TIDMSIS

RNS Number : 3822E

Science in Sport PLC

29 June 2023

The following sentence has been deleted from note 1 of the Notes

to the Consolidated Financial Statements for the full year results

announcement released on 29 June 2023 at 7.00 am with RNS number

3025E as the results are unaudited: "The auditors' report on the

statutory accounts for the year ended 31 December 2022 and the year

ended 31 December 2021 is unqualified, does not draw attention to

any matters by way of emphasis, and does not contain any statement

under section 498 of the Companies Act 2006." All other details

remain unchanged.

THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION AS STIPULATED

UNDER THE MARKET ABUSE REGULATION (EU NO. 596/2014) AS IT FORMS

PART OF UK DOMESTIC LAW BY VIRTUE OF THE EUROPEAN UNION

(WITHDRAWAL) ACT 2018 ("MAR").

Science in Sport plc

("Science in Sport", the "Company" or the "Group")

Unaudited Preliminary Results for the Year Ended 31 December

2022

Science in Sport plc (AIM: SIS), the premium performance

nutrition company serving elite athletes, sports enthusiasts, and

the active lifestyle community, is pleased to announce its

unaudited results for the financial year ended 31 December

2022.

Stephen Moon, Chief Executive Officer of Science in Sport plc,

said:

'After a good start to 2022, input price inflation, a

challenging consumer environment, and supply chain issues related

to global events adversely affected us. We reacted quickly and we

spent the summer months restructuring our operations and cost base.

In addition, we successfully commissioned our world-class Blackburn

supply chain facility.'

'In 2023, we are well set for profitable growth, as evidenced by

sales growth over the last four months. Our retail business,

domestically and internationally, is delivering profitable growth,

and our Amazon business is performing significantly above the same

period last year. A new partnership in the USA has step-changed

EBITDA performance in this channel. While China was affected by

COVID in Q1 2023, the business delivers a strong EBITDA margin, and

we expect the recovery to continue in H2.'

'Our brands are healthy, and the innovation pipeline is strong.

With improved margins in all channels and markets and building

revenue momentum, we are confident of executing our 2023 plan. Our

goals for the year are profitable growth, a healthy EBITDA margin,

and cash breakeven. Our medium and long-term ambitions remain

unchanged.'

Highlights

For the year-ended 31 December 2022, the business responded to

unprecedented increases in input costs, a weakening in consumer

confidence, and one-offs related to global events by quickly

introducing a range of mitigating actions. We successfully

commissioned the new Blackburn supply chain operation in parallel,

which is now delivering substantial efficiencies.

While financial results for the year were substantially below

our initial expectations given these external factors, our actions

have delivered improved margins and, together with the robustness

of our brands, have led to a solid start to 2023.

In 2023 we are seeing building sales momentum to record monthly

revenue levels and expect to deliver positive EBITDA(1) for the

year. All working capital facilities have successfully been renewed

to April 2024.

Trading results

-- Revenue growth of 2.0% to GBP63.8m (FY 2021: GBP62.5m).

Adversely impacted in the year by -GBP4.3m due to the closure of

our Russian business (GBP1.7m), port congestion issues in the US

(GBP0.9m) and supply chain issues of PhD Smart Bars over the summer

from our supplier (GBP1.7m)

-- Underlying EBITDA(1) loss of GBP2.7m (FY 2021: GBP1.5m

profit) with H2 being EBITDA break-even

-- Loss before tax of GBP10.6m (FY 2021: GBP5.3m) impacted by

raw material cost pressures and transition costs to the new

Blackburn facility

-- PhD Nutrition revenue grew by 15% to GBP34.1m (FY 2021:

GBP29.6m) with strong growth in Marketplace and Retail channels

-- Science in Sport revenue reduced by 10% to GBP29.7m (FY 2021:

GBP32.9m) predominantly due to reduced Digital revenue partially

offset by growth in Retail channels

-- Capital investment of GBP8m (FY 2021: GBP6.5m) which

completed the strategic investment cycle, culminating in the

transition to the fully operational Blackburn facility

-- Headroom of GBP4m in facilities at 31 December 2022 with cash

at bank of GBP0.9m (FY 2021: GBP4.9m),

-- Pre IFRS 16 net debt(2) of GBP10.9m as a result of full-year

peak cash outflow, given the strategic capital investment at the

Blackburn site is now complete

Execution of long-term strategy

-- A strategic review completed in April 2023 by an independent

consultant concluded shareholders' interests were best served by

maximising value through the execution of the profitable growth

plan

-- The peak capital investment cycle was completed with the

successful transition to the state-of-the-art Blackburn facility,

which has the capacity to generate over GBP200m in revenue

-- Continued execution of the global omnichannel route to

market, leveraging existing and new partnerships

-- The realisation of margin improvements driven by the new

Blackburn facility and customer price rises put in place across all

channels

-- Delivery of sustainable cash-generative profitability in the

medium term, with a target of cash breakeven for FY 2023.

Current Trading and Outlook

Previously reported Q1 2023 revenue was GBP15.6m representing

growth of 2.3% versus Q1 2022, despite COVID affecting our business

in China and Amazon executing a global destocking programme.

Momentum is building, as evidenced by revenues for each of April

to June being records for the respective months. We expect revenue

growth for H1 to be approximately 7%, with Q2 growth of

approximately 12%. Due to our extensive change programme, the

trading contribution(3) will be approximately 19% compared with 11%

for the same period in 2022. Given the superior trading

contribution and tight overhead control, we expect to be EBITDA

positive in H1.

With our three-year capital investment programme completed,

capital expenditure (including technology and new product

development) for 2023 will be approximately GBP1.5m (FY2022:

GBP8.0m), with this lower level of spending to continue in

2024.

Notes

(1) before interest, tax, depreciation, amortisation,

share-based payments and foreign exchange variance on intercompany

balances, restructuring costs, Blackburn transition costs and costs

related to the equity raise and strategic review

(2) Net debt is defined as cash, less banking working capital

facilities and asset financing and excludes property leases

(3) gross margin less advertising and promotions, carriage and

online selling costs

For further information:

Science in Sport plc T: 020 7400 3700

Stephen Moon, CEO

Daniel Lampard, CFO

Liberum (Nominated Adviser and T: 020 3100 2000

Broker)

Richard Lindley

William Hall

Lucas Bamber

CHAIRMAN'S STATEMENT

After a strong start in the first quarter of 2022, including a

record sales month in March and following the Company's consistent

ten--year high growth track record, the business was impacted in

the second quarter of 2022 by global events, reduced consumer

confidence and specific one--off events affecting sales and

costs.

