via NewMediaWire -- ABVC BioPharma, Inc. (NASDAQ: ABVC)

(“Company”), a biotechnology company specializing in botanically

based solutions that deliver high efficacy and low toxicity to

improve health outcomes, announced its 2023 annual financial and

operating results. These results, including the financial

statements included herein, can be found in the Company’s Annual

Report on Form 10-K filed with the Securities and Exchange

Commission on March 13, 2024.

2023 Annual Financial

Results

All comparisons are made on a year-over-year

basis.

Licensing Deal:

On November 12, 2023, the Company and one of its

subsidiaries, BioLite, Inc. (“BioLite”), each entered into a

multi-year, global licensing agreement (the “AIBL Agreement”) with

AiBtl BioPharma Inc. (“AIBL”) for the Company and BioLite’s CNS

drugs with the indications of MDD (Major Depressive Disorder) and

ADHD (Attention Deficit Hyperactivity Disorder) (collectively, the

“Licensed Products”). As per the respective agreements, each of

ABVC and BioLite received 23 million shares of AIBL stock (with an

expected value of $10 per share). As a result, the Company has a

controlling interest in AIBL. If certain milestones are met, the

Company and BioLite are each eligible to receive $3,500,000 and

royalties equaling 5% of net sales, up to $100 million.

The Company is hopeful that those licensing

incomes will enable it to start becoming profitable in the near

future.

Nasdaq Compliance

The Company has regained compliance with Nasdaq

Marketplace Rules relating to maintaining a minimum $1.00 bid price

and the $2.5 million minimum stockholders’ equity requirements,

completed on August 08, 2023, and September 6, 2023,

respectively.

Strategic Investments

The Company entered a cooperation agreement on

August 14, 2023, with Zhong Hui Lian He Ji Tuan, Ltd. (“Zhonghui”).

The Company acquired 20% of the ownership of a property and the

parcel of the land (the “Property”) owned by Zhonghui in Leshan,

Sichuan, China. In exchange, the Company issued Zhonghui an

aggregate of 370,000 shares (the “Shares”) of the Company’s common

stock, at a per-share price of $20.0. The Company and Zhonghui plan

to jointly develop the Property into a healthcare center for senior

living, long-term care, and medical care in the areas of ABVC’s

interests, such as Ophthalmology, Oncology, and Central Nervous

Systems. As of today, the Property is valued at US$37,000,000,

based on a third-party estimate.

On February 06, 2024, ABVC acquired an

additional real estate asset via an equity transfer of 703,495

shares at $3.50 per share to develop plant factories for ABVC’s

botanical pipeline. ABVC hopes the property will ultimately be used

as an integrated platform for the global development of the Asian

healthcare business and the medical, pharmaceutical, and

biotechnology industries. The Company believes it may be able to

leverage the value of the land (which the parties estimate at

approximately $2,962,232) for additional funding that can used for

further property development. In this way, the Company views real

estate acquisitions as a potential alternate revenue source.

To that end, on February 16, 2024, the Company

executed a definitive agreement to license its healthcare-related

expertise (“Know-How”) to Senior Paradise, Inc. (“SPI”), which will

also lease certain of the Company’s real estate properties. Under

the lease, SPI may build a plant factory based on good agricultural

practices (GAP) for ABVC’s botanical drug products and dietary

supplements. This deal marks the Company’s first step towards

generating revenue through its real estate acquisitions. Under the

agreement, SPI shall pay ABVC $3M as the license fee for the

Know-How, in cash or stock, and royalties of 2% on SPI’s revenues

earned from any projects on the leased land.

Stockholders’ Equity

On February 23, 2023, the Company entered into a

securities purchase agreement with Lind Global Fund II, LP

(“Lind”), according to which the Company issued Lind a secured,

convertible note in the principal amount of $3,704,167 (the “Lind

Offering”) for a purchase price of $3,175,000 (the “Lind Note”),

that is convertible into shares of Common Stock at an initial

conversion price of $1.05 per share, subject to adjustment. On

August 24, 2023, the Company started repaying Lind the monthly

installments due under the Lind Notes; $308,000 was repaid via the

issuance of 176,678 shares of Common Stock (the “Monthly Shares”)

at the Redemption Share Price (as defined in the Lind Note) of

$1.698 per share. Under the terms of the Lind Note, Lind increased

the amount of the next monthly payment to one million dollars, such

that as of September and together with the Monthly Shares, the

Company repaid Lind a total of $1M by September 2023.

