TIDMSERE

RNS Number : 1132E

Schroder Eur Real Est Inv Trust PLC

28 June 2023

28 June 2023

SCHRODER EUROPEAN REAL ESTATE INVESTMENT TRUST PLC

("SEREIT"/ the "Company" / "Group")

HALF YEAR RESULTS FOR THE SIX MONTHSED 31 MARCH 2023

Continental Europe occupier trends and portfolio indexation

underpins valuation resilience; dividend to be rebased to reflect

rising interest rate backdrop and capital deployment strategy

Schroder European Real Estate Investment Trust plc, the company

investing in European growth cities and regions, announces its half

year results for the six months ended 31 March 2023.

50 basis points of outward yield movement, partially offset by

asset management initiatives, supports portfolio valuation

resilience:

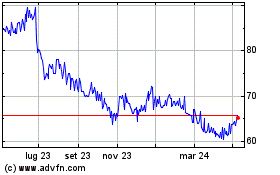

-- Net Asset Value ("NAV") total return of -4.7% based on an

IFRS loss of EUR8.7 million (31 March 2022: 5.5% total return /

EUR10.9 million IFRS profit), predominantly driven by market wide

outward yield shift as a result of interest rate increases

-- Underlying EPRA earnings increased over 50% to EUR3.8 million

(31 March 2022: EUR2.5 million)

-- Strong balance sheet with cash reserves of EUR23 million and

loan to value (LTV) of 32% gross of cash and 23% net of cash.

Average cost of drawn debt (interest-only) of 2.5%

-- In Q4 2022, the Company's management team completed the early

refinancing of its largest debt facility at a modest 85bp margin

with no covenants for five years. Loan principal was extended from

EUR14m to EUR18m to provide additional balance sheet

flexibility.

Decision to rebase dividend to provide full cover reflects

refinancing cost uncertainty and patient capital deployment

strategy:

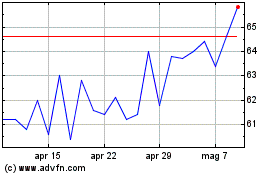

-- Announcement of a second interim dividend of 1.85 euro cents

per share ("cps"), bringing the total dividends declared relating

to the six months of the current financial year to 3.7 euro cps,

c.80% covered by recurring earnings

-- Reflecting the potential impact of higher interest costs on

the Company's earnings and more patient capital deployment

strategy, the quarterly target minimum dividend will be rebased to

1.48 euro cps per quarter (80% of the previous level), commencing

with the third interim dividend payable in October 2023. This will

allow management to be more patient deploying cash reserves into

attractive investment opportunities that are likely to arise, as

well as enabling the immediate payment of a fully covered

dividend.

Attractive indexation characteristics and strong occupational

demand to drive earnings growth:

-- Direct property portfolio independently valued at EUR220.2

million, reflecting a -4.6%, or EUR9.7 million, like-for-like

decrease over the period

-- Increased portfolio exposure to high growth industrial sector

with c.EUR11 million acquisition of an award winning property in

Alkmaar, the Netherlands, with excellent sustainability

credentials, including on site renewable energy and EPC rating of

A+

-- Concluded eight new leases and re-gears totalling c. 2,000

sqm generating EUR0.4 million of contracted rent, at a weighted

lease term of three years

-- Further improvement to the portfolio's sustainability credentials including:

-- BREEAM certification for the Stuttgart office

-- Advancement of on-site renewable energy at Houten industrial investment

-- c. 80% of landlord-procured electricity on renewable energy

and improved tenant data collection and education

-- 100% of rent due collected

-- 100% of the portfolio leases indexed to inflation, including 80% annually

Sir Julian Berney Bt., Chairman, commented:

"Notwithstanding the economic headwinds, the Board is pleased by

the portfolio's sector and winning city allocations, strong rent

collection and indexation characteristics, which together with

management's asset management expertise has enhanced valuation

resilience versus the UK-focused listed peer group. The Board,

however, is clear in its intention to be prudent in deploying the

remaining investment capacity, retaining capital in the short term

and rebasing the dividend to a quarterly minimum dividend of 80% of

the current level. Whilst the current wider market uncertainty

persists, this is a proactive move that we are convinced will

protect shareholder value over the long term, providing significant

flexibility and enabling us to pay a covered dividend that can be

grown over time."

Jeff O'Dwyer, Fund Manager for Schroder Real Estate Investment

Management Limited, added:

"Whilst we continue to operate in an environment where the

pricing of risk, value and liquidity is challenging, the Company is

well positioned, with a strong balance sheet and an ability to

refinance on the best available terms as and when required.

Recognising evolving occupier trends, our near-term capital

deployment will be focused on select sustainability-led capex

initiatives in the current portfolio, which we believe will best

optimise earnings growth and asset liquidity, thereby driving

longer term returns."

The Half Year Report is also being published in hard copy format

and an electronic copy of that document will shortly be available

to download from the Company's webpage www.schroders.co.uk/sereit .

Please click on the following link to view the document:

http://www.rns-pdf.londonstockexchange.com/rns/1132E_1-2023-6-27.pdf

The Company has submitted a pdf of the hard copy format of the

Half Year Report to the National Storage Mechanism and it will

shortly be available for inspection at

https://data.fca.org.uk/#/nsm/nationalstoragemechanism .

A further announcement will be made shortly to confirm the full

timetable of the second interim dividend.

Enquiries:

Jeff O'Dwyer

Schroder Real Estate Investment Management 020 7658 6000

Shilla Pindoria

Schroder Investment Management Limited 020 7658 6000

-------------------------------------

Dido Laurimore / Richard Gotla / Oliver 020 3727 1000

Parsons Schroderrealestate@fticonsulting.com

FTI Consulting

-------------------------------------

A presentation for analysts and investors will be held at 9.00

a.m. BST/10.00 a.m. SAST today. Registration for which can be

accessed via:

https://registration.duuzra.com/form/SEREInterim

If you would like to attend, please contact James Lowe at

Schroders on james.lowe@schroders.com or +44 (0)20 7658 2083.

Half Year Report and Condensed Consolidated Interim Financial

Statements for the six month period ended 31 March 2023

Chairman's Statement

Overview

I am pleased to report the unaudited interim results for the six

month period ended 31 March 2023. Against a challenging backdrop,

the Company has delivered a relatively good set of financial

results, underpinned by strong occupancy, the portfolio's

indexation characteristics and the quality of assets in Winning

Cities and Regions of Continental Europe. The NAV total return was

-4.7% over the period and reflected a EUR11.8 million decline in

the portfolio value, net of capex and tenant incentives, or -5.1%

on a like-for-like basis. Commercial real estate values have been

falling across the UK and Europe as a result of general economic

and political uncertainty, investors' pricing of risk and

availability and cost of financing.

Rent collection has been strong and, excluding Seville, stands

at 100% for the six months to 31 March 2023, demonstrating the

strength of underlying covenants. Overall, the Board is pleased

with the resilience of the portfolio and the Investment Manager's

efforts in delivering on its asset management programme. Having a

diversified portfolio with local management teams who truly

understand their local markets and with a strong track record in

managing sustainability improvements will be increasingly important

in managing risk and protecting shareholder value.

Whilst we have witnessed yields across the portfolio deteriorate

by 50 basis points ('bp'), this has been offset by positive

indexation assisting with rental growth. Whilst this valuation

decline compares very favourably with the UK-listed peer group,

there remains considerable uncertainty over the pace at which

investor sentiment will rebound in a meaningful way, given the

persistently high interest rate environment. Whilst the Company's

strong cash position and operational resilience enabled the

quarterly dividend of 1.85 euro cents per share to be maintained in

the financial period, we have consistently stated that we would

review the dividend position taking into account portfolio

occupancy, rent collection levels, market sentiment, refinancing

and dividend cover. Despite the Company being in a robust position

with regard to a number of these metrics, the unprecedented

macroeconomic backdrop means that we lack the clarity around

near-term recurring earnings to continue with our current dividend

strategy.

