HIGHLIGHTS

- +16.5% increase in revenue to €3,904 million in 2023

(+21.4% at constant scope and exchange rates) compared with

2022

- Growth in adjusted EBITDA to €1,108 million in 2023,

28.0% higher than in 2022 (€866 million)

- Improvement in adjusted EBITDA margin to 28.4% in 2023

compared with 25.8% in 2022 (+256 bps), reaching the margin target

set out in the 2022-24 plan (28-30%) a year in advance

- Sharply higher net profit1 at €475 million compared with

€356 million in 2022 (+33.7%) and earnings per share of €4.02

(+37.7% versus 2022)

- Robust cash generation, with free cash flow reaching €365

million after an already strong 2022 (€364 million)

- Decrease in net debt ratio to 1.2x 2023 adjusted EBITDA

compared with 1.6x at 31 December 2022

- -5.6% reduction in Scope 1 & 2 CO2 emissions2

compared with 2022 (i.e. -15.8% versus 2019) despite a lower

external cullet rate 2 of 54.1% in 2023 (-1.6 point versus

2022)

- Proposed dividend per share of €2.153

Regulatory News:

Verallia (Paris:VRLA):

“Verallia delivered an excellent performance in 2023 amid weaker

market conditions, especially in the second half. The Group’s

financial performance was remarkable, with a very strong surge in

EBITDA and robust cash generation. This performance was made

possible by the exceptional commitment of our teams and the

continued roll out of the Performance Action Plan (PAP), despite

the decision to adjust our production capacity in order to manage

our inventories.

Verallia enters 2024 in good conditions and should benefit from

a gradual rebound in activity. Meanwhile we maintain a strict cost

discipline. We are confident in our ability to generate an adjusted

EBITDA of around €1bn in 2024.

We also continue to push forward with our decarbonation roadmap

by introducing new, lighter products, tightly managing our cullet

supply chain and continuing work to start up our first electric

(Cognac) and hybrid (Zaragoza) furnaces in 2024”, noted Patrice

Lucas, Chief Executive Officer of Verallia.

REVENUE

Revenue breakdown by region

in millions of euros

2023

2022

% change

Of which organic

growth4

Southern and Western Europe

2,527.2

2,236.4

+13.0%

+14.2%

Northern and Eastern Europe

979.8

695.3

+40.9%

+18.0%

Latin America

396.8

419.8

-5.5%

+65.8% (+5.6% excluding

Argentina)

Group Total

3,903.8

3,351.5

+16.5%

+21.4% (+14.3% excluding

Argentina)

2023 revenue totalled €3,904 million, reflecting a 16.5%

increase on the previous year on a reported basis.

Foreign exchange impact was negative by -11.0% in 2023

(-€369 million). This was mainly due to the Argentinian peso’s

depreciation of almost ~80% in 2023, including a devaluation of

more than 50% in a single day in December. The impact of exchange

rates in the fourth quarter was negative by -€189 million.

At constant scope and exchange rates, revenue increased by

+21.4% over the full year and by +14.3% excluding Argentina.

Revenue in the fourth quarter was stable (-0.6% versus Q4 2022),

with strong organic growth at +18.1% fully offset by the exchange

rate impact (Argentinian peso). Since the Summer of 2023 demand has

fallen significantly in Europe due to both a decline in end demand

and large-scale inventory clearance across the whole downstream

value chain.

In terms of end markets beer was the segment most impacted by

weaker demand in 2023 as soon as the first half of the year.

Volumes in the still wine segment also declined while activity in

the spirits segment, having remained solid in the first half of the

year, deteriorated in the second half after several half-year

periods of vigorous growth. In contrast, sales of food jars and

bottles for non-alcoholic beverages and sparkling wines were more

resilient, with Champagne and Prosecco volumes holding up well.

The increase in average selling prices compared with 2022

largely fuelled top-line growth albeit with a waning effect over

the course of the year reflecting both a gradually rising

comparison base (due to a series of price hikes in 2022) and a

contained but steady drop in selling prices in 2023 in Europe. The

pricing policy and mix in Latin America remained dynamic throughout

the year, especially in Argentina where local inflation remained

particularly high. Lastly, product mix was positive throughout the

year thanks to the contribution from Italy.

By region, revenue for 2023 breaks down as follows:

- Southern and Western Europe saw

revenue grow by +13.0% on a reported basis and by +14.2% at

constant scope and exchange rates. Volumes fell sharply over the

year despite more resilient activity in Iberia and Italy. Volumes

of beer and, to a lesser extent, still wines recorded the steepest

falls but activity in the spirits segment was also affected by

declining Cognac volumes in the second half of the year, which the

more resilient sparkling wines segment failed to offset.

