TIDMSGRO

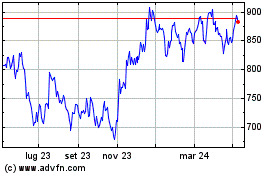

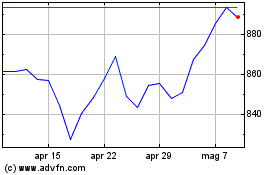

SEGRO PLC (BOURSE:SGRO)

Commenting on the results, David Sleath, Chief Executive,

said:

"SEGRO has performed well during the first six months of 2023,

delivering rental growth from our standing portfolio and from our

largely pre-let development programme. We have made great progress

in capturing reversion, delivering an average rental uplift of 20

per cent at lease events during the period in addition to

contracted indexation, whilst customer retention has increased

significantly to 85 per cent.

"The structural drivers of occupier demand remain evident across

the UK and Europe, whilst supply remains constrained in our chosen

markets, helping to drive rental growth in line with our

expectations.

"Valuations have been relatively stable in the first half of

this year, following the deep valuation correction in the latter

part of 2022. The increased volume of transactions in the last

quarter indicates that investors see value at the current levels of

pricing for prime industrial and logistics assets, given the

positive long-term outlook for our sector.

"We have significant opportunities to drive rent and create

value both within our standing portfolio and through the execution

of our profitable development programme. These factors give us

confidence in our ability to deliver attractive growth and returns

into the years ahead."

HIGHLIGHTS(A) :

-- Adjusted pre-tax profit of GBP198 million up 2.6 per cent compared with

the prior year (H1 2022: GBP193 million1), Adjusted EPS is 15.9 pence, up

1.9 per cent (H1 2022: 15.6 pence1) excluding the impact of performance

fees from our SELP joint venture.

-- Adjusted NAV per share is down 3.0 per cent to 937 pence (31 December

2022: 966 pence) driven by a 1.4 per cent decrease in the valuation of

the portfolio (UK -0.6 per cent, CE -2.7 per cent), due to outward yield

shift, mitigated by 3.7 per cent growth in estimated rental values during

the first half of the year.

-- Like-for-like rental growth of 5.1 per cent and GBP44 million of new

headline rent commitments generated during the six-month period (H1 2022:

GBP55 million), driven by our customer focus and active management of the

portfolio.

-- 340,900 sq m of development completions were delivered, equating to

GBP28 million of potential rent, of which 83 per cent of which is leased.

85 per cent of these completions were BREEAM 'Excellent' certification

(or local equivalent).

-- Future rent roll growth supported by our active development pipeline

with 740,800 sq m of projects under construction or in advanced pre-let

discussions equating to GBP76 million of potential rent (31 December

2022: 915,600 sq m, GBP86 million), of which 70 per cent is associated

with pre-lets signed or in advanced negotiations, substantially

de-risking the 2023-24 pipeline. Yield on cost for these projects is 7.2

per cent.

-- Strong balance sheet, with a modest level of gearing and significant

liquidity. LTV of 34 per cent at 30 June 2023 (31 December 2022: 32 per

cent) and access to GBP1.7 billion of cash and committed bank

facilities.

-- Attractive cost of debt due to our diverse, long-term debt structure.

No major debt maturities until 2026 and 91 per cent of debt is fixed or

capped with half of the caps active until 2029. Average cost of debt at

30 June 2023 was 2.9 per cent (31 December 2022: 2.5 per cent).

-- Interim dividend increased by 7.4 per cent to 8.7 pence (2022: 8.1

pence).

FINANCIAL SUMMARY

6 months to 6 months to Change

30 June 2023 30 June 2022 per cent

Adjusted(2) profit before tax (GBPm) 198 193(1) 2.6

IFRS (loss)/ profit before tax (GBPm) (33) 1,375 --

Adjusted(3) earnings per share

(pence) 15.9 15.6(1) 1.9

IFRS earnings per share (pence) (1.9) 110.7 --

Dividend per share (pence) 8.7 8.1 7.4

Total Accounting Return (%)(4) (1.1) 11.3 --

31 December Change

30 June 2023 2022 per cent

Assets under Management (GBPm) 21,024 20,947

Portfolio valuation (SEGRO share,

GBPm) 18,095 17,925 (1.4)(5)

Adjusted(6 7) net asset value per

share (pence, diluted) 937 966 (3.0)

IFRS net asset value per share

(pence, diluted) 913 938 (2.7)

Net debt (SEGRO share, GBPm) 6,078 5,693

Loan to value ratio including joint

ventures at share (per cent) 34 32

1. Adjusted profit before tax and Adjusted earnings per share

have been represented to exclude joint venture performance fee

income as detailed further in Note 2. The H1 2022 figures have been

changed accordingly. The FY 2022 and H1 2023 reported results are

not impacted by this change. Further discussion of the sensitivity

around the quantum of the performance fee is given in Note 6.

2. A reconciliation between Adjusted profit before tax and IFRS

profit before tax is shown in Note 2 to the condensed financial

information.

3. A reconciliation between Adjusted earnings per share and IFRS

earnings per share is shown in Note 11 to the condensed financial

information.

4. Total Accounting Return is calculated based on the opening

and closing adjusted NAV per share adding back dividends paid

during the period.

5. Percentage valuation movement during the period based on the

difference between opening and closing valuations for all

properties including buildings under construction and land,

adjusting for capital expenditure, acquisitions and disposals.

6. A reconciliation between Adjusted net asset value per share

and IFRS net asset value per share is shown in Note 11 to the

condensed financial information.

7. Adjusted net asset value is in line with EPRA Net Tangible

Assets (NTA) (see Table 5 in the Supplementary Notes for a NAV

reconciliation).

(A) Figures quoted on pages 1 to 14 refer to SEGRO's share,

except for land (hectares) and space (square metres) which are

quoted at 100 per cent, unless otherwise stated. Please refer to

the Presentation of Financial Information statement in the

Financial Review for further details.

OPERATING SUMMARY & KEY METRICS

H1 2023 H1 2022 FY 2022

RENTAL GROWTH REMAINS STRONG, SMALL DECLINE IN PORTFOLIO VALUATION DUE TO

FURTHER YIELD SHIFT (see page 8):

Valuation decline driven by further yield expansion, mostly on the Continent,

and partly offset by estimated rental value (ERV) growth and active asset

management of the portfolio.

Portfolio valuation change (%) Group (1.4) 7.2 (11.0)

UK (0.6) 8.2 (13.1)

CE (2.7) 5.2 (7.3)

Estimated rental value (ERV) growth (%) Group 3.7 5.9 10.9

UK 3.0 7.3 11.5

CE 4.8 3.6 9.9

ACTIVE ASSET MANAGEMENT DRIVING OPERATIONAL PERFORMANCE (see page 9):

Standing portfolio contributing significantly to rent roll growth as a result

of reversion capture, indexation and leases signed with existing and new

customers from a wide range of sectors, highlighting the versatility of our

portfolio.

Total new rent contracted during the period

(GBPm) 44 55 98

Pre-lets signed during the period (GBPm) 19 28 41

Like-for-like net rental income growth (%):

Group 5.1 7.1 6.7

UK 4.3 8.9 7.7

CE 6.4 4.1 4.9

Uplift on rent reviews and renewals (%) Group 20.4 23.5 23.3

(note: excludes uplifts from indexation) UK 26.4 29.0 28.0

CE 9.9 1.8 1.7

Occupancy rate (%) 95.5 96.7 96.0

Customer retention (%) 85 79 76

INVESTMENT ACTIVITY REMAINS DISCIPLINED AND FOCUSED ON SECURING PROFITABLE

GROWTH (see page 14):

Capital investment continues to focus on our development programme, through

capex and securing land to provide future growth opportunities. Development

capex for 2023, including infrastructure, expected to be c.GBP600 million.

Development capex (GBPm) 299 358 787

Acquisitions (GBPm) 326 365 867

Disposals (GBPm) 74 181 367

EXECUTING AND GROWING OUR PROFITABLE DEVELOPMENT PIPELINE (see page 10):

Our active and largely pre-let development pipeline remains a key driver of

rent roll growth and attractive returns on capital. Potential rent of GBP76

million from projects currently on site or expected to commence shortly at a

yield on cost of 7.2 per cent.

