TIDMBRWM

BlackRock World Mining Trust plc

LEI - LNFFPBEUZJBOSR6PW155

Condensed Half Yearly Financial Report 30 June 2023

PERFORMANCE RECORD

As at As at

30 June 31 December

2023 2022

Net assets (£'000)1 1,171,418 1,299,285

Net asset value per ordinary share (NAV) (pence) 612.72 688.35

Ordinary share price (mid-market) (pence) 599.00 697.00

Reference index2 - net total return 5,546.55 5,863.32

(Discount)/premium to net asset value3 (2.2%) 1.3%

======== ========

For the For the

six months year

ended ended

30 June 31 December

2023 2022

Performance (with dividends reinvested)

Net asset value per ordinary share3 -7.1% +17.7%

Ordinary share price3 -10.3% +26.0%

Reference index2 -5.4% +11.5%

======== ========

For the For the Change

six six months %

months ended

ended 30 June 2022

30 June

2023

Revenue

Net revenue profit on ordinary 31,767 37,148 -14.5

activities after taxation

(£'000)

Revenue earnings per ordinary 16.73 20.07 -16.6

share (pence)3

Dividend per ordinary share

(pence)

- 1st interim 5.50 5.50 -

- 2nd interim 5.50 5.50 -

-------- --------------- ---------------

-------

Total dividends paid and payable 11.00 11.00 -

======== ======== ========

1The change in net assets reflects portfolio movements, dividends paid and the

reissue of ordinary shares from treasury during the period.

2With effect from 31 December 2019, the reference index changed to the MSCI ACWI

Metals & Mining 30% Buffer 10/40 Index (net total return). Prior to 31 December

2019, the reference index was the EMIX Global Mining Index (net total return).

The performance returns of the reference index since inception have been blended

to reflect this change.

3Alternative Performance Measures; further details are given in the Glossary

contained within the Half Yearly Financial Report.

CHAIRMAN'S STATEMENT

Overview

The global economy performed well at the start of the year, supported by factors

such as falling energy prices, strong consumer balance sheets and the reopening

of the Chinese economy. There was positive sentiment in the mining sector too

following China's reversal of its zero COVID-19 policies which initially led to

strong commodity demand and the majority of mined commodity prices performing

well. However, relatively quickly, positive momentum stalled as global

manufacturing activity receded and China's economy, historically a major demand

engine, delivered a disappointing rebound. By the end of the first half of the

year, most mined commodity prices had fallen below the levels where they

started.

Performance

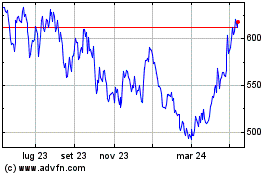

Against this backdrop, over the six months ended 30 June 2023, the Company's net

asset value per share (NAV) returned -7.1% and the share price -10.3%. The

Company's reference index, the MSCI ACWI Metals & Mining 30% Buffer 10/40 Index,

returned -5.4% (all percentages calculated in Sterling terms with dividends

reinvested).

Since the period end and up to the close of business on 22 August 2023, the

Company's NAV has decreased by 5.2% compared to a fall of 3.2% (on a net return

basis) in the reference index (in Sterling terms with dividends reinvested).

Further information on the Company's performance and the factors that

contributed to, or detracted from, performance during the six months are set out

in the Investment Manager's Report below.

Revenue return and dividends

The Company's revenue return per share for the six-month period ended 30 June

2023 amounted to 16.73p per share, compared to 20.07p per share during the same

six-month period last year. This represents a decrease of 16.6% and reflects

reductions in dividends from many mining companies.

The first quarterly dividend of 5.50p per share was paid on 31 May 2023 and,

today, the Board has announced a second quarterly dividend of 5.50p per share

which will be paid on 6 October 2023 to shareholders on the register on 8

September 2023, the ex-dividend date being 7 September 2023. It remains the

Board's intention to distribute substantially all of the Company's available

income in the future.

Management of share rating

The Directors recognise the importance to investors that the Company's share

price should not trade at a significant premium or discount to NAV, and

therefore, in normal market conditions, may use the Company's share buyback and

share issuance powers to ensure that the share price is broadly in line with the

underlying NAV.

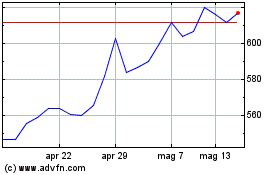

The discount of the Company's share price to the underlying NAV per share

finished the six months under review at 2.2% on a cum income basis, having stood

at a premium of 1.3% at the beginning of the period. At the close of business on

22 August 2023, the Company's shares were trading at a discount of 1.9% on a cum

income basis.

Over the six months to 30 June 2023, the Company's shares have traded at an

average premium of 0.2%, and within a range of a 4.2% discount to a 3.1%

premium. I am pleased to report that, during the first half of the year, the

Company reissued 2,430,000 ordinary shares from treasury at an average price of

644.44p per share for a total consideration of £15,691,000. All shares were

reissued at a premium to the prevailing NAV and were therefore accretive to

existing shareholders. The Company did not buy back any shares during the six

month period ended 30 June 2023. Since the period end and up to the date of this

report, no ordinary shares have been reissued or bought back.

Gearing

The Company operates a flexible gearing policy which depends on prevailing

market conditions. It is not intended that gearing will exceed 25% of the net

assets of the Company and its subsidiary. Gearing as at 30 June 2023 was 9.6%

and maximum gearing during the period was 14.6%.

Board composition

I am delighted to welcome Charles (Chip) Goodyear to the Board. Chip was

appointed today and brings a wealth of relevant industry knowledge and

experience and, subject to his re-election by shareholders, he is intended to

succeed me as Chairman immediately following the next Annual General Meeting. He

began his career at Kidder, Peabody & Co. where he participated in merger and

acquisition and financing activities for natural resources companies. Chip then

joined Freeport-McMoRan, one of the world's largest producers of copper and

gold, where he was promoted to executive vice president and chief financial

officer. In 1999 he joined BHP Billiton (now BHP), the world's largest

diversified resources company as chief financial officer and served in that role

until 2001 when he became chief development officer, a post he held until 2003

when he then became chief executive officer.

In October 2007 Chip retired from BHP and in 2009 served as CEO-designate of

Temasek Holdings, an investment company wholly owned by the Singapore Minister

for Finance. He also served on Temasek's board. He is currently the president of

Goodyear Capital Corporation and Goodyear Investment Company and a director of

several private companies. Chip has also been a member of the International

Council on Mining and Metals and the National Petroleum Council.

Market outlook

Central banks in most parts of the world have aggressively tightened monetary

policy to restrictive levels and the way forward remains uncertain as they try

to strike a delicate balance between fighting inflation and maintaining

financial stability. Headline inflation rates are currently falling in the

developed world, driven by lower energy prices and normalising supply chains.

However, core inflation, which excludes items frequently subject to volatile

prices like food and energy, does not appear likely to fall to many central

banks' 2.0% inflation target due to ongoing strength in wage growth.

Uncertainty on the interest rate path, reflecting inflation concerns, weighs on

the outlook for economic growth. However, there has never been greater demand

for metals and minerals and the mining sector must increase production to supply

businesses with the materials, such as lithium and copper, they need in enabling

the global economy to shift to a carbon-free future. The mining and metals

industry as a whole is also confident that it can reconcile rapid output growth

with sustainability goals.

Whilst near-term caution is warranted, the Board remains fully supportive of our

portfolio managers, the strength of the holdings in the portfolio and their

belief in the ability of our companies to navigate the upcoming environment.

David Cheyne

Chairman

24 August 2023

INVESTMENT MANAGERS' REPORT

The first half of 2023 finished worse than expected, despite a strong start to

the year. Commodity prices initially moved higher but by March started to fall,

finishing the period in negative territory on the back of fears of further

interest rate hikes and uncertainty on Chinese economic activity. The

combination of these two factors was able to overwhelm supportive supply side

constraints and growth from the energy transition related demand. Mining company

share prices fell in tandem with the aforementioned moves but were also

pressured by cost inflation that compressed margins.

