TIDMVAL

RNS Number : 3732X

ValiRx PLC

19 December 2023

NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION, DIRECTLY OR

INDIRECTLY, IN WHOLE OR IN PART, TO US PERSONS OR INTO OR WITHIN

THE UNITED STATES, AUSTRALIA, CANADA, SOUTH AFRICA OR JAPAN, OR ANY

MEMBER STATE OF THE EEA, OR ANY OTHER JURISDICTION WHERE, OR TO ANY

OTHER PERSON TO WHOM, TO DO SO MIGHT CONSTITUTE A VIOLATION OR

BREACH OF ANY APPLICABLE LAW OR REGULATION. PLEASE SEE THE

IMPORTANT NOTICE AT THE END OF THIS ANNOUNCEMENT.

THE COMMUNICATION OF THIS ANNOUNCEMENT AND ANY OTHER DOCUMENTS

OR MATERIALS RELATING TO THE RETAIL OFFER AS A FINANCIAL PROMOTION

IS ONLY BEING MADE TO, AND MAY ONLY BE ACTED UPON BY, THOSE PERSONS

IN THE UNITED KINGDOM FALLING WITHIN ARTICLE 43 OF THE FINANCIAL

SERVICES AND MARKETS ACT 2000 (FINANCIAL PROMOTION) ORDER 2005, AS

AMENDED (WHICH INCLUDES AN EXISTING MEMBER OF VALIRX PLC). ANY

INVESTMENT OR INVESTMENT ACTIVITY TO WHICH THIS ANNOUNCEMENT

RELATES IS AVAILABLE ONLY TO SUCH PERSONS AND WILL BE ENGAGED IN

ONLY BY SUCH PERSONS. THIS ANNOUNCEMENT IS FOR INFORMATIONAL

PURPOSES ONLY, AND DOES NOT CONSTITUTE OR FORM PART OF ANY OFFER OR

INVITATION TO SELL OR ISSUE, OR ANY SOLICITATION OF AN OFFER TO

PURCHASE OR SUBSCRIBE FOR, ANY SECURITIES OF VALIRX PLC.

THE INFORMATION CONTAINED WITHIN THIS ANNOUNCEMENT IS DEEMED BY

THE COMPANY TO CONSTITUTE INSIDE INFORMATION AS STIPULATED UNDER

ARTICLE 7 OF THE MARKET ABUSE REGULATION (EU) 596/2014 AS AMENDED

BY REGULATION 11 OF THE MARKET ABUSE (AMENDMENT) (EU EXIT)

REGULATIONS 2019/310 . UPON THE PUBLICATION OF THIS ANNOUNCEMENT

VIA REGULATORY INFORMATION SERVICE, THIS INSIDE INFORMATION IS NOW

CONSIDERED TO BE IN THE PUBLIC DOMAIN.

19 December 2023

VALIRX PLC

("ValiRx" or the "Company")

Result of Retail Offer

Director and PDMR Subscription

Further to the Conditional Fundraise, Notice of General Meeting

announcement dated 13 December 2023, ValiRx plc (the "Company")

(AIM: VAL), is pleased to announce that, following the closing of

the Retail Offer on the BookBuild platform on 19 December 2023, a

total of 3,204,068 new Shares have been subscribed for at the Issue

Price of 6 pence per Retail Offer Share in connection with the

Retail Offer, raising GBP192,244 for the Company, before expenses.

In addition, the Company has conditionally issued 499,998 new

Shares at the Issue Price of 6 pence per Subscription Share

pursuant to the Subscription.

Consequently, 26,324,997 Placing Shares, 499,998 Subscription

Shares and 3,204,068 Retail Offer Shares, resulting in a total of

30,029,063 new Shares, will be issued conditional on shareholder

approval at the Company's forthcoming general meeting and

Admission, in relation to the Placing, Subscription and Retail

Offer, raising total gross proceeds of approximately GBP1.80

million.

Subscription

In addition to the Placing and the Retail Offer, certain

Directors and PDMRs (together the "Participants") of the Company

have agreed to subscribe directly with the Company for, in

aggregate, 499,998 Subscription Shares at the Issue Price of 6

pence per Share. Details of the Subscription are set out below:

Shareholding

Subscription Shareholding as a percentage

Existing beneficial Shares subscribed on completion of the Enlarged

Director/PDMR shareholding for of the Fundraising Share Capital

Suzanne Dilly 416,668 66,666 483,334 0.37%

Kevin Cox 372,333 150,000 522,333 0.39%

Gerry Desler 128,668 66,666 195,334 0.15%

Martin Lampshire 144,000 150,000 294,000 0.22%

Cathy Tralau-Stewart - 66,666 66,666 0.05%

In addition to the Subscription, and as announced on 13 December

2023, Stella Panu, Non-Executive Director of the Company has

subscribed for 333,333 Placing Shares. Subject to the passing of

the Fundraising Resolutions, the Placing Agreement becoming

unconditional and Admission, Stella Panu will hold 333,333 Shares

representing approximately 0.25% of the Enlarged Share Capital of

the Company.