Development completions:

-- Space completed (sq m) 340,900 329,900 639,200

-- Potential rent (GBPm) (Rent secured) 28 (83%) 15 (87%) 46 (80%)

Current development pipeline potential rent

(GBPm) (Rent secured) 66 (65%) 84 (63%) 67 (73%)

Near-term pre-let development pipeline potential

rent (GBPm) 10 34 19

OUTLOOK

SEGRO has one of the best and most modern pan-European

industrial warehouse portfolios, through which we can serve our

customers' entire regional and local distribution needs. Our

strategic focus is to ensure that our properties are of the highest

quality and in the most supply constrained locations, and thus able

to generate superior long-term rental growth. We are also able to

respond tactically to shorter-term changes in market conditions,

including adapting our approach to capital allocation based on the

insights provided by our market-leading operating platform.

Occupier demand for industrial and logistics space is proving

resilient due to the long-term, structural drivers at play in our

sector. At the same time, modern sustainable space is in short

supply across our chosen sub-markets in Europe and a lack of

available land limits the potential supply response. We expect that

this supply-demand tension will drive further rental growth across

our portfolio, normalising over time towards our long-held

expectations of two to six per cent per annum. Net rental income

growth will also be supported by the GBP147 million of embedded

reversionary potential within our portfolio, equivalent to around a

quarter of our current rent roll. Most of this reversion is in the

UK and will be captured by the five-yearly open market rent review

process, and we have index-linked uplifts on over half of our

leases (mostly in Continental Europe) that will also help to

capture this reversion and provide further rental growth.

Our high-quality land bank, with the potential to add GBP370

million of rental income, provides us with the ability to respond

quickly to changing occupier demand through our development

programme. Coupled with this, our strong balance sheet provides

significant financial flexibility to continue to invest capital

profitably in those development opportunities which offer the most

attractive risk-adjusted returns.

Valuations have been much more stable in the first half of 2023

and investment has activity picked up across the market, including

our own disposal of a UK big box portfolio since the period end

(which was sold ahead of June 2023 book value). This demonstrates

that investors are seeing value at current levels of pricing, and

we believe that demand will further increase as clarity emerges

around future interest rates, with investors attracted by the

positive fundamentals and long-term structural growth potential in

logistics and industrial warehousing.

Our prime portfolio and market-leading operating platform

combine to create a strong competitive advantage, and position us

well to create value through the cycle for all of our stakeholders.

We therefore remain confident in our ability to deliver attractive

returns and continued growth in earnings and dividends into the

future.

WEBCAST / CONFERENCE CALL FOR INVESTORS AND ANALYSTS

A live webcast of the results presentation will be available

from 08:30am (UK time) at:

https://www.investis-live.com/segro/6491814000e68612004ca42e/hsgr

The webcast will be available for replay at SEGRO's website at:

http://www.segro.com/investors shortly after the live

presentation.

A conference call facility will be An audio recording of the conference

available at 08:30 (UK time) on the call will be available until 3 August

following number: Dial-in: +44 (0)800 2023 on: UK: +44 (0) 203 936 3001

358 1035 +44 (0) 204 587 0498 Access Access code: 673798

code: 022413

A video of David Sleath, Chief Executive discussing the results

will be available to view on www.segro.com, together with this

announcement, the Half Year 2023 Property Analysis Report and other

information about SEGRO.

CONTACT DETAILS FOR INVESTOR / ANALYST AND MEDIA ENQUIRIES:

SEGRO Soumen Das Tel: + 44 (0) 20 7451 9110

(Chief Financial Officer) (after 11am)

Claire Mogford Mob: +44 (0) 7710 153 974

(Head of Investor Relations) Tel: +44 (0) 20 7451 9048

(after 11am)

FTI Consulting Richard Sunderland / Eve Kirmatzis Tel: +44 (0) 20 3727 1000

FINANCIAL CALAR

2023 interim dividend ex-div date 10 August 2023

2023 interim dividend record date 11 August 2023

2023 interim dividend scrip dividend price announced 17 August 2023

Last date for scrip dividend elections 1 September 2023

2023 interim dividend payment date 22 September 2022

2023 Third Quarter Trading Update 18 October 2023

Full Year 2023 Results (provisional) 16 February 2024

ABOUT SEGRO

SEGRO is a UK Real Estate Investment Trust (REIT), listed on the

London Stock Exchange and Euronext Paris, and is a leading owner,

manager and developer of modern warehouses and industrial property.

It owns or manages 10.3 million square metres of space (110 million

square feet) valued at GBP21.0 billion serving customers from a

wide range of industry sectors. Its properties are located in and

around major cities and at key transportation hubs in the UK and in

seven other European countries.

For over 100 years SEGRO has been creating the space that

enables extraordinary things to happen. From modern big box

warehouses, used primarily for regional, national and international

distribution hubs, to urban warehousing located close to major

population centres and business districts, it provides high-quality

assets that allow its customers to thrive.

A commitment to be a force for societal and environmental good

is integral to SEGRO's purpose and strategy. Its Responsible SEGRO

framework focuses on three long-term priorities where the company

believes it can make the greatest impact: Championing Low-Carbon

Growth, Investing in Local Communities and Environments and

Nurturing Talent.

Striving for the highest standards of innovation, sustainable

business practices and enabling economic and societal prosperity

underpins SEGRO's ambition to be the best property company.

See www.SEGRO.com for further information.

Forward-Looking Statements: This announcement contains certain

forward-looking statements with respect to SEGRO's expectations and

plans, strategy, management objectives, future developments and

performance, costs, revenues and other trend information. All

statements other than historical fact are, or may be deemed to be,

forward-looking statements. Forward-looking statements are

statements of future expectations and all forward-looking

statements are subject to assumptions, risk and uncertainty. Many

of these assumptions, risks and uncertainties relate to factors

that are beyond SEGRO's ability to control or estimate precisely

and which could cause actual results or developments to differ

materially from those expressed or implied by these forward-looking

statements. Certain statements have been made with reference to

forecast process changes, economic conditions and the current

regulatory environment. Any forward-looking statements made by or

on behalf of SEGRO are based upon the knowledge and information

available to Directors on the date of this announcement.

Accordingly, no assurance can be given that any particular

expectation will be met and you are cautioned not to place undue

reliance on the forward-looking statements. Additionally,

forward-looking statements regarding past trends or activities

should not be taken as a representation that such trends or

activities will continue in the future. The information contained

in this announcement is provided as at the date of this

announcement and is subject to change without notice. Other than in

accordance with its legal or regulatory obligations (including

under the UK Listing Rules and the Disclosure Guidance and

Transparency Rules of the Financial Conduct Authority), SEGRO does

not undertake to update forward-looking statements, including to

reflect any new information or changes in events, conditions or

circumstances on which any such statement is based. Past share

performance cannot be relied on as a guide to future performance.

Nothing in this announcement should be construed as a profit

estimate or profit forecast. The information in this announcement

does not constitute an offer to sell or an invitation to buy

securities in SEGRO plc or an invitation or inducement to engage in

or enter into any contract or commitment or other investment

activities.

Neither the content of SEGRO's website nor any other website

accessible by hyperlinks from SEGRO's website are incorporated in,

or form part of, this announcement.

INTRODUCTION

The first half of 2023 has seen a strong operational performance

supported by the high quality of our portfolio, continued occupier

demand and the active approach to asset management that we take to

unlock value and drive performance.

We have a unique portfolio of prime warehouses, two-thirds of

which are located in the most supply constrained urban markets with

the remaining one-third close to transportation hubs and key

logistics corridors; an enviable land bank capable of supporting

our profitable development programme; an established pan-European,

customer-focused operating platform; and strong, strategic

relationships with other key stakeholders. These combine to provide

us with what we believe is a significant competitive advantage

which enhances our ability to outperform through the cycle and to

secure opportunities for future growth.

