UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities

Exchange Act of 1934

Date of Report (Date of

earliest event reported): February 10, 2025

AIMFINITY INVESTMENT CORP. I

(Exact name of registrant as specified in its charter)

| Cayman Islands |

|

001-41361 |

|

N/A |

| (State or other jurisdiction |

|

(Commission File Number) |

|

(IRS Employer |

| of incorporation) |

|

|

|

Identification Number) |

221 W 9th St, PMB

235

Wilmington, Delaware 19801

(Address of principal executive offices)

(425)

365-2933

(Registrant’s telephone number, including

area code)

(Former name or former address, if changed since

last report.)

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☒ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act.

| Title of each class |

|

Trading Symbol |

|

Name of each exchange

on which registered |

| Units, consisting of one Class A ordinary share, $0.0001 par value, one Class 1 redeemable warrant and one-half of one Class 2 redeemable warrant |

|

AIMAU |

|

The Nasdaq Stock Market LLC |

| Class A ordinary shares, $0.0001 par value |

|

AIMA |

|

The Nasdaq Stock Market LLC |

| Class 1 redeemable warrants, each exercisable for one Class A ordinary share at an exercise price of $11.50 |

|

AIMAW |

|

The Nasdaq Stock Market LLC |

| Class 2 redeemable warrants, each exercisable for one Class A ordinary share at an exercise price of $11.50 |

|

AIMAW |

|

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the

Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by

check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial

accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 7.01 Regulation FD Disclosure.

On February 10, 2025, Aimfinity

Investment Corp. I (“AIMA”) issued a pair of press releases in Chinese and English providing certain updates regarding

its business combination with Docter Inc., a Delaware corporation, as disclosed previously on the Current Report on Form 8-K filed on

October 16, 2023. A copy of each press release is furnished as Exhibits 99.1 and 99.2 hereto. The information in this Item 7.01 and

the press releases hereto shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934,

as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated

by reference in any filing under the Securities Act or the Exchange Act, except as expressly set forth by specific reference in such filing.

IMPORTANT NOTICES

Important Notice Regarding Forward-Looking

Statements

As disclosed previously on the Current Report

on Form 8-K filed on October 16, 2023, on October 13, 2023, AIMA entered into that certain Merger Agreement, with Docter, Purchaser, and

Merger Sub, pursuant to which AIMA will enter into a business combination with Docter that involves a reincorporation merger and an acquisition

merger.

This Current Report on Form 8-K contains certain

“forward-looking statements” within the meaning of the Securities Act of 1933 and the Securities Exchange Act of 1934, both

as amended. Statements that are not historical facts, including statements about the pending transactions described above, and the parties’

perspectives and expectations, are forward-looking statements. Such statements include, but are not limited to, statements regarding the

proposed transaction, including the anticipated initial enterprise value and post-closing equity value, the benefits of the proposed transaction,

integration plans, expected synergies and revenue opportunities, anticipated future financial and operating performance and results, including

estimates for growth, the expected management and governance of the combined company, and the expected timing of the transactions. The

words “expect,” “believe,” “estimate,” “intend,” “plan” and similar expressions

indicate forward-looking statements. These forward-looking statements are not guarantees of future performance and are subject to various

risks and uncertainties, assumptions (including assumptions about general economic, market, industry and operational factors), known or

unknown, which could cause the actual results to vary materially from those indicated or anticipated.

Such risks and uncertainties include, but are

not limited to: (i) risks related to the expected timing and likelihood of completion of the pending business combination, including the

risk that the transaction may not close due to one or more closing conditions to the transaction not being satisfied or waived, such as

regulatory approvals not being obtained, on a timely basis or otherwise, or that a governmental entity prohibited, delayed or refused

to grant approval for the consummation of the transaction or required certain conditions, limitations or restrictions in connection with

such approvals; (ii) risks related to the ability of AIMA and Docter to successfully integrate the businesses; (iii) the occurrence of

any event, change or other circumstances that could give rise to the termination of the applicable transaction agreements; (iv) the risk

that there may be a material adverse change with respect to the financial position, performance, operations or prospects of Docter or

AIMA; (v) risks related to disruption of management time from ongoing business operations due to the proposed transaction; (vi) the risk

that any announcements relating to the proposed transaction could have adverse effects on the market price of AIMA’s securities;

(vii) the risk that the proposed transaction and its announcement could have an adverse effect on the ability of Docter to retain customers

and retain and hire key personnel and maintain relationships with their suppliers and customers and on their operating results and businesses

generally; (viii): risks relating to the medical device industry, including but not limited to governmental regulatory and enforcement

changes, market competitions, competitive product and pricing activity; and (ix) risks relating to the combined company’s ability

to enhance its products and services, execute its business strategy, expand its customer base and maintain stable relationship with its

business partners. A further list and description of risks and uncertainties can be found in the prospectus filed on April 26, 2022 relating

to AIMA’s initial public offering (the “IPO Prospectus”), the annual report of AIMA on Form 10-K for the fiscal year

ended on December 31, 2023, filed on April 12, 2024 (the “Annual Report”), and in the registration statement on Form F-4/proxy

statement (File No. 333-284658) filed by Purchaser on January 31, 2025, as amended (the “F-4”), in connection with the proposed

transactions, and other documents that the parties may file or furnish with the SEC, which you are encouraged to read. Should one or more

of these risks or uncertainties materialize, or should underlying assumptions prove incorrect, actual results may vary materially from

those indicated or anticipated by such forward-looking statements. Accordingly, you are cautioned not to place undue reliance on these

forward-looking statements. Forward-looking statements relate only to the date they were made, and AIMA, Docter and their subsidiaries

undertake no obligation to update forward-looking statements to reflect events or circumstances after the date they were made except as

required by law or applicable regulation.

Additional Information and Where to Find It

In connection with the transaction described herein,

Purchaser has filed the F-4 on January 31, 2025. The proxy statement and a proxy card will be mailed to shareholders as of a record date

to be established for voting at the stockholders’ meeting of AIMA shareholders relating to the proposed transactions. Shareholders

will also be able to obtain a copy of the F-4 without charge from AIMA. The F-4 may also be obtained without charge at the SEC’s

website at www.sec.gov. INVESTORS AND SECURITY HOLDERS OF AIMA ARE URGED TO READ THESE MATERIALS (INCLUDING ANY AMENDMENTS OR SUPPLEMENTS

THERETO) AND ANY OTHER RELEVANT DOCUMENTS IN CONNECTION WITH THE TRANSACTIONS THAT AIMA WILL FILE WITH THE SEC WHEN THEY BECOME AVAILABLE

BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT AIMA, THE COMPANY AND THE TRANSACTIONS DESCRIBED HEREIN.

Participants in Solicitation

AIMA, Docter, and their respective directors,

executive officers and employees and other persons may be deemed to be participants in the solicitation of proxies from the holders of

AIMA’s ordinary shares stock in respect of the proposed transaction. Information about AIMA’s directors and executive officers

and their ownership of AIMA ordinary shares is set forth in the IPO Prospectus and the Annual Report. Other information regarding the

interests of the participants in the proxy solicitation will be included in the proxy statement pertaining to the proposed transaction

when it becomes available. These documents can be obtained free of charge from the sources indicated above.

No Offer or Solicitation

This Current Report on Form 8-K is not a proxy

statement or solicitation of a proxy, consent or authorization with respect to any securities or in respect of the transactions described

above and shall not constitute an offer to sell or a solicitation of an offer to buy the securities of AIMA or Docter, nor shall there

be any sale of any such securities in any state or jurisdiction in which such offer, solicitation, or sale would be unlawful prior to

registration or qualification under the securities laws of such state or jurisdiction. No offering of securities shall be made except

by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended, or an exemption therefrom.

Item 9.01 Financial Statements and Exhibits.

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

| |

Aimfinity Investment Corp. I |

| |

|

| Date: February 10, 2025 |

By: |

/s/ I-Fa Chang |

| |

Name: |

I-Fa Chang |

| |

Title: |

Chief Executive Officer |

3

Exhibit 99.1

Aimfinity Investment Corp. I 修改其與Docter

Inc.之間的擬議合併協定的Earnout結構,

並任命微軟前亞洲研究院副院長田江森博士加入合併後公司的董事會

(2025年2月10日,紐約)——

Aimfinity Investment Corp.

I(納斯達克代碼:AIMAU)今日宣佈,於2025年1月19日,公司已與

Docter Inc. (“Docter”) 簽署與2023年10月發佈的業務合併協議(“合併協議”)的第二次修正案(“最新修正案”),優化合併後的 Earnout(盈利達成獎勵)機制,以更符合業務條件。此外,微軟前亞洲研究院副院長田江森博士(Dr. Jonathan Tien)近期也同意加入公司與Docter Inc.擬議合併後的新上市公司(“未來上市公司”)的董事會,進一步增強未來上市公司在智慧醫療與前沿技術領域的戰略佈局。

調整 Earnout 目標時間,增強市場靈活性

根據最新修正案:

| ● | 原定於2024年的 30,000 台設備銷售目標,Earnout

獎勵將調整至 2025年,Docter股東仍可獲得 1,000,000

股額外股票。 |

| ● | 原定於2025年的 40,000 台設備銷售目標,Earnout

獎勵將調整至 2026年,Docter股東可獲得 1,500,000 股額外股票。 |

這一調整反映了

AIMAU 和 Docter的考慮,使得合併協議的條款與Docter地業務條件更好地保持一致,並且進一步激勵未來上市公司在業務重點關注領域實現業績與增長。

AIMAU 首席執行官張義發(I-Fa Chang) 表示:“這一改動不僅增強了 Docter在市場競爭中的靈活性,也確保了我們能以最優策略實現長期增長目標。

”

田江森博士同意加入未來上市公司董事會,強化前沿科技佈局

AIMAU 和

Docter Inc.同意,作為未來上市公司持續推進技術創新戰略的一部分,未來上市公司將任命田江森博士出任董事角色。

田博士曾擔任微軟亞洲研究院副院長,在

人工智慧、大數據及計算機科學領域擁有超過

30 年的經驗。 他的職業生涯涵蓋了SpaceLabs

Medical、bSQUARE 及微軟總部和亞洲研究院在AI和演算法應用領域擁有廣泛經驗。作為董事,田博士的加入將為未來上市公司在新技術發展、跨領域融合和跨境合作等方面提供戰略指引。

“智慧醫療設備行業正進入

AI 賦能的新時代,”田博士表示,“AIMAU 和

Docter的擬議合作為我們提供了一個獨特的機會,將前沿技術與實際醫療需求結合,推動健康管理的未來。

我期待與董事會成員及管理團隊攜手,共同實現未來上市公司的戰略目標。

”

合併交易穩步推進

AIMAU 預計其與Docter的擬議合併交易將在獲得股東批准後完成,未來上市公司將繼續在納斯達克交易。

此前,公司已於 2025年2月3日向美國證券交易委員提交

F-4 登記聲明(“F-4”),並將在美國證券交易委員

對F-4完成審查並宣佈生效後召開股東大會對合併交易進行投票表決。

“F-4的公開提交標誌著我們已經邁出了關鍵的一步。我們將繼續專注於推進與

Docter的合併進程。” AIMAU董事長張義發

表示,“這不僅是

AIMAU 的一項重要里程碑,更是我們兌現承諾,為股東創造長期價值的關鍵一步。

”

關於 Aimfinity Investment Corp. I(AIMAU)

AIMAU 是一家特殊目的收購公司(SPAC),專注於投資具備高成長潛力的企業,並通過合併或收購方式幫助其上市。公司致力於發掘和推動創新科技、醫療健康及新興產業的高速發展。

關於 Docter Inc.

Docter Inc. 是一家創新型醫療科技公司,專注於無創血糖監測及智能健康設備的研發。其核心產品

DocterWatch 採用先進的傳感技術,為用戶提供血糖趨勢分析、血管健康監測及早期疾病預測服務,致力於提升全球用戶的健康管理體驗。

關於前瞻性陳述的注意事項

如先前AIMAU於

2023 年 10 月

16 日向美國聯邦證券交易委員會(“SEC”)提交的

8-K 報表中披露所示,2023

年 10 月

13 日,AIMAU 與

Docter、Aimfinity Investment Merger Sub I(一家開曼群島公司和

AIMAU 的子公司)(“買方”)和

Aimfinity Investment(一家特拉華州公司和買方的子公司)達成一項合併協议,

AIMAU 將與 Docter 進行業務合併。

本新聞稿包含《1933

年證券法》和《1934 年證券交易法》(經修訂)所定義的某些「前瞻性陳述」。非歷史事實的陳述,包括關於上述未決交易的陳述以及各方的觀點和期望的陳述,均屬於前瞻性陳述。此類陳述包括但不限於有關擬議交易的陳述,例如初始企業的預期價值和交易完成後的股權價值、擬議交易的效益、整合計劃、預期的協同效應和收入機會、預期的未來財務和經營業績和結果,包括增長估計、合併後公司的預期管理和治理況,以及交易的預期交割時間。

「預期」、「相信」、「估計」、「打算」、「計劃」等字眼及類似的表述均表示前瞻性陳述。這些前瞻性陳述並非對未來績效的保證,並且受已知或未知的各種風險和不確定性、假設(包括對一般經濟、市場、行業和營運因素的假設)的影響,這些因素可能導致實際結果與所示或預期的結果有重大差異。

此等風險和不確定因素包括但不限於:(i)

與即將進行的業務合併的預期完成時間和可能性有關的風險,包括由於交易的一個或多個成交條件未得到滿足或被放棄而導致交易無法完成的風險,例如未及時或以其他方式獲得監管部門批准,或者政府機構禁止、延遲或拒絕批准交易的完成,或要求與此類批准相關的某些條件、限製或約束;

(ii) 與 AIMAU 和

Docter 成功整合業務的能力相關的風險;

(iii) 發生任何可能導致交易協議終止的事件、變更或其他情況;

(iv) Docter 或 AIMAU 的財務狀況、業績、營運或前景可能發生重大不利變化的風險;

(v)因擬議交易導致管理層無法進行持續業務運營相關的風險;

(vi) 與擬議交易有關的任何公告可能對

AIMAU 證券的市場價格產生不利影響的風險;

(vii)擬議交易及其公告可能對

Docter 维持客戶、留用和聘用關鍵人員以及維持與供應商和客戶的關係的能力以及其經營業績和業務產生不利影響的風險;

(viii):與醫療器材產業相關的風險,包括但不限於政府監管和執法變化、市場競爭、競爭產品和定價活動;以及(ix)與合併後公司提升其產品和服務、執行其業務策略、擴大其客戶群以及維持與其業務夥伴的穩定關係的能力有關的風險。有關風險和不確定性的進一步列表和描述,請參考在AIMAU

於2022 年

4 月 26 日提交的與首次公開募股有關的招股說明書(“IPO

招股說明書”)、於2024

年 4 月

12 日提交的AIMAU 的2023財政年度10-K報表(“2023年報”)以及買方於2025

月2 月

3 日提交的與擬議交易有關的

F-4 招股說明書(SEC文件編號

333-284658)(經修訂)(“F-4報表”)中的相關披露,以及各方可能向

SEC 提交或提供的其他文件。如果這些風險或不確定因素中的一個或多個成為現實,或者基本假設被證明不正確,實際結果可能與此類前瞻性陳述所示或預期的結果有重大差異。因此,請注意不要過度依賴這些前瞻性陳述。前瞻性陳述僅與其作出之日有關,AIMAU、Docter

及其子公司不承擔更新前瞻性陳述以反映其作出之日後事件或情況的義務,除非法律和行政規定另有規定。

如何獲取更多資訊

就此處所述的交易而言,買方已於

2025 年 2 月

3 日提交了 F-4 報表。股東還可以從

AIMAU 免費獲得 F-4報表的副本。

F-4 報表和一旦發布,也可以在SEC網站

www.sec.gov 免費取得。我們強烈建議

AIMAU的投資者和證券持有人閱讀這些資料(包括對其的任何修訂或補充資料)以及

AIMAU 將向美國證券交易委員會提交的與交易有關的任何其他相關文件,因為它們將包含有關

AIMAU、公司和本文所述交易的重要資訊。

要約參與者

AIMAU、Docter

及其各自的董事、高管和員工以及其他人員可被視為就擬議交易向

AIMAU 普通股持有人發出交易要約的參與者。有關

AIMAU 董事和高管以及他們所持

AIMAU 普通股的資訊載於

IPO 招股說明書和2023年報中。關於AIMAU

普通股持有人的利益的其他資訊載於擬買方提交的F-4

報表中。這些文件可以從上面指出的來源免費取得。

無要約或徵集

本新聞稿不構成出售任何證券的要約或購買任何證券的要約邀請,在任何管轄區,在未按該轄區證券法進行登記、取得資格或豁免權前,不得該轄區進行任何證券銷售,因為在該司法管轄區進行此類要約、邀請或銷售均屬非法。

3

Exhibit 99.2

Aimfinity Investment Corp. I Amends Earnout Structure

of Proposed Business Combination with Docter Inc. and appoints Dr. Jonathan Tien, Former Associate Director of Microsoft Research Asia,

to join the Post-Merger Board of Directors

(Monday, Feb 10, 2025, New York) - Aimfinity Investment

Corp. I (NASDAQ: AIMAU) (“AIMAU”) announced today that, on January 29, 2025, it entered into an Amendment No. 2 to the Plan

and Agreement of Merger (the “Merger Agreement”) with Docter Inc. (“Docter”), originally executed in October 2023

(the “Amendment”) to optimize the post-merger earnout mechanism to better align with the business conditions. In addition,

recently, Dr. Jonathan Tien, former Associate Director of Microsoft Research Asia, has agreed to join the Board of Directors of the public

company (“Pubco”) following the Company’s proposed business combination with Docter Inc. to further strengthen Pubco’s

strategic development at the cross-sections of smart healthcare and emerging technologies.

Adjustment of Earnout Target Time to increase

market flexibility

According to the Amendment:

| ● | the original 2024 earnout award in the amount

of 1 million shares, payable to Docter shareholders upon equipment sales of at least 30,000 in 2024, has been amended to track equipment

sales in 2025; and |

| ● | the original 2025 earnout award in the amount

of 1.5 million shares, payable to Docter shareholders upon equipment sales of at least 40,000 in 2025, has been amended to track equipment

sales in 2026. |

This adjustment reflects AIMAU’s and Docter’s

consideration to better align the terms of the Merger Agreement with the business conditions and to further incentivize the PubCo’s

performance and growth in its key areas of focus.

I-Fa Chang, AIMAU’s Chief Executive Officer,

commented that “This change not only enhances Docter’s flexibility to compete in the market, but also ensures that we are

optimized to achieve our long-term growth objectives.”

Dr. Jonathan Tien joins PubCo Board of Directors

to strengthen emerging technology positioning

As a part of the strategy to further promote technological

innovation, AIMAU and Docter have agreed to appoint Dr. Jonathan Tien as a Director.

Dr. Tien was formerly the Associate Director of

Microsoft Research Asia and has over 30 years of experience in artificial intelligence, big data, and computer science. His career spans

SpaceLabs Medical, bSQUARE, and Microsoft headquarters and Microsoft Research Asia, accumulating extensive experience in artificial intelligence

and algorithmic applications. As director, Dr. Tien will counsel the PubCo on strategic issues involving emerging technology development,

cross-disciplinary integrations, and cross-border collaborations.

“The smart medical device industry is entering

a new era of AI empowerment,” said Dr. Tien, “The proposed collaboration between AIMAU and Docter provides us with a unique

opportunity to combine cutting-edge technology with real-world healthcare needs to drive the future of healthcare management. I look forward

to working with the board members and management team to realize the PubCo’s strategic goals. “

The merger transaction is moving ahead steadily

AIMAU anticipates that the proposed business combination

with Docter will be successfully completed upon receipt of shareholder approval and that PubCo will continue to trade on the NASDAQ. A

shareholder meeting will convene once the SEC completes its review and declares the PubCo’s registration statement on Form F-4 (the

“F-4”) effective. Most recently, the F-4 was filed publicly by PubCo on February 3, 2025.

“The public filing of the F-4 marks an important

step forward and we will continue to focus on advancing the merger process with Docter.” I-Fa Chang, Chief Executive Officer of

AIMAU, said, “This is not only an important milestone for AIMAU, but also a critical step in delivering on our commitment to create

long-term value for our shareholders.”

About Aimfinity Investment Corp. I (AIMAU)

AIMAU is a special purpose acquisition company

(SPAC) that focuses on investing in companies with high growth potential and helping them to go public through mergers and acquisitions.

The Company is committed to identify and drive the rapid growth of innovative technology, healthcare and emerging industries.

About Docter Inc.

Docter Inc. is an innovative medical technology

company focusing on the development of non-invasive blood glucose monitoring and smart health devices. Its core product, the DocterWatch,

utilizes advanced sensing technology to provide users with blood glucose trend analysis, vascular health monitoring and early disease

prediction services, and is dedicated to enhance the health management experience of users worldwide.

Important Notice Regarding Forward-Looking

Statements

As disclosed previously on the Current Report

on Form 8-K filed on October 16, 2023, on October 13, 2023, AIMAU entered into that certain Merger Agreement, with Docter, Aimfinity Investment

Merger Sub I, a Cayman Islands company and subsidiary of AIMAU (“Purchaser”) and Aimfinity Investment Merger Sub II Inc. a

Delaware corporation and subsidiary of Purchaser (“Merger Sub), pursuant to which AIMAU will enter into a business combination with

Docter that involves a reincorporation merger and an acquisition merger.

This press release contains certain “forward-looking

statements” within the meaning of the Securities Act of 1933 and the Securities Exchange Act of 1934, both as amended. Statements

that are not historical facts, including statements about the pending transactions described above, and the parties’ perspectives

and expectations, are forward-looking statements. Such statements include, but are not limited to, statements regarding the proposed transaction,

including the anticipated initial enterprise value and post-closing equity value, the benefits of the proposed transaction, integration

plans, expected synergies and revenue opportunities, anticipated future financial and operating performance and results, including estimates

for growth, the expected management and governance of the combined company, and the expected timing of the transactions. The words “expect,”

“believe,” “estimate,” “intend,” “plan” and similar expressions indicate forward-looking

statements. These forward-looking statements are not guarantees of future performance and are subject to various risks and uncertainties,

assumptions (including assumptions about general economic, market, industry and operational factors), known or unknown, which could cause

the actual results to vary materially from those indicated or anticipated.

Such risks and uncertainties include,

but are not limited to: (i) risks related to the expected timing and likelihood of completion of the pending business combination, including

the risk that the transaction may not close due to one or more closing conditions to the transaction not being satisfied or waived, such

as regulatory approvals not being obtained, on a timely basis or otherwise, or that a governmental entity prohibited, delayed or refused

to grant approval for the consummation of the transaction or required certain conditions, limitations or restrictions in connection with

such approvals; (ii) risks related to the ability of AIMAU and Docter to successfully integrate the businesses; (iii) the occurrence

of any event, change or other circumstances that could give rise to the termination of the applicable transaction agreements; (iv) the

risk that there may be a material adverse change with respect to the financial position, performance, operations or prospects of Docter

or AIMAU; (v) risks related to disruption of management from ongoing business operations due to the proposed transaction; (vi) the risk

that any announcements relating to the proposed transaction could have adverse effects on the market price of AIMAU’s securities;

(vii) the risk that the proposed transaction and its announcement could have an adverse effect on the ability of Docter to retain customers

and retain and hire key personnel and maintain relationships with their suppliers and customers and on their operating results and businesses

generally; (viii): risks relating to the medical device industry, including but not limited to governmental regulatory and enforcement

changes, market competitions, competitive product and pricing activity; and (ix) risks relating to the combined company’s ability

to enhance its products and services, execute its business strategy, expand its customer base and maintain stable relationship with its

business partners. A further list and description of risks and uncertainties can be found in the prospectus filed on April 26, 2022 relating

to AIMAU’s initial public offering (the “IPO Prospectus”), the annual report of AIMAU on Form 10-K for the fiscal year

ended on December 31, 2023, filed on April 12, 2024 (the “Annual Report”), and in the registration statement on Form F-4/proxy

statement (File No. 333-284658) filed by Purchaser on February 3, 2025, as amended (the “F-4”), in connection with the proposed

transactions, and other documents that the parties may file or furnish with the SEC, which you are encouraged to read. Should one or

more of these risks or uncertainties materialize, or should underlying assumptions prove incorrect, actual results may vary materially

from those indicated or anticipated by such forward-looking statements. Accordingly, you are cautioned not to place undue reliance on

these forward-looking statements. Forward-looking statements relate only to the date they were made, and AIMAU, Docter and their subsidiaries

undertake no obligation to update forward-looking statements to reflect events or circumstances after the date they were made except

as required by law or applicable regulation.

Additional Information and Where to Find

It

In connection with the transaction described

herein, Purchaser has filed the F-4 on February 3, 2025. The proxy statement and a proxy card will be mailed to shareholders as of a record

date to be established for voting at the stockholders’ meeting of AIMAU shareholders relating to the proposed transactions. Shareholders

will also be able to obtain a copy of the F-4 without charge from AIMAU. The F-4 may also be obtained without charge at the SEC’s

website at www.sec.gov. INVESTORS AND SECURITY HOLDERS OF AIMAU ARE URGED TO READ THESE MATERIALS (INCLUDING ANY AMENDMENTS OR SUPPLEMENTS

THERETO) AND ANY OTHER RELEVANT DOCUMENTS IN CONNECTION WITH THE TRANSACTIONS THAT AIMA WILL FILE WITH THE SEC WHEN THEY BECOME AVAILABLE

BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT AIMAU, THE COMPANY AND THE TRANSACTIONS DESCRIBED HEREIN.

Participants in Solicitation

AIMAU, Docter, and their respective directors,

executive officers and employees and other persons may be deemed to be participants in the solicitation of proxies from the holders of

AIMAU’s ordinary shares stock in respect of the proposed transaction. Information about AIMAU’s directors and executive officers

and their ownership of AIMAU ordinary shares is set forth in the IPO Prospectus and the Annual Report. Other information regarding the

interests of the participants in the proxy solicitation is set forth in the F-4. These documents can be obtained free of charge from the

sources indicated above.

No Offer or Solicitation

This press release is not a proxy statement

or solicitation of a proxy, consent or authorization with respect to any securities or in respect of the transactions described above

and shall not constitute an offer to sell or a solicitation of an offer to buy the securities of AIMAU or Docter, nor shall there be any

sale of any such securities in any state or jurisdiction in which such offer, solicitation, or sale would be unlawful prior to registration

or qualification under the securities laws of such state or jurisdiction. No offering of securities shall be made except by means of a

prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended, or an exemption therefrom.

3

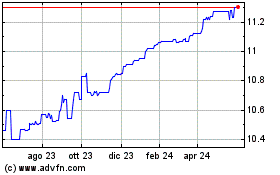

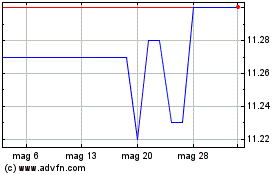

Grafico Azioni Aimfinity Investment Cor... (NASDAQ:AIMBU)

Storico

Da Gen 2025 a Feb 2025

Grafico Azioni Aimfinity Investment Cor... (NASDAQ:AIMBU)

Storico

Da Feb 2024 a Feb 2025