B&M European Value Retail S.A. PCA Notification (2961X)

19 Dicembre 2023 - 10:04AM

UK Regulatory

TIDMBME

RNS Number : 2961X

B&M European Value Retail S.A.

19 December 2023

19 December 2023

B&M European Value Retail S.A. (the "Company")

PCA Notification

We refer to the Company's announcements made on 13 and 15

December 2023.

In accordance with its regulatory obligations, the Company is

publishing below the contents of a "person closely associated with"

("PCA") notification received in relation to the sale of shares in

the Company by SSA Investments S.ar.l. ("SSA") last week.

The PCA notification was a regulatory requirement of SSA as it

is a PCA connected with Bobby Arora (who is a "person discharging

management responsibilities" in relation to the Company)

notwithstanding that Bobby Arora's beneficial shareholding in the

Company remains unchanged.

As set out in the notification below, the sale of shares by SSA

Investments solely relates to the shares in the Company held for

the benefit of its indirect shareholders Simon Arora and Robin

Arora. Bobby Arora has not reduced his beneficial shareholding in

the Company.

Persons Discharging Managerial Responsibilities and persons closely

associated with them notification

1. Details of the person discharging managerial responsibilities/person

closely associated

--------------------------------------------------------------------------

Legal person SSA Investments S.àr.l.

with registered address at 5, Heienhaff, Sennigerberg,

L-1736 Luxembourg and registered with the Luxembourg

Trade and Companies Register under number RCS Luxembourg

B 187251

--------------------------------------------------------------------------

2. Reason for the notification

--------------------------------------------------------------------------

This notification concerns SSA Investments S.àr.l.

Position/status ("SSA Investments"), a shareholder of B&M European Value

Retail S.A. (the "Issuer"), as a person closely associated

("PCA") with the following persons discharging managerial

responsibilities ("PDMR"):

Bobby Arora, Group Trading Director, PDMR in relation

to the Issuer's Group.

SSA Investments is an investment vehicle for certain

members of the Arora family through which they beneficially

own 4.194% of the shares in the Issuer. As Simon Arora

and Bobby Arora each hold approximately 38.6% of the

shares in SSA Investments with the remainder held by

Robin Arora and Praxis Nominees Limited, SSA Investments

qualifies as a PCA of Bobby Arora in the sense of article

3(1)(26)(d) of MAR.

This sale of shares by SSA Investments solely relates

to the shares in the Issuer held for the benefit of Simon

Arora and Robin Arora. Bobby Arora has not reduced his

beneficial shareholding in the Issuer.

--------------------------------------------------------------------------

Initial Initial

notification/

amendment

--------------------------------------------------------------------------

3. Details of the issuer, emission allowance market participant,

auction platform, auctioneer or auction monitor

--------------------------------------------------------------------------

Issuer B&M European Value Retail S.A.

--------------------------------------------------------------------------

LEI 213800UK7ZRLY2K1X530

--------------------------------------------------------------------------

4. Details of the transaction(s)

--------------------------------------------------------------------------

Description Shares

of the financial

instrument,

type

of Instrument

--------------------------------------------------------------------------

Identification ISIN LU1072616219

Code

--------------------------------------------------------------------------

Nature of Disposal

the transaction

--------------------------------------------------------------------------

Currency GBP

--------------------------------------------------------------------------

Price(s) and Price Volume Total

volume(s)

-------------------------- ------------------- -------------------------

GBP 5.809568399 27,821,400 GBP 161,630,326

-------------------------- ------------------- -------------------------

Aggregated Price Volume Total

Information

-------------------------- ------------------- -------------------------

GBP 5.809568399 27,821,400 GBP 161,630,326

-------------------------- ------------------- -------------------------

Date of Transaction 13 December 2023

--------------------------------------------------------------------------

Place of transaction Outside a trading venue

--------------------------------------------------------------------------

Date and

signature

Shane

Califf

Marija

Prechtlein

13/12/2023

(1) For natural persons: the first name and the last name(s).

For legal persons: full name including legal form as provided

for in the register where it is incorporated, if applicable.

(2) For persons discharging managerial responsibilities: the

position occupied within the issuer, emission allowances market

participant/auction platform/auctioneer/auction monitor should

be indicated, e.g. CEO, CFO.

For persons closely associated:

* an indication that the notification concerns a person

closely associated with a person discharging

managerial responsibilities,

* the name and position of the relevant person

discharging managerial responsibilities.