The fundamentals for industrial assets remain attractive and we

expect to see continued rental growth in our markets due to the

supply-demand imbalance of high-quality space. This is in addition

to the embedded reversionary potential already within the portfolio

and the increased levels of indexation that we are capturing across

Continental Europe.

With modest leverage, no near-term refinancing requirements, and

a significant amount of liquidity at our disposal we have financial

flexibility to continue to invest capital in the development

opportunities that offer the most attractive risk-adjusted

returns.

We continue to invest in and de-risk the future of the business

through our Responsible SEGRO strategic priorities. We are making

great steps in our ambition to Champion low-carbon growth by

focusing on: driving down the carbon emissions produced by our

development programme; making the running of our warehouses more

efficient; and adding solar panels to help reduce our customers'

emissions.

Through Investing in our local communities and environments we

are making a real difference to the lives of thousands of people

who live close to our parks and estates. During the first half of

2023 our people volunteered 380 days to projects running within our

Community Investment Plans (CIPs). In addition, working with local

delivery partners, SEGRO-funded projects have delivered some great

outcomes so far in 2023: more than 3,800 students participated in

our schools programme; 582 unemployed people took part in our

training, skills and job brokerage programme; and we delivered 18

environmental projects to enhance biodiversity and community health

and wellbeing.

Finally, the management changes that we announced in June show

the importance of Nurturing talent within our business. We were

able to appoint four of our existing leadership team into Executive

Committee roles, helping us to benefit from their many years of

experience within SEGRO and the wider business world. We are now in

the process of making changes to align our operational business

units to the new organisational structure, which will create many

more opportunities for talent to progress within SEGRO and help to

ensure that our business is in the best shape possible for success

in the coming years.

PORTFOLIO PERFORMANCE

The Group's property portfolio was valued at GBP18.1 billion at

30 June 2023 (GBP21.0 billion of assets under management). The

portfolio valuation, including completed assets, land and buildings

under construction, decreased by 1.4 per cent (adjusting for

capital expenditure and asset recycling) during the first six

months of the year, compared to an increase of 7.2 per cent in the

first half of 2022 and a decline of 16.6 per cent in the second

half of 2022.

The slower rate of valuation declines in the first half of 2023

was due to some modest, market-driven yield expansion, 30 basis

points across the whole portfolio (UK: 20bps, CE: 40bps), mostly

offset by gains from strong rental growth, development profits and

asset management across the portfolio.

In the six months to 30 June 2023, the MSCI UK Monthly index

showed capital growth of 0.3 per cent, ahead of SEGRO's UK

portfolio. However, over the 12 months to 30 June 2023, which we

consider to be a more appropriate period due to the significant

changes in the property investment market over the past year,

SEGRO's UK portfolio outperformed the MSCI UK Monthly index,

showing a capital decline of -21.9 per cent vs -26.5 per cent

respectively.

Occupier demand has remained healthy and occupancy rates across

our markets are high, driving further market rental growth. The

external valuer's estimate of the market rental value of our

portfolio increased by 3.7 per cent (H1 2022: 5.9 per cent) during

the period.

Assets held throughout the year decreased in value by 1.6 per

cent. In the UK, the decrease was 0.8 per cent (H1 2022: 7.5 per

cent increase). The net true equivalent yield applied to our UK

portfolio was 5.0 per cent, 20 basis points higher than at 31

December 2022 (4.8 per cent). Rental values improved by 3.0 per

cent (H1 2022: 7.3 per cent).

Assets held throughout the year in Continental Europe decreased

in value by 3.0 per cent (H1 2022: 4.2 per cent increase) on a

constant currency basis, reflecting a combination of yield

expansion to 5.2 per cent (31 December 2022: 4.8 per cent) and

rental value growth of 4.8 per cent (H1 2022: 3.6 per cent).

Property portfolio metrics at 30 June 2023(1)

Portfolio value, GBPm Yield(3)

Topped-up

Combined Combined Valuation net Net true Occupancy

Lettable Land & property property movement(2) initial equivalent (ERV)

area sq m Completed develop-ment portfolio portfolio % % % %

(AUM) (AUM)

UK

Greater

London 1,319,894 6,039 273 6,312 6,325 (1.5) 3.5 4.7 92.6

Thames

Valley 607,770 2,390 838 3,228 3,228 0.6 4.3 5.4 97.7

National

Logistics 817,388 1,369 602 1,971 1,971 0.2 5.3 5.4 98.9

UK Total 2,745,052 9,798 1,713 11,511 11,524 (0.8) 4.0 5.0 94.9

Continental

Europe

Germany 1,838,304 1,664 289 1,953 2,800 -- 4.0 4.5 96.8

Netherlands 260,042 162 24 186 371 (1.8) 4.7 5.3 100.0

France 1,606,749 1,663 446 2,109 2,632 (4.8) 4.4 5.3 94.1

Italy 1,608,488 983 166 1,149 1,648 (4.1) 5.1 5.2 99.8

Spain 313,199 247 70 317 510 (5.0) 4.5 4.8 100.0

Poland 1,711,512 685 84 769 1,336 (3.8) 6.0 6.3 96.1

Czech

Republic 169,513 97 4 101 203 (2.0) 4.7 6.0 97.7

Continental

Europe

Total 7,507,807 5,501 1,083 6,584 9,500 (3.0) 4.6 5.2 96.7

GROUP TOTAL 10,252,859 15,299 2,796 18,095 21,024 (1.6) 4.2 5.1 95.5

1. Figures reflect SEGRO wholly-owned assets and its share of

assets held in joint ventures unless stated "AUM" which refers to

all assets under management.

2. Valuation movement is based on the difference between the

opening and closing valuations for properties held throughout the

period, allowing for capital expenditure, acquisitions and

disposals.

More details of our property portfolio can be found in the H1

2023 Property Analysis Report at www.SEGRO.com/investors.

INVESTMENT ACTIVITY

Net investment during the first half of the year was GBP551

million comprising: development capital expenditure of GBP299

million and GBP326 million of acquisitions, partly offset by GBP74

million of disposals during the period.

Acquisitions during the first half of 2023 focused on land

acquisitions to create future development opportunities (see page

13 for further information).

Disposals comprised GBP51 million of proceeds from the disposal

of two non-core office assets and GBP23 million of land disposals,

primarily small plots of residual land that were unsuitable for

industrial development.

Since the period end, we agreed the conditional exchange of a

portfolio of UK big box assets in the Midlands, reflecting a price

above 30 June 2023 valuation. The conditions have subsequently been

met and the transaction is expected to complete in early

August.

ASSET MANAGEMENT

Our continued focus on Operational Excellence has helped us

deliver GBP34 million of rent roll growth in the first half of 2023

(H1 2022: GBP43 million).

Growing rental income from capturing reversion, letting existing

space and new developments

At 30 June 2023, our portfolio generated passing rent of GBP605

million, rising to GBP660 million once rent free periods expire

('headline rent'). During the period, we contracted GBP44 million

of new headline rent, consistent with our expectations after the

elevated levels seen during the pandemic and its immediate

aftermath (H1 2022: GBP55 million). We grew the rent from our

existing space significantly through the capture of reversionary

potential at rent reviews and renewals and also due to the impact

of index-linked leases. Strong occupier demand for new space also

helped us sign further pre-let agreements for delivery over the

next two years.

Our customer base remains well diversified, reflecting the

flexibility of warehouse space. Our top 20 customers account for 32

per cent of total headline rent. Amazon remains our largest

customer, accounting for 7 per cent of our total rent roll.

Customers from the transport and logistics and retail sectors

were the largest takers of our space during the first six months of

2023, with these sectors focused on ensuring they have efficient

and resilient supply chains and distribution networks, as well as

building out their capability to respond to increase levels of

e-commerce penetration across Europe. The Slough Trading Estate

remains a popular location for data centres, and we signed a new

lease to deliver space with a leading global data centre operator

during the period.

-- GBP11 million of net new rent from existing assets. We generated GBP8

million of headline rent from new leases on existing assets (H1 2022:

GBP11 million) and GBP12 million from rent reviews, lease renewals and

indexation (H1 2022: GBP13 million). This was offset by rent from space

returned of GBP9 million (H1 2022: GBP10 million), much of it for

refurbishment. Less than GBP1 million of rent was lost due to insolvency

(H1 2022: GBP1 million).

