TIDMICP

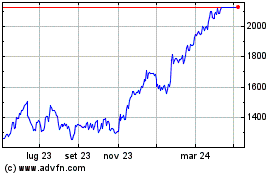

ICG plc

Interim Results Statement for the six months ended 30 September

2023

Delivering growth today, visibility on future opportunities

Highlights

-- Total AUM of $81.0bn, up 3%1 compared to 31 March

2023

-- Fee-earning AUM of $64.2bn, up 4%1 compared to 31

March 2023, and $14.3bn of AUM not yet earning fees

-- Fundraising in line with our expectations at $5.0bn,

with demand both for our flagship strategies ($3.2bn)

and scaling strategies ($1.8bn); remain on track to

meet our medium-term fundraising guidance

-- Management fee income of GBP234m (H1 FY23: GBP252m),

up 5% YoY excluding catch-up fees (H1 FY23: GBP29.3m,

H1 FY24: nil)

-- Performance fee income of GBP29m (H1 FY23: GBP14m)

-- FMC PBT of GBP162.7m (H1 FY23: GBP143.7m), operating

margin of 55%

-- Balance sheet investment performance delivering an

annualized NIR of 11% (five year average: 11%)

-- Group profit before tax of GBP241.9m (H1 FY23:

GBP35.6m) and Group EPS of 71.5p (H1 FY23: 13.5p)

-- NAV per share of 714p (31 March 2023: 694p), robust

capitalisation: net gearing of 0.48x, total available

liquidity of GBP1.0bn

-- Interim dividend of 25.8p per share, in line with

policy (H1 FY23: 25.3p per share)

Note: unless otherwise stated the financial results

discussed herein are on the basis of Alternative Performance

Measures (APM) - see page 5.

(1) On a constant currency basis.

Benoît Durteste

CEO and CIO

ICG had a strategically and financially successful

first half. We are executing on our strategy of "scaling

up" and "scaling out", and are investing in our people

and platform. Our broad waterfront of products today,

built on our 35 years' experience of managing credit,

positions us well to succeed across cycles. During

the period we made progress across flagship, scaling

and seeding strategies. Fee-earning AUM, profits from

our fund management activities, and the value of our

balance sheet all grew. Visibility on our future growth

and earnings prospects increased.

Key funds generated value for our clients and shareholders,

with low default rates, resilient NAVs, and $1.9bn

of realisations(1) . This is underpinned by portfolio

companies being appropriately capitalised and growing

their earnings. Today, clients in our debt funds are

enjoying historically high returns, and our teams

in more equity-oriented funds are successfully navigating

the impact of rising rates on those portfolios.

We are continuing to invest in further diversification,

making seed investments during the period for strategies

including LP Secondaries, Real Estate Equity, Life

Sciences, and Infrastructure Asia. We are also exploring

ways to leverage the breadth of ICG's platform to

distribute products to the HNW and UHNW market, building

on success of Strategic Equity.

In a fast-changing macro background, our long-term

business model is performing. We have the right strategic

and financial resources to execute on the substantial

growth potential embedded in ICG today, and we expect

to make further strategic and financial progress in

the second half of the year and beyond.

(1) Fee-earning AUM of direct investment funds

PERFORMANCE OVERVIEW

Unless stated otherwise, the financial results discussed herein

are on the basis of alternative performance measures (APM), which

the Board believes assists shareholders in assessing the financial

performance of the Group. See page 5 for further information.

Financial performance

Six months to Six months to Year-on-year Twelve months to Last five

30 September 2023 30 September 2022 growth(1) 30 September 2023 years CAGR(1,2)

------------ ------------------ ------------------ ------------- ------------------ ----------------

Total AUM $81.0bn $68.5bn 12% 18%

Fee-earning

AUM $64.2bn $57.3bn 7% 19%

Management

fee income GBP233.9m GBP251.5m (7) % GBP463.8m 23%

Performance

fee income GBP29.3m GBP13.8m n/m GBP35.1m 5%

Annualised

Net

Investment

Return % 11% (2) % 10% 11%(3)

Fund

Management

Company

profit

before tax GBP162.7m GBP143.7m 13% GBP329.7m 23%

Group profit

before tax GBP241.9m GBP35.6m n/m GBP464.4m 9%

Group

earnings

per share 71.5p 13.5p n/m 138.3p 4%

NAV per

share 714p 658p 9% 8%

Dividend per

share 25.8p 25.3p 2% 21%

------------ ------------------ ------------------ ------------- ------------------ ----------------

(1) AUM on constant currency basis.

(2) AUM and per share calculations based on 30 September 2018 to

30 September 2023, all other items LTM 30 September 2018 to LTM 30

September 2023. Dividend includes H1 FY24 declared dividend.

(3) Five year average.

Business activity

Six months to 30 September 2023 Fundraising Deployment(1) Realisations(1,2)

------------------------------- ----------- ------------- -----------------

Structured and Private Equity $2.6bn $0.5bn $0.4bn

Private Debt $1.4bn $1.6bn $1.0bn

Real Assets $0.6bn $1.1bn $0.5bn

Credit $0.4bn

------------------------------- ----------- ------------- -----------------

Total $5.0bn $3.2bn $1.9bn

------------------------------- ----------- ------------- -----------------

(1) Direct investment funds.

(2) Realisations of third-party fee-earning AUM.

Guidance

Our guidance remains unchanged and is set out below.

Fundraising Performance fees FMC Net Investment Returns

operating

margin

------------------------------------------------- ----------------------------------------------------- --------- -----------------------------------------------------

At least $40bn fundraising in aggregate between 1 Performance fees to represent 10 - 15% of third-party In excess Low double-digit percentage points over the

April 2021 and 31 March 2024 fee income over the medium-term of 50% medium-term

------------------------------------------------- ----------------------------------------------------- --------- -----------------------------------------------------

COMPANY PRESENTATION

A presentation for shareholders, debtholders and analysts will

be held at 09:00 GMT today: join via the link on our

https://www.globenewswire.com/Tracker?data=E2AgyQ5KslMoyRrcy0EccMwIbbgRs1MHyW7jh-utK4WkzO_uoho6WoTCOvje6eEXwUPYeU9MHlkVDONp_w9SmkUhzkwb3qRwuLavRqCiH6Iwv7rZ8IxwnSr87L0LZiHc

website. A recording and transcript of the presentation will be

available on demand from the same location in the coming days.

COMPANY TIMETABLE

Ex-dividend date 7 December 2023

Record date 8 December 2023

Last date to elect for dividend reinvestment 14 December 2023

Payment of ordinary dividend 8 January 2024

Q3 trading statement 25 January 2024

Seminar: Deep-dive on "scaling out" 21 February 2024

ENQUIRIES

Shareholders & Debtholders / analysts:

Chris Hunt, Head of Corporate Development & Shareholder

Relations, ICG +44(0)20 3545 2020

Media:

Fiona Laffan, Global Head of Corporate Affairs, ICG +44(0)20 3545 1510

This results statement may contain forward looking statements.

These statements have been made by the Directors in good faith

based on the information available to them up to the time of their

approval of this report and should be treated with caution due to

the inherent uncertainties, including both economic and business

risk factors, underlying such forward looking information.

ABOUT ICG

ICG provides flexible capital solutions to help companies

develop and grow. We are a global alternative asset manager with

over 30 years' history, operating across four asset classes:

Structured and Private Equity, Private Debt, Real Assets, and

Credit.

We develop long-term relationships with our business partners to

deliver value for shareholders, clients and employees. We are

committed to being a net zero asset manager across our operations

and relevant investments by 2040.

ICG is listed on the London Stock Exchange (ticker symbol: ICP).

Further details are available at www.icgam.com.

FINANCIAL REVIEW

AUM

Refer to the

https://www.globenewswire.com/Tracker?data=Tn9AweSSUcFIbFB-Da24yiEynY3x0jLMyGUbjsrVvFUwNd0ySm7P7nhhN4wsA9n28K-qZz4A0iDVmTB0GwMx9STk9KDUkcPhJJNFeOhfPqSAgaGdfkyXIBvsz68olrff

Datapack issued with this announcement for further detail on AUM

(including fundraising, realisations and deployment by fund).

Total AUM

During the period, Total AUM grew 3% on a constant currency

basis (up 1% on a reported basis) and at 30 September 2023 was

$81.0bn (31 March 2023: $80.2bn). The balance sheet investment

portfolio accounted for 4.0% of the Total AUM (31 March 2023:

4.1%).

