TIDMAJB

RNS Number : 9500V

AJ Bell PLC

07 December 2023

7 December 2023

AJ Bell plc

Final results for the year ended 30 September 2023

AJ Bell plc ('AJ Bell' or the 'Company'), one of the UK's

largest investment platforms, today announces its final results for

the year ended 30 September 2023.

Highlights

Financial performance

-- Record financial performance, with revenue up 33% to GBP218.2

million (FY22: GBP163.8 million) and profit before tax

(PBT) up 50% to GBP87.7 million (FY22: GBP58.4 million)

-- PBT margin of 40.2% (FY22: 35.6%), reflecting an increased

revenue margin of 29.8bps (FY22: 22.6bps) together with

total cost growth in line with previous guidance

-- Diluted earnings per share up 46% to 16.53 pence (FY22:

11.35 pence)

-- Final dividend of 7.25 pence per share proposed, increasing

the total ordinary dividend for the year by 46% to 10.75

pence per share (FY22: 7.37 pence per share) in line with

the Company's stated dividend policy. This is the 19(th)

consecutive year of ordinary dividend growth

Platform business

-- Another successful year, with customers increasing by 50,880

to 476,532 and platform net inflows of GBP4.2 billion (FY22:

GBP5.8 billion)

-- Record assets under administration (AUA) of GBP70.9 billion

(FY22: GBP64.1 billion), up 11% driven by the net inflows

across the platform and favourable market movements of

GBP2.6 billion

-- Customer retention rate remained high at 95.2% (FY22: 95.5%)

-- Consistently high customer service levels evidenced by

AJ Bell's Trustpilot rating of 4.8

AJ Bell Investments

-- Record net inflows in the year of GBP1.65 billion, up 57%

versus the prior year (FY22: GBP1.05 billion underlying

net inflows)

-- Assets under management ("AUM") of GBP4.7 billion, up 68%

in the year (FY22: GBP2.8 billion)

Michael Summersgill, Chief Executive Officer at AJ Bell,

commented:

"I am pleased to report another year of strong financial

performance for the business which has demonstrated our ability to

continue to grow in different market conditions. Revenue increased

33% to GBP218.2 million, enabling us to reinvest in our customer

proposition and our people, whilst delivering a record profit

before tax of GBP87.7 million which supports an increased dividend

for shareholders.

"We added over 50,000 customers to the platform in the year,

reflecting the quality and value of our propositions, as well as

increased investment in our brand. The growth in customers enabled

us to deliver over GBP4 billion of net inflows, an excellent result

which again highlights the benefit of operating our dual-channel

platform.

"As we approach half a million platform customers, we remain

focused on providing a great value proposition, with a philosophy

of sharing our scale benefits with customers. Having reduced

several fees across the platform in 2022, this year we have

increased the interest rates paid to customers several times and

will soon be increasing them further, with a particular focus on

pension drawdown where there is a customer need to hold cash to

fund income payments.

"We continue to invest in our customer proposition with a focus

on making it easy for people to invest. In the D2C market we have

recently added the option to purchase bonds and gilts online in

response to increased demand for these investments in the higher

interest rate environment. Our free pension finding service has

proved popular with customers trying to track down and consolidate

lost pension pots and next year we will be expanding this into a

low-cost pension consolidation service. This will enable people to

find and automatically consolidate their existing pensions into one

simple pension with ready-made investment options and a single

annual charge of between 0.45% and 0.60%.

"In the advised market we continue to invest in new

functionality to help advisers manage their client portfolios. A

focus this year has been supporting advisers with the

implementation of the Consumer Duty and next year we will roll out

a new client onboarding process which will streamline the new

business process for advisers. We have recently added a money

market portfolio to our MPS range to provide another investment

option for advisers and their clients in the current interest

environment.

"Maintaining a strong culture and motivated workforce is

essential to facilitating our continued business growth. We made

several enhancements to our pay and benefits package in the year,

including a new free share award scheme for all employees which

encourages our staff to think and act like business owners. The

success of our business is down to the quality of work and

commitment of our people, and I would like to thank them for their

outstanding contribution during the year.

"The strong financial performance of the business has led the

Board to propose a final ordinary dividend of 7.25 pence per share,

increasing the ordinary dividend for the year by 46% to 10.75 pence

per share. This extends our record of ordinary dividend increases

to 19 years.

"Our dual-channel platform has continued to perform strongly

against the current backdrop of elevated inflation and interest

rates, demonstrating our resilience through the economic cycle.

Whilst the current challenging environment is likely to persist in

the short term, I am confident that our long-term focus and

continued investment in the business positions us well to take

advantage of the structural growth opportunity for the platform

market."

Financial highlights

Year ended Year ended

30 September 30 September

2023 2022 Change

Revenue GBP218.2 million GBP163.8 million 33%

----------------- ----------------- --------

Revenue per GBPAUA* 29.8bps 22.6bps 7.2bps

----------------- ----------------- --------

PBT GBP87.7 million GBP58.4 million 50%

----------------- ----------------- --------

PBT margin 40.2% 35.6% 4.6ppts

----------------- ----------------- --------

Diluted earnings per share 16.53 pence 11.35 pence 46%

----------------- ----------------- --------

Total ordinary dividend

per share 10.75 pence 7.37 pence 46%

----------------- ----------------- --------

Non-financial highlights

Year ended Year ended

30 September 30 September

2023 2022 Change

Number of retail customers 491,402 440,589 12%

---------------- ---------------- ----------

- Platform 476,532 425,652 12%

---------------- ---------------- ----------

- Non-platform 14,870 14,937 -

---------------- ---------------- ----------

AUA* GBP76.1 billion GBP69.2 billion 10%

---------------- ---------------- ----------

- Platform GBP70.9 billion GBP64.1 billion 11%

---------------- ---------------- ----------

- Non-platform GBP5.2 billion GBP5.1 billion 2%

---------------- ---------------- ----------

AUM* GBP4.7 billion GBP2.8 billion 68%

---------------- ---------------- ----------

Customer retention rate 95.2% 95.5% (0.3ppts)

---------------- ---------------- ----------

*see definitions

Contacts:

AJ Bell

Shaun Yates, Investor Relations

-- Director +44 (0) 7522 235 898

-- Mike Glenister, Head of PR +44 (0) 7719 554 575

Results presentation details

A pre-recorded video with Michael Summersgill (CEO) and Peter

Birch (CFO) discussing these results will be available on our

website ( ajbell.co.uk/investor-relations ) along with an

accompanying investor presentation from 07.00 GMT today. Management

will be hosting a meeting for sell-side analysts at 09:30 GMT

today. Attendance is by invitation only.

Management will also be hosting a group call for investors at

15.00 GMT today. Please contact Camilla Crowe at

c.crowe@dbnumis.com for registration details.

Forward-looking statements

The full year results contain forward-looking statements that

involve substantial risks and uncertainties, and actual results and

developments may differ materially from those expressed or implied

by these statements. These forward-looking statements are

statements regarding AJ Bell's intentions, beliefs or current

expectations concerning, among other things, its results of

operations, financial condition, prospects, growth, strategies, and

the industry in which it operates. By their nature, forward-looking

statements involve risks and uncertainties because they relate to

events and depend on circumstances that may or may not occur in the

future. These forward-looking statements speak only as of the date

of these full year results and AJ Bell does not undertake any

obligation to publicly release any revisions to these

forward-looking statements to reflect events or circumstances after

the date of these results.

