TIDMSRC

RNS Number : 3767W

AIM

11 December 2023

ANNOUNCEMENT TO BE MADE BY THE AIM APPLICANT PRIOR TO ADMISSION

IN ACCORDANCE WITH RULE 2 OF THE AIM RULES FOR COMPANIES ("AIM

RULES")

COMPANY NAME:

SigmaRoc plc ("SigmaRoc" or the "Company")

COMPANY REGISTERED OFFICE ADDRESS AND IF DIFFERENT, COMPANY

TRADING ADDRESS (INCLUDING POSTCODES) :

SigmaRoc plc: 6 Heddon Street, London W1B 4BT, United Kingdom

COUNTRY OF INCORPORATION:

United Kingdom

COMPANY WEBSITE ADDRESS CONTAINING ALL INFORMATION REQUIRED

BY AIM RULE 26:

https://www.sigmaroc.com/investors/aim-26

COMPANY BUSINESS (INCLUDING MAIN COUNTRY OF OPERATION) OR,

IN THE CASE OF AN INVESTING COMPANY, DETAILS OF ITS INVESTING

POLICY). IF THE ADMISSION IS SOUGHT AS A RESULT OF A REVERSE

TAKE-OVER UNDER RULE 14, THIS SHOULD BE STATED:

SigmaRoc is an existing AIM-quoted lime and industrial limestone

group targeting quarried materials assets in the UK (main country

of operation) and Northern Europe. It seeks to create value

by purchasing assets in fragmented materials markets and extracting

efficiencies through active management and by forming the assets

into larger groups. It seeks to de-risk its investments via

strong asset backing at its projects.

On 22 November 2023, the Company announced it entered into

an agreement pursuant to which it has conditionally agreed

to acquire certain European lime businesses from CRH plc ("CRH"),

a global diversified building materials business, that CRH

has deemed non-core comprising of standalone businesses in

Germany, Czech Republic and Ireland (the "Deal 1 Targets").

The Deal 1 Targets comprise: (i) the entire issued share capital

of Fels Holding GmbH including its fully owned (direct or indirect)

subsidiaries Fels-Werke GmbH, Fels Netz GmbH and Fels Vertriebs

und Service GmbH & Co. KG (together, the "German Target") from

the German Seller; (ii) 75% of the issued share capital of

Vápenka Vitošov s.r.o. (the "Czech Target") from

the Czech Seller; and (iii) the entire issued share capital

of Clogrennane Lime Limited (the "Irish Target") from the Irish

Seller.

The total consideration payable by SigmaRoc for the Deal 1

Targets only is EUR745 million (c. GBP645 million) (including

c.EUR211.5 million in connection with the assignment of the

German Intercompany Loan Receivables) (subject to customary

adjustments in respect of the target entities' net debt and

working capital position as at 1 January 2024).

In addition, the Company has entered into call options pursuant

to which, subject to certain conditions, it has been granted

the right (but not the obligation) to acquire, separately the

UK and Polish lime operations of CRH (respectively, the "UK

Target" and the "Polish Target"). The assets and businesses

which will in due course constitute the UK Target and Polish

Target are at present integrated within other CRH businesses

and need to be carved out into standalone entities before they

can be acquired. Subject to the Company exercising the relevant

call option, the Company currently expects to complete the

acquisition of the UK Target and the Polish Target by 28 March

2024 and 30 September 2024, respectively.

In the event that both call options are exercised by SigmaRoc,

the total consideration payable by SigmaRoc for all of the

Deal 1 Targets, the UK and Polish Targets is c.EUR1 billion

(c.GBP870 million).

The consideration, following customary purchase price adjustments,

will be satisfied by a c.EUR230 million (c.GBP200 million)

equity raise, c.EUR175 million (c.GBP155 million) of deferred

consideration, with the balance c.EUR505 million (c.GBP435

million) to be financed via debt.

On 22 November 2023, the Company announced it had raised c.

GBP198.8 million (before expenses) via the conditional issue

of 418,464,565 new ordinary shares of GBP0.01 each in the capital

of the Company ("Ordinary Shares") at a price of 47.5 pence

per share (the "Placing Price") (the "Placing"). The Company

also raised gross proceeds of approximately GBP1.2 million,

via the subscription for, in aggregate, 2,588,066 new Ordinary

Shares at the Placing Price (the Placing and the REX Intermediaries

Offer being the "Fundraising"). In total the Fundraising was

for GBP200 million.

