TIDMLSAA

RNS Number : 7357N

Life Settlement Assets PLC

27 September 2023

LIFE SETTLEMENT ASSETS PLC

LEI: 2138003OL2VBXWG1BZ27

(the "Company" or "LSA")

Half-Year Announcement

LSA, a closed-ended investment company which manages portfolios

of whole and fractional interests in life settlement policies

issued by life insurance companies operating predominantly in the

United States, is pleased to announce its unaudited half-year

results for the period ended 30 June 2023.

Highlights

-- Total maturities during the period were USD $14.2 million (H1 2022 USD $16.3 million)

-- Estimated AE ratio ("actual to expected ratio") of HIV

segment of 80%, and of non-HIV segment of 147%, aggregating to

119%

-- The Company's Net Asset Value ("NAV") as at 30 June 2023 was $USD 2.16 per share

-- Cost reductions continue to be a strategic priority.

Michael Baines, Chairman, commented:

"While these results cover a period when market fears of

stagflation are accompanied by inflation and rising interest rates,

the non-correlation of our performance with financial markets works

in favour of our investment case. It is worth noting the

outperformance of the portfolio when measured against other long

duration fixed income assets over the last two years.

The non-HIV policy component of the portfolio has experienced a

high level of maturities, while the HIV policy component had

somewhat less. On an aggregated basis, this has meant higher than

expected cash receipts, but with maturities closely reflecting

their book values, NAV has not been materially affected.

With the completion of the acquisition and the current

assimilation of the acquired policies into the portfolio, the Board

remains focussed on assessing the mortality risk in the Company's

portfolio. Alongside continuing to make further distributions when

maturities occur, controlling costs against the background of the

inflationary environment remains a core priority for the

Board."

Enquiries

For further information, please visit https://www.lsaplc.com/ ,

or contact:

Acheron Capital Limited (Investment Manager)

Jean-Michel Paul

020 7258 5990

Shore Capital (Financial Adviser and Broker)

Robert Finlay

020 7408 4080

ISCA Administration Services Limited

Company Secretary

Tel: 01392 487056

Company performance

Performance analysis is provided in the tables below:

A Share Class

As at As at Percentage

30 June 31 December Change

2023 2022 (%)

Net assets attributable to

Shareholders (USD '000) 107,776 109,913 (1.9)

-------------- -------------- -------------

Shares in issue 49,826,784 49,826,784 -

-------------- -------------- -------------

NAV per share (USD) 2.16 2.21 (1.9)

-------------- -------------- -------------

Closing share price (USD) 1.56 1.37 13.9

-------------- -------------- -------------

(Discount) to NAV (%) (27.9) (38.0) 10.1

-------------- -------------- -------------

Period ended Period ended Percentage

30 June 30 June Change

2023 2022 (%)

-------------- -------------- -----------

Total maturities (USD '000) 14,190 16,266 (12.8)

-------------- -------------- -----------

Net income from portfolio

(USD '000) 5,446 4,892 11.3

-------------- -------------- -----------

Profit for the period (USD

'000) 864 101 7.6

-------------- -------------- -----------

Chairman's Statement

On behalf of the Board, I am pleased to present the Company's

half year results for the period ended 30 June 2023.

These results cover a period when market fears of stagflation

are accompanied by inflation and rising interest rates. Positively

for the Company, the non-correlation of our performance with

financial markets works in favour of our investment case. In this

context it is worth noting the outperformance of the portfolio when

measured against other long duration fixed income assets over the

last two years.

Investment overview

The financial highlights above show the results for the half

year to 30 June 2023. As investors are aware, in the first half of

2023 the acquisition of the MBC portfolio of insurance policies in

the MBC Trust was completed. However, the Company still awaits

confirmation of the final distribution by MBC to its investors,

including APT. Confirmation of the value of the portfolio was

conducted by the Company's external actuary, and this value has

been incorporated into the estimated NAV as at 30 June 2023.

The Company's portfolio has experienced a number of sizeable

maturities in the period, with an aggregate value of USD 14.2

million arising from a total of 51 policies.

Policy administration costs are a key component in determining

the future returns available on the Company's portfolio and

Acheron, continues its review of the policy administration cost

base. Whilst the Company's portfolio structure has been somewhat

simplified following the MBC acquisition, the overall cost of

holding life settlements has, nevertheless, been increasing due to

inflationary pressures on all market participants.

