TIDMVAL

RNS Number : 2736K

ValiRx PLC

24 August 2023

VALIRX PLC

("ValiRx", "the Company" or "the Group")

HALF YEARLY REPORT FOR THE PERIODED 30 JUNE 2023

London, UK., 2023 : ValiRx Plc (AIM : VAL), a life science

company, focussing on early-stage cancer therapeutics and women's

health, , today announces its Half Yearly Report for the period

ended 30 June 2023 and provides an update on significant

post-period events.

HIGHLIGHTS

Operational

-- Launch of wholly owned subsidiary, Inaphaea BioLabs Limited

("Inaphaea"), with post-period event of first external sales

-- Acquisition of scientific assets of Imagen Therapeutics Limited ("Imagen Therapeutics")

-- Signature of collaboration service agreements for Inaphaea

with Physiomics PLC ("Physiomics"), OncoBone Limited ("OncoBone"),

and post-period with Agility Life Sciences Limited ("Agility")

-- Expansion of evaluation agreement with the University of

Barcelona to enable study of a second KRAS project and to establish

standard terms for future agreements

Financial

-- Research and developments costs GBP207,721 (2022: GBP200,531)

-- Administrative expenses GBP925,866 (2022: GBP611,370)

-- Share-based payment charge GBP17,733 (2022: GBP261,052)

-- Total comprehensive loss for the period of GBP1,035,424 (2022: GBP992,481)

-- Loss before income taxation of GBP1,152,325 (2022: GBP1,074,784)

-- Expenditure in H1 includes one-off costs associated with the

set-up of Inaphaea and acquisition of Imagen assets

-- Loss per share from continuing operations of 1.03p (2022: Loss 1.53p)

-- Cash and cash equivalents at 30 June 2023 of GBP 891,246 (2022: GBP97,699)

-- Post period receipt of the FY22 R&D tax credits of GBP192,671 (2021: GBP133,413)

The information contained within this announcement is deemed by

the Company to constitute inside information as stipulated under

the Market Abuse Regulations (EU) No. 596/2014 as it forms part of

UK Domestic Law by virtue of the European Union (Withdrawal) Act

2018 ("UK MAR"). The Directors of the Company take responsibility

for this announcement.

***S ***

For more information, please contact:

ValiRx plc Tel: +44 (0) 2476 796496

www.valirx.com

D r S J Dilly suzanne.dilly@valirx.com

Cairn Financial Advisers LLP (Nominated Tel: +44 (0) 20 7213

Adviser) 0880

Liam Murray / Jo Turner / Ludovico

Lazzaretti

Cenkos Securities Limited (Joint Tel: +44 (0) 20 7397 8900

Broker)

Dale Bellis / Michael Johnson (Sales)

Callum Davidson / Giles Balleny (Corporate

Finance)

Turner Pope Investments (TPI) Limited Tel: +44 (0) 20 3657 0050

(Joint Broker)

James Pope / Andy Thacker

Notes for Editors

About ValiRx

ValiRx PLC accelerates the development of innovative medicines

that enhance patient experience. We do this by combining

intellectual and financial resources to select, progress and

partner a balanced portfolio of risk-reduced, early-stage

technologies for translation into clinical candidates.

The Company listed on the AIM Market of the London Stock

Exchange in October 2006 and trades under the ticker symbol:

VAL.

CHAIRMAN'S STATEMENT FOR THE HALF YEARED 30 JUNE 2023

Having shifted the tCRO(R) strategy towards a build-and-buy

approach in the latter part of 2022, the primary activity in the

first half of 2023 has been to establish in-house, cell-based

testing capabilities to support both our collaborative development

pipeline and generate income through third-party business.

The outcome of this has been the launch of a wholly owned

subsidiary, Inaphaea, which has been set up and become operational

at a fraction of the cost of acquiring a company with existing

infrastructure. The business is already developing a strong

pipeline of potential customers and successfully completed its

first deal quickly after launch, a testament to the hard work of

all those involved in the lab set up, business development and

operations.