Given the negative backdrop of the period, returns would historically have been

worse than what transpired due to weak balance sheets, overspending on growth

and falling margins. These factors have nearly always resulted in enlarging the

negative returns and driving the steep cyclicality most investors associate with

the sector, but once again the sector proved to be more resilient than in the

past. Mining companies have largely paid down debt, leaving balance sheets

supportive rather than the opposite. Disciplined capital spending has reduced

commitments to growth related capital expenditure and thus freed up cash to

spend on buybacks and dividends. If companies can hold to the capital allocation

frameworks outlined at last cycle's low point, 2016, then there is a strong

probability that once the near-term economic noise dissipates, the underlying

fundamentals should drive returns.

Over the period, the NAV of the Company was down by 7.1% with dividends

reinvested and the share price total return was down by 10.3%. This compares to

the FTSE 100 Index which was up by 3.2%, the Consumer Price Index (during the 12

months to 30 June 2023) which was up by 7.9% and the reference index (MSCI ACWI

Metals & Mining Index 30% Buffer 10/40 Index net total return) which was down by

5.4% (all total return numbers based in Sterling terms).

The old enemy - inflation

Central banks from the Federal Reserve, the Bank of England, the European

Central Bank and nearly all other regions sought to raise rates in a battle

against inflation. A near perfect storm of supply chain issues, strong consumer

balance sheets and tight labour markets drove inflation to levels not seen for

years. In addition, the stickiness of the data continually defied market

expectations that rates would peak in the near term.

Given the focus of governments, society and central banks on bringing inflation

under control, we consider that it is likely that rates will remain higher than

expected and for longer, especially if the consumer continues to spend down the

"personal balance sheet" built up during the COVID-19 pandemic. However, recent

data points are starting to show a reprieve in areas such as energy costs, raw

materials and food prices. Time will tell if these will result in a steep enough

fall in overall inflation data allowing central banks to pause rather than raise

interest rates again.

As shown in the chart on page 8 of the Half yearly Financial Report, rates are

now at a level where investors seem to be satisfied with the return available on

short-term deposit rates of 5% or more. The attractiveness of this creates a

significant burden for general equities given the higher volatility and lower

yields versus the simple return on cash. In addition, ongoing economic

uncertainty in certain parts of the world means that equity returns are likely

to remain divergent. The year to date moves in large cap technology companies

versus companies aligned to the broader economy is a case in point (as seen in

the chart on page 7 of the Half Yearly Financial Report).

ESG issues and the social licence to operate

ESG (Environmental, Social and Governance) issues are highly relevant to the

mining sector and we seek to understand the ESG risks and possible related

opportunities facing companies and industries in the portfolio. As an extractive

industry, the mining sector naturally faces a number of ESG challenges given its

dependence on water, carbon emissions and geographical location of assets.

However, we consider that the sector can provide critical infrastructure, taxes

and employment to local communities, as well as materials essential to

technological development, enabling the carbon transition through the production

of the metals required for the technology underpinning that transition.

We consider ESG insights and data, including sustainability risks, within the

total set of information in our research process and makes a determination as to

the materiality of such information as part of the investment process used to

build and manage the portfolio. ESG insights are not the sole consideration when

making investment decisions but, in most cases, the Company will not invest in

companies which have high ESG risks (risks that affect a company's financial

position or operating performance) and which have no plans to address existing

deficiencies.

-We take a long-term approach, focused on engaging with portfolio company boards

and executive leadership to understand the drivers of risk and financial value

creation in companies' business models, including material sustainability

-related risks and opportunities, as appropriate.

-There will be cases where a serious event has occurred and, in that case, we

will assess whether the relevant portfolio company is taking appropriate action

to resolve matters before deciding what to do.

-There will be companies which have derated (the downward adjustment of

multiples) as a result of an adverse ESG event or generally due to poor ESG

practices where there may be opportunities to invest at a discounted price.

However, the Company will only invest in these value-based opportunities if we

are satisfied that there is real evidence that the relevant company's culture

has changed and that better operating practices have been put in place.

The main areas of focus during the period have been on decarbonisation plans. It

is increasingly clear how essential it is for resource producers to move away

from the carbon heavy processes that have been used for generations. New

technologies will be required to facilitate this transition, as well as

significant amounts of capital. It is also important that investors understand

that the journey will not be a straight line, as companies contend with both the

speed of decarbonisation and the importance of growing production to meet the

needs of customers. In order to monitor progress, it is hoped that some new

industry standards are implemented that will make assessing progress easier, as

happened when the sector focused on safety many years ago.

Another area of focus during the period has been on governance. Given the battle

to grow either by investing in new supply or via mergers and acquisitions, it is

important that management teams respect their fiduciary duty when dealing with

the latter. It is too easy for executives to shy away from opportunities by

retreating into the safety of their own structure rather than engaging to see

what might be possible. It is our hope that the positives delivered by increased

focus on capital discipline are not wasted when it comes to evaluating value

accretive opportunities.

Weaker prices

The first half of 2023 has seen markedly lower prices versus both the start of

the year and versus the average prices seen in the same period last year. Double

digit falls are commonplace across the industrial metals arena, with only

precious metals showing upwards moves. Despite the scale of the falls, current

prices continue to deliver strong margins for the producers and it is therefore

important to highlight the ongoing cash generation the sector is likely to

enjoy. In addition, inventory levels have fallen to record lows for a number of

metals meaning that when demand strength returns the impact on prices from

restocking could be dramatic.

Commodity price moves

Commodity 30 June 2023 % change % change average price

YTD in 1H 23 1H23 vs 1H22

Gold US$/oz 1,916 5.5% 3.1%

Silver US$/oz 22.76 -4.2% 0.1%

Platinum US$/oz 897 -15.8% 1.7%

Palladium US$/oz 1,254 -29.9% -31.8%

Copper US$/lb 3.77 -0.5% -10.9%

Nickel US$/lb 9.23 -31.9% -15.4%

Aluminium US$/lb 0.96 -10.3% -23.9%

Zinc US$/lb 1.08 -20.6% -26.0%

Lead US$/lb 0.97 -8.5% -5.9%

Tin US$/lb 12.46 11.0% -34.6%

Iron Ore (China 62% 114 -3.4% -15.3%

fines) US$/t

Thermal Coal (Newcastle) 159 -42.0% 12.0%

US$/t

Metallurgical Coal US$/t 230 -14.0% -8.0%

Lithium (Battery Grade 106.2 -44.5% -21.2%

China) US$/kg

West Texas Intermediate 70.6 -12.0% -26.4%

Oil (Cushing) US$/barrel

======== ======== ========

Sources: Datastream and Bloomberg, June 2023.

The key exposures for the Company are to producers of iron ore and copper.

Average prices for these two commodities were lower in the first half of 2023

versus the first half of 2022 with iron ore down by 15% and copper down by 10%.

What is interesting is that the actual year to date return for copper is flat,

highlighting the volatility during the period. Inventories are now at levels

rarely seen before, leaving consumers heavily exposed to price risk when they

decide to rebuild stocks.

It is not just metals prices that have suffered during the period but also

prices for other commodities such as oil and agricultural crops. During the

period, OPEC (Organisation of Petroleum Exporting Countries) has had to step

into the market to cut supply twice this year in order to protect prices in the

face of lower economic activity. On the other side of the equation, sales of oil

from the US Strategic Petroleum Reserve have moderated and the US Government has

said they would look to restock at around US$70/bbl which is not far from

current levels.

Capital allocation

It is now seven years since companies started to introduce changes to their

capital allocation frameworks. The focus on value over volume, balance sheet

risk, looking through the cycle, flexibility, improved payments to shareholders

etc. have entrenched a culture of discipline which has steadied the ship during

volatile times. It is great to see ongoing support for these plans and it is

clear from the reduced share price volatility in periods like the first half of

2023 that they are working.