- In Northern and Eastern Europe,

revenue grew by +40.9% on a reported basis and by +18.0% at

constant scope and exchange rates. The region benefited from a very

positive scope effect (+29.2%) thanks to the full-year

consolidation of Allied Glass, which was acquired in November 2022

and renamed Verallia UK on 1 January 2023. Foreign exchange

fluctuations had a negative impact of -6.3%, mainly due to the

devaluation of the Russian rouble over the period. Sales volumes

fell sharply, mainly because of declining beer and still wine

volumes in Germany, which contrasted with resilient volumes of food

jars and a solid performance in sparkling wines (Sekt). Activity

was stronger in Russia and Ukraine, where the swift restart of the

second furnace at the Zorya site fuelled a marked recovery in

activity. As the situation in the country remains uncertain,

Verallia’s priority is to keep its teams safe and serve its local

customers.

- In Latin America, revenue was down

-5.5% on a reported basis, in contrast with strong organic growth

of +65.8%. However, these figures were deeply impacted by activity

in Argentina which experienced vigorous organic growth, driven by

repeated price increases in a context of high inflation, but a

deeply negative foreign exchange effect linked to the unprecedented

devaluation of the peso, which lost almost 80% of its value against

the euro in 2023. Excluding Argentina, Latin America recorded

organic growth of +5.6% as higher Brazilian volumes following the

opening in December 2022 of the second furnace at the Jacutinga

site was partly offset by weaker activity in Chile, which had a

challenging start to the year.

ADJUSTED EBITDA

Breakdown of adjusted EBITDA by region

in millions of euros

2023

2022

Southern and Western Europe

Adjusted EBITDA5

725.2

554.5

Adjusted EBITDA margin

28.7%

24.8%

Northern and Eastern Europe

Adjusted EBITDA7

244.2

146.5

Adjusted EBITDA margin

24.9%

21.1%

Latin America

Adjusted EBITDA7

138.5

164.6

Adjusted EBITDA margin

34.9%

39.2%

Group Total

Adjusted EBITDA7

1,108.0

865.5

Adjusted EBITDA margin

28.4%

25.8%

Adjusted EBITDA increased by +28.0% in 2023 (and by +32.5% at

constant scope and exchange rates) to exceed the €1 billion mark

for the first time in the Group’s history and reach €1,108

million. The unfavourable effect of exchange rates, mainly

attributable to the very steep depreciation of the Argentinian

peso, reached -€89 million in 2023, while the positive scope effect

was mainly linked to the consolidation over 12 months of Allied

Glass, acquired in November 2022.

In 2023, Verallia generated a largely positive inflation spread6

at Group level and in all divisions, as the cumulative effect of

price rises in 2022 and early 2023, together with a positive mix

effect, more than offset another sharp rise in production costs.

However, this effect gradually waned over the course of the

year.

Sharply lower cash production costs (PAP) once again contributed

significantly to the improvement in adjusted EBITDA, by €53 million

or 2.1% of cash production costs, beating the Group’s 2%

target.

Adjusted EBITDA margin increased to 28.4% from 25.8% in

2022.

By region, adjusted EBITDA for 2023 breaks down as follows:

- Southern and Western Europe

reported adjusted EBITDA of €725 million (versus €555 million in

2022) and a margin of 28.7% compared with 24.8% a year earlier. The

positive inflation spread, especially in the first half of the

year, fuelled the increase in EBITDA despite the sharp rise in

costs; the positive impact of the PAP and the favourable mix

(Italy) also contributed.

- In Northern and Eastern Europe,

adjusted EBITDA totalled €244 million (versus €147 million in

2022), raising its margin to 24.9% compared with 21.1%. Growth in

adjusted EBITDA was primarily organic (+€60 million), driven by a

positive inflation spread and the positive impact of the PAP. The

full-year consolidation of Allied Glass also contributed to this

increase whereas foreign exchange rate effect was negative (-€11

million) due to the rouble’s devaluation. The rapid restart of the

second furnace at our Zorya site, made possible by the dedication

and professionalism of our local teams, drove a sharp increase in

EBITDA in Ukraine.

- In Latin America, adjusted EBITDA

came to €139 million (versus €165 million in 2022), reaching a

margin of 34.9% compared with 39.2% a year earlier. This decrease

was entirely due to the devaluation of the Argentinian peso, which

generated a strongly negative translation effect of local earnings

into euros. Excluding Argentina, adjusted EBITDA improved as strong

activity in Brazil, the positive inflation spread and the effect of

the PAP more than offset the drop in volumes in Chile, which was

particularly strong at the start of the year.

The increase in net profit to €475 million (i.e. €4.02

per share) was mainly due to the improvement in adjusted EBITDA,

which more than offset higher financial expenses and income tax.

Net profit for 2023 includes, as it does every year, an

amortisation expense for customer relationships, recognised upon

the acquisition of Saint-Gobain's packaging business in 2015 and

scheduled to end in 2027, of €45 million or €0.38 per share (net of

taxes). Net profit would be €520 million or €4.40 per share

excluding this expense. This expense was €44 million or €0.38

per share in 2022.

