TIDMOTV2

Octopus Titan VCT plc

Half-Yearly Results

Octopus Titan VCT plc ('Titan' or the 'Company') announces the

half-yearly results for the six months ended 30 June 2023.

Titan's mission is to invest in the people, ideas and industries

that will change the world.

Highlights

HY2023 HY2022 FY2022

Net assets (GBP'000) GBP1,055,683 GBP1,180,101 GBP1,051,760

Loss after tax (GBP'000) GBP(87,609) GBP(148,242) GBP(319,215)

NAV per share 68.2p 91.3p 76.9p

Total value(1) 168.2p 186.3p 173.9p

Total return (p)(2) (5.7)p (11.4)p (23.8)p

Total return %(3) (7.4)% (10.8)% (22.5)%

Dividends paid in the year 3.0p 3.0p 5.0p

Dividend yield %(4) 3.9% 2.8% 4.7%

Dividend declared 2.0p 2.0p 3.0p

1. Total value is an alternative performance measure, calculated as NAV plus

cumulative dividends paid since launch.

2. Total return is an alternative performance measure, calculated as

movement in NAV per share in the period plus dividends paid in the

period.

3. Total return % is an alternative performance measure, calculated as total

return/opening NAV.

4. Dividend yield is an alternative performance measure, calculated as

dividends paid/opening NAV.

Interim Management Report

Chair's statement

Titan's total return for the six months to 30 June 2023 was

minus 7.4% with net assets at the end of the period totalling

GBP1.1 billion.

The Net Asset Value (NAV) per share at 30 June 2023 was 68.2p

which, adjusting for dividends paid of 3.0p per share in May 2023,

represents a net decrease of 5.7p per share from 31 December 2022.

The total return (NAV plus cumulative dividends paid per share

since launch) at the end of the period was 168.2p (31 December

2022: 173.9p). This further decline is, of course, disappointing

but reflects the combination of a continuation of the difficult

global macro environment and the ongoing readjustment of valuation

multiples and funding availability in the early--stage ventures

space since 2021. The Octopus Ventures team are supporting Titan's

portfolio companies through these more challenging times, offering

additional resource, expertise or network contacts where relevant.

Despite the decrease in NAV, the tax-free annual compound return

for the original shareholders since Titan's launch in October 2007

is 3.9%.

We were pleased to raise over GBP237 million in our most recent

fundraise which closed on 5 April 2023 and, on 26 June 2023, we

announced our intention to launch a new offer for subscription

later this calendar year. As of 30 June 2023, we had uninvested

cash reserves(1) of GBP232.4 million (GBP179.0 million as at 31

December 2022) to allow us to support our existing portfolio of 140

companies, as well as make new investments in early--stage,

high-growth businesses which we believe embody the objectives of

the VCT scheme.

In the six months to 30 June 2023, we utilised GBP130.7 million

of our cash resources, comprising GBP65.0 million in new and

follow-on investments, GBP34.4 million in dividends (net of the

Dividend Reinvestment Scheme), GBP18.2 million in share buybacks

and GBP13.1 million in investment management fees and other running

costs. Together, this utilised 73% of our cash and cash equivalents

at 31 December 2022.

Dividends

As shareholders will know, our target to date has been to pay an

annual dividend of 5p per share, supplemented by special dividends

when appropriate. I am pleased to confirm that the Titan Board has

now decided to declare an interim dividend of 2p per share (2022:

2p per share), which will be paid on 21 December 2023 to

shareholders on the register as at 1 December 2023.

If you are one of the 26% of shareholders who take advantage of

the Dividend Reinvestment Scheme (DRIS), your dividend will be

receivable in Titan shares. This is an excellent way to achieve

your investment objectives if you prefer the capital value of your

investment to grow.

Since inception, we have now paid 100p in tax-free dividends per

share, excluding the recently declared dividend.

Following careful consideration of Titan's dividend policy, the

Board are proposing to move from an annual target dividend of 5p

per share to an annual target dividend of 5% of NAV, supplemented

by special dividends when appropriate.

Principal risks and uncertainties

The Board continues to review the risk environment in which

Titan operates on a regular basis. There have been no significant

changes to the key risks which were described on pages 51 to 54 of

the annual report for the year ended 31 December 2022. Given the

volatility of the current environment, the Board will continue to

evaluate whether there are any significant changes to these

risks.

Board of Directors

Following Matt Cooper's retirement at the Annual General Meeting

(AGM) in June 2023, I am pleased to welcome Julie Nahid Rahman who

was appointed as a Non--Executive Director on 1 August 2023. Julie

brings to the Board a wealth of experience drawn from her long

career in private equity, executive search and strategy

consulting.

Outlook

Over the period, we have continued to see a readjustment of the

early-stage ventures space in which Titan operates. Valuation

multiples have continued to reduce from the levels we were seeing

in 2022 and there has been a decline in funding availability and

exit opportunities.

Companies have been looking to raise smaller amounts at lower

company valuations; there has been an intense focus on extending

cash runway leading to cost reductions, largely through

redundancies; and a significant scale-back of activity by market

incumbents, especially growth-stage companies, which has reduced

exit opportunities.