Third-party AUM and fee-earning AUM

Dry powder and AUM not yet earning fees: at 30 September 2023,

we had $22.3bn of third-party AUM available to deploy in new

investments, $14.3bn of which is not yet earning fees but will do

so when the capital is invested or enters its investment

period.

Current fundraising: at 30 September 2023, closed-end funds that

were actively fundraising included SDP V and SDP SMAs; Strategic

Equity V; North America Credit Partners III; Europe Mid-Market II;

Infrastructure Europe II; LP Secondaries I; Life Sciences I; and

various Real Estate equity and debt strategies. The timings of

closes for these funds depends on a number of factors, including

the prevailing market conditions.

Structured

and

Third-party AUM Private Private Real

($m) Equity Debt Assets Credit Total

------------------- ---------- ---------- ---------- ------------- ----------

At 1 April 2023 27,728 23,641 7,863 17,755 76,987

Additions 2,633 1,464 634 388 5,119

Realisations (428) (312) (334) (1,241) (2,315)

Net additions /

(realisations) 2,205 1,152 300 (853) 2,804

FX and other (1,137) (563) (190) (134) (2,024)

------------------- ---------- ---------- ---------- ------------- ----------

At 30 September

2023 28,796 24,230 7,973 16,768 77,767

------------------- ---------- ---------- ---------- ------------- ----------

Change $m 1,068 589 110 (987) 780

Change % 4% 3% 1% (6) % 1%

Change % (constant

exchange rate) 6% 4% 3% (4) % 3%

------------------- ---------- ---------- ---------- ------------- ----------

Structured

and

Fee-earning AUM Private Private Real

($m) Equity Debt Assets Credit Total

------------------- ---------- ---------- ---------- ------------- ----------

At 1 April 2023 23,840 14,249 6,862 17,898 62,849

Funds raised:

fees on

committed

capital 2,412 -- 405 -- 2,817

Deployment of

funds: fees on

invested

capital 79 1,620 710 490 2,899

Total additions 2,491 1,620 1,115 490 5,716

Realisations (409) (965) (497) (1,282) (3,153)

Net additions /

(realisations) 2,082 655 618 (792) 2,563

Stepdowns (220) -- (92) -- (312)

FX and other(1) (371) (253) (225) (47) (896)

------------------- ---------- ---------- ---------- ------------- ----------

At 30 September

2023 25,331 14,651 7,163 17,059 64,204

------------------- ---------- ---------- ---------- ------------- ----------

Change $m 1,491 402 301 (839) 1,355

Change % 6% 3% 4% (5) % 2%

Change % (constant

exchange rate) 9% 5% 6% (3) % 4%

------------------- ---------- ---------- ---------- ------------- ----------

(1) See page 16 for FX exposure of fee-earning AUM, fee income,

FMC expenses and Balance sheet investment portfolio.

Group financial performance

The Board and management monitor the financial performance of

the Group on the basis of Alternative Performance Measures (APM),

which are non-UK-adopted IAS measures. The APM form the basis of

the financial results discussed in this review, which the Board

believes assist shareholders in assessing their investment and the

delivery of the Group's strategy through its financial

performance.

The substantive difference between APM and UK-adopted IAS is the

consolidation of funds, including seeded strategies, and related

entities deemed to be controlled by the Group, which are included

in the UK-adopted IAS consolidated financial statements at fair

value but excluded for the APM in which the Group's economic

exposure to the assets is reported.

Under IFRS 10, the Group is deemed to control (and therefore

consolidate) entities where it can make significant decisions that

can substantially affect the variable returns of investors. This

has the impact of including the assets and liabilities of these

entities in the consolidated statement of financial position and

recognising the related income and expenses of these entities in

the consolidated income statement.

The Group's profit before tax on an UK-adopted IAS basis was

above prior period at GBP259.9m (H1 FY23: GBP30.8m). On the APM

basis it was above the prior period at GBP241.9m (H1 FY23:

GBP35.6m).

Detail of these adjustments can be found in note 3 to the

UK-adopted IAS condensed consolidated financial statements on pages

27 to 28.

Twelve months

to 30

30 September September

GBPm unless 2023 30 September 2022 2023

stated (Unaudited) (Unaudited) Change % (Unaudited)

-------------- ------------- ----------------- --------------- -------------

Management

fees 233.9 251.5 (7) % 463.8

Performance

fees 29.3 13.8 n/m 35.1

Third-party

fee income 263.2 265.3 (1) % 498.9

Movement in FV

of

derivative -- (45.6) (100) % 18.8

Other Fund

Management

Company

income 32.8 37.2 (12) % 61.3

-------------- ------------- ----------------- --------------- -------------

Fund

Management

Company

revenue 296.0 256.9 15% 579.0

-------------- ------------- ----------------- --------------- -------------

Fund

Management

Company

operating

expenses (133.3) (113.2) 18% (249.3)

-------------- ------------- ----------------- --------------- -------------

Fund

Management

Company

profit before

tax 162.7 143.7 13% 329.7

-------------- ------------- ----------------- --------------- -------------

Fund

Management

Company

operating

margin 55.0% 55.9% (0.9) % 57.0%

-------------- ------------- ----------------- --------------- -------------

Net investment

return 159.4 (26.5) n/m 288.2

Other

Investment

Company

Income (17.6) (7.7) n/m (13.8)

Investment

Company

operating

expenses (48.6) (47.7) (2) % (104.0)

Interest

income 10.0 3.9 n/m 20.0

Interest

expense (24.0) (30.1) 20% (55.7)

-------------- ------------- ----------------- --------------- -------------

Investment

Company

(loss) /

profit before

tax 79.2 (108.1) n/m 134.7

-------------- ------------- ----------------- --------------- -------------

Group profit

before tax 241.9 35.6 n/m 464.4

-------------- ------------- ----------------- --------------- -------------

Tax (37.5) 3.1 n/m (69.4)

-------------- ------------- ----------------- --------------- -------------

Group profit

after tax 204.4 38.7 n/m 395.0

-------------- ------------- ----------------- --------------- -------------

Earnings per 71.5p 13.5p n/m 138.3p

share

Dividend per 25.8p 25.3p 2% 78.0p

share

Liquidity GBP1.0bn GBP1.3bn

Balance sheet GBP3.0bn GBP2.9bn

investment

portfolio

Net gearing 0.48x 0.55x

Net asset 714p 658p

value per

share

Structured and Private Equity

Overview

Flagship strategies Scaling strategies Seeding strategies

------------------- ----------------------- ------------------

European Corporate European Mid-Market Life Sciences

Strategic Equity Asia Pacific Corporate US Mid-Market

LP Secondaries

------------------- ----------------------- ------------------

Six months to Six months to

30 September 2023 30 September 2022 Year-on-year growth(1) Twelve months to 30 September 2023 Last five years CAGR(1,2)

------------- ------------------ ------------------ ---------------------- ---------------------------------- -------------------------

Total AUM $30.9bn $25.3bn 16% 21%

Fee-earning

AUM $25.3bn $23.1bn 4% 20%

Fundraising $2.6bn $3.0bn (15) % $3.0bn

Deployment $0.5bn $1.5bn (65) % $3.3bn

Realisations $0.4bn $0.7bn (39) % $2.1bn

Effective

management

fee rate 1.25% 1.25% -- %

Management

fees GBP127m GBP154m (18) % GBP256m 25%

Performance

fees GBP22m GBP9m n/m GBP27m 6%

Balance sheet

investment

portfolio GBP1.8bn

Annualised

net

investment

return 13% 2% 16%(3)

-------------------------

(1) AUM on constant currency basis.

(2) AUM calculation based on 30 September 2018 to 30 September

2023, all other items LTM 30 September 2018 to LTM 30 September

2023.

(3) Five year average.

