TIDMFIPP

RNS Number : 7792R

Frontier IP Group plc

31 October 2023

The information contained within this announcement is deemed by

the Group to constitute inside information as stipulated under the

Regulation 11 of the Market Abuse (Amendment) (EU Exit) Regulations

2019/310 ("MAR"). With the publication of this announcement via a

Regulatory Information Service, this inside information is now

considered to be in the public domain.

31 October 2023

Frontier IP Group Plc

("Frontier IP" or the "Group")

Final results for the year ended 30 June 2023

Financial highlights

-- Net assets per share as at 30 June 2023 decreased 8% to 81.8p (30 June 2022: 88.5p)

-- Basic loss per share of 5.85p (2022: earnings per share of 18.60p)

-- Part-disposal of holding in Exscientia generated cash of

GBP4,926,000 in the period under review (2022: GBP6,525,000)

realising a loss of GBP786,000 (2022: profit of GBP2,867,000)

-- Unrealised loss on the revaluation of investments of

GBP966,000 (2022: unrealised gain of GBP10,908,000)

-- Fair value of our equity portfolio decreased by 17% to

GBP32,964,000 (2022: GBP39,712,000) following disposals of

GBP5,713,000 (2022: GBP3,659,000) and additions of GBP745,000

(2022: GBP1,378,000)

-- Loss before tax of GBP4,370,000 (2022: profit before tax GBP10,879,000)

-- Cash balances at 30 June 2023 of GBP4,603,000 (2022: GBP4,368,000)

Corporate highlights

-- Generated cash proceeds of GBP4.93 million from selling

shares in portfolio company Exscientia during the year. Following

the Exscientia share sales, Frontier IP is interested in 493,550

Advanced Depositary Shares in Exscientia representing 0.4% of

Exscientia's issued share capital. In total the Group has raised

net proceeds of GBP11.45 million through selling Exscientia shares

since January 2022. During the period a total of GBP2.4 million was

invested in the portfolio by Frontier IP off its own balance sheet

through debt and equity investments and through advances of which

GBP1.08 million was invested into CamGraPhIC.

-- Appointed Nigel Grierson and Dr David Holbrook as independent

Non-Executive Directors and Professor Dame Julia King, Baroness

Brown of Cambridge DBE FREng FRS became a Senior Independent

Director in March 2023. All are members of the audit, remuneration

and nomination committees. Campbell Wilson stepped down as a

Non-Executive Director in April 2023, having served nine years on

the board of directors.

-- Expanded our portfolio with the incorporation of two new

portfolio companies during the year: Enfold Health and

GraphEnergyTech. After the year end, the Group took an equity stake

in early-stage company Deakin Bio-Hybrid Materials.

-- Post period end the Group announced that Chairman Andrew

Richmond would not be offering himself for re-election at the

coming Annual General Meeting, having served for over eleven years

as an independent Non-Executive Director, the majority of which

time was as Chairman. Baroness Brown will become Group Chair

following the AGM in December.

Portfolio highlights

-- The portfolio continues to mature. Several companies are

generating revenues having achieved commercial traction. Others

have made significant industrial and technical progress and are

either at or reaching their inflection points. Chief Executive

Officers were appointed at two companies during the year and one

post-year end as we strengthened management teams. Two new

portfolio companies were incorporated, and a further one joined the

portfolio after the end of the year. Despite difficult market

conditions, several portfolio companies raised funds.

Highlights included:

o Alusid launched its first range of mass-produced wall tiles

made from sustainable materials with Topps Tiles, the retail arm of

Topps Tiles plc the UK's no.1 tile specialist. The company is now

developing its first range of floor tiles following a collaboration

with Imerys, a world leader in speciality minerals

o CamGraPhIC raised GBP1.26 million to develop and scale up its

graphene-based photonics and announced that Sir Michael Rake, the

former chair of BT Group, is to join the board of directors. Post

year end, the company secured a loan facility for up to a further

GBP1.5 million

o Pulsiv launched Pulsiv Osmium, a technology to improve the

energy efficiency of nearly all mains-powered applications,

including power supplies and battery chargers. The company raised

GBP1.5 million, has built a global distribution network, sent

reference designs to potential customers and is in talks with major

manufacturers

o Celerum appointed David Gladding as CEO during the year and

successfully renewed its contract with Colin Lawson Transport, the

first customer for its Truck Logistics System software. Post year

end, the company added two more customers including Grampian

Continental, its first operating internationally

o Steve Cable was appointed CEO of Elute. He has a history of

growing software companies as part of his 25 years' experience. The

company is testing a beta version of an IP analysis product for

investment professionals

o Cambridge Raman Imaging made first sales of its graphene-based

ultra-fast lasers for use in Raman imaging microscopes. In tests,

its digital imaging technology helped histopathologists detect

tumours ahead of traditional methods

o The Vaccine Group successfully completed two government-backed

projects to develop candidates for a transmissible Lassa fever

vaccine and a Streptococcus suis vaccine. After the year end, the

company announced plans to expand its vaccine portfolio

-- Other post period end developments included:

o Pulsiv appointed serial technology entrepreneur Mark Gerhard

as chair, and Tim Moore joined full time from his role at

SharkNinja

o Fieldwork Robotics announced a GBP1.5 million fundraise from

Elbow Beach Capital, and appointed David Fulton as Chief Executive

Officer

Key extracts from the Annual Report can also be viewed below

which include the basis for a qualified audit opinion and material

uncertainty relating to going concern.

ENQUIRIES

Frontier IP Group Plc T: 020 3968 7815

Neil Crabb, Chief Executive neil@frontierip.co.uk

Andrew Johnson, Communications & Investor M: 07464 546 025

Relations

Company website: www.frontierip.co.uk

Allenby Capital Limited (Nominated T: 0203 328 5656

Adviser)

Nick Athanas / George Payne

Singer Capital Markets (Broker) T: 0207 496 3000

Harry Gooden / James Fischer

ABOUT FRONTIER IP

Frontier IP unites science and commerce by identifying strong

intellectual property and accelerating its development through a

range of commercialisation services. A critical part of the Group's

work is involving relevant industry partners at an early stage of

development to ensure technology meets real world demands and

needs.

The Group looks to build and grow a portfolio of equity stakes

and licence income by taking an active involvement in spin-out

companies, including support for fund raising and collaboration

with relevant industry partners at an early stage of

development.

Chairman's Statement

Performance

The year to June 2023 was a period of excellent commercial and

technical progress for Frontier IP's portfolio. Although it was

disappointing to report our first pre-tax loss, the numbers in fact

represented a resilient performance when placed in the context of

exceptionally difficult markets, particularly for early-stage

technology companies, and continued economic uncertainty, high

inflation and interest rates. Neil addresses some of the issues in

his statement, highlighting the success some companies have enjoyed

in moving beyond inflection points to winning commercial contracts.

Briefly, revenue generation within the portfolio is increasing as

seen in Alusid, Celerum and Fieldwork Robotics. Pulsiv has put in

place a global distribution network, and launched its first

commercial product, Pulsiv Osmium to improve the power efficiency

of almost all mains-powered devices.

Others are approaching inflection points, the stage at which

potential starts to be realised, the technology validated and the

route to scale up clear. The Vaccine Group successfully completed

two government-funded projects; CamGraPhIC is now gaining industry

traction from beyond the telecoms industry and Elute Intelligence

is beta testing a product aimed at investment professionals.

CamGraPhIC and Pulsiv completed funding rounds during the year.