On July 27, 2023, the Company entered into a

certain securities purchase agreement relating to the offer and

sale of 300,000 shares of common stock, par value $0.001 per share,

and 200,000 pre-funded warrants, at an exercise price of $0.001 per

share, in a registered direct offering. According to the related

purchase agreement, the Company agreed to sell the shares and

pre-funded warrants at a per-share purchase price of $3.50 for

gross proceeds of $1,750,000 before deducting any estimated

offering expenses. On August 1, 2023, the pre-funded warrants were

exercised.

On August 14, 2023, the Company entered a

cooperation agreement with Zhonghui. The Company acquired 20% of

the ownership of a property and the parcel of the land owned by

Zhonghui in Leshan, Sichuan, China. During the third quarter of

2023, the Company issued to Zhonghui an aggregate of 370,000 shares

of the Company’s common stock at a per-share price of $20 for its

ownership in the acquired Property. The Company also issued 29,600

common stock to consultants for providing consulting services on

the above transaction.

On November 17, 2023, the Company entered into a

securities purchase agreement (the “2nd Lind Securities Purchase

Agreement”) with Lind, under which the Company issued Lind a

secured, convertible note in the principal amount of $1,200,000

(the “2nd Lind Offering”), for a purchase price of $1,000,000 (the

“2nd Lind Note”), that is convertible into shares of the Company’s

common stock at a conversion price equal to $3.50 per share for the

first 180 days following the issuance date of the 2nd Lind Note,

after which the conversion price shall be based on a variable price

set forth therein (the “Variable Price”). Lind will also receive a

5-year, common stock purchase warrant (the “2nd Lind Warrant”) to

purchase up to 1,000,000 shares of the Company’s common stock at an

initial exercise price of $2 per share, subject to adjustment.

On January 17, 2024, the Company entered into a

third securities purchase agreement with Lind, under which the

Company issued Lind another secured, convertible note in the

principal amount of $1,000,000 for a purchase price of $833,333

(the “3rd Lind Note”), that is convertible into shares of the

Company’s common stock at a conversion price equal to $3.50 per

share for the first 180 days following the issuance date of the 3rd

Lind Note, after which the conversion price shall be based on a

variable price set forth therein (the “Variable

Price”). Lind will also receive a 5-year, common stock

purchase warrant to purchase up to 1,000,000 shares of the

Company’s common stock at an initial exercise price of $2 per

share, subject to adjustment.

The Company and Lind later agreed to a floor

price of $1.00 for the Variable Price of the 2nd Lind Note and 3rd

Lind Note and that the Company would compensate Lind in cash if the

Variable Price were less than such floor price at the time of

conversion.

As of December 31, 2023, the Company achieved a

total of stockholders’ equity of $8,388,050.