Many of the historic return plans continue to drive support for the sector. It

is noteworthy the scale of delivery and ongoing ambition around share buyback

plans that continue to erode the number of shares in issue for various

companies. For example, ArcelorMittal has reduced its share count by 31.0%,

Glencore by 5.2% and Vale by 7.4%. The full impact of deploying capital in this

way is yet to be felt during an upswing in markets and time will tell just how

much value can be generated from them but the potential is very exciting.

In regard to dividends, it is clear that based on current levels of

profitability and existing pay-out policies, dividends to shareholders are

likely to be lower and in some cases significantly lower in 2023 than the prior

year. This is to be expected but what should not be ignored is just how

competitive the forecast yields continue to be versus the broader market e.g.

the reference index has a dividend yield of 4.1% versus the MSCI All Country

World Index at 2.2%.

Decarbonisation a multi decade driver for the sector

The low carbon transition is one of the most encouraging structural

opportunities that we see in the market and creates a compelling growth

opportunity for those companies supplying the materials that enable the

transition. In 2022 global battery electric vehicle sales reached 10million

units, with the International Energy Agency (IEA) forecasting this to increase

to 13 million units in 2023. Energy storage systems doubled in 2022 compared

with 2021 and are on track to double again in 2023. We also saw record spending

on renewable energy in 2022 at almost US$600 billion, with China alone adding

100GW of solar capacity (+70% versus 2021) where they are looking to increase

this to 150GW in 2023.

Policy continues to be supportive of this trend where we have seen an

acceleration in legislation to support the transition to a low-carbon economy

over the last 12 months. The US Inflation Reduction Act (IRA), passed in August

2022, contains a range of measures to support the transition with nearly US$400

billion of public spending in the form of tax incentives, rebates and loans. The

IRA has contributed to a doubling of real manufacturing construction spending

since late 2021. In Europe, the Green Deal Industrial Plan has earmarked more

than EUR 600 billion in public sector investment to incentivise European

production of clean technology and critical raw materials to ensure Europe

remains competitive in the global race to net-zero.

Base metals

It was a difficult half year for the base metals as concerns around global

growth, the strength of the recovery in China and higher interest rates

depressed demand. Base metal prices for the first half of 2023 were between 11%

to 26% lower than the corresponding period last year. While physical markets

remain robust, particularly in the case of copper, the impact of using higher

rates to stem inflation overwhelmed prices in the first six months.

Encouragingly, as we approached the end of the period, China's two most senior

politicians sought to allay concerns around China's growth and have indicated

that they will look to stimulate parts of the economy to support growth.

Copper has been caught in the crossfires of a macro versus micro debate this

year. The fundamentals of the copper market look robust - inventory levels are

low and drawing down and China's apparent consumption is strong (copper imports

into China reached a record level in May 2023). However, concerns around the

growth outlook in China and the rest of the world depressed the price, with

copper finishing the first half of the year flat (-0.5%) versus the beginning of

the year. The copper price has benefited over the last two years from a number

of project delays and supply downgrades. Whilst we do not see a wall of new

supply entering the market, we will begin to see delayed production from assets

such as Anglo American's Quelleveco mine in Peru and Teck Resources' QB2 project

in Chile which began ramping up production this year.

With the long-term fundamentals of the copper market remaining robust, in

particular copper's role in enabling the energy transition, we continue to

remain positively exposed to copper producers within the Company. Encouragingly,

we saw a better performance from copper equities versus the underlying copper

price during the period. A number of mid-cap and development companies performed

particularly well. Lundin Mining (0.8% of the portfolio) delivered improved

operational performance and acquired a 51% stake in the Casserone's copper mine

in Chile. This is located close to the undeveloped Josemaria project and

provides Lundin Mining with a strong presence in the Vicuna district of Chile

which is also home to the world class Filo del Sol project owned by Filo Mining,

another Lundin Group company. Ivanhoe Mines (2.2% of the portfolio) continues to

deliver as they ramp-up their Komoa-Kakula asset in the Democratic Republic of

the Congo. Ivanhoe Electric (2.8% of the portfolio) announced a concurrent

equity investment and 50/50 exploration joint venture with Ma'aden (Saudi

Arabia's leading mining company) to explore minerals in the Middle Eastern

country which will see them invest US$126 million for a 9.9% stake in the

company. This formerly private investment has continued to perform well now that

it is listed on the New York Stock Exchange.

The aluminium price was down 13% compared with last year but has largely traded

around its cost curve, which is used to estimate its price support level. This

is a function of the move down in energy prices which are the largest cost

component of producing aluminium. There have been risks to China's aluminium

supply base with production restrictions imposed in Yunnan due to low hydro

levels, but overall supply and demand have been reasonably well balanced in

China. While the demand for "green" or low-carbon aluminium continues to grow,

we have seen an element of aluminium de-stocking year-to-date. The Company's

largest exposure to aluminium is via Norsk Hydro (2.4% of the portfolio) which

is one of the lowest-carbon producers of aluminium by virtue of its access to

hydro power in Norway and it continues to pursue its strategy of growing the low

-carbon product mix via recycling and investing into renewable energy.

The nickel market was particularly challenged in 2023 as stainless steel

production, its key source of demand, declined year-on-year. With Indonesian

nickel pig iron supply continuing to grow, a substantial surplus has built up

which caused the nickel price to decline 32% during the first half of the year.

Nickel pig iron (NPI) producers are increasingly looking to adapt their

facilities allowing production of nickel matte and other intermediary products.

This move allows them to sell into the market for Class 1 battery grade nickel

where demand is likely to remain high and could command a premium over time. The

Company has two pure play* exposures to nickel - the first is Nickel Industries

(0.9% of the portfolio), today a NPI producer which is transitioning towards LME

grade nickel production which will improve earnings and margins. The second

investment was done via a "PIPE" deal in 2022 that has now taken Lifezone Metals

from private into a public company at the end of June. Lifezone Metals, in

conjunction with BHP, owns the Kabanga project in Tanzania which is one of the

world's largest undeveloped nickel sulphide deposits. As at the end of July,

Lifezone Metals was trading 19.7% above the capital raising entry price of US$10

per share.

*Companies with significant revenue exposure to the commodity.

Bulk commodities and steel

The outlook for the iron ore market at the end of last year was largely positive

with most investors expecting to see a recovery in construction activity,

particularly in China, leading to better prices during the first half of the

year. To a large extent this proved correct with the iron ore price reaching

US$125/t in Q1 and averaging US$112/t for the first half of the year. While this

iron ore price does not support the record levels of dividends paid by the iron

ore exposed diversified miners in 2021 and 2022 it is a very attractive price

for these low-cost producers.

The Company's exposure to iron ore is via the diversified majors BHP (8.9% of

the portfolio), Vale (9.1% of the portfolio) and Rio Tinto (2.6% of the

portfolio). Whilst iron ore prices have softened versus the prior year, so too

have the share prices and the companies continue to offer an attractive and well

supported dividend yield. In addition, the Company has exposure to two pure play

high grade iron ore producers, Champion Iron and Labrador Royalty Company.

Champion Iron is ramping up its Bloom Lake operation in Canada and targeting the

production of high grade (69% Fe) iron ore which is a key component of low

carbon steel production.

China's domestic steel mills are currently operating at break-even margins, with

the steel price largely tracking moves in its key cost inputs, iron ore and

coking coal. As we look into the second half of the year, we would expect to see

a moderation in steel production rates in China given the government's goal of

maintaining to reducing steel production year-on-year. During the first half of

the year, China's steel output was annualising at 1,050Mt versus their capacity

target of around 1,000Mt. Addressing oversupply and measuring the carbon

intensity of production in the Chinese steel market is positive for those

producers (namely European) who compete against Chinese imports.