The impact of these factors on Titan's underlying portfolio

companies has led to a decline in Titan's NAV. We recognise this is

disappointing, however, we believe the Company is well placed to

navigate this turbulent period with the support of shareholders and

given the diversity of the underlying portfolio in terms of sector,

vintage and stage.

While these conditions are a challenge for existing portfolio

companies, they also present opportunities to invest in, and build,

new early-stage companies at attractive valuations. Titan can take

advantage of this, and our long-term view of early-stage venture

capital remains extremely positive.

We also believe that innovation will continue at pace, thanks to

the powerful combination of exceptional entrepreneurs, experienced

talent and the opportunities created by pain points in many sectors

not being appropriately addressed by the status quo. We will

continue to strive to back the people, ideas and industries that

will change the world.

In the six months to 30 June 2023, Titan invested GBP65.0

million in new and follow-on opportunities, which brings the total

number of companies in the portfolio to 140 at 30 June 2023. The

range of both exciting new investments and the upcoming pipeline of

opportunities is testament to the work the investment team continue

to put into sourcing, securing and working with businesses across

all its areas of investment focus. VCTs have long provided a

compelling opportunity for UK investors to provide funding for such

businesses in a tax--efficient way, and we look forward to Titan

continuing to do so in the future.

I would like to conclude by thanking both the Board and the

Octopus team on behalf of all shareholders for their hard work.

Tom Leader

Chair

(1) The cash reserves include GBP0.2 million of cash at bank,

GBP127.0 million of money market funds and GBP105.2 million of

corporate bonds as set out in the balance sheet.

Portfolio Manager's review

Focus on performance

The NAV of 68.2p per share at 30 June 2023 represents a decrease

of 5.7p in NAV per share versus a NAV of 76.9p per share as at 31

December 2022 (when adjusted for dividends paid in the period).

This decline in NAV is disappointing, however, as shown in the

graphs, the long-term opportunity offered by early-stage ventures

is still extremely compelling.

The performance over the five years to 30 June 2023 is shown

below:

Year Period(1) Year Year Period

ended ended Year ended ended ended ended

31 31 31 31 31 30

October December December December December June

2018 2019 2020 2021 2022 2023

NAV (p) 93.1 95.2 97.0 105.7 76.9 68.2

Cumulative dividends paid (p) 71.0 76.0 81.0 92.0 97.0 100.0

Total value (p) 164.1 171.2 178.0 197.7 173.9 168.2

Total return (%) 1.8 7.6 7.1 20.3 (22.5) (7.4)

Dividend yield (%) 5.2 5.4 5.3 11.3 4.7 3.9

Equivalent dividend yield for a higher rate tax payer

(%) 7.7 8.0 7.8 16.8 7.0 5.9

1. The period to December 2019 was 14 months.

The decrease in NAV over the six-month period has largely been

driven by the downward valuation movement of GBP97.4 million across

76 companies in the now 140-strong portfolio. The drivers of the

movement are a combination of factors, including: further market

comparable valuation multiple compression; some externally led

funding rounds into portfolio companies, which have had dilutive

effects on Titan's shareholding; downward foreign exchange (FX)

adjustments in our USD-denominated holdings; and a slowing of

growth across the portfolio as companies optimise for efficiency

and profitability (where possible). Slowing growth means the

typical uplifts in value have been insufficient in this period to

offset some of the headwinds mentioned previously.

The most significant portfolio movements have been Big Health,

Secret Escapes and ManyPets. Big Health, despite strong underlying

performance, has seen its valuation multiple reduced further to

reflect the continued softening of comparable digital health

company valuations. Secret Escapes has raised further capital at

dilutive terms in the context of low availability of capital for

growth stage companies. Finally, ManyPets saw a small decline in

gross written premium as it took steps to drive higher efficiency

and target profitability in the short term, which, given the

relative size of the holding, drove a meaningful downward movement

in value.

Conversely, 31 companies saw an increase in valuation in the

period, delivering a collective increase in valuation of GBP24.8

million. These valuation increases reflect businesses which have

successfully concluded further funding rounds, grown revenues or

met certain important milestones. Notable strong performers in the

portfolio include Vitesse and Skin+Me, which are both growing

strongly and have successfully raised further capital in the

period. This further evidences that, even in times of economic

decline, there are opportunities available for companies to thrive,

and Titan's diverse portfolio allows multiple avenues to be

explored.

The gain on Titan's uninvested cash reserves was GBP1.4 million

in the six months to 30 June 2023 (31 December 2022: loss of

GBP12.6 million), primarily driven by fair value movements in the

corporate bond portfolio and returns on money market funds. The

Board's objective for these investments is to generate sufficient

returns through the cycle to cover costs, at limited risk to

capital.

Valuations

Below illustrates the split of valuation methodology (shown as a

percentage of portfolio value and number of companies). 'External

price' includes valuations based on funding rounds that typically

completed in the last 12 months to the period end or shortly after

the period end, and exits of companies where terms have been issued

with an acquirer. 'External price' also includes quoted holdings,

which are held at their quoted price as at the valuation date.