Performance of key funds

Refer to the

https://www.globenewswire.com/Tracker?data=Tn9AweSSUcFIbFB-Da24yowiEyrTqpDQXSxu1x8co8N5oBvAkZCjGcOKaqPHYZ4Zi6S3x9PDbODb6RkI2BOSgB_8a3O0W_TdKcTIK4foN1Rx7hnWD6ZhaB-c4bwSA9UG

(Datapack) issued with this announcement for further detail on fund

performance

Total

fund Gross Gross

Vintage size Status % deployed MOIC IRR DPI

------------ -------- --------- ------------ ---------- ----- ----- ----

Europe VI 2015 EUR3.0bn Realising 2.2x 23% 179%

Europe VII 2018 EUR4.5bn Realising 1.8x 20% 42%

Europe VIII 2021 EUR8.1bn Investing 43% 1.2x 16% --

Europe

Mid-Market

I 2019 EUR1.0bn Investing 87% 1.5x 27% 7%

Europe

Mid-Market

II Fundraising

Asia Pacific

III 2014 $0.7bn Realising 2.1x 18% 103%

Asia Pacific

IV 2020 $1.0bn Investing 44% 1.4x 24% --

Strategic

Secondaries

II 2016 $1.1bn Realising 3.0x 48% 155%

Strategic

Equity III 2018 $1.8bn Realising 2.4x 47% 29%

Strategic

Equity IV 2021 $4.3bn Investing 97% 1.7x 53% 4%

Strategic Equity V Fundraisi

ng

LP Secondaries I Fundraisi

ng

Key drivers

Business Fundraising: Strategic Equity ($1.8bn) and Europe

activity Mid-Market II ($0.8bn)

Deployment: Majority coming from European Corporate

($0.2bn) and Europe Mid -Market ($0.2bn)

Realisations: European Corporate ($0.2bn) and Strategic

Equity ($0.2bn)

-------------- --------------------------------------------------------------

Fee income Management fees: Prior period included GBP29.3m of

catch-up fees (H1 FY24: nil)

Performance fees: H1 FY24 includes inaugural recognition

of performance fees for Europe VII (GBP12.5m)

-------------- --------------------------------------------------------------

Balance sheet Investment returns: European Corporate and Strategic

investment Equity drove positive NIR, with underlying portfolio

portfolio companies in both strategies generally continuing

to grow profits, as well as some realisations

Cash flow: GBP86m cash generation, driven by net realisations

in European Corporate and Strategic Equity

-------------- --------------------------------------------------------------

Fund Portfolio continuing to demonstrate earnings growth;

performance exits during the period in Europe VIII, Strategic

Equity IV and LP Secondaries underpinning fund valuations

and DPI

-------------- --------------------------------------------------------------

Private Debt

Overview

Flagship strategies Scaling strategies Seeding strategies

-------------------- ----------------------------- ------------------

Senior Debt Partners North America Credit Partners -

-------------------- ----------------------------- ------------------

Six months to Six months to

30 September 2023 30 September 2022 Year-on-year growth(1) Twelve months to 30 September 2023 Last five years CAGR(1,2)

------------- ------------------ ------------------ ---------------------- ---------------------------------- -------------------------

Total AUM $24.4bn $18.7bn 24% 20%

Fee-earning

AUM $14.7bn $11.8bn 18% 24%

Fundraising $1.4bn $1.0bn 49% $4.3bn

Deployment $1.6bn $2.5bn (35) % $3.6bn

Realisations $1.0bn $1.5bn (37) % $1.4bn

Effective

management

fee rate 0.82% 0.85% (0.03) %

Management

fees GBP47m GBP40m 16% GBP90m 28%

Performance

fees GBP7m GBP4m 73% GBP9m 16%

Balance sheet

investment

portfolio GBP0.2bn

Annualised

net

investment

return 10% 13% 10%(3)

-------------------------

(1) AUM on constant currency basis.

(2) AUM calculation based on 30 September 2018 to 30 September

2023, all other items LTM 30 September 2018 to LTM 30 September

2023.

(3) Five year average.

Performance of key funds

Refer to the

https://www.globenewswire.com/Tracker?data=Tn9AweSSUcFIbFB-Da24ytGHV-RHeI43m4pZ8y8vWzQz5zZ8-32RsKuRGGEOZYfkDEXA6rFXrYQlB6xPR8u7d9DyT86pIWKBJNE3Z-ZYbl06-SjFStkquEMr20V48oM0

(Datapack) issued with this announcement for further detail on fund

performance

Total

fund Gross Gross

Vintage size Status % deployed MOIC IRR DPI

--------- -------- --------- ------------ ---------- ------ ------ ----

Senior

Debt

Partners

II 2015 EUR1.5bn Realising 1.3x 9% 81%

Senior

Debt

Partners

III 2017 EUR2.6bn Realising 1.3x 9% 43%

Senior

Debt

Partners

IV 2020 EUR5.0bn Investing 100% 1.1x 11% --

Senior

Debt

Partners Fundraising

V / Investing

North

American

Private

Debt I 2014 $0.8bn Realising 1.5x 16% 128%

North

American

Private

Debt II 2019 $1.4bn Investing 94% 1.3x 14% 24%

North America Credit Partners Fundraisi

III ng

Key drivers

Business Fundraising: Senior Debt Partners ($1.0bn) and North

activity America Credit Partners III ($0.4bn)

Deployment: Senior Debt Partners ($1.4bn) and North

America Credit Partners ($0.2bn)

Realisations: Senior Debt Partners ($0.9bn)

--------------- -------------------------------------------------------------

Fee income Management fees: continued net deployment driving

higher fee earning AUM

Performance fees: higher investment returns (largely

due to base rate rises) increasing performance fee

potential

--------------- -------------------------------------------------------------

Balance sheet Investment returns: higher base rate and low impairments

investment supporting NIR

portfolio Cash flow: GBP18m cash generation, driven by cash

interest received and modest net realisations

--------------- -------------------------------------------------------------

Fund High base rate, favourable supply / demand dynamics

performance and low impairments continue to drive attractive performance

across our Private Debt strategies

--------------- -------------------------------------------------------------

Real Assets

Overview

Flagship strategies Scaling strategies Seeding strategies

------------------- ---------------------------------- -------------------

- Infrastructure Europe Infrastructure Asia

Strategic Real Estate Europe Real Estate Asia

Metropolitan (Real Estate Equity)

Real Estate Debt

------------------- ---------------------------------- -------------------

Six months to Six months to

30 September 2023 30 September 2022 Year-on-year growth(1) Twelve months to 30 September 2023 Last five years CAGR(1,2)

------------- ------------------ ------------------ ---------------------- ---------------------------------- -------------------------

Total AUM $8.4bn $7.7bn -- 16%

Fee-earning

AUM $7.2bn $6.3bn 5% 18%

Fundraising $0.6bn $0.6bn (2) % $1.0bn

Deployment $1.1bn $1.0bn 6 % $1.8bn

Realisations $0.5bn $0.7bn (29) % $0.8bn

Effective

management

fee rate 0.91% 0.88% --

Management

fees GBP27m GBP25m 9% GBP51m 19%

Performance

fees -- GBP1m (100) % GBP(1)m n/m

Balance sheet

investment

portfolio GBP0.3bn

Annualised

net

investment

return 7% (4) % 6%(3)

-------------------------

(1) AUM on constant currency basis.

(2) AUM calculation based on 30 September 2018 to 30 September

2023, all other items LTM 30 September 2018 to LTM 30 September

2023.

(3) Five year average.

Performance of key funds

Refer to the

https://www.globenewswire.com/Tracker?data=Tn9AweSSUcFIbFB-Da24yhOu2OiZQFwNyACn7DJpgjmxc5kYnkjiu70jXcJQLAXQ6kQ1f6QLzvXybEYR0XsEgPh9AHPBAsZdnLl38_RXjn861WI-0tHicxfeeLhYyYT7

(Datapack) issued with this announcement for further detail on fund

performance

Total

fund Gross Gross

Vintage size Status % deployed MOIC IRR DPI

--------------- -------- --------- ------------ ---------- ----- ----- ---

Real Estate

Partnership

Capital IV 2015 GBP1.0bn Realising 1.2x 6% 97%

Real Estate

Partnership

Capital V 2018 GBP0.9bn Investing 1.2x 10% 25%

Real Estate

Partnership Fundraising

Capital VI / Investing

Infrastructure

Equity I 2020 EUR1.5bn Investing 90% 1.3x 23% 1%

Infrastructure Fundraising

II / Investing

Sale &

Leaseback I 2019 EUR1.2bn Investing 99% 1.1x 8% 8%

Strategic Real Estate II Fundraisi

ng /

Investing

Key drivers

Business Fundraising: Real Estate equity strategies ($0.3bn)

activity and Infrastructure II ($0.2bn)

Deployment: Real Estate equity and debt strategies

($0.8bn), Infrastructure Europe ($0.2bn)

Realisations: Real Estate debt strategies ($0.5bn)