The US has remained a bastion of relative strength for steel, supported by

domestic construction, government policy and a recovery in automotive demand

from the chip-impacted production in 2020-2022. As we look forward there is an

increasingly positive outlook for steel in the US with higher infrastructure and

re-shoring investment. The energy transition is also supportive of steel demand,

with steel intensity of certain renewable power more steel intensive than a

natural gas fired power plant, such as onshore wind at 3.4x for the same level

of energy generation.

The Company's exposure to steel is focused on companies with a track record of

capital returns through share buybacks and dividends, as well as disciplined

growth and an industry leading approach to decarbonisation. Our preference in

the Company is to have exposure to low carbon producers, such as the US EAF

producers including Nucor and Steel Dynamics, or to be invested in those

producers who might be carbon intensive today, but have credible plans to

decarbonise their production as is the case with ArcelorMittal. During the first

half, we saw Nucor (1.6% holding in the portfolio) announce a new US$4 billon

share buyback plan in May - since 2020 Nucor has reduced its share count by 17%,

with the newly announced buyback compressing this further. ArcelorMittal and

Steel Dynamics (2.7% and 1.8% holdings respectively) have also reduced their

share count by 27% and 20% respectively since the end of 2020 and we expect this

trend to continue.

Coal markets have been some of the most interesting commodity markets over the

last couple of years with record prices achieved for both metallurgical and

thermal coal during 2022. While coal markets have continued to be interesting,

the price performance has been the worst among the commodities, primarily due to

an elevated starting point and lower demand due to a warmer than expected

northern hemisphere winter. With coal demand in Europe, Japan and South Korea

relatively muted year-to-date, China has been dominating imports with their coal

burn up 16% year-on-year in May. From here, the outlook for coal is largely

weather dependent. If the northern hemisphere winter is colder than average,

inventories will need to be replenished which should be supportive of prices.

The Company's thermal coal exposure is via our 8.0% position in Glencore which

is using elevated thermal coal prices to deleverage the business and remains

focused on decreasing its coal exposure over time. During the first half of

2023, Glencore made a proposal to Teck Resources to merge their two businesses

and subsequently demerge the combined coal business to create two separate

companies - a metals business and a coal business. While the Teck Resources

board has not accepted the proposal from Glencore, Glencore is separately

pursuing an acquisition of Teck Resources' coking coal business that they have

indicated will allow them to separate coal from the rest of the business over

time. As a reminder, the Company has no exposure to pure play thermal coal

producers.

A consistent feature of the metallurgical coal market has been its

susceptibility to upside price surprises due to seasonal weather effects during

the first half of the year. This has resulted in prices spiking to over US$600/t

in recent years when Queensland, Australia's key coking coal region, was heavily

impacted by extreme flooding. While not to the same extreme, volatility has been

a feature of the hard coking coal market this year with prices reaching close to

US$400/t in February as exports from Australia hit 6-year lows, to subsequently

decline to around US$230-250/t at present as supply recovered. Limited

investment into new supply and ongoing supply side risks are likely to keep this

market well supported over the medium term. The Company's exposure to

metallurgical coal remains in the two leading producers, BHP and Teck Resources,

which have been able to generate very strong levels of free cash flow from their

coking coal businesses to support returns to shareholders in recent years.

Precious metals

The last three years have seen a range bound environment for gold with the

average annual price in a range of circa 10%. Whilst the price in US Dollar

terms has been relatively stable, the performance of gold in non-US Dollar terms

has been far stronger. In 2023 gold has traded at the top-end of its recent

trading range surpassing US$2,000/oz, supported by persistent inflation

concerns, heightened geopolitical tension and currency debasement. As we look to

the remainder of the year, the performance of gold will be likely dictated by

the outlook for inflation and in turn rates. If inflation proves to be more

persistent than expected, yet central banks choose to pause on interest rate

hikes, we will see real yields compress and a positive gold price environment

emerge.

The silver price has modestly underperformed gold when looking at average prices

during the first half of 2023 versus the same period last year. Longer term we

see upside potential from greater solar penetration (the greater proportion of

solar within the energy mix) and increasing usage of semi-conductors.

An encouraging feature of the gold equity market over recent years has been the

increased focus on shareholder returns, free cash flow and dividends. Cost

inflation has been a challenge for the gold producers over the last couple of

years. However signs are suggesting the cost inflation is reaching a peak and

the move up in gold prices is also supporting margins.

The Company has modestly increased its exposure to gold producers during the six

-month period given the improved outlook. However, we have maintained our

strategy of focusing on high quality producers which have an attractive

operating margin and solid production profile and resource base. This includes

the Company's exposure to the royalty companies Franco-Nevada (2.2% of the

portfolio) and Wheaton Precious Metals (3.1% of the portfolio) which have

generally outperformed the gold equities during the year given their stronger

margins and lack of exposure to cost inflation. We have also seen further

consolidation in the sector with the Newcrest Mining (2.4% of the portfolio)

board recommending Newmont Corporation's (3.2% of the portfolio) proposal to

acquire Newcrest Mining to create the world's largest gold producer.

It was a torrid period for the platinum group metals (PGMs) with destocking

driving prices significantly lower during the first half, with the platinum

price down by 16%, palladium down by 30% and rhodium falling a spectacular 65%

during the half given the elevated price levels over the last 18 months. It has

been a challenging period for the PGMs with global auto production still

tracking circa 15% below pre-COVID-19 levels, with Battery Electric Vehicles

(BEV) continuing to take market share from Internal Combustion Engine (ICE)

vehicles. We expect to see a modest recovery in auto sales in 2023 as chip

shortages begin to ease, but an environment of rising inflation and interest

rates is challenging for auto demand.

Among the PGMs, platinum has fared better than palladium which faces the

structural challenge of declining diesel vehicle demand. Platinum continues to

see autocatalyst demand growth, with increasing emissions standards requiring

more platinum loading for autocatalysts in China. While the demand outlook has

well recognised challenges, the supply of PGMs has come under significant

pressure in recent years due to the lack of reinvestment and operating

challenges (mainly power related) in South Africa. A key question for global PGM

supply is whether sanctions are placed on Russian materials, which would

significantly tighten the market.

As at the end of the period, the Company had a combined exposure of 2.3% to PGM

producers through Bravo Mining, Impala Platinum, Northam Platinum and Sibanye

Stillwater versus 2.0% at the same time last year. In addition, the Company has

reduced its exposure to Anglo American (2.4% of the portfolio) which owns 79% of

Anglo American Platinum. The clear bright spot for the Company's PGM exposure

was from Bravo Mining, a Brazilian-based PGM exploration and development company

which the Company invested in pre-IPO in April 2022 at US$0.50/share due to our

belief in the assets and management's potential. Since our initial investment

the company has successfully done an IPO and as at 30 June 2023 was trading at

C$4/share, which represents a 500% return on our initial investment. They

continue to have great success with the initial exploration phase confirming the

occurrence of rhodium in the orebody, along with the potential for nickel

sulphide.

Energy transition metals

It was a volatile half for lithium, a critical component of batteries, with the

prices beginning the year at elevated levels and subsequently falling by 60%

between January and April, due to de-stocking along the battery supply chain.

Lithium demand is expected to remain solid this year at +20%, with the market to

remain in balance which should support the recent rally in prices. Much has been

said around the potential for meaningful supply growth in lithium. However,

project delays have become a feature of this market in recent years. Concerns

around the future availability of lithium has seen a number of OEM's (Original

Equipment Manufacturers) including Ford and General Motors look to fund lithium

projects and producers through a combination of equity investments, off-takes

(the amount of goods purchased during a given period) and loans. Following the

pullback in lithium equities alongside the fall in spot prices during Q1, the

Company added to its lithium holdings through Albemarle (1.6% of the portfolio)

and Mineral Resources (1.3% of the portfolio). The Company's lithium holdings

constitute 7.8% of the portfolio.