Book capital expenditure amounted to €418 million (i.e.

10.7% of total revenue), compared with €367 million in 2022. This

capital expenditure comprised €234 million of recurring capital

expenditure (versus €270 million in 2022) and €184 million of

strategic capital expenditure (versus €97 million in 2022)

mainly related to the construction of new furnaces at Jacutinga in

Brazil and Pescia in Italy and the electric furnace at Cognac in

France, as well as investments linked to reductions in CO2

emissions.

Operating cash flow7 rose to €582 million compared with

€538 million in 2022, thanks to strong growth in adjusted EBITDA

and despite higher outflows for capital expenditure and higher

working capital requirements due to the Group’s inventory rebuild

in the first half of the year.

Free cash flow8 amounted to €365 million, in line with an

already very robust 2022 figure (€364 million).

A VERY STRONG BALANCE SHEET

Verallia improved its net debt ratio over the course of 2023

thanks to sharply higher EBITDA combined with lower net debt.

Verallia’s net debt stood at €1,365 million at end-December

2023, down by more than €40 million despite €209 million

returned to shareholders (€167 million in dividends and €42 million

in share buybacks) and the acquisition of five cullet processing

plants from the Santaolalla Group in Iberia. The ratio thus

stood at 1.2x 2023 adjusted EBITDA compared with 1.6x at

end-December 2022.

Verallia closed a €1.1 billion syndicated credit facility

refinancing in April 2023 allowing it to refinance in advance its

existing bank debt. Its long term corporate credit ratings were

upgraded by Moody’s and Standard & Poor’s in the second quarter

of 2023 and the Group is now rated Investment Grade with both

agencies.

The Group had €866 million of liquidity9 at 31 December

2023 and does not face any significant maturities until 2027.

ACQUISITION OF FIVE CULLET PROCESSING PLANTS FROM THE

SANTAOLALLA GROUP IN IBERIA

Verallia has finalised the acquisition of three companies in

Spain and Portugal from the Santaolalla Group: Ecosan Ambiental,

Ecolabora and Vidrologic. In doing so, it has taken over five new

cullet processing plants, both for industrial flat glass and hollow

glass.

The main objective of this investment is to continue Verallia’s

strategy of maximising cullet use in its production process and to

progress towards its CO2 reduction target, the first major

milestone of which is a 46% reduction in emissions by 2030 compared

to 2019. Each 10-point increase in the cullet rate used by

Verallia’s furnaces reduces CO2 emissions by around 5%.

These five new cullet processing plants join Verallia’s four

existing plants in the Iberian Peninsula, two of which - Calcin

Ibérico and Revimon in joint venture with TMA Recicla - have

started up recently.

VERALLIA IS REVOLUTIONISING THE TIMELESS BORDELAISE BOTTLE BY

INTRODUCING ONE OF THE MOST INNOVATIVE BOTTLES IN THE MARKET: THE

BORDELAISE AIR 300G

As the leading European and third-largest global producer of

glass packaging for beverages and food products, Verallia has

designed one of the lightest Bordelaise bottles ever while

preserving the iconic aesthetic contours that have defined the

classic Bordelaise bottle for generations. This innovation

represents a major revolution in terms of eco-design, positioning

Verallia at the forefront of innovative and sustainable

packaging.

With a remarkable weight of just 300 grams, this ground-breaking

innovation reflects Verallia’s commitment to its purpose of

“Re-imagining glass for a sustainable future”. This has been

achieved without compromising on the bottle’s aesthetics, a

hallmark of the Bordelaise Air 300G.

The continuous reduction in bottle weight is a significant

strategic challenge for winemakers as they strive to meet their CO2

emission reduction commitments.

For the French market, this innovation will be launched with a

white and green screw neck. The Bordelaise Air 300G was exhibited

at the SITEVI trade fair in Montpellier at the end of November

2023.

SUSTAINABLE DEVELOPMENT INDICATORS

Verallia's Scope 1 & 2 CO2 emissions totalled 2,602 kt

CO2 for the year 2023, a decrease of -5.6% compared with 2022

emissions of 2,756 kt CO2 (i.e. -15.8% versus 2019). Verallia is

therefore in line with its trajectory of reducing its Scope 1 &

2 CO2 emissions10 by 46% in absolute terms by 2030 (reference year

2019)11.

Emissions decreased even as the external cullet usage rate11

fell to 54.1% in 2023, 1.6 points lower than in 2022 (55.7%).

However the year saw Verallia continue to deploy its long-term

strategy for cullet rate increase with for instance the acquisition

of 6 cullet centres in Spain and Portugal, in order to reach its

objective of 59% of external cullet rate in 2025.