| |

● |

Revenues. We generated $152,430 and $969,783 in revenues for the

years ended December 31, 2023, and 2022, respectively. The decrease

of $817,353, or approximately 84%, was primarily caused by the

completion of ongoing projects and waiting for new approval. |

| |

● |

Operating Expenses. Our operating expenses were $8,066,902 in the

year ended December 31, 2023, compared to $15,797,780 in December

31, 2022. Such a decrease in operating expenses was mainly

attributable to decreased stock-based compensation and selling,

general, and administrative expenses by $6,100,337 and decreasing

research and development expenses of $1,630,541. |

| |

● |

Other Income (expense). The other expense was $2,437,773 in the

year ending December 31, 2023, compared to other Incomes of

$400,184 on December 31, 2022. The change was principally caused by

the increase in interest expense, mainly from the convertible notes

payable, while being offset by the increase in foreign exchange for

the year ended December 31, 2023, loss on investment in equity

securities, and decrease in impairment loss and investment loss for

the year ended December 31, 2023. |

| |

● |

Net Loss. The net loss was $10,910,288 for the year ended December

31, 2023, compared to $16,312,374 for the year ended December 31,

2022. Through certain reduced expenses, the Company was able to

reduce its net loss by $5,061,086 or approximately 31%

during the year ended December 31, 2023, from 2022, through more

effective usage of funding and discontinuing certain consulting

services. |

| |

● |

Cash and Cash Equivalents. The Company considers highly liquid

investments with three months or less maturities as cash

equivalents when purchased. As of December 31, 2023, and 2022, the

Company’s cash and cash equivalents amounted to $60,155 and

$85,265, respectively. |

Recent R&D Operational

Highlights

Patents and FDA Approvals

The Company received a US patent (US

16/936,032), valid until September 04, 2040, a Taiwanese (TW

I821593) Patent, valid until July 22, 2040, and an Australian

(AU2021314052B2) Patent, valid until April 09, 2041, for Polygala

extract for the treatment of major depressive disorder. The Company

received a US (US17/120,965), valid until December 20, 2040, and

Taiwanese (TW 110106546), valid until February 24, 2041, Patent for

Polygala Extract for treating Attention Deficit Hyperactive

Disorder. A Taiwanese Patent (TW I792427) for Storage Media for the

Preservation of Corneal Tissue was obtained on February 11, 2023,

and is valid till July 19, 2041. As we work towards expanding our

patent map into global coverage, we eagerly await the results of

patent applications in the European Union, China, Japan, and

others.

On December 30, 2022, the Company received US

FDA approval for the IND ABV-1519 to proceed with the Combination

therapy for treating Advanced Inoperable or Metastatic EGFR

Wild-type Non-Small Cell Lung Cancer was approved and the study can

proceed. The IND was then submitted to the Taiwan FDA, and the

approval was received on January 04, 2024. The United States Food

& Drug Administration (US FDA) has approved four INDs, ABV-1501

for Triple Negative Breast Cancer (TNBC), ABV-1519 for Non-Small

Cell Lung Cancer (NSCLC), ABV-1702 for Myelodysplastic Syndrome

(MDS), and ABV-1703 for Pancreatic Cancer Therapy.

Neurology

The MDD Phase II trials for ABV-1504 were

completed successfully with good tolerance to the drug, and no

serious adverse effects were reported. The product is ready for an

End-of-Phase 2 meeting with the FDA to finalize the protocol for

Phase III trials. At the same time, we commenced the ADHD Phase IIb

trials at the University of California, San Francisco (UCSF) and

five other sites in Taiwan. The trials are heading for the interim

report, which we expect to complete by early Q2 2024. ABV-1601 for

MDD in cancer patients has completed Phase I study preparation,

including the Site Initiation Visit (SIV). The study is set to

initiate in Q2 2024.

On July 31, 2023, ABVC signed a legally binding

term sheet with a Chinese pharmaceutical company, Xinnovation

Therapeutics Co., Ltd, for the exclusive licensing of ABV-1504 for

Major Depressive Disorder (MDD) and ABV-1505 for Attention-Deficit

Hyperactivity Disorder in mainland China. Under this agreement,

Xinnovation will hold exclusive rights to develop, manufacture,

market, and distribute our innovative drugs for MDD and ADHD in the

Chinese market and shall bear the costs for clinical trials and

product registration in China. We are negotiating definitive

agreements with Xinnovation and are excited that the licensing deal

carries a possible aggregate income of $20 million for ABVC if all

expected sales are made. However, since the definitive agreements

and the licensing are conditional on the satisfaction of several

closing conditions, there can be no guarantee that definitive

agreements will be executed and the licensing consummated on the

terms contemplated by the term sheet or at all.