---------------- ------------------------------------------------------------

Fee income Management fees: higher fee earning AUM driven by

fundraising and net deployment

Performance fees: limited given early stages of performance

fee-generating strategies

---------------- ------------------------------------------------------------

Balance sheet Investment returns: Infrastructure and Real Estate

investment Equity driving positive NIR, more than offsetting

portfolio a modest reduction in Real Estate Debt

Cash flow: GBP36m cash consumptive due to net deployments

in Infrastructure and Real Estate equity

---------------- ------------------------------------------------------------

Fund performance Strategic Real Estate and Infrastructure reporting

increases in funds NAV, generally resilient performance

in Real Estate Debt

---------------- ------------------------------------------------------------

Credit

Overview

Flagship strategies Scaling strategies Seeding strategies

------------------- ------------------ ------------------

CLOs Liquid Credit -

------------------- ------------------ ------------------

Six months to Six months to

30 September 2023 30 September 2022 Year-on-year growth(1) Twelve months to 30 September 2023 Last five years CAGR(1,2)

------------- ------------------ ------------------ ---------------------- ---------------------------------- -------------------------

Total AUM $17.2bn $16.8bn (2) % 12%

Fee-earning

AUM $17.1bn $16.0bn 2% 13%

Fundraising $0.4bn $1.0bn (62) % $1.3bn

Realisations $1.3bn $0.9bn (45) % $2.1bn

Effective

management

fee rate 0.49% 0.48% 0.01%

Management

fees GBP34m GBP33m 2% GBP66.5m 13%

Performance

fees -- -- -- -- --

Balance sheet

investment

portfolio GBP0.4bn

Annualised

net

investment

return 9% (22) % 0%(3)

-------------------------

(1) AUM on constant currency basis.

(2) AUM calculation based on 30 September 2018 to 30 September

2023, all other items LTM 30 September 2018 to LTM 30 September

2023.

(3) Five year average.

Key drivers

Business activity Fundraising: US CLO ($0.4bn), with equity tranche

supported by ICG's third-party risk retention fund

Realisations: Liquid Credit ($0.9bn) and CLOs ($0.3bn)

------------------ ----------------------------------------------------------

Fee income Management fees: Modest increase due to higher fee-earning

AUM and effective management fee rate

Performance fees: Limited performance fee-eligible

strategies within Credit

------------------ ----------------------------------------------------------

Balance sheet Investment returns: positive valuation impacts across

investment CLO equity, CLO debt and liquid funds

portfolio Cash flow: cash flow neutral, with realisations and

cash interest receipts (excluding dividends from CLO

equity) offsetting new investments

----------------------------------------------------------

Fund Management Company

The Fund Management Company (FMC) is the Group's principal

driver of long-term profit growth. It manages our third-party AUM,

which it invests on behalf of the Group's clients.

Management fees

Management fees for the period totalled GBP233.9m (H1 FY23:

GBP251.5m), a year-on-year increase of 5% excluding the impact of

catch-up fees (H1 FY23: GBP29.3m, H1 FY24: nil). The effective

management fee rate on our fee-earning AUM at the period end was

0.91% (FY23: 0.90%).

Performance fees

Performance fees for the period totalled GBP29.3m (H1 FY23:

GBP13.8m). The year-on-year increase was largely due to the

inaugural recognition in the current period of performance fees

relating to Europe VII (GBP12.5m). At 30 September 2023 the Group

had an asset of GBP58.9m of accrued performance fees on its balance

sheet (31 March 2023: GBP37.5m):

GBPm

---------------------------------------------- -----

Accrued performance fees at 31 March 2023 37.5

Accruals during period 29.3

Received during period (8.0)

FX and other movements 0.1

---------------------------------------------- -----

Accrued performance fees at 30 September 2023 58.9

---------------------------------------------- -----

Other income and movements in fair value of derivatives

Other income includes dividend receipts of GBP20.3m (H1 FY23:

GBP23.8m) from investments in CLO equity, which are continuing to

be received in line with historical experiences. The FMC also

recognised GBP12.3m of revenue for managing the IC balance sheet

investment portfolio (H1 FY23: GBP12.7m), as well as other income

of GBP0.2m (H1 FY23: GBP0.7m).

During FY23 the Group decided to no longer enter into FX

transaction hedges for its fee income as a matter of course

(although it may still do so on an ad hoc basis), and economically

closed out all outstanding such hedges. For H1 FY24 the movement in

fair value of derivatives within the FMC was zero (H1 FY23:

GBP(45.6)m).

Operating expenses and margin

Operating expenses increased by 18% compared to H1 FY23 and

totalled GBP133.3m (H1 FY23: GBP113.2m). Salaries increased ahead

of headcount (which grew 6%), largely due to a number of senior

hires, while other expenses grew due to timing of expenses compared

to the prior year, a number of senior hires with higher incentives

compared to salary, and ongoing investment in our operating

platform.

Six months ended Six months ended Twelve months ended

GBPm 30 September 2023 30 September 2022 Change 30 September 2023

--------------- ------------------ ------------------ ------------- -------------------

Salaries 47.3 41.9 13% 90.4

Incentive

scheme costs 55.2 46.0 20% 101.4

Administrative

costs 27.4 22.5 22% 50.6

Depreciation

and

amortisation 3.4 2.8 21% 6.9

--------------- ------------------ ------------------ ------------- -------------------

FMC operating

expenses 133.3 113.2 18% 249.3

FMC operating

margin 55.0% 55.9% (1) % 57.0%

--------------- ------------------ ------------------ ------------- -------------------

The FMC recorded a profit before tax of GBP162.7m (H1 FY23:

GBP143.7m), a year-on-year increase of 13% and an increase of 15%

on a constant currency basis.

Investment Company

The Investment Company (IC) invests the Group's balance sheet to

seed new strategies, and invests alongside the Group's scaling and

established strategies to align interests between our shareholders,

clients and employees. It also supports a number of costs,

including for certain central functions, a part of the Executive

Directors' compensation, and the portion of the investment teams'

compensation linked to the returns of the balance sheet investment

portfolio (Deal Vintage Bonus, or DVB).

Balance sheet investment portfolio

The balance sheet investment portfolio was valued at GBP3.0bn at

30 September 2023 (31 March 2023: GBP2.9bn). During the period, it

generated net realisations and related interest of GBP26.6m (H1

FY23: GBP122.4m), being net realisations of GBP3.2m (H1 FY23:

GBP103.2m) and cash interest receipts of GBP23.4m (H1 FY23:

GBP19.2m).

We made seed investments totalling GBP170m, including on behalf

of LP Secondaries, Real Estate Equity, Life Sciences and

Infrastructure Asia.

As at 30

As at 31 New Gains/ (losses) FX & September

GBPm March 2023 investments Realisations in valuation other(2) 2023

------------ ----------- ------------ ------------ --------------- -------- ---------

Structured

and Private

Equity 1,751 32 (118) 111 (10) 1,766

Private Debt 169 6 (14) 8 1 170

Real Assets 289 58 (22) 11 (3) 333

Credit(1) 363 6 (7) 17 (2) 377

Seed

Investments 330 170 (138) 11 2 375

------------ ----------- ------------ ------------ --------------- -------- ---------

Total

Balance

Sheet

Investment

Portfolio 2,902 272 (299) 158 (12) 3,021

------------ ----------- ------------ ------------ --------------- -------- ---------

(1) Within Credit, at 30 September 2023 GBP71m was invested in

liquid strategies, with the remaining GBP306.4m invested in CLO

debt (GBP106.2m) and equity (GBP200.2m).

(2) See page 16 for FX exposure of fee-earning AUM, fee income,

FMC expenses and Balance sheet investment portfolio.

Net Investment Returns

For the five years to 30 September 2023, Net Investment Returns

(NIR) have been in line with our medium-term guidance, averaging

11%. For the six months to 30 September 2023, NIR were GBP159.4m

(H1 FY23: GBP(26.5)m), equating to an annualised rate of 11% (H1

FY23: 2%).

NIR were comprised of interest of GBP59.2m from interest-bearing

investments (H1 FY23: GBP53.0m), unrealised gains of GBP99.0m (H1

FY23: loss of GBP(79.5)m) and other income of GBP1.1m. NIR were

split between asset classes as follows:

Six months to 30 Six months to 30 Twelve months to 30

September 2023 September 2022 September 2023

------------------- ----------------------

NIR Annualised NIR Annualised NIR NIR

GBPm (GBPm) NIR (%) (GBPm) (%) (GBPm) NIR (%)

--------------- ------ ----------- ------ -------------- ------ ------------

Structured and

Private

Equity 111.4 13% 18.2 2 % 206.1 12%

Private Debt 8.9 10% 10.3 13 % 13.0 8%

Real Assets 11.2 7% (6.7) (4) % 38.6 12%

Credit 17.0 9% (45.9) (22) % 32.8 8%

Seed

Investments(1) 11.0 6% (2.4) (3) % (2.2) (1%)

--------------- ------ ----------- ------ -------------- ------ ------------

Total net

investment

returns 159.4 11% (26.5) (2) % 288.3 10%

--------------- ------ ----------- ------ -------------- ------ ------------

(1) FY23 NIR adjusted to reflect three assets with Seed

Investments that were previously included within Real Assets.

