2024 results: Solid growth, record operating profit and net cash;

Financial guidance exceeded

Press Release

February 20, 2025 |

|

|

20250220_Renault Group_Press Release_2024 FY results

2024 results: Solid

growth, record operating

profit and net cash

Financial guidance

exceeded

- Record profitability and cash

generation, exceeding 2024 FY financial guidance:

- Group

revenue: €56.2bn, +7.4% and +9.0% at constant exchange

rates1 vs 2023. This robust performance is driven by our

complementary auto brands, all 3 of which delivered growth

- Historical

Group operating profit in absolute value at €4.3bn (+€146m

vs. 2023 and +15% growth when excluding Horse impacts2),

7.6% of revenue

- Net

income – Group share:

- €2.8bn (excluding a total of

-€2.0bn of Nissan’s impacts related to capital loss on Nissan’s

shares disposals, Nissan’s contribution and partial impairment of

investment in Nissan)3, +21% vs 2023

- Reported net income – Group share:

€0.8bn

- Solid free

cash flow4: €2.9bn vs guidance

at ≥€2.5bn, driven by a strong operational performance

- Record

Automotive net cash financial position, almost doubled:

€7.1bn at December 31, 2024 (+€3.4bn vs December 31, 2023)

- Solid

orderbook in Europe around 2 months of forward sales

- A dividend

of €2.20 (+19% vs last year) will be

submitted to approval of the Annual General Meeting on April 30,

2025 versus €1.85 per share in respect of 2023 financial year

- In 2025,

considering market uncertainties especially due to

CO2 emissions

regulation impact in Europe (CAFE), Renault Group is aiming to

achieve:

- A Group

operating margin ≥7% (it includes around 1 point of

estimated CAFE negative impact)

- A free cash

flow ≥€2bn including €150m of Mobilize Financial Services

(MFS) dividend (vs €600m in 2024) due to a minimum level of MFS

equity to keep complying with European Central Bank and the credit

rating agencies solvency ratios. From next year, MFS dividends will

rise again to return to a level in line with historical average

(subject to regulatory and MFS board approvals).

“Renault Group continues to improve

its operational performance, execute its strategy and deliver on

its targets. 2024 was an important year with the first benefits of

our unprecedented product offensive. This performance is the result

of an in-depth transformation of the company driven by a remarkable

collective work. We have turned Renault Group into a much more

flexible, efficient and performant company.

And we will not stop there! Thanks to the strong

fundamentals built over the last 4 years and driven by an agile and

innovative mindset, we are now preparing the next chapter, aiming

for profitable growth while investing for the future. I want to

thank our colleagues for these achievements: their passion,

commitment, and team spirit are key drivers to our

success.” said

Luca de Meo, CEO of Renault

Group

Boulogne-Billancourt, February 20, 2025

Commercial performance

-

Complementary and growing automotive brands:

- Strong line-up renewal with 10

launches and 2 facelifts in 2024 and 7 launches and 2 facelifts to

come in 2025.

- In Europe, Renault Group is on the

podium of OEMs:

- Renault brand #3 in

PC+LCV5 and #1 in LCV6 in Europe, #1 in

France in PC, in electric vehicles and in LCV2.

- Dacia in the top 10 best-selling

brands in Europe and on the podium for sales to retail customers.

Sandero best-selling car across all channels.

- Alpine sales increased +5.9% at

4,585 units in 2024, before its product offensive.

-

Electrification7

offensive:

- Renault Group continued its

electrification offensive, with a mix of electrified3

sales at 33% in Europe (+4.1 points vs. 2023), with a hybrid mix at

24% and an EV mix close to 9% in a transition year in the Group’s

EV line-up. The EV offensive started to be reflected in the

4th quarter, with an EV mix at 12%, almost 5 points more

than the rest of the year. Renault brand posted a 49% electrified

sales mix in Europe: Renault brand was #2 in hybrid (HEV) in Europe

with sales up 30% at 36% mix and EV sales at 13% reaching more than

16% in Q4.

- In 2024, Renault Group confirms it

achieved its CAFE targets (passenger cars and light commercial

vehicles) in Europe.