It's important we maintain the pipeline of new companies joining

the portfolio, so it was pleasing to see Enfold Health and

GraphEnergyTech incorporated during the year with DeakinBio, an

existing firm in which we took an equity stake, added after the

year end.

A crucial element of our business model is to strengthen the

management of our portfolio companies when they reach the point of

achieving commercial viability. So, it is highly encouraging to see

a number of important appointments made during the course of the

year and beyond. Portfolio companies also bolstered their

management teams, with Steve Cable and David Gladding becoming

chief executives of Elute and Celerum respectively during the year,

with David Fulton filling the same role at Fieldwork Robotics and

significant appointments at Pulsiv after the year end. Alusid

appointed Stuart Christie as chief financial officer.

We've also enhanced our own board. Two new independent

Non-Executive Directors were appointed to the Frontier IP Board of

Directors during the year. Nigel Grierson and Dr David Holbrook

have many years of experience in industry and finance at the

highest levels.

Nigel has 20 years' experience in the IT industry with positions

in product development, marketing, and senior management, and, as

Managing Director of venture capital funds managing investments of

over $500 million in start-up companies across Europe. He was

co-Managing Director of the Doughty Hanson Technology Fund and has

held senior roles at Intel Corporation, including running strategic

programmes working directly for Intel's then Chief Executive

Officer Dr Andrew Grove and Chief Operating Officer Dr Craig

Barrett.

David is a leading healthcare technology investment professional

with 30 years' experience in the life sciences sectors. He has sat

on more than 20 boards of directors during his career. He is

currently a non-executive director at AIM quoted Oxford BioDynamics

plc, a senior advisor to digital health investor RYSE Asset

Management and Chairman of The Liver Group Charity. Involved in

healthcare for 40 years, David has been a physician, held senior

business development roles with major multinationals and spent the

last 25 years specialising in the innovation space with much of

that time in seed venture investing focused primarily on university

spin outs.

They joined Dame Julia King, Baroness Brown of Cambridge, as

part of the non-executive team on the board. Julia was appointed

our Senior Independent Director in March this year and will become

Chair at our Annual Meeting in December 2023. I will not be

standing for re-election having served for more than eleven years

as an independent Non-Executive Director, the majority of which as

Chair.

To attract such high-calibre and experienced directors to our

board is, I believe, a very strong vindication of Frontier IP's

innovative business model, the expertise and skill of our team, and

the quality of companies within our portfolio.

The appointments of Nigel and David followed the decision of

Campbell Wilson to step down from his role as a Non-Executive

Director in April having served on the Board for nearly nine years.

Campbell played a vital part in helping Frontier develop and grow.

I am delighted to say he remains involved with the Group in an

advisory role with several portfolio companies and would like to

express my thanks to him for his work on behalf of the Group for

the past nine years.

This is my final statement as your Chairman. Having served

eleven years on the Board of Directors, it is time for me to leave,

so I will not be standing for re-election as this year's Annual

General Meeting. Replacing me is Professor Dame Julia King,

Baroness Brown of Cambridge, DBE FREng FRS FMedSci. It has been an

immense privilege to serve on the board of such an exciting company

and to witness the Group's growth during my time here. Julia has

already proved to be an invaluable member of the board. In the two

years she has been with us, she has put her extensive experience

and knowledge of industry, academic and the political world to

Frontier IP's great benefit. The Group is in capable hands.

Our governance

Good governance is vital for long-term sustainable growth, and

we strive to achieve the highest standards for a business our size.

We have adopted the Quoted Companies Alliance Corporate Governance

Code, introduced in April 2018. To see more details about how we

apply the principles of the Code, see the Our Governance section of

this report and our website:

https://www.frontierip.co.uk/about/governance/ .

Results

The results represented a resilient performance in what continue

to be challenging markets for technology companies and their

investors. The fall in fair value of our equity portfolio to

GBP32,964,000 reflected disposals of GBP5,713,000 and additions of

GBP745,000. We made an unrealised loss on the revaluation of

investments of GBP966,000, against an unrealised gain for the year

to June 2022 of nearly GBP11 million.

The part-disposal of our holding in Exscientia, generated nearly

GBP5 million cash during the year. Our cash balances at 30 June

2023 were GBP4.6 million.

Outlook

The markets and economic outlook remain difficult to predict

given the high levels of global uncertainty. However, I am

confident about the prospects for both the group and the portfolio,

which is addressing some of the most critical global challenges we

face today.

Andrew Richmond

Chairman

30 October 2023

Chief Executive Officer's Statement

Despite a difficult year financially, I am delighted with the

significant commercial and technical progress made by companies

across the portfolio this year and into the period beyond. Alusid,

Nandi Proteins, Cambridge Raman Imaging, Celerum, and Fieldwork

Robotics are all either generating revenues or are about to start,

taking further strides forward to commercial viability. The day

moves closer for a second portfolio company to follow Exscientia in

launching an initial public offering or to execute a trade

sale.

Alusid has said it is exploring options for an IPO in 2024. The

company enjoyed a breakthrough year after successfully completing a

deal with Topps Tiles, the UK's no. 1 tile specialist, and

Starbucks - Alusid is now selling to franchisees across Europe and

the Middle East. The company also made good technical progress in

developing a hard-wearing floor tile for which industry interest is

already high.

Other companies to watch include Nandi Proteins, which

successfully scaled up its technology to create functional food

ingredients and is now looking forwards to making important

commercial progress in the coming year. Industrial interest in the

company's products is high.

CamGraPhIC is another company making excellent technical and

commercial progress with its graphene-based photonics technology.

The company was already working closely with major multinationals

in data and telecommunications but is now starting to gain traction

from beyond the sector and from governmental organisations.

Celerum secured its first repeat customer and additional new

customers for AI-driven Truck Logistics Software, and Cambridge

Raman Imaging gained important validation for its technology with

the first sales of its graphene-based ultra-fast lasers for medical

imaging. Fieldwork Robotics continues to develop its

raspberry-harvesting robots. These are already picking raspberries

for supermarkets, and the company's new Chief Executive David

Fulton is aiming to have more than a hundred commercially available

robots by the end of 2025.

All this represents great progress in the context of an

increasingly difficult economic and market backdrop of rising

costs, rising inflation and rising interest rates. If there is not

going to be an economic contraction in the UK, growth is still

likely to be sluggish. Of course, it has taken companies several

years to reach this point, perhaps longer than anticipated. But

developing the kind of deep technologies, based on substantiative

scientific or engineering advances, in which we specialise, takes

time. It is not easy. This is a positive: competitors attempting to

replicate the technologies successfully developed across our

portfolio will find the task hard. The barriers to entry are

high.

There are things that could be done to make deep technology

commercialisation easier, however. The fear, uncertainty and doubt

now stalking the markets are exposing and exacerbating long-term

structural problems within the UK: the failure of the education and

capital markets to connect properly.

We are home to some of the world's best universities and

researchers. There is not a shortage of scientific and engineering

expertise, of ideas or innovation, or people to make them work. We

are home to a globally important financial sector able to deploy

deep and vast reserves of liquidity. Money is available.

However, the sources of innovation and the sources of capital

are not linking efficiently together.

Part of the problem reflects the fact that public equity markets

have struggled for some time. In 1966, there were comfortably more

than 4,000 companies listed on London's main market; by the end of

2022, the number was about 1,100. Many factors have been put

forward for this market failure, including the weightier burdens

and greater costs of regulation. Alternative sources of finance,

such as venture capital and private equity have grown and prospered

in consequence. These changing trends accelerated post the

financial crisis as central banks slashed interest rates and

launched quantitative easing. Cheap money flooded the markets.

