53 |

0 |

0 |

53 |

|

|

Travel Fnac |

2 |

2 |

0 |

4 |

|

|

Proximity Fnac |

16 |

2 |

0 |

18 |

|

|

Fnac Connect |

4 |

0 |

1 |

3 |

|

|

MediaMarkt Portugal |

0 |

10 |

0 |

10 |

|

| Of which

franchised stores |

6 |

0 |

0 |

6 |

|

| |

|

|

|

|

|

|

Belgium and Luxembourg |

86 |

1 |

3 |

84 |

|

|

Traditional Fnac*** |

13 |

0 |

1 |

12 |

|

|

Proximity Fnac |

1 |

0 |

0 |

1 |

|

|

Darty (Vanden Borre) |

72 |

1 |

2 |

71 |

|

| |

|

|

|

|

|

|

Fnac Darty Group |

987 |

43 |

20 |

1,010 |

|

|

Traditional Fnac |

162 |

2 |

3 |

161 |

|

|

Suburban Fnac |

17 |

0 |

0 |

17 |

|

|

Travel Fnac |

38 |

5 |

2 |

41 |

|

|

Proximity Fnac |

96 |

5 |

0 |

101 |

|

|

Fnac Connect |

11 |

0 |

1 |

10 |

|

|

Darty/Vanden Borre |

558 |

18 |

13 |

563 |

|

|

Fnac/Darty |

1 |

0 |

0 |

1 |

|

|

MediaMarkt |

0 |

10 |

0 |

10 |

|

|

Nature & Découvertes |

104 |

3 |

1 |

106 |

|

| Of which

franchised stores |

420 |

26 |

9 |

437 |

|

* including 13 Fnac stores abroad: 3 in Qatar, 3

in Tunisia, 2 in Senegal, 2 in Ivory Coast, 1 in the Congo, 1 in

Cameroon, 1 in Saudi Arabia and 3 Darty stores abroad in Tunisia;

and including 18 stores in the French overseas territories.

Excluding 17 Fnac shop-in-shops opened in Manor stores.** including

Nature & Découvertes subsidiaries managed from France: 4 stores

in Belgium, 1 store in Luxembourg, 7 franchises in Switzerland, 1

franchise in Portugal and 5 franchises in the French overseas

territories.*** Including one store in Luxembourg, which is managed

from Belgium.

MONITORING OF THE NON-FINANCIAL INDICATORS OF THE

EVERYDAY PLAN

|

INDICATORS |

2021 |

2022 |

2023 |

2025 objective |

|

Sustainability score18 |

111 |

115 |

118 |

135 |

|

Number of products repaired |

2.1 million |

2.3 million |

2.5 million |

2.5 million |

|

Percentage of Women in the top 200 managers |

27% |

30% |

33% |

35% |

|

Percentage of women on the Executive Committee |

38% |

42% |

42%19 |

>40% |

DEFINITIONS OF ALTERNATIVE PERFORMANCE

INDICATORS

REVENUE The Group’s reported

revenue (or profit from ordinary activities) corresponds to its

published revenue. The Group uses the following notions of change

in revenue:Change in revenue at a constant exchange

rateChange in revenue at a constant exchange rate means

that the impact of changes in exchange rates has been excluded. The

exchange rate impact is eliminated by recalculating sales for

period N-1 using the exchange rates used for period

N.Change in revenue on a comparable scope of

consolidationChange in revenue at a comparable scope of

consolidation means that the impact of changes in the scope of

consolidation is corrected so as to exclude the modifications

(acquisition, disposal of subsidiary). Revenue of subsidiaries

acquired or sold since January 1 of period N-1 are, therefore,

excluded when calculating the change (in the event of a significant

variation at Group level).Change in revenue on a same-store

basisThe change in revenue on a same-store basis means

that the impact of directly owned store openings and closures is

excluded. Revenue of stores opened or closed since January 1

of period N-1 is excluded from calculations of the change.

CURRENT OPERATING INCOMEThe

total operating income of Fnac Darty includes all the income and

costs directly related to Group operations, whether the income and

expense are recurrent or whether they result from one-off

operations or decisions.“Other non-current operating income and

expense” reflects the unusual and material items for the

consolidated entity that could disrupt tracking of the Group’s

economic performance.As a result, and in order to monitor the

Group’s operating performances, Fnac Darty uses current operating

income as the main management balance. This is defined as the

difference between the total operating income and the “Other

non-current operating income and expense.”Current operating income

is an intermediate line item intended to facilitate the

understanding of the entity’s operating performance and that can be

used as a way to estimate recurring performance. This indicator is

presented in a manner that is consistent and stable over the long

term in order to ensure the continuity and relevance of financial

information.

CURRENT EBITDA

In addition to the results published, the Group

presents the current EBITDA performance indicator, which excludes

Interest, Taxes, Depreciation, Amortization and provisions on

operational fixed assets from current operating income. Current

EBITDA is not an indicator stipulated by IFRS and does not appear

in the Group consolidated financial statements. Current EBITDA has

no standard definition and, therefore, the definition used by the

Group may not match the definition of this term used by other

companies. The application of IFRS 16 significantly changes

the Group’s current EBITDA. Current EBITDA excluding IFRS 16

is used in the context of the applicable financial covenants under

the Loan Agreement.EBITDA = current operating income before net

additions for depreciation, amortization and provisions on

non-current operating assets recognized in current operating

income.

FREE CASH-FLOW FROM OPERATIONS

The Group also uses an intermediate line item to

track its financial performance described as free cash-flow from

operations. This financial indicator measures the net cash flows

linked to operating activities and the net cash flows from

operational investments (defined as acquisitions and disposals of

property, plant and equipment and intangible assets, and the change

in trade payables for non-current assets). The application of

IFRS 16 significantly changes the Group’s free cash-flow from

operations.Free cash-flow from operations = net cash flows related

to operating activities + net cash flows from net operating

investments.