For further discussion on balance sheet investment performance

by asset class, refer to pages 6 - 9 of this announcement.

In addition to the NIR, the other adjustments to IC revenue were

as follows:

Six months Six months Twelve months

ended 30 ended 30 ended 30

September September September

GBPm 2023 2022 Change 2023

---------------- ------------- -------------- -------------- -------------

Changes in fair

value of

derivatives(1) (5.8) 3.8 n/m 7.2

Inter-segmental

fee (12.3) (12.7) 3 % (24.6)

Other 0.5 1.2 (58) % 3.6

---------------- ------------- -------------- -------------- -------------

Other IC revenue (17.6) (7.7) n/m (13.8)

---------------- ------------- -------------- -------------- -------------

(1) See page 16 for FX exposure of fee-earning AUM, fee income,

FMC expenses and Balance sheet investment portfolio.

As a result, the IC recorded total revenues of GBP141.8m (H1

FY23: GBP(34.2)m).

Investment Company expenses

Operating expenses in the IC of GBP48.6m increased by 2%

compared to H1 FY23 (GBP47.7m), with modest increases in salaries

and incentive scheme costs being offset by a decrease in

administrative costs:

Six months Six months Twelve months

ended 30 ended 30 ended 30

September September Change September

GBPm 2023 2022 % 2023

--------------- -------------- -------------- -------------- -------------

Salaries 9.9 9.2 8% 20.7

Incentive

scheme costs 28.6 26.6 8% 61.6

Administrative

costs 8.7 10.6 (18) % 18.8

Depreciation

and

amortisation 1.4 1.3 8% 2.9

--------------- -------------- -------------- -------------- -------------

IC operating

expenses 48.6 47.7 2% 104.0

--------------- -------------- -------------- -------------- -------------

Incentive scheme costs included DVB accrual of GBP15.4m (H1

FY23: GBP15.3m), due both to the passage of time and the impact of

underlying valuation changes.

Employee costs for teams who do not yet have a third-party fund

are allocated to the IC. For H1 FY24, the directly-attributable

costs within the Investment Company for teams that have not had a

first close of a third-party fund was GBP12.2m (H1 FY23: GBP10.7m).

When those funds have a first close, the costs of those teams are

transferred to the Fund Management Company. During the period,

certain costs within real estate were transferred from the IC to

FMC, resulting in GBP2.4m of expenses being recognised in the

FMC.

Interest expense was GBP24.0m (H1 FY23: GBP30.1m) and interest

earned on cash balances was GBP10.0m (H1 FY23: GBP3.9m).

The IC recorded a profit before tax of GBP79.2m (H1 FY23: loss

before tax GBP(108.1)m).

Group

Tax

The Group recognised a tax charge of GBP(37.5)m (H1 FY23: tax

credit of GBP3.1m), resulting in an effective tax rate for the

period of 15.5% (H1 FY23: (8.7)%). The increase compared to the

prior year is due to an increase from 19 to 25% in the UK tax rate

and positive NIR.

As detailed in note 7, the Group has a structurally lower

effective tax rate than the statutory UK rate. This is largely

driven by the Investment Company, where certain forms of income

benefit from tax exemptions. The effective tax rate will vary

depending on the income mix.

Dividend

ICG has a progressive dividend policy, and over the long-term

the Board intends to increase the dividend per share by at least

mid-single digit percentage points on an annualised basis.

In line with our policy of paying an interim dividend equal to

one third of the prior year's total dividend, the Board is

declaring an interim dividend of 25.8p per share (H1 FY23: 25.3p).

We continue to make the dividend reinvestment plan available.

Balance sheet

We use our balance sheet's asset base to grow our fee-earning

AUM, and do this through two routes:

-- investing alongside clients in our existing strategies to align

interests; and

-- making investments to seed new strategies.

During the year we made gross investments of GBP102m alongside

existing strategies and GBP170m in seed investments. See page 11

for more information on the performance of our balance sheet

investment portfolio during the period.

To support this asset base, we maintain a robust capitalisation

and a strong liquidity position.

GBPm (unless stated) 30 September 2023 31 March 2023

----------------------------------- ----------------- -------------

Balance sheet investment portfolio 3,021 2,902

Cash and cash equivalents 485 550

Other assets 430 424

----------------------------------- ----------------- -------------

Total assets 3,936 3,876

Financial debt (1,477) (1,538)

Other liabilities (413) (361)

Total liabilities (1,890) (1,899)

----------------------------------- ----------------- -------------

Net asset value 2,046 1,977

----------------------------------- ----------------- -------------

Net asset value per share 714p 694p

----------------------------------- ----------------- -------------

Liquidity and net debt

At 30 September 2023 the Group had total available liquidity of

GBP1,035m (31 March 2023: GBP1,100m), net financial debt of GBP992m

(31 March 2023: GBP988m) and net gearing of 0.48x (31 March 2023:

0.50x).

During the period cash reduced by GBP65m from GBP550m to

GBP485m, including the repayment of GBP51m of borrowings that

matured.

The table below sets out movements in cash:

GBPm H1 FY24 FY23

----------------------------------------------------------- ------- -----

Opening cash 550 762

Operating activities

Fee and other operating income 232 573

Net cash flows from investment activities and investment

income(1) 30 162

Expenses and working capital (153) (322)

Tax paid (1) (32)

------- -----

Group cash flows from operating activities - APM(2,3) 108 381

Financing activities

Interest paid (15) (64)

Interest received on cash balances 13 14

Purchase of own shares -- (39)

Dividends paid (150) (236)

Net repayment of borrowings (51) (195)

------- -----

Group cash flows from financing activities - APM(2) (203) (520)

Other cash flow(4) 26 (77)

FX and other movement 4 4

----------------------------------------------------------- ------- -----

Closing cash 485 550

----------------------------------------------------------- ------- -----

Available undrawn ESG-linked RCF 550 550

----------------------------------------------------------- ------- -----

Cash and undrawn debt facilities (total available

liquidity) 1,035 1,100

----------------------------------------------------------- ------- -----

(1) The aggregate cash (used)/received from balance sheet

investment portfolio (additions), realisations, and cash proceeds

received from assets within the balance sheet investment

portfolio.

(2) Interest paid, which is classified as an Operating cash flow

under UK-adopted IAS, is reported within Group cash flows from

financing activities - APM.

(3) Per note 9 of the Financial Statements, Operating cash flows

under UK-adopted IAS of GBP(75.0)m (FY23: GBP291.6m) include

consolidated credit funds. This difference to the APM measure is

driven by cash consumption within consolidated credit funds as a

result of their investing activities during the period.

(4) Cash flows in respect of purchase of intangible assets,

purchase of property, plant and equipment and net cash flow from

derivative financial instruments.

At 30 September 2023, the Group had drawn debt of GBP1,477m (31

March 2023: GBP1,538m). The change is due to the repayment of

certain facilities as they matured, along with changes in FX rates

impacting the translation value:

GBPm

--------------------------------- -----

Drawn debt at 31 March 2023 1,538

Debt (repayment) / issuance (51)

Impact of foreign exchange rates (10)

--------------------------------- -----

Drawn debt at 30 September 2023 1,477

--------------------------------- -----

Net financial debt therefore increased by GBP4m to GBP992m (31

March 2023: GBP988m):

GBPm 30 September 2023 31 March 2023

------------------- ----------------- -------------

Drawn debt 1,477 1,538

Cash 485 550

------------------- ----------------- -------------

Net financial debt 992 988

------------------- ----------------- -------------

At 30 September 2023 the Group had credit ratings of BBB (stable

outlook) / BBB (stable outlook) from Fitch and S&P,

respectively.

The Group's debt is provided through a range of facilities. All

facilities except the ESG-linked RCF are fixed-rate instruments.