As part of the roll-out of its decarbonation strategy, the Group

also confirmed that it is starting up its first 100%-electric

furnace in Cognac (France) in the second quarter of 2024; this

technology should emit 60% fewer CO2 emissions than a traditional

furnace. Moreover, the first hybrid furnace is set to become

operational in Zaragoza (Spain) at the end of 2024, lowering CO2

emissions by 50% compared with a traditional furnace.

CAPACITY INCREASES

Verallia is moving forward with the construction of two new

furnaces in Brazil (Campo Bom) and Italy (Pescia). The startup of

these two furnaces is scheduled in the third quarter of 2024 for

Campo Bom and in the second quarter of 2025 for Pescia. The Group

will continue to monitor demand trends in order to confirm these

startup dates.

Regarding planned capacity additions scheduled in Spain in 2025

(Montblanc) and again in Italy in 2026, the Group has decided to

postpone their commissioning beyond 2026. Pre-engineering studies

are in progress and the Group will begin investing in construction

as soon as demand has sufficiently recovered.

SHARE BUYBACK

As part of its capital allocation strategy, and having finalised

the acquisition of Allied Glass, Verallia launched a share buyback

programme in December 2022 and entrusted an investment services

provider with a share buyback mandate for a maximum amount of €50

million over a period running from 7 December 2022 to November

2023. This programme was completed in November 2023 and involved as

planned a total amount of €50 million, of which €42 million in the

course of 2023.

As part of the share buyback programme implemented between

December 2022 and November 2023, Verallia has repurchased a total

1,484,080 own shares for an amount of approximately €50 million. On

14 February 2024, Verallia consequently decided to proceed with the

cancellation of 1,484,080 own shares.

2023 DIVIDEND

Verallia’s Board of Directors decided during their meeting on 14

February 2024 to propose the payment of a €2.15 cash dividend per

share for the 2023 financial year. This amount will be subject to

the approval of the Annual General Shareholders' Meeting which will

take place on 26 April 2024.

2024 OUTLOOK

After 2023 saw a sharp weakening in demand in Europe under the

combined effect of a drop in end consumption and destocking

downstream of the value chain, we foresee a gradual recovery in

activity over the course of 2024.

In this context and in spite of limited visibility, Verallia has

set itself a target to generate adjusted EBITDA of around €1

billion in 2024, with such EBITDA down year-on-year in the first

half (high 2023 comparison base) but up year-on-year in the second

half (rebound in volumes).

This objective will be achieved thanks to the expected growth in

activity combined with another annual reduction in cash production

costs (PAP) of 2%.

Verallia is also set to continue its developments in the areas

of new eco-designed products, cullet processing and decarbonation,

which lie at the heart of its CSR roadmap.

The Verallia Group's consolidated financial statements for the

financial year ended 31 December 2023 were approved by the Board of

Directors on 14 February 2024. The consolidated financial

statements have been audited by the Statutory Auditors.

An analysts’ conference call will be held at 9.00am (CET) on

Thursday 15 February 2024 via an audio webcast service (live and

replay) and the earnings presentation will be available on

www.verallia.com.

FINANCIAL CALENDAR

- 3 April 2024: start of the quiet period.

- 24 April 2024: financial results for Q1 2024 - Press release

after the market close and conference call/presentation the next

day at 9.00am CET.

- 26 April 2024: Annual General Shareholders' Meeting.

- 3 July 2024: start of the quiet period.

- 24 July 2024: results for H1 2024 - Press release after the

market close and conference call/presentation the next day at

9.00am CET.

- 1 October 2024: start of the quiet period.

- 22 October 2024: financial results for 9M 2024 - Press release

after the market close and conference call/presentation the next

day at 9.00am CET.

About Verallia

At Verallia, our purpose is to re-imagine glass for a

sustainable future. We want to redefine how glass is produced,

reused and recycled, to make it the world’s most sustainable

packaging material. We are joining forces with our customers,

suppliers and other partners across the value chain to develop new,

beneficial and sustainable solutions for all.

With more than 10,000 employees and 34 glass production

facilities in 12 countries, we are the European leader and world's

third-largest producer of glass packaging for beverages and food

products. We offer innovative, customised and environmentally

friendly solutions to over 10,000 businesses worldwide.

Verallia produced more than 16 billion glass bottles and jars in

2023 and recorded revenue of €3.9 billion. Verallia is listed on

compartment A of the regulated market of Euronext Paris (Ticker:

VRLA – ISIN: FR0013447729) and trades on the following indices: CAC

SBT 1.5°, STOXX600, SBF 120, CAC Mid 60, CAC Mid & Small and

CAC All-Tradable.

Disclaimer

Certain information included in this press release consists not

of historical facts but of forward-looking statements. These

forward-looking statements are based on current beliefs,

expectations and assumptions, including, without limitation,

assumptions regarding Verallia’s present and future business

strategies and the economic environment in which Verallia operates.