'Multiples' is predominantly used for valuations that are based on

a multiple of revenues for portfolio companies. Where there is

uncertainty around the potential outcomes available to a company, a

probability weighted 'scenario analysis' is considered.

Valuation methodology -- by value:

-- Multiples 57%

-- External price 26%

-- Scenario analysis 17%

Valuation methodology -- by number of companies:

-- Multiples 24%

-- External price 37%

-- Scenario analysis 30%

-- Write off 9%

New and follow-on investments

Titan completed follow-on investments into 12 companies and made

14 new investments in the period. Together, these totalled GBP65.0

million (made up of GBP22.7 million invested in the existing

portfolio and GBP42.3 million in new companies). The total value of

the portfolio is GBP819.9 million, as at 30 June 2023.

Below are some examples of new investments made across our seven

areas of investment focus during the period. For a full list,

please refer to the investment portfolio.

Fintech

-- Flock is an insurtech managing general agent (MGA) providing connected

insurance for commercial motor fleets.

Health

-- Little Journey has created a digital eSupport platform that prepares,

informs and provides support for families, healthcare procedures and

clinical trials.

-- Tympa has developed a novel device and software platform to improve ear

and hearing health screening and diagnostics.

B2B software

-- Pivotal Future automates and improves the measurement and prediction of

biodiversity.

-- Secfix automates the preparation for, and the ongoing maintenance of, IT

compliance certifications.

Deep tech

-- Puraffinity is a smart materials company which has developed a design

platform to create materials which can capture the family of 'forever

chemicals' PFAS (per- and polyfluoroalkyl substances).

-- TitanML has created a solution which enables businesses to reduce the

processing requirements of high spec artificial intelligence (AI) models

quickly and cheaply.

Consumer

-- Haiper is developing ground-breaking AI to advance the field of computer

graphics.

-- Correcto is an AI writing and grammar tool for the Spanish language.

Bio

-- Pear Bio is a precision medicine diagnostics and therapeutics discovery

company which can recreate a tumour's microenvironment and assess and

monitor the effects of different therapies.

Climate

-- Kita is a carbon credit insurance company.

Top 20 investments

Here we set out the cost and valuation of the top 20 holdings,

which account for approximately 57% of the value of the

portfolio.

Company Investment Total valuation Investment focus

cost including cost

1 ManyPets GBP10.0m GBP97.8m Fintech

2 Skin+Me GBP11.5m GBP43.3m Health

3 Amplience GBP13.6m GBP38.3m B2B software

4 Permutive GBP19.0m GBP36.8m B2B software

5 Orbex GBP10.3m GBP25.2m Deep tech

6 Pelago(1) GBP15.9m GBP24.6m Health

7 Token GBP12.6m GBP18.5m Fintech

8 Vitesse GBP10.1m GBP18.1m Fintech

9 vHive GBP8.0m GBP17.6m Deep tech

10 IOVOX GBP7.2m GBP16.6m B2B software

11 Sofar GBP11.5m GBP16.1m Consumer

12 Legl GBP7.3m GBP15.8m B2B software

13 Elliptic GBP7.7m GBP15.7m Fintech

14 XYZ GBP15.3m GBP15.5m Consumer

15 Big Health GBP12.9m GBP15.1m Health

16 Ometria GBP11.5m GBP12.7m B2B software

17 Elvie GBP6.4m GBP11.2m Health

18 Uniplaces GBP9.5m GBP10.6m Consumer

19 Automata GBP10.5m GBP10.5m Health

20 Oribiotech GBP9.1m GBP10.5m Bio

1. Digital Therapeutics, Inc., formerly Quit Genius, has rebranded as

Pelago.

Disposals

In the period, Arena Flowers (the UK's number one rated ethical

flower delivery company) acquired and merged with portfolio company

Patch. As a result, Titan now holds shares in the combined

business. The businesses are highly complementary, and the growth

potential and synergies create opportunities to deliver value to

the stakeholders of the enlarged group.

There have been three disposals made at a loss: Commazero was

acquired by Weavr (Paystratus Group Limited); Chronext sold to a

Swiss investment group; and By Miles was acquired by private motor

insurance Direct Line Group. In aggregate, these disposals

generated negligible proceeds compared to an investment cost of

GBP16.2 million.

Unfortunately, having been unsuccessful in securing further

funding and having explored and exhausted all available options,

ThirdEye was liquidated. The underperformance of a portfolio

company is always disappointing for Octopus and shareholders alike,

but it is a key characteristic of a venture capital portfolio, and

we believe the successful disposals will continue to significantly

outweigh the losses over the medium term.

As Titan's current portfolio continues to mature, we believe

that when conditions improve in the future, there should be

opportunities for many portfolio companies to take the next step on

their growth journey. Successful exits enable Titan to realise the

growth a portfolio company has achieved over its investment

lifespan.