The launch of Inaphaea and subsequent successful acquisition of

the scientific assets of Imagen Therapeutics was made possible

through the funds raised in 2022 and the placing and broker offer

in January 2023.

Following its launch, Inaphaea has continued to build the

tCRO(R) concept by developing collaborations with companies that

provide complementary capabilities, such as Physiomics, Oncobone

and, more recently, Agility Life Sciences. Their services, when

aligned with the cell-based testing of Inaphaea, present a very

compelling service offering to companies seeking to translate

preclinical assets into clinical candidates, including ValiRx's own

development pipeline.

The ValiRx R&D team are continuing to build a risk-balanced

portfolio of novel science in oncology and women's health, with a

number of potential candidates in late-stage discussions. Building

and funding a strong portfolio of evaluation projects also means

that not all the science will meet our rigorous selection criteria,

as evidenced by the conclusion of the Hokkaido project as announced

on 16 June 2023. The benefit of such decisions is that funds can be

re-directed towards projects that may have a greater chance of

success and value creation for shareholders, such as the expansion

of the Barcelona evaluation agreement to investigate new drug

candidates in oncology, as announced on 7 June 2023.

The continued progress of ValiRx during the first half of 2023

has been encouraging. However, this has been against the backdrop

of challenging market conditions, with the biotechnology sector in

general suffering from a change in sentiment in a post-Covid world.

Although there are expectations of additional income from Inaphaea,

the Company will be managing its resources in the most efficient

manner to maintain momentum over the next period.

Kevin Cox

Chairman

24 August 2023

CHIEF EXECUTIVE OFFICER'S STATEMENT FOR THE HALF YEARED 30 JUNE

2023

The key event for ValiRx in the first half of 2023 was the

launch of our service-providing subsidiary, Inaphaea. A wholly

owned subsidiary, Inaphaea is intended to be central to our designs

for a translational Contract Research Organisation (tCRO(R))

offering capabilities to the ValiRx internal pipeline projects as

well as to third party, fee-for-service clients.

Initially offering a cell-based assay capability, Inaphaea's

intention is to incorporate and validate a suite of in vitro and in

silico testing technologies to enhance the central ethos of

building strong preclinical evidence to de-risk the later stages of

drug development. Focussing on reproducibility, translatability

(suitability for later and clinical stages of development), and

humanisation of preclinical science, Inaphaea's tCRO(R) offering is

intended to occupy a high value segment of the market.

In June 2023, the establishment of Inaphaea's initial service

offering was substantially accelerated by the acquisition of the

scientific assets of Imagen Therapeutics. These assets included

several high specification items of equipment, providing Inaphaea

with capabilities around partial automation and live imaging during

cell-based assays. Additionally, a biobank of patient derived

cancer cells, consisting of over 500 unique samples was included,

enabling Inaphaea to take the first step towards improving

humanisation and relevance of the cell-based assays on offer. Soon

after, the first external customer was signed up, with an initial

multi-stage, defined project taking place between July and

September.

In order to build out the service offering within Inaphaea,

several collaboration agreements have already been set up, with

others currently proposed and under negotiation. This includes the

collaboration with Physiomics to offer biological modelling and

advanced data analysis; with Agility to offer pre-formulation and

formulation assessments and with OncoBone to enable Inaphaea to be

incorporated into their virtual CRO offering. Inaphaea has also

successfully listed on the Scientist.com database to increase

visibility to a larger field of potential clients.

Throughout this period work has also continued to advance the

ValiRx internal pipeline of research, with current projects

progressing to expected milestones, and new projects sought. These

are detailed individually below.

Evaluation Projects:

Hokkaido University

The project under Evaluation from Hokkaido University completed

its evaluation period in June 2023. The data did not support the

launch of the full in-licensing process for this project at this

time, so we returned all the data to the originating academics

along with our suggestions for their further development. We intend

to maintain a relationship with the University to assess other

programmes, or to re-assess this programme in the future.

