TIDMATM

RNS Number : 6970X

Andrada Mining Limited

22 December 2023

22 December 2023

The information contained within this announcement is deemed by

the Company to constitute inside information as stipulated under

the Market Abuse Regulations (EU) No. 596/2014 (MAR) as in force in

the United Kingdom pursuant to the European Union (Withdrawal) Act

2018. Upon the publication of this announcement via Regulatory

Information Service (RIS), this inside information will be in the

public domain.

Andrada Mining Limited

("Andrada" or the "Company")

Q3 Operational update for the period ended 30 November 2023

Production of saleable lithium concentrate from the pilot

plant

Andrada Mining Limited (AIM: ATM, OTCQB: ATMTF), the African

technology metals mining company with a portfolio of mining and

exploration assets in Namibia hereby provides an unaudited

operational update for the third quarter ended 30 November 2023 for

the financial year 2024 ("Q3 FY2024").

HIGHLIGHTS

Operations

-- Over 100% year-on-year ("YoY") increase in tin concentrate to

346 tonnes (Q3 FY2023: 145 tonnes).

-- Over 100% YoY increase in contained tin metal to 202 tonnes

(Q3 FY2023: 87 tonnes).

-- Plant utilisation increased to 86% (Q3 FY2023: 63%).

-- Production of 10 tonnes on-specification saleable lithium

concentrate.

-- Lithium pilot plant ("Pilot Plant") production ramp up to 250

tonnes per month planned for Q1 CY2024.

Exploration

-- Reverse Circulation ("RC") drilling programme completed on

the Lithium Ridge licence area.

- All holes intersected pegmatites with significant lithium

mineralisation along a 6km strike length.

- Spodumene and petalite identified as the primary minerals.

-- Commencement of an exploration programme on Brandberg West

licence area.

- Historically a producer of tin and tungsten with strong indications of copper mineralisation.

-- Plans completed for lithium exploration drilling campaigns on

all mining licence areas in CY2024.

Metallurgy

-- On-going metallurgical testwork for production of battery

grade lithium hydroxide.

-- Preliminary metallurgical investigations on Spodumene Hill

and Lithium Ridge material.

-- Metallurgical testwork to optimise production at Uis

progressing well.

Sustainability

-- Completion and publication of the 2023 Sustainability Report

for the 12 months ended February 2023, highlighting Andrada's

contribution of GBP33 million to the Namibian economy since

inception.

-- Lost Time Injury Frequency Rate ("LTIFR") at 2.45 (Q3 FY2023:

5.47) at the end of the quarter compared to 0.86 at the end of Q2

FY2024.

-- Increased social engagement during the quarter to align with

the objective of contributing to resilient communities.

Financial

-- Average C1(1) operating cash cost at USD 18 917 was within

management guidance of between USD17 000 and USD20 000 per tonne of

contained tin.

-- Average C2(2) operating cost at USD 21 386 was within

management guidance for the year of between USD20 000 and USD25 000

per tonne of contained tin.

-- All-in sustaining cost ("AISC") (3) at USD 30 452 was

slightly above management guidance of between USD25 000 and USD30

000 per tonne of contained tin.

-- Receipt of USD 25million from Orion Mining Finance funding,

including a USD12.5 million tin royalty. (See announcement of 16

November for more details of this arrangement).

-- Conclusion of the Development Bank of Namibia NAD 100 million

funding and receipt of 50% of the funds for the Continuous

Improvement 2 ("CI2") project at Uis Tin Mine. (See announcement

dated 5 September 2023).

-- Unaudited cash balance on 30 November 2023 of GBP21 million

(USD26 million).

Post-period

Production of spodumene concentrate

-- High-grade spodumene concentrate, at a grade of 6.8% Li O

(75% spodumene), produced from laboratory-scale flotation tests of

two Lithium Ridge exploration samples.

- The flotation test achieved a Li O recovery of 76% or, specifically, 80% spodumene recovery.

Appointment of joint corporate brokers

-- Appointment of Joh. Berenberg, Gossler & Co. KG

("Berenberg") and WH Ireland Limited ("WHI") as joint corporate

brokers to access a wider investor base and top-tier research

capability.

Anthony Viljoen, Chief Executive Officer, commented:

"We made significant strides in Q3 towards becoming a

multi-technology producer. Drilling confirmed notable lithium

intersections at Lithium Ridge, and post-period metallurgical

production of spodumene concentrate marked major milestones towards

entering downstream lithium markets. We also launched an

exploration programme at Brandberg West, with the potential to

expand our portfolio to include tungsten and copper.