(3) Indication that this is an initial notification or an amendment

to prior notifications. In case of amendment, explain the error

that this notification is amending.

(4) Full name of the entity.

(5) Legal Entity Identifier code in accordance with ISO 17442

LEI code.

(6) Indication as to the nature of the instrument:

* a share, a debt instrument, a derivative or a

financial instrument linked to a share or a debt

instrument;

* an emission allowance, an auction product based on an

emission allowance or a derivative relating to an

emission allowance.

(7) Instrument identification code as defined under Commission

Delegated Regulation supplementing Regulation (EU) Ndeg 600/2014

of the European Parliament and of the Council with regard to

regulatory technical standards for the reporting of transactions

to competent authorities adopted under Article 26 of Regulation

(EU) Ndeg 600/2014.

(8) Description of the transaction type using, where applicable,

the type of transaction identified in Article 10 of the Commission

Delegated Regulation (EU) 2016/522 adopted under Article 19(14)

of Regulation (EU) Ndeg 596/2014 or a specific example set out

in Article 19(7) of Regulation (EU) No 596/2014. Pursuant to

Article 19(6)(e) of Regulation (EU) Ndeg 596/2014, it shall be

indicated whether the transaction is linked to the exercise of

a share option programme.

(9) Where more than one transaction of the same nature (purchases,

sales, lendings, borrows, ...) on the same financial instrument

or emission allowance are executed on the same day and on the

same place of transaction, prices and volumes of these transactions

shall be reported in this field, in a two columns form as presented

above, inserting as many lines as needed.

Using the data standards for price and quantity, including where

applicable the price currency and the quantity currency, as defined

under Commission Delegated Regulation supplementing Regulation

(EU) Ndeg 600/2014 of the European Parliament and of the Council

with regard to regulatory technical standards for the reporting

of transactions to competent authorities adopted under Article

26 of

Regulation (EU) Ndeg 600/2014.

(10) The volumes of multiple transactions are aggregated when

these transactions:

* relate to the same financial instrument or emission

allowance;

* are of the same nature;

* are executed on the same day; and

* are executed on the same place of transaction.

Using the data standard for quantity, including where applicable

the quantity currency, as defined under Commission Delegated

Regulation supplementing Regulation (EU) Ndeg 600/2014 of the

European Parliament and of the Council with regard to regulatory

technical standards for the reporting of transactions to competent

authorities adopted under Article 26 of Regulation (EU) Ndeg

600/2014.

(11) Price information:

* In case of a single transaction, the price of the

single transaction;

* In case the volumes of multiple transactions are

aggregated: the weighted average price of the

aggregated transactions.

Using the data standard for price, including where applicable

the price currency, as defined under Commission Delegated Regulation

supplementing Regulation (EU) No 600/2014 of the European Parliament

and of the Council with regard to regulatory technical standards

for the reporting of transactions to competent authorities adopted

under Article 26 of Regulation (EU) No 600/2014.

(12) Date of the particular day of execution of the notified

transaction. Using the ISO 8601 date format: YYYY-MM-DD; UTC

time.

(13) Name and code to identify the MiFID trading venue, the

systematic internaliser or the organised trading platform outside

of the Union where the transaction was executed as defined under

Commission Delegated Regulation supplementing Regulation (EU)

Ndeg 600/2014 of the European Parliament and of the Council with

regard to regulatory technical standards for the reporting of

transactions to competent authorities adopted under Article 26

of Regulation (EU) Ndeg 600/2014, or if the transaction was not

executed on any of the above

mentioned venues, please mention 'outside a trading venue'.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

DSHEANANFEEDFEA

(END) Dow Jones Newswires

December 19, 2023 04:04 ET (09:04 GMT)

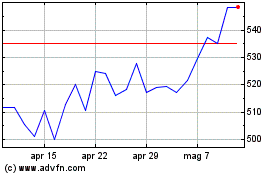

Grafico Azioni B&m European Value Retail (LSE:BME)

Storico

Da Apr 2024 a Mag 2024

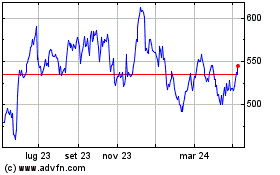

Grafico Azioni B&m European Value Retail (LSE:BME)

Storico

Da Mag 2023 a Mag 2024