They involve known and unknown risks, uncertainties and other

factors, which may cause actual performance and results to be

materially different from those expressed or implied by these

forward-looking statements. These risks and uncertainties include

those discussed and identified in Chapter 4 ‘Risk Factors” of the

Universal Registration Document approved by the AMF and available

on both the Company’s website (www.verallia.com) and that of the

AMF (www.amf-france.org). These forward-looking information and

statements are no guarantee of future performance.

This press release includes only summary information and does

not purport to be comprehensive.

Personal data protection

You can unsubscribe from our press release mailing list at any

time by sending your request to the following email address:

investors@verallia.com. Press releases will still be available via

the website https://www.verallia.com/en/investors/.

Verallia SA, as data controller, processes personal data for the

purpose of implementing and managing its internal and external

communication. This processing is based on legitimate interests.

The data collected (last name, first name, professional contact

details, profiles, relationship history) is essential for this

processing and is used by the relevant departments of the Verallia

Group and, where applicable, its subcontractors. Verallia SA

transfers personal data to its service providers located outside

the European Union, who are responsible for providing and managing

technical solutions related to the aforementioned processing.

Verallia SA ensures that the appropriate guarantees are obtained in

order to supervise these data transfers outside of the European

Union. Under the conditions defined by the applicable regulations

for the protection of personal data, you may access and obtain a

copy of the data concerning you, object to the processing of this

data and request for it to be rectified or erased. You also have a

right to restrict the processing of your data. To exercise any of

these rights, please contact the Group Financial Communication

Department at investors@verallia.com. If, after having contacted

us, you believe that your rights have not been respected or that

the processing does not comply with data protection regulations,

you may submit a complaint to the CNIL (Commission nationale de

l'informatique et des libertés — France’s regulatory body).

APPENDICES - Key figures

in millions of euros

2023

2022

Revenue

3,903.8

3,351.5

Reported growth

+16.5%

+25.3%

Organic growth

+21.4%

+26.5%

of which Southern and Western Europe

2,527.2

2,236.4

of which Northern and Eastern Europe

979.8

695.3

of which Latin America

396.8

419.8

Cost of sales

(2,853.5)

(2,527.1)

Selling, general and administrative

expenses

(212.4)

(194.4)

Acquisition-related items

(71.3)

(65.6)

Other operating income and expenses

(5.2)

(6.1)

Operating profit/(loss)

761.3

558.3

Financial income/(expense)

(119.0)

(80.7)

Profit (loss) before tax

642.4

477.6

Income tax

(167.4)

(122.1)

Share of net profit (loss) of

associates

0.3

0.2

Net profit/(loss)12

475.3

355.6

Earnings per share

€4.02

€2.92

Adjusted EBITDA13

1,108.0

865.5

Group margin

28.4%

25.8%

of which Southern and Western Europe

725.2

554.5

Southern and Western Europe margin

28.7%

24.8%

of which Northern and Eastern Europe

244.2

146.5

Northern and Eastern Europe margin

24.9%

21.1%

of which Latin America

138.5

164.6

Latin America margin

34.9%

39.2%

Net debt at end of period

1,364,5

1,405,9

Last 12 months adjusted EBITDA

1,108.0

865.5

Net debt/last 12 months adjusted

EBITDA

1.2x

1.6x

Total capex14

418.0

367.0

Cash conversion15

62.3%

57.6%

Change in operating working capital

(108.3)

39.4

Operating cash flow16

581.7

537.9

Free cash flow17

365.3

363.8

Strategic capex18

183.6

97.4

Recurring capex19

234.4

269.6

Change in revenue by type in millions of euros during

2023

in millions of euros

2022 revenue

3,351.5

Volumes

(149.2)

Price/Mix

+867.5

Foreign exchange impact

(369.2)

Scope effect

+203.2

2023 revenue

3,903.8

Change in adjusted EBITDA by type in millions of euros during

2023

in millions of euros

2022 adjusted EBITDA20

865.5

Activity contribution

-155.1

Price-mix/Cost spread

+392.8

Net productivity

+52.5

Foreign exchange impact

-89.3

Other

+41.6

2023 adjusted EBITDA

1,108.0

Key figures for the fourth quarter

in millions of euros

Q4 2023

Q4 2022

Revenue

829.2

833.9

Reported growth

-0.6%

+27.9%

Organic growth

+18.1%

+32.9%

Adjusted EBITDA

192.9

211.3

Adjusted EBITDA margin

23.3%

25.3%

Reconciliation of operating profit (loss) to adjusted

EBITDA

in millions of euros

2023

2022

Operating profit/(loss)

761.3

558.3

Depreciation and amortisation21

326.7

295.9

Restructuring costs

3.4

(0.8)

IAS 29 Hyperinflation (Argentina)22

5.8

4.3

Management share ownership plan and

associated costs

6.2

6.2

Company acquisition costs and

earn-outs

0.7

5.1

Other

3.9

(3.5)

Adjusted EBITDA

1,108.0

865.5

Adjusted EBITDA and cash conversion are alternative performance

measures according to AMF Position n°2015-12.