The unwillingness of the UK pension and investment industry to

commit to equity investment especially in technology stocks, has

compounded the problem. Much of the pension fund money has been

switched into bonds as part of a broader move towards indexation to

mitigate risks. You could argue that buying long-dated bonds at low

yields guarantees only poor returns at best when held to maturity

and substantial losses when interest rates go up. Yet it is the

case that Arm is owned by Japanese group SoftBank and is listed on

Nasdaq; and Oxford Nanopore and Exscientia received no money from

traditional UK venture capital backers as they grew. One is now

listed in London, the other in New York.

Other possible challenges are emerging. One is the National

Security Investment Act. The Act introduces constraints on who can

invest in areas defined as strategic by the government. It risks

further costs and delays. The full impact has yet to be felt, but

unintended consequences could be losing important technologies to

foreign markets as companies seek capital abroad or technologies

failing because there is no capital.

Therefore, it is good to see government persuading major pension

funds to enter a voluntary agreement to commit 5 per cent of their

investments to early-stage businesses by 2030, even though it is

not mandated that this should be solely in UK companies. It is a

small step, but a welcome one.

More can be done. To encourage pension funds to commit capital

to technology, I would suggest linking the substantial tax benefits

they enjoy to investing in venture capital. The regulatory

framework should be tweaked to encourage more asset diversification

and longer-term, strategic thinking. From our perspective,

incorporating new companies and working with very young businesses,

the Enterprise Investment Scheme (EIS) and Seed EIS are important.

They were limited by European Union state aid rules, but

post-Brexit there is the opportunity to take a more expansive

approach.

Despite the challenges, I remain optimistic about the potential

for our companies to achieve success.

Crises spur innovation. Wars are the most commonly cited

example, but depressions have an impact too. The United States, for

example, following the Wall Street crash, enjoyed a decade of then

unprecedented technological progress in the run up to its entry

into the Second World War in 1941. Important steps were made in

areas such as electrical and chemical engineering, aeronautics, and

power generation.

Today, the world is facing crises around climate, energy, food,

water and health, as well as the uncertainty caused by the Ukraine

war and around the direction in the economy and markets. Technology

is at the heart of our efforts to meet these challenges and provide

a path to prosperity.

And when times are tough, there is always a greater emphasis on

costs. Our approach, driven by our industry expertise and

partnerships with major companies is highly responsive to their

requirements. And given the current economic climate, they are

obviously concerned with costs and as swift a return on technology

deployment as possible.

Pulsiv's novel technology cuts the amount of energy wasted in

converting power from about half to less than 10 per cent. It has

the potential to cut costs for manufacturers and energy bills for

consumers and, if deployed at scale, it has the potential to reduce

the strain on national power grids. The company has successfully

built out a global distribution network and made two major board

appointments after the year end. Mark Gerhard became chairman. Mark

is a serial entrepreneur with a very strong record of growing and

exiting technology businesses. And Tim Moore, a Pulsiv

non-executive director, left his job as Chief Technology Officer of

Nasdaq-listed consumer electronics group SharkNinja to join the

company full time as Chief Product Officer. Both appointments

support our belief that Pulsiv will become a significant green

technology company. Mark said on his appointment that Pulsiv is

"highly analogous" to Arm.

CamGraPhIC's graphene-based photonics run at higher speed and

lower temperatures than equivalent technologies - therefore using

less energy. Data centres, which are reckoned to consume about one

per cent of global energy output, are one potential market for the

company's optical transceivers.

Our pipeline of new companies is also in robust health. One,

GraphEnergyTech, is developing graphene inks to replace silver

electrodes in photovoltaic solar cells. This could prove to be a

critically vital technology. A study from the University of New

South Wales said on current rates of solar energy growth, the

industry could consume all known global silver reserves within the

next decade. Another new company, DeakinBio, is developing new

materials for tiles and other surfaces, joining Alusid in

developing technologies that reduces the energy consumed by

manufacturing.

The impacts of ultra-processed foods and obesity and the mighty

costs they impose on health services are subject to widespread

concern. Nandi Protein can help. Its technology uses natural

ingredients such as fava beans and whey to replace fat, gluten and

chemical, E-number additives in a wide range of different foods.

The Vaccine Group is focused on using its novel herpesvirus-based

vaccine platform to develop animal vaccines to combat economically

harmful and zoonotic diseases. Fieldwork Robotics' fruit and

vegetable harvesters address the global shortage of labour prepared

to work in the fields. AquaInSilico and Molendotech are both

striving towards better water quality. AquaInSilico through its

novel software algorithms to improve wastewater treatment,

Molendotech with faster tests for harmful bacteria in water, which

cut the time needed from days into hours, or even quicker.

We took the decision during the year to strengthen our Board of

Directors with two new independent Non-Executive directors,

broadening the board's skills base and helping position us for the

next phase of our evolution. More recently we announced that Andrew

Richmond would not be offering himself for re-election at the

coming Annual General Meeting and that Baroness Brown would replace

Andrew as Group Chair following the AGM in December. I would like

to take this opportunity to thank Andrew for his service, support

and counsel over the years of our growth. I wish him every success

for the future.

Our companies are striving towards creating technologies with

the potential to make material impacts in the areas in which they

operate. The pipeline of innovation remains fruitful, as shown by

the three new companies added during the year and after. Our strong

relationships with industry partners and their engagement with the

portfolio gives us confidence that companies are meeting market

needs and demands. For all the challenges, I remain upbeat about

the Group's future prospects.

Neil Crabb, Chief Executive Officer

30 October 2023

Basis for qualified audit opinion

As noted within the external auditor's report set out in the

Annual Report and Financial Statements, expected to be published

and sent to shareholders on or around 20 November 2023, the

Directors were not able to provide the external auditor with

sufficient and appropriate evidence in relation to the estimation

of fair value for certain investments, specifically being those

investments described as 'Stage 2' in the accounting policies,

which have been valued at GBP1.2 million (representing 3.6% of

equity investments of GBP32.9 million and 2.6% of net assets) as at

30 June 2023. As a result, the external auditor was unable to

conclude in respect of the valuation of these investments and was

unable to perform alternative procedures. Consequently, this formed

the basis for a qualified opinion on these Stage 2 investments.

The external auditors were therefore unable to determine whether

any adjustment was necessary to these amounts as at 30 June 2023 or

whether there was any consequential effect on the Group and Parent

Company's other comprehensive income for the year ended 30 June

2023.

Material uncertainty related to going concern

We draw attention to the accounting policies in the financial

statements, which indicate that the Group has insufficient cash to

cover its operating expenditure for the 12 months from the date of

the signing of these Group and Parent Company financial statements.

However, the Directors intend to realise further cash from the

Group's sole quoted investment in Exscientia, valued at GBP2.3

million at 30 June 2023, which they expect will provide the Group

and Parent Company with sufficient cash to cover its operating

expenditure for this period. The timing and amount of exit proceeds

is subject to uncertainty. This condition, and the other matters

noted in the accounting policies, indicate the existence of a

material uncertainty that may cast significant doubt on the Group's

and Parent Company's ability to continue as a going concern. The

financial statements do not include any adjustments that may be

necessary if the Group or Parent Company were not a going

concern.

Key Performance Indicators and Alternative Performance

Measures

The Key Performance Indicators and Alternative Performance

Measures for the Group are:

KPI / APM Description 2023

Performance

Basic earnings Profit Loss of 5.8p

per attributable (2022:

share (KPI) to profit of

shareholders 18.6p)

divided

by the

weighted

average

number of

shares in

issue during

the year.

