TIDMAPH

RNS Number : 2929G

Alliance Pharma PLC

18 July 2023

For immediate release 18 July 2023

ALLIANCE PHARMA

("Alliance", "Company" or the "Group")

Half Year Trading Update

Strong growth in Kelo-Cote in-market sales

Board's expectations for Group's FY operating performance

unchanged

Alliance Pharma plc (AIM: APH), the international healthcare

group, announces its trading update for the six months ended 30

June 2023 (the "Period"), ahead of the expected announcement of the

Group's interim results on 19 September 2023.

Summary

The Group delivered see-through(1) revenues of GBP82.4m in the

Period (H1 22: GBP81.6m), up 1.1% versus the prior period and down

1.7% at constant exchange rates ("CER") including revenue from our

most recent US acquisition (ScarAway(TM) and the US rights to

Kelo-Cote(TM)). Whilst the first half had a mixed performance with

regulatory issues resulting in some manufacturing delays in certain

smaller products, revenue growth for the Kelo-Cote(TM) franchise

and Nizoral(TM) was in line with the Board's expectations, and

Amberen(TM) revenues returned to growth in Q2 on a like-for-like

basis. Importantly in-market demand for Kelo-Cote continues to grow

strongly and the Board's expectations for Group operating

performance in the full year remains unchanged.

Kelo-Cote

Demand for Kelo-Cote in the China cross-border market continues

to recover in-line with our expectations. The scar-treatment

category increased 10% in the first four months of 2023 (the latest

available data), with Kelo-Cote in-market revenues increasing 23%.

Kelo-Cote now has 29% value share of the China cross-border market

YTD, up 450bp on the prior period. The China domestic market is

also demonstrating strong growth, up 8% in the first four months of

the year, and with Kelo-Cote in-market revenues up 31%.

Group revenues from the total Kelo-Cote franchise grew 6.2% CER

to GBP25.6m (H1 22: GBP22.9m) in the Period, including our US

acquisition which is growing in line with expectations. As

previously reported the destocking at our China cross-border

distributor, which continued through much of H1 23, meant that

like-for-like Kelo-Cote revenues were down 4.1% CER. With this

destocking now substantially complete, together with increasing

in-market demand, we have strong expectations for revenues in H2,

driving revenue growth above 20% for the full year.

Nizoral

Nizoral revenues grew strongly in the Period rising 40.4% CER to

GBP11.1m (H1 22: GBP7.9m), reflecting both market share and

distribution gains and the timing of orders in the prior period.

Adjusting for the delayed order in June 2022, underlying Nizoral

growth was in the low double digits. Our new Chinese distributor

has created strong growth opportunities through expanding the

brand's reach, supported by our new marketing initiatives and the

introduction of updated packaging. The performance to date provides

confidence to reiterate guidance of high single digit revenue

growth for Nizoral in FY 2023.

Amberen

Amberen revenues declined 3.6% CER in the Period, on a

like-for-like basis excluding sales from a leading discount store

account that was lost in 2022 and have returned to growth in Q2 on

the same basis. On a reported basis, Amberen sales were GBP5.9m in

the Period (H1 22: GBP7.5m). Alliance is continuing to invest in

transitioning Amberen towards the higher growth e-commerce channel

and refreshing its marketing campaign and packaging to accelerate

this transition. We continue to anticipate double-digit revenue

growth on a like-for-like basis in FY 2023.

Other products

There was a mixed performance in Other Consumer Healthcare with

regulatory challenges in some products impacting stock availability

in H1 23. As a result, other Consumer Healthcare sales declined

10.0% (11.9% CER) to GBP17.2m (H1 22: GBP19.0m) and total Consumer

Healthcare revenues for the Period were GBP59.7m (H1 22: GBP57.4m),

up 3.9% on the prior year (up 0.5% CER). Regulatory issues also

impacted some prescription medicines with sales down 5.7% (6.9%

CER) to GBP22.7m (H1 22: GBP24.1m). These regulatory issues in both

Other Consumer and prescription medicines have been addressed,

which we expect to drive positive momentum in H2.

