TIDMAJB

RNS Number : 5234W

AJ Bell PLC

12 December 2023

12 December 2023

AJ Bell plc

Price reductions and increases to cash interest rates

At its annual results last week, AJ Bell plc ("AJ Bell" or the

"Company") stated its intention to continue with its philosophy of

sharing economies of scale with customers as it grows. Today the

Company confirms a significant package of pricing changes it has

been working on for some time that will benefit its customers by

around GBP14 million per annum. These changes were factored into

the financial guidance the Company provided at its annual results

last week.

The FCA's guidance to the industry on retention of interest

earned on cash has provided clarification on the expectations of

firms in this area. Fair value should be assessed in the context of

the overall costs and service provided to customers and should be

understood by consumers in line with the Consumer Duty. In that

regard, platforms' use of cross subsidies can reduce core platform

charges and deliver significant benefits to retail customers where

firms believe it is right to do so.

Michael Summersgill, Chief Executive at AJ Bell, comments:

"Our philosophy has always been to share our economies of scale

with customers as we grow - an approach that is very much aligned

with the Consumer Duty. We announced GBP5 million of price

reductions for our customers last year and have increased our

interest rates on cash balances several times as base rate has

increased.

"We have been planning these latest pricing changes for some

time. Now we have clarity from the regulator, we are pleased to

confirm another significant package of pricing changes which will

benefit our customers to the tune of GBP14m a year. It is clear

platforms are able to use cross subsidies where they do so to

deliver fair value to customers across their entire proposition.

So, as well as improving the competitive rates of interest we pay,

we are also reducing our dealing charges for D2C customers and

reducing the custody charges advised customers pay.

"The financial impact is fully factored into the guidance we

provided in our annual results last week and our enhanced

competitive position puts us in a great place to continue to grow

our market share."

The full detail of the pricing changes is provided below.

Pricing changes

With effect from 1 April 2024, AJ Bell is making several price

reductions for customers investing via its platform in the

Direct-to-Consumer (D2C) and Advised markets, alongside increases

to the interest rates paid on cash held by AJ Bell's D2C

customers.

D2C platform (AJ Bell)

Trading fees

The costs customers pay to buy and sell exchange traded

investments (Shares, ETFs, Investment Trusts and Bonds) via the AJ

Bell D2C platform are being reduced from GBP9.95 to GBP5.00 per

trade. The dealing charges for frequent traders* will reduce from

GBP4.95 to GBP3.50 per trade.

Cash interest rates

Cash held on the AJ Bell D2C platform is readily available for

customers to invest or withdraw and in most cases represents a

short-term position while customers wait for investment

opportunities. This can differ for pensions, particularly where

customers are approaching or in retirement, as they will often hold

larger cash balances to fund short to medium term income

withdrawals.

AJ Bell is therefore introducing higher rates of interest on

cash held in pension drawdown, ranging from 3.45% for balances

below GBP10,000 to 4.45% for balances over GBP100,000.

It is also introducing higher rates of interest paid on large

cash balances held in both ISAs and pensions in accumulation of

2.70% and 3.95% respectively. A full table of the new interest

rates is provided below.

Interest rates paid on cash via the AJ Bell D2C platform - the

rates in bold text are new and come into effect on 1 April

2024:

ISA SIPP (accumulation) SIPP (drawdown)

First GBP10,000 GBP100,000+ First GBP10,000 GBP100,000+ First GBP10,000 GBP100,000+

GBP10,000 to GBP10,000 to GBP10,000 to

GBP100,000 GBP100,000 GBP100,000

----------- ------------ ----------- ----------- ------------ ----------- ----------- ------------

1.95% 2.45% 2.70% 3.2% 3.70% 3.95% 3.45% 3.95% 4.45%

----------- ------------ ----------- ----------- ------------ ----------- ----------- ------------

AJ Bell does not apply its annual platform custody charge to

cash balances.

Advised platform (AJ Bell Investcentre)

Annual custody charges

A number of reductions are being made to the annual custody fees

for investing via the Funds and Shares Service (F&SS):

* A new tier from GBP0.5m to GBP1.0m is being

introduced with a lower annual charge of 0.175%

(currently 0.20%)

* The annual charge for assets between GBP1.5m and

GBP2.0m is being reduced to 0.075% (currently 0.10%)

* The annual charge is now capped for all accounts with

assets over GBP2.0m

Charge tier Current charges Reduced charges from

1 April 2024

Assets up to GBP500k 0.20% 0.20%

------------------- -----------------------

Assets from GBP500k

to GBP1m 0.20% 0.175%

------------------- -----------------------

Assets from GBP1m

to GBP1.5m 0.15% 0.15%

------------------- -----------------------

Assets from GBP1.5m

to GBP2m 0.10% 0.075%

------------------- -----------------------

Assets over GBP2m 0.00% to 0.025% 0.00%

------------------- -----------------------

The reduction in the custody charge adds further value for

advised clients in achieving a very competitive overall net outcome

when considering the impact of interest paid on typically smaller

cash balances and the custody charges applied to other assets. AJ

Bell Investcentre does not apply its custody charge to cash.

Fixed charges

In addition to the above, two fixed charges are being

removed:

-- SIPP in-specie transfer-in charge (currently GBP60 + VAT)

-- Conversion of a SIPP into a Retirement Investment Account (currently GBP75 + VAT)

*Defined as a customer that places 10 or more trades in the

preceding month.

Contacts:

AJ Bell

-- Shaun Yates, Investor Relations Director +44 (0) 7522 235

898

-- Tom Selby, Director of Public Policy +44 (0) 7702 858 234

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

STREADAAFANDFFA

(END) Dow Jones Newswires

December 12, 2023 08:33 ET (13:33 GMT)

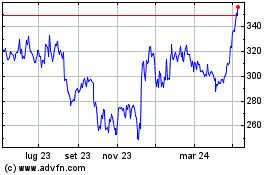

Grafico Azioni Aj Bell (LSE:AJB)

Storico

Da Apr 2024 a Mag 2024

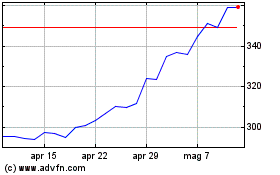

Grafico Azioni Aj Bell (LSE:AJB)

Storico

Da Mag 2023 a Mag 2024