Adjusted EBITDA and cash conversion are not standardised

accounting measures meeting a single definition generally accepted

by IFRS. They must not be considered as a substitute for operating

income or cash flows from operating activities, which are measures

defined by IFRS, or as a measure of liquidity. Other issuers may

calculate adjusted EBITDA and cash conversion differently from the

definitions used by the Group.

IAS 29: Hyperinflation (Argentina)

The Group has applied IAS 29 in Argentina since 2018. The

adoption of this standard requires the restatement of non-monetary

assets and liabilities and of the statement of income to reflect

changes in purchasing power in the local currency. These

restatements may lead to a gain or loss on the net monetary

position included in financial income and expense.

Financial items for the Argentinian subsidiary are converted

into euros using the closing exchange rate for the relevant

period.

In 2023, the net impact on revenue was -€53.4 million.

The hyperinflation impact has been excluded from consolidated

adjusted EBITDA as shown in the table “Reconciliation of operating

profit (loss) to adjusted EBITDA”.

Financial structure

in millions of euros

Nominal amount or maximum

amount drawable

Nominal rate

Final maturity

31 Dec 2023

Sustainability-linked bond

May 202123

500

1.625%

May 2028

503.2

Sustainability-linked bond

November 202123

500

1.875%

Nov. 2031

494.6

Term Loan B – TLB23

550

Euribor +1.25%

Apr. 2027

550.2

Revolving credit facility (RCF)

550

Euribor +0.75%

Apr. 2028

-

Negotiable commercial paper (Neu CP)23

500

158.2

Other borrowings24

132.9

Total borrowings

1,839.1

Cash and cash equivalents

(474.6)

Net debt

1,364.5

Consolidated statement of income

in millions of euros

2023

2022

Revenue

3,903.8

3,351.5

Cost of sales

(2,853.5)

(2,527.1)

Selling, general and administrative

expenses

(212.4)

(194.4)

Acquisition-related items

(71.3)

(65.6)

Other operating income and expenses

(5.2)

(6.1)

Operating profit/(loss)

761.3

558.3

Financial income/(expense)

(119.0)

(80.7)

Profit (loss) before tax

642.4

477.6

Income tax

(167.4)

(122.1)

Share of net profit (loss) of

associates

0.3

0.2

Net profit/(loss)

475.3

355.6

Attributable to shareholders of the

Company

470.0

342.0

Attributable to non-controlling

interests

5.3

13.6

Basic earnings per share (in

euros)

4.02

2.92

Diluted earnings per share (in

euros)

4.01

2.92

Consolidated balance sheet

in millions of euros

31 Dec. 2023

31 Dec. 2022

ASSETS

Goodwill

687.8

664.0

Other intangible assets

416.2

482.4

Property, plant and equipment

1,795.6

1,609.0

Investments in associates

6.7

5.9

Deferred tax

33.6

27.5

Other non-current assets

57.8

186.3

Non-current assets

2,997.7

2,975.1

Current portion of non-current and

financial assets

1.4

1.3

Inventories

711.5

536.8

Trade receivables

144.3

250.4

Current tax receivables

15.1

5.4

Other current assets

115.7

392.3

Cash and cash equivalents

474.6

330.8

Current assets

1,462.6

1,517.0

Total assets

4,460.3

4,492.1

LIABILITIES

Share capital

413.3

413.3

Consolidated reserves

494.6

590.1

Equity attributable to

shareholders

907.9

1,003.4

Non-controlling interests

50.6

64.0

Equity

958.5

1,067.4

Non-current financial liabilities and

derivatives

1,610.5

1,562.2

Provisions for pensions and other employee

benefits

88.9

87.4

Deferred tax

141.9

276.2

Provisions and other non-current financial

liabilities

45.5

23.2

Non-current liabilities

1,886.8

1,949.0

Current financial liabilities and

derivatives

249.2

200.9

Current portion of provisions and other

non-current financial liabilities

49.8

54.3

Trade payables

627.1

740.6

Current tax liabilities

66.3

44.3

Other current liabilities

622.6

435.6

Current liabilities

1,615.0

1,475.7

Total equity and liabilities

4,460.3

4,492.1

Consolidated cash flow statement

in millions of euros

2023

2022

Net profit/(loss)

475.3

355.6

Depreciation, amortisation and impairment

of assets

326.7

295.9

Interest expense on financial

liabilities

53.2

29.4

Change in inventories

(191.8)

(92.8)

Change in trade receivables, trade

payables & other receivables & payables

92.7

50.9

Current tax expense

176.8

135.5

Cash tax paid

(131.4)

(105.9)

Changes in deferred taxes and

provisions

0.2

0.8

Other

56.2

29.8

Net cash flow from (used in) operating

activities

857.9

699.2

Acquisition of property, plant and

equipment and intangible assets

(418.0)

