Fidelity China Special Situations Plc Proposed Combination with abrdn China Investment Company

28 Novembre 2023 - 8:00AM

UK Regulatory

TIDMFCSS

NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION, DIRECTLY OR INDIRECTLY, IN WHOLE

OR IN PART, IN, INTO OR FROM THE UNITED STATES OF AMERICA (INCLUDING ITS

TERRITORIES AND POSSESSIONS, ANY STATE OF THE UNITED STATES AND THE DISTRICT OF

COLUMBIA), AUSTRALIA, CANADA, JAPAN, NEW ZEALAND, THE REPUBLIC OF SOUTH AFRICA,

ANY MEMBER STATE OF THE EEA OR ANY OTHER JURISDICTION IN WHICH THE SAME WOULD BE

UNLAWFUL.

This announcement is not an offer to sell, or a solicitation of an offer to

acquire, securities inthe United Statesor in any other jurisdiction in which the

same would be unlawful. Neither this announcement nor any part of it shall form

the basis of or be relied on in connection with or act as an inducement to enter

into any contract or commitment whatsoever.

28 November 2023

Fidelity China Special Situations PLC

Legal Entity Identifier: 54930076MSJ0ZW67JB75

Proposed Combination with abrdn China Investment Company Limited

Introduction

The Board of Fidelity China Special Situations PLC (the "Company" or "FCSS") is

pleased to announce that it has agreed heads of terms with the Board of abrdn

China Investment Company Limited ("ACIC") in respect of a proposed combination

of ACIC with the Company. The combination, if approved by the companies'

respective shareholders, will be effected by way of a Guernsey scheme of

reconstruction and winding up of ACIC (the "Scheme") and the associated transfer

of part of the cash, assets and undertaking of ACIC to the Company in exchange

for the issue of new ordinary shares in the Company ("New FCSS Shares")

(together the "Proposals").

Following implementation of the Proposals, the enlarged FCSS will continue to be

managed, in accordance with its existing investment objective and policy, by FIL

Investment Management (Hong Kong) Limited with Dale Nicholls continuing as the

named portfolio manager.

The Board of the Company believes that, if the Proposals are implemented, FCSS

shareholders will benefit from, amongst other things, the economies of scale

that are expected to result from the enlarged asset base, including improved

market liquidity in FCSS shares (including in relation to its existing share

buyback policy) and cost efficiencies.

The Proposals will be subject to approval by the shareholders of both FCSS and

ACIC in addition to regulatory and tax approvals.

Summary of the Scheme

The Proposals will be effected by way of a Guernsey scheme of reconstruction of

ACIC, resulting in the voluntary winding up of ACIC and the transfer of part of

ACIC's cash, assets and undertaking to FCSS on a formula asset value ("FAV") for

FAV basis.

Under the Scheme, ACIC shareholders will be deemed to have elected to receive

New FCSS Shares in respect of their ACIC shares unless they elect to receive

cash in respect of some or all of their ACIC shares (the "Cash Option").

The Cash Option is limited to 33 per cent. of ACIC's shares in issue (excluding

treasury shares). Should total elections for the Cash Option exceed this 33 per

cent. threshold, excess elections for the Cash Option will be scaled back into

New FCSS Shares on a pro rata basis.

The Cash Option will be offered at a discount of 2 per cent. to the ACIC FAV per

share (less the further costs of any realisations required to fund the cash

pool) (the "Cash Discount"). The benefit of the Cash Discount will be credited

towards the interests of the ACIC shareholders rolling over their shareholdings

in ACIC into the enlarged FCSS.

The Scheme will be subject to approval by the shareholders of both companies in

addition to regulatory and tax approvals. In accordance with customary practice

for such transactions involving investment trusts, the City Code on Takeovers

and Mergers is not expected to apply to the Scheme. A timetable and further

details of the Scheme will be announced in due course.

Benefits of the Proposals

The Board believes that, if implemented, the Proposals will have a number of

benefits for FCSS shareholders, including:

· Scale and enhanced profile: the enlarged FCSS is expected to have net assets

of approximately £1.2 billion (as at 28 November 2023). As the flagship UK

closed ended vehicle for investment in China and a constituent of the FTSE 250

Index, it is expected that the enlarged FCSS would benefit from enhanced profile

and marketability.

· Enhanced liquidity: the scale of the enlarged FCSS, as the largest and most

liquid company in the sector, is expected to further improve secondary market

liquidity for the Company's shareholders (including in relation to its share

buyback policy).