In November 2023, each of ABVC and one of its

subsidiaries, BioLite, Inc. (“BioLite”), entered into a multi-year,

global licensing agreement with AIBL for the Company and BioLite’s

CNS drugs with the indications of MDD (Major Depressive Disorder)

and ADHD (Attention Deficit Hyperactivity Disorder) (the “Licensed

Products”). The license covers the Licensed Products’

clinical trial, registration, manufacturing, supply, and

distribution rights. The Licensed Products for MDD and ADHD, owned

by ABVC and BioLite, were valued at $667M by a third-party

evaluation. The parties are determined to collaborate on the global

development of the Licensed Products. The parties are also working

to strengthen new drug development and business collaboration,

including technology, interoperability, and standards development.

As per each of the respective agreements, each of ABVC and BioLite

received 23 million shares of AIBL stock at $10 per share, and if

certain milestones are met, each may be eligible to receive

$3,500,000 and royalties equaling 5% of net sales, up to $100

million.

Ophthalmology

Vitargus®, a vitreous substitute, is a

groundbreaking, advanced-staged R&D product that we believe

will be the first biodegradable hydrogel used in retinal detachment

surgery. Vitargus® has completed the feasibility study in Australia

and was approved by the Australian Therapeutic Goods Administration

(TGA) to initiate the next trial phase in two participating sites.

This is vital to obtaining final regulatory approval for Vitargus®

in Australia.

The Science Park Administration in Taiwan

approved ABVC’s plan to set up a pilot Good Manufacturing Practice

(GMP) facility to produce Vitargus® and to pursue the process

development work for manufacturing optimization. We are undertaking

this project, proposed by ABVC’s Taiwan affiliate and

co-development partner, BioFirst Corporation, to upgrade the

Vitargus® manufacturing processes with the expectation that it can

ultimately handle the global market supply. ABVC and BioFirst

Corporation expect to complete the facility’s construction in

Hsinchu Biomedical Science Park, Taiwan, in 2025.

Oncology/Hematology

The United States Food & Drug Administration

(US FDA) approved the Investigational New Drug (IND) application

for the proposed clinical investigation of BLEX 404, the primary

active ingredient in ABV-1519, for advanced inoperable or

metastatic EGFR wild-type non-small cell lung cancer. This

treatment is being co-developed by BioKey, Inc. (“BioKey”) and by

the Rgene Corporation, Taiwan. The study received approval from the

Taiwan FDA. This is the fourth IND approved by the US FDA for BLEX

404. The previous three INDs are for the combination therapies of

triple-negative breast cancer, myelodysplastic syndromes (MDS), and

pancreatic cancer.

CDMO

BioKey, a wholly-owned subsidiary of the Company

based in Fremont, California, produces dietary supplements derived

from the maitake mushroom in tablet and liquid forms. BioKey has

entered the second year of the distribution agreement with Define

Biotech Co. Ltd. BioKey is currently set to produce an additional

$1 million worth of products for the global market. We continue to

work on distribution for the US and Canadian markets with Shogun

Maitake.

On the regulatory services front for our

clients, we received two ANDA approvals from the US FDA. We have a

three-year contract, worth up to $3 million, for clinical

development services between BioKey and Rgene Corporation.

About ABVC BioPharma

ABVC BioPharma is a clinical-stage

biopharmaceutical company with an active pipeline of six drugs and

one medical device (ABV-1701/Vitargus®) under development. For its

drug products, the Company utilizes in-licensed technology from its

network of world-renowned research institutions to conduct

proof-of-concept trials through Phase II of clinical development.

The Company’s network of research institutions includes Stanford

University, University of California at San Francisco, and

Cedars-Sinai Medical Center. For Vitargus®, the Company intends to

conduct global clinical trials through Phase III.

Forward-Looking Statements

Clinical trials are in early stages, and there

is no guarantee that any specific outcome will be achieved. This

press release contains “forward-looking statements.” Such

statements may be preceded by the words “intends,” “may,” “will,”

“plans,” “expects,” “anticipates,” “projects,” “predicts,”

“estimates,” “aims,” “believes,” “hopes,” “potential,” or similar

words. Forward-looking statements are not guarantees of future

performance, are based on certain assumptions, and are subject to

various known and unknown risks and uncertainties, many of which

are beyond the Company’s control, and cannot be predicted or

quantified, and, consequently, actual results may differ materially

from those expressed or implied by such forward-looking statements.