------------------------------------- ---------------------------------------

Net assets per Value of the 81.8p (2022:

share Group's 88.5p)

(KPI) assets less

the value

of its

liabilities

per share

outstanding

------------------------------------- ---------------------------------------

Total revenue Growth in the Negative income

and aggregate of

other of revenue GBP1,380,000

operating from (2022:

income services, positive income

(KPI) change in of

fair value GBP14,104,000)

of

investments

and

realised

profit on

disposal of

investments

------------------------------------- ---------------------------------------

Profit (KPI) Profit before Loss of

tax GBP4,370,000

for the year (2022: profit

of

GBP10,879,000)

------------------------------------- ---------------------------------------

Aggregate

percentage

Total initial equity

equity earned from

in new new

portfolio portfolio

companies companies

(APM) Note during the

1 year 108% (2022:20%)

------------------------------------- ---------------------------------------

Note 1 - The total initial equity in portfolio companies is not

an IFRS measure. It is used by Directors to measure the total

percentage equity stakes received in all new spin-out companies

during the year. It does not reflect holdings in individual

spin-outs and does not include equity received through post

spin-out investment. For 2023 it is the aggregate percentage

holding from two new spin-out companies during the year.

The Group achieved its initial equity Alternative Performance

Measure but failed to achieve its four Key Performance Indicators

reflecting the difficult market conditions during the year.

Net assets per share decreased by 8% to 81.8p (2022: 88.5p)

reflecting a loss after tax of GBP3,244,000. The value of the

Group's investments decreased to GBP37,589,000 (2023:

GBP42,693,000) reflecting the opening value of Exscientia shares

sold of GBP5,713,000, purchase of investments of GBP1,576,000 and

net unrealised losses on revaluation of GBP966,000. The Exscientia

shares sold generated proceeds of GBP4,926,000. Loss after tax for

the Group for the year to 30 June 2023 was GBP3,244,000 (2022:

profit of GBP10,230,000) after a deferred tax credit of

GBP1,126,000 (2022: charge of GBP649,000). This result includes a

realised loss on disposal of investments of GBP786,000 (2022: gain

of GBP2,867,000), an unrealised loss on the revaluation of

investments of GBP966,000 (2022: gain of GBP10,908,000) and

reflects an increase in services revenue to GBP372,000 (2022:

GBP329,000) Administrative expenses of GBP3,130,000 (2022:

GBP3,104,000) were flat primarily due to no bonuses being paid in

2023.

Operational Review

During the year, we took the opportunity to refresh our Board of

Directors with the appointments of Nigel Grierson and David

Holbrook as independent Non-Executive Directors from 15(th) March

2023. Both Nigel and David have extensive experience in industry

and finance.

Professor Dame Julia King, Baroness Brown of Cambridge DBE FREng

FRS FMedSci, who joined the Board in October 2021, became Senior

Independent Director on the same date. Campbell Wilson stepped down

in April 2023 having served as a Non-Executive Director for nine

years but continues to support the Group in an advisory capacity

with selected portfolio companies.

Companies across the portfolio continued to make good technical

and commercial progress, with several starting to generate revenues

for the first time as longer-term industry engagement started to

translate into contracts and sales. We continued to strengthen

management teams across the portfolio. Elute Intelligence and

Celerum appointed Chief Executive Officers during the year, as did

Fieldwork Robotics after the year end. Pulsiv and CamGraPhIC

successfully raised funds during the year, with Fieldwork Robotics

following after the year end.

As a people focussed business, we took steps to expand our team

and to ensure we attract and retain the best people. We hired four

full-time employees to the Frontier IP team during the year.

Our Remuneration Committee began to implement the changes to our

remuneration arrangements recommended in last year's external

review. Progress is set out in in detail in the Remuneration

Committee Report.

Portfolio Review

Frontier IP strives to develop and maximise value from its

portfolio. We do so by taking founding stakes in companies at

incorporation and then working in long-term partnerships with

shareholders, academic and industry partners.

As part of our sustainability agenda, we have mapped our

portfolio companies to relevant United Nations Sustainability

Development Goals (UN SDGs). All equity holdings are as at 30 June

2023.

Core portfolio

Alusid: Frontier IP stake: 37.4 per cent

Alusid creates beautiful, premium-quality tiles, tabletops and

other surfaces by recycling industrial waste ceramics and glass,

most of which would otherwise be sent to high-impact landfill.

The company has successfully scaled up its technology for mass

production on industry-standard manufacturing equipment and during

the year signed a contract to sell its first mass-manufactured tile

range, Principle, through Topps Tiles, the UK's no.1 tile

specialist.

Alusid also successfully completed a collaboration with one of

the world's leading specialty minerals group, Imerys, which

resulted in the company developing floor tiles, a missing product

from its ranges. Pilot trials are now underway to see if the floor

tiles can be mass produced, with high industry interest in the

product.

The company is also selling products to Starbucks franchisees

across Europe, Middle East and Africa. Other customers include

H&M, Cos, Nando's, the BBC and the Stonehenge Visitor Centre,

run by English Heritage.

UN Sustainable Development Goal mapping: SDG 9, industry,

innovation and infrastructure; SDG 12, responsible consumption and

production.

Amprologix: Frontier IP stake: 10.0 per cent

Amprologix was created to commercialise the work of Mathew

Upton, Professor of Medical Microbiology at Plymouth's Institute of

Translational and Stratified Medicine.

The company continued to make progress with development of its

new family of antibiotics based epidermicin, which is derived from

bacteria found on human skin, to tackle antimicrobial-resistant

MRSA and other superbugs. Ingenza, a leader in industrial

biotechnology and synthetic biology, is also a shareholder and is

working with Amprologix to develop and scale up the technology.

COVID-19 heightened interest in other threats to human health

globally. During the year, the World Health Organisation reiterated

its warnings about the threats from antimicrobial-resistant

superbugs and called for a step up in efforts to create new

antibiotics.

UN SDG mapping: SDG 3, good health and well-being

AquaInSilico: Frontier IP stake: 29.0 per cent

AquaInSilico is developing sophisticated software tools able to

understand and predict how biological and chemical processes unfold

in different operating conditions.

These can be used to optimise wastewater treatment across many

industries, including municipal wastewater treatment plants, oil

groups, brewers, pulp, paper and steel makers, food processing and

waste recovery businesses.

During the year, the company saw its digital tools implemented

by a client in Cape Verde as part of the Phos-Value project to

recycle environmentally harmful nutrients as biofertilisers and

improve water quality

in the islands. The project was supported by the United Nations

Development Program. AquaInSilico was also selected to take part in

a European PathFinder project to develop sustainable products and

made good progress in gaining municipal and industrial interest in

its UPWATER(R) technology.

UN SDG mapping: SDG 6, clean water and sanitation, SDG 12,

responsible consumption and production, SDG 14, life below

water

Cambridge Raman Imaging: Frontier IP stake: 26.8 per cent

Our first graphene spin out, Cambridge Raman Imaging (CRI) is

developing Raman imaging technology based on graphene-based

ultra-fast lasers, to detect and monitor tumours. The company was

formed as a result of a partnership between the University of

Cambridge and the Politecnico di Milano in Italy.

The main application creates digital images of patient cells and

tissue, and the company is developing FFAI based analysis of

chemical signatures for accurately differentiating between healthy

tissue and diseased tissue in the patient samples, augmenting or

replacing subjective diagnosis of samples by histopathologists. The

technology removes the need for chemical staining - eliminating a

major contributor to sample variation seen between one lab and the

next.