"Operational performance improved against the same quarter in

FY2023 due to the lower comparative base. We aim to further enhance

cost efficiencies by increasing tin production through the CI2

project. The tin royalty will provide the necessary funding to

produce up to 2,000 tonnes of contained tin per annum, positioning

Andrada as a major global supplier.

"To further strengthen our investor outreach, we have appointed

Berenberg and WHI as joint corporate brokers. Together with our

current corporate brokers, Hannam & Partners, these

appointments give us extensive reach into the UK and European

capital markets."

OPERATIONAL review

Table 1: Unaudited Uis Mine quarterly production and cost

performance

Description Unit Q1 FY Q2 FY Q3 FY Q3 FY YoY QoQ

2024 2024 2024 2023(1) % <DELTA> % <DELTA>

Feed grade % Sn 0,144 0,152 0,134 0,140 1% -12%

---------------- ------- ------- ------ -------- ---------- ----------

Plant processing

rate tph 135 138 138 107 29% 0%

---------------- ------- ------- ------ -------- ---------- ----------

228

Ore processed t 214 467 232 154 234 90 278 153% -2%

---------------- ------- ------- ------ -------- ---------- ----------

Tin concentrate t 359 398 346 145 139% -13%

---------------- ------- ------- ------ -------- ---------- ----------

Contained tin t 216 238 202 87 132% -15%

---------------- ------- ------- ------ -------- ---------- ----------

Tin recovery* % 70 67 66 68 -3% -4%

---------------- ------- ------- ------ -------- ---------- ----------

Plant availability % 91 92 89 73 22% -3%

---------------- ------- ------- ------ -------- ---------- ----------

Plant utilisation % 79 83 86 63 37% 4%

---------------- ------- ------- ------ -------- ---------- ----------

Uis mine C1 USD/t contained

operating cost(2) tin 15 741 19 560 18 917 30 907 -39% -3%

---------------- ------- ------- ------ -------- ---------- ----------

Uis mine C2 USD/t contained

operating cost(3) tin 18 235 22 252 21 386 33 207 -36% -4%

---------------- ------- ------- ------ -------- ---------- ----------

USD/t contained

Uis mine AISC tin 21 377 26 671 30 452 38 570 -21% 14%

---------------- ------- ------- ------ -------- ---------- ----------

USD/t contained

Tin price achieved tin 25 149 25 183 24 749 22 625 9% -2%

---------------- ------- ------- ------ -------- ---------- ----------

(1) Production period includes a five - week shutdown of the

processing plant from 7 September 2022 - 13 October 2022 which was

required to complete the construction and commissioning of the

expanded crushing and tin concentrating circuits.

(2) C1 refers to operating cash cost per unit of production

excluding selling expenses and sustaining capital expenditure

associated with

Uis Mine.

(3) C2 operating cash cost is the C1 amount including selling

expenses (logistics, smelting and royalties).

All-in sustaining cost (AISC) incorporates all costs related to

sustaining production, capital expenditure associated with

developing

and maintaining the Uis operation as well as pre-stripping waste

mining costs.

*Tin recovery includes stockpiles

Tin concentrate production increased by 139% to 346 tonnes (Q3

FY2023: 145 tonnes) resulting in a 132% increase in contained tin

to 202 tonnes YoY. The plant processing rate increased by 29% YoY

reflecting the improvement in productivity resulting from the

modular plant expansion in Q3 FY2023. It is important to highlight

that the significant variances YoY are due to the low production

volumes in Q3 FY2023 arising from the planned plant outages to

implement the expansion project.

Lithium and tantalum development

Lithium Pilot Plant

Approximately 10 tonnes of saleable concentrate were produced in

October 2023. The production rate is expected to increase to 250

tonnes per month by the end of March 2024. By the end of February

2024, the Company aims to produce concentrate for initial

commercial sales into the spot market, a goal which the Directors

believe is a realistic prospect. Initial internal estimates suggest

that the petalite concentrate from the Pilot Plant could be priced

between USD1 600 and USD2 200 per tonne in the current spot market

(pricing provided for guidance purposes only). Importantly, Andrada

has commenced production of petalite concentrate for metallurgical

testwork to determine appropriate specifications for the lithium

battery refinery market.