Whilst the option to continue paying an uncovered dividend, as

many of the peer group do, was strongly considered, the Investment

Manager and Board believe that the more prudent, responsible and

decisive course of action, and the one that best protects the

interest of shareholders, is to rebase the target quarterly

dividend level to 1.48 euro cents per share commencing with our

third interim dividend payable in October 2023. The drivers of this

decision are threefold. The Company faces a number of upcoming

refinancings in 2023 and 2024 and, whilst we have had very

encouraging conversations with a wide pool of lenders, the backdrop

is more challenging. Secondly, there is no appetite to be forced

into the investment market simply to improve the rent roll. We have

always been highly selective in deploying shareholder capital and

would rather wait patiently for the right opportunities to come

along, albeit we recognise that this does not deliver near-term

income. And finally, the Investment Manager is reviewing a

programme of sustainability-led capital expenditure initiatives as

a means of improving

income, quality and asset liquidity as an alternative to new

acquisitions, which it has the expertise to deliver but will

require a more medium-term horizon. The rebased dividend will

differentiate the Company from a number of our peers, providing

significant flexibility, and enabling us to pay a covered dividend,

that can be grown over time.

As at 31 March 2023, the Company's direct property portfolio was

valued at EUR220.2 million. In addition, the Company has a 50%

interest in a joint venture in Seville which continues to be

recognised at nil interest. The direct portfolio consists of 15

investments in the most liquid investment markets in France,

Germany and the Netherlands, concentrated in Winning Cities such as

Paris, Stuttgart, Hamburg, Frankfurt and Berlin. The exposure to

higher-growth sectors such as industrial has increased over the

period to c.30%. The office exposure comprises c.34% and is

concentrated to assets in leading urban centres, in highly

accessible sub-markets and leased off affordable rents whilst the

retail exposure (c.17%) is solely focused on DIY/grocery, the more

essential-spend consumer sub-sectors. In addition the Company has

EUR23 million of available cash, providing a robust position to

manage the Company through current headwinds.

The Board has been clear in its intention to be prudent in its

approach to deploying the remaining investment capacity of c.EUR40

million, including further gearing.

The Investment Manager continues to screen investment

opportunities consistent with the investment strategy. In this

regard, the recent acquisition of the c.EUR11.2 million industrial

investment in Alkmaar, the Netherlands, is a welcome addition. The

investment improves the diversification and quality of the

portfolio from a construction, sustainability and income

perspective, particularly given it is a twenty year sale and

leaseback to a strong covenant.

The expectations are for volatility in markets to continue. It

is clear that the banking industry is tightening its approach to

lending, particularly on those office and retail assets that rate

poorly from a sustainability perspective. These issues, together

with broader macroeconomic and political concerns, are likely to

see further pressures on values. The Company has a number of

refinancings to manage over the course of 2023 and 2024 and the

ability to refinance, and at competitive rates, will be paramount

to how cash is utilised. Gearing levels are considered modest c.32%

(23% net of cash) and the intention, for now, is to continue to run

the Company with headroom to the maximum loan to value ('LTV') of

35%.

European leases typically provide for rents to be indexed to

inflation. The majority (80%) of the Company's income is subject to

annual indexation with the remaining 20% linked to a hurdle

(typically 10%), hence we expect nearly all the leases to directly

benefit from inflation. Across the direct portfolio, all tenants

have complied with payments in accordance with their respective

indexation clauses.

We continue to finalise the remaining items around the Paris BB

refurbishment. As at 31 March 2023, a further EUR1.5 million

remains to be paid to the contractor and the Company is owed EUR5.3

million from the purchaser and is subject to meeting certain

criteria. There remains potentially up to EUR1.3 million of pre-tax

profit still to be released in the NAV.

Sustainability considerations continue to gain momentum and are

becoming increasingly more prevalent in occupier and investor

decisions. The Investment Manager continues to review each asset

and ways to improve sustainability credentials, making the

investments more relevant to occupiers, lenders and investors and

supporting delivery of enhanced returns.

Strategy

The strategy remains focused on delivering shareholders with an

attractive level of income together with the potential for income

and capital growth through investing in commercial real estate in

Continental Europe. The Investment Manager takes an active

approach, seeking ways to improve the quality, liquidity,

sustainability and appeal of investments to both occupiers and

investors through active management and capital investment. It is

well positioned to drive income and value growth, relying heavily

on its local sector specialist teams who are recognised for their

operational excellence and hospitality mindset. They manage each

asset as a business by itself, with a tailored business plan,

engaging with local tenants to optimise long-term sustainable

income and value across the lifetime of the investment. Being

diversified has been helpful, particularly given the headwinds

facing secondary offices and select retail.

The recent Dutch industrial acquisition has increased our

industrial exposure to c.30%, a sector the Investment Manager

expects stronger growth in, whilst our retail exposure centres on

DIY and grocery, which fall into the 'essential spend' category and

are showing strong resilience. Our offices reflect c. 34% and are

in leading cities and, although not prime, have characteristics

suited to many occupiers, particularly given their urban locations,

accessibility and affordability. Pricing risk and value with

today's uncertainty is challenging. It is the intention to remain

prudent in our investment approach with a clear bias to protecting

asset values and liquidity, whilst also being mindful of

maintaining a robust balance sheet.

Financial results

The NAV total return was -4.7% over the interim period based on

an IFRS loss of EUR8.7 million. Returns were driven primarily by a

fall in valuations. All sectors are seeing re-pricing, driven

largely by higher discount rates, partially as a result of the

change in availability and cost of financing. The independent

valuers have reduced capitalisation rates between 20bp and 75bp

(weighted average c.50bp) with value declines mitigated by rental

indexation and for some assets, notably Hamburg and Stuttgart

offices, by ERV growth. Underlying EPRA earnings were EUR3.8

million for the period, (H1 22: EUR2.5 million). Earnings will

further increase with the recent acquisition in Alkmaar and

investment of capital into enhancing opportunities. The Company's

NAV as at 31 March 2023 decreased EUR11.1 million, or 6%, to

EUR177.1 million, or 132.4 euro cents per share, over the

period.

Balance sheet and debt

With current market volatility and uncertainty the retention of

a healthy balance sheet is vital. At the period end, third-party

debt totalled EUR84.7 million, representing an LTV net of cash of

23% against the overall gross asset value of the Company. This

compares to a net LTV cap of 35%. The Company has seven loans

secured by individual assets or groups of assets, with no

cross-collateralisation between loans. The average weighted total

interest rate of the loans is 2.5% per annum. The weighted average

duration of the loans is 2.3 years, with the earliest loan maturity

in 2023. All loans except Seville are in compliance with their

default covenants. The Seville loan remains in a cash trap and is

being managed under an LTV covenant waiver to facilitate a sale.

Cost of debt has increased markedly over the period with the

five-year swap increasing to c.300bp. Traditional lenders are

tightening their approach, being more selective on not only who

they lend to, LTV limits, but also around asset quality. In some

instances, we are seeing alternative lending platforms step in to

fill the void as banks scale back their appetite for risk. More

detail of the individual loans is provided in the Investment

Manager's Report. The Company has c.EUR40 million of cash and debt

capacity, which provides significant flexibility.