In light of the economic and trading environment, in September

2022 the Board took the decision to strengthen the balance sheet

with a placing of new ordinary shares raising gross proceeds of

GBP5m.

At the same time in September 2022 the Board announced the

initiation of a Strategic Review.

This review was completed in April 2023, and the Board concluded

that shareholders' interests are best served by seeking to maximise

value through focusing on accelerating the profitable growth of the

business under an ambitious growth and efficiency plan.

The Board's decision is consistent with that of the independent

corporate adviser appointed to advise on the Strategic Review.

The key drivers of the Board's decision were:

-- A high level of confidence that the business model,

operational and marketing assets and strategy will provide long

term profitable growth in global markets; and

-- A high level of confidence in the Board's comprehensive

prioritised profitable growth plan to build progressively to

industry profitability benchmarks.

-- Trading in the year to date in 2023 indicates that the

business is responding well to the new plan, with growth across

both different geographies and sales channels, price increases, and

lower costs attributed to the recently commissioned manufacturing

and distribution facility, all contributing to improved

profitability.

Strategic investment complete

Our decade-long high growth trajectory required us to invest in

additional manufacturing and supply chain capacity to meet our

strategic plan and maintain our competitive edge in gross margin.

We completed a GBP7.5m investment in our 160,000 sq. ft.

world-class supply chain site with supply capability to generate

over GBP200m in revenue. It opened on schedule as a logistics

operation in April. In September, we finished the commissioning of

the gel line, two protein powder lines and installed our e-commerce

packing operation.

At the end of 2022 we commissioned a state-of-the-art protein

bar line which is now fully operational. This asset eliminates

proposed substantial 2023 co-manufacturing cost increases and will

contribute significantly to profitability. In addition to a

transformation in margin, the new line underpins innovation

projects which are expected to deliver incremental revenue in

2023.

We are pleased to report that the Blackburn operation is

delivering savings in line with the investment case, with further

efficiencies anticipated in 2023.

In February 2023, our USA business transferred to 'The Feed',

the leading online distributor of endurance nutrition brands in the

region. As well as accessing our core consumer market, the deal

results in a strong improvement in expected cash generation for

2023.

A strategic partnership has been agreed for our already strong

Marketplace business with Flywheel Digital, the global leader in

Amazon growth delivery. 2023 sales to consumers are showing good

growth, and we expect to see this continue because of the new

partnership.

Overview

While our results reflect a challenging year with an

unprecedented backdrop of reduced consumer confidence, input price

increases, supply chain issues and the closure of our Russia

business, we put in place a number of actions during H2 which are

delivering positive results.

Group revenue was GBP63.8m (FY 2021: GBP62.5m), up 2.0% on prior

year, with our UK Retail, International and Marketplace delivering

encouraging growth.

Underlying EBITDA(1) loss of GBP2.7m (FY 2021: GBP1.5m profit),

due predominantly to the higher input costs in H1, with H2 being

break-even as mitigations of customer price rises, supply chain

efficiencies and the benefits of the restructuring came into

effect.

The reported loss before tax was GBP10.6m (FY 2021: GBP5.3m

loss), the increased loss predominantly due to the impact of

underlying trading EBITDA, non-recurring costs related to the

transition to Blackburn and the one-off restructuring costs.

As noted above, we completed the strategic investment cycle

resulting in peak cash outflows for the Group. The Group's cash at

bank on 31 December 2022 was GBP0.9m (31 December 2021: cash at

bank of GBP4.9m), with over GBP4m headroom in place as at 31

December 2022.

We demonstrated our business's ability to react promptly to

unprecedented challenges in the year, executing mitigating and

value enhancing actions to place the business in a strong position

as we exited 2022.

Our proven growth strategy remains unchanged, focusing on

science and elite-led product innovation, building brand equity,

driving global online scale supported with world-class data

science, through an efficient supply chain.

Our People

We streamlined the business during 2022 and now have in place a

leaner executive and senior leadership team which is optimal for

the Company. This has delivered cost savings and improved the

efficiency of executing the strategic objectives.

The business underwent huge change during the year with the

transition to the Blackburn facility, and due to the huge effort

and commitment of the entire workforce the project was delivered

on-time with minimal business disruption.

We have a world class team in place across all parts of the

organisation who have shown outstanding commitment during a

turbulent year.

On behalf of the board and myself, I would like to thank our

employees, suppliers and customers for their invaluable

contributions and support in what has been an unprecedented trading

environment with significant challenges.

Development of the Board

The Board must ensure the Group is managed for the long--term

benefit of all shareholders, with effective and efficient

decision--making. Corporate governance is an essential part of that

role, reducing risk and adding value to our business.

The board regularly reviews the environmental, social and

governance performance of the group. This year we have shown

industry leadership in recyclable packaging, Real Living Wage and

Carbon Neutral accreditation.

John Clarke

Non-Executive Chairman

29 June 2023

Notes

1 before interest, tax, depreciation, amortisation, share-based

payments and foreign exchange variance on intercompany balances,

restructuring costs, Blackburn transition costs and costs related

to the equity raise and strategic review

CEO's REPORT

Strategic Intent

Although 2022 was challenging, we ended the year in a much

stronger position and are well positioned for 2023. The macro

trends of the COVID-19 pandemic, with consumers increasing focus on

health and wellbeing expected to continue, and the sports nutrition

market, worth $24.6bn in 2022 is forecast to grow by a 5.9% CAGR

from 2022 to 2027(4) .

Our medium-term ambition is unchanged, to deliver GBP100 million

of revenue, with high cash generation. The key drivers of our

proven growth strategy remain:

-- Win in Science, Win in Product, Win in Elites: premium

products based on leading scientific research and used by elite

teams globally to win

-- Premium Brand: investment in brand awareness, driving

conversion and usage with the highly engaged consumers in the

category

-- Best in Class Data Science: driving customer acquisition,

retention, and revenue through investing in our customer data

platform and technology

-- Global Online Scale: growth driven by the two pillars of our

digital platform and marketplace business, enabling us to grow

strategic markets globally

-- Efficient Supply Chain: simpler, more cost-effective,

scalable, and increasingly in-house, driven from our new Blackburn

supply chain site

Win in Science, Win in Product, Win in Elites

Revenue from new products was GBP2.9m for the period (FY 2021:

GBP3.9m) reflecting a lower number of new product launches in the

year, consistent with management's plan.