Chair's statement

Dear shareholder

"AJ Bell is a great business with a justifiable reputation for

innovation, customer focus and a commitment to delivering real

value to customers and advisers."

I am delighted to present my first Annual Report as your new

Chair.

Since my appointment on 1 May 2023, I have spent time getting to

know many people across the business, as well as having the

pleasure of engaging with some of our shareholders and other key

stakeholders, discussing both AJ Bell's business and the wider

platform market. It has been a really interesting and informative

period since joining, which has reaffirmed my initial very

favourable impression of the people and the business. I am very

excited to lead the Board and support the executive team in the

goals we have set ourselves.

I am pleased to report that we have delivered a strong financial

performance during the year with PBT of GBP87.7 million. Over the

past 12 months customer numbers increased by 50,813 to 491,402 and

we delivered GBP4.1 billion of net inflows, ending the year with

total AUA of GBP76.1 billion. This strong performance demonstrates

the resilience of our business model during a challenging year and

continued uncertainties around the UK economy. The Financial review

contains further information on this year's performance.

As the uncertainties in the wider economy continued into 2023,

it created further challenges for our customers, our people and our

wider stakeholders. As a Board we were particularly mindful of this

and so our focus remained on the wellbeing of our staff, while

maintaining a high-quality, value-for-money service to our

customers and delivering positive outcomes for all our

stakeholders.

Our governance structure and cohesive culture provide a solid

framework for achieving our long-term strategic goals. The Board

remains focused on delivering AJ Bell's purpose; to help people

invest.

Culture, purpose and stakeholder engagement

The Board plays a vital role in shaping and embedding a strong

and healthy culture through promoting the core values and

principles of the Group and this continued to be a focus throughout

the year. We welcomed the opportunity to engage with our staff and

shareholders in person again this year, providing invaluable

insight into the operation and culture of our business. I was

delighted to be appointed as the nominated Employee Engagement

Director in May, which has given me an opportunity to refresh the

Employee Voice Forum (EVF).

During the year we also reviewed the AJ Bell Way and our guiding

principles; challenging ourselves on their continued alignment with

our purpose and culture following significant growth of the

business. It was encouraging to see the level of engagement from

our people and our customers and advisers, affirming how well our

core values resonate with our key stakeholders. Whilst the key

elements of our guiding principles remain relevant, some

refinements have been made to simplify them and reflect the

feedback received to ensure they continue to be embraced by our

people on a day-to-day basis.

Consideration of our wider stakeholders in some of our key

decisions in the year are outlined in our Section 172

statement.

We recognise the importance of an engaged workforce and it was

pleasing to see that this year's staff survey showed positive

progress with an overall response rate of 87%. Our people are at

the heart of our continued growth and success and so how we

motivate, reward and support them is a key priority for the Board.

The introduction of the new free share award scheme for all

employees has been very well received and we expect the level of

share ownership to increase further for the coming year. Our pay

and benefits package introduced at the start of FY23 has also seen

further enhancements to base pay and pension contributions for the

coming year.

We have made good progress embedding our Diversity and Inclusion

framework. As reported last year our primary focus was on the

senior management and talent pipeline where I am pleased to see we

have already made positive steps on the recruitment at executive

level. The Board will continue to monitor and challenge progress on

our initiatives for the wider workforce where we expect to see

further improvements in the coming year.

Further details on our ESG-related activities can be found in

our Responsible Business section.

Board changes and succession

On 1 May 2023 I succeeded Baroness Helena Morrissey as Chair. On

behalf of the Board, I would like to thank Helena for her

significant contribution to AJ Bell as Chair and look forward to

her continued involvement through her consultancy role where we are

benefiting from her passion and commitment to diversity and

inclusion.

As previously announced when Andy Bell stepped down from the

Board in September 2022, it was agreed that he would have the right

to nominate a Non-Executive Director to represent his interests on

the Board whilst a significant shareholder. This agreement was

formalised in July 2023 when we announced that Les Platts would

join the Board as Andy's Representative Director. I would like to

take this opportunity to formally welcome Les to the Board and very

much look forward to working with him. Les' in-depth knowledge of

the financial services sector and AJ Bell in particular, will

further enhance the experience on the Board and help us drive the

future growth of the Company.

During the year we resumed our search for two new independent

Non-Executive Directors (NED), the first being a replacement for

Simon Turner who has completed nine years' service and will step

down from the Board once a successful handover is complete. The

Board is extremely mindful of the importance of having a diverse

range of skills, experience and perspective around the Board table

and so this was at the forefront of our minds throughout the

recruitment process. I am pleased to report that since the year end

we have appointed Fiona Fry as an independent Non-Executive

Director with effect from 7 December 2023. Fiona will succeed Simon

Turner, as Chair of the Risk & Compliance Committee, subject to

regulatory approval. Fiona is a highly experienced risk

professional, having spent the majority of her career at KPMG

where, as a partner she focused on financial services regulation.

Fiona sat on the UK Board of KPMG for six years. She was previously

Head of investigations at the Financial Services Authority (now the

FCA). Fiona is currently Chair of the Risk Committee at Aviva

Insurance Limited.

Our commitment to addressing both the Parker Review

recommendations and the FCA diversity requirements remains a key

consideration as we continue our search for a further independent

NED to join the Board in the coming year. Whilst we are pleased

with our progress, we acknowledge there is still more to be done to

continue to drive greater diversity at both Board and executive

level.

Further details on Board changes can be found in the Nomination

Committee report.

Dividend

In line with our commitment to a progressive dividend, the Board

is pleased to announce a final ordinary dividend of 7.25p per

share, reflecting the financial strength of the business and strong

capital position. The final ordinary dividend will be paid, subject

to shareholder approval, at our AGM on 30 January 2024, to

shareholders on the register at the close of business on 12 January

2024.

This brings the total ordinary dividend for the financial year

to 10.75p per share, representing an increase of 46% on the

previous year.

Looking ahead

I have really enjoyed my first seven months as AJ Bell's Chair.

First impressions are of a committed, strong management team,

collaborative Board and strong performance despite the wider

economic backdrop. I truly believe this is a great business and I

can see the growth potential. Our dual-channel business model is a

real strength in the investment platform market and with a focus on

ease of use and value for money, AJ Bell is well-positioned to

continue to attract new customers and assets to the platform and

further increase our market share.

I am very grateful to the Board and all those in the business

who have helped me over the first few months as part of my

induction and I am very much looking forward to continuing to work

with them over the coming years.

AJ Bell is a financially strong business as evidenced by a

profitable, well-capitalised and highly cash-generative business

model, and the Board remains confident in the long-term prospects

of the business. Whilst the macroeconomic environment remains

challenging in the short term, it is clear that the fundamental

growth drivers for the platform market remain firmly in place and I

look forward to working with Michael, the executive team and the

Board to ensure the business takes advantage of the growth

opportunities that lie ahead.

