WORLDLINE : Q1 2024 revenue

Q1 2024 revenueQ1 2024

Group revenue: € 1,097 million +2.5% organically

+3.9% in Merchant Services

Transformation initiatives on

trackRedesign of Merchant Services operating model

with two new go-to-market channelsPower24

transformation plan in motion and rolled-out in targeted

countries

Launch of Crédit Agricole and Worldline

joint-venture Unconditional approval received from

the European Commission in MarchJV to operate

under new brand CAWL, providing innovative payment services to all

merchants in France

Governance

updateWilfried Verstraete coopted as future

Chairman of the Board Board resized to 12 members

plus 2 employee Directors with 3 new entrants and 6

leavers

All 2024 objectives

confirmedOrganic revenue growth at least

3%Adjusted EBITDA at least

€1.17bnFree Cash-Flow at least €230m

Paris, La Défense, May 2 2024 –

Worldline [Euronext: WLN], a global leader in payment services,

today announces its revenue for the first quarter of

2024.

Gilles Grapinet, CEO of Worldline,

said: "Worldline is fully on track to meet its 2024

targets after posting 2.5% organic growth in the first quarter,

supported by our Merchant Services activities posting a growth

close to 4% despite a consumer spending context that remains soft.

I am also satisfied by the solid and promising commercial

developments achieved over the last months in terms of new

contracts and partnerships, paving the way to our Merchant Services

growth acceleration.

During the quarter, we continue to execute the

immediate actions taken in 2023. Our Merchants’ termination process

is now completed. Our accelerated transformation program Power24 is

in full motion with reorganization already initiated in targeted

countries, while social processes are progressing as per plan. It

will reinforce Worldline competitiveness and structural mid-term

profile, with full benefits expected in 2025.

We also reached significant milestones regarding

our joint-venture with Crédit Agricole, after having received an

unconditional agreement from the European Commission. We have now

launched the JV, branded CAWL, headed by Meriem Echcherfi with a

confirmed objective to go live early 2025. It is another key step

in our strategic partnership with the Crédit Agricole in France, a

highly promising market for Worldline.

Finally, we have recently announced the

cooptation of Wilfried Verstraete as future Chairman and an

evolution and a resizing of our Board of Directors, thus reshaping

the group’s governance for Worldline’s next strategic phase that we

will detail during a Capital Market Day planned for the second half

of 2024.

Based on these first quarter achievements, we

fully confirm that we are well advanced in our transition to a

streamlined Group through a reinforced focus, rigorous execution

and the combined support of our talents and strategic

partners.”

Q1 2024 revenue by Global Business

Line

|

In € million |

Q12024 |

Q42023* |

Organic growth (Published) |

Organic growth (NNR) |

|

Merchant Services |

787 |

757 |

+3.9% |

+2.9% |

|

Financial Services |

225 |

229 |

-1.4% |

-0.6% |

|

Mobility & e-Transactional Services |

85 |

84 |

+0.7% |

+0.7% |

|

Worldline |

1,097 |

1,070 |

+2.5% |

+1.7% |

* at constant scope and exchange rates

Worldline’s Q1 2024 revenue reached €

1,097 million, representing +2.5% organic

growth. Merchants Services division was resilient in the

current macroeconomic context and termination of merchant contracts

were slightly offset by the underlying growth of our acceptance

activities, and the commercial momentum in Italy. Financial

Services division was impacted by low volumes in Account payments

activity despite good underlying volumes in Acquiring and Issuing

processing. Mobility & e-Transactional Services benefited from

good dynamic in security and cryptographic solutions as well as

ticketing volume increase.

Merchant Services

Merchant Services’ revenue in

Q1 2024 reached € 787 million, representing an

organic growth of +3.9% (+6.5%

excluding merchant termination). Despite good results achieved in

the new markets addressed, such as Italy, the quarter was impacted

by the continuously soft macro-economic context and the termination

of some specific merchants’ contracts. The performance by division

was the following:

- Commercial

Acquiring: Soft growth impacted as expected by termination of

merchant contracts, with a good underlying growth driven by

commercial momentum in Italy and resilient activity in

Switzerland.

- Payment

Acceptance: Good performance led by Travel and Gaming transactional

online volumes benefitting from the good ramp-up of contracts

signed last year.

- Digital

Services: Robust results thanks to sustained business in Germany

and Türkiye.

Merchant Services growth profile should improve

along the year with a progressive growth re-acceleration in the

second half of the year due to a more normative comparison

basis.