Our Win in Elites operation supported over 320 elite teams

globally during the year. We have customer relationships at the

highest levels in football, cycling, cricket, professional

basketball, American football, rugby union, rugby league, running

and other sports. The strong link between our Win in Science team

and elite sport is critical in our strategy and underpins our

premium brands.

We have extended our reach into world class running with the

signing of the Elite Running team (over 90 individuals) which

includes Gotytom Gebreslase (World Champion Marathon holder) and

numerous gold and world record holders.

Premium Brands

PhD has made strong progress in brand awareness and has

maintained its position as the number #3 brand in the UK market,

and is number #1 in Lean Whey and the number #2 sports nutrition

bar in the UK(5) .

Science in Sport continues to enjoy market leadership in

endurance nutrition in the UK in awareness, all brand equity

scores, and conversion to purchase. We remain the number #1

Endurance Brand in UK Retail(5) .

Both brands have market leading conversion from awareness to

purchase online, and brand equity scores are extremely strong

across all measures.

We became an official performance partner to Tottenham Hotspur

and Nice football clubs during the year. We continued our

partnership with the Milwaukee Bucks and retained our long-standing

relationship with Ineos Grenadiers cycling. Win in Science and Win

in Elites are a key element of the Science in Sport brand

strategy.

Our focus on quality remains, and our brands continue to be two

of the top four major sports nutrition brands in the UK in 2022, as

measured by Trustpilot.

Blackburn investment complete

Gross margin decreased to 42% (FY 2021: 50%), due to higher

input costs, reduced mix of online revenue and the lag in achieving

price rise increases that came into effect in the latter half of FY

2022. We have reacted quickly to these challenges through two waves

of customer price increases, restructuring the business and having

the Blackburn site fully operational.

The 160,000 sq ft facility gives headroom to grow in excess of

GBP200m in revenue, consolidating the Group's four operational

sites to one has delivered immediate supply chain savings.

Medium-term we foresee improving margins as a key driver of

profitability.

In addition to the gel line and two protein lines we invested in

a bar line at the end of the year which will give us both cost and

operational efficiencies that will benefit margin in 2023.

Technology and Data Science

2021 saw us build a high-quality in-house technology and data

science team, this being a key strategic enabler to providing

valuable consumer insight, and we continued to invest during

2022.

Although our own channel digital online revenue volumes reduced

during the year, this was driven from lower traffic volumes, while

both our conversion and average order value ('AOV') grew year on

year (on a like for like basis). The benefits in conversion and AOV

were both being driven from the investment we have made in the

ecommerce platform.

We have recently launched our subscription offering to

customers, which is underpinned by the ecommerce platform and

consumer insight we have generated over the last 18 months.

Segmental Performance

2022 2021

SiS PhD Total SiS PhD Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

--------------- -------- -------- -------- -------- -------- --------

Digital 8,859 3,618 12,477 10,974 5,105 16,079

Marketplace 6,377 14,882 21,259 8,230 10,581 18,811

--------------- -------- -------- -------- -------- -------- --------

Global Online 15,236 18,500 33,736 19,204 15,686 34,890

--------------- -------- -------- -------- -------- -------- --------

International

Retail 6,491 3,904 10,395 6,208 3,374 9,582

UK Retail 7,981 11,661 19,642 7,527 10,540 18,067

--------------- -------- -------- -------- -------- -------- --------

Retail 14,472 15,565 30,037 13,735 13,914 27,649

--------------- -------- -------- -------- -------- -------- --------

Total sales 29,708 34,065 63,773 32,939 29,600 62,539

--------------- -------- -------- -------- -------- -------- --------

Global Online

Online sales decreased 4% to GBP33.7m (FY 2021: GBP34.9m).

Online sales via the Group's digital platforms were down 23% with

third--party marketplace sites up 12%. The reduction in our own

channel digital sales was driven from lower traffic and the

decision to cease operating the Japanese and Australian sites. Our

marketplace channel (comprising Amazon, China and smaller

marketplace channels such as eBay) performed well with growth of

12%, driven from strong growth in China partially offset by a

reduction in our Amazon sales due to their global destocking in the

latter half of FY 2022. Overall, online sales accounted for 53% of

total sales (FY 2021: 56%).

Our US business was broadly flat delivering GBP4.7m (FY 2021:

GBP4.8m). We have recently formed an exclusive partnership with the

feed.com, who are the number one endurance sports nutrition direct

to consumer business in the US. The feed.com will be responsible

for operations and fulfilment of our products in the US to both

direct to consumer and marketplace channels. The partnership took

effect in Q1 FY 2023 and is expected to yield significant

improvements in overall contribution in FY 2023.

UK Retail

UK Retail delivered another year of solid growth, with sales

rising by 9% to GBP19.6m (FY 2021: GBP18.1m). Major grocery

accounts grew steadily at 3%, but the main source of growth was

through our High Street channel which grew by 24%. We strategically

exited from some smaller, lower margin convenience stores.

PhD Retail sales grew by 11%. We are the second largest

manufacturer on sports nutrition shelves in UK Retail as well as

the number #1 manufacturer of lean whey powder and plant-based

protein powders, with our growth outperforming the category. In

plant protein bars, we are number #1, and in sports nutrition

protein bars we are number #2 in grocery.

Science in Sport delivered growth of 6% in UK Retail, with our

high gross margin gels continuing their consistent growth trend.

Science in Sport is still the clear number #1 in endurance

nutrition in UK Retail.

International Retail

International Retail had strong growth, and sales were GBP10.4m

(FY 2021: GBP9.6m), 8% up on the prior year. This was achieved

despite the closure of our Russian business resulting in lost

revenue of GBP1.4m.

In 2022, we exited multiple markets, to focus on building scale

in key global economies. We developed our business with our

strategic global partner Shimano which delivered growth of 23%.

Both PhD and Science in Sport grew in the Baltics very strongly and

continued to grow in Germany and Italy.

Overall, PhD International Retail grew 16%, with Science in

Sport also growing solidly by 5%.