Fiona Clutterbuck

Chair

6 December 2023

Board Priorities

Performance and resilience:

I am very proud of the strong performance that the business has delivered

in 2023. However, I am acutely aware of the need to continue growing

the business, whilst at the same time managing our cost base against

a backdrop of significant macroeconomic uncertainty. These are two

key priorities in the coming year. I am also keen that we continue

to embrace the entrepreneurial culture which was so much a hallmark

of the business under Andy Bell's leadership.

Performance such as that which the business has demonstrated this

year is only achievable if the business is resilient; technology plays

a very important role in embedding this resilience so this too will

be a focus for FY24.

Culture:

AJ Bell has always justifiably prided itself on a strong cohesive

culture. In my first few months as Chair I have had the opportunity

to experience this first hand. Interactions with my colleagues across

the business have confirmed an open and transparent culture that permeates

throughout the whole organisation. Our role as a Board is to monitor

how we nurture this culture and ensure it remains a real strength

as we continue to grow.

One of the most important facets of the AJ Bell purpose-led culture

has been its extraordinary focus on doing the right thing for its

customers. We place good customer outcomes at the heart of everything

we do, with good value products, simple communications and strong

processes to support our customers.

The initial implementation of the Consumer Duty has been a key area

of focus for the Board and the business as a whole during the year,

with Simon Turner, our Chair of the Risk & Compliance Committee being

appointed as our designated Non-Executive Director Consumer Duty Champion.

Although we believe our culture is aligned with the requirements of

Consumer Duty, we are by no means complacent and the Board's focus

during FY24 will be on maintaining oversight to ensure the business

is delivering good outcomes for its customers which are consistent

with the Duty.

Succession planning:

The Board remains focused on maintaining good corporate governance

and ensuring these principles are embedded into our culture. I strongly

believe that diversity in all its forms leads to more productive and

balanced Board discussions, and maintaining a diverse and inclusive

Board is a key priority. This includes meeting our targets for gender

and ethnic diversity, whilst at the same time ensuring that all Board

appointments are made on merit.

As I have already mentioned, we are well progressed in our search

for two new independent NEDs. It will be important to ensure that

our new NEDs receive an appropriate induction, matched to their skills

and experience, together with the right level of support from the

Board in their first year. We will also be focusing on putting in

place succession planning for the Committee Chair roles.

Chief Executive Officer's review

Overview

"We are in a great position to maintain our growth momentum and

capitalise on the significant long-term opportunities in our market

by providing investors with an easy-to-use, low-cost platform,

supported by excellent customer service."

We are pleased to report another strong set of results for 2023,

delivering organic growth in customer numbers, AUA and AUM, across

both the advised and D2C market segments. This growth, alongside a

record financial performance, demonstrates the strength of our

dual-channel platform and diversified revenue model to deliver in

different market conditions.

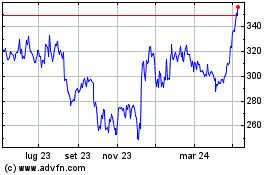

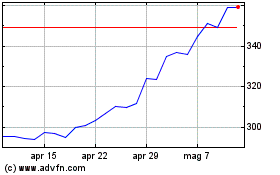

In the five years since our IPO in December 2018 we have

delivered the significant growth that was expected, increasing our

share of the fast-growing platform market each year, whilst also

paying an increasing ordinary dividend to shareholders. Our focus

on providing great value through our high-quality products has led

to nearly half a million platform customers now trusting us with

their investments.

The investment platform market continues to grow. Whilst we are

winning new business from our competitors within the platform

market, crucially we are still growing the platform market by

attracting assets held off-platform in legacy products, as

investors seek the flexibility and control that platforms offer.

This growth is set to continue with approximately two-thirds of the

estimated GBP3 trillion addressable market currently held

off-platform. Our dual-channel model, serving both the advised and

D2C segments of the market, enables us to capture assets across the

whole addressable market, whilst the benefits of our scale, coupled

with our efficient operating model, enable us to keep costs low for

customers and invest in our platform with a focus on ease of use.

Together with our market-leading customer service levels, these

factors have been key to our success to date and ensure we are

positioned at the forefront of the platform market to capitalise on

the significant long-term growth opportunities.

The current macroeconomic environment has presented challenges

for investors and advisers, with high inflation leading to higher

interest rates. These conditions have impacted consumer confidence

and led to stronger demand for cash savings products. We expect

these conditions to persist in the short term, however the

versatility of our open-architecture platform enables us to

continue to grow across a range of market conditions, as

demonstrated in recent years. Our platform provides customers with

the flexibility to choose from a broad range of investment options,

enabling them to respond to changing market dynamics. In the higher

interest rate environment, we have seen increased demand for

government bonds and money market funds. Separately, our Cash

savings hub has provided a convenient option for customers seeking

higher returns on their cash savings.

Strong performance

Our platform delivered growth of over 50,000 customers in the

year, increasing total platform customers by 12% to 476,532 (FY22:

425,652). Our low-cost products position us well at a time when

customers are increasingly looking for value. Demand has been

strong from D2C customers, supported by the investments in our

brand and improved mobile app functionality. We maintained our

excellent service levels throughout this period, as evidenced by

our high customer retention rate of 95.2% (FY22: 95.5%).

The strength of our open-architecture platform, offering

customers a wide range of investment options, was demonstrated as

we delivered over GBP4 billion of net inflows. This contributed to

an 11% increase in platform AUA which ended the year at GBP70.9

billion (FY22: GBP64.1 billion). Our investments business achieved

another year of significant growth, with total AUM increasing by

68% to GBP4.7 billion (FY22: GBP2.8 billion). The strong demand has

been fuelled by our excellent long-term investment performance,

with all six of our multi-asset growth funds being placed in the

top quartile of returns when compared to their Investment

Association peers over the last five years.

Our diversified revenue model has enabled us to deliver a record

financial performance whilst also investing in long-term

initiatives to support future growth. Revenue increased by 33% to

GBP218.2 million (FY22: GBP163.8 million), largely driven by growth

in platform AUA and higher rates of interest generated on cash

balances held on the platform.

We have been mindful of the need to share the benefits of higher

revenue margins across all our stakeholders. For customers we have

kept our prices low, paid a competitive interest rate on their cash

balances and invested in our propositions; for our people we have

improved our pay and benefits package in response to the rising

cost of living; and for our shareholders our investments in brand

and propositions position us to continue to increase our market

share, whilst once again increasing our ordinary dividend.

Investing for long-term growth

We continue to innovate and invest in our products with a focus

on ease of use.

A significant proportion of our addressable market sits in

legacy pension products. Most adults have several employers during

their career, and subsequently accumulate a number of different

pension pots which can be inefficient to manage separately. Our

free pension finding service, which is now live for new and

existing customers, has proved popular with customers trying to

track down and consolidate pension pots. In FY24, we will launch

our new ready-made pension product that consolidates a customer's

pension into a simple product, offering an investment range of four

AJ Bell growth funds with a transparent all-in charging structure

starting from 45bps. The streamlined nature of this product will

reduce barriers for customers who are less confident in managing

their own investments and provides an enhanced journey for new

customers opening a pension with us in the future.

Our product philosophy of utilising our scale to keep charges

low for our customers ensures we continue to provide excellent

value for money. We reduced a number of charges across our

full-service propositions in the second half of FY22 and are

committed to continually reviewing our customer charges as we

grow.