The Life Settlement Market

The secondary market in life settlements continues to be active,

with the decorrelation of the asset class (especially in US

dollars) attracting investors in search of a safe haven.

Portfolio

The overall portfolio is subdivided into portfolios exposed to

either HIV-positive policy holders or non-HIV positive policy

holders. The following table provides information on the Company's

policies by exposure to HIV and non-HIV positive insureds as at 30

June 2023.

Share Class A HIV Non-HIV Total

Number of policies 4 214 129 4 343

------------ ----------- ------------

Total gross face

value 413 951 446 83 568 597 497 520 043

------------ ----------- ------------

Valuation 51 338 880 22 081 700 73 420 580

------------ ----------- ------------

Percentage of

face 12.4% 26.4% 14.8%

------------ ----------- ------------

The non-HIV policy component of the portfolio has experienced a

high level of maturities, while the HIV policy component had

somewhat less. On an aggregated basis, this has meant higher than

expected cash receipts, but with maturities closely reflecting

their book values, NAV has not been materially affected.

Maturities in the period up to 30 June 2023 are shown in the

table below.

Class A

HIV Maturities

(USD) 4 014 946

-----------

Non-HIV Maturities

(USD) 10 175 040

-----------

Total Maturities

(USD) 14 189 986

-----------

In the period under review the non-HIV segment of the portfolio

experienced an estimated AE ("Actual to Expected") ratio of 147%.

However, the HIV segment of the portfolio had an estimated AE ratio

of 80%. While the Non-HIV portfolio has performed well above

expectations, the HIV portfolio has underperformed against

expectation during the first half year.

AE* All classes

HIV 80%

------------

Non-HIV 147%

------------

Total 119%

------------

* in maturity dollar amounts, estimated until June 2023.

The Board believes results over the long term are the best

indicator of underlying performance, and it will continue to

monitor performance in the second half to ascertain whether model

assumptions remain accurate.

On 30 June 2023, Share Class A had a NAV of USD 2.1630 per share

with the NAV performance history shown in the table below.

Class A Year Jan Feb Mar April May Jun YTD

Total NAV

Return 2023 3.87% -0.85% -1.19% 1.33% -1.01% -1.33% 0.78%

------ ------ ------- ------- ------ ------- ------- ------

Portfolio Composition

Further information on the composition of the portfolio as at 30

June 2023 can be found in the Factsheet on our website

https://www.lsaplc.com/investor-relations/announcements/ .

Distributions

On 3 February 2023 the Company declared a special dividend of

6.0209 cents per share totalling approximately USD3.0 million,

which was paid on 24 February 2023 to Shareholders on the register

on 10 February 2023. The Board anticipates being in a position to

make further distributions following receipt of the MBC proceeds,

and, in the meantime, Acheron will be evaluating the future

potential cashflows from the portfolio in the light of its work on

reviewing administration costs.

Outlook

With the completion of the acquisition and the current

assimilation of the acquired policies into the portfolio, the Board

remains focussed on assessing the mortality risk in the Company's

portfolio. Alongside continuing to make further distributions when

maturities occur, controlling costs against the background of the

inflationary environment remains a core priority for the Board. At

the same time the Board will continue to promote awareness of the

relative benefits to investors of the Company ' s investment

case.

Michael Baines

Chairman

26 September 2023

Key Performance Indicators (KPIs)

The Board monitors success in implementing the Company's

strategy against a range of key performance indicators (KPIs),

which are viewed as significant measures of success over the longer

term. These key indicators are those provided in the performance

tables above. Although performance relative to the KPIs is

monitored over quarterly periods, it is success over the long-term

that is viewed as more important. This is particularly important

given the inherent volatility of maturities and short-term

investment returns.

The Board has adopted the following KPIs:

-- Share Price - a key measure for Shareholders to show the most

likely realisable value of this investment if it was sold. Changes

in the share price are closely monitored by the Board.

-- NAV per share - as this is the primary indicator of the

underlying value attributable to each share.

-- Premium/(discount) to NAV - as this measure can be used to

monitor the difference between the underlying Net Asset Value and

share price.

-- Total maturities (USD) - the value of the total maturities in

USD provides an indicator of the underlying cash flow that the

Company receives from its main source of income - policy

maturities. There are factors which could impact the outcome of

this performance measure including: average life expectancy and the

age of the underlying policy holders. Please note that the Actual

to Expected ("A/E") ratio, which is closely linked to the total

maturities KPI, is a key method by which the Board monitors the

level of maturities. The A/E ratio measures the declared maturities

compared to the projected maturities based on the actuarial models.

