TIDMASC

RNS Number : 4645M

ASOS PLC

12 January 2023

12 January 2023

ASOS plc ("the Company")

Trading Statement for the four months ended 31 December 2022

("P1")

ASOS delivers significant progress on Driving Change agenda in

P1

Confident in outlook, with significant improvement in

profitability and cash generation expected in H2 FY23

-- Revenue down 3%(1) , broadly in line with expectations,

reflecting challenging trading conditions and prioritisation of

structural profitability improvements and cash generation through a

more disciplined approach to capital deployment.

-- Adjusted gross margin(2) broadly flat with encouraging

progress through the period relative to prior year, with

significant improvement expected in H2 FY23.

-- Significant progress made against Driving Change agenda, with

profitability measures identified for FY23 in excess of GBP300m;

majority now in delivery phase with benefits accelerating in H2

FY23 to more than offset inflationary headwinds and normalisation

of return rates.

-- Balance sheet flexibility retained, with cash and undrawn

facilities of c.GBP430m, in-line with plan and reflecting typical

seasonal working capital flows.

-- On track to reduce FY22 year-end inventory levels by c.5% by

the end of H1 FY23, with a further improvement from increased stock

turn expected in H2 FY23.

-- Full-year guidance for cash outflow of (GBP100m) - GBP0m

reiterated. ASOS continues to expect significantly improved

profitability and cash generation in H2 FY23 and beyond, following

H1 FY23 loss.

Four months to 31 December

CCY(ii) Reported CCY change

GBPm(i) 2022 2021 change change ex Russia(iii)

-------- -------- -------- --------- ----------------

UK total sales 591.3 645.2 (8%) (8%)

EU total sales 417.3 390.2 6% 7%

US total sales 198.1 172.6 (2%) 15%

ROW total sales 129.8 185.1 (31%) (30%) (10%)

Total group revenue(iv) 1,336.5 1,393.1 (6%) (4%) (3%)

-------- -------- -------- ---------

(i) All numbers subject to rounding throughout this document,

(ii) Co nstant currency is calculated to take account of hedged

rate movements on hedged sales and spot rate movements on unhedged

sales, (iii) Calculation of metrics, or movements in metrics, on an

ex-Russia basis involves the removal of Russia from September -

December 2021 performance. This adjustment allows year-on-year

comparisons to be made on a like-for-like basis following the

decision to suspend trade in Russia on 2 March 2022, (iv) Includes

retail sales, wholesale and income from other services. All

references to segmental sales throughout the document are total

sales unless otherwise stated.

(1) All sales numbers quoted in this statement are at constant

currency and exclude Russia from the FY22 comparative base period

unless otherwise stated.

(2) Adjusted gross margin is the reported gross margin excluding

the impact of a provision raised in relation to the previously

announced stock write-off of c.GBP90m. The final stock write-off is

expected to be at the upper end of the range of GBP100m-GBP130m

with the balance of the provision expected to be booked in H1

FY23.

P1 Results Summary

-- Revenue decline of 3%, broadly in line with expectations,

reflecting challenging trading conditions and the prioritisation of

structural profitability improvements and cash generation through

more disciplined approach to capital deployment. Trading in the

period was volatile and we expect these trends to continue through

this financial year, but basket economics have proved

resilient.

o UK sales down 8%, reflecting weak consumer sentiment. This was

particularly significant in September, which was impacted by

national newsflow, and December, which was affected by disruption

in the delivery market. This resulted in earlier cut-off dates for

Christmas and New Year deliveries, and ASOS reduced marketing spend

in response. In addition, there was a strong comparative period in

December 2021, as the Omicron COVID variant boosted online

retail.

o EU sales grew 6%, driven by improved basket economics

supported by price increases, and customer growth, with the

Netherlands and Ireland notably strong.

o US sales fell 2%, with slower wholesale performance acting as

a drag on retail sales.

o ROW sales fell 10% reflecting implementation of a range of

strategic measures, including a reduction in performance marketing

spend to optimise return on investment, and changes to delivery

thresholds and charges.