Trust and brand awareness are key drivers of a new customer's

decision when choosing an investment platform.

We have built a brand which is highly trusted by our customers,

and this year, we commenced our multi-year strategy to enhance

brand awareness and to continue increasing our share of the growing

platform market. This strategy was kick-started with our 'feel

good, investing' multi-channel advertising campaign, alongside our

new five-year partnership as the title sponsor of the Great Run

Series.

Q&A with Michael Summersgill

It has now been five years since AJ Bell's IPO. How do you

reflect on this time?

We have achieved significant organic growth in customers and

AUA, in line with the strategy set out to investors at the time of

the IPO. Over this period, platform AUA has increased by 84% to

GBP70.9 billion and platform customers have risen by 160% to

476,532. This growth has been organic and hasn't required

shareholder capital, in fact we have paid GBP147.5 million in

dividends since the IPO.

Key to this growth has been investing in our platform

propositions whilst consistently delivering excellent service to

our customers, as reflected by our recognition as the Which?

Recommended Investment Platform provider for five consecutive years

and our market-leading Trustpilot score of 4.8-stars.

This service would not be possible without the dedication of our

people. Culture and employee engagement have always been key

strengths of the business, and we have maintained this as we

continued to grow, achieving a 3-star accreditation in the Best

Companies to Work For survey every year since we listed.

Looking ahead to the next five years, I am confident we will

deliver on the significant growth opportunities our market

continues to present.

How will your platform products drive growth?

I expect AJ Bell and Investcentre, our well-established

full-service platform propositions, to continue to be the core

drivers of growth. Alongside this, our new simplified products

represent a key area of our growth strategy. Dodl, our simplified

D2C platform proposition, is aimed at less-experienced investors.

Given the success we have seen on our D2C brand work in 2023, we

have decided to revitalise Dodl in FY24, so that it is brought much

closer to our core AJ Bell branding and delivers an optimised

marketing approach. We are confident in the high-quality customer

outcomes the product delivers and this change will help to maximise

future growth.

We continue to develop Touch, our simplified advised product.

This will expand our offering for advisers, helping them to cater

for clients looking for a digital service model. We completed a

closed beta launch in the year and plan to deliver the initial

proposition to market during 2024.

How will you maintain a strong culture?

Maintaining a strong, purpose-led culture is key for me. Our

guiding principles are an important tool in fostering the right

culture, having been first established around 10 years ago. We have

revisited them this year to ensure they continue to reflect who we

are as a business. This involved stakeholder engagement which

highlighted how deep-rooted our guiding principles are. We have

made some changes which are a refinement of the existing framework

that has served us well, rather than a fundamental change. These

refreshed guiding principles have been embraced by our people who

continue to apply them in their roles each day.

Employee share ownership is ingrained in our culture, ensuring

staff share in the success of the business. The introduction of our

annual all-employee free share scheme will facilitate a

continuation of this culture, with the first awards having been

made in January 2023.

Business update

Advised

Advised customers Advised AUA

159,256 GBP48.2 billion

+10% +8%

Our advised business has performed resiliently during a

challenging period for the market, delivering a 13,885 increase in

customer numbers and GBP3.4 billion increase in AUA. This increase

was driven by net AUA inflows of GBP1.9 billion (FY22: GBP3.3

billion) and GBP1.5 billion of favourable market movements (FY22:

GBP4.3 billion of adverse market movements). Net AUA inflows were

42% lower than prior year as a result of a moderation in transfer

activity as advisers and their clients exercised more caution in

the face of ongoing uncertainty in the macroeconomic

environment.

We have continued to develop our full-service advised

proposition, Investcentre, with a focus on ease of use. This

included new dealing functionality which allows advisers to make

one-off investments using their customers' model portfolio asset

allocation, helping to avoid any unnecessary friction when adding

money to portfolios. We have also made significant progress on

enhancements to the onboarding journey, due to be rolled out in the

first half of FY24, delivering an improved interface mapped to the

advice process which streamlines the new business process for

advisers.

In the higher interest environment a number of customers are

looking for cash-like returns, whilst maintaining the benefits of

remaining in their existing tax wrappers and having the flexibility

to easily invest in other assets again at a time of their choosing.

To support advisers in servicing those customers, we launched the

AJ Bell Investments Money Market MPS in November. This product is

at a market-leading low-price with no management fees and an

ongoing charges figure (OCF) of just 10bps.

We engage with advisers through a range of events and technical

support every year. We continued our 'on and off the road'

seminars, and hosted our flagship Investival conference in

November, which was attended by over 400 financial professionals.

This regular communication with advisers allows us to forge strong

relationships and earn their trust as a platform provider.

D2C

D2C customers D2C AUA

317,276 GBP22.7 billion

+13% +18%

Our D2C business has delivered a strong performance, with a

36,995 increase in customer numbers and a GBP3.4 billion increase

in AUA. This increase was driven by net inflows of GBP2.3 billion

(FY22: GBP2.5 billion), with over 95% of these net inflows into

tax-wrappers and dealing accounts, and GBP1.1 billion of favourable

market movements (FY22: GBP2.7 billion of adverse market

movements).

At the start of the financial year we retired the Youinvest

sub-brand, renaming our full-service D2C platform as AJ Bell. This

change has helped to drive the strong growth in the year by

simplifying the journey for new customers, and improving the

effectiveness of our direct marketing activity.

We have continued to focus on making the customer journey easier

and have rolled out multiple enhancements to the AJ Bell platform.

In November, we introduced the ability to purchase a select list of

gilts online in response to increased demand for those instruments

in the higher interest rate environment. We also delivered our

pension finding service for new and existing customers.

Following the increases in the UK base rate throughout the year,

we raised the rates we pay to customers on cash held on the

platform. Early in 2024, we will be introducing a higher interest

rate on cash held in SIPP drawdown, reflecting the fact that these

customers often hold more of their portfolio in cash to fund their

short-to-medium term retirement plans, as well as higher rates for

SIPP and ISA customers with large cash balances.

We provide high-quality investment content for our D2C

customers, covering the latest market trends. In May, we made our

weekly Shares magazine free for all D2C customers, and our weekly

Money & Markets and Money Matters podcasts provide further

market information and expert analysis to support our customers in

navigating their investment decisions.

Investments

AUM

GBP4.7 billion

+68%

Our investments business offers a range of simple, transparent

investment solutions at a low cost. In a market where many asset

managers are suffering persistent net outflows, the strong

performance and low-cost nature of our multi-asset investment

solutions continue to attract new assets in both the advised and

D2C markets.

The growth has been particularly strong from advised and

external platform customers who value the long-term track record of

performance our investments have delivered.

Customer services and technology

We provide a high-quality service to our customers, with over

95% of customer calls in the year answered within 20 seconds. This

excellent service is reflected in our 4.8-star Trustpilot score, as

rated by our D2C customers, and our 95.2% platform customer

retention rate.

We continue to invest in our technology to deliver a great

customer experience. Our secure and scalable platform has been

designed to facilitate growth and drive operational gearing,

utilising a hybrid technology model which allows us to build

adaptable, easy-to-use interfaces. During the year, we have

continued to invest in the resilience of our platform through

further investment in our cyber security and disaster recovery

capabilities. In addition, we have increased the resource in the

change teams in order to improve the speed at which we deliver

further enhancements to our platform propositions.