None of the outcomes expressed herein are guaranteed. Such risks

and uncertainties include, without limitation, risks and

uncertainties associated with (i) our inability to manufacture our

product candidates on a commercial scale on our own, or in

collaboration with third parties; (ii) difficulties in obtaining

financing on commercially reasonable terms; (iii) changes in the

size and nature of our competition; (iv) loss of one or more key

executives or scientists; and (v) difficulties in securing

regulatory approval to proceed to the next level of the clinical

trials or to market our product candidates. More detailed

information about the Company and the risk factors that may affect

the realization of forward-looking statements is set forth in the

Company’s filings with the Securities and Exchange Commission

(SEC), including the Company’s Annual Report on Form 10-K and its

Quarterly Reports on Form 10-Q. Investors are urged to read these

documents free of charge on the SEC’s website at

http://www.sec.gov. The Company assumes no obligation to publicly

update or revise its forward-looking statements as a result of new

information, future events or otherwise.

This press release does not constitute an offer

to sell or the solicitation of an offer to buy these securities,

nor shall there be any sale of these securities in any state or

jurisdiction in which such offer, solicitation or sale would be

unlawful prior to registration or qualification under the

securities laws of that state or jurisdiction.

Contact:

Leeds ChowEmail: leedschow@ambrivis.com

ABVC BIOPHARMA, INC. AND

SUBSIDIARIESCONSOLIDATED BALANCE

SHEETS

|

|

|

December 31,2023 |

|

|

December 31,2022 |

|

|

ASSETS |

|

|

|

|

|

|

|

Current Assets |

|

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

60,155 |

|

|

$ |

85,265 |

|

|

Restricted cash |

|

|

656,625 |

|

|

|

1,306,463 |

|

|

Accounts receivable, net |

|

|

1,530 |

|

|

|

98,325 |

|

|

Accounts receivable – related parties, net |

|

|

10,463 |

|

|

|

757,343 |

|

|

Due from related parties – current |

|

|

747,573 |

|

|

|

513,819 |

|

|

Short-term investments |

|

|

79,312 |

|

|

|

75,797 |

|

|

Prepaid expense and other current assets |

|

|

101,051 |

|

|

|

150,235 |

|

|

Total Current Assets |

|

|

1,656,709 |

|

|

|

2,987,247 |

|

|

|

|

|

|

|

|

|

|

|

|

Property and equipment, net |

|

|

7,969,278 |

|

|

|

573,978 |

|

|

Operating lease right-of-use assets |

|

|

809,283 |

|

|

|

1,161,141 |

|

|

Long-term investments |

|

|

2,527,740 |

|

|

|

842,070 |

|

|

Deferred tax assets, net |

|

|

- |

|

|

|

117,110 |

|

|

Prepaid expenses – non-current |

|

|

78,789 |

|

|

|

135,135 |

|

|

Security deposits |

|

|

62,442 |

|

|

|

58,838 |

|

|

Prepayment for long-term investments |

|

|

1,274,842 |

|

|

|

2,838,578 |

|

|

Due from related parties – non-current, net |

|

|

113,516 |

|

|

|

865,477 |

|

|

Total Assets |

|

$ |

14,492,599 |

|

|

$ |

9,579,574 |

|

|

|

|

|

|

|

|