-- Active customers(3) flat at 25.5m versus P1 FY22, reflecting

the annualisation of benefits of COVID tailwinds to customer

acquisition.

-- Whilst adjusted gross margin (excluding the impact of the

previously announced stock write-off) was broadly flat (-10bps to

42.9%), actions taken on pricing and the reduced use of air freight

drove an encouraging progression through the period relative to the

prior year. Reported gross margin declined by 690bps to 36.1%. A

significant improvement in gross margin is expected in H2 FY23.

(3) Active customers including those in Russia who shopped in

the last 12 months as at 31(st) December is 25.8m (as at 31(st)

December 2021: 26.7m); excluding Russia 25.5m (as at 31(st)

December 2021: 25.5m)

Driving Change

In October 2022, CEO José Antonio Ramos Calamonte outlined four

key actions to drive rapid improvement in the Company's operations.

ASOS has made significant progress in delivery of these actions in

P1 FY23:

-- Renewed commercial model:

o Approximately half of the stock units identified for write-off

already physically extracted from ASOS' core network.

o Commercial flexibility strengthened with (i) expansion of

Partner Fulfils from two to 23 brands across the UK and Europe,

(ii) technology work for ASOS Fulfilment Services accelerated and

now planned to complete development in H2 FY23, and (iii) trialling

'Test and React' in key categories.

o Growth in full-price sales mix in P1 FY23 resulting from a

shift in approach to clearance, implementing deeper discounts on a

narrower range of assortment. Further improvement anticipated as

inventory levels reduce.

-- Stronger order economics and a lighter cost profile:

o Identification of profit optimisation and cost mitigation

measures with an estimated FY23 impact in excess of GBP300m;

already in delivery phase, with benefits to be strongly

H2-weighted. These are expected to more than offset headwinds from

inflation and return rates annualisation throughout the year to

generate a modest improvement in full-year profitability (from an

expected H1 FY23 loss).

o Examples include:

-- Winding down three ancillary storage facilities (one in

Europe, one in the UK and one in the US) in H2 FY23.

-- Optimising use of the Lichfield fulfilment centre to

eliminate UK split orders.

-- Rationalising office space.

-- Removing 35 unprofitable brands from the ASOS platform by the

end of H1 FY23.

-- Implementing low-single digit price increases supporting

relative market positioning for own-brand.

-- Optimising marketing spend and reallocating investment to

improve return on investment.

-- Reducing staff costs by c.10% via previously reported action

on headcount.

o A review of order economics in ASOS' largest markets

completed; remedial actions taken to improve profitability in

underperforming geographies.

-- Robust, flexible balance sheet:

o Balance sheet flexibility retained with cash and undrawn

facilities of c.GBP430m.

o Return to cash generation in H2 FY23, underpinned by delivery

of Driving Change initiatives.

o On track to reduce FY22 year-end inventory levels by c.5% by

end of H1 FY23, with further improvement from increased stock turn

expected in H2 FY23.

o Capex has been scaled back and re-prioritised in line with

full-year guidance.

-- Reinforced leadership team and refreshed culture:

o Management team strengthened by appointment of Christoph Stark

as Group Director of Supply Chain in January 2023. Christoph brings

wealth of experience in supply chain, logistics and fulfilment from

high-profile online retailers including Wayfair and Zalando.

o ASOS Board bolstered by appointment of Wei Gao and Marie

Gulin-Merle as Non-Executive Directors. Mai Fyfield appointed Chair

of Remuneration Committee.

o Meaningful progress on embedding reinvigorated culture, built

on simplicity, transparency, operational effectiveness, and

innovation.

Outlook

-- Guidance for full-year free cash flow of (GBP100m) - GBP0m remains unchanged.

-- Adjusted gross margin, and cash and undrawn facilities at H1

FY23 expected to be similar to P1 FY23.