Barcelona University

On completion of the evaluation programme from the University of

Barcelona, we were delighted to share the news that the University

has been awarded further funding to develop the project in their

own group. Barcelona University has a number of research groups

working on areas of interest to ValiRx, and we have agreed an

over-arching agreement that states standard terms on which we can

commence evaluations on subsequent projects; with the first of

these being a further KRAS project. KRAS(2) consists of a lead

series of molecules that bind to a different proposed binding

domain of KRAS, with our evaluation considering the activity of a

selection of molecules from the lead series.

Further Evaluation Projects

With an ambition to secure 3-4 new evaluation projects every

year, we have been focussing substantial effort on identifying and

qualifying further assets that meet our criteria to build a

diversified preclinical project pipeline.

Clinical Stage Assets

VAL201 remains subject to the Letter of Intent ("LoI") with

TheoremRx Inc, and we maintain good lines of communications with

the TheoremRx team to ensure that they are focussed on securing the

financing which will enable the VAL201 sub-license to complete.

In June 2023, we announced the carve-out of the Greater China

region from the exclusivity clause in the TheoremRx letter of

intent. This enables us to re-commence active marketing of the

project in this region in order to explore additional lines of

revenue.

VAL401 is subject to an intensive business development programme

with an external provider of partnering services who are exploring

options around partners focussed on oncology and supportive

care.

Preclinical Stage Assets

CLX001 was placed in the single asset subsidiary company,

Cytolytix Limited ("Cytolytix") in Q4 2022, and has undergone a

programme of formulation development during the first half of 2023.

The peptide active ingredient requires a nanoformulation to ensure

that the peptide is delivered to cancer cells at appropriate levels

and to stabilise the active ingredient within the therapeutic agent

with the lead formulation now proposed and undergoing testing in

the Inaphaea facility.

Once the lead formulation has been confirmed as being

biologically active, a full programme of preclinical development

including manufacturing, toxicology, disease impact and regulatory

activities will be pursued.

Opportunities for early partnering are being explored for

Cytolytix, with active commercial development to promote the

project to potential industry partners.

VAL301 in vitro preclinical optimisation is ongoing within the

Inaphaea tCRO(R) facility, with variations of the molecule being

studied for impact on growth rates of estrogen dependent cells

under a variety of stimulatory conditions. These assays will

determine whether an alternative molecular structure can improve

the potential for disease modifying impact for endometriosis, as

well as offering the potential for new patent filings to refresh

the intellectual property portfolio surrounding the project.

BC201 remains in assessment in the collaboration between Black

Cat Bio Limited and Oncolytika, with preclinical assessments

considering the impact of the active ingredient against viral

infections and immune responses.

Dr S J Dilly

CEO

24 August 2023

ValiRx Plc

Consolidated statement of comprehensive income

Six months Six months

ended ended Year ended

Note 30 June 30 June 31 December

------------------ -------------------- -----------------

2023 2022 2022

(unaudited) (unaudited) (audited)

GBP GBP GBP

Continuing operations

Research and development (207,721) (200,531) (551,233)

Administrative expenses (925,866) (611,370) (1,502,355)

Share-based payment charge (17,733) (261,052) (539,791)

Operating loss (1,151,320) (1,072,953) (2,593,379)

Finance costs (1,005) (1,831) (5,456)

------------------ -------------------- -----------------

Loss before income taxation (1,152,325) (1,074,784) (2,598,835)

Income tax credit 2 90,000 70,000 192,671

------------------ -------------------- -----------------

Loss on ordinary activities

after taxation (1,062,325) (1,004,784) (2,406,164)

Non-controlling interests 26,901 12,303 39,676

------------------ -------------------- -----------------

Loss for the period and total

comprehensive income attributable

to owners of the parent (1,035,424) (992,481) (2,366,488)