On the online cross-border, Worldline signed

recently a strategic partnership with Lidio, one of Türkiye’s

leading Fintech companies, to offer a direct access to local

payment means, such as Troy cards, through domestic corridor. In

addition, Worldline is the first online payment service provider

authorized by the Turkish central for international payments. With

this authorization and with the partnership with Lidio, Worldline

will help global online businesses to gain competitive advantage in

the $72bn Turkish expanding e-commerce market.

On the distribution side, Worldline reinforced

its footprint in the fast-food industry with Tabesto, the

order-taking and payment specialist. This ISV partnership will take

place in 36 countries and will promote SoftPos Worldline Tap on

Mobile technology to enhance ordering and payment kiosk

experience.

During the first quarter, commercial activity in

Merchant Services has been dynamic with many contracts signed, in

particular in the EV charging industry, such as Electra, Road,

Kempower, as well as in the Hospitality vertical (Preferred Hotels

& Resorts), and in the Retail sector with ASDA.

Financial Services

Q1 2024 revenue reached

€ 225 million, implying -1.4% organic

growth, despite a good dynamic in acquiring and issuing

processing. The performance by division was the following:

- Card-based

payment processing activities (Issuing Processing and Acquiring

Processing): Good level of performance fueled by project activity,

in particular with ING, and improved volumes in Belgium and the

Netherlands.

- Digital Banking:

Stable overall despite higher customer demand for Sanctions

Securities and Monitoring solutions in Belgium and the

Luxembourg.

- Account

Payments: Activity was impacted by lower volumes in Germany and

Italy, which were not offset by deliveries on EPC projects.

After a stabilization of the activity in H1,

Financial Services should slow down in the second half with lower

volumes on existing contracts and some re-insourcing processes,

partially offset by improving commercial dynamics on fertilization

projects.

On the commercial front, following the completed

migration of Consorsbank’s Visa Card Portfolio and as a testament

to the success of the migration, Financial Services signed several

contracts extension with Consorsbank, a German brand of BNP

Paribas, for Worldline’s issuing processing solution.

Mobility & e-Transactional Services

Mobility & e-Transactional Services

revenue reached € 85 million,

up +0.7% organically, driven by a good dynamic on

our security and cryptographic solution as well as ticketing volume

increase. The performance by division was the following:

- Trusted

Services*: Good momentum driven by new sales of security hardware,

additional licenses and business with our cryptographic solution

for e-health in Germany.

- Transport &

Mobility*: Significant performance led by project activity in rail

industry and increased volumes on e-ticketing in the UK.

- Finally,

Omnichannel interactions*: Solid pipeline but impacted by projects

delivery delays in France.

Mobility & e-Transactional Services growth

is expected to improve throughout the year.

In terms of business, Worldline secured a

five-year contract renewal in the UK and Ireland with a large

customer to continue to deliver data and customer information

systems and application support services in the rail industry. We

also continued to expand our full offering covering billing,

invoicing and card management solution with a major integrated

energy company. Meanwhile, in Germany, we signed an agreement with

Secunet virtualizing and simplifying access to digital medicine and

health services for doctors, nurses, pharmacists and all health

professional in Germany through our Telematics Infrastructure

Gateway.

Launch of Crédit Agricole and Worldline

joint-venture

On March 20, 2024, Crédit Agricole and Worldline

received unconditional authorization from the European Commission

to create their joint-venture for digital payment services for

merchants in France. Announced one year ago, the joint-venture aims

to become a major player in payment services in France. It will

leverage Worldline’s technological performance and innovation

capabilities and will integrate the "Cartes Bancaires" (CB)

domestic payment scheme.

Laurent Bennet, Chief Executive Officer of

Crédit Agricole des Savoie, was elected Chairman of the Board of

Directors of the joint venture and Meriem Echcherfi was appointed

Chief Executive Officer.

This new entity, branded CAWL, will offer

all-in-one payment solutions combining acceptance and acquisition

and integrating value-added services specific to each business

sector: industry-vertical offerings that will simplify merchants’

processes and allow them to focus on the development of their

business.

CAWL is still expected to become fully

operational and start generating sales and gross operating income

as early as 2025, in line with our initial plan.

Governance update

New Chairman of the Board of

directors

Worldline’s Board of directors met on March

20th, 2024, and upon recommendation of the Nomination Committee,

decided to coopt Wilfried Verstraete as independent director,

replacing Bernard Bourigeaud. Wilfried Verstraete will be proposed

for election, by the Board of directors, as Chairman of the Board

of directors following the company’s Annual General Meeting on June

13th, 2024.

Wilfried Verstraete joined the Strategy and

Investment committee as well as the Nomination committee and was

immediately involved in the Company’s strategic priorities, as well

as in the expected Board of directors’ evolution.

The nomination of Wilfried Verstraete marked a

new chapter in Worldline’s development and will allow the Company

to successfully enter this new transformation phase.

