TIDMEAAS

RNS Number : 4228A

eEnergy Group PLC

22 January 2024

THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION FOR THE PURPOSES

OF ARTICLE 7 OF REGULATION 2014/596/EU AS IT FORMS PART OF THE LAW

OF ENGLAND AND WALES BY VIRTUE OF THE EUROPEAN UNION (WITHDRAWAL)

ACT 2018.

22 January 2024

eEnergy Group plc

("eEnergy", "the Company" or "the Group")

Disposal of Energy Management Division

and

Notice of General Meeting to approve the Disposal

eEnergy (AIM: EAAS), the net zero digital energy services

provider, is pleased to announce that it has entered into an

agreement to sell the Company's wholly owned energy management

division (the "Energy Management Division") to Flogas Britain

Limited ("Flogas") for initial consideration of GBP29.1 million

(the "Transaction" or "Disposal"), and additional contingent

consideration based on the trading performance of the Energy

Management Division for the period to 30 September 2025.

Flogas is part of DCC Energy and a subsidiary of DCC plc, a

leading international sales, marketing and support services

group.

Highlights:

-- Initial total consideration of GBP29.1 million, comprising

GBP25.0 million cash ("Initial Cash Consideration) being received

by the Group with the balance of GBP4.1 million being used to repay

amounts due from the Group to the Energy Management Division

-- Initial Cash Consideration will be paid on completion

following approval of the Transaction by eEnergy shareholders at a

General Meeting to be held on or about 7 February 2024

-- Initial total consideration equates to an enterprise value of

GBP30 million after customary adjustments reflecting net debt and

normalised working capital

-- Additional contingent consideration, estimated by the Company

to be in the range of GBP8 million to GBP10 million, subject to the

Energy Management Division achieving strong growth in line with its

business plan, linked to net cash generated by the Energy

Management Division from completion to 30 September 2025 (the

"Earnout Period"),

-- Net proceeds will be used to pay down the Group's debt

facilities of GBP8.1 million in full, to reinvest into high growth

energy services division which grew 87% in the 12-month period up

to 30 June 2023 and for general working capital purposes

-- Transaction delivers an immediate return on GBP23.4 million

invested into the Energy Management Division since December 2020,

with potential to benefit from the performance of the division

through the Earnout Period

-- Disposal unlocks significant value for shareholders and will

enable eEnergy to focus on its dedicated energy services business,

driving the continued roll out of its EV and Solar products and

enabling investment into other high growth opportunities

-- Strengthened balance sheet will remove cash constraints which

have held back growth in recent periods, as a result of which the

Board currently expect trading for the period to 31 December 2023

to be at the lower end of market expectations.

The Company expects to announce a trading update for the

18-month period ended 31 December 2023 in the second half of

February 2024.

Harvey Sinclair, eEnergy CEO, comments: "I am pleased to

announce this agreement to sell our Energy Management Division to

Flogas. Once approved by Shareholders, the Transaction will unlock

significant immediate cash for eEnergy and give the opportunity to

deliver significant additional value to shareholders through the

Earnout Period. Whilst Energy Management is the smaller by revenue

of our two divisions, the initial transaction proceeds alone will

be c. 90% of eEnergy's current market capitalisation.

"The sale of the Energy Management Division will allow us to

focus entirely on our similar sized, high growth Energy Services

Division which grew 87% in the past 12 month period despite being

undercapitalised. The sale will simplify our business, strengthen

our balance sheet and will bring the opportunity to invest further

in the higher growth segments of Solar and EV Charging across the

UK.

"I would like to thank our colleagues in the Energy Management

Division. They will have an excellent new owner in Flogas who is in

an ideal position to take the business forward."

Ivan Trevor, Managing Director, Flogas Britain comments: "Flogas

are delighted to welcome the Energy Management Division of eEnergy

Group plc to DCC Energy. Together with Certas and the recent

acquisitions of Protech, Centreco and DTGen, this acquisition

further expands our capability in energy management services,

providing a comprehensive range of products and services to partner

with our customers on their journey to Net Zero and supporting our

ambition to halve the carbon emissions of the energy we supply by

2030. "

Background to the Transaction

As announced on 8 November 2023, in early 2023, the Board

received a number of unsolicited approaches expressing an interest

in acquiring the Energy Management Division. As a result, the Board

engaged professional advisers to conduct a strategic review of the

Energy Management Division and evaluate these approaches.