A ratio close to 100% indicates maturities correspond exactly to

the model. A percentage greater than 100% means the maturities are

more than anticipated by the models and less than 100% the opposite

is the case.

-- Earnings per share - this is a key measure of financial

performance used to assess the fortunes of the Company over each

financial period.

-- Profit/(loss) for the period - this is a key measure of

financial performance used to assess the fortunes of the Company

over each financial period.

-- Running costs - The Ongoing Charges of the Company for the

financial period under review represented 5.0% (year to 31 December

2022: 7.1%) of average net assets. Excluding the servicing and

legal costs the ratio would be 2.5%.

Shareholders should note that this ratio has been calculated in

accordance with the Association of Investment Companies' ("AIC")

recommended methodology, published in May 2012. This figure

indicates the annual percentage reduction in Shareholder returns as

a result of recurring operational expenses. Although the Ongoing

Charges figure is based on historic information, it does provide

Shareholders with a guide to the level of costs that may be

incurred by the Company in the future.

Please Note: The Company regularly uses alternative performance

measures to present its financial performance. These measures may

not be comparable to similar measures used by other companies, nor

do they correspond to IFRS standards or other accounting

principles.

Directors' Statement of Principal Risks and Uncertainties

The important events that have occurred during the period under

review and the key factors influencing the financial statements are

set out in the Chairman's Statement above.

In accordance with DTR 4.2.7, the Directors consider that the

principal risks and uncertainties facing the Company have not

materially changed since the publication of the Annual Report and

Accounts for the year ended 31 December 2022.

The principal risks faced by the Company include, but are not

limited to:

-- HIV Mortality risk

-- Premium management risk

-- Volatility risk

-- Fractional premium risk

-- Fractional ownership risk

-- Advance age mortality risk

-- Discount rate risk

-- Modelling risk

-- Tax

-- Breach of applicable legislative obligations

-- Counterparty risk

A more detailed explanation of these risks and the way in which

they are managed can be found in the Strategic Report on pages 21

to 23 and in Note 4 to the Financial Statements on pages 63 to 66

of the 2022 Annual Report and Accounts - copies can be found via

the Company's website, www.lsaplc.com .

There have been no significant changes in the related party

disclosures set out in the Annual Report.

Directors' Statement of Responsibilities in Respect of the

Financial Statements

In accordance with Disclosure and Transparency Rule (DTR) 4.2.10

Michael Baines (Chairman), Christopher Casey (Audit Committee

Chairman) and Guner Turkmen, the Directors, confirm that to the

best of their knowledge:

-- The condensed set of financial statements contained within

this Half-Yearly financial report have been prepared in accordance

with International Accounting Standard ("IAS") 34 as adopted in the

UK and gives a true and fair view of the assets, liabilities,

financial position and profit of the Company; and

-- The Half-Yearly financial report includes a fair review of

the information required by the FCA's Disclosure and Transparency

Rule 4.2.7R being disclosure of important events that have occurred

during the first six months of the financial year, their impact on

the condensed set of financial statements and a description of the

principal risks and uncertainties for the remaining six months of

the year; and

-- The Half Yearly financial report includes a fair review of

the information required by the FCA's Disclosure and Transparency

Rule 4.2.8R being disclosure of related party transactions during

the first six months of the financial year, how they have

materially affected the financial position of the Company during

the period and any changes therein.

This Half-Yearly Report was approved by the Board of Directors

on 26 September 2023 and the above responsibility statement was

signed on its behalf by:

Michael Baines

Chairman

26 September 2023

Condensed Statement of Comprehensive Income

for the six months ended 30 June 2023

______________________________________________

Six months ended Six months ended Year ended

30 June 2023 30 June 2022 31 December 2022

(unaudited) (unaudited) (audited)

Note Revenue Capital Total Revenue Capital Total Revenue Capital Total

USD'000 USD'000 USD'000 USD'000 USD'000 USD'000 USD'000 USD'000 USD'000

Income

Gains from life

settlement

portfolios 3

Maturities - 14,190 14,190 - 16,266 16,266 - 27,197 27,197

Acquisition cost

of maturities

and fair value

movement - (4,213) (4,213) - (3,644) (3,644) - (10,220) (10,220)