Cash and debt

Free cash flow in the Period was GBP5.7m higher than the prior

period at GBP10.8m (H1 22: GBP5.1m) and net debt decreased GBP7.5m

to GBP94.5m at 30 June 2023 (31 December 2022: GBP102.0m). Group

leverage(2) (as at 30 June 2023) is expected to be approximately

2.7x (31 December 2022: 2.6x).

We continue to expect Group revenues, including the Kelo-Cote

franchise, to build throughout H2, driving strong gross margin

improvement and substantial EBITDA expansion, underpinning the

Board's expectations of a strong second half performance. Net debt

and Group leverage are both expected to fall materially in H2,

reflecting the Group's strong cash generation, and Group leverage

is expected to be below 2.0x by the end of the year.

Peter Butterfield, Chief Executive Officer of Alliance,

commented :

"I am pleased to be back in the business full time and to be

focused on driving the Company's growth through the implementation

of our long-term strategy. We are encouraged by the recovery in

China and the significant market share gains made by Kelo-Cote,

along with the excellent progress of Nizoral. Meanwhile our wider

portfolio continues to provide a robust platform from which to grow

our Consumer Healthcare brands.

"Our free cash flow is expected to continue to build strongly

throughout 2023, which we anticipate will reduce our net debt and

leverage by the end of the year. The Board's expectation for full

year operating performance is unchanged."

(1) See-through revenue includes sales from Nizoral(TM) as if

they had been invoiced by Alliance as principal. For statutory

accounting purposes the product margin relating to Nizoral sales

made on an agency basis is included within Revenue, in line with

IFRS 15.

(2) Adjusted net debt / enlarged Group EBITDA, calculated using

pro forma EBITDA on a trailing 12-month basis.

For further information:

Alliance Pharma plc + 44 (0)1249 466966

Cora McCallum, Head of Investor Relations

& Corporate Communications + 44 (0)1249 705168

ir@allianceph.com

+ 44 (0)20 7466

Buchanan 5000

Mark Court / Hannah Ratcliff

alliancepharma@buchanan.uk.com

Numis Securities Limited (Nominated Adviser + 44 (0)20 7260

and Joint Broker) 1000

Freddie Barnfield / Duncan Monteith / Sher

Shah

+ 44 (0)20 7597

Investec Bank plc (Joint Broker) 5970

Patrick Robb / Maria Gomez de Olea

About Alliance

Alliance Pharma plc (AIM: APH) is a growing consumer healthcare

company. Our purpose is to empower people to make a positive

difference to their health and wellbeing by making our trusted and

proven brands available around the world.

We deliver organic growth through investing in our priority

brands and channels, in related innovation, and through selective

geographic expansion to increase the reach of our brands.

Periodically, we may look to enhance our organic growth through

selective, complementary acquisitions.

Headquartered in the UK, the Group employs around 285 people

based in locations across Europe, North America, and the Asia

Pacific region. By outsourcing our manufacturing and logistics we

remain asset-light and focused on maximising the value we can

bring, both to our stakeholders and to our brands.

For more information on Alliance, please visit our website :

www.alliancepharmaceuticals.com

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTFLFFADTIDLIV

(END) Dow Jones Newswires

July 18, 2023 02:00 ET (06:00 GMT)

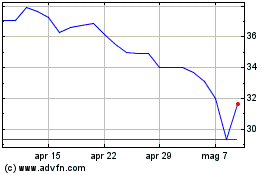

Grafico Azioni Alliance Pharma (LSE:APH)

Storico

Da Apr 2024 a Mag 2024

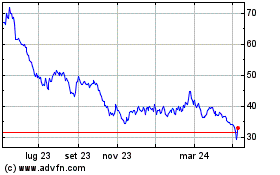

Grafico Azioni Alliance Pharma (LSE:APH)

Storico

Da Mag 2023 a Mag 2024