(367.0)

Increase (decrease) in debt on fixed

assets

(1.5)

75.2

Acquisitions of subsidiaries, net of cash

acquired

(35.5)

(247.9)

Other

(4.6)

(0.3)

Net cash flow from (used in) investing

activities

(459.6)

(540.0)

Capital increase (decrease)

18.6

13.0

Dividends paid

(163.8)

(122.7)

Increase (decrease) in own shares

(41.7)

(8.4)

Transactions with shareholders of the

parent company

(186.9)

(118.1)

Transactions with non-controlling

interests

(3.1)

(2.7)

Increase (decrease) in bank overdrafts and

other short-term borrowings

34.5

(1.7)

Increase in long-term debt

569.7

6.8

Decrease in long-term debt

(565.0)

(172.3)

Financial interest paid

(51.2)

(28.1)

Change in gross debt

(12.0)

(195.3)

Net cash flow from (used in) financing

activities

(202.0)

(316.1)

Increase (decrease) in cash and cash

equivalents

196.3

(156.9)

Impact of changes in foreign exchange

rates on cash and cash equivalents

(52.6)

(6.9)

Opening cash and cash

equivalents

330.8

494.6

Closing cash and cash

equivalents

474.6

330.8

GLOSSARY

Activity: corresponds to the sum of the change in volumes

plus or minus the change in inventories.

Organic growth: corresponds to revenue growth at constant

scope and exchange rates. Revenue growth at constant exchange rates

is calculated by applying the same exchange rates to the financial

indicators presented for the two periods being compared (by

applying the exchange rates of the previous period to the financial

indicators for the current period).

Adjusted EBITDA: this is a non-IFRS financial measure. It

is an indicator for monitoring the underlying performance of

businesses adjusted for certain expenses and/or income which are

non-recurring or liable to distort the Company’s performance.

Adjusted EBITDA is calculated on the basis of operating profit

adjusted for depreciation, amortisation and impairment,

restructuring costs, acquisition and M&A costs,

hyperinflationary effects, management share ownership plans,

subsidiary disposal-related effects and subsidiary contingencies,

site closure costs, and other items.

Capex: short for “capital expenditure”, this corresponds

to purchases of property, plant and equipment and intangible assets

necessary to maintain the value of an asset and/or adapt to market

demand and to environmental, health and safety requirements, or to

increase the Group’s capacity. The acquisition of securities is

excluded from this category.

Recurring capex: recurring capex corresponds to purchases

of property, plant and equipment and intangible assets necessary to

maintain the value of an asset and/or adapt to market demand and to

environmental, health and safety requirements. It mainly includes

furnace renovations and maintenance of IS machines.

Strategic capex: strategic capex corresponds to purchases

of strategic assets that significantly enhance the Group’s capacity

or its scope (for example, the acquisition of plants or similar

facilities, greenfield or brownfield investments), including the

building of additional new furnaces. Since 2021 it has also

included investments associated with implementing the plan to

reduce CO2 emissions.

Cash conversion: refers to the ratio between cash flow

and adjusted EBITDA. Cash flow refers to adjusted EBITDA less

capex.

Free cash flow: defined as operating cash flow - other

operating impacts - interest paid & other financing costs -

taxes paid.

The Southern and Western Europe segment comprises

production sites located in France, Spain, Portugal and Italy. It

is also designated by its acronym “SWE”.

The Northern and Eastern Europe segment comprises

production sites located in Germany, the United Kingdom, Russia,

Ukraine and Poland. It is also designated by its acronym “NEE”.

The Latin America segment comprises production sites

located in Brazil, Argentina and Chile and, since January 1, 2023,

Verallia’s operations in the USA.

Liquidity: calculated as available cash + undrawn

revolving credit facilities – outstanding negotiable commercial

paper (Neu CP).

Amortisation of intangible assets acquired through business

combinations: corresponds to the amortisation of customer

relationships recognised upon acquisition.