-------- ---------- ---------- -------- ---------- ---------- -------- ----------- -----------

Sub total - 9,977 9,977 - 12,622 12,622 - 16,977 16,977

Incurred premiums

paid in period

on all policies - (9,415) (9,415) - (7,944) (7,944) - (15,551) (15,551)

Unrealised gains

Fair value

adjustments - 4,554 4,554 - (89) (89) - 6,795 6,795

Income from life

settlement

portfolios 307 - 307 301 - 301 623 - 623

Other income 23 - 23 6 - 6 9 - 9

Net foreign exchange

loss (1) - (1) (4) - (4) - - -

______ ______ ______ ______ ______ ______ _______ _______ ______

Total income 329 5,116 5,445 303 4,589 4,892 632 8,221 8,853

Operating expenses

Investment management

fees 4 (810) (743) (1,553) (820) 267 (553) (1,640) 409 (1,231)

Other expenses (1,927) - (1,927) (3,832) - (3,832) (6,051) - (6,051)

______ ______ ______ ______ ______ ______ _______ _______ _____

(Loss)/profit

before finance

costs and taxation (2,408) 4,373 1,965 (4,349) 4,856 507 (7,059) 8,630 1,571

Finance costs

Interest payable (1,102) - (1,102) (406) - (406) (972) - (972)

______ ______ ______ ______ ______ ______ _______ _______ _____

(Loss)/profit/before

taxation (3,510) 4,373 863 (4,755) 4,856 101 (8,031) 8,630 599

Taxation - - - - - - - - -

______ ______ ______ ______ ______ ______ _______ _______ _____

(Loss)/profit

for the period (3,510) 4,373 863 (4,755) 4,856 101 (8,031) 8,630 599

====== ===== ====== ====== ===== ====== ======= ====== =====

Return per class

A share USD 6 (0.070) 0.087 0.017 (0.095) 0.097 0.002 (0.161) 0.173 0.012

All revenue and capital items in the above statement derive from

continuing operations of the Company.

The Company does not have any income or expense that is not

included in the profit for the period and therefore the profit for

the period is also the total comprehensive income for the

period.

The total column of this statement is the Statement of Total

Comprehensive Income of the Company. The supplementary revenue and

capital columns are prepared in accordance with the Statement of

Recommended Practice ("SORP") issued by the Association of

Investment Companies ("AIC") in July 2022.

The notes form part of these financial statements.

Condensed Statement of Financial Position

as at 30 June 2023

As at As at As at

30 June 30 June 31 December

2023 2022

(unaudited) 2022 (audited)

Note (unaudited)

USD'000 USD'000 USD'000

Non-current assets

Financial assets at fair value through

profit or loss:

- Life settlement investments 8 73,421 65,902 62,742

_______ _______ _______

73,421 65,902 62,742

Current assets

Maturities receivable 7,518 15,454 7,410

Trade and other receivables 12,180 17 2,051

Premiums paid in advance 4,488 6,277 5,264

Cash and cash equivalents 13,908 25,902 35,907

_______ _______ _______

38,094 47,650 50,632

_______ _______ _______

Total assets 111,515 113,552 113,374

_______ _______ _______

Current liabilities

Other payables (1,557) (1,556) (1,522)

Provision for performance fees 9 (2,182) (2,581) (1,939)

_______ _______ _______

Total liabilities (3,739) (4,137) (3,461)

_______ _______ _______

Net assets 107,776 109,415 109,913

====== ====== ======

Represented by

Capital and reserves

Share capital 10 498 498 498

Special reserve 11 91,290 94,290 94,290

Capital redemption reserve 213 213 213

Capital reserve 57,727 49,580 53,354

Revenue reserve (41,952) (35,166) (38,442)

_______ _______ _______

Total equity attributable to ordinary

Shareholders of the Company 107,776 109,415 109,913

======= ======= =======

Net Asset Value per share basic

and diluted

Class A shares USD 12 2.16 2.20 2.21

Registered in England and Wales with Company Registration

number: 10918785

The notes form part of these financial statements.