ESG

As a premium performance nutrition business, we recognise our

impact on the wellness of our colleagues and the wider community.

It is important our actions help to drive positive, sustainable

change in the environment and society.

All PhD and Science in Sport protein containers are recyclable.

For bar and gel wrappers not currently recyclable at kerb side we

offered a specialised recycling solution for customers.

Consolidating operations into the new Blackburn site is reducing

carbon emissions, as we previously were moving product between the

multiple sites in the existing footprint. The new building

incorporates many energy saving features such as low flow plumbing

fixtures, programmable air temperature control units, LED lighting

and the use of natural daylight to reduce lighting requirements.

These actions partly offset increasing emissions from international

online sales. We continue to be accredited as Carbon Neutral by

Carbon Neutral Britain.

We support a wide range of initiatives to facilitate sportswomen

and men from disadvantaged and under-represented communities. We

have a long-term relationship with Los Angeles Bike Academy to

support underserved communities and give young athletes new

opportunities in the workplace and in cycle racing.

We are partners to Black Unity Bike Ride, Football Beyond

Frontiers, and Tour de Lunsar cycling race in Sierra Leone, which

is West Africa's largest grassroots race. We partner L39ION of Los

Angeles cycling team, whose aim is to eliminate boundaries, promote

diversity, and provide a pathway for young athletes from all

backgrounds.

The diversity of our workforce is a strength, and in 2022 19% of

our workforce identified as non-UK nationals, ahead of the 15% UK

average in the 2022 ONS Labour Force Survey. We completed the

Gender Pay Gap report in 2022 with a 55%/45% divide of men and

women in relation to pay.

We retained our position as a Real Living Wage employer during,

following the success of the second year of the partnerships, we

continued working with Career Ready and expanded employment and

work experience opportunities by working with local colleges in

low-income areas.

We have an extensive wellbeing programme in place for all our

colleagues, which ranges from company-wide wellness events, through

to access to confidential mental health support.

The Board has adopted the QCA corporate governance Code in line

with the LSE requirement that AIM-listed companies adopt and comply

with a recognised corporate governance code. This policy is

reviewed and updated annually. Full corporate governance disclosure

can be found on our sisplc.com website.

Outlook

We are delivering a return to profitable growth year to date for

2023.

Previously reported Q1 2023 revenue was GBP15.6m representing

growth of 2.3% versus Q1 2022, despite COVID affecting our business

in China and Amazon executing a global destocking programme.

Momentum is building, as evidenced by revenues for each of April

to June being records for the respective months. We expect revenue

growth for H1 to be approximately 7%, with Q2 growth of

approximately 12%. Due to our extensive change programme, the

trading contribution(3) will be approximately 19% compared with 11%

for the same period in 2022. Given the superior trading

contribution and tight overhead control, we expect to be EBITDA

positive in 2023.

With our three-year capital expenditure programme completed,

capital expenditure (including technology and new product

development) for 2023 will be approximately GBP1.5m (FY2022:

GBP8.0m), with this lower level of spending to continue in

2024.

Stephen Moon

Chief Executive Officer

29 June 2023

Notes

3 gross margin less advertising and promotions, carriage and

online selling costs

4 Euromonitor Passport Database Global Assessment (October

2022)

5 Nielsen IQ L52week, L12wks 11th Feb 2023

FINANCIAL REVIEW

Revenue

The Group delivered GBP63.8m revenue in the year ended 31

December 2022, up 2.0% on prior year (FY 2021: GBP62.5m).

Retail channels grew 9% year on year and now represent 47% of

Group sales, with online channels declining by 4% being 53% of the

Group sales.

Profitability

2022 2021

H1 H2 Total H1 H2 Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

-------------------------------------------- --------- --------- --------- --------- --------- ---------

Revenue 32,279 31,494 63,773 29,264 33,275 62,539

Cost of goods (18,473) (18,364) (36,837) (14,048) (17,141) (31,189)

-------------------------------------------- --------- --------- --------- --------- --------- ---------

Gross profit 13,806 13,130 26,936 15,216 16,134 31,350

Selling & general administration costs (10,223) (7,388) (17,611) (9,850) (9,780) (19,630)

-------------------------------------------- --------- --------- --------- --------- --------- ---------

Trading contribution 3,583 5,742 9,325 5,366 6,354 11,720

Underlying operating expenses (6,383) (5,631) (12,014) (5,083) (5,131) (10,214)

-------------------------------------------- --------- --------- --------- --------- --------- ---------

Underlying EBITDA (2,800) 111 (2,689) 283 1,223 1,506

Depreciation and amortisation (2,571) (2,237) (4,808) (1,660) (1,974) (3,634)

Foreign exchange variances on intercompany

balances 60 (159) (99) (44) (28) (72)

Share-based payment charges (660) 398 (262) (1,418) (1,480) (2,898)

Blackburn transition costs (618) (457) (1,075) - (125) (125)

Restructuring and one-off costs (272) (616) (888) - - -

Loss from operations (6,861) (2,960) (9,821) (2,839) (2,384) (5,223)

-------------------------------------------- --------- --------- --------- --------- --------- ---------

The Group generated a gross profit of GBP26.9m (FY 2021:

GBP31.4m) with a gross margin of 42% compared with 50% in 2021.

Gross margin was significantly impacted by raw material price

increases of over GBP4m in 2022, offset by GBP0.6m of price

increases, with channel and brand mix having a negative impact of

GBP1.8m partially offset by a positive volume impact of GBP0.6m.

Further price rises were introduced in Q4 FY 2022 and Q1 FY 2023

addressing the input price increases that occurred in 2022.

Trading contribution was GBP9.3m (14.6% contribution margin) (FY

2021: GBP11.7m; 18.7% contribution margin) which was impacted by

the flow through of raw material price increases. Cost mitigations

from reduced advertising and promotion spend and logistic

efficiencies with moving into the site at Blackburn delivering a

partial offset. The H2 position showing significant recovery, with

trading contribution margin in H2 FY 2022 of 18.2% compared to H1

FY 2022 of 11.1%.

Selling and administration costs of GBP17.6m (FY 2021: GBP19.6m)

decreased by GBP2m in the year, with significant reductions year on

year in H2. This being due to advertising and promotional

efficiencies, largely through reduced digital performance marketing

spend and logistical cost savings due to Blackburn efficiencies and

lower direct to consumer costs as a result of lower volumes.