Due to its size, the acquisition of the Deal 1 Targets comprises

a reverse takeover of the Company pursuant to Rule 14 of the

AIM Rules for Companies and completion of the Deal 1 Acquisition

is therefore conditional on, inter alia, the approval of Shareholders

at the General Meeting on 11 December 2023.

The Deal 1, UK and Polish Target's operations include extracting

limestone from quarries as well further processing the limestone

to, e.g., limestone flour or burn the limestone to produce

quicklime. In total, the Target operates 11 quarries and 14

production sites with kilns. The Target comprises of 5 individual

operating company businesses, spread across 5 geographic clusters

(Germany, Czech Republic, Ireland, Poland and the United Kingdom).

Poland and the United Kingdom are proposed to be NewCos (both

these operations currently include non-lime activities).

The Deal 1, UK and Polish Targets are part of the CRH group,

a leading provider of building materials solutions with c.

75,800 employees across 29 countries. The Existing Group as

enlarged by the Deal 1 Targets and UK and Polish Targets would

be one of the largest lime producers in Europe.

DETAILS OF SECURITIES TO BE ADMITTED INCLUDING ANY RESTRICTIONS

AS TO TRANSFER OF THE SECURITIES (i.e. where known, number

and type of shares, nominal value and issue price to which

it seeks admission and the number and type to be held as treasury

shares):

1,114,854,530 Ordinary Shares of GBP0.01 each in the capital

of the Company comprising:

(i) 693,801,899 Existing Ordinary Shares; and

(ii) 421,052,631 Placing Ordinary Shares (including 2,588,066

Ordinary Shares in relation to the Retail Offer).

The Ordinary Shares are and will remain freely transferable

and have no restrictions as to transfer placed on them.

The issue price of the new Ordinary Shares: 47.5 pence.

No Ordinary Shares are or will be held in treasury.

CAPITAL TO BE RAISED ON ADMISSION (AND/OR SECONDARY OFFERING)

AND ANTICIPATED MARKET CAPITALISATION ON ADMISSION:

The Company has raised GBP198.8 million from the Placing and

GBP1.2 million from the Retail Offer.

Anticipated market capitalisation on Admission c. GBP530 million

(at the issue price of 47.5 pence).

PERCENTAGE OF AIM SECURITIES NOT IN PUBLIC HANDS AT ADMISSION:

Shares representing c. 16% of the Company's issued share capital

on Admission are anticipated not to be in public hands.

DETAILS OF ANY OTHER EXCHANGE OR TRADING PLATFORM TO WHICH

THE AIM SECURITIES (OR OTHER SECURITIES OF THE COMPANY) ARE

OR WILL BE ADMITTED OR TRADED:

None.

FULL NAMES AND FUNCTIONS OF DIRECTORS AND PROPOSED DIRECTORS

(underlining the first name by which each is known or including

any other name by which each is known):

Maximilian (Max) Alphons Vermorken, Chief Executive Officer

Garth Mervyn Palmer, Chief Financial Officer

David Kenneth Barrett, Executive Chairman

Simon Roy Chisolm, Non-Executive Director

Jacques Gaetan Emsens, Non-Executive Director

Timothy (Tim) Conrad Langston Hall, Non-Executive Director

Axelle Henry, Non-Executive Director

FULL NAMES AND HOLDINGS OF SIGNIFICANT SHAREHOLDERS EXPRESSED

AS A PERCENTAGE OF THE ISSUED SHARE CAPITAL, BEFORE AND AFTER

ADMISSION (underlining the first name by which each is known

or including any other name by which each is known):

