U.S. Dollar Lower As Treasury Yields Fall

14 Aprile 2022 - 6:33AM

RTTF2

The U.S. dollar weakened against its major counterparts in the

Asian session on Thursday, as U.S. treasury yields dropped amid

signals that inflation may have peaked and investors awaited the

European Central Bank's monetary policy decision later today for

rate hike outlook.

Federal Reserve board member Christopher Waller said on

Wednesday that the central bank will continue with its plan for

rate hikes to curb inflation even though the pace of price

increases is likely to have peaked.

The economy is strong enough to support higher rates, enabling

the Fed to move prices down without causing a recession, Waller

added.

Investors await a slew of data including retail sales, initial

jobless claims, and the University of Michigan's consumer sentiment

index due later today for more direction.

With euro area inflation touching an all-time high of 7.5

percent last month, the ECB could end the asset purchase program

early in the third quarter and open the door for a first rate hike

later this year.

Risk sentiment improved after China's cabinet signaled upcoming

cuts to banks' reserve requirement ratios and interest rates to

counter the impact of Covid-19 and boost the recovery and growth of

consumption.

The greenback edged down to 0.9324 against the franc, from a

high of 0.9353 it touched at 9 pm ET. Against the kiwi, it reached

as low as 0.6834. The currency is likely to locate support around

0.90 against the franc and 0.70 against the kiwi.

The greenback slipped to a 2-day low of 125.10 against the yen

and a 9-day low of 1.3147 against the pound, following its prior

highs of 125.70 and 1.3100, respectively. The greenback is seen

finding support around 119.00 against the yen and 1.33 against the

pound.

The greenback touched a 3-day low of 1.0923 against the euro and

a 1-week low of 1.2541 versus the loonie, off its previous highs of

1.0883 and 1.2569, respectively. The next possible support for the

greenback is seen around 1.12 against the euro and 1.23 versus the

loonie.

The greenback, however, climbed to 0.7442 versus the aussie,

after dropping to 0.7468 earlier in the session. If the dollar

rises further, 0.72 is likely seen as its next resistance

level.

Looking ahead, the European Central Bank will announce interest

rate decision at 7:45 am ET. The ECB is expected to hold its main

refi rate at a record low zero percent and the deposit rate at

-0.50 percent.

U.S. weekly jobless claims for the week ended April 9, business

inventories data for February, University of Michigan's preliminary

U.S. consumer sentiment index for April, retail sales and export

and import prices for March are due out in the New York

session.

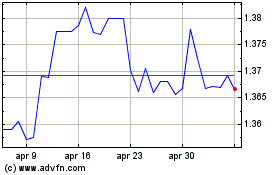

Grafico Cross US Dollar vs CAD (FX:USDCAD)

Da Mar 2024 a Apr 2024

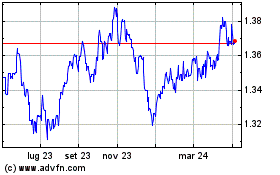

Grafico Cross US Dollar vs CAD (FX:USDCAD)

Da Apr 2023 a Apr 2024