Dividends

The Board has elected, for this quarter, to continue with the

1.85 euro cps quarterly dividend. Total dividends declared relating

to the six months of the current financial year are now 3.7 euro

cps. The dividend cover for the interim period was c.80%. Whilst

the option to continue paying an uncovered dividend, as many of the

peer group, was strongly considered, the Investment Manager and

Board believe that the more prudent, responsible and decisive

course of action, and the one that best protects the interest of

shareholders, is to rebase the target quarterly dividend level to

1.48 euro cps commencing with our third interim dividend payable in

October 2023.

Sustainability

The Board and the Investment Manager believe that focusing on

sustainability throughout the real estate life cycle will deliver

enhanced long-term returns for shareholders as well as a positive

impact on the environment and the communities where the Company is

investing. Our research and the evidence across the portfolio

demonstrates that there is a material rental and value premium for

buildings with green certifications. There is increasing pressure

on minimum building standards not only from an EPC perspective but

data coverage (for water, gas, electricity and waste) and

ultimately carbon footprint. Demand from occupiers for space is

increasingly biased towards better quality buildings, driven not

only by legal obligations, tenant environmental aspirations but as

a means to match corporate ethos and attract talent.

Reflecting the evolving landscape, sustainability-led

initiatives will be increasingly central to the strategy. The

Manager is carrying out a comprehensive review of the

sustainability characteristics of the portfolio encompassing

building fabric, energy systems, services and utilities, climate

risk and resilience, water consumption, waste management,

biodiversity and green infrastructure, transport and mobility,

health and wellbeing, community and social integration. This

analysis will inform a baseline score across a range of

quantitative and qualitative factors against which we will measure

future improvements at an asset level to enable us to provide

transparent reporting to stakeholders.

Outlook

Confidence surrounding the European economy is improving with

recessionary fears diminishing. Expectations are for economic

growth to be modest for some time, as governments continue to

tighten economic policies to reduce inflation and preserve

financial stability. As a result, the pricing of real estate will

continue to be challenging and exacerbated by rising debt costs,

sustainability concerns and corporates post-Covid optimum

occupational intentions. Banks are becoming much more discerning on

who they lend to and the type of real estate they wish to lend on.

Their clear preference to focus on better quality assets that meet

sustainability benchmarks will continue. As a result, we anticipate

further valuation falls as investors face refinancing dilemmas,

sustainability risks and equity investors re-price their cost of

capital. We will continue to manage the portfolio in light of these

risks, ensuring a strong balance sheet and an ability to refinance

on the best available terms as and when required, and invest in the

portfolio to enhance its sustainability credentials, thereby

optimising earnings growth and asset liquidity, in order to drive

longer-term returns. With the strength of our balance sheet,

underlying assets and the growth regions that we are exposed to, we

believe that we are well placed to manage such risks.

Sir Julian Berney Bt.

Chairman

27 June 2023

Investment Manager's Report

Results

The net asset value ('NAV') as at 31 March 2023 stood at

EUR177.1 million (GBP155.9 million), or 132.4 euro cents (116.6

pence) per share, resulting in a NAV total return of -4.7% over the

six months to 31 March 2023.

The table below provides an analysis of the movement in NAV

during the reporting period as well as a corresponding

reconciliation in the movement in the NAV in euro cents per

share.

% change

NAV movement EURm cps(1) per cps(2)

--------------------------------- ----- ------ -----------

Brought forward as at 1 October

2022 188.2 140.8 -

--------------------------------- ----- ------ -----------

Unrealised gain in the valuation

of the real estate portfolio (9.7) (7.3) (5.2)

--------------------------------- ----- ------ -----------

Capital expenditure (2.2) (1.6) (1.2)

--------------------------------- ----- ------ -----------

Transaction costs (1.2) (0.9) (0.6)

--------------------------------- ----- ------ -----------

Paris BB post-tax development

profit (0.0) (0.0) (0.0)

--------------------------------- ----- ------ -----------

Movement on the Seville JV

investment (0.0) (0.0) (0.0)

--------------------------------- ----- ------ -----------

EPRA earnings(3) 3.8 2.8 2.0

--------------------------------- ----- ------ -----------

Non-cash/capital items 0.7 0.5 0.3

--------------------------------- ----- ------ -----------

Dividends paid (2.5) (1.9) (1.3)

--------------------------------- ----- ------ -----------

Carried forward as at 31 March

2023 177.1 132.4 (6.0)

--------------------------------- ----- ------ -----------

1 Based on 133,734,686 shares.

2 Percentage change based on the starting NAV as at 1 October 2022.

3 EPRA earnings as reconciled on page 30 of the financial statements.

Strategy

The Company aims to provide shareholders with an attractive

level of income with the potential for long-term, sustainable

income and growth. The strategy to deliver this includes:

-- Driving income and value growth through a hospitality

approach in tenant management (understanding tenant business,

strengths and pressures) and operational excellence in all sectors

(optimising operations in the assets, minimising use of scarce

resources and waste);

-- Executing asset management initiatives to enhance the income

profile, individual asset values and sustainability

credentials;

-- Applying our integrated sustainability and ESG approach at

all stages of the investment process and asset lifecycle;

-- Applying a research-led approach to determine attractive

sectors and locations in which to invest in commercial real

estate;

-- Maintaining a strong balance sheet with a loan to value, net of cash, below 35%;

-- Managing portfolio risk in order to enhance the portfolio's defensive qualities.

The following progress has been made delivering on the

strategy:

-- The acquisition of an award winning industrial investment in

Alkmaar, the Netherlands, with excellent sustainability

credentials, including on-site renewable energy and an EPC rating

of A+. The long-term sale and leaseback not only strengthens the

portfolio's physical and sustainability qualities but also income

profile given the 20 year term, covenant strength and 5.6% net

initial yield;

-- Increased exposure to higher growth sectors, in particular

increasing the industrial allocation from 25% to 30%. Other key

allocations include 35% to offices in key cities such as Stuttgart

and Hamburg; c.20% to a Berlin DIY asset and a convenience retail

centre in Frankfurt;

-- Continuation of 100% rent collection, highlighting underlying tenant strength;

-- Successful implementation of rental indexation clauses with

no discounts. European rent reviews provide for an inflation hedge,

given annual indexation and are considered a key differential to UK

leases that are typically adjusted every five years to market;

-- Maintained a high occupancy level of 96%, with an average

portfolio lease term to break of 4.8 years;

-- Concluded eight new leases and re-gears generating EUR0.4

million of contracted rent, at a weighted lease term of three

years;

-- Improved the portfolio's sustainability credentials and

understanding, which included a BREEAM certification for the

Stuttgart office, advancement of on-site renewable energy at the

Houten industrial investment, c.80% of landlord-procured

electricity on renewable energy and improved tenant data collection

and education;

-- Issued SREIM's updated Sustainable Occupier Guide to all

tenants across France, the Netherlands and Spain, advising

occupiers on low cost initiatives to achieve reduced environmental

footprints, operating costs and enhanced user wellbeing;

-- Re-financed German office debt secured against Hamburg and

Stuttgart at a modest 85bp margin with no covenants for 5 years.

Given competitive terms, loan principal was extended from EUR14m to

EUR18m to provide additional balance sheet flexibility;

-- A prudent LTV of 32% gross of cash and 23% net of cash,

comfortably below the target of 35% net of cash;

-- We continue to monitor the Ukraine crisis and its impact on

not only the portfolio but wider market volatility. We have no

exposure to eastern Europe or Russia and we are not aware that any

of our tenants have any ownership or influence from Russia. We

continue to manage the portfolio in the best interest of our

shareholders, ensuring that all international sanctions are adhered

to. The Group's key suppliers do not have operations in Ukraine or

Russia and there is not expected to be any adverse impact from the

war on our ability to manage the operations of the Group.