The weighted-average pre-tax cost of drawn debt at 30 September

2023 was 3.07% (31 March 2023: 3.17%). The weighted-average life of

drawn debt at 30 September 2023 was 3.8 years (31 March 2023: 4.1

years). The maturity profile of our term debt is set out below:

GBPm H2 FY24 FY25 FY26 FY27 FY28 FY29 FY30

------------------- -------- ---- ---- ---- ---- ---- ----

Term debt maturing -- 259 186 496 -- 103 433

For further details of our debt facilities see Other Information

(page 38).

Net asset value

Shareholder equity increased to GBP2,046m at 30 September 2023

(31 March 2023: GBP1,977m), equating to 714p per share (31 March

2023: 694p).

Net gearing

The movements in the Group's balance sheet investment portfolio,

cash balance, debt facilities and shareholder equity resulted in

net gearing decreasing to 0.48x at 30 September 2023 (31 March

2023: 0.50x).

GBPm 30 September 2023 31 March 2023 Change %

----------------------- ----------------- ------------- ----------

Net financial debt (A) 992 988 --

Net asset value (B) 2,046 1,977 3%

----------------------- ----------------- ------------- ----------

Net gearing (A/B) 0.48x 0.50x (0.02)x

----------------------- ----------------- ------------- ----------

Foreign exchange rates

The following foreign exchange rates have been used throughout

this review:

12

months

ended 30 30

31 September September

March 2023 2022

Six months ended Six months ended 2023 Period Period 31 March 2023

30 September 2023 Average 30 September 2022 Average Average end end year end

-------- -------------------------- -------------------------- ------- --------- --------- -------------

GBP:EUR 1.1597 1.1691 1.1560 1.1541 1.1394 1.1375

GBP:USD 1.2570 1.2053 1.2051 1.2200 1.1170 1.2337

EUR:USD 1.0839 1.0306 1.0426 1.0571 0.9803 1.0846

-------- -------------------------- -------------------------- ------- --------- --------- -------------

The table below sets out the currency exposure for certain

reported items:

USD EUR GBP Other

------------------------------------------------------- ----------- ----------- ----------- -----------

Fee-earning AUM (as at 30 September 23) 33% 55% 11% 1%

Fee income (6 months to 30 September 23) 31% 59% 9% 1%

FMC expenses (6 months to 30 September 23) 19% 18% 53% 10%

Balance sheet investment portfolio (as at 30 September

23) 30% 44% 20% 6%

------------------------------------------------------- ----------- ----------- ----------- -----------

The table below sets out the indicative impact on our reported

management fees, FMC PBT and NAV per share had sterling been 5%

weaker or stronger against the euro and the dollar in the period

(excluding the impact of any legacy hedges):

NAV per share at

Impact on H1 FY24 Impact on H1 FY24 30 September 2023

management fees(1) FMC PBT(1) (2)

------------------ ------------------- ------------------ -----------------

Sterling 5% weaker

against euro and

dollar GBP11.0m GBP10.9m 13p

Sterling 5%

stronger against

euro and dollar GBP(10.0)m GBP(9.9)m (12)p

------------------ ------------------- ------------------ -----------------

(1) Impact assessed by sensitising the average H1 FY24 FX

rates.

(2) NAV / NAV per share reflects the total indicative impact as

a result of a change in FMC PBT and net currency assets.

Where noted, this review presents changes in AUM, third-party

fee income and FMC PBT on a constant exchange rate basis. For the

purposes of these calculations, prior period numbers have been

translated from their underlying fund currencies to the reporting

currencies at the respective H1 FY24 period end exchange rates.

This has then been compared to the H1 FY24 numbers to arrive at the

change on a constant currency exchange rate basis.

The Group does not hedge its net currency income as a matter of

course, although this is kept under review. The Group does hedge

its net balance sheet currency exposure, with the intention of

broadly insulating the NAV from FX movements. Changes in the fair

value of the balance sheet hedges are reported within the IC.

PRINCIPAL RISKS AND UNCERTAINTIES

The principal risks and uncertainties to which the Group is

exposed for the remainder of the year have been subject to robust

assessment by the Directors and remain consistent with those

outlined in our annual report for the year ended 31 March 2023.

Careful attention continues to be paid to the elevated levels of

geopolitical and economic uncertainty and the resulting impact on

our principal risks and the overall risk profile of the Group.

There have been no material changes and we will continue to monitor

the situation and potential exposures as matters evolve.

RESPONSIBILITY STATEMENT

We confirm to the best of our knowledge:

-- The condensed set of financial statements have been prepared in

accordance with UK-adopted IAS 34 'Interim Financial Reporting' and the

Disclosure Guidance and Transparency Rules of the Financial Conduct

Authority;

-- The interim management report, which is incorporated into the Directors'

report, includes a fair review of the development and performance of the

business and the position of the Group and the undertakings included in

the consolidation taken as a whole, together with a description of the

principal risks and uncertainties that they face;

and

-- There have been no material related-party transactions that have an

effect on the financial position or performance of the Group in the first

six months of the current financial year since that reported in the 31

March 2023 Annual Report.

This responsibility statement was approved by the Board of

Directors on 14 November 2023 and is signed on its behalf by:

Benoît Durteste David Bicarregui

CEO CFO

INDEPENT REVIEW REPORT TO INTERMEDIATE CAPITAL GROUP PLC

Conclusion

We have been engaged by Intermediate Capital Group plc ('the

Group') to review the condensed consolidated financial statements

in the Interim results statement for the six months ended 30

September 2023 which comprises the condensed consolidated income

statement, condensed consolidated statement of comprehensive

income, condensed consolidated statement of financial position,

condensed consolidated statement of cash flows, condensed

consolidated statement of changes in equity and the related

explanatory notes 1 to 10 (together the 'condensed consolidated

financial statements'). We have read the other information

contained in the Interim results statement and considered whether

it contains any apparent misstatements or material inconsistencies

with the information in the condensed consolidated financial

statements.

Based on our review, nothing has come to our attention that

causes us to believe that the condensed consolidated financial

statements in the Interim results statement for the six months

ended 30 September 2023 is not prepared, in all material respects,

in accordance with UK-adopted International Accounting Standard 34,

'Interim Financial Reporting', and the Disclosure Guidance and

Transparency Rules of the United Kingdom's Financial Conduct

Authority.

Basis for Conclusion

We conducted our review in accordance with International

Standard on Review Engagements 2410 (UK) 'Review of Interim

Financial Information Performed by the Independent Auditor of the

Entity' ('ISRE 2410') issued by the Financial Reporting Council. A

review of interim financial information consists of making

enquiries, primarily of persons responsible for financial and

accounting matters, and applying analytical and other review

procedures. A review is substantially less in scope than an audit

conducted in accordance with International Standards on Auditing

(UK) and consequently does not enable us to obtain assurance that

we would become aware of all significant matters that might be

identified in an audit. Accordingly, we do not express an audit

opinion.

As disclosed in note 1, the annual financial statements of the

Group are prepared in accordance with UK-adopted international

accounting standards. The condensed consolidated financial

statements included in this Interim results statement have been

prepared in accordance with UK-adopted International Accounting

Standard 34, 'Interim Financial Reporting'.

Conclusions Relating to Going Concern

Based on our review procedures, which are less extensive than

those performed in an audit as described in the Basis for

Conclusion section of this report, nothing has come to our

attention to suggest that management have inappropriately adopted

the going concern basis of accounting or that management have

identified material uncertainties relating to going concern that

are not appropriately disclosed.

This conclusion is based on the review procedures performed in

accordance with ISRE 2410, however future events or conditions may

cause the entity to cease to continue as a going concern.

Responsibilities of the directors

The directors are responsible for preparing the Interim results

statement in accordance with the Disclosure Guidance and

Transparency Rules of the United Kingdom's Financial Conduct

Authority.

In preparing the Interim results statement, the directors are

responsible for assessing the Group's ability to continue as a

going concern, disclosing, as applicable, matters related to going

concern and using the going concern basis of accounting unless the

directors either intend to liquidate the Group or to cease

operations, or have no realistic alternative but to do so.

Auditor's Responsibilities for the review of the financial

information

In reviewing the Interim results statement, we are responsible

for expressing to the Group a conclusion on the condensed

consolidated financial statements in the Interim results statement.

Our conclusion, including our 'Conclusions Relating to Going

Concern', are based on procedures that are less extensive than

audit procedures, as described in the 'Basis for Conclusion'

paragraph of this report.

Use of our report

This report is made solely to the Group in accordance with

guidance contained in International Standard on Review Engagements

2410 (UK) 'Review of Interim Financial Information Performed by the

Independent Auditor of the Entity' issued by the Financial

Reporting Council. To the fullest extent permitted by law, we do

not accept or assume responsibility to anyone other than the Group,

for our work, for this report, or for the conclusions we have

formed.