Condensed Statement of Changes in Equity

for the six months ended 30 June 2023

Capital

Share Special redemption Capital Revenue

capital reserve reserve reserve reserve Total

USD'000 USD'000 USD'000 USD'000 USD'000 USD'000

Six months ended 30 June

2023

Balance as at 31 December

2022 498 94,290 213 53,354 (38,442) 109,913

Comprehensive income/(loss)

for the period - - - 4,373 (3,510) 863

Contributions by and distributions

to owners

Dividends paid in period - (3,000) - - - (3,000)

____ _______ _______ ______ _______ _______

Balance as at 30 June 2023 498 91,290 213 57,727 (41,952) 107,776

===== ======= ======= ====== ======= =======

Of which:

Realised gains 39,813

Unrealised gains 17,914

Six months to 30 June

2022

Balance as at 31 December

2021 498 94,290 213 44,724 (30,411) 109,314

Comprehensive income/(loss)

for the period - - - 4,856 (4,755) 101

____ _______ _______ ______ _______ _______

Balance as at 30 June 2022 498 94,290 213 49,580 (35,166) 109,415

==== ====== ======= ===== ====== ======

Of which:

Realised gains 39,752

Unrealised gains 9,828

Year ended 31 December

2022

Balance as at 31 December

2021 498 94,290 213 44,724 (30,411) 109,314

Comprehensive income/(loss)

for the year - - - 8,630 (8,031) 599

_____ _______ _______ ______ _______ ______

Balance as at 31 December

2022 498 94,290 213 53,354 (38,442) 109,913

===== ====== ======= ====== ====== ======

Of which:

Realised gains 40,500

Unrealised gains 12,854

The Special reserve was created as a result of the cancellation

of the Share premium account following a court order issued on 18

June 2019. The Special reserve is distributable and may be used to

fund purchases of the Company's own shares and to make

distributions to Shareholders.

The revenue and realised capital reserves are also distributable

reserves.

The notes form part of these financial statements.

Condensed Cash Flow Statement

for the six months ended 30 June 2023

Six Six Year ended

months ended months ended 31 December

2022

30 June 2023 30 June (audited)

2022

(unaudited) (unaudited)

USD'000 USD'000 USD'000

Cash flows generated from operating

activities

Profit for the period 863 101 599

Non-cash adjustment

* movement on portfolios (341) 3,958 3,650

Investment in life settlement

portfolios (11,904) (53) (132)

Movements in "policy advances" 1,566 18,217 21,764

Interest paid 1,102 406 972

Changes in operating assets

and liabilities

Changes in maturities receivables (108) (9,249) (1,205)

Changes in trade and other receivables (10,129) 313 (1,721)

Changes in premiums paid in advance 776 248 1,261

Changes in other payables 35 608 574

Changes in performance fee provision 243 (267) (909)

______ ______ ______

Net cash (outflows)/inflows

from operating activities (17,897) 14,282 24,853

Cash flow used in financing

activities

Dividends paid (3,000) - -

Interest paid (1,102) (406) (972)

_____ _____ ______

Net cash flows used in financing

activities (4,102) (406) (972)

______ ______ ______

Net changes in cash and cash

equivalents (21,999) 13,876 23,881

Cash balance at the beginning

of the period 35,907 12,026 12,026

______ ______ ______

Cash balance at the end of the

period 13,908 25,902 35,907

====== ====== ======

The notes form part of these financial statements.

Notes to the Condensed Financial Statements

for the six months ended 30 June 2023

Note 1 General information

Life Settlement Assets ("Life Settlement Assets" or the

"Company") is a public company limited by shares and an investment

company under section 833 of the Companies Act 2006. It was

incorporated in England and Wales on 16 August 2017 with a

registration number of 10918785. The registered office of the

Company is 115 Park Street, 4th Floor, London W1K 7AP.

The principal activity of Life Settlement Assets is to manage

investments in whole and partial interests in life settlement

policies issued by life insurance companies operating predominantly

in the United States.

In May 2018, the Company received confirmation from HM Revenue

& Customs of its approval as an investment trust for tax

accounting periods commencing on or after 26 March 2018, subject to

the Company continuing to meet the eligibility conditions contained

in section 1158 of the Corporation Tax Act 2010 and the ongoing

requirements in Chapter 3 of Part 2 of the Investment Trust

(Approved Company) (Tax) Regulations 2011(Statutory Instrument

2011/2999).

The Company currently has one class of Ordinary Shares in issue,

namely the A shares which principally participates in a portfolio

of life settlement assets and associated liabilities, which were

acquired from Acheron Portfolio Corporation (Luxembourg) SA ("APC"

or the "Predecessor Company") on 26 March 2018.

Note 2 IFRS accounting policies

2.1 Basis of preparation

These condensed interim financial statements have been prepared

using the same accounting policies and methods of computation as in

the 2022 annual financial statements.