A critical component of the electric car is also the e-motor, which most

commonly uses a Praseodymium-Neodymium (NdPr) magnet, an alloy of two rare earth

elements (REEs). REEs are commonly mined and processed in China and have been

deemed of strategic importance by both Europe and the USA. The Company has

exposure to REEs through Lynas Rare Earths, a REE miner and processor crucially

based in Malaysia and Australia, as well as through Iluka Resources which is

building a rare earths conversion facility in Western Australia to process its

Eneabba rare earths concentrate. It has been a challenging first half for Lynas

Rare Earths, with the Malaysian Government confirming that no cracking and

leaching of rare earths will be allowed at their facility in Malaysia from 1

January 2024. While Lynas Rare Earths is building a cracking and leaching plant

in Western Australia, there was hope that both cracking and leaching assets

could operate in both Malaysia and Western Australia, allowing Lynas Rare Earths

to further grow volumes.

Other metals with uses in support of the energy transition include cobalt, where

prices are down by 65% from their June 2022 peak. Demand has been challenged,

with higher cobalt battery chemistries the slowest growth among the battery

chemistries, but still up by 28% year-on-year. From a supply perspective, the

market looks well supplied with China Molybdenum increasing both production and

the processing of stockpiles. Supply growth is also set to continue, with cobalt

being a by-product of many of the Indonesian Nickel projects announced. The

Company's only exposure to cobalt is via Glencore.

Royalty and unquoted investments

Over the last year the Company has enjoyed a number of successes from the

unquoted part of the portfolio with two private holdings, Ivanhoe Electric and

Bravo Mining, going public at a substantially higher level than the Company's

initial investment. The Company's long-standing Brazilian copper and gold

royalty previously operated by OZ Minerals was transferred to BHP following its

acquisition of OZ Minerals in 2023. Jetti Resources, a copper leaching company,

completed a US$100 million fund raising at a substantially higher level than the

Company's initial investment and finally two PIPE investments completed their

business combinations and are trading above our entry price.

As at the end of the first half of 2023, the unquoted investments in the

portfolio amounted to 6.9% of the portfolio and consist of the BHP Brazil

Royalty, the Vale Debentures, Jetti Resources and MCC Mining. These, and any

future investments, will be managed in line with the guidelines set by the Board

as outlined to shareholders in the Strategic Report in the 2022 Annual Report.

BHP Brazil Royalty Contract (1.5% of the portfolio)

In July 2014 the Company signed a binding royalty agreement with Avanco

Minerals. The Company invested US$12 million in return for Net Smelter Return

(net revenue after deductions for freight, smelter and refining charges) royalty

payments comprising 2% on copper, 25% on gold and 2% on all other metals

produced from mines built on Avanco Minerals' Antas North and Pedra Branca

licences. In addition, there is a flat 2% royalty over all metals produced from

any other discoveries within Avanco Minerals' licence area as at the time of the

agreement.

In 2018 we were delighted to report that Avanco Minerals was successfully

acquired by OZ Minerals, an Australian based copper and gold producer, for A$418

million. We are now equally pleased to report that OZ Minerals was acquired by

the world's largest mining company, BHP, in early 2023, with BHP now operating

the assets underlying the royalty. Since our initial US$12 million investment

was made, we have received US$27.1 million in royalty payments, with the royalty

achieving full payback on the initial investment in 3½ years. As at the end of

June 2023, the royalty was valued at £19.4 million (1.5% of the portfolio) which

equates to a 330.8% cash return on the initial US$12 million invested.

In 2021, OZ Minerals achieved a significant milestone and commenced mining of

Pedra Branca ore. Since then we have seen production at Pedra Branca increase,

with the company targeting production of 13kt-16kt of copper and 11koz-13koz of

gold production in 2023 (Source: 2023 guidance, as at end 2022). We continue to

remain optimistic on the longer-term optionality provided by the royalty via the

development of Pedra Branca West, as well as greenfield exploration over the

licence area. Following BHP's acquisition of OZ Minerals in early 2023, BHP is

now the operator of the royalty. BHP's strong operating focus, balance sheet

strength and ESG credentials leaves the Brazilian operations in a very strong

set of hands.

Vale Debentures (2.5% of the portfolio)

At the beginning of 2019, the Company completed a significant transaction to

increase its holding in Vale Debentures. The Debentures consist of a 1.8% net

revenue royalty over Vale's Northern System and Southeastern System iron ore

assets in Brazil, as well as a 1.25% royalty over the Sossego copper mine. The

iron ore assets are world class given their grade, cost position, infrastructure

and resource life, which is well in excess of 50 years.

We currently expect dividend payments to grow once royalty payments commence on

the Southeastern System in 2024 and volumes from S11D and Serra Norte in the

Northern System improve later in 2023 where project ramp-ups have been

challenged in 2022 by licensing. In December, Vale reduced its longer-term iron

ore production profile in light of licensing challenges and also a greater focus

on high grade material. This now sees Vale target modest volume growth from the

Northern System out to 2026. However, the improvement in grade will aid received

pricing which the royalty will benefit from.

The Debentures continue to offer an attractive yield of circa 10.2% based on the

1H-2023 annualised dividend. This is an attractive yield for a royalty

investment, with this value opportunity recognised by other listed royalty

producers Franco-Nevada and Sandstorm Royalties, which have both acquired stakes

in the Debentures since the sell-down occurred in 2021.

Whilst the Vale Debentures are a royalty, they are also a listed security on the

Brazilian National Debentures System. As we have highlighted in previous

reports, shareholders should be aware that historically there has been a low

level of liquidity in the Debentures and price volatility is to be expected. We

continue to actively look for opportunities to grow royalty exposure given it is

a key differentiator of the Company and an effective mechanism to lock-in long

-term income which further diversifies the Company's revenues.

Jetti Resources (2.2% of the portfolio)

In early 2022, the Company made an investment into mining technology company

Jetti Resources (Jetti) which has developed a new catalyst that improves copper

recovery from primary copper sulphides (specifically copper contained in

chalcopyrite, which is often uneconomic) under conventional leach conditions.

Jetti is currently trialling their technology across a number of mines where

they will look to integrate their catalyst into existing heap leach SX-EW

(solvent extraction and electrowinning) mines to improve recoveries at a low

capital cost. The technology has been demonstrated to work at scale at

Capstone's Pinto Valley copper mine, as well as Freeport-McMoRan's Bagdad and El

Abra operations. If Jetti's technology is proven to work at scale, we see

valuation upside with Jetti sharing in the economics of additional copper

volumes recovered through the application of their catalyst.

During the second half of 2022 we were pleased to report that Jetti completed

its Series D financing to raise US$100 million and a substantially higher

valuation than when our investment was made at the beginning of 2022. This sees

the company fully financed to execute on their expected growth plans in the

years ahead.

MCC Mining (0.4% of the portfolio)

MCC Mining operates as a mineral exploration company focused on exploring for

copper in Colombia. The company has several large porphyry targets which we

believe could have significant potential. Shareholders include other mid to

large cap copper miners, which is another indication of the strategic value of

the company. The valuation of the Company is based on the US$170.7 million

equity value implied by the April 2022 equity raise. The money they raised will

fund a drilling campaign, which commenced in Q4 2022 at their Comita project, a

joint venture with Rio Tinto, with drilling on two other projects (Urrao and

Pantanos) commencing during the first half of 2023. Whilst it is still very

early days, initial drilling looks encouraging. Importantly, MCC's three

projects are located in the Forestry Reserve in Colombia which allows for

exploration drilling in the forestry reserve based on new regulations introduced

in Colombia in early 2022.