We recognise the significant opportunities that artificial

intelligence presents for us to increase our efficiency as a

business as well as the risks it presents for customer security. In

June, we dedicated engineering and business resources to execute an

artificial intelligence hackathon, building several innovative

proofs of concept. The output of this process was very encouraging,

with lots of initiatives discussed and many ideas generated which

we will consider adopting in the future. We will embrace artificial

intelligence, with the focus initially on internal,

non-customer-facing operations, as part of our efforts to

continually improve operational efficiency.

People and culture

As our business continues to grow, it is important that we

maintain a strong culture, along with our high levels of staff

engagement and wellbeing. It is therefore pleasing to have once

again achieved a 3-star accreditation in the 'Best Companies to

Work For', and to be recognised as one of the top 20 large

companies to work for in the UK.

At the start of FY23 we introduced several enhancements to our

pay and benefits package, representing an increase in staff costs

of over 10%, including our new free share award scheme for all

employees. We remained mindful of the impact of the continuing

cost-of-living pressures on our people when considering employee

benefits for the forthcoming year. A number of additional

enhancements to our pay and benefits package were made, including

an average increase in base pay of 5.8% and a further uplift in

pension contributions.

As part of our review of the AJ Bell Way, we have refreshed some

of our guiding principles and relaunched these to staff across the

business, further details of which can be found in our Responsible

Employer section.

Our apprenticeship programmes continue to be a huge success,

with this year's intake of 34 new digital and investment

apprentices being the largest cohort since it was launched in 2017.

We were also pleased to have been recognised as the 'Large Employer

of the Year' at the North West Apprenticeship Awards. In addition,

our commitment to developing our internal talent pipeline was

recognised with an 'Outstanding' Ofsted rating following their

inspection of our Talent Development Programme which upskills and

develops our Team Leaders and Managers through apprenticeships.

We launched the AJ Bell Futures Foundation at the start of the

year to develop long-term partnerships with our local communities.

It has been great to see staff participating in volunteering

activities with both of our partner charities, Smart Works and

IntoUniversity, as well as taking up the chance to nominate local

charities for donations. Further information on the work of the

Foundation can be found in our Responsible Business report.

Regulatory developments

There are a number of ongoing regulatory developments that will

impact customers in our market and we continue to engage

proactively with Government and regulators on their behalf.

We were well prepared for the implementation of the new Consumer

Duty which came into force at the end of July. We are supportive of

this development and believe it will be positive for consumers,

with an increased focus on value for money and ensuring good

customer outcomes. It is disappointing the new Duty does not yet

apply to legacy schemes, as the FCA has recently stated savers in

older schemes may be at greatest risk of poor value for money.

We are continuing to work with the Government and the FCA on

their review of the boundary between advice and guidance, and their

exploration of new ways to offer support and guidance to consumers.

We believe any new rules should be applicable to new and existing

D2C customers and enable firms to deliver solutions that meet the

needs of their customer cohorts. An overly prescriptive approach

would stifle innovation and risk poor customer outcomes.

ISAs should be a simple, easy-to-use tax-efficient savings

vehicle but we now have six variations of ISAs, all aiming to cater

for slightly different customer needs, with complicated rules. We

have been campaigning for the Government to simplify ISAs by

creating a single ISA solution that is easy for consumers to

understand and will encourage them to invest more. Whilst some

relaxations were announced in the Autumn Statement such as allowing

people to subscribe to more than one of the same type of ISA each

year, we think this was a missed opportunity to launch a wider

consultation with the aim of simplifying ISAs and helping people to

invest. Whilst significant change may take some time to achieve,

our proposals have been received well both by government and the

industry, so we will continue to campaign for further change in

this area.

Executive Committee changes

Bruce Robinson stepped down from his role as Company Secretary

and Group Legal Services Director, and as a member of the Executive

Committee, at the end of September 2023. I would like to thank

Bruce for his exceptional service over the last 11 years at AJ Bell

and look forward to continuing to work with him in his new role as

an Executive Consultant.

Following this, I am pleased to report the internal promotion of

Kina Sinclair to the role of Group Legal Services Director and as a

member of the Executive Committee with effect from 1 October 2023.

Kina joined AJ Bell in July 2018 and brings extensive knowledge of

the business alongside her broad commercial law expertise.

As part of the succession plan for Bruce, we have separated the

Company Secretary role and are pleased to announce the appointment

of Olubunmi Likinyo as Company Secretary with effect from 1 October

2023.

Following the year end Kevin Doran, Managing Director of D2C and

Investments, informed the business of his decision to leave. He

will therefore be departing AJ Bell in the new year. Kevin has

helped us to build a terrific investment business and I would

particularly like to thank him for his work in this part of the

business. I am pleased to announce that Charlie Musson, our Chief

Communications Officer, has taken over as Acting Managing Director

D2C. Having worked with Charlie for many years, I look forward to

working with him in his new role as we continue to drive our D2C

platform propositions forward.

Outlook

Investment platforms play a hugely important role in helping

individuals to take control of their long-term investments. At AJ

Bell, we operate a scalable platform that provides a high-quality,

trusted service to our customers. Our continued investment in our

advised and D2C platform propositions means we are well equipped

and ready to serve both existing platform customers and new

customers seeking to invest in the future.

In the short term, the macroeconomic environment will continue

to present some headwinds. However, as we have seen this year, our

versatile platform offering enables us to continue delivering

robust growth in these conditions and the long-term structural

drivers of growth in the UK platform market remain strong. Our aim

remains to continue increasing our share of the platform market,

which for many years has grown quicker than the broader financial

services sector.

Our diversified revenue model means we are well placed to

succeed in different macroeconomic conditions. Our philosophy

remains to continually re-invest the benefits of our scale to drive

long-term growth, ensuring that we offer a great value proposition

to customers whilst investing in our brand, technology and people

at the levels required to deliver on our long-term growth

ambitions.

As a final point, I would like to thank all of our staff;

without their ongoing commitment and quality of work our continued

success would not be possible.

Michael Summersgill

Chief Executive Officer

6 December 2023

Financial review

"The advantages of our dual-channel model and diversified

revenue streams enabled us to deliver a record financial

performance in the year."

Overview

Our dual-channel platform achieved robust net inflows of GBP4.2

billion (FY22: GBP5.8 billion) and customer growth of 12% (FY22:

16%) in a challenging external environment. Our ability to continue

to grow in these circumstances is testament to the quality of our

platform propositions.

Our diversified revenue model enabled us to deliver a strong

financial performance, with revenue increasing by 33% to GBP218.2

million (FY22: GBP163.8 million) and PBT up 50% to GBP87.7 million

(FY22: GBP58.4 million), whilst investing in our people,

propositions and brand to ensure we are well placed to achieve

future growth.

Business performance

Customers

Customer numbers increased by 50,813 during the year to a total

of 491,402 (FY22: 440,589). This growth has been driven by our

platform propositions, with our advised customers up by 10% and our

D2C customers increasing by 13%.

Our platform customer retention rate remained high at 95.2%

(FY22: 95.5%).

Year ended Year ended

30 September 30 September

2023 2022

No. No.