During the year, the company successfully integrated its laser

with a widely available commercial microscope and sold its first

lasers. Tests showed histopathologists could identify tumours at an

earlier stage from digital images generated by CRI's technology

than they could from other technologies.

UN SDG mapping: SDG 3 good health and well-being

CamGraPhIC : Frontier IP stake: 20.8 per cent

CamGraPhIC develops graphene-based photonics for high-speed data

and telecommunications. Graphene photonics are seen as a key

enabler for the massive data increases being demanded by 5G and 6G

technologies by the company's industrial partners.

Initial applications are high-speed optical transceivers. In

laboratory conditions these have worked at 100Gb per second, around

twice the speed of equivalent technologies, and across multiple

wavebands. They are projected to consume at least 70 per cent less

energy. Other uses include high-performance computing and in

networks able to meet the demands of processor intensive artificial

intelligence applications.

The company raised GBP1.26 million through an equity funding

round during the year to accelerate development and scale up of the

technology, and announced that Sir Michael Rake, the former BT

Group Chairman would be joining its board of directors at an

appropriate time. After the year end, CamGraPhIC put in place a

loan facility worth up to GBP1.5 million, with Frontier IP

subscribing to loan notes worth GBP1.32 million.

UN SDG mapping: SDG 9, industry, innovation and infrastructure,

SDG 11, sustainable cities and infrastructure

Celerum: Frontier IP stake: 33.8 per cent

Celerum is developing novel artificial intelligence to improve

the operational efficiency of logistics and supply chains.

The company's technology uses specialist algorithms based on

nature-inspired computing, software and algorithms based on natural

processes and behaviours.

During the year, the company appointed David Gladding as Chief

Executive Officer. David has more than 30 years' experience in

software and IT services companies, including those specialising in

fleet management. The company is now winning customers for its

first commercial product Truck Logistics System, launched during

the year to June 2022. After the year end, the company announced it

had won its first international customer, Grampian Continental, and

was successfully developing more sophisticated versions of the

software to meet the needs of further customers.

UN SDG mapping: SDG 9, industry, innovation and

infrastructure

Des Solutio: Frontier IP stake: 25.0 per cent

Des Solutio is developing safer and greener alternatives to the

toxic solvents currently used to extract active ingredients by the

pharmaceutical, personal care, household goods and food

industries.

It does this through the use of Natural Deep Eutectic Solvents.

These are combinations of naturally occurring (often plant based)

sugars, acids, alcohols and amino acids that can be used as safe

solvents. These new green solvents can be used to replace toxic

organic solvents used in conventional processing , such as ethanol,

employed currently. This means it is contributing to the

environmentally sound management of chemicals, and reducing their

release to air, water and soil.

During the year, the company was selected as one of 10 start-ups

to take part in the UK hub of the European Institute of Innovation

& Technology's Food Network and started validation trials of a

natural food preservative.

UN SDG mapping: SDG 9 industry, innovation and infrastructure;

SDG 12, responsible consumption and production

Elute Intelligence: Frontier IP stake: 42.2 per cent

Elute's software tools are designed to help users intelligently

search, compare and analyse complex documents by mimicking the way

people read. There are a huge range of potential applications, from

searching patents and contracts, to detecting evidence of

plagiarism, collusion and copyright infringement. The company's

tools help to enhance research, support improved technological

capabilities and innovation. Existing customers for the company's

CopyCatch plagiarism detection software include UCAS, The Open

University, and Slicethepie, the largest paid review site on the

internet.

During the year, Elute announced the appointment of Steve Cable

as Chief Executive Officer and is developing Investor Insights, an

IP analyst tool for investment firms, which is now in beta

phase.

UN SDG mapping: SDG 9, industry, innovation and

infrastructure

Enfold Health: Frontier IP stake 75.8 per cent

Enfold Health, incorporated during the year, is developing novel

technology for attacking the pathogenic bacteria that drive gum

disease (gingivitis and periodontitis). The incorporation resulted

from a collaboration between Frontier IP and Dr Ioanna Mela, an

Associate Professor in the Department of Pharmacology at the

University of Cambridge.

Periodontitis increases the risk of developing many common

chronic diseases, including cardiovascular disease, Type 2

diabetes, Alzheimer's, rheumatoid arthritis and pneumonia, and

worsens associated symptoms.

Enfold's Board of Directors includes Gerard Majoor, the former

Vice President, Innovation and Development, Business Group Health

and Wellness, for Philips Oral Health Care and Mother and Child

Care.

UN SDG mapping: UN SDG 3 good health and wellbeing

Exscientia: Frontier IP stake: 0.4 per cent

Exscientia, a spin out from the University of Dundee, was the

first in our portfolio to IPO, raising total gross proceeds of $510

million through a public offer and private placements with SoftBank

and the Bill & Melinda Gates Foundation. It is listed on

Nasdaq.

Now based in Oxford, Exscientia is a world leader in artificial

intelligence-driven drug discovery. It is the company behind the

first AI-created drugs to enter human clinical trials, taking years

off traditional drug discovery processes.

During the year, the company continued to expand its pipeline of

drug candidates, with four new molecules advancing further into

clinical trials during the first half of its financial year to 30

June 2023 alone. The company is also developing its capabilities:

it is building its own hardware and software solutions to automate

a wide range of laboratory processes.

UN SDG mapping: SDG 3, good health and well-being

Fieldwork Robotics: Frontier IP stake: 22.1 per cent

Fieldwork Robotics is looking to have more than 100 robots

available for farmers to hire by 2025 following a post-year end

funding round to accelerate further development of the company's

raspberry pickers.

The moves follow the start of commercial trials of the raspberry

harvesters in Portugal, and the continued focus is on making the

robots faster and scaling up the technology.

After the year end, the company also appointed David Fulton as

Chief Executive Officer, replacing Rui Andres who is focusing full

time on Molendotech as CEO. David has more than 30 years' business

experience, most recently as co-founder and director of LAB+BONE, a

service to protect dogs' identity by using DNA. Before starting

LAB+BONE, he was Chief Executive Office of WeSee, a company using

advanced computer vision technology mimicking the human brain's

ability to understand and process visual information. He previously

held executive positions with Expedia, Adform and Microsoft.

Robotic fruit and vegetable harvesting technology has the

potential to improve agricultural productivity, reduce food waste

by more accurate picking and minimising human contact, and result

in better quality jobs, with harvesting labour replaced by skilled

robot operators. There is also potential for cutting carbon

emissions through reduced need for migrant labour.

UN SDG mapping: SDG 2, zero hunger; SDG 12 responsible

consumption and production

GraphEnergyTech: Frontier IP stake 32.1 per cent

GraphEnergyTech is developing advanced graphene technology for

lower-cost and more environmentally-friendly solar cells - and

could help save global silver reserves from exhaustion by 2050.

The company, which was incorporated into our portfolio during

the year, is developing high-conductivity graphene inks. Initial

applications are for graphene electrodes to replace expensive

silver electrodes in solar cells. Silver is the most commonly used

material for solar cell electrodes, and the solar industry is

currently using 100 million troy ounces a year at a cost of at

least $2 billion.

Research by the University of New South Wales, Australia, states

more than 85 per cent of current silver reserves could be consumed

by solar by 2050, with the upper end of its estimates as high as

113 per cent.

GraphEnergyTech's electrodes are 22 per cent cheaper than silver

at pilot stage with further reductions expected as the technology

is scaled up. The technology also enables high-efficiency

perovskite solar cells by eliminating the risk of performance

degradation caused by metal migration. Manufacturing is also easy -

the graphene inks can be applied a low-cost screen-printing

process, compatible with existing equipment.