Market overview

Economic outlook

The outlook for the eurozone economy is improving. The sharp

drop in wholesale gas prices has helped to slow inflation and

reduce the squeeze on household incomes and consumption. In

addition, global supply chain pressure has largely eased. As a

result, Schroders now forecasts that the eurozone will narrowly

avoid a recession and grow by 0.5%-1.0% p.a. through 2023 and 2024.

However, while headline inflation should moderate from 6.9% in

March 2023 to around 3% by December 2023, core inflation has been

increasing.

Interest rates and real estate yields

The European Central Bank (ECB) remains determined to fight

inflation and has continued to hike its policy interest rates. But

though inflation has started to decline, Schroders expects at least

one more rate hike of 25 bps. Hikes beyond that remain however a

possibility but depend on the trend in inflation and labour

markets. Either way we believe that the interest rate peak is

near.

The investment market is showing signs of stabilisation after a

sharp fall in liquidity and prices in the second half of 2022.

Although prime yields continued to rise in the first quarter of

2023, the rate of increase on a European aggregate level slowed to

0.1%, from 0.6%-1.0% in the second half of 2022.

Much of future pricing will depend on conditions in debt

markets. German five-year swap rates continue to be volatile and

have settled at c.3.0% in the first quarter. Bank margins on prime

offices and logistics levelled off at 1.50%-1.75% and remain

preferred lending credit. Banks continue to be more discerning on

LTVs, asset and counterparty quality which has not been helped by

the recent fallout from Credit Suisse's collapse. Despite investors

having become slightly more optimistic about future rental and

income growth, the outlook is muted by cost and availability of

debt. Overall, it seems, that while significant corrections have

now occurred, markets will see some further adjustment before

levelling off.

Offices

Demand for European offices has been somewhat muted in Q1 and

prime rental growth has been more limited. Business bankruptcies

have seen a small increase towards the end of last year and high

borrowing costs and the prospect of very low growth ahead are

impacting business decision-making. Overall conditions remain

robust though the market remains very polarised: vacancy rates have

seen some moderate increases in recent months, but remain very low

for high quality stock with strong ESG-credentials in highly

accessible locations as occupiers continue to seek these kind of

offices to retain and attract staff in tight labour markets and

meet their own ESG obligations. This continues to support prime

rents and while rental growth is likely to remain somewhat subdued

and more selective in the low-growth environment ahead, renewed

growth is expected towards the end of the year and into 2024,

particularly as supply of new space is forecast to peak this year.

For secondary space the situation is however becoming increasingly

dire, though space in accessible locations and leased off

affordable rents is showing some resilience.

Retail

The outlook for retail real estate remains challenging. Although

total retail sales should recover from 2024 onwards in step with

real household incomes, the growth of online retail means that

in-store sales are set to decline by 1%-2% p.a. in volume terms

through 2023-2027. Consequently, it is expected that retailer

demand will remain weak and that vacancy will only start to decline

when failing schemes are re-developed into apartments and other

uses. Prime shop and shopping centre rents are likely to fall by a

further 3-5% this year, before stabilising in 2024. The exceptions

are likely to be smaller food stores and a handful of luxury

streets in Barcelona, Milan and Paris, which stand to gain from the

revival in tourism. Big box retail parks should also be relatively

defensive, as low rents and service charges attract

discounters.

Logistics/industrial

Industrial rents in the eurozone are forecast to rise by 3-4%

p.a. through 2023-2025, driven by growing demand for warehouses.

Demand should be supported by both a cyclical recovery in consumer

spending and manufacturing and by the structural growth in online

retail as well as by firms holding more stock in order to improve

the resilience of their supply chains. On the supply side, the jump

in both building costs and interest rates should restrict

speculative development and prevent an over-supply. Multi-let

estates in urban areas and warehouses on major transport routes

will likely see stronger rental growth than units in less

accessible locations. At the same time, there is a strong demand

for modern space that is not only fit for higher levels of

automation, but also has strong ESG-credentials.

Real estate portfolio

The Company owns a portfolio of 15 institutional grade

properties valued at EUR220.2 million1. The portfolio is 96% let

and located across Winning Cities and Regions in France, Germany

and the Netherlands. In addition, the Company has a 50% interest in

a joint venture in Seville, Spain which continues to be recognised

at nil interest and which is therefore excluded in all relevant

statistics in the Chairman's Statement and the Investment Manager's

Report.

The table below shows the top ten properties:

Rank Property Country Sector EURm(1) % of total(1)

----- ------------------- ----------- -------------- ------- -------------

1 Paris (Saint-Cloud) France Office 39.1 16%

----- ------------------- ----------- -------------- ------- -------------

2 Berlin Germany Retail/DIY 30.1 12%

----- ------------------- ----------- -------------- ------- -------------

3 Hamburg Germany Office 23.5 10%

----- ------------------- ----------- -------------- ------- -------------

4 Stuttgart Germany Office 20.6 8%

----- ------------------- ----------- -------------- ------- -------------

5 Rennes France Industrial 19.7 8%

----- ------------------- ----------- -------------- ------- -------------

6 Apeldoorn Netherlands Mixed 16.0 7%

----- ------------------- ----------- -------------- ------- -------------

7 Alkmaar Netherlands Industrial 11.5 5%

----- ------------------- ----------- -------------- ------- -------------

8 Venray Netherlands Industrial 11.2 5%

----- ------------------- ----------- -------------- ------- -------------

9 Frankfurt Germany Retail/Grocery 11.0 5%

----- ------------------- ----------- -------------- ------- -------------

10 Rumilly France Industrial 10.0 4%

----- ------------------- ----------- -------------- ------- -------------

Total top ten properties 192.7 80%

-------------------------- ----------- -------------- ------- -------------

Remaining five

11-15 properties 27.5 11%

----- ------------------- ----------- -------------- ------- -------------

Real estate portfolio

value 220.2 91%

-------------------------- ----------- -------------- ------- -------------

Available cash(2) 23.0 9%

----- ------------------- ----------- -------------- ------- -------------

Total portfolio value 243.2 100%

-------------------------- ----------- -------------- ------- -------------

1 Excludes the Seville property for which the NAV exposure is nil.

2 Internally calculated.

The lease expiry chart features the portfolio's top ten tenants

individually.

The top ten tenants have paid 100% of their rent over the

six-month period. The portfolio generates EUR16.5 million p.a. in

contracted income. The average unexpired lease term is 4.8 years to

first break and 5.2 years to expiry.

The lease expiry profile to earliest break is shown above. The

near-term lease expiries provide asset management opportunities to:

renegotiate leases; extend weighted average unexpired lease terms;

improve income security; and generate rental growth. In turn, this

activity benefits the income profile and NAV total return.

Transactions

The Company has approximately EUR40 million of investment

capacity (including debt) to redeploy into new investments or

value-enhancing initiatives. The strategy is to maintain a strong

balance sheet, refinance on the best available terms and enhance

the sustainability of the income. We continue to selectively review

investment opportunities to further enhance the portfolio's

diversification and exposure to growth sectors, cities and regions.

Given the risks facing markets, including ESG and structural

headwinds, particularly to offices and retail, we are continuing to

be prudent and patient in our investment approach.