Following further evaluation of these approaches, the Board

resolved that the offer from Flogas represented the best option to

unlock significant potential value for shareholders. In coming to

this decision, the Board also recognised the long-term proposition

to create further value for the Group by re-investing the net

proceeds into its high growth energy services division ("Energy

Services Division").

Both the Group's Energy Management Division and Energy Services

Division are high growth businesses with strong market positions in

attractive growth markets. The Energy Management Division, for the

12-month interim period to 30 June 2023, reported revenues of

GBP13.6 million (up 17% on FY 2022) and Adj EBITDA* of GBP4.4

million (up 20% on FY 2022).

The Initial Cash Consideration of GBP25.0 million delivers an

immediate return on the GBP23.4 million invested into the Energy

Management Division since the initial acquisition of Beond Group

Limited in December 2020. As at 30 June 2023 the reported unaudited

net asset value in the Group of the Energy Management Division was

GBP26.7 million (including goodwill created on acquisition).

Payments of contingent consideration through the Earnout Period

(estimated by the Company to be in the range of GBP8 million to

GBP10 million, subject to the Energy Management Division achieving

strong growth in line with its business plan ) would further

enhance returns to eEnergy Group shareholders.

Going forward, eEnergy will focus on accelerating growth in the

Energy Services Division, supported by re-investment of t he

majority of the cash received, following debt paydown. During the

same 12-month period to 30 June 2023, the Energy Services Division

reported revenues of GBP19.5 million and Adj EBITDA* of GBP2.3

million, up 87% and 131% respectively on FY 2022, demonstrating

significant and growing demand.

* Adj EBITDA is Earnings before interest, tax, depreciation and

amortisation, excluding exceptional items. Exceptional Items are

those items which, in the opinion of the Directors, should be

excluded in order to provide a consistent and comparable view of

the underlying performance of the Energy Management Division's

ongoing business and include transaction related items,

restructuring and integration costs .

Transaction and Use of Proceeds

The Transaction will be effected through the sale of the entire

issued share capitals of eEnergy Consultancy Limited, eEnergy

Insights Limited and eEnergy Management Limited (the "EM

Subsidiaries"). Completion is expected to occur, subject to

shareholder approval as detailed further below, within three

business days of the General Meeting ("Completion").

The Initial Cash Consideration, payable by Flogas on Completion,

will be GBP25 million. Under the terms of the Transaction

agreement, a further GBP4.1 million of the initial consideration

will be used to repay amounts due from the Group to the Energy

Management Division, bringing the initial total consideration to

GBP29.1 million. The Initial Consideration reflects an estimate of

the financial position of the EM Subsidiaries at Completion and may

be subject to certain subsequent adjustments to take account of the

actual financial position of the EM Subsidiaries at Completion,

with the intention that they are being sold on a debt free/cash

free basis and with a normalised level of working capital. In

addition, further amounts in relation to certain historical

contingent liabilities of the EM Subsidiaries may be paid to

eEnergy as additional consideration to the extent that such

liabilities do not crystallise.

As set out in its latest interim results, the Board identified a

need to strengthen the Group's balance sheet.

Part of the Initial Cash Consideration will be applied to the

repayment of the Group's debt facilities with HSBC Innovation

Finance (previously known as Silicon Valley Bank) in the amount of

GBP5m and which are due for repayment in February 2024, and its

other subordinated debt comprising secured discounted capital

bonds, also due for repayment in May 2024. The repayment of these

aggregate GBP8.1 million of Group borrowings (inclusive of accrued

interest) will significantly strengthen the balance sheet, making

the Group debt free. The Company has continued discussions with

various parties as an alternative option to refinance these

facilities. In the unlikely event that the Disposal did not proceed

for any reason, the Directors are confident that the Company would

be able to extend its debt facilities to allow those alternative

options to be concluded and would be required to strengthen the

balance sheet on a timely basis to support the growth in the

Group's combined operations and for general working capital

purposes.