In the period, Titan also received deferred proceeds from the

sale of WaveOptics (to SNAP Inc in 2021) and Conversocial (to

Verint Systems Inc in 2021).

The following table shows dividends paid and disposal proceeds

over the last five financial years and the current period of 30

June 2023:

Period ended

Year ended Period(1) ended 30

31 31 Year ended Year ended Year ended June

October 2018 December 2019 31 December 2020 31 December 2021 31 December 2022 2023 Total

Dividends

(GBP'000) 24,178 33,187 46,037 101,976 49,596 34,378 289,352

------------ ------------- --------------- ----------------- ----------------- ----------------- ------------ -------

Disposal

proceeds(2)

(GBP'000) 22,367 26,334 23,915 221,504 62,213 39,960 396,293

1. The period to 31 December 2019 was 14 months.

2. This table includes proceeds received in the period.

VCT qualifying status

Shoosmiths LLP provides both the Board and Octopus with advice

concerning ongoing compliance with HMRC rules and regulations

concerning VCTs and has advised that Titan continues to be in

compliance with the conditions set by HMRC for maintaining approval

as a VCT.

As at 30 June 2023, over 92% of the portfolio (as measured by

HMRC rules) was invested in VCT-qualifying investments,

significantly above the 80% current VCT--qualifying threshold.

Outlook

The decline in Titan's NAV is disappointing and is reflective of

the rebasing of valuation multiples and funding availability which

we have seen over the last year, overlaid with global macroeconomic

headwinds. Titan's unquoted portfolio companies are valued in

accordance with UK GAAP accounting standards and the International

Private Equity and Venture Capital (IPEV) valuation guidelines.

This means we value the portfolio at fair value, which is the price

we expect people would be willing to buy or sell an asset for,

assuming they had all the information available we do; are

knowledgeable parties with no pre-existing relationship; and that

the transaction is carried out under the normal course of business.

Several of Titan's portfolio companies have been affected by the

challenges the economic backdrop has created, with costs increasing

and consumer confidence and spending declining, and valuations have

been reappraised in line with all these factors.

More challenging periods, such as these, often bring opportunity

and great businesses can be built in times of economic downturn as

barriers to adopting new technologies lessen, talent availability

improves and there is increased openness to new ways of working. As

we continue to meet with extraordinary entrepreneurs and invest in

truly disruptive innovation with the support of shareholders, Titan

is well placed to take advantage of and navigate these difficult

times. Having analysed the portfolio's projected revenue growth for

2023, we are also forecasting strong collective growth and over 75%

of Titan's portfolio companies have more than 12 months cash runway

available to them.

We have seen demand across our areas of focus for the support

and expertise offered by our in-house people and talent team as

they lean in to help scale and grow the portfolio companies. The

team have recently launched new initiatives such as management

training and a larger suite of policy documents being made

available for portfolio companies to easily adopt, which have been

well received. Members of the investment team continue to be

thought leaders within their areas of focus too -- for example, the

health team recently launched their 'Resilience of Early-stage

European Healthtech' report. This offers a deep dive into the

landscape and an analysis of emerging trends set to change the face

of healthcare, as well as a guide to regulatory challenges.

The past 18 months have been a period of immense geopolitical

and economic change, and Titan has not been immune to the impact of

this, with the NAV declining and opportunities to successfully exit

companies being less frequent. However, we are reassured by the

extraordinary entrepreneurs we continue to meet and invest in, and

the drive and passion of our team. We believe this combination will

provide Titan with the opportunities it needs for continued success

in the future.

Malcolm Ferguson

Partner and Titan Lead Fund Manager

Directors' responsibilities statement

The Directors confirm that to the best of their knowledge:

-- the half-yearly financial statements have been prepared in accordance

with 'Financial Reporting Standard 104: Interim Financial Reporting'

issued by the Financial Reporting Council;

-- the half-yearly financial statements give a true and fair view of the

assets, liabilities, financial position and profit or loss of the

Company; and

-- the half-yearly report includes a fair review of the information required

by the Financial Services Authority Disclosure and Transparency Rules,

being:

-- we have disclosed an indication of the important events that have

occurred during the first six months of the financial year and

their impact on the condensed set of financial statements;

-- we have disclosed a description of the principal risks and

uncertainties for the remaining six months of the year; and

-- we have disclosed a description of related party transactions that

have taken place in the first six months of the current financial

year, that may have materially affected the financial position or

performance of the Company during that period, and any changes in

the related party transactions described in the last annual report

that could do so.