- Strong

focus on value:

- Sales to retail customers in

Europe8 represent 63% of the Group sales (+21 points vs.

market average) with 4 models9 in the top 10 of this

category.

- C-segment and above at 41.3% for

Renault brand in Europe (+ 15 points in 4 years).

- Residual values10 higher

than in 2023, (respectively +9.1 points and + 9.5 points for

Renault and Dacia in 4 years) outperforming the market in

2024.

Financial results

The consolidated financial statements of Renault

Group and the company accounts of Renault SA at December 31, 2024

were approved by the Board of Directors on February 19, 2025 under

the chairmanship of Jean-Dominique Senard.

Group revenue reached €56,232

million, up 7.4% compared to 2023. At constant exchange

rates11, it increased by 9.0%.

Automotive revenue stood at

€50,519 million, up 4.9% compared to 2023. It included 1.4 points

of negative exchange rates effect mainly related to the Argentinean

peso, to the Turkish lira devaluation and to a lesser extent to the

Brazilian Real. At constant exchange rates4, it

increased by 6.3%, mainly due to the following:

- Volume:

+1.3 points, in line with the increase of our registrations thanks

to the growing impact of our launches and a higher restocking

within the dealership network compared 2023 to secure the ongoing

product offensive. As of December 31, 2024, total inventories of

new vehicles stood at 540,000 vehicles, of which 437,000 at

independent dealers and 103,000 at Group level.

- Product

mix: +2.7 points, in constant improvement over the year in line

with the Group’s recent launches (Scenic, Rafale, Duster, Symbioz,

Renault 5, Koleos, Espace…) which have more than offset the

negative effect from the end of life of Zoe, the continuing success

of Sandero and the transition to new Master.

- Price:

+0.6 points, as expected, reflecting the entry into a phase of

price stabilization. Renault Group aims to offset negative currency

effects by pricing actions while giving a portion of its cost

reduction back to its customers mostly through content. Thereby, it

further supports the competitiveness of the Group’s vehicles while

protecting margins.

-

Geographic mix: +0.4 points.

- Sales to

partners: -0.9 points, due to the decrease of new vehicles sales to

partners in a transition period before the launch of new products,

partially offset by R&D billings to partners in line with the

ramp-up of common projects.

- Other:

+2.2 points, primarily related to the strong performance of parts

and accessories.

The Group posted a

record operating profit in absolute value at

€4,263m, up €146m vs. 2023. It represented 7.6% of revenue.

Adjusted from the impacts of Horse

operations12, the Group operating margin increased by

15% in absolute value and by 0.5 points from 6.9% in 2023 to 7.4%

in 2024.

Automotive operating margin

stood at 5.9% of Automotive revenue or €2,996m compared to €3,051

million in 2023. This evolution was mainly explained by the

following:

- A

positive impact of foreign exchange of +€143 million, mostly

attributable to the impact of the Turkish lira devaluation on

production costs.

- A flat

volume effect of +€4 million, the positive impact of Group sales

being offset by lower sales to partners.

-

Price/mix/enrichment and costs effects represented together a

positive impact of €325 million. Price/mix/enrichment effect was

negative by -€467 million and costs were reduced by €792 million

thanks to a strong purchasing performance and to a lesser extent to

a raw materials tailwind. The Group continued to reduce its costs

and to pass part of those gains to its customers to boost the

competitiveness by offering attractive vehicles in terms of price

and content while offsetting regulatory requirements, especially on

new models and facelifts. Renault Group’s strategy is to work on

the combination of these two effects to improve margins.

- A

negative effect of R&D of -€115 million: the increase in gross

R&D spendings and the lower capitalization rate in 2024

compared to 2023 (-7.4 points) were only partially offset by

R&D billings to partners, and lower amortization of capitalized

R&D expenses.

- A

negative impact of SG&A, which increased by €177 million,

mainly driven by an increase of marketing costs related to the

brands’ offensives and motorsport activities.

- The

“others” item was positive at +€157 million thanks to the strong

performance of the aftersales business.

- Prior to

deconsolidation, Horse was under the IFRS 5 assets held for sale

accounting treatment and therefore, amortization of its assets had

been suspended. Since Horse was deconsolidated on May

31st, 2024, invoices paid to Horse by Renault Group

include the cost of amortization again as well as Horse's mark up.