-- ASOS continues to expect H1 FY23 loss, driven by usual profit

phasing(4) , headwinds from inflation and annualisation of elevated

return rates. These headwinds are expected to persist into H2 FY23

but will be more than offset by accelerating benefits from Driving

Change agenda and previously highlighted tailwind from freight.

(4) Usual profit phasing pre-pandemic (i.e. pre-FY21).

José Antonio Ramos Calamonte, Chief Executive Officer, said:

"We are undertaking necessary strategic and operational changes,

with our focus shifting from prioritising top-line growth to

building a more relevant and competitive fashion business with a

disciplined approach to capital allocation and ROI. At the same

time, we are working to reinforce our credibility as a leading

destination for our fashion-loving customers.

"We have made good early progress against a number of measures

to simplify the business, including re-positioning our inventory

profile, reviewing our operational model in our top markets and

reducing our cost base. While there is more to do, I am pleased by

the progress made in this period and am confident in the direction

we are going. We retain ample balance sheet flexibility and

reiterate our expectations for FY23."

Investor and Analyst conference call:

ASOS will be hosting a conference call for analysts and

investors at 8.30am (UK time) on 12(th) January 2023. To access

live please dial 0800 640 6441 / +44 20 3936 2999, and use

passcode: 535936

A recording of this webcast will be available on the ASOS Plc

website later today:

https://www.asosplc.com/investor-relations/

For further information:

ASOS plc Tel: 020 7756 1000

Jose Antonio Ramos Calamonte, Chief Executive

Officer

Katy Mecklenburgh, Interim Chief Financial

Officer

Taryn Rosekilly, Director of Investor Relations

Holly Cassell, Head of Investor Relations

Katja Hall, Director of Corporate Affairs

Website: www.asosplc.com/investors

Headland Consultancy Tel: 020 3805 4822

Susanna Voyle / Stephen Malthouse

JPMorgan Cazenove

Tel: 020 7742 4000

Bill Hutchings / Will Vanderspar

Numis Securities Tel: 020 7260 1000

Alex Ham / Jonathan Wilcox / Tom Jacob

Berenberg Tel: 020 3207 7800

Michelle Wilson / Richard Bootle

Background note

ASOS is a destination for fashion-loving 20-somethings around

the world, with a purpose to give its customers the confidence to

be whoever they want to be. Through its app and mobile/desktop web

experience, available in ten languages and in over 200 markets,

ASOS customers can shop a curated edit of over 70,000 products,

sourced from nearly 900 global and local third-party brands

alongside a mix of fashion-led own-brand labels - ASOS Design, ASOS

Edition, ASOS 4505, Collusion, Reclaimed Vintage, Topshop, Topman,

Miss Selfridge and HIIT. ASOS aims to give all of its customers a

truly frictionless experience, with an ever-greater number of

different payment methods and hundreds of local deliveries and

return options, including Next-Day Delivery and Same-Day Delivery,

dispatched from state-of-the-art fulfilment centres in the UK, US

and Germany.

Forward looking statements:

This announcement may include statements that are, or may be

deemed to be, "forward-looking statements" (including words such as

"believe", "expect", "estimate", "intend", "anticipate" and words

of similar meaning). By their nature, forward-looking statements

involve risk and uncertainty since they relate to future events and

circumstances, and actual results may, and often do, differ

materially from any forward-looking statements. Any forward-looking

statements in this announcement reflect management's view with

respect to future events as at the date of this announcement. Save

as required by applicable law, the Company undertakes no obligation

to publicly revise any forward-looking statements in this

announcement, whether following any change in its expectations or

to reflect events or circumstances after the date of this

announcement.

