ECB Holds Rates Steady, Signals Easing Ahead

11 Aprile 2024 - 11:00AM

RTTF2

The European Central Bank left its key interest rates unchanged

on Thursday, but signaled policymakers are gaining confidence on

inflation returning to the 2 percent target and could lower rates

in coming months.

The Governing Council, led by ECB President Christine Lagarde,

left the main refinancing rate, or refi, unchanged at 4.50 percent,

as expected.

The deposit facility rate was held steady a record high 4.00

percent and the lending rate was retained at 4.75 percent.

Policymakers consider that the key interest rates are at levels

that are making a substantial contribution to the ongoing

disinflation process, the ECB said. Future decisions will ensure

that its policy rates will stay sufficiently restrictive for as

long as necessary, the bank added.

"If the Governing Council's updated assessment of the inflation

outlook, the dynamics of underlying inflation and the strength of

monetary policy transmission were to further increase its

confidence that inflation is converging to the target in a

sustained manner, it would be appropriate to reduce the current

level of monetary policy restriction," the ECB said.

Markets widely expect the central bank for the single currency

bloc to lower interest rates in the June 6 policy session.

Expectations have been strengthened by the easing trends in

inflation data, though underlying price pressures remain high, and

recent comments from ECB policymakers including Lagarde. "Even if

the policy announcement does not explicitly mention June as the

moment for a first rate cut, we think that today's meeting should

mark the final stop before the cut," ING economist Carsten Brzeski

said.

"The faster-than-expected drop in headline inflation, as well as

anaemic growth, have opened the door for some rate cuts. Not a

full reversal of the rate hikes since July 2022, but rather a soft

loosening of a still restrictive stance."

Capital Economics economist Jack Allen-Reynolds said the ECB's

decision to update its guidance suggests that an interest rate cut

at the next meeting in June is very likely.

"...we think that the conditions will be in place for the Bank

to bring the deposit rate down to 3 percent by the end of the year

and further next year," the economist added.

The bank reiterated that it will continue to follow a

data-dependent and meeting-by-meeting approach to determining the

appropriate level and duration of restriction, and that it is not

pre-committing to a particular rate path.

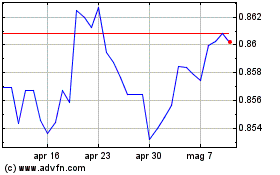

Grafico Cross Euro vs Sterling (FX:EURGBP)

Da Mar 2024 a Apr 2024

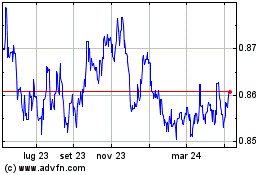

Grafico Cross Euro vs Sterling (FX:EURGBP)

Da Apr 2023 a Apr 2024