Trading update 30 September 2023

27 Ottobre 2023 - 8:00AM

Trading update 30 September 2023

STRONG OPERATIONAL PERFORMANCE DOES NOT FULLY TRANSLATE INTO

FINANCIAL RESULTS

• Slight decrease of the net result from core activities per

share of 0.5% to € 3.51 at 30 September 2023 (€ 3.53 at 30

September 2022);• 6% like-for-like rental growth;•

Slight increase of the fair value of the investment property

portfolio (+ 0.4% compared to 31 December 2022);• Stable

EPRA occupancy rate of total portfolio of 95.2% at 30 September

2023 (95.2% at 31 December 2022);• Slight decrease of EPRA

occupancy rate of the retail portfolio to 97.0% at 30 September

2023 (97.7% at 31 December 2022);• Increase of the EPRA

occupancy rate of the office portfolio to 85.2% as of 30 September

2023 (81.5% at 31 December 2022);• Healthy debt ratio of

29.4% as at 30 September 2023 (28.6% as at 31 December

2022);• Due to the impact of rising market interest rates,

increase in the provision for doubtful debts (mainly in the office

portfolio) as well as the effect of

uncollectability of certain charges in the office portfolio,

decrease of the expected net result from core

activities to € 4.70 - € 4.80 per share.

- Trading update 30 September 2023

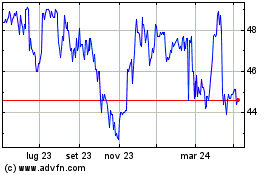

Grafico Azioni Wereldhave Belgium (EU:WEHB)

Storico

Da Mar 2024 a Apr 2024

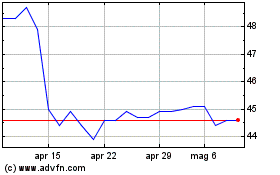

Grafico Azioni Wereldhave Belgium (EU:WEHB)

Storico

Da Apr 2023 a Apr 2024