TIDMNWG TIDMTTM

RNS Number : 4720V

NatWest Group plc

09 August 2022

,

August 9, 2022

NATWEST GROUP PLC AND NATWEST MARKETS N.V. - RESULTS OF SEPARATE

CASH TER OFFERS FOR CERTAIN OF THEIR RESPECTIVE OUTSTANDING

NOTES

NatWest Group plc ("NatWest Group") and NatWest Markets N.V.

("NWM N.V.") (each an "Offeror" and, together, the "Offerors") are

each today announcing the results of their previously announced

separate cash tender offers (with respect to the tender offers

launched by NatWest Group, the "NatWest Group Offer", and with

respect to the tender offers launched by NWM N.V., the "NWM N.V.

Offer", each an "Offer") in respect of any and all of certain

series of their respective U.S. dollar denominated notes set out in

the table below (collectively, the "Notes").

The NatWest Group Offer was made on the terms and subject to the

conditions set out in NatWest Group's offer to purchase dated

August 1, 2022 and the related Notice of Guaranteed Delivery (the

"NatWest Group Offer to Purchase"). The NWM N.V. Offer was made on

the terms and subject to the conditions set out in NWM N.V.'s offer

to purchase dated August 1, 2022 and the related Notice of

Guaranteed Delivery (the "NWM N.V. Offer to Purchase" and, together

with the NatWest Group Offer to Purchase, the "Offers to

Purchase"). Capitalized terms with respect to the NatWest Group

Offer not otherwise defined in this announcement have the same

meaning as in the NatWest Group Offer to Purchase. Capitalized

terms with respect to the NWM N.V. Offer not otherwise defined in

this announcement have the same meaning as in the NWM N.V. Offer to

Purchase.

Results for the NatWest Group Offer

With respect to the NatWest Group Offer, the Tender Agent

informed NatWest Group that $3,395,689,000 in aggregate principal

amount of its Notes were validly tendered and not validly withdrawn

by 5:00 p.m., New York City time, on August 8, 2022 (the

"Expiration Deadline"), as more fully set forth in the table below.

NatWest Group has accepted all Notes that were validly tendered and

not validly withdrawn prior to the Expiration Deadline. In

addition, $6,098,000 in aggregate principal amount of the Notes

were tendered in the NatWest Group Offer using the Guaranteed

Delivery Procedures.

With respect to the NatWest Group Offer, the table below sets

forth, among other things, the principal amount of each series of

Notes validly tendered and not validly withdrawn at or prior to the

Expiration Deadline:

Aggregate

Principal Aggregate

Amount Tendered Principal

Excluding Amount Tendered

Notes Tendered Using Guaranteed

Principal Using Guaranteed Delivery

Title of Amount Delivery Procedures Purchase

Security Issuer(1) ISIN/CUSIP Outstanding Procedures Price(2)

-------------------- -------------- ------------- ---------------- ----------------- ----------------- ---------

The Royal

Bank of

6.125% Subordinated Scotland US780099CE50

Tier 2 Notes Group plc /

due 2022 (1) 780099CE5 $1,303,830,000 $402,115,000 $0 $1,010.05

The Royal

Bank of

6.100% Subordinated Scotland US780097AY76

Tier 2 Notes Group plc /

due 2023 (1) 780097AY7 $465,426,000 $312,800,000 $53,000 $1,015.73

The Royal

6.000% Subordinated Bank of US780097AZ42

Tier 2 Notes Scotland /

due 2023 Group plc(1) 780097AZ4 $1,396,278,000 $736,763,000 $0 $1,019.74

The Royal

5.125% Subordinated Bank of US780099CH81

Tier 2 Notes Scotland /

due 2024 Group plc(1) 780099CH8 $1,241,175,000 $364,867,000 $200,000 $1,007.51

The Royal

3.875% Bank of

Senior Notes Scotland US780097BD21

due 2023 Group plc(1) / 780097BD2 $2,650,000,000 $1,579,144,000 $5,845,000 $998.85

-------------------- --------------

(1) Currently NatWest Group plc.

(2) Per $1,000 principal amount of the Notes validly tendered and accepted for purchase.

Results for the NWM N.V. Offer

With respect to the NWM N.V. Offer, the Tender Agent informed

NWM N.V. that $163,431,000 in aggregate principal amount of its

Notes were validly tendered and not validly withdrawn by the

Expiration Deadline, as more fully set forth in the table below.

NWM N.V. has accepted all Notes that were validly tendered and not

validly withdrawn prior to the Expiration Deadline. No Notes were

tendered in the NWM N.V. Offer using the Guaranteed Delivery

Procedures.

With respect to the NWM N.V. Offer, the table below sets forth,

among other things, the principal amount of each series of Notes

validly tendered and not validly withdrawn at or prior to the

Expiration Deadline:

Aggregate

Title of Principal Principal Purchase

Security Issuer(1) ISIN/CUSIP Amount Outstanding Amount Tendered Price(2)

-------------------- ---------- ------------- ------------------- ---------------- ---------

7.750% Subordinated

Deposit Notes, NatWest

Series B, Markets US00077TAA25

due 2023 N.V.(1) / 00077TAA2 $135,566,000 $35,044,000 $1,028.32

7.125% Subordinated

Deposit Notes, NatWest

Series B, Markets US00077TAB08

due 2093 N.V.(1) / 00077TAB0 $150,000,000 $128,387,000 $1,647.06

-------------------- ----------

(1) NatWest Markets N.V. (formerly known as ABN AMRO Bank N.V.,

of which ABN AMRO Bank N.V., New York Branch, was a part).