Derivatives activity

The Company from time to time enters into derivatives contracts, mostly

involving the sale of "puts" and "calls". These are taken to revenue and are

subject to strict Board guidelines which limit their magnitude to an aggregate

10% of the portfolio. In the first half of 2023 income generated from options

was £2.5 million. Volatility levels for most of the period were lower, making

option writing less value accretive to the Company, but nonetheless a number of

opportunities presented themselves allowing healthy levels of income to be

earned. At the end of the period the Company had 0% of the net assets exposed to

derivatives and the average exposure to derivatives during the period was less

than 5% of net assets.

Gearing

At 30 June 2023 the Company had £150.2 million of net debt, with a gearing level

of 9.6%. The debt is held principally in US Dollar rolling short-term loans and

managed against the value of the portfolio as a whole. During the period the

Company reviewed the use of gearing given the sharp increase in rates, which had

an impact on the returns for using debt to make investments. Less debt was used

during the period than in prior years, which softened the impact of the negative

drag on returns during the six months. At present we remain optimistic that, as

some of the macro risks fade, opportunities will present themselves for gearing

levels to rise back to normal levels even though the debt will have a higher

cost. On the back of this, facilities were refreshed with our lenders and remain

at £200 million for the revolving credit facility and £30 million for the

overdraft. The current total cost of debt for the Company remains low at 5.99%

and is linked to SONIA following the demise of LIBOR.

Outlook

The first half of the year was weaker than expected both in absolute terms and

versus the broader market. Valuation multiples compressed alongside lower than

forecast metal prices leading to reduced levels of profitability. As mentioned

previously, we believe these poor returns are due both to the short-term focus

on interest rates and to Chinese economic data. The energy transition appears to

be happening faster than expected with EV car sales beating estimates,

deployment of renewable infrastructure accelerating and corporate

decarbonisation spending becoming mainstream. Supply of materials remains

constrained and growth projects seem to be taking longer and costing more.

In this environment, shareholders should expect the portfolio to remain fully

invested with a focus on stock specific outcomes rather than just market related

factors such as commodity price sensitivity. This approach has delivered strong

results over the last few years and the current mix of holdings has a high

degree of exposure to similar dynamics, which we consider bodes well for the

future.

In addition, the Company will continue to seek out opportunities to maximise

income during the balance of the year in order to try to offset recent

reductions to dividends from core holdings. Achieving this is integral to the

goal of delivering a superior total return for shareholders through the cycle.

Evy Hambro and Olivia Markham

BlackRock Investment Management (UK) Limited

24 August 2023

TEN LARGEST INVESTMENTS

1 ? Vale1,2 (2022: 2nd)

Diversified mining group

Market value: £117,277,000

Share of investments: 9.1% (2022: 9.1%) comprising equity 6.6% and debentures

2.5%

One of the largest mining groups in the world, with operations in 30 countries.

Vale is the world's largest producer of iron ore and iron ore pellets and the

world's largest producer of nickel. The group also produces manganese ore,

ferroalloys, metallurgical and thermal coal, copper, platinum group metals,

gold, silver and cobalt.

2 ? BHP (2022: 1st)

Diversified mining group

Market value: £113,843,000

Share of investments: 8.9% (2022: 9.5%)

The world's largest diversified mining group by market capitalisation. The group

is an important global player in a number of commodities including iron ore,

copper, thermal and metallurgical coal, manganese, nickel, silver and diamonds.

3 ? Glencore (2022: 3rd)

Diversified mining group

Market value: £102,143,000

Share of investments: 8.0% (2022: 7.7%)

One of the world's largest globally diversified natural resources groups. The

group's operations include approximately 150 mining and metallurgical sites and

oil production assets. Glencore's mined commodity exposure includes copper,

cobalt, nickel, zinc, lead, ferroalloys, aluminium, thermal coal, iron ore, gold

and silver.

4 ? Teck Resources (2022: 9th)

Diversified mining group

Market value: £57,999,000

Share of investments: 4.5% (2022: 3.6%)

A diversified mining group headquartered in Canada. The company is engaged in

mining and mineral development with operations and projects in Canada, the US,

Chile and Peru. The group has exposure to copper, zinc, metallurgical coal and

energy.

5 ? Freeport-McMoRan (2022: 8th)

Copper producer

Market value: £50,113,000

Share of investments: 3.9% (2022: 4.0%)

A global mining group which operates large, long-lived, geographically diverse

assets with significant proven and probable reserves of copper, gold and

molybdenum.

6 ?First Quantum Minerals1 (2022: 6th)

Copper producer

Market value: £45,866,000

Share of investments: 3.6% (2022: 4.1%) comprising equity 2.8% and bonds 0.8%

A Canadian-based mining and metals group with principal activities that include

mineral exploration, development and mining. Its main product is copper.

7 ? Newmont Corporation (2022: 18th)

Gold producer

Market value: £40,518,000

Share of investments: 3.2% (2022: 1.9%)

Following the acquisition of Goldcorp in the first half of 2019, Newmont

Corporation is the world's largest gold producer by market capitalisation. The

group has gold and copper operations on five continents, with active gold mines

in Nevada, Australia, Ghana, Peru and Suriname.

8 ? Wheaton Precious Metals (2022: 14th)

Gold producer

Market value: £39,577,000

Share of investments: 3.1% (2022: 2.3%)

One of the world's largest precious metals streaming companies. The company

purchases silver and gold production from mines that it does not own and

operate. The company has streaming agreements with 19 operating mines and 13

development projects worldwide.

9 ? Ivanhoe Electric/I-Pulse1 (2022: 11th)

Copper producer

Market value: £36,296,000

Share of investments: 2.8% (2022: 2.4%) comprising equity 1.9% and bonds 0.9%

An American minerals exploration and development company focused on advancing

their portfolio of electric metals projects located primarily in the United

States. Ivanhoe Electric has a specific focus on sources of electric metals such

as copper, gold, silver and nickel. These metals are essential for the world's

revolutionary transition to an electrified economy. I-Pulse is the former parent

company of Ivanhoe Electric and today retains a minority shareholding interest

in Ivanhoe Electric which was spun-out from the I-Pulse group in 2021.

10 ? ArcelorMittal (2022: 7th)

Steel producer

Market value: £35,172,000

Share of investments: 2.7% (2022: 4.0%)

A multinational steel manufacturing group, with a focus on producing safe `lower

carbon' steel. The group has operations across the globe and is the largest

steel manufacturer in North America, South America and Europe.

1Includes fixed income securities.

2Includes investments held at Directors' valuation.

All percentages reflect the value of the holding as a percentage of total

investments. For this purpose, where more than one class of securities is held,

these have been aggregated.

Together, the ten largest investments represented 49.8% of total investments of

the Company's portfolio as at 30 June 2023 (ten largest investments as at 31

December 2022: 54.3%).