The condensed financial statements, which comprise the unaudited

results of the Company have been prepared in accordance with UK

adopted International Reporting Standards ("IFRS") and with the

requirements of the Companies Act 2006. They have also been

prepared in accordance with the SORP for investment companies

issued by the AIC in July 2022, except to the extent that it

conflicts with IFRS. The accounting policies are as set out in the

Report and Accounts for the year ended 31 December 2022.

The half-year financial statements have been prepared in

accordance with IAS 34 "Interim Financial Reporting".

The financial information contained in this Half-Yearly

financial report does not constitute statutory accounts as defined

by the Companies Act 2006.The financial information for the periods

ended 30 June 2023 and 30 June 2022 have not been audited or

reviewed by the Company's Auditor. The figures and financial

information for the year ended 31 December 2022 are an extract from

the latest published audited statements and do not constitute the

statutory accounts for that year. Those accounts have been

delivered to the Registrar of Companies and include a report of the

Auditor, which was unqualified and did not contain a statement

under either Section 498(2) or 498(3) of the Companies Act

2006.

2.2 Going concern

The Directors have made an assessment of the Company's ability

to continue as a going concern and are satisfied that the Company

has adequate resources to continue in operational existence for the

foreseeable future (being a period of 12 months from the date these

financial statements were approved). Furthermore, the Directors are

not aware of any material uncertainties that may cast significant

doubt upon the Company's ability to continue as a going concern,

having taken into account the liquidity of the Company's investment

portfolio and the Company's financial position in respect of its

cash flows, liabilities from its assets and the ongoing charges,

including annual premiums. Therefore, the financial statements have

been prepared on the going concern basis and on the basis that

approval as an investment trust will continue to be met.

Note 3 Gains from life settlement portfolios

When a maturity is declared, a realised capital gain or loss is

recognised on the investment in the policy, calculated by deducting

from the value of the maturity the initial acquisition cost and the

previously unrealised fair value adjustments.

The amount of premiums incurred during the period is reflected

as a deduction of income from life settlement portfolios. The

amount of premiums paid in advance as at 30 June 2023 amounted to

USD 4,488,000 (30 June 2022: USD 6,277,000, 31 December 2022: USD

5,264,000).

Note 4 Management fees and performance fees

30 June 30 June 31 December

2023 2022 2022

USD'000 USD'000 USD'000

Acheron Capital management

fees 810 820 1,640

Performance fees 743 (267) (409)

______ ______ _____

1,553 553 1,231

===== ===== =====

Under an agreement dated 26 March 2018, the Investment Manager

is entitled to a management fee payable by the Trust at an annual

rate of no more than 1.5% of the Net Asset Value. Management fees

paid during the period amounted to USD 810,000 (30 June 2022: USD

820,000, 31 December 2022: USD 1,640,000).

Until 30 June 2022 the Performance fee in respect of the Trust

was an amount equal to 20% of the sum of the distributions made to

the holders of the Shares in the Company corresponding to the

Trust, in excess of the Performance Hurdle (assessed at the time of

each distribution).

The Performance Hurdle " was met when (from time to time) the

aggregate distributions (in excess of the Catch-Up Amount) made to

the holders of the corresponding Ordinary Shares compounded at 3%

per annum.

The"Catch-Up Amount"was an amount equal to the distributions

that would have been required to be made to the Predecessor Company

' s shareholders of the corresponding share class in order for the

Accrued Performance Distributions (less, where applicable, any

clawback of such Accrued Performance Distributions) to be paid

(determined as at 31 December 2021), reduced by an amount equal to

any distributions paid to the Predecessor Company's shareholders of

the relevant share class prior to the Acquisition.

On 30 June 2022 the Company announced that after discussions

with Acheron Capital Limited ("ACL " ) an agreement had been

reached with ACL that once the current litigation process with one

of the policy trustees has been resolved, the performance fee will

be reduced from 20% as described above to 10% over the existing

hurdle rate.

In consideration of this reduction the Board agreed to release

any accrued performance fees payable to ACL held by the Company in

excess of USD 1 million, as calculated at 31 January 2023, as a

one-off payment. In acknowledgement of the significant work that

ACL has had to perform with regard to the legal dispute over a long

period, the Directors of LSA agreed to make an advance to ACL on 30

June 2022, subject to an agreed clawback mechanism, of USD 0.5

million, which was credited against the amount to be paid under the

above arrangement, following the publication of the 2022 financial

results.