The balance of the net proceeds of the Initial Cash

Consideration will be reinvested to support accelerated growth in

the Energy Services Division, including through retaining increased

interests in long-term revenue generating assets to improve overall

returns to the Group.

As part of the Transaction, further contingent cash

consideration may also be payable on the following basis and

subject to the EM Subsidiaries delivering an agreed minimum level

of earnings during the period:

-- an amount equal to the free cashflow generation from the EM

Subsidiaries (excluding the impact of My ZeERO from completion to

30 September 2025; and

-- a payment per successfully completed My ZeERO Installation during the same period as above.

The contingent consideration is estimated by the Company to be

in the range of GBP8 million to GBP10 million, subject to the

Energy Management Division achieving strong growth in line with its

business plan, and is capped at GBP20 million.

Any contingent consideration will be payable in two instalments,

covering the period from completion to 30 September 2024, and the

12-month period to 30 September 2025.

The Group has provided certain warranties and indemnities to

Flogas regarding, inter alia, the business and tax affairs of the

Energy Management Division and has entered into certain restrictive

covenants.

On Completion, the Company will enter into certain agreements,

as set out below:

-- The Company and Flogas will enter into a transitional

services agreement ("TSA") under which the Company will provide

Flogas with certain services as previously provided by the Company

to the Energy Management Division; and Flogas will provide the

Company with certain reverse services as previously provided by the

Energy Management Division to the Group. Under the terms of the

TSA, the parties will migrate the relevant services as soon as

reasonably practicable and in any event both parties must migrate

and cease to use the services within 12 months of Completion.

-- The Company and the EM Subsidiaries will enter into a brand

licence agreement, under which the Company will grant the EM

Subsidiaries a non-exclusive, royalty-free, non-transferable

licence to use certain trademarks owned by the Company, for a

period of two years from Completion, for the purpose of the EM

Subsidiaries carrying on each of their respective businesses.

-- The Company and EML will also enter into a cross-referral and

licensing agreement (the "CLA"), under which the Company and EML

shall cross-refer the other party's services to their own client

base with a referral fee being paid for successful referrals. EML

shall licence to the Company the use of MY ZeERO, including the

right permit the Company to sell up to an agreed number of MY ZeERO

eMeters per year to its client base. The CLA is for an initial

period of two years, following which it may be extended further by

mutual agreement. The CLA provides for non-compete provisions

between the Company and EML, in which the Company and EML are

prohibited from canvassing, soliciting or endeavouring to sell to

or entice away any person who is or was a client of the other party

in respect of the relevant services as at the date of the CLA.

Strategy of the continuing Group following the Disposal

The Disposal will allow the Group to focus entirely on its high

growth Energy Services Division, which grew 87% in the past

12-month period despite being undercapitalised. The Disposal will

simplify the Group's business, strengthen its balance sheet and

will bring the opportunity to invest further in the higher growth

segments of solar and EV charging across the UK.

Notice of General Meeting

In view of the size of the Energy Management Division relative

to the Company, the Disposal will result in a fundamental change in

the business of the Company for the purpose of Rule 15 of the AIM

Rules and it is therefore conditional upon the approval of

Shareholders, amongst other matters.

Accordingly, that approval will be sought at a general meeting

of the Company to be held at 9.00 am on or about 7 February 2024 at

Fieldfisher's offices, 9th Floor, Riverbank House, 2 Swan Lane,

London EC4R 3TT, United Kingdom (the "General Meeting").

Certain Shareholders (which include the following Directors:

Nigel Burton, Crispin Goldsmith, Andrew Lawley, David Nicholl,

Harvey Sinclair and Gary Worby) have irrevocably undertaken to vote

or procure to vote in favour of the resolution to be proposed at

the General Meeting in respect of 165,902,704 Ordinary Shares, in

aggregate, representing approximately 42.8% of the issued ordinary

share capital of the Company.

The Directors believe that the Transaction will promote the

success of the Company for the benefit of shareholders as a whole.