================== ============== ==============

Advised platform 159,256 145,371

D2C platform 317,276 280,281

===================== ============== ==============

Total platform 476,532 425,652

Non-platform 14,870 14,937

===================== ============== ==============

Total 491,402 440,589

--------------------- -------------- --------------

Assets under administration

Year ended 30 September 2023

Advised Total

platform D2C platform platform Non-platform Total

GBPbn GBPbn GBPbn GBPbn GBPbn

-------------------------- ========== ============= ========== ============= =======

As at 1 October 2022 44.8 19.3 64.1 5.1 69.2

-------------------------- ---------- ------------- ---------- ------------- -------

Inflows 5.0 4.3 9.3 0.2 9.5

Outflows (3.1) (2.0) (5.1) (0.3) (5.4)

-------------------------- ---------- ------------- ---------- ------------- -------

Net inflows / (outflows) 1.9 2.3 4.2 (0.1) 4.1

-------------------------- ---------- ------------- ---------- ------------- -------

Market and other

movements 1.5 1.1 2.6 0.2 2.8

========================== ========== ============= ========== ============= =======

As at 30 September

2023 48.2 22.7 70.9 5.2 76.1

-------------------------- ---------- ------------- ---------- ------------- -------

Year ended 30 September 2022

Advised Total

platform D2C platform platform Non-platform Total

GBPbn GBPbn GBPbn GBPbn GBPbn

========================== ========== ============= ========== ============= =======

As at 1 October 2021 45.8 19.5 65.3 7.5 72.8

-------------------------- ---------- ------------- ---------- ------------- -------

Inflows 6.2 3.9 10.1 0.2 10.3

Outflows (2.9) (1.4) (4.3) (2.2) (6.5)

-------------------------- ---------- ------------- ---------- ------------- -------

Net inflows / (outflows) 3.3 2.5 5.8 (2.0) 3.8

-------------------------- ---------- ------------- ---------- ------------- -------

Market and other

movements (4.3) (2.7) (7.0) (0.4) (7.4)

========================== ========== ============= ========== ============= =======

As at 30 September

2022 44.8 19.3 64.1 5.1 69.2

-------------------------- ---------- ------------- ---------- ------------- -------

We achieved robust total net inflows of GBP4.1 billion (FY22:

GBP3.8 billion), driven by our platform.

Total advised platform net inflows were GBP1.9 billion (FY22:

GBP3.3 billion). The year-on-year reduction was driven by a fall in

gross inflows to GBP5.0 billion (FY22: GBP6.2 billion). There has

been a moderation in transfer activity as advisers and their

clients exercise more caution in the face of ongoing uncertainty in

the macroeconomic environment, whilst existing customer inflows

into tax-wrapped products remained stable. Advised outflows in the

year increased to GBP3.1 billion (FY22: GBP2.9 billion).

Total D2C platform net inflows were GBP2.3 billion (FY22: GBP2.5

billion). Gross inflows increased to GBP4.3 billion (FY22: GBP3.9

billion) with the increase driven by changes to the annual pension

allowance, competitive dynamics and strong inflows from new

customers supported by the investments made in our brand. Outflows

increased to GBP2.0 billion (FY22: GBP1.4 billion) as customers

drew down on their investments amidst the cost-of-living

pressures.

Non-platform net outflows of GBP0.1 billion (FY22: GBP2.0

billion) were significantly lower than FY22 following the closure

of the institutional stockbroking business in the prior year.

Favourable market movements contributed GBP2.8 billion as global

equity markets recovered some of the losses experienced in the

prior year, when adverse market movements contributed to a GBP7.4

billion reduction in AUA. This resulted in closing AUA of GBP76.1

billion (FY22: GBP69.2 billion).

Assets under management

Year ended Year ended

30 September 30 September

2023 2022

GBPbn GBPbn

============== ============== ==============

Advised 2.5 1.7

D2C 1.3 1.0

Non-platform 0.9 0.1

================= ============== ==============

Total 4.7 2.8

----------------- -------------- --------------

Our range of funds and MPSs are highly valued by financial

advisers, their clients and our retail customers. Total AUM closed

at GBP4.7 billion (FY22: GBP2.8 billion), representing a 68%

increase in the year. The growth has been particularly strong from

our advised customers, as well as a significant increase in AUM

from customers investing via external third-party platforms.

Financial performance

Revenue

Year ended Year ended

30 September 30 September

2023 2022

GBP000 GBP000

====================== ============== ==============

Recurring fixed 30,666 29,787

Recurring ad valorem 161,152 102,184

Transactional 26,416 31,876

======================= ============== ==============

Total 218,234 163,847

------------------------- -------------- --------------

Revenue increased by 33% to GBP218.2 million (FY22: GBP163.8

million).

Revenue from recurring fixed fees increased by 3% to GBP30.7

million (FY22: GBP29.8 million), primarily due to higher pension

administration revenue from our advised platform customers.

Recurring ad valorem revenue grew by 58% to GBP161.2 million

(FY22: GBP102.2 million). The key driver of this growth was the

higher levels of interest generated on cash balances held on the

platform following increases to market rates of interest in the

year, combined with elevated average cash balances in the first

half of the year. Our economies of scale enable us to benefit from

these interest rate rises whilst also sharing them with our

customers by paying a market-competitive rate on their cash

balances. Further information on the impact to revenue of changes

to the UK base interest rate has been disclosed in note 25 to the

consolidated financial statements. Increased custody fee income as

a result of higher average platform AUA also contributed to this

revenue growth.

Revenue from transactional fees decreased by 17% to GBP26.4

million (FY22: GBP31.9 million). This decrease was due to lower

dealing activity levels in the current year, impacted by the

macroeconomic environment.

Our overall revenue margin increased by 7.2bps to 29.8bps (FY22:

22.6bps).

Administrative expenses

Year ended Year ended

30 September 30 September

2023 2022

GBP000 GBP000

========================= ============== ==============

Distribution 25,928 14,998

Technology 40,317 32,706

Operational and support 65,769 57,162

========================== ============== ==============

Total 132,014 104,866

---------------------------- -------------- --------------

Administrative expenses increased by 26% to GBP132.0 million

(FY22: GBP104.9 million), in line with expectation, as we delivered

our planned investment in our people, technology and brand, whilst

absorbing some one-off inflationary impacts and supporting

sustainable growth. Total staff costs increased by GBP9.9 million

across the business driven by the roll out of a comprehensive new

pay and benefits package which took effect on 1 October 2022 and

increased headcount to support our growth.

Distribution costs increased by 73% to GBP25.9 million (FY22:

GBP15.0 million) as we executed our plans to increase investment in

our brand. This included our multi-channel 'feel good, investing'

advertising campaign, and our new partnership as the title sponsor

of the AJ Bell Great Run Series.

Technology costs increased by 23% to GBP40.3 million (FY22:

GBP32.7 million). This increase reflects investment in our

proposition development teams, as well as increases to our

licensing and external hosting costs.

Operational and support costs increased by 15% to GBP65.8

million (FY22: GBP57.2 million). The higher costs were driven by an

increase in the average number of employees in order to support our

continued growth, as well as the investment in our pay and benefits

package for staff. This was partially offset by lower dealing costs

in the year as a result of reduced customer dealing activity.