Underlying operating costs increased by GBP1.8m year on year,

with the increase predominantly being in H1. As a result of people

restructuring and efficiencies due to the transition to the

Blackburn site, the costs reduced significantly in H2 by GBP0.8m

when comparing H2 FY 2022 (GBP5.6m) to H1 FY 2022 (GBP6.4m). The

Group has good levels of visibility on these costs due to them

relating to people, premises and related overhead costs. The Group

has fixed energy tariffs in place utill 2025 for electricity and

2027 for gas.

Underlying EBITDA(1) was a loss of GBP2.7m, a reduction from a

profit of GBP1.5m in FY 2021. The reported loss before tax is

GBP10.6m (FY 2021: GBP5.3m loss). EPS was lower at -7.9p (FY 2021:

-4.1p as restated).

The Group has chosen to report underlying EBITDA(1) as an

alternative performance measure. This is adjusted for depreciation,

amortisation, non--cash share-based payments, forex on intercompany

balances, Blackburn transition costs and material one-off costs.

The Board believes this provides additional useful information for

Shareholders to assess an underlying profit performance more

closely aligned to a cash profit value, excluding one-offs. This

measure is used by the Board for internal performance analysis. A

reconciliation of underlying EBITDA to profit from operations is

presented in note 1.

Working capital

As at 31 December 2022, the Group held inventory of GBP6.6m (31

December 2021: GBP8.4m). Inventory levels decreased as we managed

the supply chain tightly to ensure efficient working capital and

ensure optimal cover.

The year on year increase in trade debtors of GBP2.9m was due to

the increased mix of B2B revenue compared to direct to consumer.

The latter channel results in cash receipts within days of sales

compared to B2B which typically ranges between 60 to 90 days.

Correspondingly, the year on year increase in trade and other

payables of GBP5.1m, has predominantly been due to the introduction

of an invoice financing facility of GBP4.5m to assist with the

Group's management of working capital due to the increased mix of

B2B revenues.

Intangible Assets

Total intangible additions during 2022 were GBP1.9m, with

GBP1.2m being on technology spend and GBP0.7m on product

development. Technology spend relates to investment on the

warehouse management system and ecommerce platform, and product

development spend in relation to a number of elite and commercial

products across both brands.

Fixed Assets

Total fixed asset additions during 2022 were GBP6.0m with a

further GBP1.3m work in progress related to the new bar line

delivered in December 2022. This completes the strategic investment

cycle of peak cash outflows with the Blackburn investment complete.

Ongoing capital expenditure of fixed assets is anticipated to be in

the range of GBP0.5m-GBP0.75m excluding any strategic investment

opportunities.

Cash position

Cash at bank at year end 2022 was GBP0.9m (FY 2021: GBP4.9m),

lower than prior year due to capital investment of GBP8.0m (FY

2021: GBP6.5m), for the new Blackburn site, technology investment

and new product development.

A GBP6.0m flexible invoice credit facility with HSBC, our

principal bankers, was drawn to GBP4.5m. Additional trade finance

facilities of GBP2.7m were drawn at year-end. Total headroom on the

combined working capital facilities (including the undrawn element

of the virtual card) including cash was over GBP4m at the year-end.

All banking working capital facilities were successfully renewed to

April 2024, as part of an annual renewal cycle. As our business

continues to grow, particularly through the B2B channels, we will

continue to work with HSBC during FY 2023 on the optimal structure

of our facilities to ensure the appropriate financing over the

medium term.

Additionally the Group has a GBP3.4m asset finance agreement

with Lombard and residual equipment leases of GBP0.3m.

Share-based payments

The Company operates both a Short-Term Incentive Programme

("STIP") and a Long-Term Incentive Programme ("LTIP"). Together,

the Share Option Plan ("SOP") was approved by the Remuneration

Committee in June 2014 in line with the proposal contained in the

Company's AIM Admission document published in August 2013. A LTIP

scheme for financial years 2020--2022 is in place.

No charge was recognised for the 2022 LTIP and STIP schemes

(2021 schemes: GBP2.1m).

Taxation

The tax charge in the year is GBP0.3m (FY 2021: GBP0.2m charge

following a prior year restatement. The Group has cumulative tax

losses of GBP29.1m (FY 2021: GBP17.7m), a proportion of which the

Group will look to use to cover future profits. The restatement was

necessary as in the prior year the deferred tax asset recognised in

respect of losses was linked to management's estimate of future

taxable profits, rather than initially looking to the deferred tax

liabilities already recognised.

Going concern

The Group made a loss after tax for the year attributable to

owners of the parent of GBP10.9m (FY 2021: loss of GBP5.6m) of

which GBP5.1m was non-cash items such as depreciation, amortisation

and share-based payments. The net decrease in cash at bank at the

year ended 31 December 2022 was GBP3.9m (FY 2021: GBP5.6m

decrease), this was primarily due the trading performance in H1 FY

2022, the transition to Blackburn and completion of the strategic

capital investment cycle.

As at 31 December 2022, following the equity raise, the Group

had cash at bank of GBP0.9m (31 December 2021: GBP4.9m), and

headroom in facilities of over GBP4m. These facilities include

working capital facilities of GBP11.1m which are renewed annually

and are currently due to be next renewed in April 2024. Due to the

nature of these facilities, which are secured against the working

capital of the business and includes a blue chip trade debtor book

and realisable inventory, and the strong relationship with the

bank, the Directors expect this to be renewed annually going

forward.

While FY 2022 was a challenging year, particularly during H1, a

number of corrective actions occurred during H2 which position the

business in a stronger position. Customer price rises have been put

in place, the operating model of the business is much leaner, the

consolidation into Blackburn is driving efficiencies and we have no

significant fixed asset capital investment requirements. Trading at

the start of 2023 has been positive and we have delivered our

highest revenue month in the history of the business in March 2023,

with the positive growth continuing into Q2, with May YTD FY 2023

revenue growth of 6% to GBP27.7m (FY 2022: GBP26.1m).

In the event of a shock or prolonged economic downturn we have a

number of mitigating actions that could be taken, plus a high level

of cost protection in place.