The cumulated effect of these 2 elements represented a negative

impact on the bridge of the operating margin of -€55 million for

the month of June and -€330 million in H2, or -€385 million for the

full year.

The contribution of Mobilize Financial

Services (Sales Financing) to the Group's operating margin

reached €1,295 million versus €1,101 million in 2023 mainly thanks

to the continuous strong growth of the customer financing activity

as well as the non-repetition of a -€84 million negative impact of

swaps valuation observed in 2023.

Mobility Services contribution to the Group’s

operating profit increased by €7 million versus 2023 at -€28

million in 2024.

Other operating income and

expenses were negative at -€1,687 million (versus -€1,632

million in 2023). This amount included -€1.5 billion of capital

loss on the disposals of Nissan’s shares made in March and

September 2024, +€0.5 billion of capital gain on Horse

deconsolidation, -€0.3 billion of impairment on vehicles

developments and specific production assets and -€0.3 billion of

restructuring costs.

After taking into account other operating income

and expenses, the Group’s operating income stood

at €2,576 million versus €2,485 million in 2023 (+€91 million

versus 2023).

Net financial income and

expenses amounted to -€517 million compared to -€527

million in 2023. This evolution is explained by a lower cost of net

debt partially offset by the negative impact of hyperinflation in

Argentina.

The contribution of associated

companies amounted to -€521 million compared to €880

million in 2023. This included +€211 million related to Nissan's

contribution and -€694 million of adjustment of the investment in

Nissan following the impairment test carried out on December 31,

2024 subsequent to Nissan’s most recent assumptions.

The contribution of associated companies also included +€64 million

of Horse contribution since its deconsolidation.

Current and deferred taxes

represented a charge of -€647 million, compared to -€523 million in

2023. This increase is due to the performance improvement. The

effective tax rate stood at 18%, stable compared to 2023.

Thus, net income stood at €891

million, and net income, Group share, was €752

million (or €2.76 per share). Excluding the capital loss on

Nissan’s shares disposal (-€1.5 billion), Nissan’s contribution

(+€0.2 billion) and the partial impairment of investment in Nissan

(-€0.7 billion), net income stood at €2.8 billion versus €2.3

billion in 2023.

The cash flow of the

Automotive business reached €5,239 million in 2024. It

included €600 million of Mobilize Financial Services dividend.

Tangible and intangible investments before asset disposals stood at

€2,915 million (€2,821 million net of disposals) and restructuring

expenses amounted to €379 million.

The change in working capital requirement was

positive at €844 million due to the strong activity in Q4 2024.

Excluding the impact of asset disposals, the

Group's net CAPEX and R&D stood at €4,066 million in 2024,

representing 7.2% of revenue compared to 7.3% of revenue in 2023.

It amounted to

7.1% including asset disposals.

Free cash

flow13 stood at €2,883 million

including €600 million of Mobilize Financial Services dividend.

The Automotive net financial

position stood at a record level of €7,096 million on

December 31, 2024, compared to €3,724 million on December 31, 2023,

an improvement of €3,372 million. This increase was driven by the

strong free cash flow, a positive impact of Horse operations

(€1,058 million of which €324 million from the 10% stake sale to

Aramco), cash received from the disposal of Nissan’s shares (€852

million) and dividends received from Nissan (€142 million). It was

partly offset by dividends paid to shareholders for €631 million

(of which €540 million of dividend paid by Renault SA to its

shareholders), financial investments for €478 million, of which

€260 million in Flexis SAS, and -€454 million of other effects

mainly related to treasury stock and IFRS16 impact.

Automotive liquidity reserve at

the end of December 2024 stood at a high level at €18.5 billion

versus €17.8 billion on December 31, 2023.

Dividend

The proposed dividend for the financial year

2024 is €2.20 per share, up 19%

versus last year (+€0.35 per share). The payout ratio is 21.5% of

Group consolidated net income – parent share14. It would

be paid fully in cash and will be submitted for approval at the

Annual General Meeting on April 30, 2025. The ex-dividend date is

scheduled on May 8, 2025 and the payment date on May 12, 2025.

