VGP NV: Full Year Results 2023

22 Febbraio 2024 - 7:00AM

VGP NV: Full Year Results 2023

Regulated Information - Inside

Information

22 February 2024, 7:00am, Antwerp,

Belgium: VGP NV (‘VGP’ or ‘the Group’), a European

provider of high-quality logistics and semi-industrial real estate,

today announces the results for the year ended 31 December

2023:

-

- A net profit of € 87.3 million, an increase of

€ 209.8 million versus FY ‘22.

- Executed three joint venture closings

resulting in a strong net cash recycling of € 676.2

million. All transactions, including those that are

committed to close in ’24 have been realized or agreed at a

premium versus the recognized fair value at year-end ’22,

resulting in a realized gain of € 59 million in ’23 on the

effectuated transactions.

- Established two new joint ventures with Deka

and Areim for a total gross asset value of over

€ 2.6 billion. Together with two closings with

Allianz in H1 ’23, VGP has transacted and/or secured a future

pipeline of transactions of € 3 billion gross asset

value. Upcoming closings in ’24 expect to recycle minimum

€ 525 million of gross proceeds at pre-agreed pricing.

- € 69.5 million of new and renewed leases

signed year-to-date bringing the annualized committed

leases at year-end to € 350.8 million1 (+

€ 47.6 million compared to 31 December 2022, which is +16%

y-o-y).

- 1,933,000 m² of new development land acquired2

and 1,324,000 m² of development land deployed to support the

developments started up during the year. Total secured land bank

stands at 9.4 million3 m² at the end of 2023

representing a development potential of over 4.3 million m². Pro

forma today’s announced sale of LPM in ‘24, the total secured land

bank lowers to 8.6 million m2. Total acquisitions represent a

capex of € 212.4 million and

include the purchase of some iconic land plots in the vicinity of

Paris and Frankfurt.

- 24 projects delivered during the year

representing 641,000 m², or € 42.3 million in additional annual

rent (of which 12 projects totalling 330,000 m² delivered during

the 2H 2023), currently 100% let. As a result, net rental

income, on a look through basis4, grew

48%, from € 107.4 million to € 159.1 million,

knowing that at year-end € 304 million (€ +66 million y.o.y), or €

194.3 million on a proportional look through basis, has become cash

generative.

- 26 projects under construction representing

774,000 m² (of which 23 projects totalling 600,000 m² started up

during the year) and € 51.9 million in

additional annual rent once fully built and let. The

pipeline under construction is 77.3% pre-let.

Pre-let ratio lowered as a result of certain speculative assets

that initiated construction in Q4 ’23 following amongst others a

decline in construction costs.

- Property portfolio5 virtually fully let with occupancy

at 99% (compared to 99 % as at 31 December 2022). 75.9 %

of the completed portfolio is certified, amongst other a DGNB

Platinum has been awarded for VGP Park Laatzen, the first German

property developed and owned by a developer.

- Photovoltaic (PV) capacity grew 79.9% YoY with

operational capacity passing the 100 MWp-mark at 101.8 MWp (vs.

56.6MWp in Dec-22). 69.0 MWp PV projects

under development and a further 99.7 MWp being planned.

The ongoing transition to green energy consumption in our

buildings, as well as other eco-efficiency measures contributed to

the four-star GRESB developer rating, the second

highest among peers in the European logistics

segment.

- Solid balance sheet with € 400 million undrawn credit

facility availability and lower debts of € 375 million

following repayment of two bonds in April and September. Finally,

VGP was able to obtain a credit facility of the European Investment

Bank of € 150 million to support its renewable

energy business unit. As per 5 February 2024, VGP has drawn € 135

million of the facility at an interest rate of 4.15% on a ten-year

period.

- Certain important events occurred after the balance sheet date.

It concerns the sale of VGP’s stake in the LPM Joint Venture in Q1

’24, whereby VGP recycled approximately € 170 million of

gross proceeds. VGP also acquired its First Danish land

plot located in Vejle.

- The board of directors proposes an ordinary dividend of € 80.5

million (+ 7.3% versus last year), as well as an extraordinary €

20.5 million top-up following the record net cash recycling with

the existing and new Joint Ventures in ‘23. This brings the total

annual gross dividend to € 101 million, or € 3.70 per

share.

For the full detail of the results please see the

attachted press release.