Evolution of the composition of the Board

of Directors

Worldline is continuously adapting its

organization and governance to better respond to the rapidly

evolving payment industry whilst accelerating the execution of its

strategy. In this context, the Group announced that its Board of

directors' composition is expected to be reduced from 15 to 12

Board members (plus two employee directors whose designation

follows a dedicated procedure) following the next Annual General

Meeting on June 13th, 2024.

Details of the contemplated changes are as

follow:

- Ms. Agnès Park and

Ms. Sylvia Steinmann to join as independent Directors, bringing

strong expertise from leading positions in large companies and

complex environments.

- Mr. Olivier

Gavalda, deputy CEO of Credit Agricole SA in charge of Universal

Banking, to join upon the proposal of Crédit Agricole SA, bringing

strong banking, financial and payments industry expertise.

- The renewed Board

will have a largely international profile with a diversified set of

skills to support the Group’s strategic transformation.

- As previously

announced, Wilfried Verstraete will chair this new Board of

Directors, which Interim Chairman Georges Pauget has decided to

leave after the AGM and a successful transition period.

- In line with its past commitments,

Worldline’s Board of Directors will therefore be reduced from 15 to

12 members (excluding two employee representatives), with three new

entrants and six members resigning.

All 2024 objectives

confirmed

- Organic revenue

growth of at least 3%, assuming unchanged macro environment in core

geographies with softer growth in H1’24 mainly due to merchants’

termination impact (Implied organic revenue growth above 5%

excluding such termination impact).

- Adjusted EBITDA

of at least € 1.17 billion, with first benefits of Power24 ramp-up

associated to operating leverage accelerating in H2’24.

- Free cash flow

of at least € 230 million, Including c.€ 150-170 million one-off

Power24 implementation costs.

Appendices

RECONCILIATION OF Q1 2023 STATUTORY

REVENUE WITH Q1 2023 REVENUE AT CONSTANT SCOPE AND EXCHANGE

RATES For the analysis of the Group’s performance, Q1 2023

revenue at constant scope and exchange rates as presented below per

Global Business Lines:

|

In € million |

|

Q1 2023 |

Scope effects** |

Exchange rates effects |

Q1 2023* |

|

Merchant Services |

|

758 |

3 |

-3 |

757 |

|

Financial Services |

|

228 |

0 |

0 |

229 |

|

Mobility & e-Transactional Services |

|

84 |

0 |

1 |

84 |

|

Worldline |

|

1 070 |

3 |

-3 |

1 070 |

|

* At constant scope and March 2024 YTD average exchange rates |

|

|

|

|

|

|

** At December 2023 YTD average exchange rates |

|

|

|

|

|

Exchanges rates effect in Q1 were mainly due to

depreciation of Australian Dollar, and Turkish Lira while scope

effects are mainly related to the integration of Banco Desio within

MS division.

2023 ESTIMATED PRO FORMAFY 2023

estimated pro forma at constant scope is presented below (per

Global Business Lines):

|

|

|

2023 estimated proforma* |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Revenue |