During the period, the Company completed an industrial

acquisition in Alkmaar, the Netherlands. The architectural award

winning, freehold industrial warehouse was acquired for

approximately EUR11.2 million, equating to EUR1,250 per sqm and a

net initial yield of 5.6%. The weighted unexpired lease term was

approximately 20 years to term and 15 years to break. The

investment was a rare opportunity to acquire a highly sustainable

asset with a strong and visible income profile that enhances the

Company's sector weighting, average unexpired lease term and credit

strength. We continue to manage the Seville investment, seeking to

stabilise occupancy with a view to a disposal.

Portfolio performance

During the period, total property returns for the underlying

property portfolio were negative at -2.3%, despite healthy property

income returns of +3.2%. This was due to negative property capital

returns of -5.3% net of capex as real estate values decreased over

the six months, primarily driven by a c.50 basis points outward

yield movement, which more than offset the positive impact of

rental growth increasing the portfolio net initial yield to

6.2%.

Property returns over the last 12 months are -0.4% and 7.4% p.a.

over the last three years.

Finance

The Company completed the early refinancing of its largest debt

expiry in 2023, a loan secured against its Hamburg and Stuttgart

office investments. The Company has elected to extend the previous

EUR14 million facility by a further EUR4 million, obtaining

competitive financing for the new EUR18 million loan with VR Bank

Westerwald at a total interest cost of 3.8% being the five-year

euro swap rate at the time of signing (2.95%) plus a 0.85%

margin.

With this new facility, the Company's third party debt totals

EUR84.7 million across seven loan facilities as at 31 March 2023.

This represents a loan to value ('LTV') net of cash of 23% against

the Company's gross asset value (gross of cash LTV is 32%). There

is a net of cash LTV cap of 35% that restricts concluding new

external loans if the Company's net LTV is above 35%. An increase

in leverage above 35% as a result of valuation decline is excluded

from this cap. The current blended all-in interest rate is 2.5% and

the average remaining loan term is 2.3 years.

A loan facility of EUR3.7 million secured against the Rumilly

asset has since expired in April 2023 and was repaid post reporting

end with the additional debt raised from the new Hamburg/Stuttgart

loan.

The Company is in discussions with lenders regarding its other

two debt expiries which occur within the next twelve months and is

confident in its ability to refinance these loans at similar LTVs,

albeit current swap rates would result in the overall cost of debt

increasing.

The individual loans are detailed in the table below. Each loan

is held at the property-owning level instead of the group level and

is secured by the individual properties noted in the table. There

is no cross-collateralisation between loans. Each loan has specific

LTV and income default covenants. We detail the headroom against

those covenants in the latter two columns of the table below.

Headroom Headroom

LTV default net income

Maturity Outstanding Interest covenant default covenant

Lender Property date principal rate (% decline) (% decline)

------------------- -------------------- ----------- ----------- ------------- --------------- -----------------

BRED Banque

Populaire Paris (Saint-Cloud) 15/12/2024 EUR17.00m 3M Eur +1.34% 28% 20%

------------------- -------------------- ----------- ----------- ------------- --------------- -----------------

VR Bank Westerwald Stuttgart/Hamburg 30/12/2027 EUR18.00m 3.80% no covenant no covenant

------------------- -------------------- ----------- ----------- ------------- --------------- -----------------

Deutsche

Pfandbriefbank

AG Berlin/Frankfurt 30/06/2026 EUR16.50m 1.31% 35% 44%

------------------- -------------------- ----------- ----------- ------------- --------------- -----------------

Münchener

Hypothekenbank

eG Seville (50%)(1) 22/05/2024 EUR11.68m 1.76% In breach(2) In cash trap

------------------- -------------------- ----------- ----------- ------------- --------------- -----------------

Netherlands

HSBC Bank Plc industrials(3) 27/09/2023 EUR9.25m 3M Eur +2.15% 36% 52%

------------------- -------------------- ----------- ----------- ------------- --------------- -----------------

Landesbank SAAR Rennes 28/03/2024 EUR8.60m 3M Eur +1.40% 32% 55%

------------------- -------------------- ----------- ----------- ------------- --------------- -----------------

Landesbank SAAR Rumilly 30/04/2023 EUR3.70m(4) 3M Eur +1.30% not relevant(5) not relevant(5)

------------------- -------------------- ----------- ----------- ------------- --------------- -----------------

Total EUR84.73m

------------------------------------------------------ ----------- ------------- --------------- -----------------

1 Includes the Company's 50% share of external debt in the

Seville joint venture of EUR11.7 million and excludes unamortised

finance costs.

2 Temporary waiver for breach of LTV covenant in Seville agreed with the lender.

3 The HSBC loan is secured against four Netherlands industrial

assets: Venray, Houten, Utrecht and Venray II.

4 Rumilly loan with Landesbank SAAR was repaid in full post period end.

5 Sufficient headroom to current covenant. Covenant no longer

relevant as loan was repaid in Q2 2023.

At Seville, a reduction in rental income has resulted in a

requirement under the loan to retain all excess income generated by

the Seville property in the property-owning special purpose

vehicle. The Seville loan is being managed under an LTV covenant

waiver to facilitate a sale. The loan is secured solely against the

Seville investment, with no recourse back to the Company or any

other entity within the Group.

The German and Spanish loans are fixed rate for the duration of

the loan term. The French and Dutch loans are based on a margin

above three-month Euribor.

The Company has acquired interest rate caps to limit future

potential interest costs if Euribor were to increase. The combined

fair value of the derivative contracts is EUR1.0 million as at 31

March 2023. The strike rates on the interest rate caps are between

0.25% p.a. and 1.25% p.a.

Details of individual interest derivative contracts were as

follows:

-- Saint-Cloud loan with BRED Banque Populaire: two caps

totalling the full EUR17.0m of the loan which expire on 15 December

2024 with a strike rate of 1.25%;

-- Dutch industrials loan with HSBC: a cap totalling the full

EUR9.25m of the loan which expires on 28 September 2023 with a

strike rate of 1%;

-- Rennes loan with Landesbank SAAR: a cap totalling the full

EUR8.60m of the loan which expires on 27 March 2024 with a strike

rate of 1%; and

-- Rumilly loan with Landesbank SAAR: a cap totalling the full

EUR3.70m of the loan which expired on 28 April 2023 with a strike

rate of 0.25%. The associated Rumilly loan was fully repaid in

April 2023.

Outlook

We continue to operate in an environment where the pricing of

risk, value and liquidity is challenging. All sectors are seeing

re-pricing, driven largely by higher discount rates, primarily as a

result of the change in the availability and cost of debt. In

addition, office occupiers are still adjusting to hybrid working

following the pandemic, although we are seeing good demand for

better quality offices which are well specified in terms of energy

efficiency, break-out areas and connectivity and are in city

centres with good amenities and public transport. We anticipate

that values will continue to decline in the short term until

investors are confident that inflation has peaked and interest

rates have settled at a new, higher equilibrium. Assets in fringe

markets and for secondary assets are likely to take the biggest

hit. However, the repricing which has already occurred is creating

some attractive investment opportunities and we anticipate a

broader buying opportunity as the year progresses.

The immediate focus is on maintaining a strong and healthy

balance sheet, de-risking upcoming re-financings and actively

managing the investments with an increasing operational mindset

that makes the assets more relevant in this changing

environment.

Jeff O'Dwyer

Fund Manager

Schroder Real Estate Investment Management Limited

27 June 2023

Principal risks and uncertainties

The principal risks and uncertainties with the Company's

business relate to the following risk categories: investment policy

and strategy; implementation of investment strategy, economic and

property market; custody; gearing and leverage; accounting, legal

and regulatory (including tax); valuation; service provider; and

health and safety. A detailed explanation of the risks and

uncertainties in each of these categories can be found on pages 30

to 32 of the Company's published Annual Report and Consolidated

Financial Statements for the year ended 30 September 2022.

