Beasley Broadcast Group Inc. (Nasdaq: BBGI), a multi-platform

media company (the “Company”), today announced that its Board of

Directors (the “Board”) has approved a reverse stock split of its

Class A Common Stock and Class B Common Stock (collectively, the

“Common Stock”) at a ratio of 1-for-20. Stockholders previously

approved the reverse stock split on August 26, 2024 and provided

the Board with discretion to determine the final reverse stock

split ratio.

The reverse stock split is being conducted to

regain compliance with the $1.00 minimum bid price requirement for

continued listing on the Nasdaq Capital Market (“Nasdaq”).

The reverse stock split is expected to become

effective on September 23, 2024 (the “Effective Date”). Shares

of the Company’s Class A Common Stock are expected to begin trading

on a split-adjusted basis on Nasdaq on September 24, 2024. Shares

of the Class A Common Stock will continue to trade under the symbol

“BBGI” and the new CUSIP number will be 074014 200.

On the Effective Date, every 20 shares of the

Company’s Class A Common Stock issued and outstanding will be

automatically converted into one share of Class A Common Stock, and

every 20 shares of the Company’s Class B Common Stock issued and

outstanding will be automatically converted into one share of Class

B Common Stock.

No fractional shares of Common Stock will be

issued in connection with the reverse stock split. Holders of

Common Stock who would otherwise receive a fractional share of

Common Stock pursuant to the reverse stock split will receive cash

in lieu of the fractional share equal to the closing sales price of

the Class A Common Stock on the Effective Date.

The reverse stock split has no effect on the par

value of the Company’s Common Stock or authorized shares of any

class of Common Stock. Immediately after the reverse stock split,

each stockholder’s percentage ownership interest in the Company and

proportional voting power will remain unchanged, except for minor

changes that will result from the treatment of fractional

shares.

Equiniti Trust Company, LLC is acting as

transfer and exchange agent for the reverse stock split. Registered

stockholders who hold shares of Common Stock in book entry are not

required to take any action to receive split-adjusted shares.

Stockholders who own shares via a broker, bank, trust or other

organization will have their positions automatically adjusted to

reflect the reverse stock split, subject to such organization’s

particular processes, and will not be required to take any action

in connection with the reverse stock split. Registered stockholders

of certificate(s) representing Common Stock prior to the Effective

Date will receive a Letter of Transmittal from the exchange agent

to trade in their certificate(s) for new certificate(s).

For more information on the reverse stock split,

please refer to the Company’s definitive information statement

filed with the U.S. Securities and Exchange Commission (the “SEC”)

on September 3, 2024, or the Company’s Current Report on Form 8-K

filed on September 19, 2024.

About Beasley Broadcast Group

The Company is a multi-platform media company whose primary

business is operating radio stations throughout the United States.

The Company offers local and national advertisers integrated

marketing solutions across audio, digital and event platforms. The

Company owns and operates stations in the following markets:

Atlanta, GA, Augusta, GA, Boston, MA, Charlotte, NC, Detroit, MI,

Fayetteville, NC, Fort Myers-Naples, FL, Las Vegas, NV, Middlesex,

NJ, Monmouth, NJ, Morristown, NJ, Philadelphia, PA, and Tampa-Saint

Petersburg, FL. Approximately 20 million consumers listen to the

Company’s radio stations weekly over-the-air, online and on

smartphones and tablets, and millions regularly engage with the

Company’s brands and personalities through digital platforms such

as Facebook, Twitter, text, apps and email.

Contact

Joseph Jaffoni, Jennifer Neuman JCIR(212)

835-8500bbgi@jcir.com

Heidi Raphael, BBGI(239) 263-5000

Forward-Looking Statements

This release contains “forward-looking statements” about the

Company, which relate to future, not past, events. All statements

other than statements of historical fact included in this release

are forward-looking statements. These forward-looking statements

are based on the current beliefs and expectations of the Company’s

management and are subject to known and unknown risks and

uncertainties. Words or expressions such as “expects,”

“anticipates,” “intends,” “plans,” “believes,” “estimates,” “may,”

“will,” “plans,” “projects,” “could,” “should,” “would,” “seek,”

“forecast,” or other similar expressions are intended to identify

such forward-looking statements.

Forward-looking statements, by their nature, address matters

that are, to different degrees, uncertain. Although the Company

believes the expectations reflected in such forward-looking

statements are based upon reasonable assumptions, it can give no

assurance that the expectations will be attained or that any

deviation will not be material. Readers are cautioned not to place

undue reliance on these forward-looking statements, which speak

only as of the date on which they are made.

Forward-looking statements involve a number of risks and

uncertainties, and actual results or events may differ materially

from those projected or implied in those statements. Factors that

could cause actual results or events to differ materially from

these forward-looking statements include, but are not limited to:

the Company’s ability to regain compliance with the $1.00 minimum

bid price requirement for continued listing on Nasdaq; the timing

and effectiveness of the reverse stock split; the continued listing

of the Class A Common Stock on Nasdaq; the Company’s financial

condition; and other risk factors as discussed in more detail in

the Company’s filings with the SEC.

Although the Company believes the expectations reflected in any

of its forward-looking statements are reasonable, actual results

could differ materially from those projected or assumed in any of

its forward-looking statements. The Company does not intend, and

undertake no obligation, to update any forward-looking

statement.

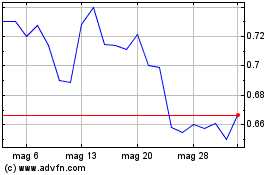

Grafico Azioni Beasley Broadcast (NASDAQ:BBGI)

Storico

Da Dic 2024 a Gen 2025

Grafico Azioni Beasley Broadcast (NASDAQ:BBGI)

Storico

Da Gen 2024 a Gen 2025