-- Rental growth from lease reviews and renewals. These generated an

uplift of 20.4 per cent (H1 2022: 23.5 per cent) for the portfolio,

compared to previous headline rent. During the year, new rents agreed at

review and renewal were 26.4 per cent higher in the UK (H1 2022: 29.0 per

cent) as reversion accumulated over the past five years was reflected in

new rents agreed. This includes the impact of a particularly large rent

review dating back to 2020, and therefore agreed in line with 2020 ERVs;

excluding this the uplift would have been 24.0 per cent for the Group and

35.7 per cent for the UK. In Continental Europe, rents agreed on renewal

were 9.9 per cent higher (H1 2022: 1.8 per cent higher), as a result of

market rental growth continuing to outpace the indexation provisions that

have accumulated over recent years.

-- Continued strong demand from customers for pre-let agreements. We

contracted GBP19 million of headline rent from pre-let agreements and

lettings of speculative developments prior to completion (H1 2022: GBP28

million). This includes a second pre-let at our new UK logistics park in

Coventry, space for third-party logistics operators, retailers and

manufacturers across Continental Europe, and a data centre in Slough.

-- Rent roll growth of GBP34 million. Rent roll growth, which reflects net

new headline rent from existing space (adjusted for takebacks of space

for development), take-up of developments and pre-lets agreed during the

period, was GBP34 million in H1 2023 (H1 2022: GBP43 million).

Summary of key leasing data for H1 2023

Summary of key leasing data(1) for the six months to

30 June H1 2023 H1 2022

Take-up of existing space(2) (A) GBPm 8 11

Space returned(3) (B) GBPm (9) (10)

NET ABSORPTION OF EXISTING SPACE(2) (A-B) GBPm (1) 1

Other rental movements (rent reviews, renewals,

indexation)(2) (C) GBPm 12 13

RENT ROLL GROWTH FROM EXISTING SPACE GBPm 11 14

Take-up of pre-let developments completed during the

period (signed in prior years)(2) (D) GBPm 21 11

Take-up of speculative developments completed in the

past two years(2) (D) GBPm 6 4

TOTAL TAKE-UP(2) (A+C+D) GBPm 47 39

Less take-up of pre-lets and speculative lettings

signed in prior years(2) GBPm (22) (12)

Pre-lets signed in the period for future delivery(2) GBPm 19 28

RENTAL INCOME CONTRACTED DURING THE PERIOD(2) GBPm 44 55

Takeback of space for redevelopment GBPm (1) (2)

Retention rate(4) % 85 79

1. All figures reflect exchange rates at 30 June 2023 and

include joint ventures at share.

2. Headline rent.

3. Headline rent, excluding space taken back for

redevelopment.

4. Headline rent retained as a percentage of total headline rent

at risk from break or expiry during the period.

Existing portfolio continues to perform well and delivered

another set of strong operating metrics

We monitor a number of asset management indicators to assess the

performance of our existing portfolio:

-- Occupancy has remained high. The occupancy rate at 30 June 2023 was

95.5 per cent (31 December 2022: 96.0 per cent), reflecting the

completion of newly-completed speculative urban warehousing in South

London as well as relocating a number of other customers into brand new

space at SEGRO Park Hayes and SEGRO Park Tottenham, allowing us to

refurbish and redevelop their former, older space on existing estates.

The occupancy rate excluding recently completed speculative developments

remains high at 96.7 per cent (31 December 2022: 97.3 per cent). The

average occupancy rate during the period was 95.7 per cent (H1 2022: 96.7

per cent) which is at the high end of our 94 to 96 per cent target.

-- Customer retention rate increased to 85 per cent. Approximately GBP42

million of headline rent at risk from a break or lease expiry during the

period was settled, of which we retained 82 per cent in existing space,

with a further 3 per cent retained but in new premises.

-- Lease terms continue to offer attractive income security. The level of

incentives agreed for new leases (excluding those on developments

completed in the period) represented 6.1 per cent of the headline rent

(H1 2022: 5.9 per cent). We maintained the portfolio's weighted average

lease length, with 7.0 years to first break and 8.2 years to expiry (31

December 2022: 7.0 years to first break, 8.3 years to expiry). Lease

terms are longer in the UK (8.0 years to break) than in Continental

Europe (5.6 years to break), reflecting the market convention of shorter

leases in countries such as France and Poland.

Focusing on visibility of customer energy use, highly

sustainable refurbishments and the installation of solar panels

onto existing assets.

Integrated into the day-to-day management of our portfolio, our

teams continue to work hard on our Responsible SEGRO commitment to

Champion low-carbon growth and be a net-zero carbon business by

2030. We have a science-based target to reduce the absolute

corporate and customer carbon emissions from our portfolio by 42

per cent by 2030 (compared to a 2020 baseline), in line with the

1.5 degree scenario.

The recent introduction of green lease clauses is helping us to

improve our visibility of customer emissions, which in turn allows

us to better identify opportunities to help them operate their

buildings more efficiently, reducing their carbon footprint and

operating costs.

We continue to improve the carbon footprint of our portfolio

through the ongoing maintenance and refurbishment of our

warehouses. One such refurbishment, SEGRO Park Greenford in West

London, was awarded BREEAM 'Outstanding' during the period and

rated EPC A+. It is our most sustainable refurbishment to date and

includes the installation of photo voltaic panels, SMART building

sensors, dynamic LED lighting, a green wall which is estimated to

remove 260kg of carbon emissions per year (the equivalent to

planting ten trees), as well as other features such as EV charging

points and air purifiers.

We are also working hard to expand the solar capacity of our

portfolio through retrofitting onto existing assets and installing

panels on every new development where feasible. During the first

half of the year our most significant installation was 6,204 solar

panels on a site in Granollers, Spain, which added 2.6 MW to our

capacity. We have a pipeline of further projects expected to

complete in the second half of the year.

DEVELOPMENT

Growing through development

Development activity

During the first six months of 2023, we invested over GBP600

million in our development pipeline, which comprised GBP299 million

(H1 2022: GBP358 million) in development spend, of which GBP37

million was for infrastructure, and a further GBP322 million of

land to secure future development-led growth opportunities.

Development projects completed

We completed 340,900 sq m of new space during the first half of

2023. These projects were 77 per cent pre-let prior to the start of

construction and were 83 per cent let as at 30 June 2023,

generating GBP23 million of headline rent, with a potential further

GBP5 million to come when the remainder of the space is let. The

yield on total development cost (including land, construction and

finance costs) will be 6.1 per cent when fully let (excluding

developments completed by third parties on a forward funded basis

acquired at investment value), around 100bp above the portfolio

investment yield. The completion yield is slightly lower than in

recent years mainly due to the mix of projects and the fact that

most of these projects commenced when land and construction costs

were at their peak in early 2022.

We completed 260,100 sq m of big box warehouse space, including

on one of our last remaining plots at SEGRO Logistics Park East

Midlands Gateway. This also included 155,900 sq m of big box

warehouses across all of our major European markets, let to

third-party logistics operators, retailers and manufacturers.

We completed 80,800 sq m of urban warehouses and data centres in

Slough, London, Berlin and Paris, the majority of which was

developed speculatively and 65 per cent is already let.

Reducing embodied carbon in our development programme is

critical to helping us achieve net-zero carbon by 2030 and we

continue to make progress in reducing the carbon intensity of our

developments towards our science-based target of a 20 per cent

reduction by 2030 (from a 2020 baseline). We use best available

data, including Building Information Modelling (BiM) for our life

cycle assessments at design stage, which helps us to assess how

best to reduce the carbon footprint of our developments.

All of our eligible development completions during the first

half of 2023 have been, or are expected to be, accredited at least

BREEAM 'Very Good' (or local equivalent), with 85 per cent

'Excellent' or 'Outstanding'.