The aggregate participation by all Directors and PDMRs pursuant

to the Placing and Subscription is approximately GBP50k.

The participation of the Participants in the Subscription

constitutes a related party transaction for the purposes of Rule 13

of the AIM Rules by virtue of the Participants being a director or

PDMR of the Company and therefore a related party (the

"Transactions"). Stella Panu, Non-Executive Director, being a

director of the Company independent of the Transactions considers,

having consulted with Cairn Financial Advisers LLP, the Company's

nominated adviser for the purposes of the AIM Rules, that the terms

of the Transactions are fair and reasonable in so far as the

Shareholders are concerned.

The Retail Offer Shares and Subscription Shares will, when

issued, be credited as fully paid up and will have the same rights

as the Existing Ordinary Shares including, voting, dividend, return

of capital and other rights, and will on issue be free of all

claims, liens, charges, encumbrances and equities.

Capitalised terms used in this announcement have the meaning

given to them in the Conditional Fundraise, Notice of General

Meeting announcement dated 13 December 2023, unless otherwise

defined in this announcement.

For more information, please contact:

ValiRx plc Tel: +44 (0) 2476 796496

www.valirx.com

Dr Suzanne Dilly, CEO Suzanne.Dilly@valirx.com

V Formation (Public Relations) +44 (0) 115 787 0206

www.vformation.biz

Lucy Wharton - Senior PR Executive

Sue Carr - Director lucy@vformation.biz

sue@vformation.biz

--------------------------

Cairn Financial Advisers LLP (Nominated Tel: +44 (0) 20 7213

Adviser) 0880

Liam Murray/Jo Turner/Ludovico Lazzaretti

--------------------------

Cavendish Capital Markets Limited Tel: +44 (0) 20 7397

(Joint Broker) 8900

Dale Bellis/Michael Johnson (Sales)

Callum Davidson/Giles Balleny (Corporate

Finance)

--------------------------

Turner Pope Investments (Joint Broker) Tel: +44 (0) 20 3657

James Pope / Andy Thacker 0050

--------------------------

Notes for Editors

About ValiRx

ValiRx is a life science company focused on early-stage cancer

therapeutics and women's health, accelerating the translation of

innovative science into impactful medicines to improve patient

lives.

ValiRx provides the scientific, financial, and commercial

framework for enabling rapid translation of innovative science into

clinical development.

Using its extensive and proven experience in research and drug

development, the team at ValiRx selects and incubates promising

novel drug candidates and guides them through an optimised process

of development, from pre-clinical studies to clinic and

investor-ready assets.

ValiRx connects diverse disciplines across scientific,

technical, and commercial domains, with the aim of achieving a more

streamlined, less costly, drug development process. The team works

closely with carefully selected collaborators and leverages the

combined expertise required for science to advance.

Lead candidates from ValiRx's portfolio are outlicensed or

partnered with investors through ValiRx subsidiary companies for

further clinical development and commercialisation.

ValiRx listed on the AIM Market of the London Stock Exchange in

October 2006 and trades under the ticker symbol: VAL.

For further information, visit: www.valirx.com

Cautionary statement

Certain statements made in this announcement are forward-looking

statements. Such statements are based on current expectations and

assumptions and are subject to a number of risks and uncertainties

that could cause actual events or results to differ materially from

any expected future events or results expressed or implied in these

forward-looking statements. Persons receiving this announcement

should not place undue reliance on forward-looking statements.

Unless otherwise required by applicable law, regulation or

accounting standard, the Company does not undertake to update or

revise any forward-looking statements, whether as a result of new

information, future developments or otherwise.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

ROIGZMMZRLVGFZM

(END) Dow Jones Newswires

December 19, 2023 13:11 ET (18:11 GMT)

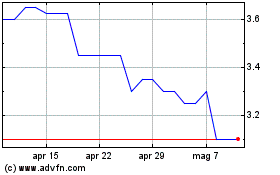

Grafico Azioni Valirx (LSE:VAL)

Storico

Da Apr 2024 a Mag 2024

Grafico Azioni Valirx (LSE:VAL)

Storico

Da Mag 2023 a Mag 2024