Tullow Oil PLC Final Results of the Tender Offer for 2025 Notes (9898W)

15 Dicembre 2023 - 10:37AM

UK Regulatory

TIDMTLW

RNS Number : 9898W

Tullow Oil PLC

15 December 2023

NOT FOR DISTRIBUTION IN ANY OTHER JURISDICTION WHERE IT IS

UNLAWFUL TO DISTRIBUTE THIS DOCUMENT.

THIS ANNOUNCEMENT IS FOR INFORMATION ONLY AND IS NOT AN OFFER TO

PURCHASE OR A SOLICITATION OF AN OFFER TO SELL ANY NOTES.

Tullow Oil plc

Final Results of the Tender Offer for 2025 Notes

December 15, 2023 - Tullow Oil plc (the "Company") announces the

final results of its previously announced invitation to holders of

its outstanding 7.00% Senior Notes due 2025 (the "Notes") to tender

such Notes for purchase by the Company for cash (the "Tender

Offer") up to an aggregate tender consideration, excluding any

accrued and unpaid interest, of U.S.$300,000,000 (the "Aggregate

Tender Consideration") in respect of tenders from registered

holders of Notes ("Holders") who validly tendered their Notes on or

prior to 5:00 p.m., New York City time, on December 14, 2023 (the

"Expiration Deadline").

As of the Expiration Deadline, U.S.$140,933,000 principal amount

of Notes were validly tendered (including Notes validly tendered

prior to November 29, 2023 (the "Early Tender Deadline")). The

table below identifies the principal amount of Notes validly

tendered and accepted as of the Expiration Deadline:

Outstanding Principal

Principal Amount Outstanding

Amount as Principal after the

at the date Amount Final Payment

Title of of the Offer Tendered Date Tender

Security CUSIP/ISIN to Purchase and Accepted Consideration(1)

7.00% Senior Rule 144A: U.S.$633,463,000 U.S.$140,933,000 U.S.$492,530,000 U.S.$920.00

Notes due 899415AE3

2025 (the / US899415AE32

"Notes")

Regulation

S: G91237AA8

/ USG91237AA87

---------------- ----------------- ----------------- -------------------- ------------------

Notes:

(1) The clearing price per U.S.$1,000 principal amount of Notes

validly tendered and accepted for purchase (the "Tender

Consideration") (exclusive of any accrued and unpaid interest on

such Notes from, and including, the last interest payment date

applicable to such Notes, which will be paid in addition to the

Tender Consideration to, but not including, the Final Payment Date

(as defined herein)).

Richard Miller, Chief Financial Officer, Tullow , commented

today:

"2023 has been a transformative year for our balance sheet.

Following the start-up of the Jubilee South East project earlier

this year, we are now in a period of material free cash flow, with

approximately $800 million expected to be generated between 2023 to

2025. This free cash flow, together with cash on balance sheet and

the $400 million notes facility commitment from Glencore, will

allow us to fully address all outstanding 2025 Notes and puts us in

a strong position to successfully refinance the remaining 2026

Notes. We have reduced gross debt by almost $400 million this year

and we remain on track to becoming a low-debt business with a

sustainable capital structure."

Capitalized terms used in this announcement but not defined

herein have the meanings given to them in the offer to purchase

dated November 15, 2023 (the "Offer to Purchase").

The Tender Consideration for each U.S.$1,000 principal amount of

Notes validly tendered on or prior to the Expiration Deadline and

accepted for purchase pursuant to the Tender Offer shall be

U.S.$920.00.

Pursuant to the terms of the Tender Offer, the settlement date

for the Notes tendered on or prior to the Expiration Deadline and

accepted for purchase will be December 20, 2023 (the "Final Payment

Date"). Holders will also receive with respect to any Notes validly

tendered and accepted for purchase accrued and unpaid interest on

such Notes from, and including, the last interest payment date

applicable to such Notes to, but not including, the Final Payment

Date.

Questions and requests for assistance in connection with the

Tender Offer should be directed to the Lead Dealer Managers :

ING Bank N.V., London Branch Standard Chartered Bank

1 Basinghall Avenue

8-10 Moorgate London EC2V 5DD

London EC2R 6DA United Kingdom

United Kingdom Attention: Liability Management

Attention: Liability Management Group Telephone: +1 212 667 0351 / +44 20 7885 5739 /

Telephone: +44 20 7767 6784 + 852 3983 8658 / +65 6557 8286

Email: liability.management@ing.com Email: liability_management@sc.com

The Co-Dealer Managers in connection with the Tender Offer

are:

Absa Bank Limited DNB Markets, J.P. Morgan Nedbank Limited The Standard

(acting through Inc. Securities (acting through Bank of South

its Corporate LLC its Nedbank Africa Limited

and Investment Corporate

Banking Division) and Investment

Banking Division)

Questions and requests for assistance in connection with the

Tender Offer may also be directed to the Information and Tender

Agent:

Information and Tender Agent

Morrow Sodali Limited

29/F. No. 28 Stanley 103 Wigmore Street 333 Ludlow Street

Street London W1U 1QS South Tower, 5(th)

Central Hong Kong United Kingdom Floor

Stamford, CT 06902

United States

Telephone: +44 20

Telephone: +852 2319 4513 6933 Telephone: +1 203

4130 658 9457

Email: tullowoil@investor.morrowsodali.com

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

RTENKPBNCBDKNBD

(END) Dow Jones Newswires

December 15, 2023 04:37 ET (09:37 GMT)

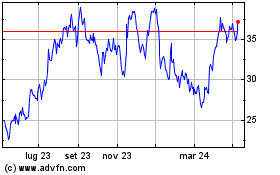

Grafico Azioni Tullow Oil (LSE:TLW)

Storico

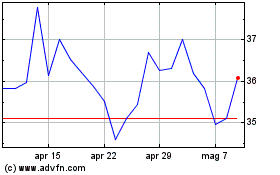

Da Apr 2024 a Mag 2024

Grafico Azioni Tullow Oil (LSE:TLW)

Storico

Da Mag 2023 a Mag 2024