Current development pipeline

At 30 June 2023, we had development projects approved,

contracted or under construction totalling 616,500 sq m,

representing GBP271 million of future capital expenditure to

complete and GBP66 million of annualised gross rental income when

fully let. 65 per cent of this rent has already been secured and

these projects should yield 7.2 per cent on total development cost

when fully occupied.

In the UK, we have 197,900 sq m of space approved or under

construction. Within this are our first multi-level warehouse

scheme in West London, three new data centres on the Slough Trading

Estate and big box warehouses at our logistics parks in Coventry

and East Midlands Gateway.

In Continental Europe, we have 418,600 sq m of space approved or

under construction. This includes pre-let big box warehouses for a

variety of different occupiers, from retailers to manufacturers,

across all our European markets. We are also developing further

phases of our successful urban warehouse parks in Amsterdam,

Cologne, Lyon and Paris.

We continue to focus our speculative developments on urban

warehouse projects, particularly in cities such as London, Paris

and Berlin, where modern space is in short supply and occupier

demand is strong.

We have factored current construction and financing costs into

the development returns for our future development projects.

Encouragingly, we are seeing build costs stabilise across most of

our markets and in some regions have started to see construction

tenders coming in at reduced prices. We expect to be able to

develop at a margin over the valuation yields on equivalent

standing assets of at least 150 basis points, meaning that it

remains a profitable way of growing the rent roll.

FUTURE DEVELOPMENT PIPELINE

Near-term development pipeline

Within the future development pipeline are a number of pre-let

projects close to being approved, awaiting either final conditions

to be met or planning approval to be granted. We expect to commence

these projects within the next six to 12 months.

These projects total 124,300 sq m of space, equating to

approximately GBP94 million of future capital expenditure and GBP10

million of potential annual rent.

Land bank

Our land bank identified for future development (including the

near-term projects detailed above) totalled 1,125 hectares as at 30

June 2023, valued at GBP1.8 billion, roughly 10 per cent of our

total portfolio value. This includes GBP741 million of land

acquired for future re-development but which is currently income

producing, reducing the holding costs until development can start

(equating to GBP20 million of annualised rent, excluded from

passing rent).

The land bank includes GBP322 million of land acquired during

the first six months of the year, including land associated with

developments already underway or expected to start in the short

term. This includes the acquisition of Bath Road Shopping Park in

Slough, which creates significant further potential for data centre

development in the Slough Trading Estate. We also acquired the

former Radlett Aerodrome in Hertfordshire, a brown-field site on

the edge of London and close to the M25, which provides us with the

opportunity to develop an exceptionally rare site of scale that

will deliver over 330,000 sq m of logistics buildings. It will be

supported by a strategic rail freight interchange and we will also

be creating a substantial country park for use by the local

community. We also purchased small plots of land in Italy, France,

Spain and Poland.

We estimate our land bank can support 3.7 million sq m of

development over the next five to seven years. The estimated

capital expenditure associated with the future pipeline is

approximately GBP3.4 billion. It could generate GBP370 million of

gross rental income, representing a yield on total development cost

(including land and notional finance costs) of around 7 per cent.

These figures are indicative, based on our current expectations,

and are dependent on our ability to secure pre-let agreements,

planning permissions, construction contracts and on our outlook for

occupier conditions in local markets.

Conditional land acquisitions and land held under option

agreements

Land acquisitions (contracted but subject to further conditions)

and land held under option agreements are not included in the

figures above, but represent significant further development

opportunities. These include sites for big box warehouses in the UK

Midlands as well as in Italy and Poland. They also include urban

warehouse sites in East and West London.

The options are held on the balance sheet at a value of GBP23

million (including joint ventures and associates at share). Those

we expect to exercise over the next two to three years are for land

capable of supporting almost 1.6 million sq m of space and

generating almost GBP154 million of headline rent, for a blended

yield of approximately 7 per cent.

Further details of our completed projects and development

pipeline are available in the H1 2023 Property Analysis Report, at

www.SEGRO.com/investors.

INTERIM DIVID OF 8.7 PENCE PER SHARE

Consistent with its previous guidance that the interim dividend

would normally be set at one-third of the previous year's total

dividend, the Board has declared an increase in the interim

dividend of 0.6 pence per share to 8.7 pence (H1 2022: 8.1 pence),

a rise of 7.4 per cent. This will be paid as a Property Income

Distribution (PID) on 22 September 2023 to shareholders on the

register at the close of business on 9 August 2023.

The Board will offer a scrip dividend option for the 2023

interim dividend, allowing shareholders to choose whether to

receive the dividend in cash or new shares. In respect of the 2022

final dividend, 49 per cent of shareholders, representing GBP107

million of dividend payments, elected for the scrip option which

resulted in the issue of 14.5 million new shares.

FINANCIAL REVIEW

Like-for-like net rental income growth and income from new

developments were the primary drivers of the 3 per cent increase in

Adjusted profit before tax compared to H1 2022. Adjusted NAV per

share decreased by 3 per cent to 937 pence compared to December

2022, primarily due to the valuation deficit on the property

portfolio.

Financial highlights

30 June 30 June 31 December

2023 2022 2022

IFRS net asset value (NAV) per share (diluted)

(p) 913 1,212 938

Adjusted NAV per share(1) (diluted) (p) 937 1,249 966

IFRS (loss)/profit before tax (GBPm) (33) 1,375 (1,967)

Adjusted profit before tax(2) (GBPm) 198 193(3) 386

IFRS earnings per share (EPS) (p) (1.9) 110.7 (159.7)

Adjusted EPS(2) (p) 15.9 15.6(3) 31.0

1. A reconciliation between IFRS NAV and Adjusted NAV is shown

in Note 11.

2. A reconciliation between IFRS profit before tax and Adjusted

profit before tax is shown in Note 2 and between IFRS EPS and

Adjusted EPS is shown in Note 11.

3. The Adjusted profit before tax and Adjusted EPS for HY 2022

has been represented to exclude the impact of the SELP performance

fee as detailed further below and in Note 2.

Presentation of financial information

The condensed financial information is prepared under IFRS where

the Group's interests in joint ventures and associates are shown as

a single line item on the income statement and balance sheet,

whereas subsidiaries are consolidated line by line.

The Adjusted profit measure better reflects the underlying

recurring performance of the Group's property rental business,

which is SEGRO's core operating activity. It is based on the Best

Practices Recommendations of the European Public Real Estate

Association (EPRA) which are widely used alternate metrics to their

IFRS equivalents (further details on EPRA Best Practices

Recommendations can be found at www.epra.com). In calculating

Adjusted profit, the Directors may also exclude additional items

considered to be non-recurring, not in the ordinary course of

business or significant by virtue of size and nature.

At 30 June 2022 estimated SELP performance fees were included in

Adjusted Profit. They were not excluded because it was anticipated

that further fees would subsequently be recognised throughout the

latter part of the performance period and therefore these would not

be considered unusual. The market volatility that was seen in the

latter half of 2022 significantly impacted property valuations and

consequentially, management's consideration of SELP performance

fees, leading to the reversal of the fee recognised in the six

months to 30 June 2022 and no performance fee recognised for the

year ended 31 December 2022 or the six months ended 30 June 2023.

Based on this volatility, these fees are now considered unusual as

they are inherently uncertain and sensitive to movements in

property valuations (which themselves are excluded from the EPRA

profit metric). In excluding such items going forward, management

believe this gives a more reliable and relevant measure of the

underlying performance of the business. At 30 June 2022 (as

previously reported) the performance fee recognised was GBP42

million within Joint venture fee income; a cost of GBP19 million

within Share of joint ventures' and associates adjusted profit

after tax (being the share of performance fee cost of GBP21 million

less a tax credit of GBP2 million); and a tax charge of GBP7

million was recognised in respect of the performance fee income.

Overall, the net profit after tax impact is a decrease in the

previously reported Adjusted profit of GBP16 million. The H1 2022

Adjusted profit has therefore been represented to exclude these

items and the previously reported amount has decreased from GBP204

million to GBP188 million (as detailed further in Note 2). The FY

2022 and H1 2023 reported results are not impacted by this

change.