On behalf of the Board

Tom Leader

Chair

Income statement

Unaudited Unaudited Audited

Six months to 30 Six months to 30 Year to 31 December

June 2023 June 2022 2022

Revenue Capital Total Revenue Capital Total Revenue Capital Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

(Loss)/gain on

disposal of fixed

asset investments -- (1,922) (1,922) -- (472) (472) -- 66 66

Loss on valuation

of fixed asset

investments -- (72,556) (72,556) -- (127,603) (127,603) -- (284,465) (284,465)

Gain/(loss) on

valuation of

current asset

investments -- 589 589 -- (11,724) (11,724) -- (12,682) (12,682)

Investment income 1,543 -- 1,543 438 -- 438 864 -- 864

Investment management

fees (522) (9,917) (10,439) (567) (10,772) (11,339) (1,125) (21,383) (22,508)

Other expenses (3,168) -- (3,168) (3,527) -- (3,527) (7,060) -- (7,060)

Foreign exchange

translation -- (1,656) (1,656) -- 5,985 5,985 -- 6,570 6,570

Loss before tax (2,147) (85,462) (87,609) (3,656) (144,586) (148,242) (7,321) (311,894) (319,215)

---------------------- ------- -------- -------- ------- --------- --------- ------- --------- ---------

Tax -- -- -- -- -- -- -- -- --

---------------------- ------- -------- -------- ------- --------- --------- ------- --------- ---------

Loss after tax (2,147) (85,462) (87,609) (3,656) (144,586) (148,242) (7,321) (311,894) (319,215)

---------------------- ------- -------- -------- ------- --------- --------- ------- --------- ---------

Loss per share

-- basic and

diluted (p) (0.1) (5.9) (6.0) (0.3) (11.2) (11.5) (0.6) (24.0) (24.6)

-- The 'Total' column of this statement is the profit and loss account of

the Company; the supplementary revenue return and capital return columns

have been prepared under guidance published by the Association of

Investment Companies.

-- All revenue and capital items in the above statement derive from

continuing operations.

-- The Company has only one class of business and derives its income from

investments made in shares and securities and from bank and money market

funds.

Titan has no other comprehensive income for the period.

The accompanying notes form an integral part of the financial

statements.

Balance sheet

Unaudited Unaudited Audited

As at 31 December

As at 30 June 2023 As at 30 June 2022 2022

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

-------- --------- -------- ---------- -------- ---------

Fixed asset

investments 819,886 922,316 827,449

Current

assets:

Money market

funds 127,037 88,297 58,701

Corporate

bonds 105,196 104,775 104,244

Applications

cash(1) 338 407 23,299

Cash at bank 228 10,588 16,120

Debtors 4,246 55,310 47,374

237,045 259,377 249,738

-------------- -------- --------- -------- ---------- -------- ---------

Current

liabilities (1,248) (1,592) (25,427)

-------------- -------- --------- -------- ---------- -------- ---------

Net current

assets 235,797 257,785 224,311

-------------- -------- --------- -------- ---------- -------- ---------

Net assets 1,055,683 1,180,101 1,051,760

-------------- -------- --------- -------- ---------- -------- ---------

Share capital 1,548 129,209 1,368

Share premium 248,511 212,313 92,896

Capital

redemption

reserve 52 11,597 27

Special

distributable

reserve 823,000 585,828 887,288

Capital

reserve

realised (65,269) (21,711) (53,430)

Capital

reserve

unrealised 88,667 296,808 160,634

Revenue

reserve (40,826) (33,943) (37,023)

Total equity

shareholders'

funds 1,055,683 1,180,101 1,051,760

-------------- -------- --------- -------- ---------- -------- ---------

NAV per share

(p) 68.2 91.3 76.9

1. Cash held but not yet allotted.

The accompanying notes form an integral part of the financial

statements.

The statements were approved by the Directors and authorised for

issue on 21 September 2023 and are signed on their behalf by:

Tom Leader

Chair

Company Number 06397765

Statement of changes in equity

Capital Special Capital Capital

Share Share redemption distributable reserve reserve Revenue

capital premium reserve reserve(1) realised(1) unrealised reserve(1) Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

As at 1 January

2023 1,368 92,896 27 887,288 (53,430) 160,634 (37,023) 1,051,760

---------------- -------- -------- ----------- -------------- ------------ ----------- ----------- ---------

Comprehensive

income for the

period:

Management fees

allocated as

capital

expenditure -- -- -- -- (9,917) -- -- (9,917)

Current year

loss on

disposal of

fixed asset

investments -- -- -- -- (1,922) -- -- (1,922)

Loss on fair

value of fixed

asset

investments -- -- -- -- -- (72,556) -- (72,556)

Gain on fair

value of

current asset

investments -- -- -- -- -- 589 -- 589

Loss after tax -- -- -- -- -- -- (2,147) (2,147)

Foreign exchange

translation -- -- -- -- -- -- (1,656) (1,656)

Total

comprehensive

income for the

period -- -- -- -- (11,839) (71,967) (3,803) (87,609)

---------------- -------- -------- ----------- -------------- ------------ ----------- ----------- ---------

Contributions by

and

distributions to

owners:

Share issue

(includes

DRIS) 205 160,895 -- -- -- -- -- 161,100

Share issue

costs -- (5,280) -- -- -- -- -- (5,280)

Repurchase of

own shares (25) -- 25 (18,161) -- -- -- (18,161)

Dividends paid

(includes

DRIS) -- -- -- (46,127) -- -- -- (46,127)