================== ==================== =================

Loss per share - basic and

diluted

From continuing operations 3 (1.03)p (1.53)p (3.06)p

================== ==================== =================

ValiRx Plc

Consolidated statement of financial position

As at 30 June 31 December

---------------------------------------------------- ------------------------

2023 2022 2022

(unaudited) (unaudited) (audited)

GBP GBP GBP

ASSETS

NON-CURRENT ASSETS

Goodwill 1,602,522 1,602,522 1,602,522

Intangible assets 818,097 1,007,770 903,900

Property, plant and equipment 274,744 - -

Right-of-use assets 1,702 9,278 5,561

------------------------ -------------------------- ------------------------

2,697,065 2,619,570 2,511,983

------------------------ -------------------------- ------------------------

CURRENT ASSETS

Trade and other receivables 201,368 79,291 133,815

Tax receivable 282,671 203,413 192,671

Cash and cash equivalents 891,246 97,699 1,137,477

------------------------

1,375,285 380,403 1,463,963

------------------------ -------------------------- ------------------------

TOTAL ASSETS 4,072,350 2,999,973 3,975,946

======================== ========================== ========================

SHAREHOLDERS' EQUITY

Share capital 9,707,266 9,669,995 9,695,120

Share premium account 27,873,048 24,519,456 26,772,630

Merger reserve 637,500 637,500 637,500

Reverse acquisition reserve 602,413 602,413 602,413

Share-based payment reserve 1,062,960 723,433 986,816

Retained earnings (35,679,063) (33,284,988) (34,643,639)

------------------------ -------------------------- ------------------------

4,204,124 2,867,809 4,050,840

Non-controlling interest (251,440) (197,170) (224,539)

------------------------ -------------------------- ------------------------

TOTAL EQUITY 3,952,684 2,670,639 3,826,301

------------------------ -------------------------- ------------------------

LIABILITIES

NON-CURRENT LIABILITIES

Borrowings 16,818 28,056 22,070

Lease liabilities - 2,486 -

------------------------ -------------------------- ------------------------

16,818 30,542 22,070

------------------------ -------------------------- ------------------------

CURRENT LIABILITIES

Trade and other payables 90,830 281,955 111,933

Borrowings 10,264 9,747 9,962

Lease liabilities 1,754 7,090 5,680

------------------------ -------------------------- ------------------------

102,848 298,792 127,575

------------------------ -------------------------- ------------------------

TOTAL LIABILITIES 119,666 329,334 149,645

------------------------ -------------------------- ------------------------

TOTAL EQUITY AND LIABILITIES 4,072,350 2,999,973 3,975,946

======================== ========================== ========================

ValiRx Plc

Consolidated statement of changes in shareholders' equity

Share-based Reverse

Share Share Retained Merger payment acquisition Non-controlling

capital premium earnings reserve reserve reserve interest Total

GBP GBP GBP GBP GBP GBP GBP GBP

Unaudited

Balance at 1

January

2023 9,695,120 26,772,630 (34,643,639) 637,500 986,816 602,413 (224,539) 3,826,301

Loss for the

period - - (1,035,424) - - - (26,901) (1,062,325)

Issue of

shares 12,146 1,287,854 - - - - - 1,300,000

Costs of

shares

issued - (129,025) - - - - - (129,025)

Share-based

payment

movement - (58,411) - - 76,144 - - 17,733

Balance at

30 June

2023 9,707,266 27,873,048 (35,679,063) 637,500 1,062,960 602,413 (251,440) 3,952,684

================== ======================== ======================== ================== =================== =================== =================== ======================

Unaudited

Balance at 1

January

2022 9,669,995 24,490,618 (32,292,507) 637,500 491,219 602,413 (184,867) 3,414,371

Loss for the

period - - (992,481) - - - (12,303) (1,004,784)

Lapse of

share

options

and

warrants - 28,838 - - (28,838) - - -

Share-based

payment

movement - - - - 261,052 - - 261,052

Balance at

30 June

2022 9,669,995 24,519,456 (33,284,988) 637,500 723,433 602,413 (197,170) 2,670,639