A detailed reconciliation between Adjusted profit after tax and

IFRS profit after tax is provided in Note 2 of the condensed

financial information. The Adjusted NAV per share measure reflects

the EPRA Net Tangible Asset metric and based on the EPRA Best

Practices Reporting Recommendations. A detailed reconciliation

between Adjusted NAV and IFRS NAV is provided in Note 11(ii) of the

condensed financial information.

The Supplementary Notes to the condensed financial information

include other EPRA metrics as well as SEGRO's Adjusted income

statement and balance sheet presented on a proportionately

consolidated basis.

SEGRO monitors the above alternative metrics, as well as the

EPRA metrics for vacancy rate, net asset value, loan-to-value ratio

and total cost ratio, as they provide a transparent and consistent

basis to enable comparison between European property companies.

Look-through metrics provided for like-for-like net rental

income include joint ventures and associates at share in order that

our full operations are captured, therefore providing more

meaningful analysis.

ADJUSTED PROFIT

Adjusted profit

Six months to

Six months to 30 June 2022

30 June 2023 (represented(3) )

GBPm GBPm

Gross rental income 266 239

Property operating expenses (42) (36)

Net rental income 224 203

Joint venture management fee income 16 15

Management and development fee income 3 2

Net solar energy income -- 1

Administrative expenses (33) (31)

Share of joint ventures and associates'

Adjusted profit after tax(1) 40 35

Adjusted operating profit before interest

and tax 250 225

Net finance costs (52) (32)

Adjusted profit before tax 198 193

Tax on Adjusted profit (5) (5)

Adjusted profit after tax(2) 193 188

1. Comprises net property rental income and management income

less administrative expenses, net interest expenses and

taxation.

2. A detailed reconciliation between Adjusted profit after tax

and IFRS profit after tax is provided in Note 2 to the condensed

financial information.

3. Adjusted profit for HY 2022 has been represented to exclude

the impact of the SELP performance fee as detailed further in Note

2.

Adjusted profit before tax increased by GBP5 million (3 per

cent) to GBP198 million (H1 2022: GBP193 million) during H1 2023.

The results are driven by growth in net rental income (including

joint ventures and associates at share) of GBP31 million which has

been offset by an increase in net finance costs of GBP20 million as

detailed further below.

Adjusted profit is detailed further in Note 2 of the condensed

financial information.

Net rental income (including joint ventures and associates at

share)

Six months to Six months to

30 June 2023 30 June 2022

Net rental income GBPm GBPm Change(3) %

UK 153 147 4.3

Continental Europe 98 92 6.4

Like-for-like net rental income

before other items(1) 251 239 5.1

Other(2) (3) (3)

Like-for-like net rental income

(after other) 248 236 5.1

Development lettings 22 1

Properties taken back for

development 7 9

Like-for-like net rental income

plus developments 277 246

Properties acquired 3 1

Properties sold -- 4

Net rental income before

surrenders, dilapidations and

exchange 280 251

Lease surrender premiums and

dilapidations income 1 3

Other items and rent lost from

lease surrenders 5 5

Impact of exchange rate difference

between periods -- (4)

Net rental income (including joint

ventures and associates at

share)(5) 286 255

SEGRO share of joint venture

management fees (6) (6)

Net rental income after SEGRO

share of joint venture management

fees 280 249

1. Like-for-like change by Business Unit: Greater London 4.5%,

Thames Valley 3.8%, National Logistics 4.5%, Northern Europe 8.1%,

Southern Europe 4.8%, Central Europe 8.7%.

2. Other includes the corporate centre and other costs relating

to the operational business which are not specifically allocated to

a geographical business unit.

3. Percentage change has been calculated using the figures

presented in the table above in millions accurate to one decimal

place.

4. The like-for-like net rental growth metric is based on

properties held throughout both 2023 and 2022 on a proportionally

consolidated basis. This provides details of net rental income

growth excluding the distortive impact of acquisitions, disposals,

and development completions. Where an asset has been sold into a

joint venture (sales to SELP, for example) the 50 per cent share

owned throughout the period is included in like-for-like

calculation or development lettings where applicable, with the

balance shown as disposals.

5. Net rental income based on Adjusted profit metrics in Table 2

which exclude joint venture management fees and performance

fees.

The like-for-like rental growth metric is based on properties

held throughout both H1 2023 and H1 2022 and comprises wholly-owned

assets (net rental income of GBP224 million) and SEGRO's share of

net rental income held in joint ventures and associates (GBP56

million) totalling GBP280 million.

Net rental income increased by GBP31 million in H1 2023,

reflecting the positive impact of like-for-like rental growth of

GBP12 million and GBP21 million of additional income from

development lettings.

On a like-for-like basis, before other items, net rental income

increased by GBP12 million, or 5.1 per cent, compared to H1 2022.

In the UK there was a 4.3 per cent increase and in Continental

Europe a 6.4 per cent increase. This is due to strong rental

performance from rent reviews and indexation across our

portfolio.

Income from joint ventures and associates

Joint venture management fee income increased by GBP1 million to

GBP16 million in H1 2023. The prior period recognition of a

performance fee of GBP42 million in respect of the SELP joint

venture (as detailed further in Note 6 of the condensed financial

information) has been excluded from Adjusted profit as discussed

above.

SEGRO's share of joint ventures and associates' Adjusted profit

after tax increased by GBP5 million from GBP35 million in H1 2022

to GBP40 million in H1 2023 as a result of growth in net rental

income in the SELP joint venture.

Administrative and operating costs

The Total Cost Ratio ('TCR') for H1 2023 of 20.4 per cent was

broadly consistent with H1 2022 (20.5 per cent). Excluding the

impact of share-based payments, the cost of which are directly

linked to the relative total return of the property portfolio, the

Cost Ratio of 18.8 per cent in H1 2023 was also broadly consistent

with H1 2022 (18.7 per cent). The calculations are set out in Table

9 of the Supplementary Notes to the condensed financial

information.

Property operating expenses in the wholly-owned portfolio have

increased in the period from GBP36 million in H1 2022 to GBP42

million in H1 2023, as the portfolio has grown in size.

Administrative expenses have increased by GBP2 million, as a result

of increased staff costs following headcount increases.

Net finance costs

Net finance costs have increased by GBP20 million during the

period from GBP32 million in H1 2022 to GBP52 million in H1 2023.

The increased net interest costs on overdrafts, loans and related

derivatives (GBP41 million higher) reflect the higher interest

rates in H1 2023 compared to H1 2022. This is partially offset by

an increase of GBP21 million interest capitalised on the

development of properties, reflecting the higher interest cost of

new borrowings to fund this expenditure.

Taxation

The tax charge on Adjusted profit of GBP5 million (H1 2022: GBP5

million) reflects an effective tax rate of 2.5 per cent (H1 2022:

2.6 per cent).

The Group's tax rate reflects the fact that over three-quarters

of its assets are located in the UK and France and qualify for REIT

and SIIC status respectively in those countries. This status means

that income from rental profits and gains on disposals of assets in

the UK and France are exempt from corporation tax, provided SEGRO

meets a number of conditions including, but not limited to,

distributing 90 per cent of UK taxable profits.

Adjusted earnings per share

Adjusted earnings per share were 15.9 pence (H1 2022: 15.6

pence) reflecting the GBP5 million increase in Adjusted profit

after tax slightly offset by the higher average number of shares

compared to the prior period. The increase in shares is primarily

as a result of the scrip dividend take-up for the 2022

dividends.

IFRS (LOSS)/PROFIT

IFRS (loss)/profit before tax has decreased by GBP1,408 million

from a profit of GBP1,375 million in H1 2022 to a loss of GBP33

million in H1 2023 as a result of the movements described below,

primarily due to property revaluation losses in the period.

IFRS (loss)/profit after tax has decreased by GBP1,357 million

to a GBP23 million loss in H1 2023. This equated to post-tax IFRS

loss per share of 1.9 pence compared with IFRS earnings per share

of 110.7 pence for H1 2022.