Total

contributions

by and

distributions

to owners 180 155,615 25 (64,288) -- -- -- 91,532

Balance as at

30 June 2023 1,548 248,511 52 823,000 (65,269) 88,667 (40,826) 1,055,683

1. Reserves available for distribution.

Capital Special Capital Capital

Share Share redemption distributable reserve reserve Revenue

capital premium reserve reserve(1) realised(1) unrealised reserve(1) Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

As at 1 January

2022 129,850 201,163 9,759 642,873 (14,122) 439,790 (36,272) 1,373,041

---------------- -------- -------- ----------- -------------- ------------ ----------- ----------- ---------

Comprehensive

income for the

period:

Management fees

allocated as

capital

expenditure -- -- -- -- (10,772) -- -- (10,772)

Current year

loss on

disposal of

fixed asset

investments -- -- -- -- (472) -- -- (472)

Loss on fair

value of fixed

asset

investments -- -- -- -- -- (127,603) -- (127,603)

Loss on fair

value of

current asset

investments -- -- -- -- -- (11,724) -- (11,724)

Loss after tax -- -- -- -- -- -- (3,656) (3,656)

Foreign exchange

translation -- -- -- -- -- -- 5,985 5,985

Total

comprehensive

income for the

year -- -- -- -- (11,244) (139,327) 2,329 (148,242)

---------------- -------- -------- ----------- -------------- ------------ ----------- ----------- ---------

Contributions by

and

distributions to

owners:

Share issue

(includes

DRIS) 1,197 11,204 -- -- -- -- -- 12,401

Share issue

costs -- (54) -- -- -- -- -- (54)

Repurchase of

own shares (1,838) -- 1,838 (18,345) -- -- -- (18,345)

Dividends paid

(includes

DRIS) -- -- -- (38,700) -- -- -- (38,700)

Total

contributions

by and

distributions

to owners (641) 11,150 1,838 (57,045) -- -- -- (44,698)

---------------- -------- -------- ----------- -------------- ------------ ----------- ----------- ---------

Other movements:

Prior year fixed

asset gains now

realised -- -- -- -- 3,655 (3,655) -- --

Total other

movements -- -- -- -- 3,655 (3,655) -- --

---------------- -------- -------- ----------- -------------- ------------ ----------- ----------- ---------

Balance as at

30 June 2022 129,209 212,313 11,597 585,828 (21,711) 296,808 (33,943) 1,180,101

1. Reserves available for distribution.

Capital Special Capital Capital

Share Share redemption distributable reserve reserve Revenue

capital premium reserve reserve(1) realised(1) unrealised reserve(1) Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

As at 1 January

2022 129,850 201,163 9,759 642,873 (14,122) 439,790 (36,272) 1,373,041

------------------ --------- --------- ----------- -------------- ------------ ----------- ----------- ---------

Comprehensive

income for the

year:

Management fees

allocated as

capital

expenditure -- -- -- -- (21,383) -- -- (21,383)

Current year gain

on disposal of

fixed asset

investments -- -- -- -- 66 -- -- 66

Loss on fair value

of fixed asset

investments -- -- -- -- -- (284,465) -- (284,465)

Loss on fair value

of current asset

investments -- -- -- -- -- (12,682) -- (12,682)

Loss after tax -- -- -- -- -- -- (7,321) (7,321)

Foreign exchange

translation -- -- -- -- -- -- 6,570 6,570

Total

comprehensive

income for the

year -- -- -- -- (21,317) (297,147) (751) (319,215)

------------------ --------- --------- ----------- -------------- ------------ ----------- ----------- ---------

Contributions by

and distributions

to owners:

Share issue

(includes DRIS) 1,299 106,307 -- -- -- -- -- 107,606

Share issue costs -- (2,260) -- -- -- -- -- (2,260)

Repurchase of own

shares (1,864) -- 1,864 (41,192) -- -- -- (41,192)

Dividends paid

(includes DRIS) -- -- -- (66,220) -- -- -- (66,220)

Total

contributions by

and distributions

to owners (565) 104,047 1,864 (107,412) -- -- -- (2,066)

------------------ --------- --------- ----------- -------------- ------------ ----------- ----------- ---------

Other movements:

Share premium

cancellation -- (212,314) (11,596) 223,910 -- -- -- --

Reduction in the

nominal value of

share capital (127,917) -- -- 127,917 -- -- -- --

Prior year fixed

asset gains now

realised -- -- -- -- 9,575 (9,575) -- --

Transfer between

reserves -- -- -- -- (27,566) 27,566 -- --

Total other

movements (127,917) (212,314) (11,596) 351,827 (17,991) 17,991 -- --

------------------ --------- --------- ----------- -------------- ------------ ----------- ----------- ---------

Balance as at

31 December 2022 1,368 92,896 27 887,288 (53,430) 160,634 (37,023) 1,051,760

1. Reserves are available for distribution.

The accompanying notes form an integral part of the financial

statements.