Note 5 Taxation

The Company has an effective UK tax rate of 0% for the year

ending 31 December 2023. The estimated effective tax rate is 0% as

investment gains are exempt from tax owing to the Company's status

as an investment trust and there is expected to be an excess of

management expenses over taxable income.

The company suffers US withholding tax on income received

dividends and interest. The tax charge for the period amounted to

USD nil.

5.1 Withholding tax on matured policies

In accordance with the taxation treaty between the United States

of America and the United Kingdom, withholding tax on matured

policies is not due if at least 6% of the average capital stock of

the main class of Shares is traded during the previous year on a

recognised stock exchange. The Board believes that in the period

ended 31 December 2022 the Company fulfilled this requirement.

Note 6 Return per share

As stated in Note 10, the share capital of the Company comprises

49,826,784 A shares. All Shares are fully paid. Neither unpaid

shares nor any kind of option are outstanding, so the basic

profit/(loss) per share is also the diluted profit/(loss) per

share.

Six months Six months Year ended

ended 30 ended 30 31 December

June 2023 June 2022 2022

Earnings per share:

Revenue return (USD'000) (3,510) (4,755) (8,031)

Capital return (USD'000) 4,373 4,856 8,630

Total return (USD'000) 863 101 599

Weighted average number

of shares in the period 49,826,784 49,826,784 49,826,784

Income return per share

(USD) (0.070) (0.095) (0.161)

Capital return per share

(USD) 0.087 0.097 0.173

Basic and diluted total

earnings per share (USD) 0.017 0.002 0.012

Note 7 Financial instruments measured at fair value

The life settlement portfolios have been classified as financial

assets held at fair value through profit or loss as their

performance is evaluated on a fair value basis.

The fair value hierarchy set out in IFRS 13 groups financial

assets and liabilities into three levels based on the significant

inputs used in measuring the fair value of the financial assets and

liabilities.

The fair value hierarchy has the following levels:

- level 1: quoted prices (unadjusted) in active markets for identical assets or liabilities;

- level 2: inputs other than quoted prices included within Level

1 that are observable for the assets or liabilities, either

directly (i.e as prices) or indirectly (i.e. derived from prices);

and

- level 3: inputs for the assets or liabilities that are not

based on observable market data (unobservable inputs).

The life settlement portfolios of USD 73,421,000 (30 June 2022:

USD 65,902,000, 31 December 2022: USD 62,742,000) are all

classified as level 3.

Note 8 Financial assets held at fair value through profit or

loss: Life Settlement Portfolios

As at As at As at 31

30 June 30 June December

2023 2022 2022

USD'000 USD'000 USD'000

Movements for the period

are as follows:

Opening valuation 62,742 88,024 88,024

Acquisitions during the

period 11,904 53 132

Proceeds from matured policies (14,190) (16,266) (27,197)

Net realised gains on policies 9,978 12,622 16,977

Movements in cash from policy

advances (1,566) (18,217) (21,764)

Escrow rebate - (225) 6,795

Movements in unrealised

valuation 4,553 (89) (225)

_______ _______ ______

Closing valuation 73,421 65,902 62,742

======= ======= ======

Details at period end: USD'000 USD'000 USD'000

Acquisition value 95,955 91,409 88,770

Unrealised capital gains 17,914 9,828 12,854

Policy advances (40,448) (35,335) (38,882)

_______ _______ _______

Closing valuation 73,421 65,902 62,742

====== ====== =======

Distribution of the portfolio by class of Shares and by type of

risk:

30 June 30 June 31 December

2023 2022 2022

USD'000 USD'000 USD'000

Elderly life insurance

(non-HIV) portfolio 22,082 23,770 22,075

HIV portfolio 51,339 42,132 40,667

(________) (________) (_________)

Balance as at 30 June 2023 73,421 65,902 62,742

===== ===== ======

Fair market value reflects the view of Acheron Capital Limited,

the Investment Manager of the trust in which the policies of Class

A are kept.