Ernst & Young LLP

London

14 November 2023

CONDENSED CONSOLIDATED INCOME STATEMENT

For the six months ended 30 September 2023

Six months ended Six months ended

30 September 2023 30 September 2022

(Unaudited) (Unaudited)

Notes GBPm GBPm

--------------------------------------------------------- ----- ------------------ ------------------

Fee and other operating income 2 253.5 257.0

Finance loss (6.3) (46.1)

Net gains on investments 215.9 5.8

--------------------------------------------------------- ----- ------------------ ------------------

Total Revenue 463.1 216.7

Other income(1) 10.1 4.7

Finance costs (24.9) (31.4)

Administrative expenses (188.0) (164.1)

Share of results of joint ventures accounted for using

the equity method (0.4) 4.9

--------------------------------------------------------- ----- ------------------ ------------------

Profit before tax from continuing operations 259.9 30.8

--------------------------------------------------------- ----- ------------------ ------------------

Tax charge 7 (42.3) 3.3

--------------------------------------------------------- ----- ------------------ ------------------

Profit after tax from continuing operations 217.6 34.1

Profit/(loss) after tax on discontinued operations 4.4 (1.9)

--------------------------------------------------------- ----- ------------------ ------------------

Profit for the period 222.0 32.2

--------------------------------------------------------- ----- ------------------ ------------------

Attributable to:

Equity holders of the parent 225.0 33.4

Non-controlling interests (3.0) (1.2)

--------------------------------------------------------- ----- ------------------ ------------------

222.0 32.2

--------------------------------------------------------- ----- ------------------ ------------------

Earnings per share attributable to ordinary equity

holders of the parent

Basic (pence) 5 78.7p 11.7p

Diluted (pence) 5 77.8p 11.5p

Earnings per share for profit from continuing operations

attributable to ordinary equity holders of the parent

Basic (pence) 5 76.1p 11.9p

Diluted (pence) 5 75.2p 11.7p

1. Interest income for the period ended 30 September 2022 has been

re-presented in line with the format adopted for the period ended 31

March 2023.

The accompanying notes are an integral part of these condensed

financial statements.

CONDENSED CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

For the six months ended 30 September 2023

Six months ended 30 September 2023 Six months ended 30 September 2022

(Unaudited) (Unaudited)

Group GBPm GBPm

------------------------------------------------------ ---------------------------------- ----------------------------------

Profit after tax 222.0 32.2

Items that may be subsequently reclassified to profit

or loss if specific conditions are met

------------------------------------------------------ ---------------------------------- ----------------------------------

Exchange differences on translation of foreign

operations 5.6 46.8

Deferred tax on equity investments translation (0.4) --

------------------------------------------------------ ---------------------------------- ----------------------------------

Total comprehensive income for the year 227.2 79.0

------------------------------------------------------ ---------------------------------- ----------------------------------

Attributable to:

Equity holders of the parent 230.2 80.2

Non-controlling interests (3.0) (1.2)

------------------------------------------------------ ---------------------------------- ----------------------------------

227.2 79.0

------------------------------------------------------ ---------------------------------- ----------------------------------

The accompanying notes are an integral part of these condensed

financial statements.

CONDENSED CONSOLIDATED STATEMENT OF FINANCIAL POSITION

As at 30 September 2023

30

September

2023 31 March 2023

(Unaudited) (Audited)

Notes GBPm

---------------------------------------------------- ----- ----------- -------------

Non-current assets

Intangible assets 13.2 14.9

Property, plant and equipment 85.2 88.2

Investment property 0.8 0.8

Investment in Joint Venture accounted for under the

equity method -- 5.8

Trade and other receivables 48.5 37.1

Financial assets at fair value 4 6,961.6 7,036.6

Derivative financial assets 4 7.6 8.4

Deferred tax asset 19.5 17.6

---------------------------------------------------- ----- ----------- -------------

7,136.4 7,209.4

---------------------------------------------------- ----- ----------- -------------

Current assets

Trade and other receivables 304.8 232.0

Current tax debtor 16.1 57.0

Financial assets at fair value 4 9.9 4.7

Derivative financial assets 4 4.8 13.6

Cash and cash equivalents 709.5 957.5

---------------------------------------------------- ----- ----------- -------------

1,045.1 1,264.8

---------------------------------------------------- ----- ----------- -------------

Assets of disposal groups held for sale 689.5 578.3

---------------------------------------------------- ----- ----------- -------------

Total assets 8,871.0 9,052.5

---------------------------------------------------- ----- ----------- -------------

Non-current liabilities

Trade and other payables 44.8 71.1

Financial liabilities at fair value 4,8 4,376.4 4,572.7

Financial liabilities at amortised cost 8 1,237.1 1,478.2

Other financial liabilities 8 75.3 79.6

Derivative financial liabilities 4,8 -- 0.9

Deferred tax liabilities 37.7 35.5

---------------------------------------------------- ----- ----------- -------------

5,771.3 6,238.0

---------------------------------------------------- ----- ----------- -------------

Current liabilities

Trade and other payables 400.7 471.4

Current tax creditor 7.0 14.8

Financial liabilities at amortised cost 8 247.8 58.5

Other financial liabilities 8 7.4 5.8

Derivative financial liabilities 4,8 41.1 14.8

---------------------------------------------------- ----- ----------- -------------

704.0 565.3

---------------------------------------------------- ----- ----------- -------------

Liabilities of disposal groups held for sale 269.2 204.0

---------------------------------------------------- ----- ----------- -------------

Total liabilities 6,744.5 7,007.3

---------------------------------------------------- ----- ----------- -------------

Equity and reserves

Called up share capital 77.3 77.3

Share premium account 181.3 180.9

Other reserves 38.1 19.0

Retained earnings 1,813.4 1,742.6

---------------------------------------------------- ----- ----------- -------------

Equity attributable to owners of the Company 2,110.1 2,019.8

---------------------------------------------------- ----- ----------- -------------

Non-controlling interest 16.4 25.4

---------------------------------------------------- ----- ----------- -------------

Total equity 2,126.5 2,045.2

---------------------------------------------------- ----- ----------- -------------

Total equity and liabilities 8,871.0 9,052.5

---------------------------------------------------- ----- ----------- -------------

The accompanying notes are an integral part of these condensed

financial statements.

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

For the six months ended 30 September 2023

Six months Six months

ended 30 ended 30

September September

2023 2022

Notes (Unaudited) (Unaudited)

GBPm GBPm

------------------------------------------------------ ----- ----------- -----------

Cash flows (used in)/generated from operations (73.4) 149.3

Taxes paid (1.6) (16.5)

------------------------------------------------------ ----- ----------- -----------

Net cash flows (used in)/from operating activities 9 (75.0) 132.8

------------------------------------------------------ ----- ----------- -----------

Investing activities

Purchase of intangible assets (2.1) (2.8)

Purchase of property, plant and equipment (2.0) (0.5)

Net cash flow from derivative financial instruments 33.7 (50.9)

Cash flow as a result of change in control of

subsidiary -- (7.0)

------------------------------------------------------ ----- ----------- -----------

Net cash flows from/(used in) investing activities 29.6 (61.2)

------------------------------------------------------ ----- ----------- -----------

Financing activities

Purchase of own shares -- (38.9)

Payment of principal portion of lease liabilities (3.8) (0.6)

Repayment of long-term borrowings (50.7) (34.9)

Dividends paid to equity holders of the parent (149.5) (164.4)

------------------------------------------------------ ----- ----------- -----------

Net cash flows used in financing activities (204.0) (238.8)

------------------------------------------------------ ----- ----------- -----------

Net decrease in cash and cash equivalents (249.4) (167.2)

Effects of exchange rate differences on cash and cash

equivalents 1.4 37.4

Cash and cash equivalents at 1 April 957.5 991.8

------------------------------------------------------ ----- ----------- -----------

Cash and cash equivalents at 30 September 709.5 862.0

------------------------------------------------------ ----- ----------- -----------

The Group's cash and cash equivalents include GBP224.2m (31

March 2023: GBP407.5m) of restricted cash held principally by

structured entities controlled by the Group.

The presentation of the condensed consolidated statement of cash

flows have been updated to improve the presentation of this

information. The reconciliation of cash used in/generated from

operations to profit before tax from continuing operations is now

disclosed in note 9.