The Board continues to be mindful of the Ukraine war and the

economic ramifications (particularly inflation and corresponding

interest rate increases), the structural changes concerning the

Covid-19 pandemic, sustainability and occupier preferences which

could affect the use and prospects of some real estate sectors. The

Company does not have any exposure to Russia, and is not aware of

any such exposure through its tenants or suppliers. There has been

no identifiable impact on the Company's operations to date. The

Board keeps these matters under review, particularly in connection

with its decisions to re-deploy investable cash.

The Company's portfolio remains resilient, as evidenced by rent

collection levels over the half year. Covenant, interest rates,

cost of debt and expiry profiles continue to be actively managed as

part of cash flow forecasting and liquidity management. Good

progress is also being made to reinvest the remaining proceeds of

the Paris BB forward sale, with a view to further diversifying the

Company's portfolio by both number of assets and tenants, as well

as increasing its allocation to the high growth industrial

sector.

Other than as outlined above, the principal risks and

uncertainties have not materially changed during the six months

ended 31 March 2023.

Going concern

The Board believes it is appropriate to adopt the going concern

basis in preparing the financial statements. A comprehensive going

concern statement setting out the reasons the Board considers this

to be the case is set out in note 1 on page 22.

Related party transactions

There have been no transactions with related parties that have

materially affected the financial position or the performance of

the Company during the six months ended 31 March 2023. Related

party transactions are disclosed in note 13 of the condensed

consolidated interim financial statements.

Statement of Directors' responsibilities

The Directors confirm that to the best of their knowledge:

-- The half year report and condensed consolidated interim

financial statements have been prepared in accordance with the UK

adopted International Accounting Standard IAS 34 Interim Financial

Reporting; and

-- The Interim Management Report includes a fair review of the

information required by 4.2.7R and 4.2.8R of the Financial Conduct

Authority's Disclosure Guidance and Transparency Rules.

Sir Julian Berney Bt.

Chairman

27 June 2023

Condensed Consolidated Interim Statement of Comprehensive

Income

For the period ended 31 March 2023

Six months Six months

to to Year to

31 March 31 March 30 September

2023 2022 2022

EUR000 EUR000 EUR000

Notes (unaudited) (unaudited) (audited)

-------------------------------------------- ----- ------------ ------------ -------------

Rental and service charge income 2 9,490 9,174 18,153

-------------------------------------------- ----- ------------ ------------ -------------

Property operating expenses (2,613) (3,396) (5,516)

-------------------------------------------- ----- ------------ ------------ -------------

Net rental and related income 6,877 5,778 12,637

-------------------------------------------- ----- ------------ ------------ -------------

Net (loss)/gain from fair value adjustment

on investment property 3 (12,958) 7,853 6,351

-------------------------------------------- ----- ------------ ------------ -------------

Development revenue 4 63 9,744 17,942

-------------------------------------------- ----- ------------ ------------ -------------

Development expense 4 (63) (7,905) (15,436)

-------------------------------------------- ----- ------------ ------------ -------------

Realised gain/(loss) on foreign exchange (16) (3) 77

-------------------------------------------- ----- ------------ ------------ -------------

Net change in fair value of financial

instruments at fair value through profit

or loss 9 107 235 921

-------------------------------------------- ----- ------------ ------------ -------------

Provision of loan made to Seville joint

venture 5 - (221) (444)

-------------------------------------------- ----- ------------ ------------ -------------

Expenses

-------------------------------------------- ----- ------------ ------------ -------------

Investment management fee 13 (1,028) (1,137) (2,198)

-------------------------------------------- ----- ------------ ------------ -------------

Valuers' and other professional fees (378) (515) (981)

-------------------------------------------- ----- ------------ ------------ -------------

Administrator's and accounting fees (211) (210) (453)

-------------------------------------------- ----- ------------ ------------ -------------

Auditors' remuneration (201) (189) (333)

-------------------------------------------- ----- ------------ ------------ -------------

Directors' fees 13 (123) (108) (217)

-------------------------------------------- ----- ------------ ------------ -------------

Other expenses (226) (251) (613)

-------------------------------------------- ----- ------------ ------------ -------------

Total expenses (2,167) (2,410) (4,795)

-------------------------------------------- ----- ------------ ------------ -------------

Operating profit (8,157) 13,071 17,253

-------------------------------------------- ----- ------------ ------------ -------------

Finance income 37 224 451

-------------------------------------------- ----- ------------ ------------ -------------

Finance costs (809) (562) (1,128)

-------------------------------------------- ----- ------------ ------------ -------------

Net finance costs (772) (338) (677)

-------------------------------------------- ----- ------------ ------------ -------------

Share of loss of joint venture 6 - - -

-------------------------------------------- ----- ------------ ------------ -------------

(Loss)/profit before taxation (8,929) 12,733 16,576

-------------------------------------------- ----- ------------ ------------ -------------

Taxation 7 266 (1,842) (2,585)

-------------------------------------------- ----- ------------ ------------ -------------

Profit/(loss) for the period/year (8,663) 10,891 13,991

-------------------------------------------- ----- ------------ ------------ -------------

Other comprehensive income/(expense):

-------------------------------------------- ----- ------------ ------------ -------------

Other comprehensive (loss)/income items

that may be reclassified to profit or

loss:

-------------------------------------------- ----- ------------ ------------ -------------

Currency translation differences - 2 (73)

-------------------------------------------- ----- ------------ ------------ -------------

Total other comprehensive (expense)/income - 2 (73)

-------------------------------------------- ----- ------------ ------------ -------------

Total comprehensive (expense)/income

for the period/year (8,663) 10,893 13,918

-------------------------------------------- ----- ------------ ------------ -------------

Basic and diluted (loss)/earnings per

share attributable to owners of the parent 8 (6.5c) 8.1c 10.4c

-------------------------------------------- ----- ------------ ------------ -------------

All items in the above statement are derived from continuing

operations. The accompanying notes 1 to 16 form an integral part of

the condensed consolidated interim financial statements.

Condensed Consolidated Interim Statement of Financial

Position

As at 31 March 2023

Six months Six months

to to Year to

31 March 31 March 30 September

2023 2022 2022

EUR000 EUR000 EUR000

Notes (unaudited) (unaudited) (audited)

-------------------------------------- ----- ------------ ------------ -------------

Assets

-------------------------------------- ----- ------------ ------------ -------------

Non-current assets

-------------------------------------- ----- ------------ ------------ -------------

Investment property 3 219,011 209,591 217,456

-------------------------------------- ----- ------------ ------------ -------------

Investment in joint venture 6 - - -

-------------------------------------- ----- ------------ ------------ -------------

Non-current assets 219,011 209,591 217,456

-------------------------------------- ----- ------------ ------------ -------------

Current assets

-------------------------------------- ----- ------------ ------------ -------------

Trade and other receivables 7,822 18,037 16,680

-------------------------------------- ----- ------------ ------------ -------------

Interest rate derivative contracts 9 1,041 248 934

-------------------------------------- ----- ------------ ------------ -------------

Cash and cash equivalents 32,985 52,458 34,324

-------------------------------------- ----- ------------ ------------ -------------

Current assets 41,848 70,743 51,938

-------------------------------------- ----- ------------ ------------ -------------

Total assets 260,859 280,334 269,394

-------------------------------------- ----- ------------ ------------ -------------

Equity

-------------------------------------- ----- ------------ ------------ -------------

Share capital 10 17,966 17,966 17,966

-------------------------------------- ----- ------------ ------------ -------------

