Latecoere Business Development Market Update

05 Aprile 2022 - 7:21PM

Business Wire

Regulatory News:

General M&A Update

Following Latécoère’s (Paris:LAT) capital increase completed in

August 2021, the Group has completed two acquisitions during 2021

(SDM in Mexico and TAC in Belgium) and announced a further

acquisition during H2 2021, targeting closing in H1 2022 (see

below). This market communication provides a further update on

Latecoere’s ongoing efforts to strengthen the business through

acquisition, to create long term sustainable shareholder value.

Acquisition of MADES

Latécoère announced the acquisition of Malaga Aerospace, Defense

& Electronics Systems (“MADES”) on 13 December 2021. Latécoère

is making good progress on the conditions precedent to closing,

including filing with the Spanish Council of Ministers, which was

formally submitted in January this year. Latécoère continues to

target completion of the MADES acquisition during H1 2022.

Potential acquisition(s) in North America

Separately, Latécoère confirms it continues to progress

discussions with multiple potential targets, which, if successful,

would have a meaningful impact on the combined group.

In particular, following the completion of its technical due

diligence, Latécoère submitted two non- binding offer letters, for

the acquisition of 100% of two separate companies both based in

North America and active in Aerostructures solutions and which, in

aggregate, generated revenues of circa €90 million in 2021.

One of these offers, relating to the largest of the two targets,

has been approved by Latécoère and Target Board for the proposed

combination and the parties entered today into exclusive

negotiations through 29 April 2022 to achieve definitive legal

documentation. The second offer is under consideration by the

smaller of the two target’s Board and will be subject to inter-alia

Latécoère Board approval and agreeing definitive transaction

documentation.

Should these transactions be successful, they would require a

maximum total investment in cash of circa €95 million

(approximately split 70 / 30 if both transactions were completed),

to be fully funded with the August 2021 right issue proceeds, and

to be completed in the next 12 months.

There can be no certainty that these transactions will be

successful.

About Latécoère

As a "Tier 1" international partner of the world's major

aircraft manufacturers (Airbus, Boeing, Bombardier, Dassault,

Embraer and Mitsubishi Aircraft), Latécoère serves aerospace with

innovative solutions for a sustainable world. The Group is active

in all segments of the aeronautics industry (commercial, regional,

business and military aircraft), in two areas of activity:

- Aerostructures (46% of turnover): fuselage sections and

doors,

- Interconnection Systems (54% of turnover): wiring, electrical

furniture and on-board equipment.

As of December 31, 2021, the Group employed 4,764 people in 14

different countries. Latécoère, a French limited company

capitalised at €132,745,925 divided into 530,983,700 shares with a

par value of €0.25, is listed on Euronext Paris - Compartment B,

ISIN Codes: FR0000032278 - Reuters: LAEP.PA - Bloomberg:

LAT.FP.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20220405006092/en/

Taddeo Antoine Denry / Investor Relations +33 (0)6 18 07

83 27 Marie Gesquière / Media Relations +33 (0)6 26 48 97 98

teamlatecoere@taddeo.fr

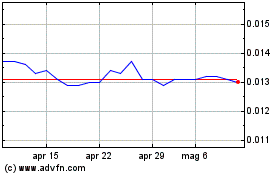

Grafico Azioni Latecoere (EU:LAT)

Storico

Da Mar 2024 a Apr 2024

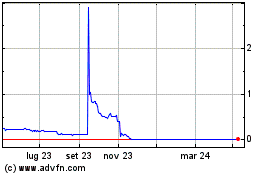

Grafico Azioni Latecoere (EU:LAT)

Storico

Da Apr 2023 a Apr 2024