KEY FINANCIAL METRICS

|

Operations and results |

FY 2023 |

FY 2022 |

Change (%) |

|

Committed annualized rental income (€mm) |

350.8 |

303.2 |

+15.7% |

|

IFRS Operating profit (€mm) |

118.8 |

(115.6) |

n.a. |

|

IFRS net profit (€mm) |

87.3 |

(122.5) |

n.a. |

|

IFRS earnings per share (€ per share) |

3.20 |

(5.49) |

n.a. |

|

Portfolio and balance sheet |

Dec 23 |

Dec 22 |

Change (%) |

|

Portfolio value, including joint venture at 100% (€mm) |

7,194 |

6,443 |

+11.7% |

|

Portfolio value, including joint venture at share (€mm) |

4,828 |

4,605 |

+4.8% |

|

Occupancy ratio of standing portfolio (%) |

98.9 |

98.9 |

0.0% |

|

EPRA NTA per share (€ per share)1 |

83.10 |

84.35 |

-1.5% |

|

IFRS NAV per share (€ per share) |

81.14 |

80.69 |

+0.6% |

|

Net financial debt (€mm) |

1,778 |

1,669 |

+6.5% |

|

Gearing2(%) |

40.3% |

34.4% |

+17.2% |

1 See note 10.2

2 Calculated as Net debt / Total equity and

liabilities

WEBCAST FOR INVESTORS AND ANALYSTS

VGP will host a webcast at 10:30 (CET) on 22 February

2024

Webcast link:

https://channel.royalcast.com/landingpage/vgp/20240222_1/

- Click on the link above to attend the presentation from your

laptop, tablet or mobile device. The webcast will stream through

your selected device. Please join the event webcast 5-10 minutes

prior to the start time

A presentation will be available on VGP website:

https://www.vgpparks.eu/en/investors/publications/

CONTACT DETAILS FOR INVESTORS AND MEDIA

ENQUIRIES

|

Investor Relations |

Tel: +32 (0)3 289 1433 investor.relations@vgpparks.eu |

|

Karen Huybrechts (Head of Marketing) |

Tel: +32 (0)3 289 1432 |

ABOUT VGP

VGP is a pan-European owner, manager and

developer of high-quality logistics and semi-industrial properties

as well as a provider of renewable energy solutions. VGP has a

fully integrated business model with extensive expertise and many

years of experience along the entire value chain. VGP was founded

in 1998 as a family-owned Belgian property developer in the Czech

Republic and today operates with around 368 full-time employees in

17 European countries directly and through several 50:50 joint

ventures. In December 2023, the gross asset value of VGP, including

the 100% joint ventures, amounted to € 7.19 billion and the company

had a net asset value (EPRA NTA) of € 2.3 billion. VGP is listed on

Euronext Brussels (ISIN: BE0003878957).

For more information, please visit:

https://www.vgpparks.eu

Forward-looking statements:

This press release may contain forward-looking statements.

Such statements reflect the current views of management regarding

future events, and involve known and unknown risks, uncertainties

and other factors that may cause actual results to be materially

different from any future results, performance or achievements

expressed or implied by such forward-looking statements. VGP is

providing the information in this press release as of this date and

does not undertake any obligation to update any forward-looking

statements contained in this press release considering new

information, future events or otherwise. The information in this

announcement does not constitute an offer to sell or an invitation

to buy securities in VGP or an invitation or inducement to engage

in any other investment activities. VGP disclaims any liability for

statements made or published by third parties and does not

undertake any obligation to correct inaccurate data, information,

conclusions or opinions published by third parties in relation to

this or any other press release issued by VGP.

1 Including Joint Ventures at

100%. As at 31 December 2023 the annualized committed leases of the

Joint Ventures stood at € 225.1 million.

2 Including Development Joint Ventures

at 100%

3 Includes 720,000 m2 of land sold in

LPM Joint Venture

4 Refer to “supplementary notes”,

income statement proportionally consolidated

5 Including Joint Ventures at

100%

- VGP_Press_Release_FY2023 ENG

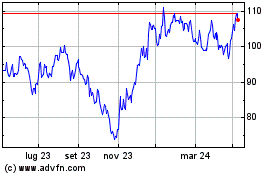

Grafico Azioni VGP NV (EU:VGP)

Storico

Da Mar 2024 a Apr 2024

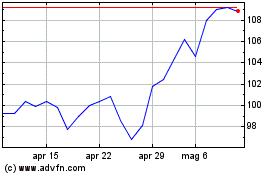

Grafico Azioni VGP NV (EU:VGP)

Storico

Da Apr 2023 a Apr 2024