2025 financial outlook

In a market still marked by uncertainty on

demand and regulatory constraints, Renault Group will benefit in

2025 from full year impact of 2024 launches and 2025 product

offensive, combined with the acceleration of cost reduction. They

will be the drivers of operational performance and sound cash

generation.

In 2025, considering market

uncertainties especially due to

CO2 emissions

regulation impact in Europe (CAFE), Renault Group is aiming to

achieve:

- A Group

operating margin ≥7% (it includes around 1 point of

estimated CAFE negative impact).

- A free cash

flow ≥ €2bn including €150m of Mobilize Financial Services

(MFS) dividend (versus €600m in 2024).

MFS dividend policy is based on a minimum level

of equity to keep complying with both the European Central Bank and

the credit rating agencies solvency ratios. Therefore, MFS pay-out

ratio depends on the level of financing outstandings and equity.

Financing outstandings have strongly increased in 2024 due

to the increase of business and to the sharp rise in average

vehicle prices, leading MFS to consider a dividend of €150m. From

next year, MFS dividends will rise again to return to a level in

line with historical average (subject to regulatory and MFS board

approvals).

Renault Group's consolidated results

|

In € million |

2023 |

2024 |

Change |

|

Group revenue |

52,376 |

56,232 |

+7.4% |

|

Operating margin |

4,117 |

4,263 |

+146 |

|

% of revenue |

7.9% |

7.6% |

-0.3 pts |

|

Other operating income and expenses |

-1,632 |

-1,687 |

-55 |

|

of which capital loss on Nissan’s shares disposal |

-880 |

-1,527 |

-647 |

|

Operating income |

2,485 |

2,576 |

+91 |

|

Net financial income and expenses |

-527 |

-517 |

+10 |

|

Contribution from associated companies |

880 |

-521 |

-1,401 |

|

of which Nissan |

797 |

-483 |

-1,280 |

|

Current and deferred taxes |

-523 |

-647 |

-124 |

|

Net income |

2,315 |

891 |

-1,424 |

|

Net income, Group share |

2,198 |

752 |

-1,446 |

|

Net Income, Group share, adjusted from Nissan’s

impacts1 |

2,281 |

2,762 |

+481 |

|

Free cash flow |

3,024 |

2,883 |

-141 |

|

Automotive net financial position |

+3,724

at 2023-12-31 |

+7,096

at 2024-12-31 |

+3,372 |

1FY 2023: +€797m of contribution from Nissan’s

results and -€880 million of capital losses on Nissan’s shares

disposal.

FY 2024: +€211m of contribution from Nissan’s results and

-€1,527 million of capital losses on Nissan’s shares disposals and

-€694 million of impairment of investment in Nissan.

Horse accounting impacts on operating margin

|

In € million |

2022 1 |

2023 |

2024 |

|

Operating margin |

2,570 |

4,117 |

4,263 |

|

% of revenue |

5.5% |

7.9% |

7.6% |

|

Horse impacts |

87 |

482 |

97 |

|

Operating margin excluding Horse impacts |

2,483 |

3,635 |

4,166 |

|

% of revenue |

5.4% |

6.9% |

7.4% |

1The 2022 figures include restatements following the

first application of IFRS 17 "Insurance contracts" in 2023.

Dividend payout calculation

|

2023 |

2024 |

|

Net income, Group share (€m) |

2,198 |

752 |

|

Capital loss on Nissan shares disposal (€m) |

880 |

1,527 |

|

Partial impairment of investment in Nissan (€m) |

- |

694 |

|

Net income adjusted, Group share |

3,078 |

2,973 |

|

Dividend by share (€) |

1.85 |

2.20 (1) |

|

Variation vs. previous year |

|

+18.9% |

|

Dividend paid or to be paid by Renault SA (€m) |

540 (2) |

638 (3) |

|

Payout ratio |

17.5% |

21.5% |

1 FY 2024 dividend pending Shareholders’ General

Meeting approval.

2 Paid in 2024 for FY 2023.

3 Estimate based on number of shares as of Dec. 31,

2024, to be paid in 2025 pending Shareholders’ General Meeting

approval.

Additional information

The consolidated financial statements of Renault

Group and the company accounts of Renault SA at December 31, 2024

were approved by the Board of Directors on February 19, 2025.

The Group’s statutory auditors have conducted an

audit of these financial statements, and their report will be

issued shortly.

The earnings report, with a complete analysis of

2024 financial results including condensed financial accounts, is

available at www.renaultgroup.com in the "Finance" section.

2024 Financial Results Conference

Link to follow the conference at 8am CET on February

20th, and available in replay:

events.renaultgroup.com/en/

About Renault Group

Renault Group is at the forefront of a mobility

that is reinventing itself. The Group relies on the complementarity

of its 4 brands - Renault - Dacia - Alpine and Mobilize - and

offers sustainable and innovative mobility solutions to its

customers. Established in 114 countries, Renault Group sold 2.265

million vehicles in 2024. It employs more than 98,000 people who

embody its Purpose every day, so that mobility brings people

closer.

Ready to pursue challenges both on the road and in competition, the

Group is committed to an ambitious and value-generating

transformation focused on the development of new technologies and

services, and a new range of even more competitive, balanced, and

electrified vehicles. In line with environmental challenges, the

Group’s ambition is to achieve carbon neutrality in Europe by

2040.

https://www.renaultgroup.com/en/

RENAULT

GROUP INVESTOR

RELATIONS |

|

Philippine de

Schonen

+33 6 13 45 68 39

philippine.de-schonen@renault.com

|

|

|

RENAULT

GROUP

PRESS

RELATIONS

|

|

Rie Yamane

+33 6 03 16 35 20

rie.yamane@renault.com

François Rouget

+33 6 23 68 07 88

francois.rouget@renault.com |

|

|

1 In order to analyze the variation

in consolidated revenue at constant exchange rates, Renault Group

recalculates the revenue for the current period by applying average

exchange rates of the previous period.

2 The adjustment from the impacts of Horse operations

includes the cessation of assets amortization in 2023 (12 months)

and 2024 (5 months) prior to the deconsolidation on May 31, 2024

and a mark-up invoiced by Horse since the deconsolidation (7 months

in 2024).

3 Excluding -€1,527 million of capital losses on

Nissan’s shares disposals, +€211m of contribution from Nissan’s

results and -€694 million of impairment of investment in

Nissan.

4 Automotive free cash flow: cash flow after interest

and taxes (excluding dividends received from listed companies) less

tangible and intangible investments net of disposals +/- change in

working capital requirement.

5 PC + LCV: Passenger Cars + Light Commercial

Vehicles.

6 Excluding pick-up trucks.

7 Includes EV, hybrid (HEV) and Plug-In hybrid (PHEV)

passenger cars, excludes Mild-hybrid (MHEV).

8 France, Germany, Spain, Italy and United Kingdom.

9 Sandero, Duster, Clio and Captur.

10 For Renault brand and Dacia brand PC in France,

Germany, Spain, Italy and United Kingdom.

11 In order to analyze the variation

in consolidated revenue at constant exchange rates, Renault Group

recalculates the revenue for the current period by applying average

exchange rates of the previous period.

12 The adjustment from the impacts of Horse operations

includes the cessation of assets amortization in 2023 (12 months)

and 2024 (5 months) prior to the deconsolidation on May 31, 2024

and a mark-up invoiced by Horse since the deconsolidation (7 months

in 2024).

13 Automotive free cash flow: cash

flow after interest and taxes (excluding dividends received from

listed companies) less tangible and intangible investments net of

disposals +/- change in working capital requirement.

14 Excluding -€1,527m of capital loss on Nissan’s shares

disposal and -€694m of impairment of investment in Nissan.

- 20250220_Renault Group_Press Release_2024 FY results

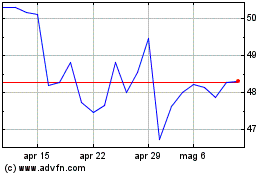

Grafico Azioni Renault (EU:RNO)

Storico

Da Gen 2025 a Feb 2025

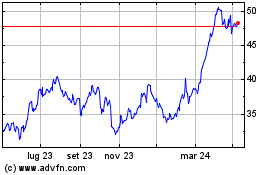

Grafico Azioni Renault (EU:RNO)

Storico

Da Feb 2024 a Feb 2025