Using graphene inks will also reduce the environmentally

damaging extraction of metals, including the use of mercury and

cyanide.

UN SDG mapping: UN SDG 7 affordable and clean energy, UN SDG 9,

industry, innovation and infrastructure,

InSignals Neurotech: Frontier IP stake: 32.9 per cent

InSignals Neurotech continues to make progress with its novel

technology to analyse the motor symptoms of Parkinson's disease and

other neurological disorders. The company is developing wireless

devices to measure motor symptoms, such as wrist rigidity, in real

time to help surgeons and neurologists assess the extent of the

disease. Initial prototypes were designed to help identify the best

locations to place implants in the brain. However, an improved

version can now be used to monitor symptoms more broadly for

disease tracking and to understand better how patients are

responding to treatment. A multi-centred clinical trial has been

established to test the devices., and a collaboration with the

University of Santiago de Compostela in Spain confirmed how object

measurements could produce deeper insights into disease

progression. A mobile application of the technology is now under

development.

The spin out from the Portuguese Institute for Systems and

Computer Engineering, Technology and Science ("INESC TEC"), with

the support of São João University Hospital, part of the University

of Porto.

UN SDG mapping: SDG 3 good health and well-being

Molendotech: Frontier IP stake: 10.4 per cent

Molendotech has developed Bacterisk+, a proprietary screening

test for faecal contamination in water. The tests, which can be

used on site, cuts testing times from up to two days to under 30

minutes because samples do not need to be sent to a laboratory,

enabling environmental agencies and other authorities to assess

water quality swiftly. It has been used to screen marine bathing

waters, inland recreational waters, irrigation water and food

process water.

The company has also developed a test to detect specific

bacterial strains, including pathogens, for use in the food

industry, animal feeds, veterinary practices and ballast

waters.

UN SDG mapping: SDG 6, clean water and sanitation; SDG 12

responsible consumption and production

Nandi Proteins: Frontier IP stake: 19.8 per cent

Nandi Proteins successfully demonstrated commercial scale up of

its egg white replacer further extending its range of customised

ingredients based on vegetable and animal proteins. The company

continued to develop industry relationships over the year, which is

expected to result in significant commercial progress in the

future.

The company's technology is able to create a wide range of

customised ingredients based on naturally occurring vegetable and

animal proteins. Nandi's functional proteins can be used to replace

undesirable ingredients, such as fat, gluten and chemical E-number

additives in processed foods, or to replace animal proteins with

vegetable proteins.

Nandi's technology has the potential to contribute to more

sustainable agriculture and food production by supporting the

plant-based alternative meat industry, by reducing chemical

ingredients in processed and ultra-processed foods and by reducing

the amount of meat used in processed meat products.

UN SDG mapping: SDG 2, end hunger; SDG 12, responsible

consumption and production

PoreXpert: Frontier IP stake: 15.0 per cent

PoreXpert, a software and consultancy firm, has developed novel

software and methods to model the voids within porous materials and

how gases, liquids and colloidal suspensions behave within

them.

Applications include helping companies understand and exploit

the nature of oil and gas reserves to improve the efficiency of

exploration and extraction, supporting industry efforts to reduce

their impact on the environment. It is also being used to help

maximise the lifespan of the UK's Advanced Gas Cooled nuclear

reactors, which generate 20 per cent of the national energy

requirement, without greenhouse gas emissions.

UN SDG mapping: SDG 7, affordable and clean energy; SDG 12,

responsible consumption and production

Pulsiv: Frontier IP stake: 18.2 per cent

Pulsiv's progress during the year included the launch of its

first commercial product, Pulsiv Osmium, building out a global

distribution network and a funding round that raised GBP1.5

million. The fundraising valued the company at GBP50 million pre

money.

The company also established a global distribution network after

signing agreements with partners across North America, Europe and

Asia. The company continues to evolve and post period-end

significantly strengthened its board with two key appointments of

serial entrepreneur Mark Gerhard as chair and Tim Moore, who joined

full time as Chief Product Officer from his role at SharkNinja.

Pulsiv's technology has the potential to make a profound impact

on the energy sector. It cuts the amount of energy consumed by

devices, therefore reducing the strain on power grids, and can

boost the output of photovoltaic solar cells. Pulsiv Osmium is

initially aimed at improving the efficiency of power supplies, LED

lighting and battery chargers, but it can be used across nearly all

mains-powered devices.

Because the technology uses fewer components, its new power

conversion techniques can be incorporated in smaller, lighter and

more cost-effective designs, so the technology has the potential to

reduce strains on power grids and cut costs for manufacturers and

bills for consumers.

It also works from device to mains, significantly improving the

efficiency of renewable sources. The company is also working on a

solar microinverter to maximise the output from photovoltaic solar

cells.

UN SDG mapping: SDG 7, affordable and clean energy; SDG 13,

climate action

The Vaccine Group: Frontier IP stake: 17.0 per cent

The Vaccine Group is creating a wide range of vaccines based on

a novel herpesvirus-based platform. Its core focus is on preventing

the spread of economically damaging diseases in livestock.

During the year, the company successfully completed two

government-funded projects. The first funded by the UK and Chinese

governments, developed a vaccine candidate for Streptococcus suis,

a bacterial disease carried by pigs that causes significant

productivity losses in the global pig industry. However, it can

also cause meningitis and other symptoms in humans. The disease is

currently poorly served as there are no highly effective vaccines

and treatment uses antibiotics but is showing signs of resistance.

A Chinese commercial collaborator, the Pulike Biological

Engineering Company has demonstrated candidate vaccine production

using commercial manufacturing techniques at pilot scale.

The second project involved developing a transmissible candidate

vaccine against a virus, Lassa fever, for use in the rats that

spread the disease. A small-scale trial showed the candidate could

be transmitted between rats, significantly improve their immunity

to Lassa fever and reduce its spread between them. Technology to

scale up for commercial production was also developed as part of

the project, and the company is now in discussion with potential

partners about further development. The work was funded by the US

Defense Advanced Research Projects Agency, led by the University of

California Davis, and involved TVG collaborating with academic

partners from around the world.

TVG now has eight vaccine candidates approaching proof of

principle. Its most advanced projects are for pigs: in addition to

streptococcus suis, the company is also developing vaccines for

porcine reproductive and respiratory syndrome virus, porcine

circovirus and African swine fever. It is adding more candidates to

its pipeline to target diseases affecting horses, cattle, cats and

dogs.

