Global Gaming Shares Dive After China Proposes Online-Gaming Curbs -- 2nd Update

22 Dicembre 2023 - 1:13PM

Dow Jones News

By Jiahui Huang and Mauro Orru

Global gaming stocks sank after Beijing released draft

regulations for the online game industry that included restrictions

on incentives to play or spend more online.

Shares of Netease, one of China's major online gaming companies,

fell some 25% in Hong Kong. Tencent Holdings, the Chinese tech

juggernaut that is also a domestic gaming giant, ended the day down

more than 12%--wiping out $46 billion in market value and

representing its largest one-day share loss since 2008.

In Europe, shares of Prosus, which holds a large stake in

Tencent, slumped 17%. Shares of Assassin's Creed maker Ubisoft

Entertainment plunged almost 8% in early morning trading in

Paris.

Meanwhile in the U.S., Electronic Arts and Take-Two Interactive

Software shares were down more than 1% premarket, while

Microsoft--which closed its $75 billion acquisition of Activision

Blizzard in October--was down 0.3%.

The rout came after China's National Press and Publication

Administration, the country's media and videogame regulator,

proposed curbs to users' in-game spending as well as banning minors

from tipping players and hosts who livestream games.

The regulations would also prevent companies from offering

probability-based lottery services to minors. Game companies

wouldn't be allowed to set rewards that might encourage more time

or money being spent online, including incentives for daily logins

and maximum amount of recharges according to the draft rules.

The National Press and Publication Administration said it is

seeking public comment on the rules until Jan. 22.

If implemented, the draft regulations would mark another

crackdown on China's lucrative gaming industry. Beijing in 2021

issued strict measures aimed at curbing what authorities described

as youth videogame addiction, banning minors from playing

videogames during the school week.

Sebastian Patulea, vice president at Jefferies's equity research

department, said the unexpected nature of the draft legislation is

a stark reminder to the market that Beijing is very much focused on

lowering in-game engagement.

"This doesn't help with stock sentiment given, by and large,

investors thought this chapter has mostly ended. In our view,

videogame developers that charge on a per-engagement model will

continue to see headwinds," Patulea said.

China is a key market for the gaming industry. The country was

the second largest gaming market globally in 2022 after the U.S. by

sales, according to gaming-market research firm Newzoo.

The proposals could lead to a reduction in player monetization,

hitting revenue and profit margins for gaming companies operating

in one of the industry's biggest markets, Equita SIM analyst

Gianmarco Bonacina wrote in a research note.

--Adria Calatayud contributed to this article.

Write to Jiahui Huang at jiahui.huang@wsj.com and Mauro Orru at

mauro.orru@wsj.com

(END) Dow Jones Newswires

December 22, 2023 06:58 ET (11:58 GMT)

Copyright (c) 2023 Dow Jones & Company, Inc.

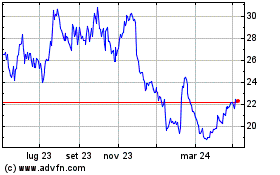

Grafico Azioni UBISoft Entertainment (EU:UBI)

Storico

Da Mar 2024 a Apr 2024

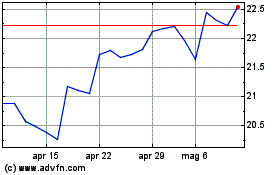

Grafico Azioni UBISoft Entertainment (EU:UBI)

Storico

Da Apr 2023 a Apr 2024