Pernod Ricard Banks on Demand for Canned Drinks After Inking Deal for Canada's ABG -- Update

13 Giugno 2023 - 10:24AM

Dow Jones News

By Joshua Kirby

Pernod Ricard said Tuesday that it reached a deal to buy a

Canadian maker of canned cocktails, a rapidly growing category in

the global drinks market, adding to the distiller's North

America-focused expansion strategy.

The group, which counts Absolut vodka, Martell cognac and

Jameson whiskey among its brands, will take a 90% stake in Ace

Beverage Group. The Ontario-based company produces the Cottage

Springs line of ready-to-drink cocktails and mixed drinks,

including vodka water and tequila soda.

The acquisition, via Pernod Ricard's majority-owned Canadian

subsidiary Corby Spirit and Wine, gives ABG an enterprise value of

165 million Canadian dollars ($123.4 million), Pernod Ricard said.

It has the option to reach 100% ownership in ABG via two call

options exercisable in 2025 and 2028.

The group already makes RTDs using products including a pine

colada made with Malibu coconut rum with and Jameson with ginger

and lime. Canned drinks are a way of introducing customers to its

products, Chief Executive Alexandre Ricard told The Wall Street

Journal in an interview earlier this year.

"People really expect some of these big brands to have

ready-to-serves ready for them," Ricard said. "It recruits into the

brand."

Globally, RTD products should rise by some $11.6 billion in

value between last year and 2026, according to data from

drinks-research firm the IWSR. Consumers are increasingly choosing

them over other options like beer, citing taste and convenience,

according to the IWSR.

RTDs had a 5% share of the U.S. drinks market last year,

according to data from Uber-owned drinks-delivery business

Drizly.

The acquisition will boost the group's exposure to the market in

Canada, said Fredrik Syren, the group's director of RTDs and

convenience.

"With ABG, Corby becomes a key player in the Canadian RTD

market, giving the scale and synergies needed in this category,"

Syren said.

Pernod Ricard's acquisition strategy has focused in recent years

on North America, where it has bought up brands oriented to a

growing thirst for pricier drinks. At the end of last year, the

group bought Codigo 1530, maker of premium tequilas and mezcals,

and upped its stake in premium group Sovereign Brands in the U.S.

This year, it added to its flavored-whiskey portfolio with the

acquisition of Skrewball, maker of peanut-butter whiskey.

Drinks sales have boomed in North America since the beginning of

the pandemic, spurred first by a boom in cocktails at home and

sustained by a return to bars when lockdowns ended. That cycle is

coming to an end, with sales momentum slowing, but structural

drivers remain very encouraging, analysts at Jefferies said in a

recent note.

Premium spirits are an affordable luxury, the analysts said,

making them more resilient than some other consumer goods to a

slowdown in spending as a worsening economy takes its toll.

Write to Joshua Kirby at joshua.kirby@wsj.com;

@joshualeokirby

(END) Dow Jones Newswires

June 13, 2023 04:09 ET (08:09 GMT)

Copyright (c) 2023 Dow Jones & Company, Inc.

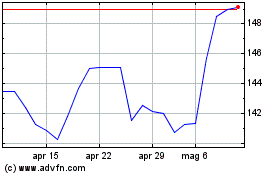

Grafico Azioni Pernod Ricard (EU:RI)

Storico

Da Mar 2024 a Apr 2024

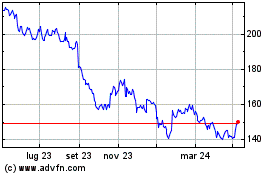

Grafico Azioni Pernod Ricard (EU:RI)

Storico

Da Apr 2023 a Apr 2024