|

Revenue |

|

Revenue |

|

Revenue |

|

Revenue |

|

Revenue |

|

Revenue |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

In € million |

|

Q1 |

|

Q2 |

|

H1 |

|

Q3 |

|

Q4 |

|

H2 |

|

FY |

|

Merchant Services |

|

760 |

|

850 |

|

1 611 |

|

868 |

|

849 |

|

1 717 |

|

3 327 |

|

Financial Services |

|

228 |

|

236 |

|

464 |

|

232 |

|

248 |

|

480 |

|

944 |

|

Mobility & e-Transactional Services |

|

84 |

|

87 |

|

171 |

|

81 |

|

89 |

|

171 |

|

342 |

|

Worldline |

|

1 073 |

|

1 173 |

|

2 246 |

|

1 181 |

|

1 186 |

|

2 367 |

|

4 612 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

In € million |

|

|

|

|

|

Adj. EBITDA |

|

|

|

|

|

Adj. EBITDA |

|

Adj. EBITDA |

|

Merchant Services |

|

|

|

|

|

400 |

|

|

|

|

|

446 |

|

846 |

|

Financial Services |

|

|

|

|

|

127 |

|

|

|

|

|

149 |

|

276 |

|

Mobility & e-Transactional Services |

|

|

|

|

|

21 |

|

|

|

|

|

26 |

|

47 |

|

Corporate costs |

|

|

|

|

|

-30 |

|

|

|

|

|

-29 |

|

-59 |

|

Worldline |

|

|

|

|

|

519 |

|

|

|

|

|

591 |

|

1 110 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

In € million |

|

|

|

|

|

Adj. EBITDA % |

|

|

|

|

|

Adj. EBITDA % |

|

Adj. EBITDA % |

|

Merchant Services |

|

|

|

|

|

24.9% |

|

|

|

|

|

26.0% |

|

25.4% |

|

Financial Services |

|

|

|

|

|

27.4% |

|

|

|

|

|

31.1% |

|

29.3% |

|

Mobility & e-Transactional Services |

|

|

|

|

|

12.5% |

|

|

|

|

|

15.2% |

|

13.8% |

|

Corporate costs |

|

|

|

|

|

-1.3% |

|

|

|

|

|

-1.2% |

|

-1.3% |

|

Worldline |

|

|

|

|

|

23.1% |

|

|

|

|

|

25.0% |

|

24.1% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

*at December 2023 YTD exchange rates |

|

|

|

|

|

|

|

|

|

|

|

|

Main components of the scope effects on 2023

estimated pro forma:

Banco Desio added contribution of 3 months

(integrated for 9 months in 2023 reported).

FORTHCOMING EVENTS

- June 13,

2024: Annual General

Meeting

- August 1,

2024: H1 2024

results

INVESTOR RELATIONS

Laurent MarieE

laurent.marie@worldline.com

Guillaume DelaunayE

guillaume.delaunay@worldline.com

COMMUNICATION

Sandrine van der GhinstE

sandrine.vanderghinst@worldline.com

Hélène CarlanderE

helene.carlander@worldline.com

ABOUT WORLDLINE

Worldline [Euronext: WLN] helps businesses of

all shapes and sizes to accelerate their growth journey – quickly,

simply, and securely. With advanced payments technology, local

expertise and solutions customised for hundreds of markets and

industries, Worldline powers the growth of over one million

businesses around the world. Worldline generated a 4.6 billion

euros revenue in 2023. worldline.com

Worldline’s corporate purpose (“raison d’être”)

is to design and operate leading digital payment and transactional

solutions that enable sustainable economic growth and reinforce

trust and security in our societies. Worldline makes them

environmentally friendly, widely accessible, and supports social

transformation.

FOLLOW US

DISCLAIMER

This document contains forward-looking

statements that involve risks and uncertainties, including

references, concerning the Group's expected growth and

profitability in the future which may significantly impact the

expected performance indicated in the forward-looking statements.

These risks and uncertainties are linked to factors out of the

control of the Company and not precisely estimated, such as market

conditions or competitors’ behaviors. Any forward-looking

statements made in this document are statements about Worldline’s

beliefs and expectations and should be evaluated as such.

Forward-looking statements include statements that may relate to

Worldline’s plans, objectives, strategies, goals, future events,

future revenues or synergies, or performance, and other information

that is not historical information. Actual events or results may

differ from those described in this document due to a number of

risks and uncertainties that are described within the 2022

Universal Registration Document filed with the French Autorité des

marchés financiers (AMF) on April 30, 2024 under the filling

number: D.24-0377..

Revenue organic growth and Adjusted EBITDA

improvement are presented at constant scope and exchange rate.

Adjusted EBITDA is presented as defined in the 2023 Universal

Registration Document. All amounts are presented in € million

without decimal. This may in certain circumstances lead to

non-material differences between the sum of the figures and the

subtotals that appear in the tables. 2024 objectives are expressed

at constant scope and exchange rates and according to Group’s

accounting standards.

Worldline does not undertake, and specifically

disclaims, any obligation or responsibility to update or amend any

of the information above except as otherwise required by law.

This document is disseminated for information

purposes only and does not constitute an offer to purchase, or a

solicitation of an offer to sell, any securities in the United

States or any other jurisdiction. Securities may not be offered or

sold in the United States unless they have been registered under

the U.S. Securities Act of 1933, as amended (the “U.S. Securities

Act”) or the securities laws of any U.S. state, or are exempt from

registration. The securities that may be offered in any transaction

have not been and will not be registered under the U.S. Securities

Act or the securities laws of any U.S. state and Worldline does not

intend to make a public offering of any such securities in the

United States.

- 20240502 - Worldline - Q1 2024 revenue - Press Release

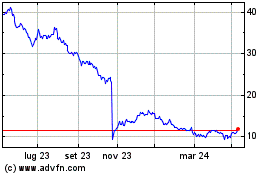

Grafico Azioni Worldline (EU:WLN)

Storico

Da Gen 2025 a Feb 2025

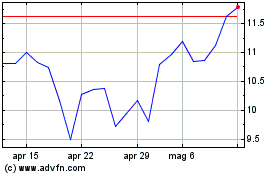

Grafico Azioni Worldline (EU:WLN)

Storico

Da Feb 2024 a Feb 2025