Cash flow statement

Unaudited Unaudited Audited

Six months Six months

to to Year to

31

30 June 30 June December

2023 2022 2022

GBP'000 GBP'000 GBP'000

Reconciliation of profit to cash flows from operating

activities

Loss before tax (87,609) (148,242) (319,215)

Decrease/(increase) in debtors 1,246 (1,867) (5,666)

Decrease in creditors (1,217) (65,457) (64,514)

(Gain)/loss on valuation of current asset investments (589) 11,724 12,682

Loss/(gain) on disposal of fixed asset investments 1,922 472 (66)

Loss on valuation of fixed asset investments 72,556 127,603 284,465

Outflow from operating activities (13,691) (75,767) (92,314)

------------------------------------------------------ ---------- ---------- ---------

Cash flows from investing activities

Purchase of current asset investments (364) (6,252) (6,679)

Purchase of fixed asset investments (64,993) (77,548) (156,973)

Sale of fixed asset investments 39,960 32,510 62,213

Outflow from investing activities (25,397) (51,290) (101,439)

------------------------------------------------------ ---------- ---------- ---------

Cash flows from financing activities

Application inflows allotted (22,961) (2,223) 20,669

Dividends paid (net of DRIS) (34,378) (28,945) (49,596)

Purchase of own shares (18,161) (18,345) (41,192)

Share issues (net of DRIS) 149,351 2,593 90,982

Share issues costs (5,280) (1) (2,260)

Inflow/(outflow) from financing activities 68,571 (46,921) 18,603

------------------------------------------------------ ---------- ---------- ---------

Increase/(decrease) in cash and cash equivalents 29,483 (173,978) (175,150)

Opening cash and cash equivalents 98,120 273,270 273,270

Closing cash and cash equivalents 127,603 99,292 98,120

------------------------------------------------------ ---------- ---------- ---------

Cash and cash equivalents comprise of:

Cash at bank 228 10,588 16,120

Applications cash 338 407 23,299

Money market funds 127,037 88,297 58,701

Closing cash and cash equivalents 127,603 99,292 98,120

Condensed notes to the half-yearly report

1. Basis of preparation

The unaudited half-yearly results which cover the six months to

30 June 2023 have been prepared in accordance with the Financial

Reporting Council's (FRC) Financial Reporting Standard 104 Interim

Financial Reporting (March 2018) and the Statement of Recommended

Practice (SORP) for Investment Companies re-issued by the

Association of Investment Companies in July 2022.

2. Publication of non-statutory accounts

The unaudited half-yearly results for the six months ended 30

June 2023 do not constitute statutory accounts within the meaning

of Section 415 of the Companies Act 2006 and have not been

delivered to the Registrar of Companies. The comparative figures

for the year ended 31 December 2022 have been extracted from the

audited financial statements for that year, which have been

delivered to the Registrar of Companies. The independent auditor's

report on those financial statements, in accordance with chapter 3,

part 16 of the Companies Act 2006, was unqualified. This

half-yearly report has not been reviewed by the Company's

auditor.

3. Earnings per share

The loss per share is based on 1,458,917,593 Ordinary shares (30

June 2022: 1,293,940,509 and 31 December 2022: 1,297,081,006),

being the weighted average number of shares in issue during the

period. There are no potentially dilutive capital instruments in

issue and so no diluted returns per share figures are relevant. The

basic and diluted earnings per share are therefore identical.

4. Net asset value per share

30 June 30 June 31 December

2023 2022 2022

Net assets (GBP'000) 1,055,683 1,180,101 1,051,760

Ordinary shares in issue 1,547,797,287 1,292,086,596 1,367,949,929

Net asset value per share 68.2p 91.3p 76.9p

5. Dividends

The interim dividend declared of 2.0p per share for the six

months ending 30 June 2023 will be paid on 21 December 2023 to

those shareholders on the register as at 1 December 2023.

On 24 May 2023, a 3.0p second interim dividend relating to the

2022 financial year was paid.

6. Buybacks and allotments

During the six months to 30 June 2023, the Company bought back

24,948,066 Ordinary shares at a weighted average price of 72.8p per

share (six months ended 30 June 2022: 18,378,101 Ordinary shares at

a weighted average price of 99.8p per share; year ended 31 December

2022: 45,009,970 Ordinary shares at a weighted average price of

92.9p per share).

During the six months to 30 June 2023, 204,539,959 shares were

issued at a weighted average price of 81.0p per share (six months

ended 30 June 2022: 11,966,301 shares at a weighted average price

of 104.6p per share; year ended 31 December 2022: 114,461,503

shares at a weighted average price of 96.9p per share).

7. Related party transactions

Octopus acts as the Portfolio Manager of the Company. Under the

management agreement, Octopus receives a fee of 2.0% per annum of

the net assets of the Company for the investment management

services, but in respect of funds raised by the Company under the

2018 Offer and thereafter (and subject to the Company having a cash

reserve of 10% of its NAV), the annual management charge on

uninvested cash will be the lower of either (i) the actual return

that the Company receives on its cash and funds that are the

equivalent of cash subject to a 0% floor and (ii) 2%. During the

period, the Company incurred management fees of GBP10,439,000

payable to Octopus (30 June 2022: GBP11,339,000; 31 December 2022:

GBP22,508,000), which were fully settled by 30 June 2023.