Appendix 1 - Total sales growth by period in sterling, including

Russia

Year ending 31 August 2023

2022/23

GBPm P1(1) YOY% P2(1) YOY% P3(1) YOY% P4(1) YOY% YTD YOY%

------- ----- ----- ----- --------

UK total sales 591.3 (8%) 591.3 (8%)

EU total sales 417.3 7% 417.3 7%

US total sales 198.1 15% 198.1 15%

ROW total sales 129.8 (30%) 129.8 (30%)

Total sales

(3) 1,336.5 (4%) 1,336.5 (4%)

------- ----- ----- ----- --------

Year ended 31 August 2022

GBPm P1(1) YOY% P2(1) YOY% P3(1) YOY% P4(1) YOY% 2021/22 YOY%

------- ----- ------- ----- --------

UK total sales 645.2 13% 250.3 (2%) 431.8 4% 435.5 6% 1,762.8 7%

EU total sales 390.2 (3%) 187.2 (3%) 294.0 (5%) 298.6 6% 1,170.0 (1%)

US total sales 172.6 7% 80.1 13% 141.9 21% 136.8 18% 531.4 14%

ROW total sales 185.1 (20%) 93.4 1% 96.4(2) (33%) 97.4 (30%) 472.3 (22%)

964.1

Total sales (3) 1,393.1 2% 611.0 -% (2) (2%) 968.3 2% 3,936.5 1%

------- ----- ------- ----- --------

Year ended 31 August 2021

GBPm P1(1) YOY% P2(1) YOY% P3(1,4) YOY% P4(1,4) YOY% 2020/21 YOY%

------- ----- ------- ------- --------

UK total sales 571.3 35% 254.5 46% 415.9 85% 410.3 5% 1,652.0 36%

EU total sales 400.6 18% 193.8 22% 310.1 33% 280.8 (6%) 1,185.3 15%

US total sales 161.7 12% 71.2 8% 117.5 25% 115.8 4% 466.2 12%

ROW total sales 230.5 16% 92.3 1% 144.5 2% 139.7 (19%) 607.0 1%

Total sales(3) 1,364.1 23% 611.8 25% 988.0 43% 946.6 (3%) 3,910.5 20%

------- ----- ------- ------- --------

(1) Periods are as follows:

P1: four months to 31 December

P2: two months to 28/29 February

P3: three months to 31 May

P4: three months to 31 August

(2) In the tables above RoW and Group total sales for P3 have

been restated. This restatement relates to the removal of the

GBP19.3m gain on RUB hedges,

which was reported as revenue at P3 but subsequently reallocated

to other income at year-end 2022.

(3) Includes retail sales, wholesale and income from other

services comprising delivery receipt payments, marketing services

and commission on partner-fulfilled sales

(4) P3 is restated to reflect only March, April, and May. P4 has

been restated to include June.

Appendix 2 - Total sales growth by period at constant currency,

including Russia

Year ending 31 August 2023

P1 (1) P2 (1) P3 (1) P4 (1) 2022/23

GBPm YOY% YOY% YOY% YOY% YOY%

UK total sales (8%) (8%)

EU total sales 6% 6%

US total sales (2%) (2%)

ROW total sales (31%) (31%)

Total sales(3) (6%) (6%)

Year ended 31 August 2022

P1 (1) P2 (1) P3 (1) P4 (1) 2021/22

GBPm YOY% YOY% YOY% YOY% YOY%

UK total sales 13% (2%) 4% 6% 7%

EU total sales 2% 1% (2%) 9% 2 %

US total sales 11% 12% 15% 4% 10 %

ROW total sales (15%) 2% (33%)(2) (31%) (20%)

Total sales(3) 5% 1% (2%) (2) 1% 2%

Year ended 31 August 2021

P1 (1) P2 (1) P3 (1,4) P4 (1,4) 2020/21

GBPm YOY% YOY% YOY% YOY% YOY%

UK total sales 35% 46% 85% 5% 36%

EU total sales 17% 20% 34% (7%) 15%

US total sales 16% 13% 40% 15% 21%

ROW total sales 20% 9% 10% (14%) 6%

Total sales(3) 24% 26% 47% (1%) 22%

(1) Periods are as follows:

P1: four months to 31 December

P2: two months to 28/29 February

P3: three months to 31 May

P4: three months to 31 August

(2) In the tables above RoW and Group total sales for P3 have

been restated. This restatement relates to the removal of the

GBP19.3m gain on RUB hedges,

which was reported as revenue at P3 but subsequently reallocated

to other income at year-end 2022.