Before Admission After Admission

Shareholder # of % of Existing # of Shares % of Enlarged

Shares Share Capital Share Capital

----------- --------------- ------------ ---------------

Blackrock Investment

Mgt (UK) 71,286,121 10.27 86,767,038 7.8

----------- --------------- ------------ ---------------

Rettig Group 50,276,521 7.25 50,276,521 4.5

----------- --------------- ------------ ---------------

Janus Henderson Investors 46,831,223 6.75 46,831,223 4.2

----------- --------------- ------------ ---------------

BGF Investments LP 46,105,973 6.65 46,105,973 4.1

----------- --------------- ------------ ---------------

Chelverton Asset

Management 44,340,000 6.39 44,340,000 4.0

----------- --------------- ------------ ---------------

Lombard Odier Investment

Managers 36,610,423 5.28 56,610,423 5.1

----------- --------------- ------------ ---------------

Canaccord Genuity

Wealth Management 36,000,000 5.19 48,632,000 4.4

----------- --------------- ------------ ---------------

M&G Investment Management 35,584,798 4.84 35,542,301 3.2

----------- --------------- ------------ ---------------

Polar Capital 33,192,021 4.78 35,297,284 3.2

----------- --------------- ------------ ---------------

Slater Investments 31,057,422 4.48 40,597,422 3.6

----------- --------------- ------------ ---------------

CRH plc - - 171,578,948 15.4

----------- --------------- ------------ ---------------

Conversant Capital

LLC - - 58,947,368 5.3

----------- --------------- ------------ ---------------

NAMES OF ALL PERSONS TO BE DISCLOSED IN ACCORDANCE WITH SCHEDULE

2, PARAGRAPH (H) OF THE AIM RULES:

None.

(i) ANTICIPATED ACCOUNTING REFERENCE DATE

(ii) DATE TO WHICH THE MAIN FINANCIAL INFORMATION IN THE ADMISSION

DOCUMENT HAS BEEN PREPARED (this may be represented by unaudited

interim financial information)

(iii) DATES BY WHICH IT MUST PUBLISH ITS FIRST THREE REPORTS

PURSUANT TO AIM RULES 18 AND 19:

(i) 31 December

(ii) 30 June 2023

(iii) 30 June 2024 in respect of the audited annual accounts

for year ended 31 December 2023, 30 September 2024 for half

year report for six months ended 30 June 2024 and 30 June 2025

for the audited annual accounts for the year ended 31 December

2024

EXPECTED ADMISSION DATE:

4 January 2024

NAME AND ADDRESS OF NOMINATED ADVISER:

Liberum Capital Limited

25 Ropemaker St

London

EC2Y 9LY

NAME AND ADDRESS OF BROKER:

Joint brokers and joint bookrunners:

Liberum Capital Limited

25 Ropemaker St

London

EC2Y 9LY

Peel Hunt LLP

7th Floor

100 Liverpool St

London

EC2M 2AT

Joint bookrunners for the purposes of the Fundraising:

Banco Santander, S.A.

Paseo de Pereda

9 - 12 Santander

Spain

BNP PARIBAS

16 boulevard des Italiens

75009

Paris

France

Redburn (Europe) Limited

2nd Floor

10 Aldermanbury

London EC2V 7RF

United Kingdom

OTHER THAN IN THE CASE OF A QUOTED APPLICANT, DETAILS OF WHERE

(POSTAL OR INTERNET ADDRESS) THE ADMISSION DOCUMENT WILL BE

AVAILABLE FROM, WITH A STATEMENT THAT THIS WILL CONTAIN FULL

DETAILS ABOUT THE APPLICANT AND THE ADMISSION OF ITS SECURITIES:

The Admission Document contains full details about the applicant

and the admission of its securities and is available on the

Company's website

https://www.sigmaroc.com/investors/corporate-documents-and-circulars

THE CORPORATE GOVERNANCE CODE THE APPLICANT HAS DECIDED TO

APPLY

The Company has adopted the Quoted Companies Alliance, Corporate

Governance Code, published by the UK Quoted Companies Alliance,

and will continue to apply this code from Admission.

DATE OF NOTIFICATION:

11 December 2023

NEW/ UPDATE:

NEW

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

PAATBBITMTTBBTJ

(END) Dow Jones Newswires

December 11, 2023 10:00 ET (15:00 GMT)

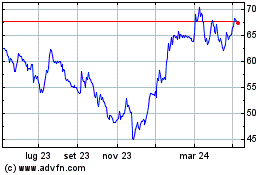

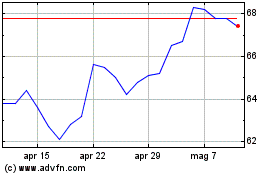

Grafico Azioni Sigmaroc (LSE:SRC)

Storico

Da Apr 2024 a Mag 2024

Grafico Azioni Sigmaroc (LSE:SRC)

Storico

Da Mag 2023 a Mag 2024