|

|

|

|

LIABILITIES AND EQUITY |

|

|

|

|

|

|

|

|

|

Current Liabilities |

|

|

|

|

|

|

|

|

|

Short-term bank loans |

|

$ |

899,250 |

|

|

$ |

1,893,750 |

|

|

Accrued expenses and other current liabilities |

|

|

3,696,380 |

|

|

|

2,909,587 |

|

|

Contract liabilities |

|

|

79,500 |

|

|

|

10,985 |

|

|

Taxes payables |

|

|

112,946 |

|

|

|

- |

|

|

Operating lease liabilities – current portion |

|

|

401,826 |

|

|

|

369,314 |

|

|

Due to related parties |

|

|

173,132 |

|

|

|

359,992 |

|

|

Convertible notes payable – third parties, net |

|

|

569,456 |

|

|

|

- |

|

|

Total Current Liabilities |

|

|

5,932,490 |

|

|

|

5,543,628 |

|

|

|

|

|

|

|

|

|

|

|

|

Tenant security deposit |

|

|

21,680 |

|

|

|

7,980 |

|

|

Operating lease liability – non-current portion |

|

|

407,457 |

|

|

|

791,827 |

|

|

Total Liabilities |

|

|

6,361,627 |

|

|

|

6,343,435 |

|

|

COMMITMENTS AND CONTINGENCIES |

|

|

|

|

|

|

|

|

|

Equity |

|

|

|

|

|

|

|

|

|

Preferred stock, $0.001 par value, 20,000,000 authorized, nil

shares issued and outstanding |

|

|

- |

|

|

|

- |

|

|

Common stock, $0.001 par value, 100,000,000 authorized, 7,940,298

and 3,286,190 shares issued and outstanding as of December 31, 2023

and 2022, respectively(1) |

|

|

7,940 |

|

|

|

3,286 |

|

|

Additional paid-in capital |

|

|

82,636,966 |

|

|

|

67,937,050 |

|

|

Stock subscription receivable |

|

|

(451,480 |

) |

|

|

(1,354,440 |

) |

|

Accumulated deficit |

|

|

(65,420,095 |

) |

|

|

(54,904,439 |

) |

|

Accumulated other comprehensive income |

|

|

516,387 |

|

|

|

517,128 |

|

|

Treasury stock |

|

|

(8,901,668 |

) |

|

|

(9,100,000 |

) |

|

Total Stockholders’ equity |

|

|

8,388,050 |

|

|

|

3,098,585 |

|

|

Noncontrolling interest |

|

|

(257,078 |

) |

|

|

137,554 |

|

|

Total Equity |

|

|

8,130,972 |

|

|

|

3,236,139 |

|

|

|

|

|

|

|

|

|

|

|

|

Total Liabilities and Equity |

|

$ |

14,492,599 |

|

|

$ |

9,579,574 |

|

|

(1 |

) |

Prior period results have been adjusted to reflect the 1-for-10

reverse stock split effected on July 25, 2023. |

ABVC BIOPHARMA, INC. AND

SUBSIDIARIESCONSOLIDATED STATEMENTS OF OPERATIONS

AND COMPREHENSIVE LOSS

|

|

|

Year Ended December 31, |

|

|

|

|

2023 |

|

|

2022 |

|

|

Revenues |

|

$ |

152,430 |

|

|

$ |

969,783 |

|

|

|

|

|

|

|

|

|

|

|

|

Cost of revenues |

|

|

302,037 |

|

|

|

286,415 |

|

|

|

|

|

|

|

|

|

|

|

|

Gross (loss) profit |

|

|

(149,607 |

) |

|

|

683,368 |

|

|

|

|

|

|

|

|

|

|

|

|

Operating expenses |

|

|

|

|

|

|

|

|

|

Selling, general and administrative expenses |

|

|

5,368,278 |

|

|

|

6,067,545 |

|

|

Research and development expenses |

|

|

1,062,916 |

|

|

|

2,693,457 |

|

|

Stock-based compensation |

|

|

1,635,708 |

|

|

|

7,036,778 |

|

|

Total operating expenses |

|

|

8,066,902 |

|

|

|

15,797,780 |

|

|

|

|

|

|

|

|

