Atalaya Mining PLC Interim Dividend Foreign Exchange Rates (0786M)

12 Settembre 2023 - 8:00AM

UK Regulatory

TIDMATYM

RNS Number : 0786M

Atalaya Mining PLC

12 September 2023

12 September 2023

Atalaya Mining Plc.

("Atalaya" or "the Company")

Interim Dividend Foreign Exchange Rates and Payment Date

Confirmation

Atalaya Mining Plc (AIM: ATYM) announces the foreign exchange

rates that will be applied to its 2023 interim dividend of US$0.05

per Ordinary Share ("2023 Interim Dividend"), which was announced

on 10 August 2023.

For shareholders that have elected to receive the 2023 Interim

Dividend in Sterling or Euros, the foreign exchange rates that will

be applied are US$1:GBP0.7987 and US$1:EUR0.9325. Accordingly, the

Sterling and Euro equivalents of the 2023 Interim Dividend are

GBP0.0399 and EUR0.0466 per Ordinary Share respectively.

The Company also confirms that the 2023 Interim Dividend will be

paid on 28 September 2023.

Contacts:

Elisabeth Cowell / Tom

SEC Newgate UK Carnegie / Matthew Elliott + 44 20 3757 6882

4C Communications Carina Corbett +44 20 3170 7973

------------------------------- ------------------

Canaccord Genuity

(NOMAD and Joint Henry Fitzgerald-O'Connor

Broker) / James Asensio +44 20 7523 8000

------------------------------- ------------------

BMO Capital Markets

(Joint Broker) Tom Rider / Andrew Cameron +44 20 7236 1010

------------------------------- ------------------

Peel Hunt LLP

(Joint Broker) Ross Allister / David McKeown +44 20 7418 8900

------------------------------- ------------------

About Atalaya Mining Plc

Atalaya is an AIM-listed mining and development group which

produces copper concentrates and silver by-product at its wholly

owned Proyecto Riotinto site in southwest Spain. Atalaya's current

operations include the Cerro Colorado open pit mine and a modern 15

Mtpa processing plant, which has the potential to become a central

processing hub for ore sourced from its wholly owned regional

projects around Riotinto that include Proyecto Masa Valverde and

Proyecto Riotinto East. In addition, the Group has a phased earn-in

agreement for up to 80% ownership of Proyecto Touro, a brownfield

copper project in the northwest of Spain, as well as a 99.9%

interest in Proyecto Ossa Morena. For further information, visit

www.atalayamining.com

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

DIVDZGMLNMNGFZM

(END) Dow Jones Newswires

September 12, 2023 02:00 ET (06:00 GMT)

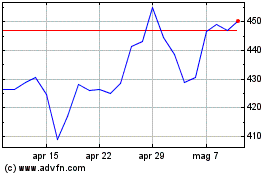

Grafico Azioni Atalaya Mining (LSE:ATYM)

Storico

Da Apr 2024 a Mag 2024

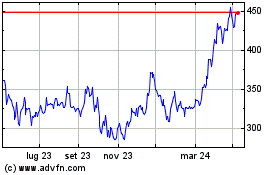

Grafico Azioni Atalaya Mining (LSE:ATYM)

Storico

Da Mag 2023 a Mag 2024