NET CASH

Net cash consists of gross cash and cash

equivalents, minus gross debt including accrued interest not yet

due as defined by the French National Accounting Council’s

recommendation No. 2013-03 on November 7, 2013. The

application of IFRS 16 significantly changes the Group’s net

cash.

NET FINANCIAL DEBT

Net financial debt consists of gross debt

including accrued interest not yet due as defined by the French

National Accounting Council’s recommendation No. 2013-03 on

November 7, 2013, minus gross cash and cash equivalents. The

application of IFRS 16 significantly changes the Group’s net

financial debt.

THE APPLICATION OF THE IFRS 16 STANDARD

On January 13, 2016, the IASB published

IFRS 16 on “Leases.” IFRS 16 replaces IAS 17 and its

interpretations. This standard, which is mandatory for annual

periods beginning on or after January 1, 2019, requires the

recognition of an asset (the right of use) and a liability (leasing

debt) on the basis of discounted in-substance fixed lease

payments.

The Group has applied IFRS 16 since

January 1, 2019. In order to ensure the transition between

IAS 17 and IFRS 16, all lease and service agreements

falling within the scope of 16 have been analyzed.

To monitor its financial performance, the Group

publishes indicators that exclude the application of IFRS 16.

These indicators are current EBITDA excluding IFRS 16, free

cash-flow from operations excluding IFRS 16, and net financial

debt excluding IFRS 16.

|

With the application of IFRS 16 |

IFRS 16 restatement |

Without the application of IFRS 16 |

|

Current EBITDA |

Rent within the scope of IFRS 16 |

EBITDA excluding IFRS 16 |

|

Current operating income before depreciation, amortization and

provisions on fixed operating assets that are recognized as

recurring operating income |

Current EBITDA including rental expenses within the scope of

application of IFRS 16 |

| |

|

|

Free cash-flow from operations |

Payment of rent within the scope of IFRS

16 |

Free cash-flow from operations excluding

IFRS 16 |

|

Net cash-flow from operating activities, less net operating

investments |

Free cash-flow from operations, including cash impacts relating to

rent within the scope of application of IFRS 16 |

| |

|

|

Net financial debt |

Leasing debt |

Net financial debt excluding IFRS

16 |

|

Gross financial debt less gross cash and cash equivalents |

Net financial debt less leasing debt |

| |

|

|

Net financial income |

Financial interest on leasing debt |

Net financial income excluding financial interest on

leasing debt |

1 Excluding IFRS 16

2 Like-for-like basis – LFL: excludes

the effect of changes in foreign exchange rates, changes in scope,

and store openings and closures.3 Corresponds to the current net

income, Group share of continuing operations, excluding IFRS 16 and

adjusted according to the provision relating to the planned

transaction with the French Competition Authority (€85 million) and

brand impairments (€20 million).4 Note de Conjoncture (economic

forecast) – December 2023, INSEE5 The Darcos Law, which took effect

on October 7, 2023, imposes upon all players in the online

bookselling market a minimum delivery fee of €3 for any purchases

of new books totaling less than €35.6

Like-for-like basis – LFL: excludes the effect of changes

in foreign exchange rates, changes in scope, and store openings and

closures.7 Market data for 2023 published by Banque de France.8

Like-for-like basis – LFL: excludes the effect of changes

in foreign exchange rates, changes in scope, and store openings and

closures.

9 Fnac Darty decided to waive its right to

contest the grievance notified to it by the French Competition

Authority’s investigation services concerning, in particular, a

vertical agreement between Darty and some distributors over a

limited period which ending in December 2014 - i.e., prior to

Fnac’s acquisition of Darty. This choice does not constitute

neither an avowal nor an acknowledgment of responsibility on the

part of the Group, but rather reflects its intention to bring a

rapid close to a complex procedure and to be able to devote all its

resources to the operational implementation of its “Everyday”

strategic plan. See the press release published on June 29, 2023.10

Corresponds to the current net income from continuing operations,

Group share, excluding IFRS 16 and adjusted according to the

provision relating to the planned transaction with the French

Competition Authority (€85 million) and brand impairments (€20

million)11 Includes trade marketing and advertising department

activities.12 Leadership as per CDP include all companies evaluated

A and A-.13 Corresponds to the current net income, Group share of

continuing operations, excluding IFRS 16 and adjusted according to

the provision relating to the planned transaction with the French

Competition Authority (€85 million) and brand impairments (€20

million)

14 Excluding IFRS 16.15

Like-for-like basis – LFL: excludes the effect of changes

in foreign exchange rates, changes in scope, and store openings and

closures.16 Exceptional non-current operating expenses in 2023

correspond to the provision relating to the planned transaction

with the French Competition Authority €85 million and brand

depreciation €20 million

17 EBITDA = current operating income before

interest, tax, depreciation, amortization and provisions on fixed

operational assets.18 Sustainability score: average of a

reliability score and a repairability score, based on data

collected by Fnac Darty’s after-sales service over the last two

years for each product and weighted by the volumes of products sold

by the Group in the year in question.

- Fnac_Darty_CP_2023_EN_22 02 2024_vdef

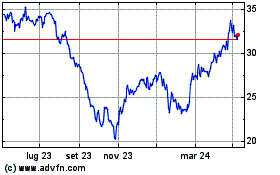

Grafico Azioni Fnac Darty (EU:FNAC)

Storico

Da Mar 2024 a Apr 2024

Grafico Azioni Fnac Darty (EU:FNAC)

Storico

Da Apr 2023 a Apr 2024