|

|

|

|

Loss from operations |

|

|

(8,216,509 |

) |

|

|

(15,114,412 |

) |

|

|

|

|

|

|

|

|

|

|

|

Other income (expense) |

|

|

|

|

|

|

|

|

|

Interest income |

|

|

185,481 |

|

|

|

187,817 |

|

|

Interest expense |

|

|

(2,493,340 |

) |

|

|

(293,968 |

) |

|

Operating sublease income |

|

|

65,900 |

|

|

|

107,150 |

|

|

Impairment loss |

|

|

- |

|

|

|

(110,125 |

) |

|

Investment loss |

|

|

- |

|

|

|

(7,446 |

) |

|

Gain (loss) on foreign exchange changes |

|

|

22,690 |

|

|

|

(259,463 |

) |

|

Loss on investment in equity securities |

|

|

(221,888 |

) |

|

|

- |

|

|

Other income (expenses) |

|

|

3,384 |

|

|

|

(24,149 |

) |

|

Total other income (expenses) |

|

|

(2,437,773 |

) |

|

|

(400,184 |

) |

|

|

|

|

|

|

|

|

|

|

|

Loss before provision income tax |

|

|

(10,654,282 |

) |

|

|

(15,514,596 |

) |

|

|

|

|

|

|

|

|

|

|

|

Provision for income tax expense |

|

|

256,006 |

|

|

|

797,778 |

|

|

|

|

|

|

|

|

|

|

|

|

Net loss |

|

|

(10,910,288 |

) |

|

|

(16,312,374 |

) |

|

|

|

|

|

|

|

|

|

|

|

Net loss attributable to noncontrolling interests |

|

|

(394,632 |

) |

|

|

110,865 |

|

|

|

|

|

|

|

|

|

|

|

|

Net loss attributed to ABVC and subsidiaries |

|

|

(10,515,656 |

) |

|

|

(16,423,239 |

) |

|

Foreign currency translation adjustment |

|

|

(741 |

) |

|

|

(22,532 |

) |

|

Comprehensive loss |

|

$ |

(10,516,397 |

) |

|

$ |

(16,445,771 |

) |

|

|

|

|

|

|

|

|

|

|

|

Net loss per share: |

|

|

|

|

|

|

|

|

|

Basic and diluted |

|

$ |

(2.43 |

) |

|

$ |

(5.19 |

) |

|

|

|

|

|

|

|

|

|

|

|

Weighted average number of common shares outstanding(1): |

|

|

|

|

|

|

|

|

|

Basic and diluted |

|

|

4,335,650 |

|

|

|

3,166,460 |

|

|

(1 |

) |

Prior period results have been adjusted to reflect the 1-for-10

reverse stock split effected on July 25, 2023. |

ABVC BIOPHARMA, INC. AND

SUBSIDIARIESCONSOLIDATED STATEMENTS OF CASH

FLOWSFOR THE YEAR ENDED DECEMBER 31, 2023 AND

2022

|

|

|

2023 |

|

|

2022 |

|

|

Cash flows from operating activities |

|

|

|

|

|

|

|

Net loss |

|

$ |

(10,910,288 |

) |

|

$ |

(16,312,374 |

) |

|

Adjustments to reconcile net loss to net cash used in operating

activities: |

|

|

|

|

|

|

|

|

|

Depreciation |

|

|

28,531 |

|

|

|

23,799 |

|

|

Stock-based compensation |

|

|

1,635,708 |

|

|

|

7,036,778 |

|

|

Inventory allowance for valuation losses |

|

|

- |

|

|

|

25,975 |

|

|

Provision for doubtful accounts |

|

|

1,455,101 |

|

|

|

184,589 |

|

|

Other non-cash expenses |

|

|

2,413,746 |

|

|

|

32,350 |

|

|

Impairment of prepaid expenses |

|

|

- |

|

|

|

110,125 |

|

|

Loss on investment in equity securities |

|

|

221,888 |

|

|

|

- |

|

|

Deferred tax expense |

|

|

115,668 |

|

|

|

864,802 |

|

|

Changes in operating assets and liabilities: |

|

|

|

|

|

|

|

|

|

Decrease (increase) in accounts receivable |