UN SDG mapping: SDG 2, end hunger; SDG 3 good health and

well-being

Core Portfolio Summary at 30 June 2023

Portfolio Company % Issued About Source

Share Capital

Alusid Limited 37.39% Recycled materials University of

Central Lancashire

--------------- ---------------------------- ------------------------

Amprologix Limited 10.0% Novel antibiotics Universities

to tackle antimicrobial of Plymouth and

resistance Manchester

--------------- ---------------------------- ------------------------

AquaInSilico Lda 29.0% Digital tools to FCT Nova

optimise wastewater

treatment

--------------- ---------------------------- ------------------------

Cambridge Raman 26.8% Medical imaging using University of

Imaging Limited ultra-fast lasers Cambridge and

Politecnico di

Milano

--------------- ---------------------------- ------------------------

CamGraPhIC Limited 20.8% Graphene-based photonics University of

Cambridge and

CNIT

--------------- ---------------------------- ------------------------

Celerum Limited 33.8% Near real-time automated Robert Gordon

fleet scheduling University

--------------- ---------------------------- ------------------------

Des Solutio Lda 25.0% Green alternatives FCT Nova

to industrial toxic

solvents

--------------- ---------------------------- ------------------------

Elute Intelligence 42.2% Software tools able Existing business

Holdings Limited to intelligently

search, compare and

analyse unstructured

data

--------------- ---------------------------- ------------------------

Enfold Health Limited 75.8% Improved oral health University of

Cambridge

--------------- ---------------------------- ------------------------

Exscientia Limited 0.4% Novel informatics University of

and experimental Dundee

methods for drug

discovery

--------------- ---------------------------- ------------------------

Fieldwork Robotics 22.1% Robotic harvesting University of

Limited technology for challenging Plymouth

horticultural applications

--------------- ---------------------------- ------------------------

GraphEnergyTech 32.1% High conductivity University of

Limited graphene inks Cambridge/École

Polytechnique

Fédérale

de Lausanne

--------------- ---------------------------- ------------------------

Insignals Neurotech 32.9% Wearable medical INESC TEC

Lda devices supporting

deep brain surgery

--------------- ---------------------------- ------------------------

Molendotech Limited 10.4% Rapid detection of University of

water borne bacteria Plymouth

--------------- ---------------------------- ------------------------

Nandi Proteins 19.8% Food protein technology Heriot-Watt University,

Limited Edinburgh

--------------- ---------------------------- ------------------------

PoreXpert Limited 15.0% Analysis and modelling University of

of porous materials Plymouth

--------------- ---------------------------- ------------------------

Pulsiv Limited 18.2% High efficiency power University of

conversion and solar Plymouth

power generation

--------------- ---------------------------- ------------------------

The Vaccine Group 17.0% Herpesvirus-based University of

Limited vaccines for the Plymouth

control of bacterial

and viral diseases

--------------- ---------------------------- ------------------------

The Group holds equity stakes in 6 further portfolio companies.

The combined value of these holdings was GBP575,000, equivalent to

1.7% of the fair value of the Group's equity investments at 30 June

2023.

Financial Review

Key Highlights

Net assets per share decreased by 8% to 81.8p (2022: 88.5p)

reflecting a loss after tax of GBP3,244,000. The loss was driven by

a net decrease on revaluation of investments of GBP966,000 and a

realised loss on part disposal of the Group's holding in Exscientia

of GBP786,000.

Loss after tax for the Group for the year to 30 June 2023 was

GBP3,244,000 (2022: profit of GBP10,230,000) after a deferred tax

credit of GBP1,126,000 (2022: charge of GBP649,000). This result

includes a realised loss on disposal of investments of GBP786,000

(2022: gain of GBP2,867,000), an unrealised loss on the revaluation

of investments of GBP966,000 (2022: gain of GBP10,908,000) and

reflects an increase in services revenue to GBP372,000 (2022:

GBP329,000) and flat administrative expenses of GBP3,130,000 (2022:

GBP3,104,000) primarily due to no bonuses being paid in 2023.

Revenue and Other Operating Income

Services revenue increased by 13% to GBP372,000 (2022:

GBP329,000) but other operating income, comprising realised and

unrealised gains and losses on investments decreased to a loss of

GBP1,752,000 (2022: gain of GBP13,775,000). The realised loss on

disposal of investments was GBP786,000 (2022: gain of GBP2,867,000)

and the unrealised loss on the revaluation of investments was

GBP966,000 (2022: gain of GBP10,908,000). The fall during the year

in the value of Exscientia, the Group's only quoted company

holding, was a significant contributor to these losses. During the

year, the Group sold a further part of its holding in Exscientia

for GBP4,926,000 realising a loss of GBP786,000 on the value of the

holding at 30 June 2022, 100% of the realised loss for the year to

30 June 2023. The decrease in the value of the Group's remaining

holding in Exscientia over the year to 30 June 2023 was

GBP2,123,000, 49% of loss before tax for the year to 30 June 2023.

The unrealised loss on the revaluation of investments of GBP966,000

comprises losses on equity investments of GBP1,780,000 and gains on

debt investments of GBP814,000. The significant contributors to the

unrealised loss on equity investments were The Vaccine Group

(decrease of GBP2,164,000), Exscientia (decrease of GBP2,123,000)

and CamGraPhIC (increase of GBP1,430,000). An increase in the value

of the Group's debt investment in CamGraPhIC of GBP724,000 was the

primary contributor to the unrealised gain on debt investments.

Administrative Expenses

Administrative expenses increased by 1% to GBP3,130,000 (2022:

GBP3,104,000). Prior year expenses included the payment of bonuses

totalling GBP480,000 that were paid to employees of the Group.

Excluding prior year bonuses, administrative expenses increased by

19%, primarily due to increased employee costs.

Share Based Payments

Share based payments decreased 53% to GBP155,000 (2022:

GBP329,000) reflecting option grants during the year.

Earnings Per Share

Basic loss per share was 5.85p (2022: earnings per share of

18.60p). Diluted loss per share was 5.64p (2022: earnings per share

17.53p).

Statement of Financial Position

The principal items in the statement of financial position at 30

June 2023 are financial assets at fair value through profit and

loss comprising equity investments of GBP32,964,000 (2022:

GBP39,712,000) and debt investments of GBP4,625,000 (2022:

GBP2,981,000). The carrying value of these items is determined by

the Directors using their judgement when applying the Group's

accounting policies. The matters taken into account when assessing

the fair value of the portfolio companies are detailed in the

accounting policy on investments. The movement during the year in

equity and debt investments is detailed in notes 13 and 14 to the

financial statement, respectively.

The Group had goodwill of GBP1,966,000 at 30 June 2023 (2022:

GBP1,966,000). The considerations taken into account by the

Directors when reviewing the carrying value of goodwill are

detailed in Note 10 to the financial statements.

The Group had net current assets at 30 June 2023 of GBP6,181,000

(2022: GBP5,201,000) reflecting primarily advances of GBP793,000

(2022: nil) made to portfolio companies prior to formalising as

loans. The current assets at 30 June 2023 include trade receivables

of GBP604,000 which are more than 90 days overdue. The portfolio

company debtors are in the process of raising funds and the

directors are confident that the amounts due to the company will be

paid.

Net assets per share

Net assets of the Group decreased to GBP45,538,000 at 30 June

2023 (30 June 2022: GBP48,699,000) resulting in net assets per

share of 81.8p (30 June 2022: 88.5p).

Cash

The Group's cash balances increased during the year by

GBP235,000 to GBP4,603,000 at 30 June 2023. Operating activities

consumed GBP3,247,000 (2022: GBP3,006,000), the increase reflecting

primarily advances made to portfolio companies prior to formalising

as loans. Investing activities generated GBP3,384,000 (2022:

GBP5,382,000). This reflected proceeds on disposal of part of

our holding in Exscientia of GBP4,926,000 (2022: GBP6,525,000) and

the purchase of equity and debt investments of GBP1,576,000 (2022:

GBP1,141,000) across nine of our portfolio companies.

Principal Risks and Challenges affecting the Group

The specific financial risks of price risk, interest rate risk,

credit risk and liquidity risk are discussed in note 1 to the

financial statements. The principal broader risks - financial,

operational, cash flow and personnel - are considered below.

The key financial risk in our business model is the inability to

realise sufficient income through the sale of our holdings in

portfolio companies to cover operating costs and investment

capital. GBP4.9 million of cash was generated during the year from

selling shares in portfolio company Exscientia. The remaining

holding in Exscientia was valued at GBP2.3 million at 30 June 2023.