Octopus provides non-investment services to the Company and

receives a fee for these services which is capped at the lower of

(i) 0.3% per annum of the Company's NAV or (ii) the administration

and accounting costs of the Company for the year ended 31 December

2020 with inflation increases in line with the Consumer Price

Index. During the period, the Company incurred non-investment

services fees of GBP1,046,000 payable to Octopus (30 June 2022:

GBP921,600; 31 December 2022: GBP1,893,000), which were fully

settled by 30 June 2023.

In addition, Octopus is entitled to performance-related

incentive fees. The incentive fee arrangements were designed to

make sure that there were significant tax-free dividend payments

made to shareholders as well as strong performance in terms of

capital and income growth, before any performance-related fee

payment was made. There were no performance fees accrued for the

six months to 30 June 2023 (30 June 2022: GBPnil; 31 December 2022:

GBPnil).

Octopus received GBP0.02 million in the six months to 30 June

2023 (six months ended 30 June 2022: GBP0.03 million; year ended 31

December 2022: GBPnil) in regard to arrangement and monitoring fees

in relation to investments made by the Company.

Titan owns Zenith Holding Company Limited, which owns a share in

Zenith LP, a fund managed by Octopus.

In the period, Octopus Investments Nominees Limited (OINL)

purchased Titan shares from shareholders to correct administrative

issues, with the intention that the shares will be sold back to

Titan in subsequent share buybacks. As at 30 June 2023, no Titan

shares were held by OINL (30 June 2022: 570 shares; 31 December

2022: nil shares) as beneficial owner. Throughout the period to 30

June 2023, OINL purchased 1,602,591 shares (30 June 2022: 283,737;

31 December 2022: 729,365 shares) at a cost of GBP1,372,000 (30

June 2022: GBP288,000; 31 December 2022: GBP678,000) and sold

1,602,591 shares (30 June 2022: 286,135; 31 December 2022: 737,002

shares) for proceeds of GBP1,171,000 (30 June 2022: GBP291,000; 31

December 2022: GBP672,000). This is classed as a related party

transaction as Octopus, the Portfolio Manager, and OINL are part of

the same group of companies. Any such future transactions, where

OINL takes over the legal and beneficial ownership of Company

shares, will be announced to the market and disclosed in annual and

half-yearly reports.

Several members of the Octopus investment team hold

non-executive directorships as part of their monitoring roles in

Titan's portfolio companies, but they have no controlling interests

in those companies.

The Directors received the following dividends from Titan:

Period Period

to to Year to

30 June 30 June 31 December

2023 2022 2022

Tom Leader (Chair) 1,625 692 1,640

Matt Cooper(1) 70,597 63,103 117,661

Jane O'Riordan 4,428 3,408 6,530

Lord Rockley 2,126 575 2,145

Gaenor Bagley 733 267 740

1. Matt Cooper stepped down as a Director on 14 June 2023.

8. Voting rights and equity management

The following table shows the percentage voting rights held by

Titan of each of the top ten investments held in Titan, on a fully

diluted basis.

% voting

rights

held by

Investments Titan

Many Group Limited (trading as ManyPets) 7.5%

Mr & Mrs Oliver Ltd (trading as Skin+Me) 20.6%

Amplience Limited 21.0%

Permutive Inc. 17.9%

Orbital Express Launch Limited (trading as Orbex) 10.8%

Digital Therapeutics (trading as Pelago, formerly

Quit Genius) 16.6%

Token.IO Ltd 13.5%

Vitesse PSP Ltd 15.4%

vHive Tech Ltd 19.0%

Iovox Limited 29.4%

9. Post balance sheet events

The following events occurred between the balance sheet date and

the signing of this half--yearly report:

-- four new investments completed totalling GBP4.1 million;

-- three follow-on investments completed totalling GBP9.8 million; and

-- a final order to cancel share premium amounting to GBP248.5 million was

granted on 1 August 2023.

10. Half-Yearly Report

The unaudited half-yearly report for the six months ended 30

June 2023 will shortly be available to view at

octopustitanvct.com.

For further information please contact:

Rachel Peat

Octopus Company Secretarial Services Limited

Tel: +44 (0)80 0316 2067

LEI: 213800A67IKGG6PVYW75

(END) Dow Jones Newswires

September 21, 2023 12:30 ET (16:30 GMT)

Copyright (c) 2023 Dow Jones & Company, Inc.

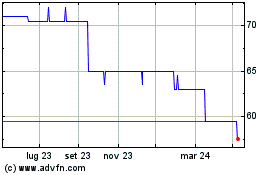

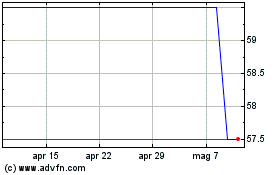

Grafico Azioni Octopus Titan Vct (LSE:OTV2)

Storico

Da Apr 2024 a Mag 2024

Grafico Azioni Octopus Titan Vct (LSE:OTV2)

Storico

Da Mag 2023 a Mag 2024