INVESTMENTS AS AT 30 JUNE 2023

Main Market % of

geographical value investments

exposure £'000

Diversified

Vale Global 85,198 } 9.1

Vale Global 32,079

Debentures*#^

BHP Global 113,843 8.9

Glencore Global 102,143 8.0

Teck Resources Global 57,999 4.5

Rio Tinto Global 33,766 2.6

Anglo American Global 30,267 2.4

Trident Global 5,214 0.4

--------------- ---------------

460,509 35.9

========= =========

Copper

Freeport Global 50,113 3.9

-McMoRan

First Quantum Global 45,866 3.6

Minerals*

Ivanhoe United States 24,125 } 2.8

Electric

I-Pulse* United States 12,171

Jetti Global 28,264 2.2

Resources#

Ivanhoe Mines Other Africa 27,768 2.2

BHP Brazil Latin America 19,350 1.5

Royalty#

Sociedad Latin America 16,107 1.3

Minera Cerro

Verde

Develop Global Australasia 15,432 1.2

Lundin Mining Global 10,197 0.8

Ero Copper Latin America 8,805 0.7

Solaris Latin America 7,823 0.6

Resources

CSA Cobar Australasia 6,852 0.5

Mine#

Foran Mining# Canada 5,876 0.5

MCC Mining# Latin America 5,506 0.4

Aurubis Global 5,095 0.4

Filo Mining# Latin America 4,179 0.3

Antofagasta Latin America 2,284 0.2

MTAL Founders Australasia 347 -

Shares#

--------------- ---------------

296,160 23.1

========= =========

Gold

Newmont Global 40,518 3.2

Corporation

Wheaton Global 39,577 3.1

Precious

Metals

Newcrest Australasia 30,243 2.4

Mining

Franco-Nevada Global 28,470 2.2

Barrick Gold Global 26,708 2.1

Northern Star Australasia 17,663 1.4

Resources

Endeavour Other Africa 9,675 0.8

Mining

Agnico Eagle Canada 5,992 0.5

Mines

Polymetal United Kingdom 1,842 0.1

International

Polyus Russia - -

--------------- ---------------

200,688 15.8

========= =========

Industrial

Minerals

Sigma Lithium Latin America 21,826 1.7

Albemarle Global 21,182 1.6

Mineral Australasia 16,236 1.3

Resources

Iluka Australasia 12,963 1.0

Resources

Chalice Mining Australasia 8,298 0.6

Lynas Rare Australasia 8,247 0.6

Earths

Sociedad Latin America 8,153 0.6

Quimica y

Minera ADR

Sheffield Australasia 5,463 0.4

Resources

--------------- ---------------

102,368 7.8

========= =========

Steel

ArcelorMittal Global 35,172 2.7

Steel Dynamics United States 23,507 1.8

Nucor United States 20,668 1.6

Stelco Canada 6,989 0.5

Holdings

--------------- ---------------

86,336 6.6

========= =========

Aluminium

Norsk Hydro Global 30,431 2.4

Alcoa Global 9,033 0.7

--------------- ---------------

39,464 3.1

========= =========

Platinum Group

Metals

Bravo Mining Latin America 21,825 1.7

Northam Global 3,456 0.3

Platinum

Impala South Africa 2,170 0.2

Platinum

Sibanye South Africa 1,169 0.1

Stillwater

--------------- ---------------

28,620 2.3

========= =========

Iron Ore

Labrador Iron Canada 12,994 1.0

Champion Iron Canada 10,238 0.8

Deterra Australasia 4,852 0.4

Royalties

Equatorial Other Africa 259 -

Resources

--------------- ---------------

28,343 2.2

========= =========

Uranium

Cameco Canada 14,083 1.1

--------------- ---------------

14,083 1.1

========= =========

Mining

Services

Woodside Australasia 7,819 0.6

Energy Group

Epiroc Global 6,082 0.5

--------------- ---------------

13,901 1.1

========= =========

Nickel

Nickel Indonesia 11,679 0.9

Industries

Bindura Nickel Global 40 -

Lifezone SPAC Global - -

Commitment#

--------------- ---------------

11,719 0.9

========= =========

Zinc

Titan Mining United States 1,667 0.1

--------------- ---------------

1,667 0.1

--------------- ---------------

Comprising: 1,283,858 100.0

========= =========

- Investments 1,283,858 100.0

--------------- ---------------

1,283,858 100.0

========= =========

*Includes fixed income securities.

#Includes investments held at Directors' valuation.

Includes mining royalty contract.

^The investment in the Vale debenture is illiquid and has been valued using

secondary market pricing information provided by the Brazilian Financial and

Capital Markets Association (ANBIMA).

All investments are in equity shares unless otherwise stated.

The total number of investments as at 30 June 2023 (including options classified

as liabilities on the balance sheet) was 66 (31 December 2022: 68).

As at 30 June 2023 the Company did not hold any equity interests in companies

comprising more than 3% of a company's share capital.

PORTFOLIO ANALYSIS AS AT 30 JUNE 2023

Commodity Exposure1

+---------------------+---------+----------+----------------+

| |2023 |2022 |2023 |

| |portfolio|portfolio#|reference index*|

+---------------------+---------+----------+----------------+

|Diversified |35.9% |40.0% |34.2% |

+---------------------+---------+----------+----------------+

|Copper |23.1% |22.0% |11.6% |

+---------------------+---------+----------+----------------+

|Gold |15.6% |13.0% |22.2% |

+---------------------+---------+----------+----------------+

|Industrial Minerals |8.0% |6.5% |2.1% |

+---------------------+---------+----------+----------------+

|Steel |6.7% |8.1% |19.6% |

+---------------------+---------+----------+----------------+

|Aluminium |3.1% |3.3% |3.1% |

+---------------------+---------+----------+----------------+

|Platinum Group Metals|2.2% |2.0% |1.6% |

+---------------------+---------+----------+----------------+

|Iron Ore |2.2% |3.1% |3.9% |

+---------------------+---------+----------+----------------+

|Uranium |1.1% |0.4% |0.0% |

+---------------------+---------+----------+----------------+

|Mining Services |1.1% |0.4% |0.1% |

+---------------------+---------+----------+----------------+

|Nickel |0.9% |0.8% |0.1% |

+---------------------+---------+----------+----------------+

|Zinc |0.1% |0.1% |0.3% |

+---------------------+---------+----------+----------------+

|Other& |0.0% |0.3% |1.2% |

+---------------------+---------+----------+----------------+

1Based on index classifications.

#Represents exposure at 31 December 2022.

*MSCI ACWI Metals & Mining 30% Buffer 10/40 Index (net total return).

&Represents a very small exposure.

+------------------------------+-----+

|Geographic Exposure1 |2023 |

+------------------------------+-----+

|Global |65.6%|

+------------------------------+-----+

|Australasia |10.4%|

+------------------------------+-----+

|Latin America |9.0% |

+------------------------------+-----+

|Other2 |7.3% |

+------------------------------+-----+

|Canada |4.4% |

+------------------------------+-----+

|Other Africa (ex South Africa)|3.0% |

+------------------------------+-----+

|South Africa |0.3% |

+------------------------------+-----+

+------------------------------+-----+

| |2022 |

+------------------------------+-----+

|Global |69.2%|

+------------------------------+-----+

|Australasia |9.0% |

+------------------------------+-----+

|Latin America |7.5% |

+------------------------------+-----+

|Other2 |7.1% |

+------------------------------+-----+

|Canada |4.1% |

+------------------------------+-----+

|Other Africa (ex South Africa)|2.4% |

+------------------------------+-----+

|South Africa |0.7% |

+------------------------------+-----+

1Based on the principal commodity exposure and place of operation of each

investment.

2Consists of Indonesia, Russia, United Kingdom and United States.

INTERIM MANAGEMENT REPORT AND RESPONSIBILITY STATEMENT

The Chairman's Statement and the Investment Manager's Report above give details

of the important events which have occurred during the period and their impact

on the financial statements.

Principal risks and uncertainties

The principal risks faced by the Group can be divided into various areas as

follows:

-Counterparty;

-Investment performance;

-Legal and regulatory compliance;

-Market;

-Political;

-Operational; and

-Financial.

The Board reported on the principal risks and uncertainties faced by the Group

in the Annual Report and Financial Statements for the year ended 31 December

2022. A detailed explanation can be found in the Strategic Report on pages 43 to

46 and note 18 on pages 113 to 131 of the Annual Report and Financial Statements

which is available on the website maintained by BlackRock at

www.blackrock.com/uk/brwm.

In the view of the Board, there have not been any changes to the fundamental

nature of the principal risks and uncertainties since the previous report and

these are equally applicable to the remaining six months of the financial year

as they were to the six months under review.

Going concern

The Directors, having considered the nature and liquidity of the portfolio, the

Group's investment objective and the Group's projected income and expenditure,

are satisfied that the Group has adequate resources to continue in operational

existence for the foreseeable future and is financially sound. The Board

believes that the Group and its key third-party service providers have in place

appropriate business continuity plans and these services have continued to be

supplied without interruption.