================== ======================== ======================== ================== =================== =================== =================== ======================

Audited

Balance at 1

January

2022 9,669,995 24,490,618 (32,292,507) 637,500 491,219 602,413 (184,867) 3,414,371

Loss for the

year - - (2,366,488) - - - (39,676) (2,406,164)

Issue of

shares 25,125 2,462,250 - - - - - 2,487,375

Costs of

shares

issued - (209,076) - - - - - (209,076)

Lapse of

share

options

and

warrants - 28,838 15,356 - (44,194) - - -

Movement in

year - - - - 539,791 - 4 539,795

Balance at

31 December

2022 9,695,120 26,772,630 (34,643,639) 637,500 986,816 602,413 (224,539) 3,826,301

================== ======================== ======================== ================== =================== =================== =================== ======================

ValiRx Plc

Consolidated cash flow statement

Year

ended

Six months ended

30 June 31 December

---------------------------------------------- -------------------

2023 2022 2022

(unaudited) (unaudited) (audited)

GBP GBP GBP

Cash flows from operating activities

Operating loss (1,151,320) (1,072,953) (2,593,379)

Depreciation of property plant

and equipment 13,558 - -

Amortisation of intangible fixed

assets 100,803 102,850 204,216

Depreciation of right-of-use

assets 3,859 4,000 7,717

(Increase) in receivables (67,552) (6,366) (60,886)

(Decrease)/increase in payables

within one year (21,103) 231,120 61,098

Share-based payment charge 17,733 261,052 539,791

------------------------ -------------------- -------------------

Net cash outflows from operations (1,104,022) (480,297) (1,841,443)

Tax credit received - - 133,413

Interest paid (432) (1,702) (4,215)

------------------------ -------------------- -------------------

Net cash outflow from operating

activities (1,104,454) (481,999) (1,712,245)

------------------------ -------------------- -------------------

Cash flows from investing activities

Purchase of intangible fixed

assets (15,000) (2,504) -

Purchase of property plant and

equipment (288,302) - -

------------------------ -------------------- -------------------

Net cash outflow from investing

activities (303,302) (2,504) -

------------------------ -------------------- -------------------

Cash flows from financing activities

Share issue 1,300,000 - 2,487,375

Costs of shares issued (129,025) - (209,076)

Repayment of lease liabilities (4,500) (4,500) (9,000)

Bank loan (4,950) (6,970) (13,249)

------------------------ -------------------- -------------------

Net cash generated from/(used

in) financing activities 1,161,525 (11,470) 2,256,050

------------------------ -------------------- -------------------

Net (decrease)/increase in

cash and cash equivalents (246,231) (495,973) 543,805

Cash and cash equivalents at

start of period 1,137,477 593,672 593,672

------------------------ -------------------- -------------------

Cash and cash equivalents at

end of period 891,246 97,699 1,137,477

======================== ==================== ===================

ValiRx Plc

Notes to the interim financial statements

1 General information

Valirx Plc is a company incorporated in the United Kingdom,

which is listed on the Alternative Investment Market of the London

Stock Exchange Group Plc. The address of its registered office is

Stonebridge House, Chelmsford Road, Hatfield Heath, Essex CM22

7BD.

Financial information

The interim financial information for the six months ended 30

June 2023 and 2022 have not been audited or reviewed and do not

constitute statutory accounts within the meaning of Section 434 of

the Companies Act 2006. The comparative financial information for

the year ended 31 December 2022 has been derived from the audited

financial statements for that period. A copy of those statutory

financial statements for the year ended 31 December 2022 has been

delivered to the Registrar of Companies. The report of the

independent auditors on those financial statements was unqualified,

drew attention to a material uncertainty relating to going concern

and did not contain a statement under Sections 498 (2) or (3) of

the Companies Act 2006.