(3) Includes retail sales, wholesale and income from other

services comprising delivery receipt payments, marketing services

and commission on partner-fulfilled sales

Appendix 3

Total sales growth by period in sterling, excluding Russia

Year ending 31 August 2023

2022/23

GBPm P1(1) YOY% P2(1) YOY% P3(1) YOY% P4(1) YOY% YTD YOY%

------- ----- ----- ----- --------

UK total sales 591.3 (8%) 591.3 (8%)

EU total sales 417.3 7% 417.3 7%

US total sales 198.1 15% 198.1 15%

ROW total sales 129.8 (9%) 129.8 (9%)

Total sales

(3) 1,336.5 (1%) 1,336.5 (1%)

------- ----- ----- ----- --------

Year ended 31 August 2022

GBPm P1(1) YOY% P2(1) YOY% P3(1) YOY% P4(1) YOY% 2021/22 YOY%

------- ----- ------- ----- --------

UK total sales 645.2 13% 250.3 (2%) 431.8 4% 435.5 6% 1,762.8 7%

EU total sales 390.2 (3%) 187.2 (3%) 294.0 (5%) 298.6 6% 1,170.0 (1%)

US total sales 172.6 7% 80.1 13% 141.9 21% 136.8 18% 531.4 14%

ROW total sales 142.0 59.7 96.4(2) (7%) 97.4 (3%) 395.5

Total sales 964.1

(3) 1,350.0 577.3 (2) 2% 968.3 7% 3,859.7

------- ----- ------- ----- --------

Total sales growth by period at constant currency, excluding

Russia

Year ending 31 August 2023

P1 (1) P2 (1) P3 (1) P4 (1) 2022/23

GBPm YOY% YOY% YOY% YOY% YOY%

UK total sales (8%) (8%)

EU total sales 6% 6%

US total sales (2%) (2%)

ROW total sales (10%) (10%)

Total sales(3) (3%) (3%)

Year ended 31 August 2022

P1 (1) P2 (1) P3 (1) P4 (1) 2021/22

GBPm YOY% YOY% YOY% YOY% YOY%

UK total sales 13% (2%) 4% 6% 7%

EU total sales 2% 1% (2%) 9% 2 %

US total sales 11% 12% 15% 4% 10 %

ROW total sales (7%)(2) (4%)

Total sales(3) 2% (2) 6%

(1) Periods are as follows:

P1: four months to 31 December

P2: two months to 28/29 February

P3: three months to 31 May

P4: three months to 31 August

(2) In the tables above RoW and Group total sales for P3 have

been restated. This restatement relates to the removal of the

GBP19.3m gain on RUB hedges,

which was reported as revenue at P3 but subsequently reallocated

to other income at year-end 2022.

(3) Includes retail sales, wholesale and income from other

services comprising delivery receipt payments, marketing services

and commission on partner-fulfilled sales

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTXFLLFXFLFBBB

(END) Dow Jones Newswires

January 12, 2023 02:00 ET (07:00 GMT)

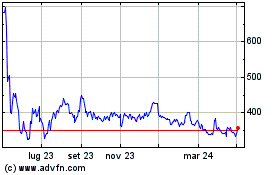

Grafico Azioni Asos (LSE:ASC)

Storico

Da Apr 2024 a Mag 2024

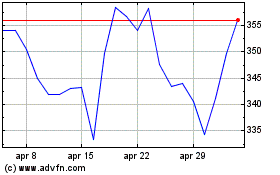

Grafico Azioni Asos (LSE:ASC)

Storico

Da Mag 2023 a Mag 2024