The 26% total increase in the year reflects our investments, as

planned, to deliver on our long-term growth plans. In FY24 we

expect this growth rate to moderate to around 15% as inflationary

pressures settle and we benefit from the operational gearing

inherent in our business model, along with a focus on efficiency.

The same factors are expected to result in lower levels of cost

growth in the medium term.

Profitability and earnings

PBT increased by 50% to GBP87.7 million (FY22: GBP58.4 million)

whilst PBT margin increased to 40.2% (FY22: 35.6%). The higher

margin versus the prior year reflects the higher revenue

margin.

Corporation tax for the period has been calculated at a rate of

22.0%, representing the average annual tax rate for the year, as

the standard rate of UK corporation tax increased from 19.0% to

25.0% on 1 April 2023. Our effective rate of tax for the period was

22.2% (FY22: 20.0%).

Basic earnings per share rose by 46% to 16.59 pence (FY22: 11.39

pence) in line with the increase to PBT. Diluted earnings per share

(DEPS), which accounts for the dilutive impact of outstanding share

awards, also increased by 46% to 16.53 pence (FY22: 11.35

pence).

Financial position

The Group's financial position remains strong, with net assets

totalling GBP166.0 million (FY22: GBP133.4 million) as at 30

September 2023 and a return on assets of 41% (FY22: 35%).

Financial resources and regulatory capital position

Our financial resources are continually kept under review,

incorporating comprehensive stress and scenario testing which is

formally reviewed and agreed at least annually.

Year ended Year ended

30 September 30 September

2023 2022

GBP000 GBP000

======================================== ============== ==============

Total shareholder funds 166,037 133,394

Less: unregulated business capital (3,675) (3,718)

=========================================== ============== ==============

Regulatory group shareholder funds 162,362 129,676

Less: foreseeable dividends (29,807) (18,843)

Less: non-qualifying assets (12,887) (14,233)

------------------------------------------- -------------- --------------

Total qualifying capital resources 119,668 96,600

Less: capital requirement (53,930) (49,252)

------------------------------------------- -------------- --------------

Surplus capital 65,738 47,348

------------------------------------------- -------------- --------------

% of capital resource requirement held 222% 196%

=========================================== ============== ==============

During the year, we have continued to maintain a healthy surplus

over our regulatory capital requirement and as at the balance sheet

date this was 222% (FY22: 196%) of the capital requirement.

We operate a highly cash-generative business, with a short

working-capital cycle that ensures profits are quickly converted

into cash. We generated cash from operations of GBP120.5 million

(FY22: GBP57.2 million) and held a significant surplus over our

basic liquid asset requirement during the period, with our year end

balance sheet including cash balances of GBP146.3 million (FY22:

GBP84.0 million).

Dividend

At half year, the Board declared an interim dividend of 3.50

pence per share (FY22: 2.78 pence per share). This was higher than

would have resulted from applying our stated interim dividend

policy, to ensure that the growth in interim dividend more closely

aligned with the increase in financial performance during the

current year.

The full year dividend policy of paying out 65% of statutory

profit after tax remains unchanged and therefore the Board has

recommended a final dividend of 7.25 pence per share (FY22: 4.59

pence per share), resulting in a total ordinary dividend of 10.75

pence (FY22: 7.37 pence).

Peter Birch

Chief Financial Officer

6 December 2023

Principal risks and uncertainties

The Board is committed to a continual process of improvement and

embedment of the risk management framework within the Group. This

ensures that the business identifies both existing and emerging

risks and continues to develop appropriate mitigation

strategies.

The Board believes that there are a number of potential risks to

the Group that could hinder the successful implementation of its

strategy. These risks may arise from internal and external events,

acts and omissions. The Board is proactive in identifying,

assessing and managing all risks facing the business, including the

likelihood of each risk materialising in the shorter or longer

term.

The principal risks and uncertainties facing the Group are

detailed below, along with potential impacts and mitigating

actions. The majority of the Group's principal risks and

uncertainties' residual risk has remained stable, however the

residual risk has increased for information security and financial

crime due to the heightened threat landscape in these areas.

Residual risk direction

Increased Stable Decreased

Risk Potential impact Mitigations

Strategic risk

Strategic risk The Group regularly

* Loss of competitive advantage, such that AUA and reviews its products

The risk that the Group customer number targets are adversely impacted. This against competitors, in

fails to remain competitive would have a negative impact on profitability. relation to pricing,

in its peer group, due to functionality

lack of innovative and service, and actively

products and services, * Reputational damage as a result of underperformance seeks to make enhancements

increased competitor and / or regulatory scrutiny. where necessary to

activity, regulatory maintain or improve

expectations, and lack of its competitive position

marketing focus and spend in line with the Group's

to keep pace with strategic objectives.

competitors. The Group remains closely

aligned with trade and

Residual risk direction industry bodies, and other

policy makers

Stable across our market. The use

of ongoing competitor

analysis provides insight

and an opportunity

to adapt strategic

direction in response to

market conditions.

------------------------------------------------------------- --------------------------

ESG risk The Group has established

* Environmental, physical and transition risks an ESG Working Group to

The risk that resulting from climate change, which may impact the manage all ESG-related

environmental, social and Group and our customers' assets. matters, including

governance factors could people- and social-related

negatively impact the matters, as well as the

Group, * Social risks, include employee wellbeing and Group's Task Force for

its customers, investors diversity and inclusion. Climate-related

and the wider community. Financial Disclosures

(TCFD). ESG-related

Residual risk direction * Governance risks, including the risks related to the strategic objectives are

Group's governance structures being ineffective, incorporated in the

Stable which could manifest in governance-related Group's

reputational and conduct risks. Business Planning Process

(BPP).

The Group is committed to

creating an inclusive

workplace and prioritising

employee wellbeing,

to establish an

environment where all

employees feel valued and

supported. The Group's

Employee

Voice Forum promotes

health and wellbeing in

and outside of the office.

The Group has a robust

governance framework.

------------------------------------------------------------- --------------------------

Operational risk

Legal and regulatory risk The Group maintains a

* Regulatory censure and / or fines, including fines strong compliance culture

The risk that the Group from the FCA and Information Commissioner's Office geared towards positive

fails to comply with (ICO). customer outcomes

regulatory and legal and regulatory compliance.

standards. The Group performs regular

* Related negative publicity could reduce customer horizon scanning to ensure

confidence and affect ability to generate new all regulatory change is

Residual risk direction inflows. detected and

highlighted to the Group

Stable for consideration.

* Poor conduct could have a negative impact on customer The Group maintains an

outcomes, impacting the Group's ability to achieve open dialogue with the FCA

strategic objectives. and actively engages with

them on relevant

proposed regulatory

change.

The Compliance function is

responsible for ensuring

all standards of the

regulatory system

are being met by the

Group. This is achieved by

implementing policies and

procedures across

the business, raising

awareness and developing

an effective control

environment. Where

appropriate,

the Compliance Monitoring

Team conducts reviews to

ensure compliance

standards have been

embedded

into the business.

