Haleon Agrees to Sell ChapStick Brand for Up to $510 Million

25 Gennaio 2024 - 8:53AM

Dow Jones News

By Michael Susin

Haleon said that it has agreed to sell ChapStick lip-care brand

to Suave Brands Co. for up to $510 million as it seeks to divest

from non-core assets and reduce debt.

The consumer-healthcare business--which was spun out of GSK and

is partly owned by Pfizer--said on Thursday it will receive cash

proceeds of around $430 million, as well as a passive minority

interest in the Suave Brands Co.--a portfolio company of

private-equity firm Yellow Wood Partners--valued at up to $80

million.

Haleon said proceeds from the sale will be used to pay down

debt.

"[ChapStick] is not a core focus for Haleon. Selling the brand

allows us to simplify our business and pay down debt more quickly,"

Chief Executive Brian McNamara said.

The sale is expected to close in the second quarter of 2024.

Write to Michael Susin at michael.susin@wsj.com

(END) Dow Jones Newswires

January 25, 2024 02:38 ET (07:38 GMT)

Copyright (c) 2024 Dow Jones & Company, Inc.

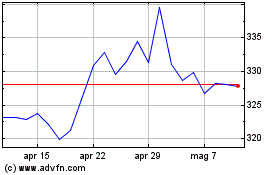

Grafico Azioni Haleon (LSE:HLN)

Storico

Da Apr 2024 a Mag 2024

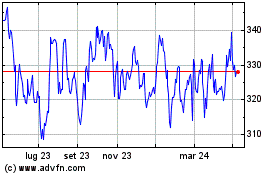

Grafico Azioni Haleon (LSE:HLN)

Storico

Da Mag 2023 a Mag 2024