Tantalum Circuit

Optimisation of the circuit is ongoing to improve productivity.

The Company is on track to supply tantalum to AfriMet on a

quarterly basis, commencing March 2024.

EXPLORATION

Lithium Ridge drilling results

Lithium Ridge infill channel sampling programme confirmed the

presence of continuous mineralisation at surface over a 6 km strike

length of multiple mineralised pegmatites. The initial RC drilling

programme confirmed the continuation of mineralisation at depth

within several pegmatites. The primary lithium minerals identified

through drilling were spodumene and petalite with notable lithium

contents at grades exceeding 2% Li O. (See announcement dated 29

August 2023, 6 September 2023 & 18 September 2023).

Lithium CY 2024 exploration strategy

The exploration programme plan for CY2024 was completed during

the quarter, with the aim of enhancing the understanding of

mineralisation on all the Company's mining licences. (See

announcement dated 27 November 2023).

These plans include:

-- Uis (ML134): Resource validation drilling over the Northern

and Central pegmatite clusters to enhance the current Mineral

Resource Estimate ("MRE") classification of tin, as well as to

establish the mineral potential for lithium and other technology

metals.

-- Lithium Ridge (ML133): High-density drilling campaign at the

historical TinTan mine for the development of a maiden MRE, and to

enhance understanding of the lithium mineralisation within the

identified high priority pegmatites.

-- Spodumene Hill (ML129): Drilling programme to delineate the

higher grade spodumene zones within the B1 and C1 pegmatites, as

well as on the mapped satellite bodies surrounding the main

mineralised units.

Brandberg West (EPL 5445)

Brandberg West has multiple documented mineral occurrences

including known concentrations of tin and tungsten. The potential

production of tungsten will expand the number of technology metals

within the Company's portfolio. Copper mineralisation has also been

documented within the mineralised area and will be investigated as

a potential by-product. A dual phased development plan to

investigate multiple occurrences of mineralisation through sampling

and geological mapping will be undertaken to determine potential

enrichment trends. (See announcement dated 12 November 2023).

Metallurgy

Lithium production focus

The primary lithium minerals at Andrada's three mining licences

are petalite and spodumene, although their distribution varies

across the licence areas. The explored pegmatites on Uis are

petalite-dominant but are spodumene-dominant on Lithium Ridge and

Spodumene Hill. Andrada's lithium development strategy will

incorporate the production of both petalite and spodumene

concentrates, enabling multiple off-take options for both the

industrial (glass-ceramics) and chemical (battery) concentrate

markets. The Company is implementing metallurgical testwork to

assess the possibility of producing battery grade lithium hydroxide

as well as to optimise production from Uis, Spodumene Hill and

Lithium Ridge.

Sustainability

Andrada's progress against its five-year sustainability

strategy, remains on track. During the quarter under review, the

Company increased its social engagement in line with a pledge to

fortify local communities. The Company continued implementing

safety campaigns to further instil and improve safety

performance.

There were no fatalities, but two lost time injury incidents

occurred during the quarter resulting in an increased LTIR of 2.45

at the end of the quarter under review, compared to 0.86 at the end

of Q2 FY2024. However, the performance was an improvement on the

5.47 rate at the end of Q3 FY2023. These incidents were thoroughly

investigated to ensure sufficient mitigation measures. Quarterly

independent audits continue to be conducted to address any

identified safety gaps.

The Company completed its Biodiversity Assessment and Climate

Change Scenario Analysis to provide vital insights for biodiversity

preservation and climate-related resilience planning. Concurrently,

the Andrada sustainability team has been reviewing the Global

Industry Standard on tailings management to minimise environmental

impact and mitigate risks. These combined efforts place the Company

in a good position to address any future challenges with foresight

and responsibility.

FINANCial

All costs in the quarter decreased YoY due to the economies of

scale from higher volumes and improved efficiencies. Although the

C1 and C2 costs decreased quarter-on-quarter remaining within the

management guidance, the AISC was approximately 2% higher at USD30

452. The latter is expected to decrease to within management

guidance as production volumes increase.

Andrada received the USD 25million Orion funding including a

USD12.5 million tin royalty. Furthermore, the NAD 100 million

funding from DBN was finalised during the quarter, with receipt of

50% of the funds for the CI2 project at Uis Tin Mine. The Company

is targeting contained tin production of up to 2 000 tonnes to

achieve the tin royalty tonnage.