(2) Per $1,000 principal amount of the Notes validly tendered and accepted for purchase.

The Settlement Date for each Offer is expected to be August 10,

2022 and the Guaranteed Delivery Settlement Date for each Offer is

expected to be August 11, 2022. For the avoidance of doubt, Holders

whose Notes are tendered and purchased in either Offer pursuant to

the Guaranteed Delivery Procedures will not receive payment in

respect of any interest or any distribution, as the case may be,

for the period from and including the relevant Settlement Date to

the relevant Guaranteed Delivery Settlement Date.

FURTHER INFORMATION

Kroll Issuer Services Limited acted as tender agent with respect

to each Offer. NatWest Markets Securities Inc., an affiliate of the

Offeror, acted as Global Arranger and Lead Dealer Manager with

respect to each Offer. Merrill Lynch International, Morgan Stanley

& Co. LLC and Wells Fargo Securities, LLC (together with

NatWest Markets Securities Inc.) acted as Dealer Managers with

respect to the NatWest Group Offer. BofA Securities Europe SA,

Morgan Stanley & Co. LLC and Wells Fargo Securities, LLC

(together with NatWest Markets Securities Inc.) acted as Dealer

Managers with respect to the NWM N.V. Offer.

Questions regarding the NatWest Group Offer should be directed

to NatWest Markets Securities Inc. at +44 20 7678 5222, +1 203 897

6166 (U.S.) or +1 866 884 2071 (U.S. Toll Free), Merrill Lynch

International at +44 20 7996 5420 (London), +1 888 292 0070 (U.S.

Toll Free) or +1 980 387 3907 (U.S.), Morgan Stanley & Co. LLC

at +44 20 7677 5040 (Europe), +1 800 624 1808 (U.S. Toll Free) or

+1 212 761 1057 (U.S.) and Wells Fargo Securities, LLC at +44 203

942 9680 (Europe), +1 866 309 6316 (U.S. Toll Free) or +1 704 410

4756 (U.S.).

Questions regarding the NWM N.V. Offer should be directed to

NatWest Markets Securities Inc. at +44 20 7678 5222, +1 203 897

6166 (U.S.) or +1 866 884 2071 (U.S. Toll Free), BofA Securities

Europe SA at +33 1 877 01057 (Europe), +1 888 292 0070 (U.S. Toll

Free) or +1 980 387 3907 (U.S.), Morgan Stanley & Co. LLC at

+44 20 7677 5040 (Europe), +1 800 624 1808 (U.S. Toll Free) or +1

212 761 1057 (U.S.) and Wells Fargo Securities, LLC at +44 203 942

9680 (Europe), +1 866 309 6316 (U.S. Toll Free) or +1 704 410 4756

(U.S.).

FORWARD-LOOKING STATEMENTS

From time to time, the Offerors may make statements, both

written and oral, regarding our assumptions, projections,

expectations, intentions or beliefs about future events. These

statements constitute "forward-looking statements". The Offerors

caution that these statements may and often do vary materially from

actual results. Accordingly, the Offerors cannot assure you that

actual results will not differ materially from those expressed or

implied by the forward-looking statements. You should read the

sections entitled "Risk Factors" in the relevant Offer to Purchase,

in the Annual Report and H1 2022 Interim Report of the relevant

Offeror which is incorporated by reference therein and

"Forward-Looking Statements" in the Annual Report and H1 2022

Interim Report of the relevant Offeror, which is incorporated by

reference in the relevant Offer to Purchase.

Any forward-looking statements made herein or in the documents

incorporated by reference herein speak only as of the date they are

made. Except as required by the U.K. Financial Conduct Authority

(the "FCA") or the Dutch Authority for the Financial Markets (the

"AFM"), as applicable, any applicable stock exchange or any

applicable law, the Offerors expressly disclaim any obligation or

undertaking to release publicly any updates or revisions to any

forward-looking statement contained in the relevant Offer to

Purchase or the documents incorporated by reference herein to

reflect any changes in expectations with regard thereto or any new

information or any changes in events, conditions or circumstances

on which any such statement is based. The reader should, however,

(i) with respect to NatWest Group consult any additional

disclosures that NatWest Group has made or may make in documents

that NatWest Group has filed or may file with the U.S. Securities

and Exchange Commission and (ii) with respect to NWM N.V. consult

any additional disclosures that NWM N.V. has made or may make in

documents that NWM N.V. has filed or may file with the AFM.

Legal Entity Identifiers

NatWest Group plc 2138005O9XJIJN4JPN90

NatWest Markets N.V. X3CZP3CK64YBHON1LE12

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

RTEUKABRUAUWRAR

(END) Dow Jones Newswires

August 09, 2022 13:26 ET (17:26 GMT)

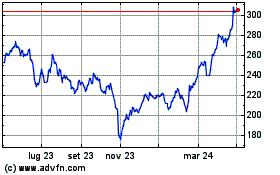

Grafico Azioni Natwest (LSE:NWG)

Storico

Da Mar 2024 a Apr 2024

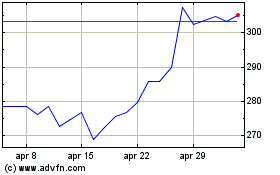

Grafico Azioni Natwest (LSE:NWG)

Storico

Da Apr 2023 a Apr 2024