Over 70% of our raw materials are on fixed pricing for the

remainder of FY 2023 and we have fixed prices for our utilities

(electricity fixed to 2025; gas fixed to 2027), rent, rates and

insurance costs. In addition we have significant non-commited

budgeted spend for marketing and technology that could be reduced

with immediate effect if required.

With regards sensitivity analysis, management have prepared

scenario planning of different revenue outcomes, including

interruption of trade, no sales growth, and customer failure to

stress-test potential impacts on the cash position of the business,

and concluded that in each of these downside stress tests

sufficient liquidity is in place. The Directors have prepared

projected cash flow information for the period ending 31 December

2024.

Accordingly, the Directors have a reasonable expectation that

the Company will have sufficient cash to meet all liabilities as

they fall due for a period of at least 12 months from the date of

approval of t

hese financial statements.

Notes

1 before interest, tax, depreciation, amortisation, share-based

payments and foreign exchange variance on intercompany balances,

restructuring, Blackburn transition costs, costs related to the

equity raise and strategic review

CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

Year ended Year ended

31 December 31 December

2022 2021

(as restated)

Notes GBP'000 GBP'000

-------------------------------------------- ------ ------------ --------------

Revenue 2 63,773 62,539

Cost of goods (36,837) (31,189)

-------------------------------------------- ------ ------------ --------------

Gross profit 26,936 31,350

Operating expenses 4 (36,757) (36,573)

-------------------------------------------- ------ ------------ --------------

Loss from operations (9,821) (5,223)

-------------------------------------------- ------ ------------ --------------

Comprising:

Underlying EBITDA 1 (2,689) 1,506

Share-based payment expense (262) (2,898)

Depreciation and amortisation (4,808) (3,634)

Foreign exchange variances on intercompany

balances (99) (72)

Restructuring and one-off costs (888) -

Blackburn new facility transition

costs (1,075) (125)

-------------------------------------------- ------ ------------ --------------

Loss from operations (9,821) (5,223)

Finance income - 5

Finance costs (757) (119)

Loss before taxation (10,578) (5,337)

Taxation expense (332) (216)

-------------------------------------------- ------ ------------ --------------

Loss for the year (10,910) (5,553)

Other comprehensive income

Cash flow hedges 2 9

Exchange differences on translation

of foreign operations (21) (62)

Income tax relating to these items - (2)

-------------------------------------------- ------ ------------ --------------

Total comprehensive loss for the

year (10,929) (5,608)

-------------------------------------------- ------ ------------ --------------

Loss per share to owners of the parent

Basic and diluted - pence 5 (7.9p) (4.1p)

All amounts relate to continuing operations.

CONSOLIDATED STATEMENT OF FINANCIAL POSITION

As at 31

As at December

Company number: 08535116 31 December 2021

2022 (as restated)

Notes GBP'000 GBP'000

-------------------------------------- ------ ------------ --------------

Non-current assets

Intangible assets 30,739 31,717

Right-of-use assets 10,536 10,659

Property, plant and equipment 10,338 5,251

Total non-current assets 51,613 47,627

-------------------------------------- ------ ------------ --------------

Current assets

Inventories 6 6,638 8,447

Trade and other receivables 7 16,524 12,679

Cash and cash equivalents 930 4,850

-------------------------------------- ------ ------------ --------------

Total current assets 24,092 25,976

-------------------------------------- ------ ------------ --------------

Total assets 75,705 73,603

-------------------------------------- ------ ------------ --------------

Current liabilities

Trade and other payables 8 (19,993) (14,865)

Provision for liabilities (901) -

Lease liabilities (415) (161)

Asset financing (843) (316)

Hire purchase agreement (80) (77)

Total current liabilities (22,232) (15,419)

-------------------------------------- ------ ------------ --------------

Non-current liabilities

Lease liabilities (10,261) (10,511)

Asset financing (2,839) (1,182)

Hire purchase agreement (82) (162)

Total non-current liabilities (13,182) (11,855)

-------------------------------------- ------ ------------ --------------

Total liabilities (35,414) (27,274)

Net assets 40,291 46,329

-------------------------------------- ------ ------------ --------------

Capital and reserves attributable to

owners of the parent company

Share capital 17,242 13,510

Share premium reserve 53,134 51,839

Employee benefit trust reserve (429) (158)

Other reserve (907) (907)

Foreign exchange reserve (138) (117)

Cash flow hedge reserve - (2)

Retained deficit (28,611) (17,836)

-------------------------------------- ------ ------------ --------------

Total equity 40,291 46,329

-------------------------------------- ------ ------------ --------------

CONSOLIDATED STATEMENT OF CASH FLOWS

Year ended

Year ended 31 December

31

December 2021

2022 (as restated)

GBP'000 GBP'000

------------------------------------------------------------- ----------- ----------- --------------

Cash flows from operating activities

Loss for the financial year (10,910) (5,553)

Adjustments for:

Amortisation of intangible assets 2,919 2,702

Depreciation of right-of-use asset 963 226

Depreciation of property, plant and equipment 926 706

Interest expense 757 112

Taxation 332 216

Share based payment charge 262 2,898

------------------------------------------------------------- ----------- ----------- --------------

Operating cash (outflow)/inflow before

changes in working capital (4,751) 1,307

------------------------------------------------------------- ----------- ----------- --------------

Changes in inventories 1,809 (1,473)

Changes in trade and other receivables (3,737) (2,838)

Changes in trade and other payables (1,970) 2,842

------------------------------------------------------------- ----------- ----------- --------------

Total cash outflow from operations (8,649) (162)

------------------------------------------------------------- ----------- ----------- --------------

Cash flow from investing activities

Purchase of property, plant and equipment (6,013) (4,119)

Purchase of intangible assets (1,941) (2,420)

Net cash outflow from investing activities (7,954) (6,539)

------------------------------------------------------------- ----------- ----------- --------------

Cash flow from financing activities

Gross proceeds from issue of share capital 5,000 -

Share issue costs (371) -

Net proceeds from asset financing 2,184 1,498

Interest paid on asset financing (143) (2)

Net proceeds from invoice financing 4,523 -

Interest paid on invoice financing (119) -

Net proceeds from trade facility 2,733 -

Interest paid on trade facility (53) -

Principal repayments of lease liabilities (629) (359)

Interest paid on lease liabilities (442) (57)

Finance income - 5

Net cash inflow from financing activities 12,683 1,085

------------------------------------------------------------- ----------- ----------- --------------