1 Net profit for 2023 includes an amortisation expense for

customer relationships, recognised upon the acquisition of

Saint-Gobain's packaging business in 2015 and applicable until

2027, of €45 million or €0.38 per share (net of taxes). If this

expense had not been taken into account, net profit would be €520

million or €4.40 per share. This expense was €44 million or €0.38

per share in 2022. 2 Cullet = recycled glass; the external cullet

rate and amount of CO2 emissions are expressed at constant scope

and exclude the contribution from Allied Glass / Verallia UK so as

to make them comparable with the starting point of 2019. 3 Subject

to approval at the Annual General Shareholders’ Meeting which will

take place on 26 April 2024. 4 Revenue growth at constant scope and

exchange rates. Revenue growth at constant exchange rates is

calculated by applying the same exchange rates to the financial

indicators presented for the two periods being compared (by

applying the exchange rates of the previous period to the financial

indicators for the current period). Growth in revenue at constant

scope and exchange rates excluding Argentina was +14.3% in 2023

compared with 2022. 5 Adjusted EBITDA is calculated based on

operating profit adjusted for depreciation, amortisation and

impairment, restructuring costs, acquisition and M&A costs,

hyperinflationary effects, management share ownership plan costs,

disposal-related effects and subsidiary contingencies, site closure

costs, and other items. 6 The spread corresponds to the difference

between (i) the increase in selling prices and the mix applied by

the Group after passing any increase in production costs onto these

selling prices and (ii) the increase in production costs. The

spread is positive when the increase in selling prices applied by

the Group is greater than the increase in its production costs. The

increase in production costs is recorded by the Group at constant

production volumes, before industrial variance and taking into

consideration the impact of the Performance Action Plan (PAP). 7

Operating cash flow corresponds to adjusted EBITDA less capex, plus

changes in operating working capital requirements including changes

in payables to fixed asset suppliers. 8 Defined as operating cash

flow - other operating impacts - interest paid & other

financing costs - taxes paid. 9 Calculated as available cash +

undrawn revolving credit facilities – outstanding commercial paper

(Neu CP). 10 Scope 1 “direct emissions” = CO2 emissions within the

physical perimeter of the plant, in other words, carbonated raw

materials, heavy and domestic fuel oil, and natural gas (melting

and non-melting activities). Scope 2 “indirect emissions” =

emissions related to electricity consumption required for the

operation of the plant. 11 Cullet = recycled glass; the external

cullet rate and amount of CO2 emissions are expressed at constant

scope and exclude the contribution from Allied Glass / Verallia UK

so as to make them comparable with the starting point of 2019. 12

Net profit for 2023 includes an amortisation expense for customer

relationships, recognised upon the acquisition of Saint-Gobain's

packaging business in 2015, of €45 million or €0.38 per share (net

of taxes). If this expense had not been taken into account, net

profit would be €520 million or €4.40 per share. This expense was

€44 million or €0.38 per share in 2022. 13 Adjusted EBITDA is

calculated based on operating profit adjusted for depreciation,

amortisation and impairment, restructuring costs, acquisition and

M&A costs, hyperinflationary effects, management share

ownership plan costs, disposal-related effects and subsidiary

contingencies, site closure costs, and other items. 14 Capex

(capital expenditure) corresponds to purchases of property, plant

and equipment and intangible assets necessary to maintain the value

of an asset and/or adapt to market demand and to environmental,

health and safety requirements, or to increase the Group’s

capacity. The acquisition of securities is excluded from this

category. 15 Cash conversion is defined as adjusted EBITDA less

capex, divided by adjusted EBITDA. 16 Operating cash flow

corresponds to adjusted EBITDA less capex, plus changes in

operating working capital requirements including changes in

payables to fixed asset suppliers. 17 Defined as operating cash

flow - other operating impacts - interest paid & other

financing costs - taxes paid. 18 Strategic capex corresponds to

purchases of strategic assets that significantly enhance the

Group’s capacity or its scope (for example, the acquisition of

plants or similar facilities, greenfield or brownfield

investments), including the building of additional new furnaces.

Since 2021, they have also included investments associated with

implementing the plan to reduce CO2 emissions. 19 Recurring capex

corresponds to purchases of property, plant and equipment and

intangible assets necessary to maintain the value of an asset

and/or adapt to market demand and to environmental, health and

safety requirements. They mainly include furnace renovations and

maintenance of IS machines. 20 Adjusted EBITDA is calculated based

on operating profit adjusted for depreciation, amortisation and

impairment, restructuring costs, acquisition and M&A costs,

hyperinflationary effects, management share ownership plan costs,

disposal-related effects and subsidiary contingencies, site closure

costs, and other items. 21 Includes depreciation and amortisation

of intangible assets and property, plant and equipment,

amortisation of intangible assets acquired through business

combinations, and impairment of property, plant and equipment. 22

The Group has applied IAS 29 (Hyperinflation) since 2018. 23

Including accrued interest. 24 Of which IFRS16 leases (€61.5

million).

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240214785191/en/

Verallia press contacts

Annabel Fuder & Stéphanie Piere verallia@wellcom.fr | +33

(0)1 46 34 60 60

Verallia investor relations contact

David Placet | david.placet@verallia.com

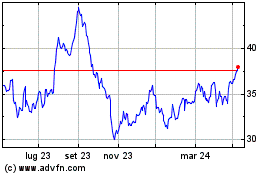

Grafico Azioni VERALLIA (EU:VRLA)

Storico

Da Dic 2024 a Gen 2025

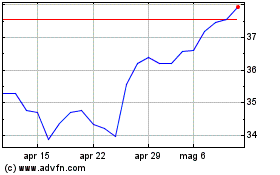

Grafico Azioni VERALLIA (EU:VRLA)

Storico

Da Gen 2024 a Gen 2025