The Group has a portfolio of investments which are predominantly readily

realisable and is able to meet all of its liabilities from its assets and income

generated from these assets. Accounting revenue and expense forecasts are

maintained and reported to the Board regularly and it is expected that the Group

will be able to meet all its obligations. Borrowings under the overdraft and

revolving credit facilities shall at no time exceed £230 million or 25% of the

Group's net asset value (whichever is the lower) and this covenant was complied

with during the period.

Ongoing charges for the year ended 31 December 2022 were approximately 0.95% of

net assets and this is unlikely to change significantly going forward. Based on

the above, the Board is satisfied that it is appropriate to continue to adopt

the going concern basis in preparing the financial statements.

Related party disclosure and transactions with the Manager

BlackRock Fund Managers Limited (BFM) was appointed as the Company's Alternative

Investment Fund Manager (AIFM) with effect from 2 July 2014. BFM has (with the

Company's consent) delegated certain portfolio and risk management services, and

other ancillary services, to BlackRock Investment Management (UK) Limited (BIM

(UK)). Both BFM and BIM (UK) are regarded as related parties under the Listing

Rules. Details of the management and marketing fees payable are set out in notes

4 and 5 respectively and note 13 below.

The related party transactions with the Directors are set out in note 14 below.

Directors' responsibility statement

The Disclosure Guidance and Transparency Rules (DTR) of the UK Listing Authority

require the Directors to confirm their responsibilities in relation to the

preparation and publication of the Interim Management Report and Financial

Statements.

The Directors confirm to the best of their knowledge that:

-the condensed set of financial statements contained within the Condensed Half

Yearly Financial Report has been prepared in accordance with UK-adopted

International Accounting Standard 34 Interim Financial Reporting; and

-the Interim Management Report, together with the Chairman's Statement and

Investment Manager's Report, include a fair review of the information required

by 4.2.7R and 4.2.8R of the Financial Conduct Authority Disclosure Guidance and

Transparency Rules.

This Condensed Half Yearly Financial Report has been reviewed by the Company's

auditors and their report is set out in the Half Yearly Financial Report.

The Condensed Half Yearly Financial Report was approved by the Board on 24

August 2023 and the above responsibility statement was signed on its behalf by

the Chairman.

David Cheyne

For and on behalf of the Board

24 August 2023

FINANCIAL STATEMENTS

CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME FOR THE SIX MONTHSED 30 JUNE

2023

Six months Six months

Year

ended ended

ended

30 June 30 June

31

2023 2022

December

(unaudited) (unaudited)

2022

(audited)

Notes Revenue Capital Total Revenue Capital

Total Revenue Capital Total

£'000 £'000 £'000 £'000 £'000

£'000 £'000 £'000 £'000

Income from 3 34,111 630 34,741 39,251 -

39,251 78,087 811 78,898

investments

held

at fair

value

through

profit or

loss

Other 3 2,891 - 2,891 2,472 -

2,472 7,909 - 7,909

income

----------- --------- --------- ----------- -------- -

------- --------- -------- --------

---- ------ ------ ---- ------- -

------ ------ ------- ------

Total 37,002 630 37,632 41,723 -

41,723 85,996 811 86,807

revenue

========= ======== ======== ========= ========

======== ======== ======== ========

Net - (123,495) (123,495) - (30,608)

(30,608) - 152,937 152,937

(loss)/profi

t

on

investments

held

at fair

value

through

profit or

loss

Net - 8,301 8,301 - (16,160)

(16,160) - (17,645) (17,645)

profit/(loss

)

on foreign

exchange

----------- --------- --------- ----------- -------- -

------- --------- -------- --------

---- ------ ------ ---- ------- -

------ ------ ------- ------

Total 37,002 (114,564) (77,562) 41,723 (46,768)

(5,045) 85,996 136,103 222,099

======== ======== ======== ======== ========

======== ======== ======== ========

Expenses

Investment 4 (1,171) (3,622) (4,793) (1,279) (3,949)

(5,228) (2,615) (8,031) (10,646)

management

fee

Other 5 (644) (11) (655) (532) (7)

(539) (1,037) (28) (1,065)

operating

expenses

----------- --------- --------- ----------- -------- -

------- --------- -------- --------

---- ------ ------ ---- ------- -

------ ------ ------- ------

Total (1,815) (3,633) (5,448) (1,811) (3,956)

(5,767) (3,652) (8,059) (11,711)

operating

expenses

========= ======== ======== ========= ========

======== ======== ======== ========

Net 35,187 (118,197) (83,010) 39,912 (50,724)

(10,812) 82,344 128,044 210,388

profit/(loss

)

on ordinary

activities

before

finance

costs and

taxation

Finance 6 (1,121) (3,432) (4,553) (306) (891)

(1,197) (1,182) (3,520) (4,702)

costs

----------- --------- --------- ----------- -------- -

------- --------- -------- --------

---- ------ ------ ---- ------- -

------ ------ ------- ------

Net 34,066 (121,629) (87,563) 39,606 (51,615)

(12,009) 81,162 124,524 205,686

profit/(loss

)

on ordinary

activities

before

taxation

Taxation (2,299) 1,212 (1,087) (2,458) 804

(1,654) (5,149) 1,883 (3,266)

(charge)/cre

dit

----------- --------- --------- ----------- -------- -

------- --------- -------- --------

---- ------ ------ ---- ------- -

------ ------ ------- ------

Net 8 31,767 (120,417) (88,650) 37,148 (50,811)

(13,663) 76,013 126,407 202,420

profit/(loss

)

on ordinary

activities

after

taxation

========= ======== ======== ========= ========

======== ======== ======== ========

Earnings/(lo 8 16.73 (63.40) (46.67) 20.07 (27.45)

(7.38) 40.68 67.64 108.32

ss)

per

ordinary

share

(pence) -

basic

and diluted

========= ======== ======== ========= ========

======== ======== ======== ========

The total columns of this statement represent the Group's Statement of

Comprehensive Income, prepared in accordance with UK-adopted International

Accounting Standards (IASs). The supplementary revenue and capital accounts are

both prepared under guidance published by the Association of Investment

Companies (AIC). All items in the above statement derive from continuing

operations. No operations were acquired or discontinued during the period. All

income is attributable to the equity holders of the Group.

The Group does not have any other comprehensive income/(loss) (30 June 2022:

£nil; 31 December 2022: £nil). The net profit/(loss) for the period disclosed

above represents the Group's total comprehensive income/(loss).

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY FOR THE SIX MONTHSED 30 JUNE

2023

Note Called Share Capital Special Capital

Revenue Total

up share premium redemption reserve reserves

reserve £'000

capital account reserve £'000 £'000

£'000

£'000 £'000 £'000

For the six

months ended

30

June 2023

(unaudited)

At 31 9,651 148,107 22,779 180,736 868,837

69,175 1,299,285

December 2022

Total

comprehensive

income:

Net - - - - (120,417)

31,767 (88,650)

(loss)/profit

for the

period

Transactions

with owners,

recorded

directly to

equity:

Ordinary - 3,386 - 12,305 - -

15,691

shares

reissued

from treasury

Share reissue - - - (31) - -

(31)

costs

Dividends 7 - - - - -

(54,877) (54,877)

paid1

--------- --------- ---------- --------- --------- ---

------ ---------

------ ------ ----- ------ ------ ---

--- ------

At 30 June 9,651 151,493 22,779 193,010 748,420

46,065 1,171,418

2023

========= ========= ========= ========= =========

========= =========

For the six

months ended

30

June 2022

(unaudited)

At 31 9,651 138,818 22,779 155,123 742,430

74,073 1,142,874

December 2021

Total

comprehensive

income:

Net - - - - (50,811)

37,148 (13,663)

(loss)/profit

for the

period

Transactions

with owners,

recorded

directly to

equity:

Ordinary - 8,752 - 21,708 - -

30,460

shares

reissued

from treasury