The combined cash and cash equivalent balance on 30 November

2023 was GBP21 million (USD26 million).

CORPORATE

The strategic process to identify an appropriate partner to

participate in the lithium development is progressing well. Further

updates on the strategic process will be communicated in due course

as appropriate.

POST-PERIOD

High-grade spodumene concentrate produced through flotation

Laboratory - scale flotation test work was undertaken on two

samples selected from exploration drill chips produced during

reverse circulation drilling. The aim of these tests was to

investigate lithium mineral composition and recovery potential in

an area of the Lithium Ridge licence where significant spodumene

occurrence had been observed during exploration. The samples

yielded a weighted average feed grade of 1.69% Li O and 15.2%

spodumene, a weighted average concentrate grade of 6.8% Li O or 75%

spodumene and a weighted average recovery 76% Li O or 80%

spodumene.

Appointment of Joh. Berenberg, Gossler & Co. KG and WH

Ireland Limited as corporate brokers

The Company has appointed Berenberg and WHI as joint corporate

brokers as of 19 December 2023. Berenberg's research expertise and

global investor reach will enhance awareness of Andrada's value

proposition, while WHI provides access to a new segment of

investors. Berenberg and WHI will work alongside Hannam and

Partners Advisory Limited, the Company's existing corporate broker,

positioning us for continued growth and success

Glossary of abbreviations

CY Calendar year for the 12 months ending December

FY Financial year for the 12 months ending March

------------------------------------------------

GBP British pound sterling

------------------------------------------------

LTIFR Lost time injury frequency rate

------------------------------------------------

NAD Namibian dollar

------------------------------------------------

Sn Symbol for tin

------------------------------------------------

t Tonnes

------------------------------------------------

USD United States Dollar

------------------------------------------------

Contact

ANDRADA MINING LIMITED

Anthony Viljoen, CEO +27 (11) 268 6555

Sakhile Ndlovu, Investor Relations investorrelations@andradamining.com

NOMINATED ADVISOR

WH Ireland Limited

Katy Mitchell +44 (0) 207 220 1666

CORPORATE BROKER & ADVISOR

H&P Advisory Limited

Andrew Chubb

Jay Ashfield

Matt Hasson +44 (0) 20 7907 8500

Berenberg

Jennifer Lee +44 (0) 20 3753 3040

WHI Capital Markets

Harry Ansell +44 (0) 20 7220 1670

FINANCIAL PUBLIC RELATIONS

Tavistock (United Kingdom) +44 (0) 207 920 3150

Jos Simson andrada@tavistock.co.uk

Catherine Drummond

Adam Baynes

About Andrada Mining Limited

Andrada Mining Limited, formerly Afritin Mining Limited, is a

London-listed technology metals mining company with a vision to

create a portfolio of globally significant, conflict-free,

production and exploration assets. The Company's flagship asset is

the Uis Mine in Namibia, formerly the world's largest hard-rock

open cast tin mine.

An exploration drilling programme is currently underway with the

aim of expanding the tin resource over the fourteen additional,

historically mined pegmatites that occur within a 5 km radius of

the current processing plant. The Company has set a mineral

resource target of 200 Mt to be delineated within the next 5 years.

The existing mine, together with its substantial mineral resource

potential, allows the Company to consider economies of scale.

Andrada is managed by a board of directors with extensive

industry knowledge and a management team with extensive commercial

and technical skills. Furthermore, the Company is committed to the

sustainable development of its operations and the growth of its

business. This is demonstrated by the manner in which the

leadership team places significant emphasis on creating value for

the wider community, investors, and other key stakeholders. Andrada

has established an environmental, social and governance system that

has been implemented at all levels of the Company and aligns with

international standards.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

UPDFFLLLXLLLFBV

(END) Dow Jones Newswires

December 22, 2023 02:00 ET (07:00 GMT)

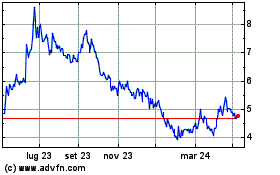

Grafico Azioni Andrada Mining (LSE:ATM)

Storico

Da Mar 2024 a Apr 2024

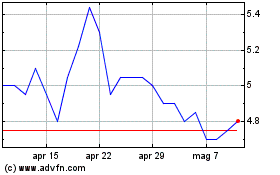

Grafico Azioni Andrada Mining (LSE:ATM)

Storico

Da Apr 2023 a Apr 2024