· Shareholder register: the implementation of the Proposals would allow a

number of shareholders to consolidate their holdings across FCSS and ACIC whilst

also creating a more diversified shareholder base through a combination of the

two share registers.

· Lower ongoing charges: the enlarged FCSS would be expected to benefit from a

lower ongoing expense ratio with the Company's fixed costs being spread over a

larger asset base.

· Contribution to costs: the Company's alternative investment fund manager,

FIL Investment Services (UK) Limited ("Fidelity"), is willing to make a material

cost contribution in respect of the Proposals, which is expected to offset the

direct transaction costs for FCSS shareholders.

· Lower tiered management fee: Fidelity has agreed that, with effect from the

admission to listing and trading of the New FCSS Shares, the base management fee

payable by the Company under the investment management agreement will be reduced

to 0.65 per cent. (currently 0.70 per cent.) in respect of the Company's net

assets in excess of £1.5 billion.

Costs of the Proposals and Fidelity Contribution

Each company intends to bear its own costs incurred in relation to the

Proposals.

As noted above, Fidelity has undertaken to make a material contribution towards

the costs of the Proposals of £500,000 plus an amount equal to eight months of

management fees in respect of the assets to be transferred from ACIC to FCSS

(the "Fidelity Contribution"). The Fidelity Contribution will first be applied

to meet the Company's costs (up to a maximum of £1 million). Any surplus will

then be applied to meet ACIC's costs. The Fidelity Contribution is expected to

fully offset the Company's direct costs in respect of the Proposals.

Continuation vote

Subject to implementation of the Scheme, FCSS will also commit to holding a

continuation vote in 2029 and every five years thereafter.

Expected timetable

A circular to shareholders of the Company, providing further details of the

Proposals and convening a general meeting to approve the Proposals, and a

prospectus in respect of the issue of New FCSS Shares in connection with the

Scheme, will be published by the Company as soon as practicable. The Proposals

are anticipated to become effective by the end of the first quarter of 2024.

The Chairman of FCSS, Mike Balfour, commented:

"I am pleased we are able to offer existing shareholders, as well as

shareholders of ACIC who roll over, the benefits of an enlarged vehicle with

additional liquidity, cementing the Company's status as the leading constituent

of the China investment company sector. The proposals will also help spread

costs over a larger base of assets, thereby reducing the ongoing charges for

both new and existing shareholders.

As a Board, we are positive about the long-term prospects of investing in China.

FCSS is seen by many as the one-stop shop solution for exposure to this asset

class and this proposal enhances the prospect of the Company building on its

long-term success story."

For further information please contact:

FIL Investment Services (UK) Limited +44 (0) 20 3986 5367

Claire Dwyer

Daniel Summerland

Dickson Minto Advisers (Financial Adviser) +44 (0) 20 7649 6823

Douglas Armstrong

Jefferies International (Corporate Broker) +44 (0) 20 7029 8000

Gaudi Le Roux

Harry Randall

Important Information

This announcement contains information that is inside information for the

purposes of Article 7 of the UK version of Regulation (EU) No. 596/2014 which is

part of UK law by virtue of the European Union (Withdrawal) Act 2018, as

amended. Following publication of this announcement, this inside information is

now considered to be in the public domain. The person responsible for arranging

for the release of this announcement on behalf of the Company is FIL Investments

International acting as company secretary.

This announcement is not for publication or distribution, directly or

indirectly, in, into or from the United States of America. This announcement is

not an offer of securities for sale into the United States. The securities

referred to herein have not been and will not be registered under the U.S.

Securities Act of 1933, as amended, and may not be offered or sold in the United

States, except pursuant to an applicable exemption from registration. No public

offering of securities is being made in the United States.

This information was brought to you by Cision http://news.cision.com

https://news.cision.com/fidelity-china-special-situations-plc/r/proposed-combination-with-abrdn-china-investment-company,c3883837

END

(END) Dow Jones Newswires

November 28, 2023 02:00 ET (07:00 GMT)

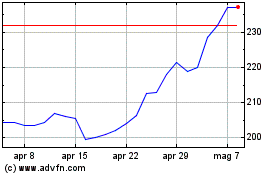

Grafico Azioni Fidelity China Special S... (LSE:FCSS)

Storico

Da Apr 2024 a Mag 2024

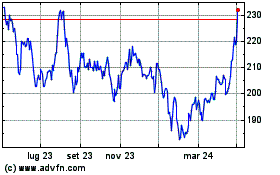

Grafico Azioni Fidelity China Special S... (LSE:FCSS)

Storico

Da Mag 2023 a Mag 2024