Share premium 10 43,005 43,005 43,005

-------------------------------------- ----- ------------ ------------ -------------

Retained earnings (475) 21,468 10,662

-------------------------------------- ----- ------------ ------------ -------------

Other reserves 116,610 116,685 116,610

-------------------------------------- ----- ------------ ------------ -------------

Total equity 177,106 199,124 188,243

-------------------------------------- ----- ------------ ------------ -------------

Liabilities

-------------------------------------- ----- ------------ ------------ -------------

Non-current liabilities

-------------------------------------- ----- ------------ ------------ -------------

Interest-bearing loans and borrowings 9 51,283 68,657 41,794

-------------------------------------- ----- ------------ ------------ -------------

Deferred tax liability 7 4,691 4,915 5,124

-------------------------------------- ----- ------------ ------------ -------------

Non-current liabilities 55,974 73,572 46,918

-------------------------------------- ----- ------------ ------------ -------------

Current liabilities

-------------------------------------- ----- ------------ ------------ -------------

Interest-bearing loans and borrowings 21,550 - 26,950

-------------------------------------- ----- ------------ ------------ -------------

Trade and other payables 5,462 6,809 5,857

-------------------------------------- ----- ------------ ------------ -------------

Current tax liabilities 7 767 829 1,426

-------------------------------------- ----- ------------ ------------ -------------

Current liabilities 27,779 7,638 34,233

-------------------------------------- ----- ------------ ------------ -------------

Total liabilities 83,753 81,210 81,151

-------------------------------------- ----- ------------ ------------ -------------

Total equity and liabilities 11 260,859 280,334 269,394

-------------------------------------- ----- ------------ ------------ -------------

Net asset value per ordinary share 132.4c 148.8c 140.8c

-------------------------------------- ----- ------------ ------------ -------------

The condensed consolidated interim financial statements on pages

18-29 were approved at a meeting of the Board of Directors held on

27 June 2023 and signed on its behalf by:

Sir Julian Berney Bt.

Chairman

The accompanying notes 1 to 16 form an integral part of the

condensed consolidated interim financial statements.

Company number: 09382477

Registered office: 1 London Wall Place, London EC2Y 5AU

Condensed Consolidated Interim Statement of Changes in

Equity

For the period ended 31 March 2023

Share Share Retained Other Total

capital premium earnings reserves equity

Notes EUR000 EUR000 EUR000 EUR000 EUR000

------------------------------------- ----- -------- -------- --------- --------- -------

Balance as at 1 October

2022 17,966 43,005 10,662 116,610 188,243

------------------------------------- ----- -------- -------- --------- --------- -------

(Loss)/profit for the period - - (8,663) - (8,663)

------------------------------------- ----- -------- -------- --------- --------- -------

Other comprehensive (expense)/income - - - - -

for the period

------------------------------------- ----- -------- -------- --------- --------- -------

Dividends paid 12 - - (2,474) - (2,474)

------------------------------------- ----- -------- -------- --------- --------- -------

Balance as at 31 March 2023

(unaudited) 17,966 43,005 (475) 116,610 177,106

------------------------------------- ----- -------- -------- --------- --------- -------

Share Share Retained Other Total

capital premium earnings reserves equity

Notes EUR000 EUR000 EUR000 EUR000 EUR000

--------------------------- ----- -------- -------- --------- --------- --------

Balance as at 1 October

2021 17,966 43,005 21,878 116,683 199,532

--------------------------- ----- -------- -------- --------- --------- --------

Profit for the year - - 13,991 - 13,991

--------------------------- ----- -------- -------- --------- --------- --------

Other comprehensive income

for the year - - - (73) (73)

--------------------------- ----- -------- -------- --------- --------- --------

Dividends paid 12 - - (25,207) - (25,207)

--------------------------- ----- -------- -------- --------- --------- --------

Balance as at 30 September

2022 (audited) 17,966 43,005 10,662 116,610 188,243

--------------------------- ----- -------- -------- --------- --------- --------

Share Share Retained Other Total

capital premium earnings reserves equity

Notes EUR000 EUR000 EUR000 EUR000 EUR000

--------------------------- ----- -------- -------- --------- --------- --------

Balance as at 1 October

2021 17,966 43,005 21,878 116,683 199,532

--------------------------- ----- -------- -------- --------- --------- --------

Profit for the period - - 10,891 - 10,891

--------------------------- ----- -------- -------- --------- --------- --------

Other comprehensive income

for the period - - - 2 2

--------------------------- ----- -------- -------- --------- --------- --------

Dividends paid 12 - - (11,301) - (11,301)

--------------------------- ----- -------- -------- --------- --------- --------

Balance as at 31 March

2022 (unaudited) 17,966 43,005 21,468 116,685 199,124

--------------------------- ----- -------- -------- --------- --------- --------

The accompanying notes 1 to 16 form an integral part of the

condensed consolidated interim financial statements.

Condensed Consolidated Interim Statement of Cash Flows

For the period ended 31 March 2023

Six months Six months

to to Year to

31 March 31 March 30 September

2023 2022 2022

EUR000 EUR000 EUR000

Notes (unaudited) (unaudited) (audited)

--------------------------------------------- ----- ------------- ------------- --------------

Operating activities

--------------------------------------------- ----- ------------- ------------- --------------

(Loss)/Profit before tax for the period/year (8,929) 12,733 16,576

--------------------------------------------- ----- ------------- ------------- --------------

Adjustments for:

--------------------------------------------- ----- ------------- ------------- --------------

Net gain from fair value adjustment

on investment property 3 12,958 (7,853) (6,351)

--------------------------------------------- ----- ------------- ------------- --------------

Share of loss of joint venture 6 - - -

--------------------------------------------- ----- ------------- ------------- --------------

Realised foreign exchange loss 16 3 (77)

--------------------------------------------- ----- ------------- ------------- --------------

Finance income (37) (224) (451)

--------------------------------------------- ----- ------------- ------------- --------------

Finance costs 809 562 1,128

--------------------------------------------- ----- ------------- ------------- --------------

Net change in fair value of financial

instruments at fair value through profit

or loss 9 (107) (235) (921)

--------------------------------------------- ----- ------------- ------------- --------------

Provision of loan made to Seville joint

venture 5 - 221 444

--------------------------------------------- ------------- ------------- --------------

Operating cash generated before changes

in working capital 4,710 5,207 10,348

--------------------------------------------- ----- ------------- ------------- --------------

Increase/(decrease) in trade and other

receivables 8,774 (236) 958

--------------------------------------------- ----- ------------- ------------- --------------

(Decrease)/Increase in trade and other

payables (574) 1,353 324

--------------------------------------------- ----- ------------- ------------- --------------

Cash generated from/(used in) operations 12,910 6,324 11,630

--------------------------------------------- ----- ------------- ------------- --------------

Finance costs paid (734) (492) (897)

--------------------------------------------- ----- ------------- ------------- --------------

Finance income received 36 3 8

--------------------------------------------- ----- ------------- ------------- --------------

Tax paid 7 (826) (532) (469)

--------------------------------------------- ----- ------------- ------------- --------------

Net cash generated from/(used in) operating

activities 11,386 5,303 10,272

--------------------------------------------- ----- ------------- ------------- --------------

Investing activities

--------------------------------------------- ----- ------------- ------------- --------------

Proceeds from sale of investment property - 16,900 16,900

--------------------------------------------- ----- ------------- ------------- --------------

Acquisitions of investment property 3 (12,310) (1,741) (10,824)

--------------------------------------------- ----- ------------- ------------- --------------