The decrease in IFRS profit after tax is driven primarily by a

fall in valuation gains and losses on the property portfolio

(including joint ventures at share) of GBP1,620 million, from a

surplus of GBP1,345 million at HY 2022 to a deficit of GBP275

million in the current period. Further breakdown is detailed in

Note 7. These losses are partially offset by a reduction in tax

charge in respect of adjustments of GBP95 million (being GBP51

million in respect of wholly-owned properties and GBP44 million in

respect of joint ventures and associates at share). These tax

movements primarily arise as a consequence of the revaluation

deficits recognised.

In addition, IFRS profit in HY 2023 has fallen GBP16 million

compared to HY 2022 due to the impact of the recognition of a

performance fee in the prior period. Further detail on the

presentation and nature of this fee is given in Note 2 and 6

respectively.

In addition, IFRS profit after tax includes GBP23 million in

respect of fair value gains from derivatives (compared to a loss of

GBP150 million in HY 2022) which mainly arise on interest rate

swaps. The overall reduction in IFRS profit after tax has therefore

been offset by GBP173 million in respect of this item.

A reconciliation between Adjusted profit before tax and IFRS

profit before tax is provided in Note 2 to the condensed financial

information.

BALANCE SHEET

Adjusted net asset value

Pence

Shares per

GBPm million share

Adjusted net assets attributable to ordinary

shareholders at 31 December 2022 11,717 1,212.5 966

Realised and unrealised property gains and losses

(including joint ventures and associates)(1) (264) (22)

Adjusted profit after tax 193 16

Dividend net of scrip shares issued (2022 final) (113) (20)

Other including exchange rate movement (net of

hedging) (33) (3)

Adjusted net assets attributable to ordinary

shareholders at 30 June 2023 11,500 1,227.4 937

1. Includes unrealised valuation losses of GBP275 million and

realised property gains of GBP11 million (being: GBP9 million

profit on sale of investment properties and other investment

income; and GBP2 million gain on sale of trading properties). See

Note 7 for further details.

At 30 June 2023, IFRS net assets attributable to ordinary

shareholders (on a diluted basis) were GBP11,203 million (31

December 2022: GBP11,373 million), equating to 913 pence per share

(31 December 2022: 938 pence).

Adjusted net asset value per share at 30 June 2023 was 937 pence

measured on a diluted basis (31 December 2022: 966 pence), a

decrease of 3 per cent in the period. The table above highlights

the principal factors behind the decrease. The dividend impact

includes the dilutive effect of issuing scrip shares in lieu of

cash.

A reconciliation between IFRS and Adjusted net assets is

available in Note 11 to the condensed financial information.

CASH FLOW AND NET DEBT RECONCILIATION

Cash flow from operations for the period was GBP254 million, an

increase of GBP29 million from H1 2022 (GBP225 million), consistent

with the increased rental income received during the period.

The largest cash outflow in the period relates to acquisitions

and developments of investment properties at GBP580 million, which

primarily reflects the Group's investment activity during the

period and ongoing development activity (see Investment Activity

and Development sections above for more details). Cash flows from

investment property sales are GBP41 million and GBP1 million was

spent on acquisitions of other property interests, giving a net

outflow of GBP540 million from property investment activity

compared to GBP441 million in the prior period.

Another significant financing cash flow is dividends paid of

GBP113 million (H1 2022: GBP100 million) reflecting the increased

dividend per share and level of scrip dividend take-up.

Furthermore, during the period, the Group paid GBP15 million to

acquire the 5 per cent of Vailog s.r.l. it did not already own.

As a result of these factors there was a net funds outflow of

GBP490 million during the period compared to GBP385 million in H1

2022.

Cash flow and net debt reconciliation

Six months to Six months to

30 June 2023 30 June 2022

GBPm GBPm

Opening net debt (4,722) (3,314)

Cash flow from operations 254 225

Finance costs (net) (65) (47)

Dividends received 3 5

Tax paid (4) (13)

Free cash flow 188 170

Dividends paid (113) (100)

Acquisitions and development of investment

properties (580) (658)

Investment property sales 41 223

Acquisitions of other interests in property and

other investments (1) (6)

Purchase of non-controlling interest (15) --

Net settlement of foreign exchange derivatives (2) 15

Net investment in joint ventures and associates 1 (31)

Other items (9) 2

Net funds flow (490) (385)

Non-cash movements (4) (4)

Exchange rate movements 88 (82)

Closing net debt (5,128) (3,785)

Capital expenditure

The table below sets out analysis of the capital expenditure on

property assets during the period on a basis consistent with the

EPRA Best Practices Recommendations. This includes acquisition and

development spend, on an accruals basis, in respect of the Group's

wholly--owned investment and trading property portfolios, as well

as the equivalent amounts for joint ventures and associates at

share.

Total spend for the period was GBP702 million, a decrease of

GBP69 million compared to H1 2022. Acquisitions for the period were

GBP326 million, a decrease of GBP39 million compared to H1 2022 and

primarily related to land at Radlett and the Bath Road Shopping

Park in Slough. Development capital expenditure for the period was

GBP299 million, a decrease of GBP59 million compared to H1 2022,

with the largest spend continuing to be on our schemes in the UK

National Logistics business unit and in Italy.

Spend on existing completed properties totalled GBP27 million

(H1 2022: GBP21 million), over half of which was for

value-enhancing major refurbishment and fit-out costs prior to

re-letting.

EPRA capital expenditure analysis

Six months to 30 June 2023 Six months to 30 June 2022

Joint

ventures Joint

Wholly- and Wholly ventures and

owned associates Total - owned associates Total

GBPm GBPm GBPm GBPm GBPm GBPm

Acquisitions 323(1) 3 326 328(1) 37 365

Development(5) 248(2) 51 299 324(2) 34 358

Capitalised

interest(4,5) 27 2 29 6 -- 6

Investment

properties:

Incremental

lettable space 1 -- 1 1 -- 1

Non-incremental

lettable space 21 5 26 16 4 20

Tenant

incentives(3) 17 4 21 16 5 21

Total 637 65 702 691 80 771

1. Being GBP323 million investment property and GBPnil trading

property (H1 2022: GBP328 million and GBPnil respectively) see Note

12.

2. Being GBP248 million investment property and GBPnil trading

property (H1 2022: GBP320 million and GBP4 million respectively)

see Note 12.

3. Includes tenant incentives, letting fees and rental

guarantees.

4. Capitalised interest on development expenditure.

5. Development and capitalised interest on development

expenditure were previously presented in total as a single line

items in the table above. In line with EPRA BPR Guidelines,

development and capitalised interest are now presented as separate

line items and the prior period comparative has been represented in

the table.

FINANCIAL POSITION AND FUNDING

Financial Key Performance Indicators

30 June 30 June 31 December

GROUP ONLY 2023 2022 2022

Net borrowings (GBPm)(3) 5,128 3,785 4,722

Available cash and undrawn committed facilities

(GBPm) (4) 1,410 1,778 1,720

Gearing (%) 45 26 41

LTV ratio (%) 34 22 32

Weighted average cost of debt1 (%) 3.0 1.7 2.6

Interest cover2 (times) 3.2 6.1 4.3

Average duration of debt (years) 8.1 9.0 9.4

INCLUDING JOINT VENTURES AND ASSOCIATES AT

SHARE

Net borrowings (GBPm) (3) 6,078 4,717 5,693

Available cash and undrawn committed facilities

(GBPm) (4) 1,687 1,966 2,007

LTV ratio (%) 34 23 32

Weighted average cost of debt1 (%) 2.9 1.6 2.5

Interest cover2 (times) 3.4 6.2 4.5

Average duration of debt (years) 7.5 8.0 8.6

1. Based on gross debt, excluding commitment fees and non-cash

interest.

2. Net rental income/adjusted net finance costs (before

capitalisation) on a rolling 12 month basis.

3. SEGRO Group cash and cash equivalents have been restated as

at 30 June 2022. See Note 1 for further details. Net borrowings as

at 30 June 2022 have been restated to reflect this change.

4. Available cash and undrawn committed facilities exclude

tenant deposit balances and uncommitted facilities as detailed

further in Note 13.