The accompanying notes are an integral part of these condensed

financial statements.

CONDENSED CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

For the six months ended 30 September 2023

Foreign

Capital currency

Share Share redemption Share based payments reserve Own translation Retained Non-controlling Total

capital premium reserve(1) (note 25) shares(3) reserve(2) earnings Total interest equity

Group GBPm GBPm GBPm GBPm GBPm GBPm GBPm GBPm GBPm GBPm

--------------------------------------------------- ------------ ------------- ----------- ---------------------------- --------------- ------------- --------------- --------------- --------------- ---------------

Balance at 1 April 2023 77.3 180.9 5.0 73.3 (103.4) 44.1 1,742.6 2,019.8 25.4 2,045.2

Profit after tax -- -- -- -- -- -- 225.0 225.0 (3.0) 222.0

Exchange differences on translation of foreign

operations -- -- -- -- -- 5.6 -- 5.6 -- 5.6

Deferred tax on equity investments translation -- -- -- -- -- (0.4) -- (0.4) -- (0.4)

--------------------------------------------------- ------------ ------------- ----------- ---------------------------- --------------- ------------- --------------- --------------- --------------- ---------------

Total comprehensive income/(expense) for the period -- -- -- -- -- 5.2 225.0 230.2 (3.0) 227.2

--------------------------------------------------- ------------ ------------- ----------- ---------------------------- --------------- ------------- --------------- --------------- --------------- ---------------

Adjustment of non-controlling interest on disposal

of subsidiary -- -- -- -- -- -- -- -- (6.0) (6.0)

Issue of share capital 0.0 -- -- -- -- -- -- 0.0 -- 0.0

Options/awards exercised(4) -- 0.4 -- (28.4) 20.6 -- (4.7) (12.1) -- (12.1)

Tax on options/awards exercised -- -- -- 0.5 -- -- -- 0.5 -- 0.5

Credit for equity settled share schemes -- -- -- 21.2 -- -- -- 21.2 -- 21.2

Dividends paid -- -- -- -- -- -- (149.5) (149.5) -- (149.5)

--------------------------------------------------- ------------ ------------- ----------- ---------------------------- --------------- ------------- --------------- --------------- --------------- ---------------

Balance at 30 September 2023 77.3 181.3 5.0 66.6 (82.8) 49.3 1,813.4 2,110.1 16.4 2,126.5

--------------------------------------------------- ------------ ------------- ----------- ---------------------------- --------------- ------------- --------------- --------------- --------------- ---------------

Share Foreign

Capital based currency

Share Share redemption payments Own translation Retained Non-controlling Total

capital premium reserve(1) reserve shares(3) reserve(2) earnings Total interest equity

Group GBPm GBPm GBPm GBPm GBPm GBPm GBPm GBPm GBPm GBPm

--------------------------------------------------- -------- -------- ---------- -------- ---------- ----------- --------- ------- --------------- -------

Balance at 1 April 2022 77.3 180.3 5.0 67.5 (93.0) 20.7 1,714.0 1,971.8 30.0 2,001.8

Profit after tax -- -- -- -- -- -- 33.4 33.4 (1.2) 32.2

Exchange differences on translation of foreign

operations -- -- -- -- -- 46.8 -- 46.8 -- 46.8

--------------------------------------------------- -------- -------- ---------- -------- ---------- ----------- --------- ------- --------------- -------

Total comprehensive income/(expense) for the period -- -- -- -- -- 46.8 33.4 80.2 (1.2) 79.0

--------------------------------------------------- -------- -------- ---------- -------- ---------- ----------- --------- ------- --------------- -------

Adjustment of non-controlling interest on disposal

of subsidiary -- -- -- -- -- -- -- -- (4.9) (4.9)

Acquisition of non-controlling interest -- -- -- -- -- -- -- -- 31.3 31.3

Own shares acquired in the year -- -- -- -- (38.9) -- -- (38.9) -- (38.9)

Options/awards exercised(4) -- -- -- (27.4) 25.8 -- (13.6) (15.2) -- (15.2)

Tax on options/awards exercised -- -- -- (2.6) -- -- -- (2.6) -- (2.6)

Credit for equity settled share schemes -- -- -- 20.4 -- -- -- 20.4 -- 20.4

Dividends paid -- -- -- -- -- -- (164.4) (164.4) -- (164.4)

--------------------------------------------------- -------- -------- ---------- -------- ---------- ----------- --------- ------- --------------- -------

Balance at 30 September 2022 77.3 180.3 5.0 57.9 (106.1) 67.5 1,569.4 1,851.3 55.2 1,906.5

--------------------------------------------------- -------- -------- ---------- -------- ---------- ----------- --------- ------- --------------- -------

1. The capital redemption reserve is a reserve created when a company buys

its own shares which reduces its share capital. GBP1.4m of the balance

relates to the conversion of ordinary shares and convertible shares into

ordinary shares in 1994. The remaining GBP3.6m relates to the

cancellation of treasury shares in 2015.

2. Other comprehensive income/(expense) reported in the foreign currency

translation reserve represents foreign exchange gains and losses on the

translation of subsidiaries reporting in currencies other than sterling.

3. The movement in the Group Own shares reserve in respect of Options/awards

exercised, represents the employee shares vesting net of personal taxes

and social security.

4. The associated personal taxes and social security liabilities are settled

by the Group with the equivalent value of shares retained in the Own

shares reserve.

The accompanying notes are an integral part of these condensed

financial statements.

NOTES TO THE INTERIM CONDENSED CONSOLIDATED FINANCIAL

STATEMENTS

For the six months ended 30 September 2023

1. General information and basis of preparation

Basis of preparation

The interim condensed consolidated financial statements have

been prepared in accordance with UK-adopted IAS 34 Interim

Financial Reporting (IAS 34), the Disclosure Guidance and

Transparency Rules of the Financial Conduct Authority, and on the

basis of the accounting policies and methods of computation set out

in the consolidated financial statements of the Group for the year

ended 31 March 2023.

The interim financial statements are unaudited and do not

constitute statutory accounts within the meaning of section 434 of

the Companies Act 2006. Within the notes to the interim financial

statements, all current and comparative data covering period to (or

as at) 30 September 2023 is unaudited. Data given in respect of 31

March 2023 is audited. The statutory accounts for the year to 31

March 2023 have been reported on by Ernst & Young LLP and

delivered to the Registrar of Companies. The report of the auditors

was (i) unqualified, (ii) did not include a reference to any

matters which the auditors drew attention by way of emphasis

without qualifying their report, and (iii) did not contain a

statement under section 498 (2) or (3) of the Companies Act

2006.

The consolidated financial statements of the Group as at and for

the year ended 31 March 2023 which were prepared in accordance with

UK-adopted International Accounting Standards (UK-adopted IAS) are

available on the Group's website, www.icgam.com.

Going concern

In making their assessment, the Directors have considered a

range of information relating to present and future conditions,

including future projections of profitability, cash flows and

capital resources through the twelve month period to 30 November

2024. The Group has good visibility on future management fees due

to the long term and diversified nature of its funds, underpinned

by a strong, well capitalised balance sheet and approximately

GBP1.0bn of liquidity in cash and undrawn facilities at 30

September 2023.

The Directors have concluded, based on the above assessment,

that the preparation of the interim condensed consolidated

financial statements on a going concern basis over the period to 30

November 2024 continues to be appropriate.

Related party transactions

There have been no material changes to the nature or size of

related-party transactions since 31 March 2023.

Changes in significant accounting policies

The accounting policies adopted in the preparation of the

interim condensed consolidated financial statements are consistent

with those followed in the preparation of the Group's annual

consolidated financial statements for the year ended 31 March 2023.

The Group has not early adopted any standard, interpretation or

amendment that has been issued but is not yet effective.

Critical judgements in the application of accounting policies

and key sources of estimation uncertainty

The critical judgements made by the Directors in the application

of the Group's accounting policies, and the key sources of

estimation uncertainty at the reporting date, are the same as those

disclosed in the Group's annual consolidated financial statements

for the year ended 31 March 2023.

Changes in the composition of the Group

The Group ceased to control 44 subsidiaries of a warehouse fund

previously reported as Discontinued operations within Disposal

groups held for sale (see note 9). The Group disposed of its

interest in ICG Nomura KK, a joint venture.

The Group acquired interests in ten controlled subsidiaries of

warehouse funds reported as Discontinued operations and six other

subsidiaries, all included within Disposal groups held for sale

with no impact on net assets.

2. Revenue