Net decrease in cash and cash equivalents (3,920) (5,616)

Opening cash and cash equivalents 4,850 10,466

------------------------------------------------------------- ----------- ----------- --------------

Closing cash and cash equivalents 930 4,850

------------------------------------------------------------- ----------- ----------- --------------

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

Share Share Employee Other Foreign Cash flow Retained Total

capital premium Benefit reserve exchange hedge deficit equity

Trust reserve reserve

reserve

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

At 31 December

2020 13,510 51,839 (191) (907) (55) (9) (15,148) 49,039

Total

comprehensive

loss for the

year (as

restated) - - - - (62) 7 (5,553) (5,608)

Transactions

with owners:

Issue of

shares held

by EBT to

employees - - 33 - - - (33) -

Share based

payments - - - - - - 2,898 2,898

At 31 December

2021 (as

restated) 13,510 51,839 (158) (907) (117) (2) (17,836) 46,329

--------------- ----------- --------- --------- --------- ----------- ----------- -------------- ---------

Total

comprehensive

loss for the

year - - - - (21) 2 (10,910) (10,929)

Transactions

with owners:

Issue of

shares 3,732 1,295 (398) - - - - 4,629

Issue of

shares held

by EBT to

employees - - 127 - - - (127) -

Share based

payments - - - - - - 262 262

At 31 December

2022 17,242 53,134 (429) (907) (138) - (28,611) 40,291

--------------- ----------- --------- --------- --------- ----------- ----------- -------------- ---------

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

1. Accounting policies

This results announcement for the year ended 31 December 2022

has been prepared in accordance with UK adopted International

Accounting Standards. The accounting policies applied are

consistent with those that will be set out in the Science in Sport

plc Annual Report and Accounts for the year ended 31 December

2022.

The financial information contained within this results

announcement for the year ended 31 December 2022 and the year ended

31 December 2021 is derived from but does not comprise statutory

financial statements within the meaning of section 434 of the

Companies Act 2006. Statutory accounts for the year ended 31

December 2021 have been filed with the Registrar of Companies and

those for the year ended 31 December 2022 will be filed following

the Company's annual general meeting.

Use of non--GAAP profit measure -- underlying EBITDA

The Group has chosen to report underlying EBITDA. This is

adjusted for depreciation, amortisation, non--cash share-- based

payments, forex on intercompany balances, restructuring and

Blackburn transitional one--off costs. The Board believes this

provides additional useful information for Shareholders to assess

an underlying profit performance more closely aligned to a cash

profit value, excluding one--offs. This measure is used by the

Board for internal performance analysis. A reconciliation of

underlying EBITDA to profit from operations is presented in the

accounts.

Underlying EBITDA is not defined by IFRS and therefore may not

be directly comparable with other companies' adjusted profit

measures. It is not intended to be a substitute for, or superior to

IFRS measurements of profit

A reconciliation of the underlying EBITDA to statutory operating

loss is provided below:

Year Ended Year Ended

31 December 31 December

2022 2021

(GBP'000) (GBP'000)

--------------------------------------------

Loss from operations (9,821) (5,223)

Share-based payment expense 262 2,898

Depreciation & amortisation 4,808 3,634

Foreign exchange variances on intercompany

balances 99 72

Restructuring and one-off costs 888 -

Blackburn new facility transition costs 1,075 125

--------------------------------------------

Underlying EBITDA (2,689) 1,506

-------------------------------------------- ------------- -------------

2. Segmental reporting

Operating segments are identified on the basis of internal

reporting and decision making. The Group's Chief Operating Decision

Maker ("CODM") is considered to be the Board, with support from the

senior management teams, as it is primarily responsible for the

allocation of resources to segments and the assessments of

performance by segment.

The Group's reportable segments have been split into the two

brands, Science in Sport (SiS) and PhD Nutrition (PhD). Operating

segments are reported in a manner consistent with the internal

reporting provided to the CODM as described above. The single

largest customer makes up 13% of revenue and is not separately

identified in segmental reporting.

The Board uses revenue, EBITDA, profit before tax and cash, as

key measures of the segment's performance. These are reviewed

regularly.

2022 2021

SiS PhD Total SiS PhD Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

---------------------- -------- -------- --------- -------- -------- ---------

Sales 29,708 34,065 63,773 32,939 29,600 62,539

---------------------- -------- -------- --------- -------- -------- ---------

Gross profit 17,383 9,553 26,936 20,064 11,286 31,350

Advertising

and promotions (6,602) (2,387) (8,989) (6,066) (4,143) (10,209)

Carriage (6,356) (756) (7,112) (6,662) (1,534) (8,196)

Online Selling

Costs (1,424) (86) (1,510) (1,141) (84) (1,225)

---------------------- -------- -------- --------- -------- -------- ---------

Trading contribution 3,001 6,324 9,325 6,195 5,525 11,720

Other operating

expenses (19,146) (16,943)

---------------------- -------- -------- --------- -------- -------- ---------

Loss from operations (9,821) (5,223)

---------------------- -------- -------- --------- -------- -------- ---------

3. Revenue from contracts with customers

The Group operates four primary sales channels, which form the

basis on which management monitor revenue. UK Retail includes

domestic grocers and high street retailers, Digital is sales

through the phd.com and scienceinsport.com platforms , Export

relates to retailers and distributors outside of the UK and

Marketplace relates to online marketplaces such as Amazon and

TMall.