At 30 June 2023, the Group's net borrowings (including the

Group's share of borrowings in joint ventures and associates) were

GBP6,078 million (31 December 2022: GBP5,693 million). The loan to

value ratio (including joint ventures and associates at share) was

34 per cent (31 December 2022: 32 per cent) with GBP1,687 million

of cash and undrawn facilities available for investment.

Gross borrowings of SEGRO Group were GBP5,231 million at 30 June

2023, all but GBP1 million of which were unsecured, and cash and

cash equivalent balances were GBP103 million. SEGRO's share of

gross borrowings in its joint ventures and associates was GBP990

million (all of which were advanced on a non-recourse basis to

SEGRO) and cash and cash equivalent balances of GBP40 million.

Cash and cash equivalent balances, together with the Group's

interest rate and foreign exchange derivative portfolio, are spread

amongst a strong group of banks, all of which have a credit rating

of A- or better.

During the period, SEGRO drew down GBP300 million and EUR407

million term loan facilities which were the main contributors to

the reduction in the duration of debt.

In May 2023, SEGRO extended the maturity of EUR200 million of

its revolving credit facilities for a further year to 2028. SELP

also extended the maturity of its EUR600 million revolving credit

facilities for a further year to 2027.

In June 2023, SEGRO arranged two further term loan facilities.

The first facility has GBP100 million of commitment maturing in

2026; the second facility has EUR150 million of commitment also

maturing in 2026. Both term loan facilities were undrawn at 30 June

2023.

MONITORING AND MITIGATING FINANCIAL RISK

The Group monitors a number of financial metrics to assess the

level of financial risk being taken and to mitigate that risk.

Treasury policies and governance

The Group Treasury function operates within a formal policy

covering all aspects of treasury activity, including funding,

counterparty exposure and management of interest rate, currency and

liquidity risks. Group Treasury reports on compliance with these

policies on a quarterly basis and policies are reviewed regularly

by the Board.

Gearing and financial covenants

The key leverage metric for SEGRO is its loan to value ratio

(LTV), which incorporates assets and net debt on SEGRO's balance

sheet and SEGRO's share of assets and net debt on the balance

sheets of its joint ventures and associates. The LTV at 30 June

2023 on this 'look-through' basis was 34 per cent (31 December

2022: 32 per cent).

Our borrowings contain gearing covenants based on Group net debt

and net asset value, excluding debt in joint ventures and

associates. The gearing ratio of the Group at 30 June 2023, as

defined within the principal debt funding arrangements of the

Group, was 45 per cent (31 December 2022: 41 per cent). This is

significantly lower than the Group's tightest financial gearing

covenant within these debt facilities of 160 per cent. Property

valuations would need to fall by around 45 per cent from their 30

June 2023 levels to reach the gearing covenant threshold of 160 per

cent.

The Group's other key financial covenant within its principal

debt funding arrangements is interest cover, requiring that net

interest before capitalisation be covered at least 1.25 times by

net property rental income. At 30 June 2023, the Group comfortably

met this ratio at 3.2 times, calculated on a rolling 12 month basis

in line with covenant requirements. On a look-through basis,

including joint ventures and associates, this ratio was 3.4

times.

We mitigate the risk of over-gearing the Company and breaching

debt covenants by carefully monitoring the impact of investment

decisions on our LTV and by stress-testing our balance sheet to

potential changes in property values. We also expect to continue to

recycle assets which would also provide funding for future

investment.

Our intention for the foreseeable future is to maintain our LTV

at around 30 per cent, although the evolution of the property cycle

will inevitably mean that there are periods of time when our LTV is

higher or lower than this. However, this level of LTV through the

cycle provides the flexibility to take advantage of investment

opportunities arising and ensures significant headroom compared

against our tightest gearing covenant should property values

decline.

The Group's debt has a range of maturities. The next debt

maturity for the Group is the GBP82 million of SEGRO 2024 sterling

bonds, which are now due in August 2023 following the announcement

of their early redemption. There are no other significant debt

maturities until the second half of 2025. This long average debt

maturity translates into a favourable, well spread debt funding

maturity profile which reduces future refinancing risk.

Interest rate risk

The Group's interest rate risk policy is designed to ensure that

we limit our exposure to volatility in interest rates. The policy

states that between 50 and 100 per cent of net borrowings

(including the Group's share of borrowings in joint ventures and

associates) should be at fixed or capped rates, including the

impact of derivative financial instruments.

As at 30 June 2023, including the impact of derivative

instruments, 91 per cent (31 December 2022: 95 per cent) of the net

borrowings of the Group (including the Group's share of borrowings

within joint ventures and associates) were at fixed or capped

rates.

GROUP ONLY 30 June 30 June 31 December

(% of net borrowings) 2023 2022 2022

Fixed rate 72 70 79

Capped rate -- triggered 13 -- 9

Capped rate -- not triggered 4 21 6

Floating rate 11 9 6

TOTAL 100 100 100

INCLUDING JOINT VENTURES AND ASSOCIATES AT

SHARE (% of net borrowings)

Fixed rate 76 74 83

Capped rate -- triggered 12 -- 8

Capped rate -- not triggered 3 17 4

Floating rate 9 9 5

TOTAL 100 100 100

As a result of the fixed and capped rate cover in place, if

short term interest rates had been 1 per cent higher throughout the

six month period to 30 June 2023, the adjusted net finance cost of

the Group would have increased by approximately GBP3 million

representing around 2 per cent of Adjusted profit after tax.

The Group elects not to hedge account its interest rate

derivatives portfolio. Therefore, movements in derivative fair

values are taken to the income statement but, in accordance with

EPRA Best Practices Recommendations Guidelines, these gains and

losses are excluded from Adjusted profit after tax.

Foreign currency translation risk

The Group has negligible transactional foreign currency exposure

but does have a potentially significant currency translation

exposure arising on the conversion of its substantial foreign

currency denominated assets (mainly euro) and euro denominated

earnings into sterling in the Group consolidated accounts.

The Group seeks to limit its exposure to volatility in foreign

exchange rates by hedging at a level between the period-end Group

LTV percentage and 100 per cent of its foreign currency gross

assets through either borrowings or derivative instruments. At 30

June 2023, the Group had gross foreign currency assets which were

77 per cent hedged by gross foreign currency denominated

liabilities (including the impact of derivative financial

instruments).

The exchange rate used to translate euro denominated assets and

liabilities as at 30 June 2023 into sterling within the balance

sheet of the Group was EUR1.16:GBP1 (31 December 2022:

EUR1.13:GBP1). Including the impact of forward foreign exchange and

currency swap contracts used to hedge foreign currency denominated

net assets, if the value of the other currencies in which the Group

operates at 30 June 2023 weakened by 10 per cent against sterling

(EUR1.28, in the case of euros), net assets would have decreased by

approximately GBP124 million and there would have been a reduction

in gearing of approximately 2.5 per cent and in the LTV of

approximately 1.5 per cent.

The average exchange rate used to translate euro denominated

earnings generated during the six months ended 30 June 2023 into

sterling within the consolidated income statement of the Group was

EUR1.14:GBP1 (H1 2022: EUR1.19:GBP1).

Based on the hedging position at 30 June 2023, and assuming that

this position had applied throughout the six month period, if the

euro had been 10 per cent weaker than the average exchange rate

(EUR1.25:GBP1), Adjusted profit after tax for the six month period

would have been approximately GBP4 million (2.1 per cent) lower

than reported. If it had been 10 per cent stronger, adjusted profit

after tax for the period would have been approximately GBP4 million

(2.1 per cent) higher than reported.

GOING CONCERN

As noted in the Financial Position and Funding section above,

the Group has significant available liquidity to meet its capital

commitments, a long-dated debt maturity profile and substantial

headroom against financial covenants.

-- In June 2023, the Group executed two additional term loan facilities.

The first facility has a commitment of GBP100 million, and a second

facility has a commitment of EUR150 million. Both term loan facilities

were undrawn at 30 June 2023 and have a three year maximum term.

-- Cash and available committed facilities, excluding tenant deposits, at

30 June 2023 were GBP1.4 billion.

-- The Group continuously monitors its liquidity position compared to