Additions to investment property 3 (1,926) (579) (698)

--------------------------------------------- ----- ------------- ------------- --------------

Investment in joint venture 6 - - -

--------------------------------------------- ----- ------------- ------------- --------------

Net cash generated(used in)/from investing

activities (14,236) 14,580 5,378

--------------------------------------------- ----- ------------- ------------- --------------

Financing activities

--------------------------------------------- ----- ------------- ------------- --------------

Proceeds from borrowings 18,000 - -

--------------------------------------------- ----- ------------- ------------- --------------

Repayment of loan facility (14,000) (1,840) (1,840)

--------------------------------------------- ----- ------------- ------------- --------------

Dividends paid 12 (2,474) (11,301) (25,207)

--------------------------------------------- ----- ------------- ------------- --------------

Net cash provided by/(used in) financing

activities 1,526 (13,141) (27,047)

--------------------------------------------- ----- ------------- ------------- --------------

Net (decrease)/increase in cash and

cash equivalents for the period/year (1,324) 6,742 (11,397)

--------------------------------------------- ----- ------------- ------------- --------------

Opening cash and cash equivalents 34,324 45,717 45,717

--------------------------------------------- ----- ------------- ------------- --------------

Effects of exchange rate change on

cash (15) (1) 4

--------------------------------------------- ----- ------------- ------------- --------------

Closing cash and cash equivalents 32,985 52,458 34,324

--------------------------------------------- ----- ------------- ------------- --------------

The accompanying notes 1 to 16 form an integral part of the

condensed consolidated interim financial statements.

Notes to the Financial Statements

1. Significant accounting policies

The Company is a closed-ended investment company incorporated in

England and Wales. The condensed consolidated interim financial

statements of the Company for the period ended 31 March 2023

comprise those of the Company and its subsidiaries (together

referred to as the 'Group'). The shares of the Company are listed

on the London Stock Exchange (Primary listing) and the Johannesburg

Stock Exchange (Secondary listing). The registered office of the

Company is 1 London Wall Place, London, EC2Y 5AU.

These condensed consolidated interim financial statements do not

comprise statutory accounts within the meaning of section 434 of

the Companies Act 2006. Statutory accounts for the year ended 30

September 2022 were approved by the Board of Directors on 5

December 2022 and were delivered to the Registrar of Companies. The

report of the auditors on those accounts was unqualified, did not

contain an emphasis of matter paragraph and did not contain any

statement under section 498 of the Companies Act 2006.

These condensed consolidated interim financial statements have

been reviewed and not audited.

Statement of compliance

The condensed consolidated interim financial statements have

been prepared in accordance with UK adopted International

Accounting Standard 34, 'Interim Financial Reporting' and the

Disclosure Guidance and Transparency Rules sourcebook of the United

Kingdom's Financial Conduct Authority. They do not include all of

the information required for the full annual financial statements

and should be read in conjunction with the consolidated financial

statements of the Group as at and for the year ended 30 September

2022. The condensed consolidated interim financial statements have

been prepared on the basis of the accounting policies set out in

the Group's consolidated financial statements for the year ended 30

September 2022. The consolidated financial statements for the year

ended 30 September 2022 have been prepared in accordance with

International Accounting Standards in conformity with the Companies

Act 2006.The Group's annual financial statements refer to new

Standards and Interpretations, none of which had a material impact

on the financial statements.

Basis of preparation

The condensed consolidated interim financial statements are

presented in euros rounded to the nearest thousand. They are

prepared on a going concern basis, applying the historical cost

convention, except for the measurement of investment property and

derivative financial instruments that have been measured at fair

value. The accounting policies have been consistently applied to

the results, assets, liabilities and cash flow of the entities

included in the condensed consolidated interim financial statements

and are consistent with those of the year-end financial report.

Going concern

The Directors have examined significant areas of possible

financial risk including: the non-collection of rent and service

charges; potential falls in property valuations; the existing and

future expected cash requirements of the Group; the ability to

refinance certain third-party loans; the refurbishment of Paris, BB

and the receipt of further future funds from the purchaser and

forward-looking compliance with third-party debt covenants, in

particular the loan to value covenant and interest cover

ratios.

Furthermore, the potential ramifications of Covid-19, the war in

Ukraine and macroeconomic variables such as rising interest rates

and inflation have also been considered regarding the Group's

investments in France, Germany, Spain and the Netherlands.

Cash flow forecasts based on plausible downside scenarios have

led the Board to conclude that the Group will have sufficient cash

reserves to continue in operation for the foreseeable future.

The Group has seven loans secured by individual assets, with no

cross-collateralisation. All loans are in compliance with their

default covenants, though there is a cash trap in operation for the

Seville loan. More detail of the individual loans, and headroom on

the loan to value and net income default covenants, is provided in

the Investment Manager's Report on page 13. Excluding the Seville

loan, for which the Group's equity in the associated joint venture

has been written down to a nil value, three loans totalling

EUR21.55 million fall due between the 31 March 2023 period end and

twelve months post the signing of the half year report. The Group

has since repaid the Rumilly loan for EUR3.70m in April 2023; good

progress is being made with the refinancing of the EUR9.25m Dutch

industrials loan which matures in September 2023; and there are no

immediate concerns with regard to the Group's future ability to

refinance the EUR8.60m Rennes loan which matures in March 2024.

Furthermore, the Group has sufficient cash or liquid assets to

repay these loans in a downside scenario of refinancing not being

achieved.

After due consideration, the Directors have not identified any

material uncertainties which would cast significant doubt on the

Group's ability to continue as a going concern for a period of not

less than 12 months from the date of the approval of the condensed

consolidated interim financial statements. The Directors have

satisfied themselves that the Group has adequate resources to

continue in operational existence for the foreseeable future.

Use of estimates and judgements

The preparation of financial statements requires management to

make judgements, estimates and assumptions that affect the

application of policies and the reported amounts of assets and

liabilities, income and expenses. The use of estimates and

judgements is consistent with the Group's consolidated financial

statements for the year ended 30 September 2022. These estimates

and associated assumptions are based on historical experience and

various other factors that are believed to be reasonable under the

circumstances, the results of which form the basis of making

judgements about the carrying values of assets and liabilities that

are not readily apparent from other sources. Actual results may

differ from these estimates. The estimates and underlying

assumptions are reviewed on an ongoing basis. Revisions to

accounting estimates are recognised in the period in which the

estimates are revised and in any future periods affected.

The most significant estimates made in preparing these financial

statements relate to the carrying value of investment properties,

as disclosed in note 3 which are stated at fair value. The fair

value of investment property is inherently subjective because the

valuer makes assumptions which may not prove to be accurate. The

Group uses an external professional valuer to determine the

relevant amounts.

The following are key areas of judgement:

-- Accounting for development revenue and variable consideration

regarding Paris, BB: When estimating an appropriate level of

development revenue to be recognised in the reporting period, the

Group considered the contractual penalties of not meeting certain

criteria within the agreement; the total development costs

incurred; the stage of completion of the refurbishment; the

milestones achieved and still to be achieved; the timing of further

future cash receipts from the purchaser; and the overall general

development risk to form a considered judgement of revenue to be

appropriately recognised in the financial statements. Further

details of the estimated variable consideration are disclosed in

note 4.

-- Tax provisioning and disclosure: Management uses external tax

advisers to monitor changes in tax laws in countries where the

Group has operations. New tax laws that have been substantively

enacted are recognised in the Group's financial statements. Where

changes to tax laws give rise to a contingent liability, the Group

discloses these appropriately within the notes to the financial

statements (further details are disclosed in note 7).