The other principal financial risk of the business is a fall in the

value of the Group's portfolio. With regards to the value of the

portfolio itself, the fair value of each portfolio company

represents the best estimate at a point in time and may be impaired

if the business does not perform as well as expected, directly

impacting the Group's value and profitability. This risk is

mitigated as the number of companies in the portfolio increases. T

he Group continues to pursue its aim of actively seeking

realisation opportunities within its portfolio to reduce the

requirement for additional capital raising.

The principal operational risk of the business is management's

ability to continue to identify spin out companies from its formal

and informal university relationships, to increase the revenue

streams that will generate cash in the short term and achieve

realisations from the portfolio.

Early-stage companies are particularly sensitive to downturns in

the economic environment. There are currently several areas of

concern that could affect the UK and wider global markets and

economy. Global risks include the continuing war in Ukraine and

emerging conflict and instability in the middle east. The impact of

both, particularly the dangers of escalation, on geopolitics,

economically and on markets, are uncertain and difficult to

predict. Inflation and interest rates are rising. Longer-term risks

include uncertainties in the US, where economic growth continues to

be slow and around next year's presidential elections, and in

China, which is facing demographic challenges and pressures in its

property sector.

Any economic downturn would mean considerable uncertainty in

capital markets, resulting in a lower level of funding activity for

such companies and a less favourable exit environment. The impact

of this may be to constrain the growth and value of the Group's

portfolio and to reduce the potential for revenue from advisory

work. The Group seeks to mitigate these risks by maintaining a

strong balance sheet, relationships with co-investors, industry

partners and financial institutions, as well as controlling the

cash burn rate in portfolio companies.

COVID-19 remains a risk with the possibility of new variants

emerging. The likeliest impacts on the Group are operational:

Frontier IP and portfolio company employees may contract the virus

and be unavailable for work for extended periods of time. The Group

seeks to mitigate these risks by maintaining a safe working

environment and e nsuring portfolio companies have considered and

addressed risks.

Changes to the basis on which IP is licensed in the Higher

Education sector might lead to reduced opportunity or a need to

vary the business model. Any uncertainty in the sector may have an

impact on the operation of the Group's commercialisation

partnerships in terms of lower levels of intellectual property

generation and therefore commercialisation activity. The Group

seeks to mitigate these risks by continuing to seek new sources of

IP from a wide range of institutions both within and outside of the

UK.

The Group is dependent on its executive team for its success and

there can be no assurance that it will be able to retain the

services of key personnel. This risk is mitigated by the Group

through recruiting additional skilled personnel and ensuring that

the Group's reward and incentive framework aids our ability to

recruit and retain key personnel. We expanded our team during the

year and, post period-end, commissioned an external review of our

remuneration framework.

After making appropriate enquiries, the Directors consider that

it remains appropriate to adopt the going concern basis in

preparing the financial statements. However, the Directors intend

to realise further cash from the Group's quoted investment in

Exscientia valued at GBP2.3 million at 30 June 2023 which they

reasonably expect will provide the Group with sufficient cash to

cover its operating expenditure for this period. The Directors also

expect that this realisation will, where appropriate, assist the

Group in supporting portfolio companies during this period. The

dependence on the amount realised from this one quoted technology

company represents a material uncertainty. More detail is provided

in the Directors' Report.

By order of the Board

Neil Crabb

Director

30 October 2023

Remuneration Review Implementation

Following the review of the Group's remuneration policy during

FY 2022, the aim of which was to ensure that the policy continued

to reinforce long-term value creation by enhancing the Group's

ability to attract and retain the best people, t he Group began the

implementation of the key findings of the Remuneration Review

during the year.

Salary

As recommended, Director's full-time equivalent salaries were

raised to GBP200,000 for the CEO, and to GBP160,000 for each of the

CFO, CCO, and COO in January 2023. The Committee is expecting to

implement further increases in FY24 which are likely to be less

than the increase in FY23 and will disclose these in the relevant

directors' remuneration report.

All non-director staff also received salary increases in order

to ease cost of living pressures during the year.

Annual Bonus

Our business model means that the availability of cash to pay

bonuses will be dependent on cash being raised through asset

realisations, and the bonus opportunity in any financial year is

dependent on this activity and will only be paid where the Group

determines there is a sufficient surplus to the medium-term

operating cash requirement.

Following review, the Remuneration Committee concluded that no

bonuses were to be paid, consequently no bonus payments were made

during the period.

LTIP

In line with Remuneration Review recommendations, the Group

implemented the 'LTIP' as set out in an advisory resolution, and

supported by shareholders, at the Company's 2022 Annual General

Meeting.

The first awards made under the LTIP were granted in March 2023,

to all staff including directors. Details of share options held by

Directors who were in office at 30 June 2023 are set out below.

Option awards were also granted to Group non-director employees

under the Group's Company Share Option Plan.

Directors' remuneration

An analysis of remuneration by director is given in Note 6 of

these financial statements.

Contracts of service

Neil Crabb's, Jacqueline McKay's, James Fish's and Matthew

White's service agreements are subject to a six-month notice

period.

Share options

The Company currently has three share option schemes.

The Frontier IP Group plc Employee Share Option Scheme 2011, as

adopted by the Board of Directors of the Company on 30 November

2012 and amended by the Board of Directors of the Company on 26

March 2018, was able to grant both options which are Enterprise

Management Incentive (EMI) approved. This scheme remains in place,

but no new options will be granted as the Group has ceased to be a

qualifying company for EMI purposes.

Two further schemes are in place: the Frontier IP Group PLC

Company Share Option Plan 2021 ("CSOP") and the Frontier IP Group

PLC Unapproved Share Option Plan 2021, as amended by Board of

Directors Resolution on 7 March 2023 ("LTIP"). During the period,

191,496 share options were granted under the CSOP and 643,376 share

options were granted under the LTIP.

Details of share options held by Directors who were in office at

30 June 2023 are set out below:

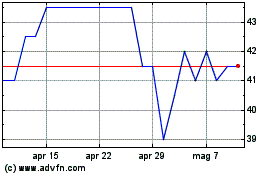

The market price of the Company's shares at 30 June 2023 was

46.0p. The range of prices during the year was 46.0p to 89.0p.

Directors' interests in shares

The Directors in office at 30 June 2023 had the following

interests in the ordinary shares of 10p each in the Company at the

year end.

2023 2022

Number Number

Neil Crabb 3,445,538 2,988,713

Jacqueline McKay 208,637 12,855

Andrew Richmond 850,000 1,000,000

James Fish 100,000 100,000

All of the above interests are beneficial.

Professor Dame Julia King, Baroness Brown of Cambridge

Chair of the Remuneration Committee

30 October 2023

Audit Committee Report

Key Responsibilities

The Committee's terms of reference are available on the Group's

website. The Committee is required, amongst other things, to:

-- monitor the integrity of the financial statements of the

Group, reviewing significant financial reporting issues and the

judgements they contain;

-- review and challenge where necessary the accounting policies

used, the application of accounting standards and the clarity of

disclosure in the financial statements;

-- keep under review the effectiveness of the Group's internal

controls and risk management systems; and

-- oversee the relationship with the external auditor, reviewing

their performance and advising the Board on their appointment and

remuneration.

Committee Governance

The Committee comprised of three non-executive directors and was

chaired by Andrew Richmond until 13 March 2023 following which the

Committee comprised of four non-executive directors and David

Holdbrook replaced Andrew Richmond as chair. It meets a minimum of

two times per year with the external auditors present. In addition,

executive directors are asked to attend.

Activities of the Audit Committee during the year

The Committee met on three occasions during the year under

review and up to the date of this Annual Report with all members

present and the external auditors in attendance. The main areas

covered by the Committee are outlined below: