false

0001173313

0001173313

2024-05-24

2024-05-24

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities

Exchange Act of 1934

Date of Report (Date of earliest event reported):

May 24, 2024

ABVC BIOPHARMA, INC.

(Exact name of registrant as specified in its charter)

| Nevada |

|

001-40700 |

|

26-0014658 |

(State or other jurisdiction

of incorporation) |

|

(Commission File Number) |

|

(IRS Employer

Identification No.) |

|

44370 Old Warm Springs Blvd.

Fremont, CA |

|

94538 |

| (Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number including area

code: (510) 668-0881

(Former name or former address, if changed since

last report)

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of Each Class |

|

Trading Symbol |

|

Name of each exchange on which registered |

| Common Stock, par value $0.001 per share |

|

ABVC |

|

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant

is an emerging growth company as defined in as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule

12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01 Entry into Material Definitive Agreements

On May 23, 2024, the Company

entered into a definitive agreement with OncoX BioPharma, Inc., a private company registered in the British Virgin Islands (“Oncox”),

pursuant to which the Company will grant Oncox an exclusive right to develop and commercialize ABVC’s BLEX 404 single-herb botanical

drug extract from the dry fruit body of Maitake Mushroom (Grifola Frondosa) for treatment of Myelodysplastic Syndrome (the “Licensed

Products”), within a certain territory, specified as 50% of the Worldwide Markets for 20 years (the “Oncox Agreement”).

In consideration thereof, Oncox shall pay ABVC a total of $6,250,000 (or 1,250,000 Oncox shares valued at $5 per share1) 30

days after entering the Oncox Agreement, with an additional milestone payment of $625,000 in cash after OncoX’s next round of fundraising,

of which there can be no guarantee. Oncox may remit cash payments of at least $100,000 towards the licensing fees and deductible from

the second milestone payment; ABVC is also entitled to royalties of 5% of Net Sales, as defined in the Oncox Agreement, from the first

commercial sale of the Licensed Product in the noted territory, which remains uncertain. Oncox may use its revenue to fund the licensing

fees. Oncox entered into the same agreement with ABVC’s affiliate, Biolite, Inc.

The

foregoing description of the agreements is not complete and is qualified in its entirety by reference to the full text of the agreements,

copies of which are attached as Exhibit 10.1 and Exhibit 10.2 to this Current Report on Form 8-K and incorporated herein by reference.

Neither this Current Report

on Form 8-K, nor any exhibit attached hereto, is an offer to sell or the solicitation of an offer to buy the Securities described herein.

Such disclosure does not constitute an offer to sell, or the solicitation of an offer to buy nor shall there be any sales of the Company’s

securities in any state in which such an offer, solicitation or sale would be unlawful. The securities mentioned herein have not been

registered under the United States Securities Act of 1933, as amended, and may not be offered or sold in the United States absent registration

or an applicable exemption from the registration requirements under the Securities Act and applicable state securities laws.

Item 9.01 Financial Statement and Exhibits

(d) Exhibits

|

1 |

Price was determined through private negotiations between the parties; no third party valuation was completed. |

SIGNATURE

Pursuant to the requirements

of the Securities and Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

| |

ABVC BioPharma, Inc. |

| |

|

|

| May 24, 2024 |

By: |

/s/ Uttam Patil |

| |

|

Uttam Patil |

| |

|

Chief Executive Officer |

2

Exhibit 10.1

Definitive Licensing Agreement

This Definitive Licensing Agreement (“Agreement”) is entered

into this May 23, 2024 (the “Effective Date”) by and between:

| (1) | ABVC BioPharma, Inc., a company registered in Nevada. (“ABVC”);

and |

| (2) | OncoX BioPharma, Inc. (“ONCOX”), a company registered

in the British Virgin Islands.; and |

ABVC and ONCOX shall be referred to

individually as a “Party” and collectively as the “Parties”.

WHEREAS, the parties have agreed to the Key Terms (see Exhibit A) as

outlined in the Term Sheet, and now formalize their understanding in this Definitive Agreement.

NOW, THEREFORE, in consideration of the mutual covenants contained

herein, the parties agree as follows:

1. Upon signing

this Definitive Agreement, ONCOX shall have the exclusive right, until

the expiration of this agreement, to negotiate and execute a definitive licensing agreement for the licensed products with ABVC.

2. ONCOX

has the right to team with partner(s) or transfer the right to a third party

to negotiate and execute a definitive licensing agreement for the licensed products with ABVC.

3. ONCOX

has satisfactorily completed a due diligence investigation of the Licensed Product.

4. ABVC and

its Representatives shall deal exclusively with ONCOX with respect to

any licensing in the same scope or similar arrangement surrounding the Licensed Product.

IN WITNESS WHEREOF, the parties hereto have executed this Definitive

Agreement as of the Effective Date.

[Signature Page]

| ABVC BioPharma, Inc. |

|

OncoX BioPharma, Inc. |

| |

|

|

| Authorized Signature/Seal |

|

Authorized Signature/Seal |

| |

|

|

| |

|

|

| Name: |

Uttam Yashwant Patil |

|

Name: |

Yen Wen Pin |

| Title: |

|

|

Title: |

|

| CEO |

|

|

CEO |

|

Exhibit A

| LICENSEE |

OncoX BioPharma, Inc. (“ONCOX”) |

| LICENSOR |

ABVC BioPharma, Inc. (“ABVC”) and its affiliates |

| THIRD PARTY |

“Third Party” means a person or entity other than ONCOX or ABVC or their respective affiliates. |

| EFFECTIVE DATE |

The effective dates of Definitive Agreement related to the Licensed Product that would be the result of Parties’ discussions |

|

LICENSED PRODUCT

|

ABVC’s BLEX 404, single-herb botanical drug extract from the dry fruit body of Maitake Mushroom (Grifola Frondosa) for treatment of Myelodysplastic Syndromes (MDS) |

| TERRITORY |

50% of the Worldwide Markets |

| GOVERNING LAW |

Laws of the United States |

| FIELD OF USE |

Myelodysplastic Syndromes (MDS) |

|

RIGHTS GRANTED

|

ABVC shall grant to ONCOX an exclusive right within the Territory license to develop and commercialize the Licensed Product in the Territory within the Field of Use. |

|

RESPONSIBILITIES & OBLIGATIONS

|

ABVC

will be responsible for conducting the clinical development of the Licensed Product outside Territory and communicating the results as

part of the Product Transfer (PT), which includes delivering the Licensed Product sufficient to support the clinical studies in Territory,

delivering associated documents, manufacturing protocols, QC protocols, to enable ONCOX to

develop and commercialize the Licensed Product in Territory.

ABVC

will be responsible to secure the supply of the Licensed Product to ONCOX in

the Territory with an agreed price and quantity while A will secure the purchase of the Licensed Products from ABVC in the Territory with

committed volume.

ONCOX shall

be responsible for completing regulatory filing of IND in the Territory.

ABVC

will be responsible for providing the Licensed Product to ONCOX at cost,

to support clinical development in the Field of Use in the Territory.

ONCOX will

be responsible for further development and commercialization of the Licensed Product in the Field of Use in the Territory, including any

clinical development, regulatory affairs (including regulatory filings and approvals), and commercialization of the Licensed Product.

As

part of this license, ONCOX will grant ABVC a perpetual, royalty-free

right to use and reference any development, regulatory, and market data associated with the Licensed Product in ONCOX’s

control. |

|

EXCLUSIVITY/

NON-COMPETE |

During the collaboration, neither Parties nor its affiliates will work on the development of or commercialize in the Territory any products containing Maitake Mushroom as the sole active ingredient or in combination with one or more other active ingredients other than with respect to any other product or usage for which the same parties have previously agreed or will agree to work on together or without a specific mutually agreed to written plan for depression indication. |

| TECHNOLOGY SHARING |

After the Effective Date, and at a time to be agreed upon by ONCOX and ABVC in the Definitive Agreement, ABVC would transfer to ONCOX in English that data related to any Licensed Products in ABVC’s possession and control that is required by regulatory authorities for opening an IND, NDA. |

|

INTELLECTUAL PROPERTY RIGHTS

|

Intellectual

Property means any patent, copyright, trade secret, trademark or other proprietary right;including

all their applications , registrations, renewals and extensions.

Each Party or its Affiliates owns all rights, title and interest of

the Intellectual Property developed or controlled by itself and will be responsible for filing and maintaining the Intellectual Property

in the Territory at its own cost.

Each Party warrants it does not and will not infringe, violate or misappropriate

any trademark, patent, copyright, industrial design, trade secret or any other intellectual property or proprietary right of any Third

Party.

No right, title or interest is granted to the other Party in the Definitive

Agreement, whether expressly or by implication, to any technology or Intellectual Property rights owned by a Party other than pursuant

to the terms of the Definitive Agreement.

Each Party will retain an unconditional and

unlimited right of access, inclusion, citation, electronic or photo copy, and regulatory cross reference, without limitation, to any

and all regulatory, technical, and scientific documentations, and any and all communications with any and all regulatory authorities

in the other Party’s Territory for all matters related to each Licensed Product during the License Term. |

| MILESTONE & ROYALTY PAYMENTS |

See Exhibit B. |

|

TAX

|

Payments to Licensor as detailed in Exhibit B are likely considered Licensor’s income generated in Territory. Licensor is responsible for income tax, value-added tax, and other related fees levied by Territory government authorities on these payments. If and to the extent that provision is made in law or regulation of Territory for withholding of taxes with respect to any such payment, Licensee shall pay such taxes on behalf of Licensor and provide Licensor with original receipt of such tax payments or withholding. |

| NET SALES |

“Net Sales” means the total amount of

invoices issued by the Licensee for selling the Product of each pack size in the Territory to the Third Parties responsible for distribution

/ logistics, minus the amount of allowable deduction items related to the Product actually provided to non-affiliates as follows:

a) sales

value added tax

b) allowance,

discount or rebate for rejection, defect, recall, return, retroactive price reduction

Net Sales shall be accounted in accordance with

arm-length principles, industry standards and practices of the Territory, covering all sales of the Product to the Field of Use in the

Territory. Any allowance, discount or rebate for any Third Party sales and marketing activities shall not be deducted from the Net Sales

calculation.

Licensee shall allow Licensor to appoint

a Third Party independent auditor to audit the financial accounts of Licensee or its affiliates to confirm the reasonableness and accuracy

of the Net Sales calculation of the Product each year during the License Term. |

| LICENSE TERMS |

The term of licensing for the Licensed Product in the Territory is 20 years. |

|

MANUFACTURING

|

Both Parties desire Licensee is responsible for

the Licensed Product API manufacturing under CMO model as global primary supplier. Both Parties agree further study and analysis are to

be performed for the feasibility from technical and financial perspective before the execution of related manufacturing agreement.

Manufacturing of Licensed Product finished product

is subject to negotiation by both Parties. |

Exhibit B

All payments below are pre-tax total payments in

USD.

| Milestones |

Timeline |

Payment to ABVC |

| Upfront |

Due 30 days after the signature of the Investment Agreement |

$6,250,000

(or 1,250,000 shares of ONCOX at $5/share) |

| A cash payment of $100,000 and above at any time will then be deducted from the second milestone payment. |

|

Completion

Of

Fundraising |

Due 30 days upon completion of next round fundraising |

US $625,000 |

| Total Licensing Fee |

$6,875,000 |

| Royalties |

5% of annual Net Sales, accumulated to a total

of US$6,250,000 |

Royalties shall be payable quarterly on annual

Net Sales of the Licensed Product from the first commercial sale of a Licensed Product in the Territory to the end of License Terms.

Exhibit 10.2

Definitive Licensing Agreement

This Definitive Licensing Agreement (“Agreement”) is entered

into this May 23, 2024 (the “Effective Date”) by and between:

| (1) | BIOLITE, INC., a company registered in Taiwan. (“BIOLITE”);

and |

| (2) | OncoX BioPharma, Inc. (“ONCOX”), a company registered

in the British Virgin Islands.; and |

BIOLITE and ONCOX shall be referred to individually as a “Party”

and collectively as the “Parties”.

WHEREAS, the parties have agreed to the Key Terms (see Exhibit A) as

outlined in the Term Sheet, and now formalize their understanding in this Definitive Agreement.

NOW, THEREFORE, in consideration of the mutual covenants contained

herein, the parties agree as follows:

1. Upon signing

this Definitive Agreement, ONCOX shall have the exclusive right, until

the expiration of this agreement, to negotiate and execute a definitive licensing agreement for the licensed products with BIOLITE.

2. ONCOX

has the right to team with partner(s) or transfer the right to a third party

to negotiate and execute a definitive licensing agreement for the licensed products with BIOLITE.

3. ONCOX

has satisfactorily completed a due diligence investigation of the Licensed Product.

4. BIOLITE

and its Representatives shall deal exclusively with ONCOX with respect

to any licensing in the same scope or similar arrangement surrounding the Licensed Product.

IN WITNESS WHEREOF, the parties hereto have executed this Definitive

Agreement as of the Effective Date.

[Signature Page]

BIOLITE, INC. |

|

OncoX BioPharma, Inc. |

| |

|

|

| Authorized Signature/Seal |

|

Authorized Signature/Seal |

| |

|

|

| |

|

|

| Name: |

Tsung Shann Jiang |

|

Name: |

Yen Wen Pin |

| Title: |

|

|

Title: |

|

| CEO |

|

|

CEO |

|

Exhibit A

| LICENSEE |

OncoX BioPharma, Inc. (“ONCOX”) |

| LICENSOR |

BIOLITE, INC. (“BIOLITE”) and its affiliates |

| THIRD PARTY |

“Third Party” means a person or entity other than ONCOX or BIOLITE or their respective affiliates. |

| EFFECTIVE DATE |

The effective dates of Definitive Agreement related to the Licensed Product that would be the result of Parties’ discussions |

|

LICENSED PRODUCT

|

BIOLITE’s BLEX 404, single-herb botanical drug extract from the dry fruit body of Maitake Mushroom (Grifola Frondosa) for treatment of Myelodysplastic Syndromes (MDS) |

| TERRITORY |

50% of the Worldwide Markets |

| GOVERNING LAW |

Laws of the United States |

| FIELD OF USE |

Myelodysplastic Syndromes (MDS) |

|

RIGHTS GRANTED

|

BIOLITE shall grant to ONCOX an exclusive right within the Territory license to develop and commercialize the Licensed Product in the Territory within the Field of Use. |

|

RESPONSIBILITIES & OBLIGATIONS

|

BIOLITE

will be responsible for conducting the clinical development of the Licensed Product outside Territory and communicating the results as

part of the Product Transfer (PT), which includes delivering the Licensed Product sufficient to support the clinical studies in Territory,

delivering associated documents, manufacturing protocols, QC protocols, to enable ONCOX to

develop and commercialize the Licensed Product in Territory.

BIOLITE

will be responsible to secure the supply of the Licensed Product to ONCOX in

the Territory with an agreed price and quantity while A will secure the purchase of the Licensed Products from BIOLITE in the Territory

with committed volume.

ONCOX shall

be responsible for completing regulatory filing of IND in the Territory.

BIOLITE

will be responsible for providing the Licensed Product to ONCOX at cost,

to support clinical development in the Field of Use in the Territory.

ONCOX will

be responsible for further development and commercialization of the Licensed Product in the Field of Use in the Territory, including any

clinical development, regulatory affairs (including regulatory filings and approvals), and commercialization of the Licensed Product.

As

part of this license, ONCOX will grant BIOLITE a perpetual, royalty-free

right to use and reference any development, regulatory, and market data associated with the Licensed Product in ONCOX’s

control. |

|

EXCLUSIVITY/

NON-COMPETE |

During the collaboration, neither Parties nor its affiliates will work on the development of or commercialize in the Territory any products containing Maitake Mushroom as the sole active ingredient or in combination with one or more other active ingredients other than with respect to any other product or usage for which the same parties have previously agreed or will agree to work on together or without a specific mutually agreed to written plan for depression indication. |

| TECHNOLOGY SHARING |

After the Effective Date, and at a time to be agreed upon by ONCOX and BIOLITE in the Definitive Agreement, BIOLITE would transfer to ONCOX in English that data related to any Licensed Products in BIOLITE’s possession and control that is required by regulatory authorities for opening an IND, NDA. |

|

INTELLECTUAL PROPERTY RIGHTS

|

Intellectual

Property means any patent, copyright, trade secret, trademark or other proprietary right;including

all their applications , registrations, renewals and extensions.

Each Party or its Affiliates owns all rights, title and interest of

the Intellectual Property developed or controlled by itself and will be responsible for filing and maintaining the Intellectual Property

in the Territory at its own cost.

Each Party warrants it does not and will not infringe, violate or misappropriate

any trademark, patent, copyright, industrial design, trade secret or any other intellectual property or proprietary right of any Third

Party.

No right, title or interest is granted to the other Party in the Definitive

Agreement, whether expressly or by implication, to any technology or Intellectual Property rights owned by a Party other than pursuant

to the terms of the Definitive Agreement.

Each Party will retain an unconditional and unlimited right of

access, inclusion, citation, electronic or photo copy, and regulatory cross reference, without limitation, to any and all regulatory,

technical, and scientific documentations, and any and all communications with any and all regulatory authorities in the other Party’s

Territory for all matters related to each Licensed Product during the License Term. |

| MILESTONE & ROYALTY PAYMENTS |

See Exhibit B. |

|

TAX

|

Payments to Licensor as detailed in Exhibit B are likely considered Licensor’s income generated in Territory. Licensor is responsible for income tax, value-added tax, and other related fees levied by Territory government authorities on these payments. If and to the extent that provision is made in law or regulation of Territory for withholding of taxes with respect to any such payment, Licensee shall pay such taxes on behalf of Licensor and provide Licensor with original receipt of such tax payments or withholding. |

| NET SALES |

“Net Sales” means the total amount of

invoices issued by the Licensee for selling the Product of each pack size in the Territory to the Third Parties responsible for distribution

/ logistics, minus the amount of allowable deduction items related to the Product actually provided to non-affiliates as follows:

a) sales

value added tax

b) allowance,

discount or rebate for rejection, defect, recall, return, retroactive price reduction

Net Sales shall be accounted in accordance with

arm-length principles, industry standards and practices of the Territory, covering all sales of the Product to the Field of Use in the

Territory. Any allowance, discount or rebate for any Third Party sales and marketing activities shall not be deducted from the Net Sales

calculation.

Licensee shall allow Licensor to appoint

a Third Party independent auditor to audit the financial accounts of Licensee or its affiliates to confirm the reasonableness and accuracy

of the Net Sales calculation of the Product each year during the License Term. |

| LICENSE TERMS |

The term of licensing for the Licensed Product in the Territory is 20 years. |

|

MANUFACTURING

|

Both Parties desire Licensee is responsible for

the Licensed Product API manufacturing under CMO model as global primary supplier. Both Parties agree further study and analysis are to

be performed for the feasibility from technical and financial perspective before the execution of related manufacturing agreement.

Manufacturing of Licensed Product finished product

is subject to negotiation by both Parties. |

Exhibit B

All payments below are pre-tax total payments in

USD.

| Milestones |

Timeline |

Payment to BIOLITE |

| Upfront |

Due 30 days after the signature of the Investment Agreement |

$6,250,000

(or 1,250,000 shares of ONCOX at $5/share) |

| A cash payment of $100,000 and above at any time will then be deducted from the second milestone payment. |

|

Completion

Of

Fundraising |

Due 30 days upon completion of next round fundraising |

US $625,000 |

| Total Licensing Fee |

$6,875,000 |

| Royalties |

5% of annual Net Sales, accumulated to a total of US$6,250,000 |

Royalties shall be payable quarterly on annual

Net Sales of the Licensed Product from the first commercial sale of a Licensed Product in the Territory to the end of License Terms.

Exhibit 99.1

Immunity Boosting Combination Therapy for Myelodysplastic Syndrome Treatment: A Milestone Collaboration Between ABVC and OncoX, ABVC Eligible

to Receive Aggregate Income of $13.75M and Royalties of up to $12.50M

Fremont, CA (May 24, 2024) – ABVC

BioPharma, Inc. (NASDAQ: ABVC) (“Company”), a clinical-stage biopharmaceutical company developing therapeutic solutions in ophthalmology,

CNS (central nervous systems), and Oncology/Hematology, announced today a significant step in the fight against Myelodysplastic Syndrome.

The Company and its subsidiary BioLite, Inc. have entered into a definitive agreement with OncoX BioPharma, Inc., a private company registered

in the British Virgin Islands, to collaborate on a combination therapy. We believe this therapy holds the potential to revolutionize Myelodysplastic

Syndrome treatment and significantly improve patient outcomes. ABVC and its subsidiary are eligible to receive an aggregate license fee

of $12,500,000 in the form of cash or shares of OncoX securities within 30 days of executing the agreement, with an additional aggregate

milestone payment of $1,250,000 in cash after OncoX’s next round of fundraising, of which there can be no guarantee. OncoX may remit partial

cash payments of at least $100,000 to the licensing fees, which would be deductible from the second milestone payment. ABVC and its subsidiary

are also entitled to receive royalties of 5% of net sales, up to $12,500,000, after the launch of the licensed product, which remains

uncertain. There is no guarantee that ABVC or its subsidiary will receive any of the fees listed.

The United States Food & Drug Administration

(US FDA) has granted its approval to four INDs, a testament to the safety and efficacy of our investigational new drugs. These include

ABV-1501 (IND 129575) for Triple Negative Breast Cancer (TNBC), ABV-1519 (IND 161602) for Non-Small Cell Lung Cancer (NSCLC), ABV-1702

(IND 131300) for Myelodysplastic Syndrome (MDS), and ABV-1703 (IND 136309) for Pancreatic Cancer Therapy. The Investigational New Drug

(IND) application for ABV-1703 proposed the clinical investigation of BLEX 404 as a Combination Therapy Drug with Chemotherapy. The active

ingredient of BLEX 404 is the β-glucan extracted from Grifola frondosa (maitake mushrooms), an edible fungus with

high medical and commercial values in Asia; it contains various bioactive constituents such as polysaccharides, pyrrole alkaloids, ergosterol,

etc., and has been widely served as functional foods for a long time in daily life.1

Myelodysplastic

Syndromes, a group of diverse bone marrow disorders characterized by ineffective blood cell production, have posed substantial challenges

to conventional treatment methodologies.2 MDS and its treatments can significantly impact patients’ quality of life due to

symptoms such as fatigue, anemia, and infection risk. More effective supportive care strategies and symptom management approaches are

needed to enhance patients’ well-being and functional status.3 In vitro results have proven that β-glucan

of MD-fraction, a key ingredient of BLEX 404, enhances bone marrow colony formation and reduces chemotherapy

toxicity.4

| 1 | https://www.sciencedirect.com/science/article/abs/pii/S0960852407001083?via%3Dihub |

| 2 | https://my.clevelandclinic.org/health/diseases/6192-myelodysplastic-syndrome-myelodysplasia |

| 3 | https://pubmed.ncbi.nlm.nih.gov/34045662/ |

| 4 | https://www.sciencedirect.com/science/article/abs/pii/S1567576903002765#:~:text=Maitake%20beta%2Dglucan%20MD%2Dfraction,doxorubicin%20toxicity%20in%20vitro%20%2D%20ScienceDirect |

“This landmark collaboration aims to revolutionize

MDS treatment by developing a novel combination therapy. We expect this innovative combination therapy, the result of extensive research

and development efforts, to significantly improve patient outcomes by addressing the underlying mechanisms of MDS more comprehensively

than current treatments allow. By leveraging synergistic effects between multiple therapeutic agents, this approach aims to enhance efficacy

while minimizing adverse effects, offering new hope to patients and healthcare professionals alike, said Dr. Uttam Patil, ABVC’s Chief

Executive Officer. He added, “Through this collaboration, we aim to redefine the standard of care for MDS patients, empowering them

with more effective and personalized treatment options.”

“We are thrilled to announce this definitive

agreement with ABVC, which marks a pivotal moment in our ongoing commitment to advancing the field of oncology and hematological disorders,”

said Wen-Pin Yen, CEO of OncoX. He added, “OncoX shares this enthusiasm for the collaboration’s potential impact and is excited

to combine the scientific expertise of ABVC’s innovative approach to develop a therapy that can potentially transform the lives of MDS

patients. This partnership represents a significant step forward in our shared mission to address unmet medical needs and improve patient

outcomes.”

Under the terms of the agreement, ABVC grants

OncoX exclusive rights for one of ABVC’s four products in its Oncology pipeline to develop, manufacture, and commercialize BLEX 404, a

promising therapeutic agent for the treatment of Myelodysplastic Syndromes. The license has a term of 20 years within a specified territory.

Management

believes the Company’s product pipeline has excellent market potential. The global cancer therapeutics market is expected to be worth

around US$393.61 billion by 2032, up from US$164 billion in 2022, growing at a CAGR of 9.20% from 2023 to 2032.5

Myelodysplastic Syndrome (MDS) Treatment market is projected to reach US$ 6102.7 million in 2029, increasing from US$ 3270 million in

2022, with the CAGR of 9.2% during the period of 2023 to 2029.6

For more information about ABVC and its subsidiaries,

stay updated on the latest updates or visit https://abvcpharma.com. ABVC urges its shareholders to sign up on the Company’s website

for the latest news alerts; visit https://abvcpharma.com/?page_id=17707

About ABVC BioPharma & Its Industry

ABVC BioPharma is a clinical-stage biopharmaceutical

company with an active pipeline of six drugs and one medical device (ABV-1701/Vitargus®) under development. For its drug

products, the Company utilizes in-licensed technology from its network of world-renowned research institutions to conduct proof-of-concept

trials through Phase II of clinical development. The Company’s network of research institutions includes Stanford University, the University

of California at San Francisco, and Cedars-Sinai Medical Center. For Vitargus®, the Company intends to conduct global clinical

trials through Phase III.

| 5 | https://www.precedenceresearch.com/cancer-therapeutics-market |

| 6 | https://www.linkedin.com/pulse/myelodysplastic-syndrome-mds-treatment-market-insights-qw6uc/ |

Forward-Looking Statements

This press release contains “forward-looking

statements.” Such statements may be preceded by the words “intends,” “may,” “will,” “plans,”

“expects,” “anticipates,” “projects,” “predicts,” “estimates,” “aims,” “believes,”

“hopes,” “potential,” or similar words. Forward-looking statements are not guarantees of future performance, are based

on certain assumptions, and are subject to various known and unknown risks and uncertainties, many of which are beyond the Company’s control,

and cannot be predicted or quantified, and, consequently, actual results may differ materially from those expressed or implied by such

forward-looking statements. None of the outcomes expressed herein are guaranteed. Such risks and uncertainties include, without limitation,

risks and uncertainties associated with (i) our inability to manufacture our product candidates on a commercial scale on our own, or in

collaboration with third parties; (ii) difficulties in obtaining financing on commercially reasonable terms; (iii) changes in the size

and nature of our competition; (iv) loss of one or more key executives or scientists; and (v) difficulties in securing regulatory approval

to proceed to the next level of the clinical trials or to market our product candidates. More detailed information about the Company and

the risk factors that may affect the realization of forward-looking statements is set forth in the Company’s filings with the Securities

and Exchange Commission (SEC), including the Company’s Annual Report on Form 10-K and its Quarterly Reports on Form 10-Q. Investors are

urged to read these documents free of charge on the SEC’s website at http://www.sec.gov. The Company assumes no obligation to publicly

update or revise its forward-looking statements as a result of new information, future events or otherwise.

This press release does not constitute an offer

to sell, or the solicitation of an offer to buy any of the Company’s securities, nor shall such securities be offered or sold in the United

States absent registration or an applicable exemption from registration, nor shall there be any offer, solicitation or sale of any of

the Company’s securities in any state or jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration

or qualification under the securities laws of such state or jurisdiction.

Contact:

Leeds Chow

Email: leedschow@ambrivis.com

v3.24.1.1.u2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

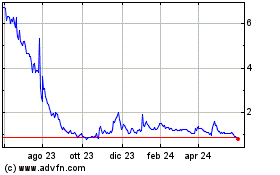

Grafico Azioni ABVC BioPharma (NASDAQ:ABVC)

Storico

Da Feb 2025 a Mar 2025

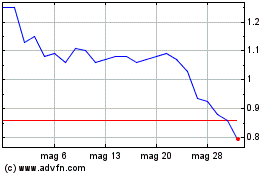

Grafico Azioni ABVC BioPharma (NASDAQ:ABVC)

Storico

Da Mar 2024 a Mar 2025