Note 9 Provision for performance fees

30 June 30 June 31 December

2023 2022 2022

USD'000 USD'000 USD'000

Provision brought forward 1,939 2,848 2,848

Increase/(reduction) in provision

during the period (note 4) 743 (267) (409)

Performance fee paid in the

period (500) (-) (500)

(________) (________) (_________)

Balance as at 30 June 2023 2,182 2,581 1,939

===== ===== ======

The Performance fee does not have a fixed date for payment but

can become payable immediately in the event that:

a. a crystallisation event as set out in the Investment

Management Agreement occurs; or

b. distributions to Shareholders exceed the Performance

Hurdle.

As a result the Performance fee has been treated as a current

liability.

As described in Note 8 on page 67 of the 2022 Annual Report, an

advance of USD 500,000 was made on 30 June 2022 as a one-off

payment. A further payment of USD 500,000 was advanced during the

period as shown in the table above .

Note 10 Share Capital

At the 30 June 2023, (the Company's share capital amounts to USD

498,268 (30 June 2022: USD 498,268 31 December 2022: USD 498,268)

and is represented by 49,826,784 Ordinary A shares of USD 0.01

each.

The issued and fully paid share capital at 30 June 2023 is

comprised of 49,826,784 Class A shares.

Class A shares relate to specific investments determined by the

Board of Directors or as the case may be, by a general meeting of

Shareholders. Each investment is undertaken for the exclusive

benefit and risk of the relevant class of shares. All shares have

equal voting rights.

Note 11 Special reserve

The Special reserve was created as a result of the cancellation

of the Share premium account following a court order issued on 18

June 2019. The Special reserve is distributable and may be used to

fund purchases of the Company's own shares and to make

distributions to Shareholders.

Note 12 Net assets and net asset value per Share Class

The Net Asset Value (NAV) is shown below.

30 June 30 June 31 December

2023 2022 2022

Net assets (USD'000) 107,776 109,415 109,913

Number of shares 49,826,784 49,826,784 49,826,784

NAV per share (USD) 2.16 2.20 2.21

Note 13 Related party transactions

Related parties to the Company are the members of the Board of

Directors of the Company, Compagnie Européenne de Révision S.à r.l.

as Administrator who previously had a member on the Board of

Directors and the Trustee of the US trust who was also previously a

member of the Board of Directors.

30 June 2023

USD'000

Per income statement:

Trustee fees 74

Compagnie Européenne de Révision

S.à r.l. 65

Directors' fees 72

Amounts payable per balance sheet:

Compagnie Européenne de Révision

S.à r.l. 51

Directors' fees 14

All transactions with related parties are undertaken

at arm's length.

Shares held by related parties (Directors and companies

under their control)

- Michael Baines 50,000 A shares

Note 14 Post balance sheet events

There are no post balance sheets events to disclose.

COMPANY INFORMATION

Directors

Michael Baines - Chairman

Christopher Casey

Guner Turkmen

Registered Office

115 Park Street

4th Floor

London W1K 7AP

Auditor

BDO LLP

55 Baker Street

London

W1U 7EU

Trust's Investment Manager

Acheron Capital Limited

115 Park Street

4th Floor

London W1K 7AP

Registrars

The City Partnership (UK) Limited

The Mending Rooms

Park Valley Mills

Meltham Road

Huddersfield

HD4 7BH

Brokers

Shore Capital and Corporate Limited

Cassini House

57 St James Street

London

SW1A 1LD

Company Secretary

ISCA Administration Services Limited

Suite 8,

Bridge House

Courtenay Street

Newton Abbot

TQ12 2QS

Email: lsa@iscaadmin.co.uk

Telephone: 01392 487056

LEI: 2138003OL2VBXWG1BZ27

Website - https://www.lsaplc.com

Registered in England and Wales with Company Registration

number: 10918785

Neither the contents of the Company's website nor the contents

of any website accessible from hyperlinks on this announcement (or

any other website) is incorporated into, or forms part of this

announcement.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR UNANROVUKUAR

(END) Dow Jones Newswires

September 27, 2023 02:00 ET (06:00 GMT)

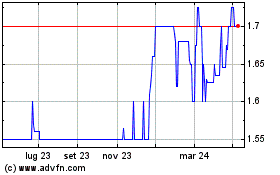

Grafico Azioni Life Settlement Assets (LSE:LSAA)

Storico

Da Mar 2024 a Apr 2024

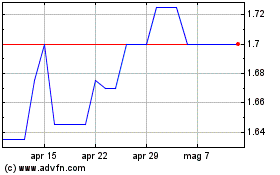

Grafico Azioni Life Settlement Assets (LSE:LSAA)

Storico

Da Apr 2023 a Apr 2024