The interim financial statements have been prepared in

accordance with International Accounting Standards in conformity

with the requirements of the Companies Act 2006 as they apply to

the financial statements of the Company for the six months ended 30

June 2023 and as applied in accordance with the provisions of the

Companies Act 2006 and under the historical cost convention or fair

value where appropriate. They have also been prepared on a basis

consistent with the accounting policies expected to be applied for

the year ending 31 December 2023 and which are also consistent with

those set out in the statutory accounts of the Group for the year

ended 31 December 2022.

The interim consolidated financial statements are presented in

pounds sterling which is the currency of the primary economic

environment in which the Group operates.

2 Taxation

Six months Six months

ended ended Year ended

30 June 30 June 31 December

------------ ------------ ------------

2023 2022 2022

(unaudited) (unaudited) (audited)

GBP GBP GBP

United Kingdom corporation tax

at 25% (2022: 19%)

Current period - R & D Tax

credit (90,000) (70,000) (192,671)

------------ ------------ ------------

Income tax credit (90,000) (70,000) (192,671)

============ ============ ============

3 Loss per ordinary share

The loss and number of shares used in the calculation of loss

per share are as follows:

Six months Six months

ended ended Year ended

30 June 30 June 31 December

----------------- --------------- --------------

2023 2022 2022

(unaudited) (unaudited) (audited)

Basic: GBP GBP GBP

Loss for the financial period (1,062,325) (1,004,784) (2,406,164)

Non-controlling interest 26,901 12,303 39,676

----------------- --------------- --------------

(1,035,424) (992,481) (2,366,488)

================= =============== ==============

Weighted average number of shares 100,808,008 65,049,156 77,301,896

Loss per share (1.03)p (1.53)p (3.06)p

================= =============== ==============

The loss and the weighted average number of shares used for

calculating the diluted loss per share are identical to those for

the basic loss per share. The exercise prices of the outstanding

share options and share warrants are above the average market price

of the shares and would therefore not be dilutive under IAS 33

'Earnings per Share.

4 Dividends

The Directors do not propose to declare a dividend in respect of

the period.

5 Copies of interim results

Copies of the interim results can be obtained from the website

www.valirx.com . From this site you may access our financial

reports and presentations, recent press releases and details about

the Company and its operations.

Caution regarding forward looking statements

Certain statements in this announcement, are, or may be deemed

to be, forward looking statements. Forward looking statements are

identi ed by their use of terms and phrases such as "believe",

"could", "should" "envisage", "estimate", "intend", "may", "plan",

"potentially", "expect", "will" or the negative of those,

variations or comparable expressions, including references to

assumptions. These forward-looking statements are not based on

historical facts but rather on the Directors' current expectations

and assumptions regarding the Company's future growth, results of

operations, performance, future capital and other expenditures

(including the amount, nature and sources of funding thereof),

competitive advantages, business prospects and opportunities. Such

forward looking statements re ect the Directors' current beliefs

and assumptions and are based on information currently available to

the Directors.

Such statements are based on current expectations and

assumptions and are subject to a number of risks and uncertainties

that could cause actual events or results to differ materially from

any expected future events or results expressed or implied in these

forward-looking statements. Persons receiving and reading this

announcement should not place undue reliance on forward-looking

statements. Unless otherwise required by applicable law, regulation

or accounting standard, the Company does not undertake to update or

revise any forward-looking statements, whether as a result of new

information, future developments or otherwise.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR DDGDILDDDGXX

(END) Dow Jones Newswires

August 24, 2023 02:00 ET (06:00 GMT)

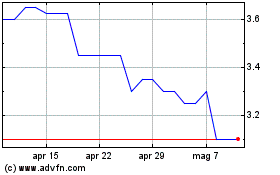

Grafico Azioni Valirx (LSE:VAL)

Storico

Da Apr 2024 a Mag 2024

Grafico Azioni Valirx (LSE:VAL)

Storico

Da Mag 2023 a Mag 2024