|

|

228,557 |

|

|

|

(614,166 |

) |

|

Decrease (increase) in prepaid expenses and other current

assets |

|

|

101,926 |

|

|

|

238,092 |

|

|

Decrease (increase) in due from related parties |

|

|

(321,776 |

) |

|

|

(837,014 |

) |

|

Increase (decrease) in accrued expenses and other current

liabilities |

|

|

786,793 |

|

|

|

1,608,784 |

|

|

Increase (decrease) in contract liabilities |

|

|

68,515 |

|

|

|

- |

|

|

Increase (decrease) in tenant security deposit |

|

|

13,700 |

|

|

|

(2,600 |

) |

|

Increase (decrease) in Taxes payables |

|

|

112,946 |

|

|

|

- |

|

|

Increase (decrease) in due to related parties |

|

|

(186,860 |

) |

|

|

242,469 |

|

|

Net cash used in operating activities |

|

|

(4,235,845 |

) |

|

|

(7,398,391 |

) |

|

|

|

|

|

|

|

|

|

|

|

Cash flows from investing activities |

|

|

|

|

|

|

|

|

|

Purchase of equipment |

|

|

(21,201 |

) |

|

|

(119,692 |

) |

|

Prepayment for equity investment |

|

|

(338,985 |

) |

|

|

(1,601,992 |

) |

|

Net cash used in investing activities |

|

|

(360,186 |

) |

|

|

(1,721,684 |

) |

|

|

|

|

|

|

|

|

|

|

|

Cash flows from financing activities |

|

|

|

|

|

|

|

|

|

Issuance of common stock |

|

|

1,050,000 |

|

|

|

3,663,925 |

|

|

Repayment of short-term bank loans |

|

|

(1,000,000 |

) |

|

|

- |

|

|

Proceeds from issuance of warrants |

|

|

2,406,338 |

|

|

|

- |

|

|

Proceeds from short-term bank loans |

|

|

- |

|

|

|

350,000 |

|

|

Proceeds from convertible notes payable |

|

|

1,462,622 |

|

|

|

- |

|

|

Net cash provided by financing activities |

|

|

3,918,960 |

|

|

|

4,013,925 |

|

|

|

|

|

|

|

|

|

|

|

|

Effect of exchange rate changes on cash and cash

equivalents and restricted cash |

|

|

2,123 |

|

|

|

(67,337 |

) |

|

|

|

|

|

|

|

|

|

|

|

Net increase (decrease) in cash and cash equivalents and

restricted cash |

|

|

(674,948 |

) |

|

|

(5,173,487 |

) |

|

|

|

|

|

|

|

|

|

|

|

Cash and cash equivalents and restricted cash |

|

|

|

|

|

|

|

|

|

Beginning |

|

|

1,391,728 |

|

|

|

6,565,215 |

|

|

Ending |

|

$ |

716,780 |

|

|

$ |

1,391,728 |

|

|

|

|

|

|

|

|

|

|

|

|

Supplemental disclosure of cash flows |

|

|

|

|

|

|

|

|

|

Cash paid during the year for: |

|

|

|

|

|

|

|

|

|

Interest expense paid |

|

$ |

33,180 |

|

|

$ |

285,465 |

|

|

Income taxes paid |

|

$ |

27,392 |

|

|

$ |

1,600 |

|

|

Non-cash financing and investing activities |

|

|

|

|

|

|

|

|

|

Purchase of Property and equipment by issuing common stock to a

third party |

|

$ |

7,400,000 |

|

|

$ |

- |

|

|

Issuance of common stock for conversion of debt |

|

$ |

3,306,112 |

|

|

$ |

- |

|

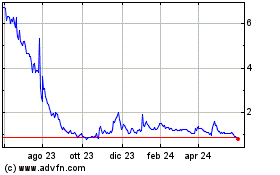

Grafico Azioni ABVC BioPharma (NASDAQ:ABVC)

Storico

Da Feb 2025 a Mar 2025

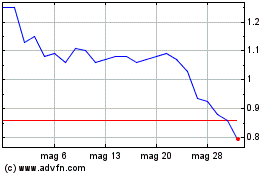

Grafico Azioni ABVC BioPharma (NASDAQ:ABVC)

Storico

Da Mar 2024 a Mar 2025