2022 2021

SiS PhD Total SiS PhD Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

--------------- -------- -------- -------- -------- -------- --------

Digital 8,859 3,618 12,477 10,974 5,105 16,079

Marketplace 6,377 14,882 21,259 8,230 10,581 18,811

--------------- -------- -------- -------- -------- -------- --------

Global Online 15,236 18,500 33,736 19,204 15,686 34,890

--------------- -------- -------- -------- -------- -------- --------

International

Retail 6,491 3,904 10,395 6,208 3,374 9,582

UK Retail 7,981 11,661 19,642 7,527 10,540 18,067

--------------- -------- -------- -------- -------- -------- --------

Retail 14,472 15,565 30,037 13,735 13,914 27,649

--------------- -------- -------- -------- -------- -------- --------

Total sales 29,708 34,065 63,773 32,939 29,600 62,539

--------------- -------- -------- -------- -------- -------- --------

Turnover by geographic destination of sales may be analysed as

follows:

Year ended Year ended

31 December 31 December

2022 2021

GBP'000 GBP'000

------------------- -------------- --------------

United Kingdom 36,574 36,622

Rest of Europe 11,391 11,419

USA 4,670 5,088

Rest of the World 11,138 9,410

Total sales 63,773 62,539

-------------------- -------------- --------------

4. Operating expenses

Year ended Year ended

31 December 31 December

2022 2021

GBP'000 GBP'000

-------------------------------- -------------- -----------------

Sales and marketing costs 17,611 19,630

--------------------------------- -------------- -----------------

Operating costs 14,076 10,411

Depreciation and amortisation 4,808 3,634

Share based payment charge (1) 262 2,898

Administrative expenses 19,146 16,943

--------------------------------- -------------- -----------------

Total operating expenses 36,757 36,573

--------------------------------- -------------- -----------------

(1) Includes associated social security credits of GBP218,000 (2021: costs of GBP238,000)

5. Loss per share

Basic and diluted loss per share is calculated by dividing the

loss attributable to owners of the parent by the weighted average

number of Ordinary shares in issue during the period. The exercise

of share options would have the effect of reducing the loss per

share and is therefore anti-dilutive under the terms of IAS 33

'Earnings per share'.

Year ended Year ended

31 December 31 December

2022 2021

(as restated)

------------------------------------------ ------------- --------------

Loss for the year attributable to owners

of the parent - GBP'000 (10,910) (5,553)

Weighted average number of shares 138,860,015 135,100,931

------------------------------------------ ------------- --------------

Basic loss per share - pence (7.9p) (4.1p)

Diluted loss per share - pence (7.9p) (4.1p)

------------------------------------------ ------------- --------------

The number of vested but unexercised share options is 16,446,937

(2021: 10,820,373).

6. Inventories

31 December 31 December

2022 2021

GBP'000 GBP'000

------------------- ------------ ------------

Raw materials 2,455 2,534

Finished goods 4,183 5,913

Total inventories 6,638 8,447

------------------- ------------ ------------

There is a provision of GBP452,000 included within inventories

in relation to the impairment of inventories (2021: GBP251,000).

The increase in provision during the year relates to the impairment

of residual packaging stock following the change in gel machinery

and a reduction in the number of active stock keeping units (SKUs).

During the year, inventories of GBP36,042,000 (2021: GBP29,856,000)

were recognised as an expense within cost of sales.

7. Trade and other receivables

31 December 31 December

2022 2021

GBP'000 GBP'000

----------------------------------------------------- ------------ ------------

Trade receivables 15,274 12,452

Less: provision for impairment of trade receivables (281) (350)

----------------------------------------------------- ------------ ------------

Trade receivables - net 14,993 12,102

Other receivables 1,046 21

----------------------------------------------------- ------------ ------------

Total financial assets other than cash and

cash equivalents classified as amortised cost 16,039 12,123

Prepayments and accrued income 485 556

----------------------------------------------------- ------------ ------------

Total trade and other receivables 16,524 12,679

----------------------------------------------------- ------------ ------------

Trade receivables represent debts due for the sale of goods to

customers.

Trade receivables are denominated in local currency of the

operating entity and converted to Sterling at the prevailing

exchange rate as at 31 December 2022. The Directors consider that

the carrying amount of these receivables approximates to their fair

value. There has been an increase in debtor days due to increased

mix of B2B revenue compared to direct to consumer. All amounts

shown under receivables fall due for payment within one year. The

Group does not hold any collateral as security.

The Group applies the IFRS 9 simplified approach to measuring

expected credit losses using a lifetime expected credit loss

provision for trade receivables and contract assets. To measure

expected credit losses on a collective basis, trade receivables and

contract assets are grouped based on similar credit risk and

aging.

The expected loss rates are based on the Group's historical

credit losses experienced over 2022, this is due to Science in

Sport using SAP which has provided more visibility over debtors.

The historical loss rates are then adjusted for current and

forward-looking information affecting the Group's customers.

At 31 December 2022 the lifetime expected loss provision for

trade receivables is as follows:

More than More than

60 days 90 days

past due past due Total

At 31 December 2022

Expected loss rate (%) 0% 5%

Gross carrying amount (GBP'000) 776 1,726

Loss provision (GBP'000) - 93 93

--------------------------------- ---------- ---------- ------

At 31 December 2021

--------------------------------- ---------- ---------- ------

Expected loss rate (%) 0% 9%

Gross carrying amount (GBP'000) 407 876

--------------------------------- ---------- ---------- ------

Loss provision (GBP'000) - 81 81

--------------------------------- ---------- ---------- ------

A further provision of GBP188,000 (2021: GBP269,000) has been

included against specific debts considered impaired.

8. Trade and other payables

31 December 31 December

2022 2021

GBP'000 GBP'000

-------------------------------------------------- ----------- -----------

Trade payables 4,981 7,643

Accruals 7,226 6,108

Invoice financing 4,523 -

Trade facility 2,733 -

-------------------------------------------------- ----------- -----------

Total financial liabilities measured at amortised

cost 19,463 13,751

Other taxes and social security 530 1,114

Total trade and other payables 19,993 14,865

-------------------------------------------------- ----------- -----------

The Directors consider that the carrying amount of these

liabilities approximates to their fair value.

All amounts shown fall due within one year.

Invoice financing is the amount due to HSBC after drawing down

from the GBP6.0m flexible invoice credit facility during the year.

This facility contains both fixed and floating charges over all the

property and undertakings of the parent company. Additionally, a

GBP3.5m uncommitted trade facility was entered into during the year

which is secured on stock. The drawdowns on the trade facility

during the year were GBP2,733,000 (2021: GBPnil) and this balance

is included within accruals above.

END

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

FR EANKNAAEDEEA

(END) Dow Jones Newswires

June 29, 2023 05:38 ET (09:38 GMT)

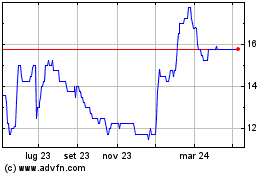

Grafico Azioni Science In Sport (LSE:SIS)

Storico

Da Apr 2024 a Mag 2024

Grafico Azioni Science In Sport (LSE:SIS)

Storico

Da Mag 2023 a Mag 2024