UK Inflation Strengthens Call For June Rate Hike

24 Maggio 2023 - 11:28AM

RTTF2

UK consumer price inflation slowed less than expected in April

and the core rate accelerated unexpectedly to a 31-year high,

strengthening the case for another interest rate hike from the Bank

of England in June.

The consumer price index, or CPI, registered an annual increase

of 8.7 percent in April after a 10.1 percent gain in March, the

Office for National Statistics reported Wednesday.

Although inflation eased from April, the rate was above

economists' forecast of 8.3 percent.

Core inflation that excludes energy, food, alcoholic beverages

and tobacco advanced to 6.8 percent in April from 6.2 percent in

the previous month.

Core inflation rose to the highest since March 1992, while

economists had expected the rate to remain unchanged at 6.2

percent.

On a monthly basis, consumer prices gained 1.2 percent, which

was faster than the 0.8 percent rise in March.

"The combination of resilient activity and rapidly easing

inflation always looked a bit too good to be true to us," Capital

Economics' economist Paul Dales said.

The research firm had earlier expected that a near-term

recession would quash inflation. But it now looks as though the

central bank is going to have to hike interest rates even higher to

generate the necessary economic weakness, Dales said.

Inflation data undoubtedly makes life harder for policymakers

and no doubt raises the chance of yet another 25 basis point rate

hike next month, ING economist James Smith said.

The next monetary policy announcement is due on June 22. The BoE

had lifted its benchmark interest rate over the last twelve

straight sessions to its highest level since 2008.

In the concluding statement of the Article IV Mission of

International Monetary Fund released Tuesday, staff said the UK

economy is set to avoid a recession and that the monetary policy

will need to remain tight to keep a lid on inflation.

The Washington-based lender cautioned that inflation would

remain above the 2 percent target until mid-2025.The IMF warned

against "premature celebrations" in the fight against

inflation.

The ONS said slowdown in overall inflation was driven by

electricity and gas prices as last April's rise dropped out of the

annual comparison. Nonetheless, electricity and gas prices

contributed 1.01 percentage points to annual inflation.

At the same time, food and non-alcoholic beverages continued to

rise in April. However, the annual increase in food and

non-alcoholic beverages prices eased to 19.1 percent from 19.2

percent.

Input price inflation hit its lowest level since February 2021

and factory gate inflation reached the weakest since July 2021, the

ONS said in a separate communique.

Input prices grew only 3.9 percent in April after March's 7.3

percent increase. At the same time, month-on-month, input prices

fell 0.3 percent, reversing a 0.2 percent rise in March.

Output price inflation slowed to 5.4 percent in April from 8.5

percent in the previous month. On a monthly basis, output prices

remained flat for the second straight month.

Elsewhere, the monthly Industrial Trends survey results from the

Confederation of British Industry showed that a net 17 percent of

manufacturers said total orders declined in May compared to 20

percent in April.

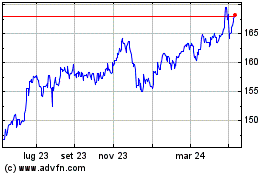

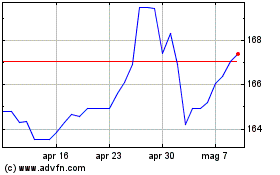

Grafico Cross Euro vs Yen (FX:EURJPY)

Da Nov 2024 a Dic 2024

Grafico Cross Euro vs Yen (FX:EURJPY)

Da Dic 2023 a Dic 2024