------------------------------------------------------------- --------------------------

Information security risk The Group continually

* Information security breaches could adversely impact reviews its cyber security

The risk of a vulnerability individuals' data rights and freedoms and could position to ensure that it

in the Group's result in fines / censure from regulators, such as protects the

infrastructure being the ICO and FCA. confidentiality,

exploited or user misuse integrity and availability

that causes harm to of its network and the

service, data and / or an * Failure to maintain or quickly recover operations data that it holds.

asset causing material could lead to intolerable harm to customers and the A defence in-depth

business impact. Group. approach is in place with

firewalls, web gateway,

Residual risk direction email gateway and

* The Group could suffer damage to its reputation anti-virus

Increased eroding trust and making it difficult to attract and amongst the technologies

retain customers, employees, partners, and investors. deployed. Staff awareness

is seen as being a key

component of the

layered defences, with

regular updates, training

and mock phishing

exercises.

Our security readiness is

subject to independent

assessment by a

penetration testing

partner

that considers both

production systems and

development activities.

This is supplemented by

running a programme of

weekly vulnerability scans

to identify configuration

issues and assess

the effectiveness of the

software patching

schedule.

The Group regularly

assesses its maturity

against an acknowledged

security framework, which

includes an ongoing

programme of staff

training and assessment

through mock security

exercises.

------------------------------------------------------------- --------------------------

Data risk The Group monitors the

* Data breaches could adversely impact individuals' adequacy of its data

Data risk is defined as the data rights and freedoms and could result in fines / governance framework via

potential threats and censure from regulators, such as the ICO and FCA. the Data Forum .

vulnerabilities that can The Group has data

compromise the protection policies and

confidentiality, integrity, * A data breach could result in financial loss due to procedures, security

availability, and the cost of investigating the breach, notifying controls to protect data

compliance of sensitive or impacted individuals, and implementing remediation such

valuable data within measures. as encryption, access

the Group and its controls and monitoring.

third-party suppliers. This The Group educates

risk encompasses the * The Group could suffer damage to its reputation, employees about data

possibility of unauthorised eroding trust and making it difficult to attract and security and the

access, loss, theft, retain customers, employees, partners, and investors. importance of protecting

alteration, or exposure of sensitive

data. data.

The Group conducts regular

Residual risk direction data audits to identify

and address potential

Stable security risks.

The Group's Data

Protection Officer / CRO

provides an assessment of

the adequacy of the

Group's

data protection framework

as part of the annual DPO

report.

------------------------------------------------------------- --------------------------

Financial crime risk Extensive controls are in

* The Group may be adversely affected, including place to minimise the risk

regulatory censure or enforcement, if we fail to of financial crime.

The risk of failure to mitigate the risk of being used to facilitate any Policies and procedures

protect the Group and its form of financial crime. include:

customers from all aspects mandatory financial crime

of financial crime, training in anti-money

including anti-money * Potential customer detriment as customers are at risk laundering and

laundering, terror of losing funds or personal data, which can subject counter-terrorist

financing, proliferation them to further loss via other organisations. financing,

financing, sanctions fraud, market abuse and

restrictions, the Criminal Finances Act

market abuse, fraud, * Fraudulent activity leading to identity fraud and / for all employees to aid

cyber-crime and the or loss of customer holdings to fraudulent activity. the detection,

facilitation of tax prevention and reporting

evasion. of financial crime. The

* The Group could suffer damage to its reputation, Group has an extensive

Residual risk direction eroding trust and making it difficult to attract and recruitment process

retain customers, employees, partners, and investors. in place to screen

Increased potential employees.

The Group actively

maintains defences against

a broad range of likely

attacks by global actors,

bringing together tools

from well-known providers,

external consultancy and

internal expertise

to create multiple layers

of defence. The latter

includes intelligence

shared through

participation

in regulatory, industry

and national cyber

security networks.

------------------------------------------------------------- --------------------------

Third-party management risk To mitigate the risk posed

* Loss of service from a third-party provider could by third-party suppliers,

The risk that a third-party have a negative impact on customer outcomes due to the Group conducts

provider materially fails website unavailability, delays in receiving and / or onboarding due diligence

to deliver the contracted processing customer transactions or interruptions to and monitors performance

services. settlement and reconciliation processes. against documented service

standards to ensure their

Residual risk direction continued commitment

* Financial impact through increased operational to service, financial

Stable losses. stability and viability.

Performance metrics are

discussed monthly with

* Regulatory fine and / or censure. documented actions for any

identified improvements.

This is supplemented by

attendance at formal user

groups with other clients

of the key suppliers,

sharing experience and

leveraging the strength of

the user base. Where

relevant and appropriate,

annual financial due

diligence on critical

suppliers and on-site

audits are also

undertaken.

------------------------------------------------------------- --------------------------

Technology risk The Group continues to

* The reliance on evolving technology remains crucial implement a programme of

The risk that the design, to the Group's effort to develop its services and increasing annual

implementation and enhance products. Prolonged underinvestment in investment in the

management of applications, technology would affect our ability to serve our technology

infrastructure and customers and meet their needs. platform. This is informed

services fail to meet by recommendations that

current and future business result from regular

requirements. * Failing to deliver and manage a fit-for-purpose architectural reviews

technology platform could have an adverse impact on of applications and of the

Residual risk direction customer outcomes and affect our ability to attract underpinning

new customers. infrastructure and

Stable services.

Daily monitoring routines

* Technology failures may lead to financial or provide oversight of

regulatory penalties, and reputational damage. performance and capacity.

Our rolling programme of

both business continuity

planning and testing, and

single point

of failure management,

maintains our focus on the

resilience of key systems

in the event of

an interruption to

service.

------------------------------------------------------------- --------------------------

Operational resilience risk The Group has developed a

* Failure to maintain or quickly recover operations comprehensive operational

The risk that the Group could lead to intolerable harm to customers and the resilience framework,

does not have an adequate Group. under the direction

operational resilience of the Operations

framework to prevent, sub-committee of ExCo. The

adapt to, respond to, * Operational resilience disruptions may lead to R&CC and Board also

recover from and learn from financial or regulatory penalties, and reputational provide oversight.

operational disruptions. damage. An annual operational

resilience self-assessment

Residual risk direction document is reviewed by

the Board and R&CC.

Stable The Group's Risk Team also

provide a 2(nd) line of

defence review of the

operational resilience

self-assessment.

------------------------------------------------------------- --------------------------

Process risk There is an ongoing

* A decline in the quality of work would have a programme to train staff

The risk that, due to financial impact through increased operational on multiple operational

unexpectedly high volumes, losses. functions. Diversifying

the Group is unable to the workforce enables the

process work within business to deploy staff

agreed service levels and / * Unexpectedly high volumes coupled with staff when high work volumes are

or to an acceptable quality recruitment and retention issues could lead to poor experienced.

for a sustained period. customer outcomes and reputational damage. Causes of increased

volumes of work, for

Residual risk direction example competitor

behaviour, are closely

Stable monitored

in order to plan resource

effectively.

The Group focuses on

increasing the

effectiveness of its

operational procedures

and, through

its business improvement

function,

aims to improve and

automate more of its

processes. This reduces

the need for manual

intervention

and the potential for

errors.

------------------------------------------------------------- --------------------------

Change risk All operational and

* Operational resilience disruptions resulting from regulatory change is

The risk of potential crystallisation of change risk may lead to financial prioritised, captured, and

negative consequences and or regulatory penalties, and reputational damage. monitored through the