Accordingly, they unanimously recommend shareholders vote in favour

of the resolution to approve the Disposal at the General Meeting as

they have irrevocably undertaken to do in respect of their own

beneficial holdings, amounting to (in aggregate) 39,185,333

Ordinary Shares representing 10.1% of the share capital of the

Company.

Shareholders are reminded that the Disposal is conditional,

amongst other things, on the passing of the Resolution to be

proposed at the General Meeting. Should the Resolution not be

passed, the Disposal will not proceed. In such an event, the

Company would be required to settle Flogas' third party costs and

expenses relating to the Disposal, capped at GBP0.9 million.

A circular containing the notice of the General Meeting will be

made available shortly on the Company's website at

www.eenergyplc.com .

Analyst and Investor Call

Following completion, Harvey Sinclair, CEO, and Crispin

Goldsmith, CFO, will be hosting an online presentation, open to all

existing and potential shareholders via Investor Meet Company the

day after Completion. Questions can be submitted pre-event via the

Investor Meet Company dashboard up until 9.00 am the day before the

meeting or at any time during the live presentation.

Investors can sign up to Investor Meet Company for free and add

to meet eEnergy Group plc via:

https://www.investormeetcompany.com/eenergy-group-plc/register-investor

eEnergy will also be hosting an online analyst briefing on the

morning after Completion at 11.00 am. Analysts wishing to attend

should contact eEnergy@tavistock.co.uk to register.

For further information, please visit www.eenergyplc.com or

contact:

eEnergy Group plc Tel: +44 20 7078 9564

Harvey Sinclair, Chief Executive info@eenergyplc.com

Officer

Crispin Goldsmith, Chief Financial

Officer

Strand Hanson Limited (Nominated Tel: +44 20 7409 3494

Adviser)

Richard Johnson, James Harris

Canaccord Genuity Limited (Joint Tel: +44 20 7523 8000

Broker)

Max Hartley, Harry Pardoe (Corporate

Broking)

Turner Pope Investments (Joint Tel: +44 20 3657 0050

Broker)

Andy Thacker, James Pope info@turnerpope.com

Tavistock Tel: +44 207 920 3150

Jos Simson, Simon Hudson, Katie eEnergy@tavistock.co.uk

Hopkins

About eEnergy Group plc

eEnergy (AIM: EAAS) is a net zero energy services provider,

empowering organisations to achieve net zero by tackling energy

waste and transitioning to clean energy, without the need for

upfront investment. It is making net zero possible and profitable

for all organisations in four ways:

-- Transition to the lowest cost clean energy through the

Group's digital procurement platform and energy management

services.

-- Tackle energy waste with granular data and insight on

energy use and dynamic energy management.

-- Reduce energy use with the right energy efficiency solutions

without upfront cost.

-- Reach net zero with onsite renewable generation and

electric vehicle (EV) charging.

eEnergy is a Top 5 B2B energy company and has been awarded the

Green Economy Mark by London Stock Exchange.

About Flogas Britain Limited

Flogas is one of the largest distributors of off-grid energy in

the UK and has over 30 years' experience of providing innovative

energy solutions to both commercial and domestic customers. The

business is at the forefront of the energy transition having

developed a prominent track record in converting customers from

higher emissions fuels to lower carbon and cleaner solutions for

the last decade.

Headquartered in Leicestershire, Flogas has revenues in excess

of GBP300 million and employs over 1,200 people across its

multi-sited operation across Britain.

-ends-

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

DISDXGDBRUDDGSB

(END) Dow Jones Newswires

January 22, 2024 02:00 ET (07:00 GMT)

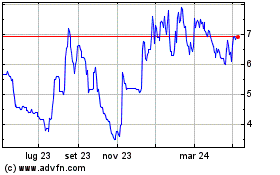

Grafico Azioni Eenergy (LSE:EAAS)

Storico

Da Nov 2024 a Dic 2024

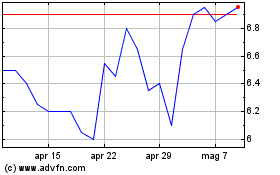

Grafico Azioni Eenergy (LSE:EAAS)

Storico

Da Dic 2023 a Dic 2024